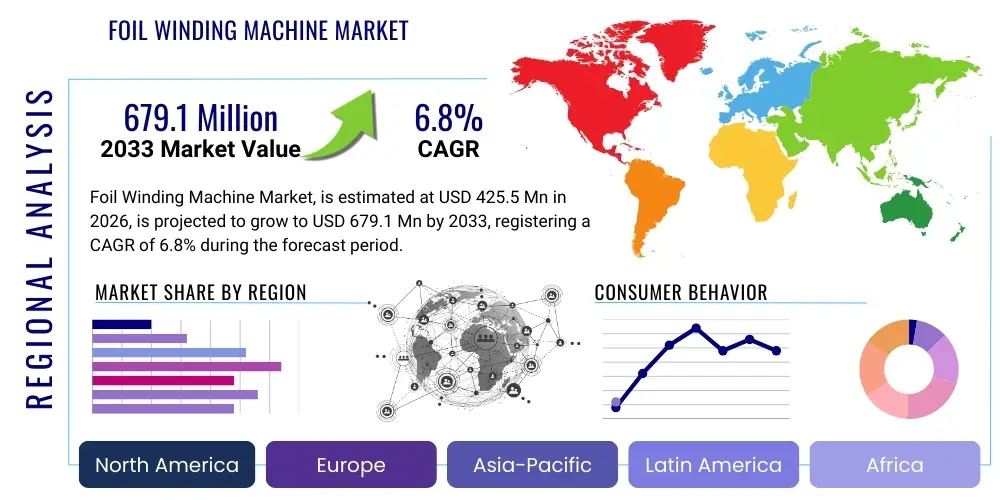

Foil Winding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435817 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Foil Winding Machine Market Size

The Foil Winding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 425.5 Million in 2026 and is projected to reach USD 679.1 Million by the end of the forecast period in 2033.

Foil Winding Machine Market introduction

The Foil Winding Machine Market encompasses specialized industrial equipment designed for the automated and semi-automated production of electrical coils utilizing metallic foil, primarily aluminum or copper. These machines are integral to manufacturing critical components such as dry-type transformers, distribution transformers, power capacitors, and increasingly, high-capacity battery cells for electric vehicles (EVs). The core function of these machines is to precisely spool, cut, and laminate foil insulation layers, ensuring optimal electrical characteristics and mechanical integrity of the resulting coils or elements. High precision in tension control, edge alignment, and insulation placement is paramount, driving the demand for advanced servo-driven and CNC-controlled systems.

Major applications for foil winding technology are concentrated within the electrical power sector and emerging sustainable energy industries. In the power industry, foil windings offer superior heat dissipation and reduced hot spot risk compared to traditional wire windings, making them highly desirable for dry-type and cast resin transformers used in commercial and industrial settings. Furthermore, their application extends deeply into the manufacturing of high-pulse power capacitors required in applications like railway traction and induction heating, where reliability and compact size are crucial. The adoption of foil winding machines is accelerated by global initiatives focused on smart grid deployment, grid modernization, and the increasing electrification of transportation systems, which necessitate efficient and highly reliable electrical components.

Key driving factors fueling market expansion include rapid industrialization across Asia Pacific (APAC), significant investment in renewable energy infrastructure requiring specialized power electronics, and the exponential growth trajectory of the lithium-ion battery manufacturing segment. Foil winding is a critical step in producing large format prismatic and pouch cells, offering enhanced energy density and consistency, thereby making the technology indispensable for EV battery gigafactories. The benefits derived from using advanced foil winding machines include reduced material waste, increased production throughput, enhanced product consistency, and the ability to handle extremely delicate and wide foil materials, which ultimately contribute to lower operational costs and higher quality end products.

Foil Winding Machine Market Executive Summary

The global Foil Winding Machine Market is characterized by robust growth, primarily driven by transformative trends in electrical infrastructure and sustainable mobility. Business trends indicate a strong shift towards fully automatic, high-speed winding solutions integrated with real-time monitoring and diagnostic capabilities, reflecting the broader adoption of Industry 4.0 standards in manufacturing. Key manufacturers are focusing on modular machine designs that allow for quick adaptation between different foil widths, material types (copper/aluminum), and product specifications (transformers vs. battery cells), thereby catering to diverse market demands and maximizing machine utilization rates. Furthermore, competitive strategies emphasize providing comprehensive after-sales support and integration services, moving beyond mere equipment sales to becoming solution providers.

Regionally, the Asia Pacific (APAC) currently dominates the market share and is expected to maintain the highest growth trajectory throughout the forecast period. This dominance is intrinsically linked to massive government and private sector investments in renewable energy production—particularly solar and wind farms—and the unparalleled expansion of the electric vehicle manufacturing ecosystem, specifically in China, South Korea, and Japan. Europe and North America represent mature markets, where growth is sustained by grid modernization projects, replacement cycles of aging infrastructure, and a strategic push toward high-efficiency, specialized transformer manufacturing compliant with stringent energy efficiency regulations. These regions show higher adoption rates of premium, automated machinery prioritizing precision and complex coil geometry capabilities.

Segment trends reveal that the Fully Automatic segment, while requiring higher initial capital expenditure, is anticipated to record the fastest Compound Annual Growth Rate, spurred by labor optimization pressures and the need for zero-defect production crucial for EV batteries and high-voltage components. In terms of end-users, the Transformer Manufacturing segment remains the largest consumer, but the emerging Lithium-Ion Battery Manufacturing segment is witnessing the most explosive growth, fundamentally altering the competitive landscape and technological requirements for winding machine manufacturers. Material-wise, aluminum foil winding remains prevalent due to cost advantages, though specialized copper foil winding machines are critical for high-performance applications demanding superior conductivity and thermal properties.

AI Impact Analysis on Foil Winding Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Foil Winding Machine Market frequently revolve around three core themes: enhancing production quality through immediate defect detection, optimizing machine performance via predictive maintenance, and automating complex setup and calibration processes. Users are concerned about how AI can mitigate human error during high-speed winding operations, particularly in maintaining stringent tolerances required for EV batteries and advanced power electronics. Expectations center on AI algorithms analyzing sensor data (tension, alignment, temperature, vibration) in real-time to prevent costly material wastage and ensure operational continuity. The integration of AI is seen less as a replacement for the winding mechanics and more as a sophisticated layer of cognitive automation crucial for achieving lights-out manufacturing and enabling complex geometric coil winding with consistent repeatability, which is currently a significant constraint in semi-automatic processes.

- AI-Driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, motor current, and thermal signatures, predicting component failure (e.g., bearings, servo motors) before it leads to unplanned downtime, thereby maximizing machine uptime and efficiency.

- Real-time Quality Control: Implementing computer vision systems powered by deep learning to inspect foil edges, insulation integrity, and winding alignment instantly, detecting micro-defects invisible to human operators or traditional sensors, ensuring zero-defect output for critical applications.

- Optimized Parameter Setting (Self-Calibration): AI models use historical production data and material specifications (foil thickness, material ductility) to automatically calculate and fine-tune optimal winding tension, speed profiles, and cutting parameters, significantly reducing manual setup time and dependence on highly skilled operators.

- Throughput Optimization: Employing reinforcement learning to analyze production line bottlenecks and dynamically adjust winding speeds and transfer protocols to maintain maximum output without compromising coil quality, adapting automatically to variations in material input.

- Energy Consumption Reduction: AI systems monitor the power draw of various machine components and optimize the operational cycle to minimize energy usage per coil produced, contributing to sustainable manufacturing goals.

DRO & Impact Forces Of Foil Winding Machine Market

The Foil Winding Machine Market is primarily propelled by the aggressive global transition toward sustainable energy sources and advanced electrical systems. Key drivers include the massive scaling of renewable energy projects, necessitating the deployment of reliable distribution and dry-type transformers, which often utilize foil windings for superior thermal management and efficiency. Simultaneously, the exponential growth of the Electric Vehicle (EV) sector, coupled with the establishment of large-scale battery gigafactories worldwide, mandates specialized, high-precision foil winding equipment for electrode assembly. Restraints, however, include the substantial initial capital investment required for purchasing high-end automatic CNC winding machines, which can be prohibitive for smaller manufacturers. Furthermore, the inherent complexity of handling wide, thin foil materials and the necessity for ultra-precise alignment pose significant technical challenges that increase operational complexity and maintenance costs.

Opportunities for market players are abundant, particularly in developing highly specialized equipment tailored for non-traditional applications like high-frequency induction coils and specialized aerospace components, demanding custom geometry winding capabilities. The trend toward customized, small-batch production of specialized transformers also opens avenues for flexible, modular winding systems. Moreover, manufacturers focusing on retrofitting older machines with advanced digital control systems and IoT capabilities (Industry 4.0 integration) can tap into the vast installed base seeking efficiency upgrades without full replacement. The impact forces acting on this market emphasize efficiency, precision, and automation; the need for lower copper/aluminum material input (material efficiency) and reduced scrap rates drives the adoption of sophisticated tension and alignment control technologies.

The synergistic impact of drivers, restraints, and opportunities dictates market evolution. While high capital costs restrain immediate widespread adoption, the long-term benefits of product consistency, reduced labor costs, and enhanced performance (driven by renewable energy and EV mandates) compel manufacturers to invest in automation. The crucial impact forces include stringent quality standards (particularly IEC and UL standards) and the relentless pursuit of higher power density in electrical components, which directly translates into demand for superior winding precision. Market participants who can successfully integrate advanced sensor technology, predictive analytics, and modular design will be best positioned to capitalize on these converging market dynamics.

Segmentation Analysis

The Foil Winding Machine Market is structurally segmented primarily based on the mode of operation, the specific end-use industry, and the type of foil material handled. Analyzing these segments provides critical insights into technological preference and demand concentration across different industrial landscapes. By Operation Mode, the market distinguishes between Semi-Automatic and Fully Automatic machines, with the latter commanding a premium due to higher throughput and minimal human intervention, increasingly preferred by large-scale manufacturers in the EV battery and large transformer sectors. End-user segmentation highlights the dominance of traditional transformer and capacitor manufacturers, though the emerging Lithium-Ion Battery manufacturing segment is the fastest growing, demanding specialized, clean-room compliant equipment.

- By Operation Mode

- Fully Automatic Foil Winding Machines

- Semi-Automatic Foil Winding Machines

- By End-User Industry

- Transformer Manufacturing (Distribution, Power, Specialty)

- Capacitor Manufacturing (Power, Film, High-Voltage)

- Inductor and Coil Manufacturing

- Lithium-Ion Battery Manufacturing (Electrode Winding)

- Others (Aerospace, Medical Devices)

- By Foil Material

- Aluminum Foil Winding Machines

- Copper Foil Winding Machines

- Hybrid/Multi-Material Winding Machines

Value Chain Analysis For Foil Winding Machine Market

The value chain of the Foil Winding Machine Market begins with upstream suppliers providing critical raw materials and specialized components. The upstream segment is defined by high-precision mechanical parts manufacturers, including suppliers of servo motors, linear guides, pneumatic systems, high-accuracy sensors (for tension control and alignment), and advanced CNC control systems and software. Suppliers of control components, particularly those providing proprietary tension control algorithms and Human-Machine Interface (HMI) systems, hold significant leverage due to the technical complexity and crucial role these components play in machine precision and reliability. Key foil winding machine manufacturers often establish long-term strategic partnerships with leading automation technology providers (such as Siemens, Fanuc, or Allen-Bradley) to ensure access to cutting-edge control technology and global servicing capabilities, which is a differentiator in this specialized capital equipment market.

The middle segment of the value chain involves the design, manufacturing, assembly, testing, and integration of the complex winding systems. This stage requires extensive engineering expertise in mechanical, electrical, and software disciplines to ensure the machine can handle high speeds while maintaining micron-level precision and repeatability. Manufacturers typically specialize either in general-purpose transformer winding machines or highly specific, clean-room grade battery winding equipment. Downstream analysis focuses on distribution and installation. The distribution channel is crucial for large, high-value machinery. Direct sales channels are often preferred for highly customized, complex, or high-volume orders, especially when dealing with major global transformer or EV battery manufacturers, as this allows for direct technical consultation and factory acceptance testing (FAT).

Indirect channels, involving regional agents, distributors, and system integrators, play a vital role in market penetration into smaller and geographically dispersed markets, providing local support and quicker response times for standard models. After-sales support, including maintenance contracts, spare parts supply, and technical training, forms a critical component of the downstream value proposition and revenue generation for machine vendors. Effective distribution channels are characterized by technical competency—the ability of sales engineers and local service teams to troubleshoot and maintain highly sophisticated CNC-driven machinery. The selection of the distribution strategy is heavily influenced by the end-user industry; for instance, sales to the highly regulated and technically demanding EV battery sector almost always require a direct, dedicated technical team presence, while sales to established transformer manufacturers might utilize robust regional distributors who can bundle equipment with other complementary machinery.

Foil Winding Machine Market Potential Customers

The primary customers in the Foil Winding Machine Market are large-scale industrial manufacturers dedicated to producing essential electrical and energy storage components. Historically, the largest segment of end-users has been Transformer Manufacturers. These include producers of dry-type, cast resin, and distribution transformers used extensively in utility infrastructure, industrial facilities, and commercial buildings. These manufacturers require robust winding machines capable of handling wide aluminum or copper foils for the primary and secondary coils, focusing on high output volume, reliability, and strict adherence to international safety and efficiency standards (such as DOE, IEC, and NEMA guidelines). The ongoing global efforts toward smart grid implementation and energy efficiency mandates continue to solidify this segment’s foundational demand for foil winding technology.

A rapidly expanding and increasingly critical customer segment is Lithium-Ion Battery Manufacturers, particularly those operating Giga-factories for electric vehicles (EVs) and grid-scale energy storage systems (ESS). These customers demand highly specialized, clean-room compliant winding equipment known as jelly roll or stack winding machines, where the foil material is the electrode (anode/cathode). Precision requirements in this sector are exceptionally stringent, often measured in micrometers, as coil quality directly impacts the safety, energy density, and lifespan of the final battery cell. The investment cycles of major EV manufacturers and their battery partners are the foremost determinants of growth in this specialized high-end machine segment, driving technological advances in alignment and tension control systems, often integrated with sophisticated AI-powered quality checks.

Other significant end-users include Power Capacitor Manufacturers, who use foil winding machines for creating film capacitors used in power factor correction, DC-link circuits, and high-frequency applications. While smaller than the transformer segment, this niche demands speed and high insulation quality. Additionally, specialty coil and inductor manufacturers, serving sectors like medical imaging (MRI coils) and aerospace (high-performance avionics), represent a premium customer base requiring highly customized, flexible machines capable of managing exotic materials and complex, low-volume geometric windings. These diverse customer requirements compel machine manufacturers to offer a wide product portfolio ranging from standard semi-automatic models to sophisticated, fully automated, integrated manufacturing cells.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 425.5 Million |

| Market Forecast in 2033 | USD 679.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AUMUND Fördertechnik GmbH, SMT Winding Systems, L. & L. Machinery Inc., Nidec Shimpo Corporation, KOLEKTOR Group, LAUFFER Machine, R. S. Machines, Mikrotech, Broach Machine, Daili Machine, Odawara Engineering Co., Ltd., Marsilli S.p.A., H. C. Starck Solutions, Zumbach Electronics AG, Itaca, AETNA Systems, GIMATIC S.p.A., RUIXIN Winding Machine Co., Ltd., Zhongshan Fuyu Automation Equipment Co., Ltd., Jovil Manufacturing Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foil Winding Machine Market Key Technology Landscape

The technological landscape of the Foil Winding Machine Market is primarily defined by the continuous pursuit of higher precision, speed, and automation capabilities, critical for meeting the demanding specifications of modern electrical components and battery cells. Central to this evolution are advanced tension control systems. Modern machines utilize closed-loop, digital servo control systems rather than traditional pneumatic or mechanical brakes. These systems integrate multiple high-resolution sensors and proprietary software algorithms to maintain highly accurate, consistent foil tension across the entire winding process, regardless of reel diameter changes or winding speed fluctuations. This precision is non-negotiable, particularly when handling delicate, wide foils where any variation in tension can result in non-uniform coils, leading to electrical breakdown or reduced battery life. Manufacturers are increasingly integrating load cell technology and sophisticated dancers to provide real-time feedback and dynamic adjustment.

Another crucial technological development involves the adoption of high-speed Computer Numerical Control (CNC) and programmable logic controller (PLC) systems. These control architectures enable multi-axis synchronization necessary for precise edge alignment and simultaneous winding of multiple foil layers and insulation materials. High-end machines feature laser or vision-based alignment systems that continuously monitor the foil edge position, correcting alignment errors instantly to ensure optimal overlap and prevent short circuits. Furthermore, the push towards Industry 4.0 integration has led to the inclusion of IoT sensors and network capabilities, allowing machines to communicate performance data, quality metrics, and maintenance warnings to centralized manufacturing execution systems (MES). This integration facilitates remote diagnostics, predictive maintenance scheduling, and comprehensive data logging for traceability, which is mandatory in highly regulated sectors like automotive EV production.

Specialized machine design for the lithium-ion battery sector represents the cutting edge of this technology landscape. These machines require proprietary stacking or winding mechanisms that operate within stringent clean-room environments. Key innovations here include non-contact handling systems, automated dust mitigation, and specialized cutting systems (ultrasonic or laser) designed to minimize particle generation and burr formation on the electrodes. The ability to switch rapidly between different battery chemistries and form factors (pouch vs. prismatic) without extensive physical retooling is also driving demand for highly modular and digitally reconfigurable machine platforms. Future technological advancements are expected to focus heavily on integrating AI and machine learning into the control loop, further enhancing quality assurance and minimizing material wastage by predicting and compensating for process variations proactively.

- Advanced Tension Control Systems: Digital closed-loop servo control systems utilizing load cells and dancers for sub-Newton accuracy in tension maintenance.

- High-Precision Alignment Technology: Implementation of laser guidance and computer vision systems for real-time edge alignment correction and precise insulation placement.

- CNC and PLC Integration: Multi-axis synchronization and proprietary algorithms ensuring high speed, complex geometry winding with consistent repeatability.

- Industry 4.0 and IoT Integration: Embedded sensors for remote monitoring, data logging, predictive maintenance, and seamless communication with MES/ERP systems.

- Specialized Cutting Mechanisms: Adoption of ultrasonic cutting or advanced shear techniques to ensure clean, burr-free foil edges, especially crucial for battery electrodes.

- Modular and Reconfigurable Design: Systems designed for quick changeovers between different coil sizes, foil widths, and material types to maximize flexibility.

Regional Highlights

Asia Pacific (APAC): APAC stands as the undisputed global leader in the Foil Winding Machine Market, both in terms of market size and projected growth rate. This dominance is fundamentally driven by the region's unparalleled manufacturing capacity in power electronics, electric vehicles, and renewable energy components. Countries like China, South Korea, and Japan are home to the largest manufacturers of Li-ion batteries (gigafactories), creating an immense, persistent demand for high-speed, fully automatic winding machines. Furthermore, rapid urbanization and significant infrastructure spending in emerging economies like India and Southeast Asia necessitate continuous investment in grid expansion and transformer manufacturing facilities. The competitive landscape in APAC is characterized by a mix of large global players and highly competitive, cost-efficient local manufacturers, resulting in a high volume market focused on efficiency and throughput. The push for localized manufacturing supply chains across major economies further bolsters the region's demand for sophisticated winding equipment.

North America: The North American market is highly mature but demonstrates steady growth, propelled primarily by initiatives related to grid resilience, modernization of aging infrastructure, and the massive scaling of EV production capacity incentivized by government policies. Demand in this region is concentrated on premium, high-automation equipment offering superior precision and long-term reliability. Strict quality standards and safety regulations, particularly in the defense and aerospace sectors (specialty coils), also drive demand for machines capable of achieving high-tolerance specifications and extensive process documentation. While the volume of installations is lower compared to APAC, the average value per machine is significantly higher, reflecting the regional preference for technologically advanced, integrated manufacturing solutions, often featuring advanced AI and IoT capabilities for optimization and remote support.

Europe: Europe represents a strong market segment driven by stringent environmental and energy efficiency regulations, leading to continuous replacement cycles of less efficient components with modern, foil-wound dry-type transformers and high-performance capacitors. Government mandates supporting renewable energy integration (onshore and offshore wind, solar) across Western Europe fuel demand for specialized electrical balance-of-plant components. Similar to North America, the European market prioritizes sustainability, precision, and adherence to Industry 4.0 principles, favoring European or Japanese vendors known for robust engineering and integration capabilities. Central and Eastern Europe are emerging as manufacturing hubs, particularly for automotive components and specialized electrical machinery, contributing steadily to regional market expansion and adoption of both semi-automatic and automatic winding technologies.

- Asia Pacific (APAC): Highest growth region; massive demand fueled by EV battery gigafactories (China, South Korea) and substantial grid infrastructure investment (India, Southeast Asia).

- North America: Focus on grid modernization, premium automated systems, and high-tolerance manufacturing for aerospace and specialty transformers.

- Europe: Driven by strict energy efficiency standards, renewable energy integration, and strong adoption of Industry 4.0 technologies in manufacturing processes.

- Latin America (LATAM): Emerging market characterized by demand for affordable, reliable semi-automatic machines to support local utility and industrial projects.

- Middle East & Africa (MEA): Growth linked to oil & gas infrastructure projects and new smart city developments, driving demand for distribution transformers and specialized power equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foil Winding Machine Market.- AUMUND Fördertechnik GmbH

- SMT Winding Systems

- L. & L. Machinery Inc.

- Nidec Shimpo Corporation

- KOLEKTOR Group

- LAUFFER Machine

- R. S. Machines

- Mikrotech

- Broach Machine

- Daili Machine

- Odawara Engineering Co., Ltd.

- Marsilli S.p.A.

- H. C. Starck Solutions

- Zumbach Electronics AG

- Itaca

- AETNA Systems

- GIMATIC S.p.A.

- RUIXIN Winding Machine Co., Ltd.

- Zhongshan Fuyu Automation Equipment Co., Ltd.

- Jovil Manufacturing Inc.

Frequently Asked Questions

Analyze common user questions about the Foil Winding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for fully automatic foil winding machines?

The primary driver is the exponential growth of the Electric Vehicle (EV) industry, requiring high-volume, zero-defect production of lithium-ion battery electrodes, where fully automatic machines ensure necessary precision and repeatability, minimizing expensive material scrap.

How does foil winding technology benefit transformer manufacturing compared to traditional wire winding?

Foil winding provides superior thermal dissipation, reduced hot spots, and lower partial discharge levels, resulting in higher efficiency and longer lifespan for dry-type and distribution transformers, essential for modern grid applications.

Which region currently holds the largest market share for foil winding machines?

The Asia Pacific (APAC) region currently dominates the market share due to its significant investments in EV battery manufacturing capacity (gigafactories) and expansive renewable energy infrastructure projects.

What are the key technological challenges in the foil winding process?

Key challenges include maintaining highly precise and consistent tension control across wide, thin foil materials, achieving micro-level alignment accuracy of multiple layers, and managing the high capital cost associated with fully automated, high-precision equipment.

How is Artificial Intelligence (AI) being utilized to enhance foil winding machine performance?

AI is primarily used for real-time quality control via computer vision for defect detection, optimizing operational parameters for maximum throughput, and implementing predictive maintenance algorithms to prevent unplanned machine downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager