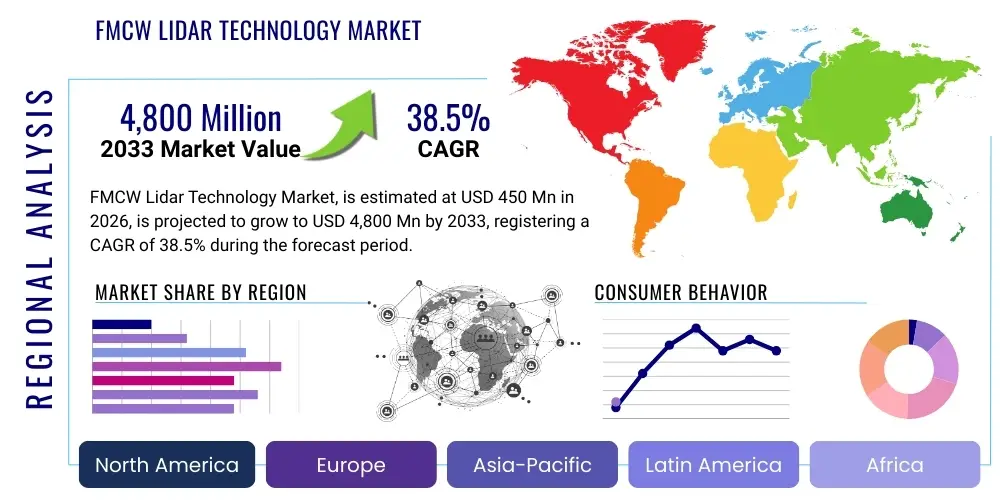

FMCW Lidar Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437817 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

FMCW Lidar Technology Market Size

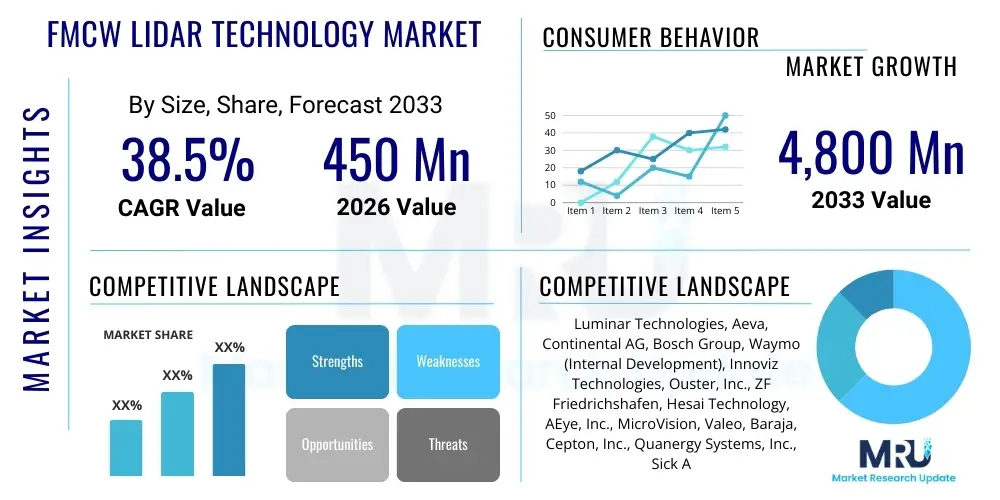

The FMCW Lidar Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 38.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 4,800 Million by the end of the forecast period in 2033.

FMCW Lidar Technology Market introduction

The Frequency-Modulated Continuous Wave (FMCW) Lidar Technology Market is experiencing rapid expansion, primarily driven by the imperative need for high-fidelity, long-range, and interference-immune sensing solutions crucial for advanced automotive safety systems (ADAS) and fully autonomous vehicles. Unlike conventional Time-of-Flight (ToF) Lidar systems, FMCW Lidar measures both distance and velocity instantaneously by detecting the Doppler shift of the reflected laser light, providing critical fourth-dimensional data. This capability significantly enhances object recognition and classification, particularly in high-speed scenarios or environments with dense Lidar sensor deployments, thereby addressing critical performance bottlenecks faced by current autonomous platforms.

FMCW Lidar systems utilize coherent detection techniques, employing components such as tunable laser sources (often distributed feedback lasers or external cavity lasers), photodetectors, and complex signal processing chips. The product description centers on its ability to offer superior immunity to solar glare and interference from other Lidar units, which is essential for mass deployment in urban and highway settings. Major applications span across the automotive sector (Level 3, 4, and 5 autonomy), industrial robotics, advanced defense systems, and precision mapping. The inherent benefits include improved signal-to-noise ratio, highly accurate velocity measurement, and operation at eye-safe wavelengths, typically around 1550 nm, allowing for higher power output and longer effective range.

Key driving factors fueling market growth include stringent global safety regulations mandated by organizations like the European New Car Assessment Programme (Euro NCAP), substantial investments in autonomous driving research and development by Original Equipment Manufacturers (OEMs) and technology giants, and the continuous technological maturation leading to miniaturization and cost reduction of critical photonic components. Furthermore, the push toward factory automation and the deployment of advanced mobile robotics in logistics and manufacturing environments heavily relies on the precise, real-time spatial mapping capabilities offered uniquely by FMCW Lidar, positioning it as a pivotal technology for future perception stacks.

FMCW Lidar Technology Market Executive Summary

The FMCW Lidar Technology market is characterized by intense technological competition and significant venture capital investment, focusing heavily on miniaturization and integration into System-on-Chip (SoC) architectures to achieve scalability for mass automotive adoption. Current business trends indicate a strategic shift from large, specialized Lidar units to compact, solid-state designs that leverage silicon photonics—a key enabler for cost reduction and reliability. Partnerships between Lidar manufacturers and tier-one automotive suppliers are accelerating, aiming to standardize FMCW Lidar integration protocols and hasten market penetration. The trend also shows established automotive players making direct investments in Lidar startups to secure early access to differentiated sensing capabilities required for next-generation vehicle launches, prioritizing systems that can handle both long-range highway operation and dense urban object differentiation simultaneously.

Regional trends highlight North America and Europe as early adoption hubs due to strong regulatory support for autonomous vehicle testing and high consumer demand for advanced driver assistance features. The Asia Pacific region, led by China and South Korea, is rapidly emerging as the largest growth market, propelled by state-backed initiatives to deploy autonomous fleets and smart city infrastructure. These nations are heavily investing in localized supply chains for semiconductor and photonics manufacturing, which will eventually drive down production costs globally. The Middle East and Africa (MEA) and Latin America currently represent nascent markets, with adoption concentrated in high-value mining automation and specific infrastructure projects, but they offer substantial long-term growth potential as regulatory frameworks evolve.

Segment trends reveal that the Automotive application segment remains the dominant revenue generator and primary innovation driver, specifically focusing on long-range sensing (>200 meters) capabilities optimized for highway autonomy. Within components, the solid-state laser source segment, particularly those based on Integrated Photonics (IP), is projected to experience the fastest growth due to its suitability for high-volume manufacturing and ruggedness. Furthermore, the industrial segment is showing accelerated adoption, moving beyond simple obstacle avoidance to precise volumetric scanning for inventory management and high-throughput robotic guidance. The ongoing shift toward 1550 nm wavelength technology continues to gain momentum over 905 nm due to safety allowances enabling greater power and range, solidifying its importance in robust FMCW designs.

AI Impact Analysis on FMCW Lidar Technology Market

Users frequently inquire about how Artificial Intelligence (AI) enhances the intrinsically rich data generated by FMCW Lidar, particularly concerning noise filtering, real-time object classification, and effective sensor fusion. Key user questions revolve around the computational demands of processing 4D data (distance, azimuth, elevation, and velocity) and whether AI can effectively handle the significant data streams without latency issues critical for safety-of-life applications. Concerns are often raised regarding the robustness of deep learning models in handling complex weather conditions (fog, heavy rain) where FMCW's coherent detection offers theoretical advantages. Users expect AI to translate the precise velocity data into accurate predictive motion trajectories, moving beyond simple static environment mapping to dynamic, predictive navigation for full autonomy.

AI's influence is profound, transforming FMCW Lidar from a sophisticated sensor into an integral component of the vehicle's cognitive system. Advanced neural networks are essential for processing the large volume of coherent detection signals, enabling high-resolution point cloud generation and immediate object segmentation, far surpassing traditional algorithmic methods. Specifically, AI algorithms are utilized for Doppler shift interpretation, minimizing false positive velocity readings, and intelligently fusing the velocity dimension with spatial data to construct a highly reliable, predictive model of the surrounding environment. This deep integration allows autonomous vehicles to anticipate object movement, such as pedestrians stepping off a curb or sudden braking by preceding vehicles, significantly enhancing reactive safety and improving driving comfort.

Moreover, AI contributes significantly to the operational efficiency and long-term viability of FMCW systems by performing continuous self-calibration and fault detection. Machine learning models analyze system performance metrics, environmental degradation (e.g., lens fouling), and component health, enabling preventative maintenance and ensuring consistent performance over the vehicle's lifespan. In the competitive landscape, companies that successfully embed proprietary, optimized AI inference chips (ASICs) directly into the Lidar unit or the centralized domain controller gain a substantial competitive edge by offering lower latency, reduced power consumption, and superior overall perception capabilities necessary for widespread commercialization of high-level autonomy.

- AI optimizes the processing of 4D point cloud data, leveraging velocity information for enhanced object tracking and predictive path planning.

- Deep learning models facilitate rapid, accurate object classification and segmentation, differentiating between road debris, pedestrians, and cyclists instantly.

- Sensor fusion algorithms, powered by AI, seamlessly combine FMCW Lidar's precise velocity data with camera vision and radar inputs for superior environmental understanding.

- AI-driven noise reduction techniques maximize the performance gains provided by FMCW’s inherent interference immunity, especially in dense sensor environments.

- Machine learning is utilized for system health monitoring, self-calibration, and ensuring sensor reliability across varying environmental conditions.

DRO & Impact Forces Of FMCW Lidar Technology Market

The FMCW Lidar Technology Market is governed by a dynamic interplay of potent drivers, structural restraints, and compelling opportunities, all contributing to the strong impact forces shaping its trajectory. A primary driver is the global pursuit of automotive autonomy, where FMCW’s ability to provide instantaneous, high-accuracy velocity data (4D sensing) addresses critical safety limitations inherent in legacy systems. This technical superiority, coupled with its inherent immunity to solar glare and cross-Lidar interference, positions it as the preferred technology for mass-market Lidar deployment. Conversely, the market is restrained by the high initial manufacturing cost associated with the necessary complex photonic integrated circuits (PICs), demanding stringent fabrication tolerances, which currently restricts its rapid adoption primarily to high-end and luxury vehicle segments. The major opportunity lies in expanding its use beyond automotive into high-value industrial automation, particularly in precision robotics and specialized surveillance applications requiring high-resolution, long-range sensing.

Key drivers center on regulatory pressures and consumer willingness to invest in higher safety standards. Governments worldwide are prioritizing road safety, pushing mandatory integration of advanced driver assistance systems (ADAS) in new vehicles. Furthermore, the inherent superiority of FMCW Lidar in accurately measuring instantaneous velocity drastically reduces the calculation burden on the vehicle's central computing unit, improving reaction times. Restraints primarily involve supply chain limitations; the specialized components, particularly the tunable, narrow-linewidth laser sources, require highly mature fabrication processes that are not yet scaled to automotive volumes, leading to bottlenecks and maintaining high unit costs. Additionally, the development of standardized data formats and robust communication interfaces for 4D Lidar data integration remains a technical hurdle that requires industry-wide collaboration to overcome.

The impact forces are substantial, pushing the industry toward solid-state solutions and higher levels of integration. The drive toward integration, particularly via Silicon Photonics, represents a powerful force that will eventually convert the current opportunity of cost reduction into a concrete market reality, overcoming the existing cost restraint. Opportunities also exist in the convergence of 5G and V2X (Vehicle-to-Everything) communication, where FMCW Lidar data can be shared and aggregated across fleets for enhanced situational awareness and real-time mapping updates. The competitive landscape is also a significant force, compelling leading manufacturers to accelerate R&D cycles, rapidly iterate on chip designs, and secure high-volume manufacturing partners, further polarizing the market between technology leaders offering integrated solutions and those relying on older, bulky mechanical scanning approaches.

Segmentation Analysis

The FMCW Lidar Technology market is comprehensively segmented based on its core components, the technology's effective range capabilities, and the diverse end-user applications it serves. This granular segmentation is essential for understanding the varying needs of different industrial verticals and the technological maturity within each segment. The component analysis focuses on the high-value subsystems required for coherent detection, such as the laser source and the processing unit, which represent the major investment areas for manufacturers. Application segmentation confirms the automotive sector's dominance while recognizing significant emerging demand from industrial and mapping sectors. Range segmentation directly addresses operational requirements, distinguishing between short-range systems optimized for parking assist and long-range systems vital for high-speed highway driving.

Component-wise, the market is heavily influenced by advancements in Integrated Photonics (IP). Silicon photonics allows for the dense integration of multiple optical and electronic functions onto a single chip, driving the shift towards solid-state Lidar. This trend impacts both the cost and reliability of the overall system, making the IP-based transmitter and receiver modules the fastest-growing component sub-segment. The sophisticated signal processing electronics required to decode the FMCW chirp and calculate range/velocity are also critical, representing a high-margin area that requires specialized ASIC development.

From an application perspective, the market's trajectory is inextricably linked to the deployment timeline of Level 3 and Level 4 autonomous vehicles. While the automotive sector is the immediate revenue driver, industrial applications, including high-precision robotics, drone-based inspection, and automated guided vehicles (AGVs) in smart factories, are expected to provide stable, diversified growth. These industrial use cases benefit immensely from FMCW Lidar’s ability to operate reliably in challenging, highly dynamic environments with moving machinery and potential interference from other sensors, underscoring the versatility of this advanced sensing technology.

- By Component:

- Laser Source (Solid-state, Tunable)

- Photodetector and Receiver Array

- Optical Scanning Module (MEMS, Optical Phased Array)

- Signal Processing Unit (ASICs/FPGAs)

- By Range:

- Short Range (up to 50m)

- Mid Range (50m to 150m)

- Long Range (150m and above)

- By Technology Wavelength:

- 1550 nm

- 905 nm (Hybrid FMCW approaches)

- By Application:

- Automotive (ADAS, Autonomous Driving)

- Industrial Automation and Robotics

- Mapping and Surveying

- Aerospace and Defense

- Smart Infrastructure and IoT

Value Chain Analysis For FMCW Lidar Technology Market

The value chain for FMCW Lidar technology is complex, extending from highly specialized upstream component manufacturing to diverse downstream integration and service provision. Upstream analysis reveals a reliance on highly specialized semiconductor and photonics manufacturers responsible for producing narrow-linewidth lasers, high-performance photodetectors, and silicon photonics wafers. This stage is characterized by high capital expenditure and stringent quality control, as the performance of the entire Lidar system hinges on the precision of these core optical components. Key players at this stage often include semiconductor foundries, specialized optical component suppliers, and material science experts, all operating within a highly technical ecosystem where proprietary designs are crucial intellectual assets.

The midstream involves the core Lidar manufacturers who integrate these components, design the optical path (often using MEMS or OPAs for beam steering), develop the proprietary signal processing electronics (ASICs), and assemble the final Lidar unit. This integration phase is where the technical differentiation occurs, particularly in packaging and thermal management. Distribution channels for these finalized units are bifurcated: direct distribution is common for emerging applications like robotics and defense, allowing for closer collaboration with integrators. Indirect channels, primarily involving Tier 1 automotive suppliers (e.g., Continental, Bosch), dominate the high-volume automotive segment, where Lidar units are treated as a sub-system to be integrated into larger vehicle architectures.

Downstream analysis focuses on the end-user applications and service providers. In the automotive sector, this involves vehicle OEMs and mobility service providers (e.g., robotaxi companies) who purchase and deploy the Lidar systems. In industrial settings, the downstream segment includes system integrators who customize the Lidar solution for specific factory floor or warehouse environments. The downstream phase often involves post-sale software and maintenance services, particularly relating to firmware updates, sensor calibration, and data processing support. The direct channel ensures better control over performance and data privacy, while the indirect channel leverages established automotive supply relationships for scalability and regulatory compliance, particularly concerning functional safety standards.

FMCW Lidar Technology Market Potential Customers

The primary and most lucrative potential customers for FMCW Lidar technology are major automotive OEMs and mobility service providers (Maas), particularly those committed to deploying Level 3 and higher levels of vehicle automation within the next five to seven years. These buyers require Lidar systems that offer unparalleled reliability, interference immunity, and crucially, 4D data (velocity measurement) to safely navigate complex driving scenarios. They prioritize systems manufactured at scale using solid-state technology to meet stringent automotive grade (AEC-Q100 equivalent) reliability and durability standards, often initiating multi-year supply contracts following rigorous validation phases.

Another major category of buyers includes industrial automation giants and robotics manufacturers. These end-users, operating in sectors like logistics, manufacturing, and heavy machinery, seek FMCW Lidar for high-precision, robust environmental sensing required for automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and sophisticated volumetric scanning applications. Their purchasing decisions are driven by the sensor's accuracy, ability to handle high dust or vibration environments, and the low total cost of ownership achieved through enhanced reliability compared to older optical sensor technologies.

A third significant customer base comprises specialized government and defense contractors, along with commercial mapping companies. Defense applications utilize FMCW for high-fidelity surveillance, target acquisition, and sophisticated situational awareness in demanding operational theatres, capitalizing on its long range and velocity detection capabilities. Mapping companies, particularly those focused on creating high-definition (HD) maps essential for autonomous vehicle infrastructure, require highly accurate, georeferenced point clouds that FMCW technology can efficiently provide, often utilizing airborne or drone-mounted systems for large-scale data acquisition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 4,800 Million |

| Growth Rate | 38.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Luminar Technologies, Aeva, Continental AG, Bosch Group, Waymo (Internal Development), Innoviz Technologies, Ouster, Inc., ZF Friedrichshafen, Hesai Technology, AEye, Inc., MicroVision, Valeo, Baraja, Cepton, Inc., Quanergy Systems, Inc., Sick AG, Leica Geosystems, Velodyne Lidar, XenomatiX, Scantinel Photonics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FMCW Lidar Technology Market Key Technology Landscape

The technological landscape of the FMCW Lidar market is dominated by advancements in coherent detection and solid-state integration, particularly leveraging Silicon Photonics (SiPh). SiPh technology is foundational, allowing manufacturers to integrate the complex optical circuitry—including the laser source, modulators, frequency shifters, and photodetectors—onto a single, small silicon chip. This approach drastically reduces the physical size, improves thermal stability, enhances shock resistance (crucial for automotive environments), and most importantly, enables high-volume, low-cost manufacturing utilizing existing semiconductor fabrication facilities. The shift to SiPh is critical for achieving the automotive grade reliability and price points necessary for mass market deployment, moving away from bulky, mechanically scanned systems.

Key technologies also include the development of highly precise, tunable, narrow-linewidth laser sources, typically operating in the 1550 nm wavelength band. This longer wavelength is favored because it is eye-safe at higher power levels, allowing for longer detection ranges necessary for highway cruising speeds (up to 300 meters). The complexity lies in maintaining the laser's coherence and frequency stability, which is essential for accurate Doppler shift measurement. Furthermore, advanced beam steering mechanisms, primarily Micro-Electro-Mechanical Systems (MEMS) mirrors or Optical Phased Arrays (OPAs), are essential for achieving the necessary field-of-view and spatial resolution without reliance on cumbersome mechanical gimbals, thereby enhancing the robustness and speed of the scanning process.

Finally, the core technology relies heavily on sophisticated Digital Signal Processing (DSP) algorithms and dedicated Application-Specific Integrated Circuits (ASICs). These specialized processors are designed to handle the fast Fourier transform (FFT) analysis required to decode the frequency-modulated continuous waveform (FMCW) signal in real-time. The processing efficiency is paramount, as the system must instantly calculate both range and velocity for millions of data points per second. Innovations in ASIC design are focused on minimizing power consumption while maximizing throughput, enabling the Lidar system to operate effectively within the tight power budget constraints of electric vehicles and mobile robotics, ensuring the final output is a clean, 4D point cloud ready for the vehicle's perception stack.

Regional Highlights

Regional dynamics play a crucial role in the growth trajectory and technological adoption pace of the FMCW Lidar Technology Market, driven by differential regulatory environments, industrial focus, and investment levels in autonomous infrastructure across major continents.

- North America (NA): A dominant market characterized by robust R&D investment, led by technology hubs in Silicon Valley and major automotive centers in Michigan. NA is a primary hub for autonomous vehicle testing (e.g., California, Arizona) and early commercial deployment of robotaxi fleets. Key relevance lies in the strong presence of major Lidar innovators (Luminar, Aeva) and high consumer demand for advanced ADAS features, focusing heavily on long-range highway autonomy.

- Europe: This region is characterized by stringent automotive safety regulations (Euro NCAP) driving OEM commitment to high-performance sensing technology. Germany, with its strong luxury automotive industry, and countries focused on industrial automation (e.g., France, Sweden) are major adopters. European efforts focus intensely on functional safety standards (ISO 26262) and leveraging FMCW Lidar’s reliability for reliable sensor redundancy in Level 3 systems.

- Asia Pacific (APAC): The fastest-growing market, primarily fueled by massive government investment in smart city infrastructure and state-backed autonomous vehicle mandates in China, Japan, and South Korea. China, in particular, is rapidly developing local supply chains for components, aiming to be a global leader in Lidar deployment and manufacturing scale. This region’s relevance is tied to its high population density and need for interference-immune sensors in congested urban environments.

- Latin America (LATAM): Currently a smaller market, growth is concentrated in specific industrial applications, such as large-scale mining operations and agricultural automation in Brazil and Chile, where high-precision, robust environmental sensing is critical for operational efficiency and worker safety in remote locations. Automotive adoption remains nascent but is expected to accelerate after 2028.

- Middle East and Africa (MEA): Adoption is highly concentrated in high-value infrastructure projects, particularly smart city developments in the UAE and Saudi Arabia, which require cutting-edge mapping and surveillance technologies. Limited automotive manufacturing means the market is driven by technology import and niche defense applications requiring high-fidelity remote sensing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FMCW Lidar Technology Market.- Luminar Technologies

- Aeva

- Continental AG

- Bosch Group

- Waymo (Internal Development)

- Innoviz Technologies

- Ouster, Inc.

- ZF Friedrichshafen

- Hesai Technology

- AEye, Inc.

- MicroVision

- Valeo

- Baraja

- Cepton, Inc.

- Quanergy Systems, Inc.

- Sick AG

- Leica Geosystems

- Velodyne Lidar

- XenomatiX

- Scantinel Photonics

Frequently Asked Questions

Analyze common user questions about the FMCW Lidar Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technical advantages of FMCW Lidar over traditional Time-of-Flight (ToF) Lidar?

FMCW Lidar provides superior performance by measuring both distance and instantaneous velocity (4D data) simultaneously, leveraging the Doppler effect. This capability offers enhanced immunity to solar glare and interference from other Lidar units, resulting in higher fidelity point clouds critical for advanced predictive autonomous driving systems.

Which application segment is expected to drive the largest revenue growth for FMCW Lidar technology?

The Automotive segment, specifically the integration into Level 3 (Conditional Automation) and Level 4 (High Automation) vehicles, is projected to be the largest revenue driver. FMCW Lidar’s requirement for long-range, high-accuracy velocity data positions it as an essential sensor for reliable highway and high-speed autonomous functions.

How does Silicon Photonics (SiPh) impact the mass market adoption of FMCW Lidar?

Silicon Photonics is crucial for enabling mass market adoption by facilitating the manufacturing of complex optical circuits on a single chip. This integration drastically reduces the system size, improves robustness, lowers manufacturing costs through scalability using standard semiconductor fabs, and ensures the system meets strict automotive-grade requirements.

What are the main restraints hindering the immediate widespread deployment of FMCW Lidar?

The primary restraints are the high initial cost associated with specialized photonic components, such as narrow-linewidth tunable lasers, and the supply chain limitations related to scaling the production of complex Integrated Photonics (IP) wafers to meet high-volume automotive demand. System integration and standardization also remain challenging.

What role does Artificial Intelligence (AI) play in maximizing the utility of FMCW Lidar data?

AI is essential for processing the large, complex 4D data streams generated by FMCW sensors. Neural networks utilize the velocity dimension for superior real-time object tracking, precise classification, and predictive motion planning, ultimately improving the safety and reliability of the vehicle’s perception stack.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager