Foam TPE Lamination Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432319 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Foam TPE Lamination Market Size

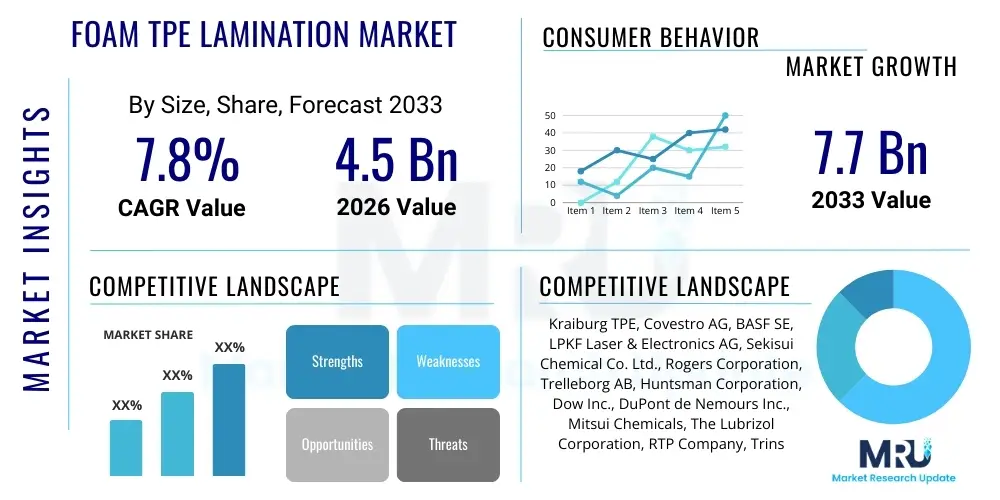

The Foam TPE Lamination Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Foam TPE Lamination Market introduction

The Foam TPE Lamination Market encompasses the manufacturing and integration of thermoplastic elastomer (TPE) materials, often in foamed states, bonded or laminated onto various substrates such as textiles, nonwovens, or other polymeric films. TPEs are highly versatile materials offering the processability of thermoplastics and the elasticity of cross-linked rubber, making them superior alternatives to traditional PVC or standard rubber materials in specific applications requiring flexibility, durability, and a soft touch. Lamination processes enhance the functional properties of composite structures, primarily focusing on improving acoustic insulation, thermal barriers, cushioning capabilities, and aesthetic finishes, particularly critical in the automotive and consumer goods sectors.

The core product involves combining TPE foam layers—which are characterized by lightweight construction and excellent resilience—with other functional layers using advanced bonding techniques like adhesive lamination, flame lamination, or heat pressing. Major applications span across interior automotive components (headliners, door panels, seating upholstery), high-performance footwear (midsoles, insoles), and specialized protective gear within the healthcare and construction industries. The inherent benefits of using TPE foam laminates include reduced weight, improved volatile organic compound (VOC) emissions compliance compared to older polymeric solutions, enhanced tactile experience, and exceptional recyclability, aligning with global sustainability trends.

The primary driving factors propelling market expansion include stringent regulations demanding lightweight materials for fuel efficiency in the automotive sector, escalating consumer demand for comfortable and durable sports and leisure footwear, and the increasing adoption of high-performance, aesthetically pleasing interior components. Furthermore, advancements in TPE foaming technologies, allowing for finer cell structure and higher material consistency, along with innovations in lamination adhesives and processes tailored for TPEs, are continuously expanding the application scope and performance profile of these laminated products globally.

Foam TPE Lamination Market Executive Summary

The Foam TPE Lamination Market is poised for robust expansion, driven primarily by fundamental shifts toward lightweighting and enhanced sustainability across key manufacturing industries. Business trends indicate a strong move toward highly customized TPE formulations, where suppliers are developing specific grades catering to niche performance requirements, such as superior UV resistance for exterior applications or enhanced anti-microbial properties for the healthcare segment. Strategic mergers, acquisitions, and technological collaborations among raw material suppliers and laminators are intensifying, aimed at vertically integrating the supply chain and optimizing production efficiency. The market is witnessing increasing adoption of solvent-free lamination techniques to meet stringent environmental standards, signaling a major transition in manufacturing processes toward greener chemistry.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid expansion in automotive production, particularly electric vehicles (EVs), and the proliferation of consumer electronics manufacturing hubs. North America and Europe maintain strong market shares, focusing on premium applications where high-performance TPE laminates are essential for achieving luxury aesthetics and superior functional characteristics, such as advanced acoustic damping in high-end automobiles. Latin America and the Middle East and Africa (MEA) are emerging regions, driven by infrastructure investments and localized manufacturing capacity expansion, although adoption rates lag behind the developed economies due to higher costs associated with advanced TPE materials.

Segment trends reveal that the Automotive segment remains the largest end-user, with a pronounced shift toward TPE-based interior laminates replacing conventional polyurethane or PVC due to superior haptics and lower fogging characteristics. The Material type segment sees Styrenic TPEs (TPE-S) leading in volume consumption due to cost-effectiveness and versatility, while Thermoplastic Polyurethane TPEs (TPE-U) are gaining traction in demanding applications requiring high abrasion resistance, particularly in footwear and durable goods. The market is generally trending towards extrusion lamination and advanced adhesive bonding methods, minimizing reliance on traditional, less efficient flame lamination techniques for mass production.

AI Impact Analysis on Foam TPE Lamination Market

User queries regarding AI's influence in the Foam TPE Lamination market frequently center on how machine learning can optimize material formulation, predict lamination defect rates, and automate quality control processes. Key themes emerging from these inquiries highlight expectations for AI-driven predictive maintenance of lamination machinery, enhancing energy efficiency in heating and curing stages, and simulating complex foam structures to accelerate product development cycles. Users are particularly concerned with leveraging AI to manage the variability inherent in TPE raw materials and complex multi-layer bonding processes, aiming for zero-defect manufacturing and reducing waste associated with faulty lamination runs. The overall expectation is that AI integration will lead to significant operational cost reductions and enable the rapid scaling of highly customized laminated products.

- AI optimizes TPE formulation by predicting material performance characteristics based on chemical composition inputs, minimizing physical prototyping.

- Machine learning algorithms enhance lamination efficiency by predicting optimal temperature, pressure, and speed parameters for various TPE-substrate combinations.

- Computer vision systems, powered by AI, enable instantaneous, non-destructive quality inspection of laminated sheets, identifying microscopic bonding defects and bubbles.

- Predictive maintenance analytics monitor lamination machinery wear and tear, reducing unplanned downtime and extending equipment lifespan.

- AI facilitates supply chain optimization, forecasting demand variability for specific TPE grades and managing volatile raw material procurement efficiently.

- Simulation tools powered by neural networks aid in designing complex TPE foam geometries, optimizing acoustic and thermal insulation properties before production.

DRO & Impact Forces Of Foam TPE Lamination Market

The Foam TPE Lamination Market dynamics are shaped by a complex interplay of internal and external forces. Drivers largely revolve around legislative demands for sustainable and lightweight components, particularly the push for electric vehicle adoption which mandates mass reduction without compromising safety or comfort. The versatility and inherent recyclability of TPE compared to traditional rubber or thermoset plastics strongly favor its adoption across multiple high-volume sectors. Opportunities are substantial in developing specialized TPE grades tailored for extreme environments, such as high-temperature resistant foams for engine bay applications or sterile, biocompatible laminates for advanced medical devices, alongside capitalizing on the burgeoning global footwear market's demand for high-comfort, low-density materials.

Conversely, significant restraints hinder market growth. The high initial cost of TPE raw materials relative to commodity plastics such as polyethylene or PVC poses a commercial challenge, particularly in cost-sensitive markets. Furthermore, achieving consistent, high-quality lamination—especially when dealing with diverse substrate materials and intricate TPE foam structures—requires sophisticated machinery and specialized operational expertise, limiting widespread adoption by smaller manufacturers. Supply chain volatility for key feedstocks used in TPE polymerization, which are often petrochemical derivatives, introduces price instability and risk for finished product manufacturers, impacting long-term planning and investment.

The impact forces influencing the market are multifaceted, encompassing macroeconomic stability, technological innovation in material science, and the evolving competitive landscape. Porter's Five Forces analysis suggests that the bargaining power of buyers is moderate to high, particularly in large sectors like automotive, which demand favorable pricing due to huge volumes. The threat of substitutes, while present from advanced flexible polyurethanes (PU) and silicone materials, is mitigated by TPE’s superior thermal stability and ease of processing. Technological innovation, particularly in surface treatment and advanced adhesive systems for TPEs, is the primary force driving differentiation and securing premium market positions for key industry players.

Segmentation Analysis

The Foam TPE Lamination Market is comprehensively segmented based on material composition, the specific application end-use, and the lamination technology employed to bond the TPE foam structure to its substrate. Understanding these segmentations is critical for market participants to tailor their product offerings and strategic focus. Segmentation by material type addresses the performance required, with each TPE subclass offering distinct benefits—Styrenic TPEs (TPE-S) are preferred for general consumer goods and cost-effective solutions, while Polyurethane TPEs (TPE-U) target high-wear resistance applications. Application segmentation provides a clear view of demand hotspots, confirming the automotive sector's dominance due to its extensive use of laminated foam for NVH (Noise, Vibration, and Harshness) reduction and interior comfort enhancement. The lamination process segments highlight technological maturity and adoption rates, reflecting a trend towards cleaner, more automated bonding techniques.

- By Material Type:

- TPE-S (Styrenic Block Copolymers)

- TPE-O (Thermoplastic Polyolefins)

- TPE-V (Thermoplastic Vulcanizates)

- TPE-U (Thermoplastic Polyurethanes)

- Others (Co-polyesters, Polyamides)

- By Application:

- Automotive (Interior, Exterior Seals, Gaskets, Headliners)

- Footwear (Midsoles, Insoles, Liners)

- Construction and Building (Insulation, Weatherstripping)

- Consumer Goods (Sports Equipment, Electronics Packaging)

- Healthcare and Medical (Orthopedics, Wearable Devices)

- Industrial and Manufacturing

- By Lamination Process:

- Hot Melt Lamination (Adhesive Bonding)

- Flame Lamination

- Extrusion Lamination

- Pressure Sensitive Adhesive (PSA) Lamination

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Foam TPE Lamination Market

The value chain for the Foam TPE Lamination Market begins with upstream activities dominated by petrochemical companies and specialized polymer manufacturers responsible for synthesizing the core TPE granules and foaming agents. This stage is highly capital-intensive and research-focused, concentrating on developing proprietary TPE formulations that meet specific performance criteria such as softness, density, and thermal properties. Raw material quality and stable supply are paramount, as slight variations can severely impact the foaming and lamination efficacy. Key activities here include polymerization, compounding, and granule production, often involving complex intellectual property related to catalyst systems and block copolymer architectures.

Midstream activities involve the TPE foam processors and the lamination service providers. Foam processors convert the TPE granules into sheets or rolls using processes like extrusion foaming or injection molding, meticulously controlling the cell structure and expansion ratio. The subsequent lamination stage involves bonding the TPE foam to a suitable substrate (e.g., fabric, metal foil, plastic film) using advanced machinery. Distribution channels are varied; direct channels are common for large-volume purchasers, particularly major Tier 1 automotive suppliers who require specialized specifications and just-in-time delivery. Indirect channels involve distributors and specialized agents who cater to smaller OEMs and diverse consumer goods manufacturers, providing localized inventory and technical support.

Downstream, the finished laminated materials are procured by original equipment manufacturers (OEMs) across the automotive, footwear, and construction sectors for final product integration. The complexity of the product and its specification heavily influences the channel structure. High-performance or customized laminates typically necessitate direct sales and robust technical collaboration between the laminator and the end-user for application engineering support. The entire chain emphasizes quality control, tracing the material from the raw polymer synthesis through to the final lamination stage to ensure compliance with industry-specific standards, especially those related to flammability and VOC emissions.

Foam TPE Lamination Market Potential Customers

The primary potential customers and end-users of TPE foam laminated products span several major industrial and consumer sectors, driven by the demand for advanced materials that offer superior comfort, sound dampening, and lightweight performance. Tier 1 and Tier 2 suppliers within the global Automotive Industry represent the largest and most critical customer base. These customers utilize TPE laminates extensively for vehicle interiors, specifically in manufacturing headliners, carpet backing, acoustic barriers within door panels, and soft-touch dashboard surfaces. The focus here is on materials that offer low weight, excellent haptics, and compliance with stringent automotive safety (e.g., crash absorption) and environmental (e.g., low VOCs) standards.

Another significant customer segment is the Footwear Industry, comprising major athletic and lifestyle brands. TPE foam laminates are highly sought after for use in performance footwear midsoles and insoles due to their exceptional energy return, lightweight nature, and customization capabilities related to cushioning properties. These end-users prioritize materials that enhance wearer comfort and provide a competitive advantage in terms of product durability and material innovation. Furthermore, the Construction and Building sector represents a growing customer base, specifically procuring TPE laminates for advanced sealing, gap filling, thermal insulation, and soundproofing applications in both residential and commercial infrastructure projects.

The Healthcare and Consumer Goods sectors also constitute vital end-user groups. In healthcare, potential customers include medical device manufacturers and orthopedic suppliers who require sterile, biocompatible, and flexible laminated foams for patient comfort and functional components in assistive devices, prosthetics, and wearable technologies. Consumer goods manufacturers utilize these materials for packaging protection, sports equipment padding (e.g., helmets, guards), and high-end electronics casing, where the soft-touch finish and impact absorption capabilities of TPE foam laminates provide distinct product benefits and improved user experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kraiburg TPE, Covestro AG, BASF SE, LPKF Laser & Electronics AG, Sekisui Chemical Co. Ltd., Rogers Corporation, Trelleborg AB, Huntsman Corporation, Dow Inc., DuPont de Nemours Inc., Mitsui Chemicals, The Lubrizol Corporation, RTP Company, Trinseo S.A., Teknor Apex, Kuraray Co. Ltd., Vancive Medical Technologies, PolyOne Corporation, SWM International, Lord Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam TPE Lamination Market Key Technology Landscape

The technological landscape of the Foam TPE Lamination Market is characterized by continuous innovation aimed at enhancing bonding strength, improving material characteristics, and adopting environmentally sustainable processing methods. Key advancements revolve around TPE foaming technology itself, transitioning from chemical foaming agents to more precise physical foaming techniques, such as supercritical fluid injection (e.g., using nitrogen or carbon dioxide), which yields foams with finer, more uniform cell structures, significantly improving compressive strength and reducing overall density. This fine cell morphology is crucial for high-performance acoustic applications in automotive interiors. Simultaneously, the focus remains on optimizing the surface energy of TPE foams, which are inherently difficult to bond, through plasma treatment or specialized primers to ensure durable adhesion to diverse substrates like metals or engineered plastics.

In the lamination domain, there is a distinct move away from traditional, high-emission methods like flame lamination, especially in regions with strict VOC regulations. Hot melt lamination using reactive polyurethane (PUR) adhesives and pressure-sensitive adhesives (PSA) is gaining prominence. These adhesive systems offer solvent-free bonding, faster processing times, and superior thermal stability in the final product. Furthermore, extrusion lamination techniques, where a thin layer of molten TPE or a compatible polymer acts as the adhesive layer, are becoming highly sophisticated. This technique allows for simultaneous bonding and coating, simplifying the manufacturing process and ensuring seamless integration of layers, particularly advantageous for high-volume production lines such as continuous floor mats or large structural panels.

Another emerging technology involves specialized non-contact bonding methods, such as laser welding or ultrasonic welding, adapted for TPE composite structures. While not traditional lamination, these welding techniques provide extremely localized, strong bonds without introducing external adhesives, addressing issues of material incompatibility and potential delamination under stress. Furthermore, material innovations focus on developing bio-based or recycled content TPEs to meet circular economy objectives. These "green" TPE formulations present unique lamination challenges, requiring the development of new bonding agents and process parameters optimized for their altered rheological properties, which is a major area of research and development for leading industry players and material science research institutions globally.

Regional Highlights

The Foam TPE Lamination Market exhibits significant geographical variations in growth trajectory and technological adoption, reflecting regional industrial maturity and regulatory environments. Asia Pacific (APAC) commands the largest market share and is projected to demonstrate the highest CAGR during the forecast period. This dominance is attributed to robust automotive manufacturing growth, especially in China, India, and Southeast Asian nations, driven by both domestic consumption and export activities. Furthermore, APAC's strong presence in the consumer electronics and footwear manufacturing sectors necessitates large volumes of lightweight, high-cushion TPE laminates, fueling rapid capacity expansion and technological investment across the region.

Europe represents a mature yet highly quality-conscious market, focusing heavily on premium applications and sustainability. European regulations, particularly concerning environmental impact (REACH) and vehicle emissions, accelerate the demand for high-performance, low-VOC TPE laminated components. The automotive sector, particularly Germany and France, drives innovation in acoustic insulation and sophisticated interior surfaces. European companies often lead in adopting advanced, solvent-free lamination processes (e.g., advanced PUR hot melts) to comply with stringent regional standards, maintaining a strong market share in terms of value, if not always volume.

North America maintains a strong position, characterized by significant investment in R&D and a high demand for specialty TPE grades in the healthcare and aerospace industries, alongside a substantial presence in the luxury automotive market. Market growth here is steady, supported by technological advancements in automated lamination equipment and the integration of smart materials. Latin America (LATAM) and the Middle East and Africa (MEA) are developing markets characterized by increasing urbanization and infrastructure development, driving initial demand in the construction and lower-cost automotive segments. While growth is accelerating in these regions, challenges remain regarding the establishment of local TPE production facilities and reliance on imported sophisticated lamination machinery.

- Asia Pacific (APAC): Market leader fueled by mass automotive and footwear production; primary focus on volume and adopting cost-effective TPE-S and TPE-O materials.

- Europe: High-value market prioritizing regulatory compliance (VOC, REACH) and driving demand for advanced TPE-U and high-performance acoustic laminates in premium vehicles.

- North America: Stable growth driven by healthcare, high-end consumer goods, and specialty material applications, emphasizing technological superiority and automation.

- Latin America (LATAM): Emerging market, growth tied to localized automotive assembly and construction expansion; sensitive to import costs for raw materials and machinery.

- Middle East and Africa (MEA): Growth potential exists in infrastructure and localized manufacturing zones; focused initially on basic TPE laminate usage in construction and industrial sealing applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam TPE Lamination Market.- Kraiburg TPE GmbH & Co. KG

- Covestro AG

- BASF SE

- Huntsman Corporation

- Dow Inc.

- DuPont de Nemours Inc.

- Mitsui Chemicals, Inc.

- The Lubrizol Corporation

- RTP Company

- Trinseo S.A.

- Teknor Apex Company

- Rogers Corporation

- Trelleborg AB

- Sekisui Chemical Co., Ltd.

- LPKF Laser & Electronics AG (Focusing on lamination technology)

- Kuraray Co., Ltd.

- PolyOne Corporation (Now Avient)

- SWM International

- Lord Corporation

- Vancive Medical Technologies

Frequently Asked Questions

Analyze common user questions about the Foam TPE Lamination market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Foam TPE Lamination and where is it primarily used?

Foam TPE Lamination involves bonding a foamed thermoplastic elastomer layer onto a substrate, typically for enhanced cushioning, sound deadening, or soft-touch aesthetics. It is primarily used in the Automotive industry for interior components like headliners and door panels, and in Footwear for performance midsoles.

Why is TPE preferred over conventional materials like PVC or standard rubber for lamination?

TPE is favored due to its superior lightweight properties, excellent recyclability, lower VOC emissions, and better haptic (soft-touch) characteristics compared to PVC. It also offers the processing ease of a thermoplastic, unlike traditional cross-linked rubbers.

Which lamination process is gaining the most traction due to environmental regulations?

Hot Melt Lamination, particularly using reactive polyurethane (PUR) adhesives, and Extrusion Lamination are gaining traction. These solvent-free methods are preferred over traditional Flame Lamination as they significantly reduce volatile organic compound (VOC) emissions, aligning with stringent environmental mandates.

What are the main drivers of market growth in the Asia Pacific region?

The main drivers in APAC are the rapid expansion of the Electric Vehicle (EV) manufacturing sector, which requires lightweight and high-performance interior components for battery efficiency, alongside robust growth in consumer goods and high-volume footwear production.

What are the key technological challenges in TPE foam lamination?

Key challenges include ensuring long-term adhesion durability between the low-surface-energy TPE foam and diverse substrates, maintaining uniform foam cell structure during high-speed production, and managing the higher initial cost of specialized TPE raw materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager