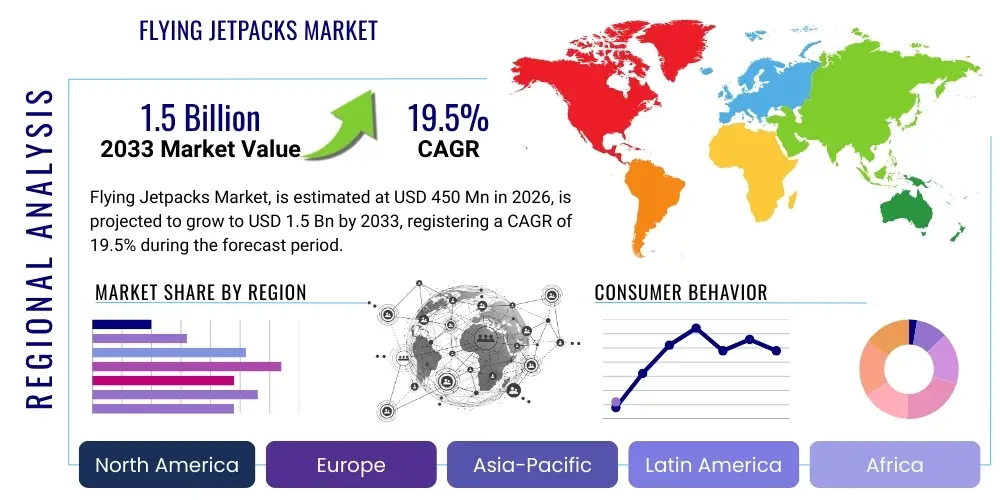

Flying Jetpacks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437742 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Flying Jetpacks Market Size

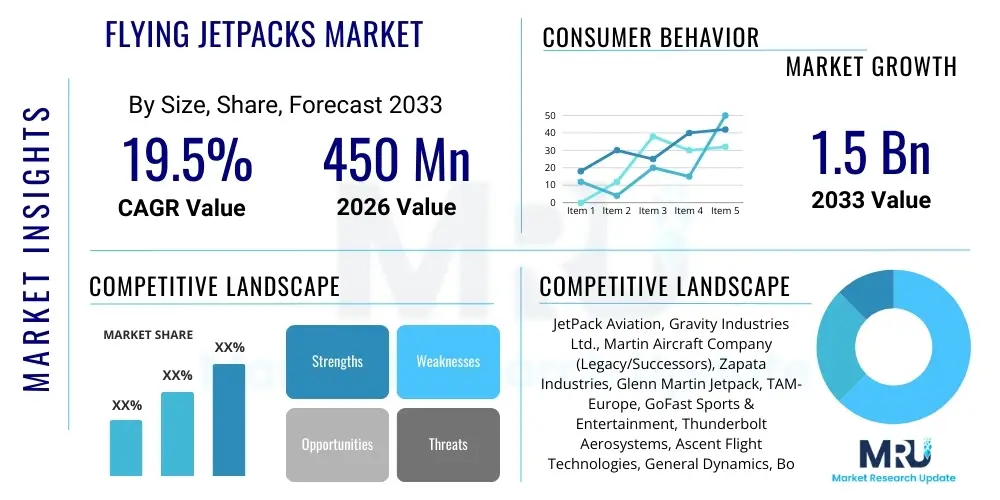

The Flying Jetpacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1.5 Billion by the end of the forecast period in 2033.

Flying Jetpacks Market introduction

The Flying Jetpacks Market encompasses the design, manufacturing, and commercialization of personal aerial propulsion systems capable of vertical take-off and landing (VTOL) and sustained flight for individual users. These sophisticated devices, primarily utilizing turbojet engines, electric ducted fans, or rocket propulsion systems, are transitioning from experimental prototypes to viable commercial and governmental tools. Early applications focused heavily on high-net-worth individual leisure, demonstration events, and critical military or emergency response missions, establishing a foundation for future urban air mobility (UAM) integration. The inherent promise of bypassing ground congestion and providing rapid, point-to-point transit is the core driver defining this nascent industry's long-term potential.

Product descriptions vary significantly based on propulsion type, with turbine-based jetpacks offering greater endurance and speed, while electric variants prioritize reduced noise and lower operational costs suitable for urban environments. Major applications currently revolve around search and rescue (SAR), tactical military operations, rapid infrastructure inspection, and entertainment/demonstration sectors. The primary benefits include unprecedented speed in short-range transport, enhanced accessibility to remote or disaster-stricken areas, and a novel approach to logistics challenges.

Key driving factors accelerating market expansion include significant advancements in lightweight materials (carbon fiber composites), miniaturization of powerful propulsion units, and exponential improvements in flight control systems, leveraging highly redundant digital flight management architectures. Furthermore, increasing investment from defense departments globally seeking tactical superiority and growing consumer interest in adventure tourism and personal aerial vehicles (PAVs) are pushing manufacturers toward scalable production models and regulatory compliance, thereby legitimizing the technology for broader commercial use.

Flying Jetpacks Market Executive Summary

The Flying Jetpacks Market is undergoing a transformation driven by converging technological maturity and evolving regulatory frameworks, positioning it as a high-growth sector within the broader Advanced Air Mobility (AAM) landscape. Current business trends indicate a strong bifurcation, with defense contracts forming the backbone of revenue stability in the short term, while civilian applications, particularly in logistics and emergency services, provide the highest long-term growth potential. Key strategic maneuvers involve partnerships between aerospace incumbents and nimble technology startups focused on battery density and autonomous flight algorithms. Capital expenditure is heavily concentrated in rigorous flight testing, safety certifications, and developing user interface technology that minimizes required pilot skill, addressing critical hurdles related to mass adoption.

Regionally, North America, spearheaded by the United States defense spending and Silicon Valley innovation, maintains market dominance, specifically in turbine-powered tactical systems. However, the Asia Pacific region is rapidly emerging as a central hub for manufacturing and potential early commercial adoption, particularly driven by high population density and corresponding urban congestion issues in countries like Japan and Singapore, necessitating novel transportation solutions. Europe is focusing intently on establishing unified air traffic management (ATM) rules tailored for these new aerial vehicles, prioritizing safety and noise reduction, which favors the development of quieter electric-powered jetpacks.

Segment trends reflect a clear shift toward electric propulsion (e-Jetpacks) due to global sustainability mandates and the suitability of shorter-duration electric flight for intra-urban scenarios, although the current market size remains dominated by fuel-based turbine systems for high-performance defense requirements. The end-user segment is stabilizing with governmental and military entities leading expenditure, but the entertainment and commercial inspection services sectors are showing the highest proportional growth rates as operational costs gradually decrease and device reliability improves. The regulatory segment remains a major influential factor, as market expansion directly correlates with successful navigation of complex airspace restrictions and certification processes.

AI Impact Analysis on Flying Jetpacks Market

User queries regarding AI's influence on the Flying Jetpacks Market primarily center on three areas: safety automation, autonomous navigation in complex urban environments, and the reduction of pilot cognitive load. Users are concerned about whether AI systems are reliable enough to manage flight stability and emergency procedures in high-stakes scenarios, especially given the catastrophic potential of system failure in personal aerial vehicles. Expectations are high that AI will democratize flight, making complex maneuvers manageable for novice users through advanced flight augmentation and automated collision avoidance (Sense-and-Avoid technologies). The analysis suggests that the core theme is the indispensable role of AI in moving jetpacks from niche, expert-operated tools to mainstream, reliable mobility solutions by ensuring robust redundancies, predictive maintenance, and seamless integration into future UAM air traffic control systems.

- AI-driven Flight Stabilization: Implementation of deep learning models to manage instantaneous thrust vectoring and attitude control, ensuring inherent flight stability regardless of external perturbations like wind shear.

- Predictive Maintenance: Use of machine learning algorithms to analyze real-time sensor data from engines, fuel systems, and composites, forecasting potential component failure before critical incidence.

- Autonomous Navigation and Route Optimization: AI systems enabling beyond visual line of sight (BVLOS) operation and dynamically optimizing flight paths based on weather, temporary flight restrictions (TFRs), and real-time air traffic density.

- Enhanced Safety and Collision Avoidance: Integration of advanced computer vision and sensor fusion techniques powered by AI for high-fidelity situational awareness, enabling automated avoidance maneuvers in dense airspace.

- Training and Simulation: Utilization of AI to create hyper-realistic, adaptive flight simulators that accelerate pilot training cycles and assess proficiency levels with objective metrics.

- Reduced Cognitive Load: Introduction of AI-powered human-machine interfaces (HMIs) that simplify complex flight inputs, allowing pilots to focus on mission objectives rather than granular systems management.

DRO & Impact Forces Of Flying Jetpacks Market

The market dynamics of Flying Jetpacks are defined by a powerful convergence of technological innovation (Drivers), significant regulatory and psychological barriers (Restraints), and expanding opportunities in specialized professional services (Opportunity). Key drivers include radical improvements in power-to-weight ratios of propulsion systems and the increasing willingness of government entities to invest in disruptive defense technology. Conversely, strict global aviation regulations regarding personal flight over populated areas and the high cost associated with certified, flight-ready units act as major restraints. The primary opportunity lies in capitalizing on niche, high-value markets such as airborne security, rapid emergency medical response (EMS), and high-voltage power line inspection, areas where the speed advantage outweighs current operational costs.

Impact forces currently skew toward the regulatory and safety aspects. Societal acceptance (a major PESTLE factor) remains low until stringent safety records are established, making regulatory approval the single most impactful external force. Economic factors, such as the initial capital investment required for market entry and the relative expense of high-performance materials, significantly impact commercial scaling. Technological innovation, specifically in battery energy density for electric models and fuel efficiency for turbine models, acts as a pivotal force determining the viability and endurance of future products, directly influencing operational range and flight time—a critical metric for end-users.

The market is also subject to competitive impact forces, driven by a race among a limited number of specialized manufacturers (e.g., Martin Aircraft Company successor entities, JetPack Aviation, Gravity Industries) to achieve the first successful, scalable commercial certification. Intellectual property (IP) protection surrounding propulsion nozzle design and proprietary flight control software represents a competitive moat. Furthermore, the indirect impact of the drone and eVTOL markets forces jetpack manufacturers to clearly differentiate their product offering based on unique capabilities—primarily extreme agility and personal mobility—as opposed to bulk logistics or passenger transport capabilities, ensuring the jetpack maintains its niche identity within the AAM ecosystem.

Segmentation Analysis

The Flying Jetpacks Market is segmented based on propulsion type, thrust, end-user, and operational capabilities, reflecting the diverse and specialized requirements across different applications. Analyzing these segments provides a clear understanding of where growth capital is being deployed and which technological paths are receiving priority investment. The segmentation highlights the current disparity between high-performance, fuel-intensive defense systems and emerging, sustainable electric concepts intended for future urban use. Furthermore, thrust and operational range are critical differentiators, separating true logistical tools from pure entertainment or demonstration units.

- By Propulsion Type:

- Fuel-Based (Turbojet/Rocket)

- Electric (E-Jetpacks utilizing Ducted Fans)

- Hybrid Systems

- By Thrust/Payload Capacity:

- Low Thrust (Under 200 lbs)

- Medium Thrust (200 lbs to 400 lbs)

- High Thrust (Above 400 lbs)

- By End-User:

- Military and Defense

- Government and Public Safety (SAR, Firefighting)

- Commercial (Logistics, Inspection, Entertainment)

- Personal/Private

- By Range/Operational Time:

- Short Range (Under 10 minutes)

- Medium Range (10 to 30 minutes)

- Extended Range (Above 30 minutes)

Value Chain Analysis For Flying Jetpacks Market

The value chain for the Flying Jetpacks Market is complex and capital-intensive, starting with highly specialized upstream suppliers and concluding with niche distribution channels. Upstream analysis focuses heavily on the procurement of advanced materials, primarily aerospace-grade carbon fiber composites for chassis and casing to ensure maximal strength-to-weight ratios. Key components also include miniaturized, high-efficiency turbine engines or high-density battery packs, highly customized inertial measurement units (IMUs), and flight control computers (FCCs) typically sourced from specialized aerospace component manufacturers. Quality control and supply chain transparency are critical at this stage due to the safety-critical nature of the final product, often requiring stringent AS9100 certification from suppliers.

The core manufacturing and integration phase involves sophisticated assembly, rigorous software development for flight augmentation, and extensive ground and tethered testing. Downstream activities involve sales and distribution channels, which are currently segmented into highly direct military procurement pipelines and limited indirect channels for commercial or entertainment units, often involving specialized dealerships or direct-to-customer high-touch sales models. Given the necessity for specialized training and maintenance protocols, the aftermarket services—including maintenance, repair, and overhaul (MRO)—constitute a significant and high-margin component of the downstream value chain.

Distribution is predominantly direct for military and large governmental contracts to maintain control over sensitive technology and provide integrated training support. For the nascent commercial market, indirect distribution relies on certified training facilities that double as sales agents, ensuring that buyers are fully vetted and trained before operating the equipment. The industry faces challenges in establishing widespread MRO networks, requiring manufacturers to either develop proprietary global service centers or enter into highly specific partnerships with established aerospace maintenance providers, a critical step for achieving the operational reliability needed for sustained commercial success.

Flying Jetpacks Market Potential Customers

The primary end-users and potential buyers for Flying Jetpack technology are currently concentrated in sectors demanding rapid response capabilities and access to difficult terrain, where the time-saving benefits justify the high investment cost. Defense and military organizations represent the largest and most stable customer base, seeking tactical mobility, insertion capabilities in complex urban or maritime environments, and silent operation (especially with electric variants). Government public safety agencies, including Search and Rescue (SAR) teams, fire departments, and border patrol, constitute the second major segment, requiring efficient aerial surveillance and transport in emergencies.

The commercial sector provides fertile ground for expansion, specifically utility companies requiring rapid inspection of critical infrastructure such as high-voltage power lines, wind turbines, and offshore oil platforms, where traditional methods are slow or hazardous. The entertainment industry, including professional air sports leagues and large event organizers, utilizes jetpacks for demonstrations and unique aerial acts. While still embryonic, the private sector, comprising affluent individuals and adventure tourism operators, represents a future target for recreational and personal transport models, pending significant regulatory easing and cost reduction.

In essence, the market targets customers facing the "last mile" problem in three dimensions—whether that is reaching a casualty on a cliff face, inspecting a structurally complex bridge, or rapidly deploying a soldier into a tight spot. The value proposition is centered entirely on mission-critical speed, unparalleled vertical maneuverability, and the ability to operate independently of standard aviation infrastructure, making specialized governmental and industrial users the most viable immediate purchasers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JetPack Aviation, Gravity Industries Ltd., Martin Aircraft Company (Legacy/Successors), Zapata Industries, Glenn Martin Jetpack, TAM-Europe, GoFast Sports & Entertainment, Thunderbolt Aerosystems, Ascent Flight Technologies, General Dynamics, Boeing (Advanced Mobility Divisions), BAE Systems, TIE Aerospace, Reaction Engines Ltd., Raytheon Technologies, Lift Aircraft, Kittyhawk, Ehang. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flying Jetpacks Market Key Technology Landscape

The technological core of the Flying Jetpacks market is centered on achieving optimal power density and advanced flight control systems within a portable, human-wearable framework. Propulsion technologies are broadly categorized into micro-turbine engines, which offer superior endurance and power but generate high noise and heat, and electric ducted fans (EDF) powered by high-density lithium batteries, which provide quieter, emission-free operation suitable for brief urban flights. The current research trajectory focuses heavily on hybrid systems that combine the immediate thrust of fuel sources with the efficiency of electric backup, aiming to bridge the gap between range and sustainability. Advances in 3D printing are also crucial, allowing for rapid prototyping and the creation of lightweight, complex parts necessary for minimizing overall device mass.

Crucial to flight safety and operability is the development of redundant, high-speed digital flight control systems. These systems utilize sophisticated sensor fusion—combining data from GPS, IMUs, magnetometers, and potentially Lidar—to maintain stable flight attitude and respond instantly to pilot input or atmospheric changes. Modern jetpacks employ fly-by-wire or fly-by-light architectures to ensure minimal latency in control surfaces (or thrust vectoring nozzles). Furthermore, ongoing development in smart textiles and ergonomic harnesses is essential to distribute thrust forces safely and comfortably across the human body, mitigating the physical stress associated with high-acceleration vertical flight.

The regulatory trajectory necessitates advancements in autonomous operations and air traffic integration. This involves implementing robust Sense-and-Avoid (SAA) technology, primarily relying on radar and computer vision, managed by onboard AI to prevent collisions, especially when operating Beyond Visual Line of Sight (BVLOS). Certification hinges on the proven reliability of these systems. Looking forward, the maturity of Solid-State Battery (SSB) technology promises to be a game-changer for electric variants, potentially overcoming current endurance limitations and dramatically increasing the viability of e-Jetpacks for commercial logistics and longer-duration rescue operations, thereby unlocking substantial market potential.

Regional Highlights

Market growth and technological deployment differ significantly across key global regions, primarily influenced by varying regulatory approaches and governmental defense priorities.

- North America (Dominance in Defense and R&D):

The North American market, particularly the United States, holds a leading position driven by substantial defense expenditures allocated to tactical personal mobility solutions. Key manufacturers and research entities are concentrated here, focusing on high-performance turbine jetpacks optimized for military applications (e.g., rapid troop insertion, ship-to-shore deployment). The Federal Aviation Administration (FAA) is currently grappling with defining the certification class for these devices, generally categorizing them as powered ultralights or special flight vehicles, significantly impacting commercialization speed. Investment in advanced materials and AI-driven flight control is higher here than in other regions, positioning the U.S. as the technological trendsetter, though commercial adoption remains stifled by strict operational regulations over populated areas.

- Europe (Focus on Regulation and Electric Mobility):

The European market is characterized by a cautious, safety-first approach, with regulatory bodies like EASA prioritizing the seamless integration of jetpacks into existing air traffic management structures. This focus heavily favors the development of quieter, electric-powered jetpacks suitable for urban use and minimizes environmental impact. Countries like the UK and France are hosts to pioneering companies (e.g., Gravity Industries) that have successfully demonstrated controlled flight for SAR and public display purposes. The growth driver in Europe is niche application in emergency services and governmental inspection roles, rather than immediate personal recreational use. The regulatory environment requires stringent noise reduction compliance and adherence to complex air safety regulations, influencing product design toward ducted fan electric systems with limited range.

- Asia Pacific (APAC) (High Potential for Commercial Urban Solutions):

The APAC region represents the highest potential growth area for commercial jetpack deployment, largely due to extreme urban density and critical congestion issues in megacities like Tokyo, Seoul, and Singapore, creating an urgent need for UAM alternatives. While military procurement is steady, the major commercial opportunity lies in utilizing jetpacks for specialized logistics, high-rise building maintenance, and disaster relief where ground access is compromised. Governments in this region are generally more amenable to fast-tracking regulatory trials for disruptive transportation technologies, provided stringent safety standards are met. China and Japan are heavily investing in proprietary battery technology and miniaturized jet engine development, indicating a strong commitment to localization of the manufacturing base.

- Latin America and Middle East & Africa (MEA) (Niche Military and High-Value Application):

The market in Latin America is small but exhibits growing interest, especially from coastal nations and law enforcement for border security and rapid intervention purposes in remote or difficult terrain. In the MEA region, the market is driven by high-net-worth individuals, adventure tourism, and robust defense spending, particularly in the Gulf Cooperation Council (GCC) countries. These regions have fewer constraints on noise pollution and often have expansive unpopulated airspace suitable for testing and initial operation. The focus remains on high-performance, turbine-based systems for demonstration and tactical government use, with less immediate pressure for electric-powered adoption compared to Europe or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flying Jetpacks Market.- JetPack Aviation

- Gravity Industries Ltd.

- Martin Aircraft Company (Legacy/Successors)

- Zapata Industries

- Glenn Martin Jetpack

- TAM-Europe

- GoFast Sports & Entertainment

- Thunderbolt Aerosystems

- Ascent Flight Technologies

- General Dynamics (Advanced Mobility Divisions)

- Boeing (R&D Divisions)

- BAE Systems (Future Mobility Projects)

- TIE Aerospace

- Reaction Engines Ltd.

- Raytheon Technologies

- Lift Aircraft (Indirect Competitor in Personal VTOL)

- Kittyhawk (Indirect Competitor in Personal VTOL)

- Ehang (Indirect Competitor in Personal VTOL)

- Veridian Aerospace

- Puma Technologies

Frequently Asked Questions

Analyze common user questions about the Flying Jetpacks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the commercial adoption and range of modern Flying Jetpacks?

The primary factor limiting the widespread commercial adoption of Flying Jetpacks is the highly restrictive global regulatory environment, particularly the lack of harmonized Federal Aviation Administration (FAA) or European Union Aviation Safety Agency (EASA) certification standards for personal flight over populated areas. Technically, the constraint is the energy density and subsequent flight endurance provided by current propulsion systems, whether limited by battery capacity for electric models or the volume/weight of fuel tanks for turbine models. Most viable jetpacks currently offer flight times under 10 minutes, making them suitable only for highly specialized, short-duration tasks like emergency retrieval or complex inspection, not general transportation. To overcome this, significant technological breakthroughs in hybrid propulsion systems and ultra-high-density solid-state batteries are required, paired with comprehensive noise reduction technologies to meet urban acceptance standards, which are essential for unlocking the substantial urban air mobility market potential. Furthermore, the prohibitive cost of certified flight systems (often exceeding $200,000 to $500,000 per unit) creates a massive barrier for personal consumer access, restricting the current market exclusively to well-funded governmental and high-value industrial sectors.

How do turbine-powered jetpacks compare to electric jetpacks in terms of performance and future market share?

Turbine-powered (fuel-based) jetpacks currently offer superior performance in terms of power-to-weight ratio, thrust, and extended flight endurance, making them the preferred choice for demanding applications such as military operations and demonstrations requiring high speed and altitude capabilities. They dominate the existing market share in high-performance niche sectors. However, their future market share faces erosion from electric jetpacks (e-Jetpacks), primarily due to significant disadvantages including high operational noise, substantial heat emission, dependence on specialized jet fuel, and higher overall maintenance complexity. Electric jetpacks, utilizing ducted fans and high-density battery packs, are significantly quieter, operate emission-free, and are mechanically simpler, aligning perfectly with global sustainability trends and urban air mobility (UAM) requirements focused on quiet operations within city limits. While current e-Jetpacks suffer from severely limited range (often less than 5 minutes of full-power flight), projected improvements in battery technology, specifically the maturity of solid-state batteries, are expected to dramatically increase their endurance, positioning them to capture the vast majority of future commercial and public safety market share by the end of the forecast period, especially once regulatory bodies establish specific operational corridors for personal electric VTOL devices.

What role does safety certification and regulatory compliance play in market growth for Flying Jetpacks?

Safety certification and strict regulatory compliance are arguably the most critical determinants of market growth, acting as a gatekeeper for mass commercialization beyond specialized government contracts. Current global aviation regulations (e.g., FAA Part 103, EASA Special Conditions) were not designed for personal, human-wearable vertical takeoff and landing (VTOL) devices, forcing manufacturers to pursue expensive and time-consuming special flight authorizations or utility certifications. Every flight operation, especially over populated areas, requires meticulous risk assessment and approval. Market expansion is directly proportional to the industry's collective ability to establish a comprehensive safety record, demonstrate robust system redundancy (especially for control systems and propulsion), and gain public trust. Regulatory bodies must be convinced that the probability of catastrophic mechanical failure or human error is mitigated through advanced technologies like artificial intelligence (AI) flight augmentation and automated collision avoidance systems (Sense-and-Avoid). The successful creation of a new, simplified, and standardized regulatory framework specifically for personal aerial vehicles (PAVs) will instantaneously unlock hundreds of millions of dollars in commercial investment, accelerating the transition from niche novelty to viable transportation mode.

Which end-user segment offers the highest immediate revenue opportunities for jetpack manufacturers?

The Military and Defense end-user segment offers the highest immediate and most stable revenue opportunities for jetpack manufacturers globally. Defense organizations, particularly those in North America and key European countries, require the unique tactical advantages provided by jetpacks: rapid short-range insertion, silent approach capability (with electric models), and unparalleled ability to navigate complex terrain or obstacles (such as crossing waterways or urban canyons) without reliance on ground vehicles or standard helicopters. These organizations possess the necessary budget flexibility to absorb the high unit costs and ongoing specialized maintenance expenses associated with cutting-edge aerospace technology. Contracts are typically long-term, focused on research, development, and procurement, providing manufacturers with the stable financial foundation needed to fund further civilian-focused R&D efforts. While the commercial sector (inspection, entertainment) shows higher long-term proportional growth potential, the volume and value of procurement contracts from governmental entities, including Search and Rescue (SAR) and specialized law enforcement units, provide the necessary initial economic impetus and technological validation for the entire jetpack market ecosystem.

How will advancements in battery technology influence the competitive landscape between different jetpack propulsion types?

Advancements in battery technology, specifically the commercialization of ultra-high-energy-density Solid-State Batteries (SSBs), are poised to fundamentally reshape the competitive landscape by drastically tipping the scales in favor of Electric Jetpacks (e-Jetpacks). Currently, turbine-powered systems maintain a performance lead due to the superior energy density of jet fuel versus current lithium-ion battery technology. However, if SSBs deliver their promised energy density gains (potentially double or triple that of Li-ion), e-Jetpacks will approach or even exceed the flight endurance and range capabilities of turbine models while retaining their inherent advantages of reduced noise, zero local emissions, and lower maintenance costs. This shift would make electric propulsion the default choice for urban and commercial applications, severely limiting turbine systems to only the most extreme, remote, or high-thrust defense missions. The competitive battlefield will move from propulsion type dominance to which manufacturer can first successfully integrate and certify SSB technology, simultaneously simplifying the supply chain and dramatically lowering the cost of electricity-based flight operations, thus attracting a broader, commercially oriented customer base that is currently unattainable due to range limitations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager