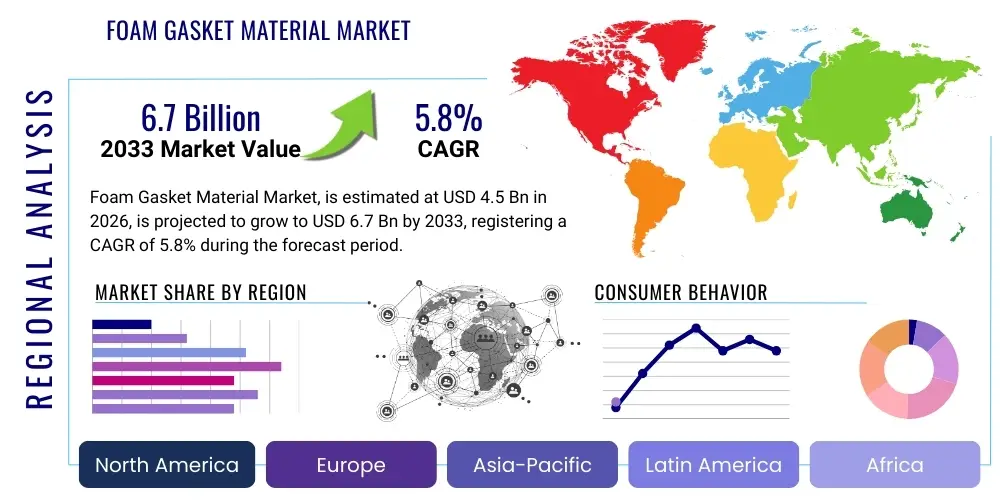

Foam Gasket Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435489 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Foam Gasket Material Market Size

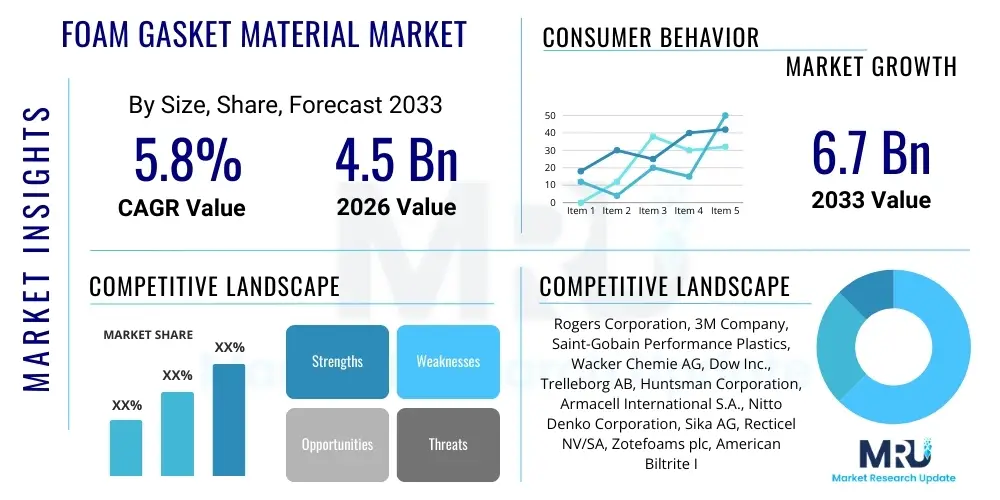

The Foam Gasket Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Foam Gasket Material Market introduction

The Foam Gasket Material Market encompasses a diverse range of polymeric and elastomeric products designed to provide sealing, cushioning, insulation, and vibration dampening capabilities across various critical industrial and commercial applications. These materials, typically supplied in sheet, roll, or die-cut forms, utilize cellular structures (either open-cell or closed-cell) to achieve superior compression set resistance, thermal stability, and environmental resistance. Key materials include silicone foam, polyurethane foam, EPDM (Ethylene Propylene Diene Monomer) foam, PVC (Polyvinyl Chloride) foam, and neoprene foam, each selected based on the specific performance requirements regarding temperature range, chemical exposure, and required IP (Ingress Protection) rating. The core function of foam gaskets is to fill irregularities between mating surfaces, preventing the passage of fluids, gases, dirt, and electromagnetic interference (EMI), thereby protecting sensitive components and ensuring operational longevity in high-reliability systems.

The primary applications driving market growth include the automotive sector, where foam gaskets are essential for battery sealing in electric vehicles (EVs), noise, vibration, and harshness (NVH) reduction, and interior/exterior weather sealing. Furthermore, the electronics industry relies heavily on foam gaskets for dust and moisture protection in smartphones, tablets, and specialized enclosures, often requiring conductive foams for EMI shielding. The construction and HVAC sectors utilize these materials extensively for thermal and acoustic insulation and sealing gaps in windows, doors, and ductwork to improve energy efficiency. The versatility of foam gaskets, characterized by their light weight, excellent conformability, and ease of customization via complex die-cutting processes, makes them indispensable components in modern manufacturing.

Market expansion is significantly driven by stringent regulatory requirements mandating higher energy efficiency and stricter environmental sealing standards, particularly in the automotive and construction industries. The proliferation of electric vehicles, which require advanced thermal management and highly reliable sealing solutions for battery packs, presents a major growth avenue. Additionally, the increasing complexity and miniaturization of electronic devices necessitate precise, durable, and highly functional sealing materials that can perform effectively in confined spaces while offering multi-functional benefits, such as simultaneous sealing and shock absorption. The market structure is characterized by continuous innovation in foam chemistry to enhance sustainability and performance characteristics, focusing on low volatile organic compounds (VOCs) and flame resistance.

Foam Gasket Material Market Executive Summary

The Foam Gasket Material Market is undergoing a rapid transformation, characterized by significant shifts in material preference towards high-performance and specialty foams, such as silicone and engineered polyurethane, driven primarily by the escalating demand from the Electric Vehicle (EV) and advanced electronics sectors. Business trends indicate a strong move towards customization and value-added processing, where manufacturers are integrating capabilities like precision die-cutting, lamination with Pressure Sensitive Adhesives (PSAs), and specialized molding techniques to meet complex OEM design specifications. A key strategic imperative for market players is securing resilient supply chains for key precursors, especially given the global volatility in silicone and petrochemical derivatives. Furthermore, strategic collaborations between material suppliers and Tier 1 automotive component manufacturers are crucial for co-developing next-generation sealing solutions that address demanding thermal and structural requirements in EV batteries and autonomous driving sensor arrays.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, propelled by robust manufacturing activities in China, Japan, and South Korea, especially concerning EV production and the manufacturing of consumer electronics and industrial machinery. North America and Europe demonstrate mature market characteristics, focusing intensely on sustainability, regulatory compliance (such as RoHS and REACH), and the adoption of advanced, high-durability foams for infrastructure and aerospace applications. The regulatory landscape in these regions encourages the adoption of halogen-free and low-smoke emission foam materials, prompting R&D investments in environmentally conscious formulations. Emerging markets in Latin America and the Middle East & Africa are showing promising growth, primarily driven by investments in construction, infrastructure development, and localized automotive assembly plants, demanding economical yet reliable sealing solutions.

Segmental trends emphasize the increasing prominence of closed-cell foams due to their superior resistance to moisture ingress and low compression set, making them ideal for exterior sealing applications. By material type, silicone foam is witnessing disproportionate growth due to its exceptional temperature stability and inherent UV resistance, positioning it as the preferred material for high-heat environments like engine compartments and critical EV battery packs. The end-use industry analysis reveals that the automotive segment retains the largest market share, though the electronics segment is exhibiting the highest CAGR, spurred by the continuous demand for sealed and resilient electronic enclosures. Manufacturers are also focusing on offering multi-functional gaskets that incorporate features like thermal conductivity or electromagnetic shielding alongside basic sealing properties, catering to the converged requirements of modern smart devices and industrial IoT applications.

AI Impact Analysis on Foam Gasket Material Market

Analysis of common user questions reveals significant interest centered around how Artificial Intelligence (AI) and machine learning (ML) can optimize material selection, predict material failure, and revolutionize manufacturing processes within the foam gasket industry. Users frequently inquire about AI's role in accelerating the discovery of novel foam chemistries, minimizing raw material waste during manufacturing (such as complex die-cutting), and enhancing quality control by automating defect detection. Key concerns revolve around the initial investment required for implementing AI-driven quality assurance systems and the need for standardized data infrastructure to train effective predictive maintenance models for gasket performance in operational environments. Users expect AI to reduce lead times for custom gasket prototyping and improve the accuracy of performance simulation under extreme conditions, thereby addressing the high-reliability demands from sectors like aerospace and medical devices.

The impact of AI is bifurcated across the value chain, focusing heavily on upstream R&D and downstream quality control. In R&D, AI algorithms can efficiently screen vast databases of polymer chemistries and processing parameters, drastically reducing the time and cost associated with developing foams that meet specific criteria (e.g., flame retardancy, low thermal conductivity, or enhanced elasticity). This capability allows manufacturers to rapidly respond to niche market demands, such as specialized EMI shielding gaskets for 5G telecommunication infrastructure. Furthermore, ML models are being deployed to predict material degradation over the lifecycle of a product, providing critical data for proactive maintenance schedules in high-capital assets like wind turbines or industrial machinery, where gasket failure can lead to catastrophic system downtime.

In manufacturing, AI-powered computer vision systems are transforming quality assurance. These systems can inspect complex die-cut geometries and identify microscopic defects in foam consistency at high throughput rates, surpassing human capabilities in speed and consistency. Predictive analytics also optimizes manufacturing efficiency by adjusting foaming agent concentrations or curing temperatures in real-time based on sensor data, minimizing batch-to-batch variability and reducing scrap material. This optimization is crucial for maintaining competitive pricing and sustainability metrics. The integration of AI tools, however, necessitates skilled personnel and secure data pipelines, which represents a new challenge for traditional foam gasket manufacturers.

- AI optimization of raw material sourcing and inventory management, predicting demand fluctuations and optimizing ordering quantities.

- Machine learning enhancement of foam chemistry R&D, accelerating the development of sustainable, high-performance polymers.

- Implementation of AI-driven computer vision systems for real-time, high-speed defect detection in die-cut gasket manufacturing.

- Predictive maintenance modeling using sensor data to forecast foam gasket lifespan and prevent operational failures in end-use applications.

- Optimization of complex manufacturing parameters (e.g., curing time, temperature, pressure) to minimize waste and ensure consistent product quality (Industry 4.0 integration).

- AI-assisted simulation tools reducing prototyping cycles for customized gasket designs, especially for automotive battery enclosures.

DRO & Impact Forces Of Foam Gasket Material Market

The dynamics of the Foam Gasket Material Market are shaped by a strong interplay of drivers (D), restraints (R), and opportunities (O), which collectively constitute the core impact forces. Key drivers include the exponential growth in the Electric Vehicle (EV) industry, requiring specialized fire-resistant and thermally stable foam seals for battery packs and enclosures, alongside strict global environmental and safety regulations that necessitate high-performance sealing solutions in construction and industrial sectors. The increasing demand for miniaturized and highly reliable electronic devices also fuels the need for custom, multi-functional foam gaskets (e.g., EMI shielding combined with sealing). These drivers ensure sustained demand across major industrialized economies, promoting innovation in material properties and manufacturing precision.

However, the market faces significant restraints, primarily stemming from the volatility and increasing cost of key raw materials, particularly silicone precursors and petroleum-based polymers like EPDM and PVC. This fluctuation challenges profitability and necessitates careful strategic sourcing. Furthermore, the industry faces stringent technical requirements regarding flammability (UL standards), VOC emissions, and durability, which raise the barrier to entry and increase R&D costs for compliance. The high degree of customization required for specific applications often leads to complexity in manufacturing and inventory management, slowing down scalability for non-standard products.

Major opportunities are centered on the development of bio-based and sustainable foam materials to address growing environmental concerns and consumer preferences, positioning manufacturers ahead of anticipated regulatory changes regarding plastic use. The expanding application scope in emerging fields, such as specialized aerospace components, high-throughput data centers, and sophisticated medical devices, provides lucrative niche markets demanding ultra-high-performance foams. Additionally, the increasing trend towards integrated sealing solutions—where gaskets also perform functions like thermal management or acoustic dampening—offers high-margin potential for companies capable of advanced material engineering and composite fabrication. These impact forces collectively push the market toward advanced processing techniques and material diversification.

Segmentation Analysis

The Foam Gasket Material Market is rigorously segmented based on material type, product form, cell structure, and end-use industry, providing a granular view of market dynamics and application-specific trends. Material segmentation reveals the dominance of synthetic elastomers, with silicone foam leading in value due to its thermal resilience, while polyurethane and EPDM foams capture significant volume due to cost-effectiveness and versatility across automotive and construction sectors. The diverse segmentation reflects the highly specialized nature of the sealing industry, where performance requirements dictate specific material chemistry and physical structure.

Cell structure, differentiating between open-cell and closed-cell foams, is crucial. Closed-cell foams, possessing low permeability and excellent environmental sealing capabilities, are preferred for fluid and moisture protection (e.g., exterior automotive seals and HVAC ducts). Conversely, open-cell foams, offering better compression set and superior acoustic absorption properties, are vital for NVH applications and cushioning in electronics. Understanding these segment dynamics is essential for manufacturers to align their production capabilities with evolving regulatory standards and technological demands from key end-use sectors like electric vehicle manufacturing and 5G network infrastructure deployment, both of which require highly specialized material specifications.

- By Material Type:

- Silicone Foam

- Polyurethane (PU) Foam

- EPDM (Ethylene Propylene Diene Monomer) Foam

- Neoprene (Polychloroprene) Foam

- PVC (Polyvinyl Chloride) Foam

- Natural Rubber Foam

- Others (e.g., Nitrile Rubber, EVA)

- By Cell Structure:

- Open-Cell Foam Gaskets

- Closed-Cell Foam Gaskets

- By Product Form:

- Die-Cut Gaskets

- Molded Gaskets

- Form-in-Place (FIP) Gaskets

- Extruded Profiles

- By End-Use Industry:

- Automotive (EV Battery Sealing, NVH, Weather Sealing)

- Electronics (Display Sealing, EMI Shielding, Cushioning)

- Construction and HVAC (Insulation, Weatherproofing)

- Industrial Machinery and Equipment

- Aerospace and Defense

- Medical Devices

- Telecommunications (5G Infrastructure Enclosures)

Value Chain Analysis For Foam Gasket Material Market

The value chain of the Foam Gasket Material Market begins with upstream activities involving the sourcing and processing of core chemical precursors. This phase is dominated by large petrochemical and specialty chemical companies that supply monomers (like silicones, polyols, and isocyanates) and additives (foaming agents, flame retardants, plasticizers). The proprietary nature of many advanced foam formulations and the dependence on a few global suppliers for high-purity precursors introduce significant price sensitivity and supply risk at this stage. Success in the upstream segment relies heavily on R&D capabilities to develop new, environmentally compliant foaming technologies and maintain stable supply contracts.

The midstream segment involves the core manufacturing process, where base materials are synthesized into foam slabs or rolls using continuous foaming, molding, or extrusion processes. This phase includes major foam producers who specialize in controlling density, cell structure (open vs. closed), and material thickness. Value is added significantly through secondary processing, such as applying Pressure Sensitive Adhesives (PSAs), lamination with films or fabrics, and specialized treatments like conductive coatings for EMI applications. The final stage of the midstream involves converting the bulk foam into final gasket components through highly precise processes like die-cutting, rotary cutting, waterjet cutting, or Form-in-Place (FIP) gasketing, tailored specifically to OEM blueprints.

Downstream distribution channels are characterized by a mix of direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and aerospace industries, and indirect sales through specialized industrial distributors and converters. Distributors play a critical role, especially for smaller volumes and diverse industrial maintenance, repair, and operations (MRO) applications, by providing inventory management and localized technical support. Direct channels ensure close collaboration for highly customized and mission-critical applications (e.g., EV battery enclosures). The efficiency and technical capability of the distribution network—ensuring prompt delivery of highly specialized components—are crucial differentiators in a market driven by just-in-time manufacturing schedules.

Foam Gasket Material Market Potential Customers

Potential customers for foam gasket materials span a wide range of industries where sealing, protection, and noise mitigation are critical requirements for product performance and reliability. The primary buyers are large-scale Original Equipment Manufacturers (OEMs) in sectors characterized by high-volume production and stringent quality control. Automotive manufacturers represent the single largest customer base, focusing heavily on sealing car body structures, complex battery packs in EVs, and specialized components for advanced driver-assistance systems (ADAS) that require precise environmental protection against dust and water ingress (IP ratings).

Another major category of customers includes manufacturers of consumer and industrial electronics. Companies producing smartphones, computing hardware, networking gear, and large-format displays are constant buyers, demanding foams that are thin, highly compressible, and often conductive for simultaneous EMI shielding and cushioning. The growth of industrial IoT devices and ruggedized military electronics also drives demand for specialized foams capable of surviving harsh operating environments and extreme temperature fluctuations. These customers prioritize materials that comply with global electronics standards (e.g., UL 94 V-0 flammability ratings and RoHS compliance).

Furthermore, significant potential lies in the construction, HVAC, and industrial machinery sectors. Construction companies require durable foam materials for window and door seals, expansion joints, and roofing applications to meet increasingly strict building codes related to thermal efficiency and air leakage. Manufacturers of industrial equipment, such as pumps, compressors, and specialized processing equipment, rely on foam gaskets to protect sensitive internal components from oil, chemicals, and vibration, ensuring operational longevity and minimizing maintenance downtime. The buying criteria for these diverse customers vary widely, ranging from cost and large-volume consistency (HVAC) to high technical performance and strict material traceability (Aerospace).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rogers Corporation, 3M Company, Saint-Gobain Performance Plastics, Wacker Chemie AG, Dow Inc., Trelleborg AB, Huntsman Corporation, Armacell International S.A., Nitto Denko Corporation, Sika AG, Recticel NV/SA, Zotefoams plc, American Biltrite Inc., GCP Applied Technologies, Boyd Corporation, Custom Fabricating & Supplies, Stockwell Elastomerics, Gaska Tape Inc., Rubberlite Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam Gasket Material Market Key Technology Landscape

The technological landscape of the Foam Gasket Material Market is primarily defined by advancements in polymerization chemistry, foaming processes, and high-precision converting techniques. A key focus area is the development of specialized silicone and polyurethane chemistries to enhance flame retardancy and thermal stability, especially critical for EV battery safety standards. Innovations include formulating materials with low heat release rates and high dielectric strength. Furthermore, there is a substantial push towards microcellular foaming technology, which creates extremely fine and consistent cell structures, resulting in foams with improved mechanical properties, reduced weight, and superior sealing integrity, particularly vital for miniaturized electronics and lightweight automotive applications.

Processing technologies are equally transformative, with continuous investment in automated, high-speed converting systems. Laser cutting and advanced rotary die-cutting techniques offer unparalleled precision for complex geometric designs required by OEMs, reducing material waste and enabling the mass production of intricate gaskets. The rising adoption of Form-in-Place (FIP) gasketing technology is a significant trend, where liquid or semi-liquid foam is dispensed directly onto components and cured in place. FIP offers high flexibility in design, excellent adhesion, and seamless sealing, reducing the need for prefabricated gaskets and minimizing potential leak paths, leading to increased reliability in demanding industrial enclosures.

Material innovation also extends to multi-functional composites. Manufacturers are increasingly integrating conductive fillers (like nickel-graphite particles) into elastomeric foams to create EMI/RFI shielding gaskets that simultaneously provide environmental sealing and electrical conductivity. This technological convergence addresses the complex requirements of modern electronic systems, where component density and electromagnetic interference are major performance limiting factors. Furthermore, sustainability is driving process innovation, with companies investing in supercritical CO2 foaming techniques, which replace traditional chemical blowing agents, reducing VOC emissions and aligning with stricter regulatory mandates in mature markets like Europe.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Engine: APAC holds the largest market share and is projected to exhibit the highest growth rate due to its position as the global hub for electronics manufacturing and automotive production. China, South Korea, and Japan drive demand, particularly fueled by massive investments in domestic Electric Vehicle manufacturing and the robust deployment of 5G and industrial IoT infrastructure. The demand here leans heavily towards cost-effective, high-volume production of EPDM and PU foams for construction, alongside high-performance silicone for electronics and new energy vehicles. Government initiatives supporting manufacturing competitiveness and infrastructural expansion solidify APAC's leading role in consumption and production.

- North America's Focus on High-Performance and EV Sector: The North American market is characterized by a high demand for premium, high-specification foam materials, largely driven by the stringent requirements of the aerospace, defense, and high-end automotive sectors. The rapid expansion of EV manufacturing facilities in the US and Canada is a major market stimulant, specifically creating substantial demand for thermally conductive and flame-retardant silicone foams for lithium-ion battery packs. The region also emphasizes regulatory compliance, leading to increased adoption of low-VOC and halogen-free formulations, pushing technological innovation in sustainability and fire safety standards.

- Europe's Emphasis on Regulatory Compliance and Sustainability: Europe represents a mature market focusing intensely on environmental sustainability and adherence to regulatory frameworks such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and stringent waste directives. Key drivers include the mature automotive industry and high demand from the construction sector for energy-efficient sealing materials. The adoption of advanced, closed-cell polyurethane and EPDM foams for passive house standards and insulation in commercial buildings is strong. Furthermore, European manufacturers are leading the development of bio-based and recyclable foam options to meet corporate social responsibility targets and emerging circular economy mandates.

- Latin America (LATAM) Emerging Industrial Applications: The Latin American market exhibits steady growth, primarily linked to the stabilization of key economies and investment in infrastructure and localized manufacturing, particularly in Brazil and Mexico. Demand is concentrated in the automotive assembly sector and construction projects. While price sensitivity remains a factor, there is increasing adoption of standardized EPDM and Neoprene foams. The modernization of industrial facilities and the subsequent need for reliable sealing solutions in sectors like mining and energy generation also contribute significantly to regional foam gasket consumption.

- Middle East and Africa (MEA) Infrastructure Development: Growth in the MEA region is intrinsically linked to mega-projects in construction, oil and gas infrastructure, and diversification efforts away from fossil fuels. High ambient temperatures necessitate foam gaskets with excellent UV resistance and thermal stability, driving demand for specialized silicone and high-grade EPDM materials in critical infrastructure applications. Investments in renewable energy projects (solar farms) and telecommunications infrastructure in countries like Saudi Arabia and the UAE further propel the requirement for durable, high-reliability sealing solutions for outdoor enclosures and thermal protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam Gasket Material Market.- Rogers Corporation

- 3M Company

- Saint-Gobain Performance Plastics

- Wacker Chemie AG

- Dow Inc.

- Trelleborg AB

- Huntsman Corporation

- Armacell International S.A.

- Nitto Denko Corporation

- Sika AG

- Recticel NV/SA

- Zotefoams plc

- American Biltrite Inc.

- GCP Applied Technologies

- Boyd Corporation

- Custom Fabricating & Supplies

- Stockwell Elastomerics

- Gaska Tape Inc.

- Rubberlite Inc.

- Sekisui Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Foam Gasket Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific material characteristics are driving the preference for foam gaskets in Electric Vehicle (EV) battery systems?

The preference for foam gaskets in EV battery systems is driven by their superior thermal management properties, essential for battery safety and longevity. Specifically, closed-cell silicone and polyurethane foams offer excellent compression set resistance, ensuring long-term sealing against moisture and dust ingress (IP standards), and high-temperature resistance coupled with low flammability (often meeting UL 94 V-0 or equivalent fire safety standards). Furthermore, some specialized foams provide crucial thermal insulation to manage temperature variations within the battery enclosure, mitigating thermal runaway risks.

How does the choice between open-cell and closed-cell foam structures impact gasket performance?

The cell structure fundamentally determines the function. Closed-cell foams possess distinct, non-interconnected bubbles, making them impermeable to liquids and gases, ideal for environmental sealing (dust, water, air). They offer good cushioning and stability under compression. Open-cell foams have interconnected bubbles, allowing air to pass through, making them highly effective for acoustic absorption (NVH applications), filtering, and pressure equalization. Open-cell structures generally have better compression set recovery but poor moisture barrier properties.

Which regions are experiencing the most significant growth in the demand for foam gaskets, and why?

The Asia Pacific (APAC) region, particularly China, South Korea, and Southeast Asia, is experiencing the most significant growth. This surge is attributed to the region's massive manufacturing base for consumer electronics, rapid scaling of domestic EV production, and significant government investment in infrastructure and 5G telecommunications deployment. These high-volume industries require substantial quantities of both standard and specialized EMI-shielding foam gaskets for component protection and reliable enclosure sealing.

What are the primary challenges related to raw material sourcing in the foam gasket market?

The primary challenge involves the high cost and supply chain volatility of key chemical precursors, notably silicone monomers and petrochemical derivatives used for EPDM and polyurethane. Disruptions in the global chemical supply chain, geopolitical events, and fluctuating oil prices directly impact manufacturing costs and market stability. This requires manufacturers to maintain diverse supplier networks and invest in vertical integration where feasible to mitigate cost fluctuation risks and ensure consistent supply of specialized additives.

What emerging technologies are transforming the manufacturing of customized foam gaskets for high-precision applications?

Form-in-Place (FIP) gasketing and advanced rotary die-cutting techniques are transforming high-precision manufacturing. FIP allows automated, non-contact dispensing of liquid foam directly onto complex substrates, creating seamless seals with superior adhesion and minimal tolerance deviations, ideal for electronics enclosures. Advanced rotary die-cutting, coupled with computer vision and AI for quality control, enables the rapid, high-volume production of intricate die-cut gaskets with extremely tight tolerances, critical for aerospace and medical device components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager