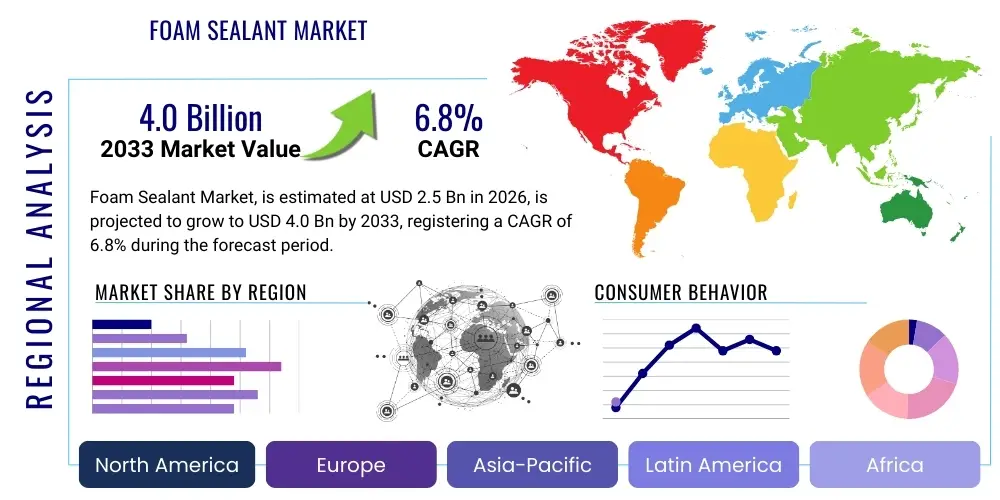

Foam Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438181 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Foam Sealant Market Size

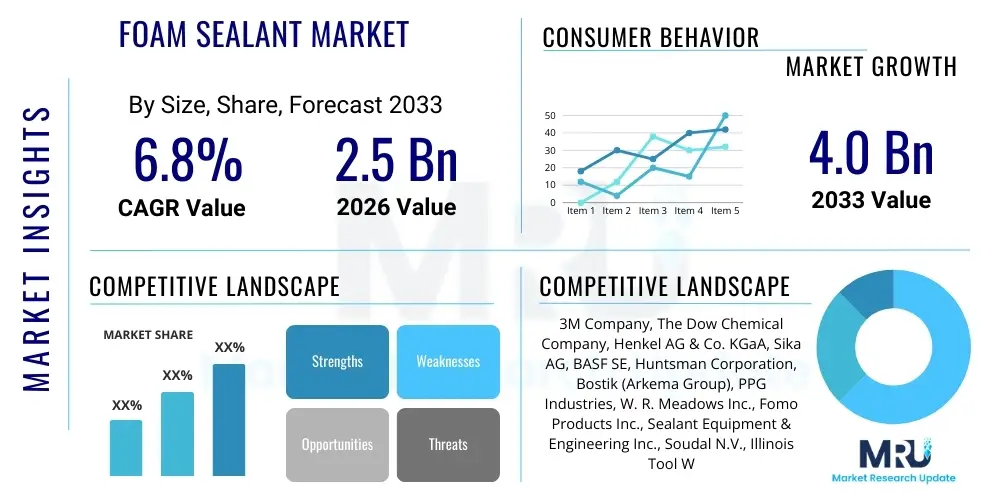

The Foam Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Foam Sealant Market introduction

Foam sealants, often based on polyurethane chemistry, are essential building and construction materials designed to fill, insulate, and seal gaps and cracks against air, moisture, and pests. These products are highly valued for their exceptional expansion capabilities, allowing them to conform to irregular surfaces and provide a continuous, high-performance thermal barrier. The market is defined by a continuous drive toward energy efficiency in both residential and commercial structures, making foam sealants a critical component in achieving stringent building codes related to airtightness and thermal performance. Their versatility extends across various applications, including sealing windows and doors, plumbing penetrations, and structural joints.

The core product description centers on pressurized chemical formulations that, upon dispensing, react with atmospheric moisture to cure and expand significantly, sometimes up to 50 times their liquid volume. This expansive property differentiates foam sealants from traditional caulks and tapes. Major applications span new construction, renovation, and repair activities within the residential, commercial, and industrial sectors. Specific uses include enhancing HVAC system efficiency by sealing ductwork, stabilizing electrical components, and providing acoustical dampening in partition walls. The adoption is particularly strong in regions experiencing extreme temperature fluctuations, where insulation quality directly impacts utility costs and occupant comfort.

Key benefits driving market adoption include superior insulation R-value compared to other gap-filling materials, exceptional adhesion to diverse substrates (wood, metal, concrete), and long-term durability. The market growth is principally driven by escalating global construction activities, favorable government policies promoting green building initiatives, and the increasing consumer awareness regarding the cost savings associated with energy-efficient homes. Furthermore, technological advancements leading to low-VOC (Volatile Organic Compound) and fire-retardant foam formulations are expanding the applicability of these sealants in sensitive environments and high-risk structural applications, ensuring continuous market momentum throughout the forecast period.

Foam Sealant Market Executive Summary

The Foam Sealant Market is characterized by robust growth, propelled primarily by global efforts toward enhancing structural energy efficiency and the rapid expansion of the construction and infrastructure sectors, particularly in the Asia Pacific region. Key business trends include the consolidation of manufacturing capabilities among major chemical producers and a heightened focus on sustainability, driving innovation towards bio-based and non-isocyanate formulations. The competitive landscape is intensely focused on product performance metrics, such as higher R-values, faster curing times, and improved dimensional stability, catering to professional contractors demanding efficiency and reliability on job sites. Furthermore, the shift towards DIY and retail channels necessitates user-friendly, single-component products, broadening the market base beyond specialized commercial applications.

Regional trends indicate that North America and Europe remain mature but significant markets, primarily driven by stringent regulations governing building thermal performance and extensive repair and renovation activities. Conversely, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market due to massive urbanization projects, burgeoning middle-class housing development, and increasing foreign direct investment in manufacturing infrastructure. These emerging markets exhibit high demand for affordable, effective sealing solutions, although regulatory harmonization related to product standards presents a mild challenge. The Middle East and Africa also show promising growth, spurred by large-scale infrastructure projects associated with economic diversification and tourism expansion.

Segmentation trends highlight the dominance of the polyurethane segment due to its versatility and cost-effectiveness, although silicone-based foams are gaining traction in high-temperature or specialized industrial applications. The single-component foam segment commands the largest market share, favored by its ease of use and suitability for DIY applications and small-to-medium contractors. However, the two-component foam segment is experiencing accelerated growth, driven by large commercial and industrial projects that require faster cure rates, superior structural integrity, and high-volume output. Application-wise, the residential construction sector remains the primary end-user, but the industrial insulation and transportation sectors are expected to contribute significantly to market expansion through specialized, high-performance foam products.

AI Impact Analysis on Foam Sealant Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Foam Sealant Market frequently focus on optimizing manufacturing processes, improving application precision, and enhancing supply chain efficiency. Key themes center around whether AI can reduce material waste during production (a common concern given the chemical nature of the product), how autonomous systems might ensure consistent foam quality and expansion characteristics, and the potential for AI-driven analytics to predict demand fluctuations across geographically diverse construction sectors. Users often express expectations regarding the integration of machine learning algorithms in quality control, moving beyond traditional batch testing to real-time, predictive analytics that ensure every canister meets strict performance standards, particularly concerning dimensional stability and R-value retention over time.

AI's influence is expected to revolutionize several aspects, starting with raw material procurement and formulation optimization. Machine learning models can analyze vast datasets concerning chemical purity, reaction kinetics, and environmental variables (temperature, humidity) to dynamically adjust chemical ratios, ensuring optimal yield and minimizing waste in pressurized containers. Furthermore, AI-powered predictive maintenance in manufacturing plants will reduce downtime and increase operational throughput, directly impacting the supply chain's ability to meet sudden surges in construction demand. The long-term impact involves integrating AI-enhanced robotics for precise, automated application of foam sealants in modular construction facilities, where consistency and speed are paramount, thereby reducing reliance on manual labor and minimizing application errors that lead to thermal bridging.

- AI optimizes chemical blending ratios for higher product consistency and reduced material waste.

- Predictive maintenance driven by AI minimizes manufacturing plant downtime, increasing production capacity.

- Machine learning algorithms enhance quality control by analyzing real-time curing data and expansion profiles.

- AI-driven supply chain management improves inventory forecasting and optimizes logistics for volatile construction demands.

- Integration of AI with robotics facilitates precise, automated foam application in large-scale modular construction.

- Advanced analytics predict regional demand shifts based on building permit data and macroeconomic indicators.

DRO & Impact Forces Of Foam Sealant Market

The Foam Sealant Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory. The primary driving force is the global imperative for energy-efficient buildings, catalyzed by regulatory mandates like net-zero building codes and rising energy costs, which necessitate high-performance insulation and sealing materials. Simultaneously, the market is constrained by the volatility in the prices of key raw materials, particularly MDI (methylene diphenyl diisocyanate) and various polyols, which impacts manufacturers' profitability and pricing strategies. However, vast opportunities exist in developing sustainable, low-Global Warming Potential (GWP) formulations and expanding specialized applications in the rapidly growing fields of electric vehicle battery enclosures and cold storage infrastructure. These internal and external pressures create measurable impact forces dictating market movement and strategic investment.

Key drivers include the massive global growth in residential and commercial remodeling, where foam sealants are vital for quick, effective air sealing upgrades. The superior performance characteristics—such as flexibility, durability, and resistance to mold and mildew—position foam sealants favorably against traditional alternatives. Restraints primarily involve regulatory hurdles surrounding VOC emissions and flammability concerns associated with traditional polyurethane foams, prompting continuous, costly R&D efforts to comply with increasingly strict health and safety standards. Furthermore, the necessity for specialized application training for two-component foams occasionally limits broader market adoption among non-professional users. Successfully navigating these restraints involves innovating toward safer, greener chemical profiles.

Impact forces are determined by the balance between technological advancements and regulatory pressures. The opportunity for market participants lies in leveraging advancements in nano-technology to create thinner, yet more effective insulating layers, and exploiting the expanding trend of modular and prefabricated construction, which requires factory-applied, highly reliable sealing solutions. The strongest impact force is the mandatory push toward sustainable chemistry; companies that successfully transition to bio-based polyols or develop reliable non-isocyanate polyurethane (NIPU) foams will gain significant competitive advantages and market leadership. Conversely, high capital expenditure required for continuous compliance with fire safety standards and environmental regulations acts as a notable barrier to entry for smaller manufacturers.

Segmentation Analysis

The Foam Sealant Market segmentation provides a critical view of product adoption based on chemical composition, product type, end-use application, and dispensing mechanism. Understanding these segments is vital for strategic market positioning, allowing manufacturers to tailor R&D efforts and marketing strategies to specific end-user requirements, such as focusing on specialized, two-component systems for large infrastructure projects or single-component, retail-friendly aerosols for the DIY consumer market. The polyurethane segment dominates due to its proven efficacy, low cost, and expansive nature, making it the default choice across standard construction applications.

Further analysis reveals distinct demand patterns across end-use sectors. The residential sector maintains the largest share, driven by homeowner emphasis on energy conservation and comfort upgrades. Conversely, the industrial sector, encompassing applications like specialized HVAC duct sealing, cold storage, and complex machinery insulation, demands higher specifications, including fire resistance, chemical inertness, and superior durability. The continued growth in infrastructure and automotive manufacturing necessitates robust, vibration-dampening foam sealants, driving the growth of high-performance, specialized formulations. This diversified demand profile underscores the need for a broad portfolio catering to varying levels of performance and environmental exposure.

- By Chemistry:

- Polyurethane Foam Sealant

- Silicone Foam Sealant

- Hybrid/Modified Foam Sealant

- By Product Type:

- Single-Component Foam Sealant

- Two-Component Foam Sealant

- By End-Use Sector:

- Residential Construction

- Commercial Construction

- Industrial (HVAC, Cold Storage, Manufacturing)

- Transportation and Automotive

- By Application Method:

- Spray Foam

- Aerosol Cans

- Cartridges

Value Chain Analysis For Foam Sealant Market

The value chain for the Foam Sealant Market begins with the upstream sourcing of crucial petrochemical derivatives, primarily MDI (Isocyanates) and various polyether or polyester polyols, along with specialized additives such as catalysts, surfactants, and blowing agents. This upstream segment is characterized by reliance on major chemical producers, making the industry susceptible to raw material price volatility dictated by global crude oil and natural gas markets. Strategic procurement and long-term contracts are essential for manufacturers to stabilize production costs and maintain competitive pricing. Innovation at this stage focuses on developing sustainable polyols, including bio-based alternatives, to reduce reliance on petrochemicals and improve the environmental profile of the final product.

The core manufacturing and formulation stage involves sophisticated chemical processing, pressurized packaging, and rigorous quality control to ensure optimal shelf life and performance characteristics (such as expansion rate and cellular structure). Downstream analysis focuses heavily on efficient distribution channels. The primary channel involves specialized construction distributors and large home improvement retail chains, catering to professional contractors and DIY consumers, respectively. Direct sales are often utilized for large-scale industrial or OEM clients who require customized formulations or high volumes of two-component systems, ensuring technical support and direct integration into the client's assembly line or construction process.

The distribution network relies on both direct sales teams offering technical support for complex applications and indirect channels utilizing third-party logistics to ensure wide geographical reach and rapid fulfillment to construction sites. The effectiveness of the value chain is largely determined by the logistical efficiency in handling pressurized aerosol products and the relationship between manufacturers and downstream professional applicators, who often influence product choice based on ease of use and perceived reliability. Manufacturers are increasingly investing in digital tools to streamline order processing and provide educational content to applicators, thereby shortening the sales cycle and maximizing product performance in real-world scenarios.

Foam Sealant Market Potential Customers

The primary customers for foam sealants are diversified across sectors requiring critical sealing, insulation, and gap-filling functions to enhance structural integrity and energy efficiency. The largest customer segment encompasses residential building contractors and renovation specialists, who use single-component foams extensively for sealing window and door frames, utility penetrations, and small structural gaps in existing homes or new residential developments. These buyers prioritize ease of application, fast cure times, and cost-effectiveness, often sourcing products through major retail home centers and regional building supply distributors.

A highly lucrative customer segment includes commercial and industrial constructors and specialized insulation contractors. These entities typically demand high-performance, two-component polyurethane foams for large-scale projects such as skyscrapers, warehouses, cold storage facilities, and large HVAC installations. Their purchasing decisions are heavily influenced by technical specifications such as R-value, fire ratings (e.g., ASTM E84 compliance), and structural adhesion capabilities. These sophisticated buyers often engage directly with manufacturers or specialized industrial distributors to ensure technical training and product consistency for high-volume applications.

Emerging and specialized end-users represent high-growth opportunities. This includes Original Equipment Manufacturers (OEMs) in the transportation sector, particularly automotive and aerospace, where sealants are used for vibration dampening, NVH (Noise, Vibration, Harshness) reduction, and specialized battery thermal management in electric vehicles. Additionally, facility managers responsible for maintaining existing institutional buildings (hospitals, schools) are recurring customers for repair and maintenance activities focused on reducing utility costs and improving indoor air quality. These specialized segments demand customized formulations that meet rigorous industry-specific standards for durability and environmental resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, The Dow Chemical Company, Henkel AG & Co. KGaA, Sika AG, BASF SE, Huntsman Corporation, Bostik (Arkema Group), PPG Industries, W. R. Meadows Inc., Fomo Products Inc., Sealant Equipment & Engineering Inc., Soudal N.V., Illinois Tool Works Inc. (ITW), Franklin International, DAP Products Inc., Selena FM S.A., RPM International Inc. (Tremco CPG Inc.), Saint-Gobain, GAF Materials Corporation, and M-D Building Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam Sealant Market Key Technology Landscape

The Foam Sealant Market is driven by continuous technological innovation focused on improving environmental safety, application ease, and overall product performance metrics, primarily R-value and fire resistance. A major technological focus involves the development of low-pressure, minimal expansion formulations that prevent bowing or distortion of sensitive materials like vinyl window frames, ensuring structural integrity during the curing process. Furthermore, manufacturers are heavily invested in optimizing propellant technology, moving away from high-GWP hydrofluorocarbons (HFCs) towards lower GWP alternatives like hydrofluoroolefins (HFOs) and hydrocarbon propellants, aligning with global environmental protocols such as the Kigali Amendment.

Another critical area of advancement is the introduction of non-isocyanate polyurethane (NIPU) foams. Traditional polyurethane relies on MDI, which poses health and safety risks. NIPU technology offers a greener, safer alternative that maintains comparable performance characteristics, addressing increasing regulatory scrutiny and satisfying the demand for safer building materials, particularly in residential and health-sensitive environments. Simultaneously, advancements in silicone-based foam technology are focusing on enhancing thermal stability and chemical resistance, expanding their applicability in high-temperature industrial settings and specialized electrical component sealing where standard polyurethanes might degrade.

Furthermore, digital integration is becoming a key technological differentiator. This involves developing smart dispensing systems that provide precise control over the flow rate and mixing ratio for two-component foams, minimizing waste and ensuring consistent application quality on site. Integrated technologies, such as IoT sensors embedded in packaging, are also emerging to monitor shelf life and temperature conditions, ensuring product efficacy upon use. The goal across the technology landscape is to create high-yield, high-performance, user-friendly products that require minimal professional training while complying with the highest environmental and fire safety standards.

Regional Highlights

North America is a mature market characterized by stringent energy efficiency regulations, such as those mandated by the Department of Energy (DOE) and local building codes, which mandate high levels of air sealing and insulation in both new construction and extensive remodeling projects. The market here is defined by high consumer awareness regarding energy costs and a strong presence of professional contractors who prioritize high-performance, low-VOC, and fire-rated products. The residential remodeling sector, specifically for weatherization and air barrier improvements, is the cornerstone of demand, ensuring stable growth. Canada, in particular, drives demand due to its extreme climate variations, necessitating superior thermal barriers.

Europe maintains a significant share, driven by the ambitious European Green Deal and related directives focused on achieving net-zero carbon emissions in the building stock by mid-century. Countries such as Germany, the UK, and France exhibit high adoption rates for advanced, certified foam sealants in large-scale renovation programs aimed at retrofitting older buildings to meet modern thermal standards. European demand is heavily skewed towards sustainable formulations, leading manufacturers to prioritize the rapid development and commercialization of bio-based and non-isocyanate chemistries to secure market advantage and align with regulatory trends focused on chemical safety and environmental responsibility. The region demonstrates high acceptance of specialized, multi-component systems for complex industrial applications.

Asia Pacific (APAC) is positioned as the fastest-growing regional market, fueled by massive infrastructural spending, rapid urbanization, and a surging demand for modern housing, particularly in rapidly developing economies like China, India, and Southeast Asian nations. While regulatory standards are sometimes less stringent than in the West, growing awareness of building durability, energy efficiency, and fire safety in commercial structures is accelerating the adoption of professional-grade foam sealants. The construction boom in industrial parks, data centers, and specialized manufacturing facilities (including automotive) creates substantial opportunities for high-volume polyurethane foam sales. The market here is highly price-sensitive, balancing cost-effectiveness with performance.

Latin America shows steady growth, primarily concentrated in economically stable countries such as Brazil and Mexico, driven by foreign investment in commercial real estate and a gradual improvement in local building standards. The challenge in this region often lies in distribution complexity and the prevalent use of traditional building materials. However, as residential development increases and the need for climate control becomes essential, demand for simple, single-component foam sealants for residential air sealing is expanding. The market is slowly transitioning from basic gap fillers to advanced insulating sealants.

Middle East and Africa (MEA) exhibits robust growth linked directly to large-scale government-backed construction projects (e.g., NEOM in Saudi Arabia, infrastructure expansion in the UAE). The severe heat experienced in the Gulf Cooperation Council (GCC) countries makes high-performance thermal insulation mandatory, providing a strong structural driver for foam sealants in commercial and luxury residential sectors. Focus is placed on products offering high heat resistance and durability against harsh desert environments. Africa's market remains nascent but is expected to grow significantly as large urban centers develop and international construction standards are adopted across key economies like South Africa and Nigeria.

- North America: Market leader in revenue, driven by stringent energy codes and high residential renovation activity, focusing on low-VOC products.

- Europe: High growth in sustainable and bio-based formulations, fueled by aggressive governmental net-zero building targets and extensive retrofitting programs.

- Asia Pacific: Fastest-growing region due to massive urbanization, infrastructural development in China and India, and rising industrial construction demand.

- Latin America: Emerging market with demand concentrated in commercial development and increasing adoption of climate-control building practices in major economies.

- Middle East and Africa: Significant adoption in large-scale, high-value infrastructure projects requiring superior thermal resistance against extreme heat conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam Sealant Market.- 3M Company

- The Dow Chemical Company

- Henkel AG & Co. KGaA

- Sika AG

- BASF SE

- Huntsman Corporation

- Bostik (Arkema Group)

- PPG Industries

- W. R. Meadows Inc.

- Fomo Products Inc.

- Sealant Equipment & Engineering Inc.

- Soudal N.V.

- Illinois Tool Works Inc. (ITW)

- Franklin International

- DAP Products Inc.

- Selena FM S.A.

- RPM International Inc. (Tremco CPG Inc.)

- Saint-Gobain

- GAF Materials Corporation

- M-D Building Products

Frequently Asked Questions

Analyze common user questions about the Foam Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between single-component and two-component foam sealants?

Single-component foam sealants cure via moisture absorption from the air, making them ideal for small gaps and DIY projects due to their ease of application. Two-component foams involve an accelerator or hardener, providing a faster cure time, higher density, and superior structural integrity, making them preferred for large commercial and industrial high-volume applications.

Are foam sealants considered environmentally friendly or sustainable?

The sustainability of foam sealants is rapidly improving. While traditional formulations contained high-GWP propellants, modern products increasingly use low-GWP alternatives and manufacturers are actively transitioning towards safer, bio-based polyols and Non-Isocyanate Polyurethane (NIPU) technologies to reduce environmental impact and VOC emissions, aligning with green building standards.

How do foam sealants contribute to energy efficiency in buildings?

Foam sealants significantly enhance energy efficiency by creating an effective air barrier, sealing critical leaks around penetrations, windows, and doors. This prevention of conditioned air loss (thermal bridging) drastically reduces the workload on HVAC systems, lowering utility consumption and increasing the overall R-value of the building envelope, thereby providing substantial long-term cost savings.

What are the key regulatory challenges facing the foam sealant industry?

The industry faces increasing regulatory scrutiny regarding Volatile Organic Compound (VOC) emissions, fire safety ratings (flammability standards), and the use of certain chemical components like isocyanates (MDI). Compliance requires continuous investment in research and development to formulate safer, non-flammable, and low-VOC products that meet varied international building codes and environmental health mandates.

Which geographical region is expected to demonstrate the highest market growth?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to unprecedented growth in construction, infrastructure development, and industrial manufacturing, particularly in emerging economies such as China, India, and ASEAN nations, where the adoption of modern sealing and insulation practices is accelerating rapidly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager