Foam Sandwich Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435035 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Foam Sandwich Panels Market Size

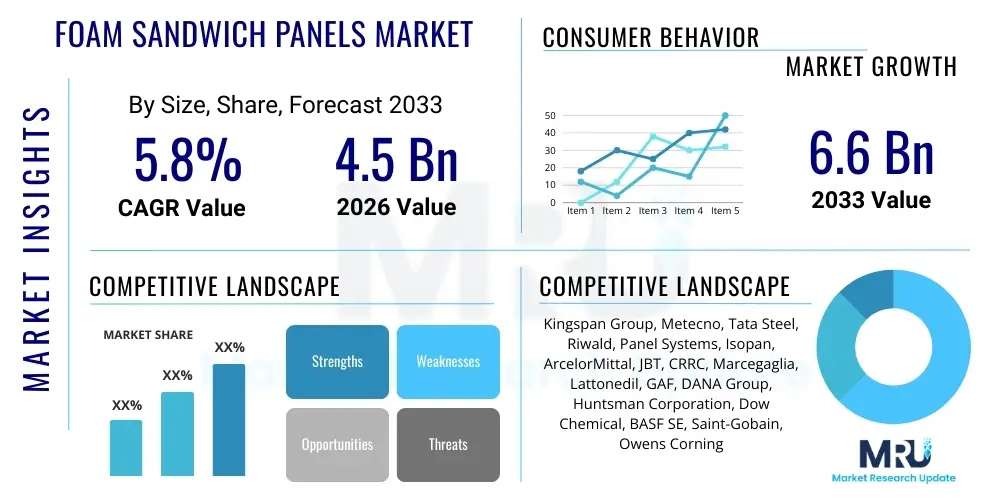

The Foam Sandwich Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasing global mandates for energy-efficient construction practices and the accelerated adoption of pre-engineered building systems across residential, commercial, and industrial infrastructure projects. The durability and superior thermal insulation properties inherent in foam sandwich panels make them a preferred material solution over traditional construction components, particularly in regions experiencing rapid urbanization and stringent building codes focused on sustainability.

Foam Sandwich Panels Market introduction

Foam Sandwich Panels, often referred to as Structural Insulated Panels (SIPs), are composite construction materials comprising a core of insulating foam (such as polyurethane, polyisocyanurate, or expanded polystyrene) bonded between two structural facings, typically made of metal (steel or aluminum), oriented strand board (OSB), or fiber cement. These panels are engineered for high-performance applications, providing exceptional thermal insulation, structural rigidity, and ease of installation. Their lightweight nature combined with high load-bearing capacity positions them as vital components in modern, fast-track construction methods, significantly reducing construction time and overall project costs.

Major applications for foam sandwich panels span cold storage facilities, industrial buildings, commercial offices, and residential housing. In industrial sectors, they are critical for maintaining precise temperature control, particularly in food processing, pharmaceutical warehousing, and refrigerated transport. The core benefit derived from their use is substantial energy savings due to minimized heat transfer, contributing directly to lower operational expenses and reduced carbon footprints. Furthermore, these panels offer excellent resistance to fire, moisture, and pests, extending the lifespan of the structures they constitute.

The market is primarily driven by global initiatives promoting sustainable infrastructure development and green building certifications. Government incentives for energy efficiency and the rising cost of conventional energy sources compel builders and developers to seek advanced insulating materials. Rapid industrialization across Asia Pacific and Latin America, coupled with the increasing demand for prefabricated and modular construction systems, further acts as a powerful catalyst for market growth, ensuring foam sandwich panels remain central to future construction material portfolios.

Foam Sandwich Panels Market Executive Summary

The Foam Sandwich Panels market is exhibiting robust growth, primarily propelled by favorable regulatory landscapes emphasizing thermal performance in buildings and rapid advancements in core material technology, such as the development of non-CFC blowing agents and enhanced fire-retardant foams. Business trends indicate a strong move toward vertical integration among key manufacturers, enabling greater control over supply chain volatility and material quality, alongside a focus on offering customized panel solutions tailored for specific climate zones and structural requirements. Furthermore, the increasing adoption of automated manufacturing processes, leveraging robotics and sophisticated metering equipment, is improving production efficiency and reducing the cost per square meter, thereby expanding the market's competitive edge against traditional construction materials.

Regionally, the Asia Pacific (APAC) stands out as the highest growth market due to massive investments in infrastructure development, particularly in China and India, focusing on modern logistics and cold chain facilities. North America and Europe, while mature markets, maintain dominance in terms of technological adoption and value, driven by stringent energy efficiency mandates like the European Union's Energy Performance of Buildings Directive (EPBD) and the push for Net-Zero Energy Buildings (NZEBs). Segment trends underscore the polyurethane (PU) and polyisocyanurate (PIR) cores as leading choices due to their superior R-value per unit thickness, dominating high-performance applications like cold storage and specialized industrial environments, whereas metal-faced panels retain the largest share among facing materials due to their durability and aesthetic flexibility.

Overall, the market trajectory suggests continued strong demand, pivoting heavily on sustainability goals and industrialized construction techniques. Strategic partnerships between panel manufacturers and construction technology providers are becoming essential for optimizing installation speed and structural integrity. Key stakeholders are investing heavily in research and development to enhance panel fire resistance (moving towards non-combustible cores like mineral wool in specific fire-sensitive applications) and improve circular economy aspects through better material recyclability, ensuring long-term market relevance and compliance with evolving global environmental standards.

AI Impact Analysis on Foam Sandwich Panels Market

User inquiries regarding AI's influence in the Foam Sandwich Panels market predominantly revolve around three critical themes: optimizing manufacturing efficiency, enhancing predictive quality control, and streamlining supply chain logistics for complex construction projects. Users are keenly interested in how Artificial Intelligence can minimize material waste during cutting and shaping processes, especially for non-standardized panel sizes required in unique architectural designs. Furthermore, there is significant concern and expectation regarding AI's ability to analyze real-time production data from sensors to preemptively detect defects in foam density or bonding strength, ensuring panels meet stringent performance standards before leaving the factory. Finally, questions frequently address AI algorithms managing complex logistics, optimizing panel stacking, sequencing deliveries to construction sites (Just-In-Time delivery), and predicting material demand fluctuations based on regional construction forecasts and economic indicators.

The integration of machine learning algorithms is poised to revolutionize the design phase of sandwich panels. AI systems can analyze vast datasets concerning climate patterns, structural loads, and material properties to generate optimal panel specifications, minimizing material usage while maximizing thermal performance and structural integrity. This transition moves the industry from traditional, empirically derived specifications toward highly customized, performance-driven panel solutions, thereby broadening the application scope and efficiency of foam sandwich panels in highly demanding construction projects. The predictive maintenance capabilities of AI also extend the operational lifespan of the manufacturing equipment itself, reducing unplanned downtime and ensuring consistent production output necessary to meet the burgeoning global demand for prefabricated building components.

Moreover, AI contributes substantially to sustainability objectives within the market. By simulating the long-term energy performance of buildings constructed with these panels under various climate scenarios, AI helps architects and engineers select the most appropriate panel type and thickness, directly contributing to lower operational carbon emissions over the building's lifecycle. The ability to forecast material pricing and identify alternative, locally sourced raw material suppliers through AI-driven analytics also enhances supply chain resilience and reduces transportation-related emissions, aligning the industry closer to circular economy principles and increasingly strict environmental, social, and governance (ESG) reporting requirements.

- AI-powered predictive maintenance optimizes manufacturing equipment uptime, enhancing production volume.

- Machine learning algorithms enable real-time quality control checks for foam density and bonding strength, minimizing defects.

- AI optimizes panel cutting patterns, significantly reducing material waste (yield optimization).

- Intelligent logistics platforms manage panel inventory, sequencing, and Just-In-Time delivery to complex construction sites.

- Generative design tools utilize AI to optimize panel specifications based on thermal load requirements and structural demands.

- Natural Language Processing (NLP) assists in analyzing complex construction blueprints for automatic panel ordering and customization.

- AI models predict future demand trends for specific panel types (e.g., PIR vs. PU), aiding strategic production planning.

DRO & Impact Forces Of Foam Sandwich Panels Market

The Foam Sandwich Panels market is driven primarily by the escalating demand for energy-efficient construction, rapid urbanization necessitating modular and prefabricated building systems, and government mandates promoting green building standards globally. Restraints include the high initial capital investment required for specialized panel manufacturing facilities and the volatility in raw material prices, particularly petrochemical-derived foam core components like MDI and TDI. Opportunities abound in the burgeoning cold chain logistics sector, the increasing need for affordable disaster-resistant housing, and the development of panels incorporating bio-based or recycled core materials, fostering sustainable innovation. The market's stability is heavily influenced by the impact forces of technological advancement in fire safety standards and the fluctuating costs of conventional energy, which directly affect the economic viability of energy-saving insulation products.

Key drivers center around the demonstrated performance benefits of these panels. Their exceptional thermal insulation translates directly into reduced heating, ventilation, and air conditioning (HVAC) costs, offering a compelling Return on Investment (ROI) for building owners. Furthermore, the inherent speed and simplicity of panel installation dramatically lower labor costs and project timelines compared to traditional brick-and-mortar or stick-built construction methods. This is particularly appealing in developed economies facing skilled labor shortages and in developing regions requiring fast construction solutions for housing and commercial expansion. The structural capabilities of SIPs also allow for larger spans and innovative architectural designs, further cementing their position in modern construction portfolios.

Conversely, the primary restraints, besides cost volatility, involve overcoming entrenched skepticism regarding non-traditional building methods and ensuring that installation practices adhere strictly to manufacturer specifications to maintain structural and thermal performance integrity. A single poorly installed panel can compromise the entire building envelope's efficiency. The impact forces are further shaped by stringent regulations governing fire resistance; as building codes evolve, manufacturers face continuous pressure to innovate core materials (e.g., transitioning from standard EPS to PIR or mineral wool) to meet heightened safety requirements, which often increases manufacturing complexity and material cost, creating a delicate balance between performance, price, and regulatory compliance.

Segmentation Analysis

The Foam Sandwich Panels market is highly segmented based on core material, facing material, application, and end-use, allowing manufacturers to cater to specialized market demands ranging from high-performance industrial cold storage to basic residential housing insulation. Core material segmentation is critical as it dictates the panel’s R-value, fire resistance, and cost structure, with Polyurethane (PU) and Polyisocyanurate (PIR) leading the high-performance segments due to superior thermal efficiency, while Expanded Polystyrene (EPS) maintains dominance in cost-sensitive and standard applications. Facing material diversity, including materials like profiled steel, aluminum, and fiber-reinforced plastic (FRP), addresses specific structural, aesthetic, and environmental resistance needs, particularly important in harsh industrial environments or food processing facilities where hygiene and chemical resistance are paramount. The sophisticated categorization reflects the industry’s maturity and its capability to provide customized solutions for highly demanding construction projects worldwide.

The application segment distinguishes panels used for roofs, walls, and floors, each requiring specific load-bearing and installation properties, driving differentiation in panel thickness and joint design. Wall panels typically represent the largest market share due to the sheer surface area of building envelopes, followed closely by roofing panels crucial for thermal performance and weatherproofing. Furthermore, the end-use segmentation provides profound insights into demand drivers, clearly separating demand generated by the residential, commercial, industrial, and infrastructure sectors. The industrial segment, characterized by high-specification requirements for temperature-controlled environments (such as cold rooms and pharmaceutical storage), is projected to experience the fastest growth due to global expansions in cold chain logistics and manufacturing automation initiatives.

Geographically, market segmentation clearly reveals regional maturity and technological readiness. North America and Europe prioritize panels that adhere to stringent fire safety and energy performance codes, leading to higher adoption rates of PIR and mineral wool cores. Conversely, APAC's market growth is highly volume-driven, with EPS cores dominating the residential and light commercial construction segments, emphasizing affordability and speed of deployment. Strategic market players must meticulously analyze these layered segmentations to accurately forecast localized demand, optimize manufacturing throughput, and tailor their product offerings and distribution channels to maximize market penetration across diverse global economic landscapes and regulatory environments.

- Core Material:

- Polyurethane (PU) Foam Sandwich Panels

- Polyisocyanurate (PIR) Foam Sandwich Panels

- Expanded Polystyrene (EPS) Foam Sandwich Panels

- Extruded Polystyrene (XPS) Foam Sandwich Panels

- Phenolic Foam Sandwich Panels

- Facing Material:

- Steel (Pre-painted Galvanized Iron - PPGI/PPGL)

- Aluminum

- Fiber-Reinforced Plastic (FRP)

- OSB (Oriented Strand Board)

- Cement Board/Plywood

- Application:

- Roofs

- Walls

- Floors

- Partition Walls

- End-Use:

- Residential Buildings

- Commercial Buildings (Offices, Retail)

- Industrial Buildings (Factories, Warehouses)

- Cold Storage & Refrigeration Facilities

- Agricultural Buildings

- Modular & Prefabricated Buildings

Value Chain Analysis For Foam Sandwich Panels Market

The value chain for the Foam Sandwich Panels market begins with the upstream suppliers responsible for providing critical raw materials. This includes major chemical producers supplying isocyanates (MDI/TDI) and polyols for PU/PIR foam cores, petrochemical companies supplying styrene monomers for EPS/XPS, and steel mills providing pre-painted galvanized iron (PPGI) or aluminum sheets for facings. Volatility in the pricing of these petrochemical and metal commodities significantly impacts the cost of the finished panel, necessitating strong supplier relationships and effective hedging strategies. Upstream analysis highlights that innovation in sustainable raw materials, such as bio-based polyols or recycled steel, is crucial for future cost stabilization and environmental compliance, pushing manufacturers toward strategic R&D investments in sustainable material sourcing.

The midstream phase is dominated by the manufacturing and processing of the panels. This involves highly mechanized continuous lamination lines (for PU/PIR/EPS) or discontinuous processes for specialized panels. Manufacturers must employ advanced machinery for precise chemical mixing, bonding, curing, and automated cutting and profiling. Efficiency in this stage is paramount, utilizing lean manufacturing principles to minimize waste and optimize panel dimensions for specific orders. Distribution channels are bifurcated into direct and indirect routes. Direct sales are common for large-scale industrial projects or specialized cold storage facilities, where manufacturers provide installation and technical support as part of the package. Indirect channels rely on established networks of distributors, material suppliers, and authorized construction contractors who stock and sell standard panel sizes to smaller commercial and residential builders.

Downstream analysis focuses on the final consumption across various end-use sectors, including general contractors, specialized cold chain builders, and modular housing developers. Demand is often project-driven and cyclical, requiring robust inventory management to meet fluctuating timelines. The success of the downstream activities is heavily dependent on skilled installation teams who ensure the panels are correctly interlocked and sealed, maximizing thermal performance and structural integrity. Effective after-sales support, including handling performance warranties and replacement parts, completes the value chain, ensuring high customer satisfaction and repeat business, particularly within the highly regulated food safety and pharmaceutical storage segments.

Foam Sandwich Panels Market Potential Customers

Potential customers for Foam Sandwich Panels span a diverse range of industries and construction modalities, essentially encompassing any entity requiring efficient, rapid, and thermally superior building envelopes. The primary segment comprises specialized contractors and developers focused on building industrial assets, particularly cold chain infrastructure such as refrigerated warehouses, deep-freeze storage facilities, and processing plants for food and pharmaceuticals. These end-users, known as institutional buyers, prioritize high R-values, stringent fire safety ratings (PIR cores), and hygienic facing materials (FRP or specialized coatings) to meet regulatory requirements and minimize critical energy expenditures associated with temperature maintenance, making them high-value, recurring customers in this market.

A second major customer category includes commercial and residential developers increasingly adopting modular and prefabricated construction techniques. As time-to-market becomes a critical competitive factor, these builders utilize SIPs for fast-track construction of hotels, temporary housing, school extensions, and office parks. For this segment, ease of installation, overall structural rigidity, and aesthetic versatility (available colors and profiles) are key purchasing criteria. The integration of building information modeling (BIM) allows manufacturers to deliver highly customized panel kits directly to the site, perfectly fitting the industrialized construction ethos employed by these forward-thinking construction management firms.

Furthermore, government and public sector entities represent significant potential customers, especially in regions focused on rapid infrastructure deployment, disaster relief housing, and energy conservation retrofits for public buildings. Utilities and telecommunication companies also utilize specialized foam sandwich panels for building protective enclosures for sensitive equipment or remote control rooms, requiring specific non-metallic or shielding properties. Ultimately, any organization seeking a long-term, low-maintenance, and highly insulated structure that contributes positively to sustainability mandates constitutes a strong potential buyer for high-quality foam sandwich panel solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group, Metecno, Tata Steel, Riwald, Panel Systems, Isopan, ArcelorMittal, JBT, CRRC, Marcegaglia, Lattonedil, GAF, DANA Group, Huntsman Corporation, Dow Chemical, BASF SE, Saint-Gobain, Owens Corning |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam Sandwich Panels Market Key Technology Landscape

The Foam Sandwich Panels market technology landscape is characterized by continuous advancements in lamination processes, core material chemistry, and joint design aimed at enhancing panel performance, fire resistance, and environmental footprint. A pivotal technology involves the evolution of continuous production lines, which utilize high-pressure, automated injection systems to ensure uniform density and adhesion of the foam core to the facings. This process, particularly crucial for producing high-quality PIR panels, leverages sophisticated metering units and robotic application systems to precisely control the exothermal reaction during curing, thereby maximizing the thermal efficiency (R-value) and structural integrity of the composite panel. Furthermore, manufacturers are increasingly integrating sensor technology and IoT monitoring directly into the production line to gather real-time data on material flows, temperature profiles, and bond line integrity, facilitating predictive quality control and minimizing production defects.

Another significant technological focus lies in developing next-generation core chemistries that eliminate harmful blowing agents and improve fire performance without compromising insulation value. The shift from HCFCs to low-Global Warming Potential (GWP) alternatives, such as HFO-based blowing agents, is a major regulatory and technological driver. Concurrently, innovations in fire-retardant additives and the increasing market acceptance of non-combustible core materials like mineral wool within the sandwich structure (hybrid panels) address the escalating demands for enhanced fire safety in densely populated commercial and industrial zones. These advancements necessitate continuous investment in chemical research and the adaptation of manufacturing equipment to handle these varied and sometimes more viscous core materials effectively, ensuring the industry maintains compliance with global safety codes like NFPA and European standards.

Beyond material composition, advancements in mechanical design, particularly proprietary joint systems (e.g., labyrinth joints, hidden fasteners, and tongue-and-groove profiles), are critical. These technologies ensure airtight and thermally efficient sealing between panels, minimizing thermal bridging and maximizing the overall performance of the building envelope. The integration of Building Information Modeling (BIM) software tools with manufacturing lines represents a crucial technological shift, allowing for seamless communication between architects, structural engineers, and the panel production facility. This digital integration facilitates the automated production of customized, pre-cut panels, reducing on-site waste and accelerating construction schedules, thereby reinforcing the foam sandwich panel's competitive advantage within the modern construction ecosystem driven by precision and efficiency.

Regional Highlights

Regional dynamics play a crucial role in shaping the Foam Sandwich Panels market, reflecting varying climatic needs, regulatory pressures, and construction practices across global markets. Each region presents unique opportunities and challenges based on its economic growth trajectory and commitment to sustainable building mandates, necessitating tailored market penetration strategies by global manufacturers.

- Asia Pacific (APAC): Represents the fastest-growing market due to rapid urbanization, massive infrastructure development, and exponential expansion of the cold chain sector driven by large populations and growing middle-class demand for fresh and frozen goods. Countries like China, India, and Southeast Asian nations are investing heavily in logistics parks, industrial zones, and affordable housing, creating immense demand for high-volume, cost-effective EPS and PU panels. Government support for manufacturing and exports further stimulates market activity.

- North America: A technologically mature market characterized by stringent building energy codes (e.g., ASHRAE 90.1) and a high preference for high R-value PIR panels. The demand is stable, driven primarily by commercial construction, refurbishment projects focused on energy retrofitting older buildings, and sophisticated industrial applications requiring high fire ratings and structural integrity. Labor costs necessitate the continued adoption of fast-installing panel systems.

- Europe: Dominated by strong environmental regulations, particularly the push toward nearly Zero Energy Buildings (nZEB). This region mandates the highest standards for thermal performance and fire safety, making PIR and mineral wool cores highly favored. Western Europe is a key market for sophisticated, architecturally exposed panels, while Eastern Europe is seeing growth tied to industrial and logistics development, leveraging EU funding and compliance requirements.

- Latin America (LATAM): Exhibits emerging growth, particularly in countries like Brazil and Mexico, driven by industrialization, mining infrastructure, and the expansion of the agricultural cold chain. The market is price-sensitive, balancing the need for insulation in diverse climates with affordability, leading to a strong presence of EPS-cored panels and increasing adoption of continuous line technology for localized production.

- Middle East and Africa (MEA): Growth is primarily fueled by large-scale commercial and industrial construction projects in the GCC states (UAE, Saudi Arabia) requiring superior insulation to combat extreme heat, coupled with significant investment in modular buildings for construction camps and temporary facilities. The African segment is nascent but offers substantial long-term potential in areas requiring rapid, low-cost housing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam Sandwich Panels Market.- Kingspan Group

- Metecno

- Tata Steel

- Riwald

- Panel Systems

- Isopan

- ArcelorMittal

- JBT

- CRRC

- Marcegaglia

- Lattonedil

- GAF

- DANA Group

- Huntsman Corporation

- Dow Chemical

- BASF SE

- Saint-Gobain

- Owens Corning

Frequently Asked Questions

Analyze common user questions about the Foam Sandwich Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Foam Sandwich Panels over conventional building materials?

Foam sandwich panels offer superior thermal performance (high R-value per thickness), leading to significant long-term energy savings. They also enable faster construction timelines, reduce on-site labor requirements, and possess excellent strength-to-weight ratios, making them ideal for rapid, energy-efficient, and structurally sound prefabricated construction.

How do PIR and EPS core materials differ in Foam Sandwich Panels?

PIR (Polyisocyanurate) panels offer significantly better fire resistance and a higher R-value (thermal resistance) compared to EPS (Expanded Polystyrene) panels, making PIR preferred for demanding commercial and industrial applications and regions with strict fire codes. EPS, while offering good insulation, is typically more cost-effective and used predominantly in standard residential or light commercial construction.

Is the Foam Sandwich Panels market sustainable, given the use of petrochemicals?

The market is increasingly transitioning toward sustainability. While traditional foam cores use petrochemicals, manufacturers are developing bio-based polyols and utilizing low-GWP (Global Warming Potential) blowing agents. Crucially, the extreme energy efficiency delivered by these panels over a building's lifecycle significantly reduces its operational carbon footprint, positioning them as a sustainable choice in modern, high-performance construction.

Which end-use segment drives the highest demand for specialized Foam Sandwich Panels?

The Industrial segment, particularly Cold Storage and Refrigeration Facilities, drives the highest demand for specialized panels. These applications require panels with maximum thermal insulation (thick PIR cores), high hygienic standards (FRP or specialized metallic facings), and specific fire safety ratings to maintain precise, consistent, and safe temperature environments.

What major regulatory factors influence the adoption of Foam Sandwich Panels globally?

Global adoption is primarily driven by mandates related to building energy efficiency, such as the EU's nZEB targets and regional government incentives for green building certifications (e.g., LEED, BREEAM). Furthermore, evolving international fire safety codes (NFPA, EN standards) dictate the choice of core materials, often favoring higher-performing PIR or mineral wool composites in commercial construction projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager