Foil Winding Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436020 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Foil Winding Machines Market Size

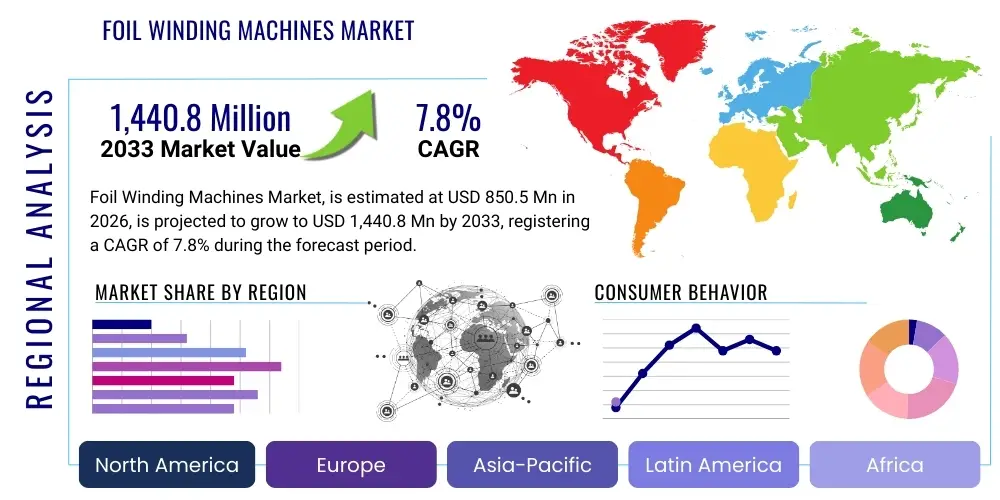

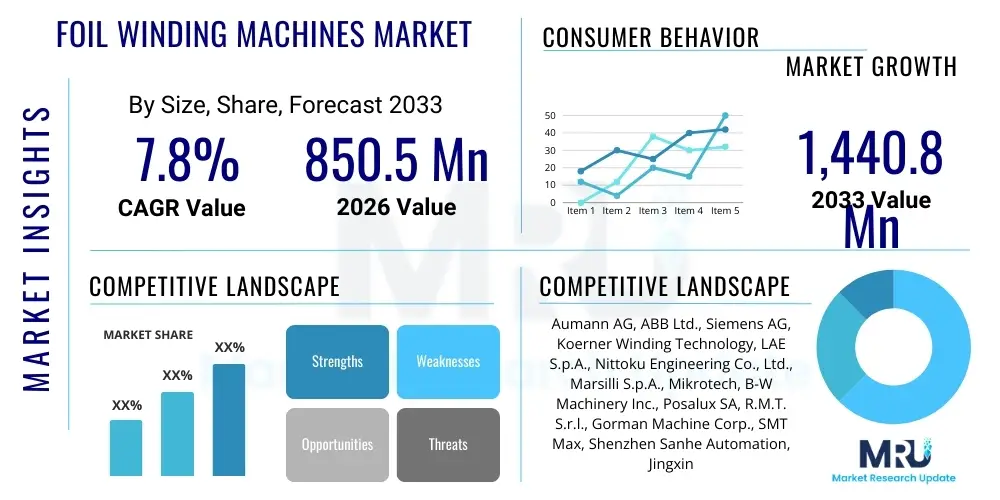

The Foil Winding Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,440.8 Million by the end of the forecast period in 2033.

Foil Winding Machines Market introduction

The Foil Winding Machines Market encompasses specialized industrial equipment designed for precisely layering conductive foils, typically aluminum or copper, along with insulating materials, to form coils utilized primarily in electrical components such as transformers, capacitors, and batteries. These machines are engineered for high precision, repeatability, and speed, crucial requirements for optimizing electrical performance and minimizing material waste. The foundational technology involves highly controlled tensioning systems, edge guiding mechanisms, and automated cutting and welding processes to ensure coil integrity and dimensional accuracy, particularly for high-voltage and high-frequency applications where insulation uniformity is paramount. Modern foil winding machines often incorporate advanced sensor technology and programmable logic controllers (PLCs) to manage complex winding patterns and adapt to varying material specifications, which is essential given the trend toward smaller, more energy-dense electrical components.

Major applications driving this market include the robust demand from the power distribution sector, where foil windings are extensively used in dry-type and oil-immersed distribution transformers due to their superior short-circuit strength and heat dissipation characteristics compared to traditional wire windings. Furthermore, the burgeoning electric vehicle (EV) industry is becoming a significant consumer, requiring high-throughput, precision winding solutions for lithium-ion battery production, specifically for generating the electrode assemblies. The consistent growth in renewable energy infrastructure, particularly solar and wind power, further mandates the need for specialized transformers and power conversion components manufactured using these advanced winding techniques, securing the market's long-term viability.

Key driving factors include global infrastructure modernization initiatives, the increasing adoption of high-efficiency transformers mandated by regulatory bodies to curb energy losses, and the explosive expansion of giga-factories dedicated to EV battery manufacturing worldwide. The benefits conferred by foil winding technology, such as reduced coil hot spots, improved cooling, and maximized space factor, directly contribute to the production of more reliable and compact electrical devices. This technological superiority, combined with the push for industrial automation, solidifies the market's trajectory toward automated, high-speed winding solutions.

Foil Winding Machines Market Executive Summary

The Foil Winding Machines market is characterized by robust growth stemming from accelerated global energy transition strategies and sustained industrial automation investments. Key business trends indicate a definitive shift toward fully automated winding systems capable of integrating seamlessly into Industry 4.0 environments, emphasizing predictive maintenance, data logging, and remote diagnostics. Manufacturers are increasingly focusing on modular machine designs to allow for rapid changeovers between different foil widths and materials, catering to diverse client requirements across power generation and electromobility sectors. Strategic partnerships between machine manufacturers and material suppliers are becoming common to optimize processing parameters for novel conductive materials, such as amorphous metals and specialized insulating polymers, further driving innovation in machine capability and winding efficiency. Competition is centered on machine cycle time reduction, precision enhancements, and total cost of ownership (TCO) improvements, particularly among leading European and Asian suppliers.

Regionally, Asia Pacific (APAC) dominates the market landscape, driven primarily by massive investments in EV battery production capacities in China, South Korea, and Japan, alongside comprehensive grid expansion and modernization efforts across India and Southeast Asia. North America and Europe demonstrate steady demand, fueled by regulatory mandates for energy-efficient transformers (Tier 2 and above) and substantial governmental support for domesticizing battery supply chains. Segment trends highlight the automatic machine category as the fastest-growing sub-segment, propelled by the labor-cost constraints and the need for zero-defect manufacturing in high-volume applications like automotive battery modules. Furthermore, the application segment focused on electric vehicle battery manufacturing is expected to exhibit the highest CAGR, surpassing traditional power transformer applications in growth velocity over the forecast period, reflecting the exponential proliferation of electric mobility solutions globally.

In summary, the market is structurally sound, underpinned by non-cyclical demand from essential infrastructure and high-growth sectors like e-mobility. Technological convergence involving advanced tension control, robotic material handling, and integrated quality inspection systems is setting new benchmarks for productivity and precision. Successful market penetration relies on providing scalable, highly automated solutions that address the specific material complexities associated with high-performance electrical components, ensuring that machine capacity aligns with the projected output requirements of large-scale manufacturing facilities globally.

AI Impact Analysis on Foil Winding Machines Market

User queries regarding AI's influence in the Foil Winding Machines Market primarily center on three themes: how AI can minimize manufacturing defects, the potential for autonomous machine operation and self-optimization, and the utilization of AI for predictive maintenance to ensure maximum machine uptime. Users are seeking clarity on the practical implementation of machine learning algorithms for real-time tension adjustment based on material characteristics (e.g., slight variations in foil thickness or surface texture), which directly impacts coil quality. Furthermore, there is significant interest in how AI can optimize complex, multi-layer winding sequences and predict machine failures by analyzing vibration, temperature, and current consumption data from various components like bearings, spindles, and cutting tools. The expectation is that AI integration will shift machine operation from reactive monitoring to proactive, prescriptive control, drastically improving yield and reducing scrap material.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze sensor data (vibration, thermal, current) to forecast component failure, reducing unplanned downtime by enabling just-in-time repairs.

- Real-Time Quality Control (RTQC): Computer vision and deep learning models monitor foil edge alignment and insulation layer consistency during winding, instantly flagging or correcting minor deviations to prevent large-scale defects.

- Process Optimization and Self-Tuning: AI determines the optimal winding speed, tension profiles, and cutting parameters based on material inputs and environmental conditions, maximizing machine throughput and energy efficiency.

- Automated Fault Diagnosis: Machine learning rapidly identifies the root cause of winding errors (e.g., telescoping, layer misalignment), drastically reducing diagnosis time compared to manual inspection.

- Supply Chain Integration: AI analyzes historical production data and material lead times to optimize material staging and inventory management, ensuring continuous machine operation without material shortages.

DRO & Impact Forces Of Foil Winding Machines Market

The Foil Winding Machines Market is influenced by a dynamic interplay of factors encompassing technological push, economic imperatives, and stringent regulatory frameworks. The primary market driver is the exponential growth of the Electric Vehicle (EV) sector, which requires specialized, ultra-precise winding machines for lithium-ion battery electrodes and high-power density traction transformers, necessitating continuous machine upgrades. Simultaneously, global infrastructure investment, particularly in smart grids and renewable energy integration, fuels demand for high-efficiency dry-type transformers, a key application area for foil winding. However, the market faces restraints, chiefly the high initial capital expenditure associated with purchasing and installing highly automated, precision winding equipment, which poses a barrier to entry for smaller manufacturers. Furthermore, the requirement for highly skilled technicians to operate and maintain these complex machines contributes to operational overheads, limiting adoption in regions with low labor skill availability. Opportunities emerge from the standardization of modular manufacturing platforms, enabling quicker customization and easier integration into existing production lines, along with the development of winding processes optimized for novel materials such as ultra-thin foils and nanomaterial-enhanced insulators, opening avenues in specialized microelectronics and aerospace applications. These forces collectively shape the competitive landscape, pushing manufacturers toward efficiency, automation, and technological precision.

Segmentation Analysis

The Foil Winding Machines Market is segmented based on the level of automation, the type of application, and the winding mechanism utilized, offering a multifaceted view of market dynamics and targeted industry demand. Segmentation by automation level (Automatic, Semi-Automatic) clearly differentiates between high-volume manufacturing environments, dominated by automatic machinery providing maximum throughput and minimal human intervention, and specialized or lower-volume production sites, which rely on semi-automatic machines offering greater flexibility and lower initial investment. Application segmentation—covering transformers (power, distribution, specialty), capacitors, and batteries—highlights the divergent technical requirements across industries, with battery production being the primary growth engine due to increasing EV adoption. The technical differentiation based on winding type, such as linear and helical/spiral, reflects the specific geometric and functional requirements of the resulting coil, influencing machine design and precision specifications.

- By Automation Level:

- Automatic Foil Winding Machines

- Semi-Automatic Foil Winding Machines

- By Application:

- Transformers (Distribution, Power, Specialty/Traction)

- Capacitors (Power Factor Correction, Film Capacitors)

- Batteries (Lithium-ion Electrode Assemblies)

- Other Industrial Components

- By Winding Type:

- Linear Winding Machines

- Helical/Spiral Winding Machines

- Layer Winding Machines

- By Winding Material:

- Aluminum Foil Winding Machines

- Copper Foil Winding Machines

Value Chain Analysis For Foil Winding Machines Market

The value chain for the Foil Winding Machines Market begins with the upstream suppliers of raw materials and precision components. This includes manufacturers of high-tolerance steel and alloys for machine frameworks, specialized electronics suppliers providing servo motors, PLCs, sensors, and computer numerical control (CNC) systems, and specialized engineering firms supplying customized tension control units and foil cutting tools. The performance and reliability of the final winding machine are heavily dependent on the quality and integration of these critical upstream components. Manufacturers of the foil winding machines then engage in complex design, precision assembly, and rigorous testing phases, adding significant value through proprietary winding algorithms and software integration that dictate the machine's efficiency and coil quality. The transition toward Industry 4.0 has increased the importance of software providers within this upstream segment, focusing on digital twins and remote diagnostic capabilities.

The midstream involves the distribution and sales channels, categorized into direct and indirect methods. Direct distribution is favored for large, custom-engineered, high-cost automatic systems, where machine manufacturers engage directly with large transformer and battery gigafactories, providing personalized technical support, installation, and post-sales servicing. This approach ensures specialized knowledge transfer and rapid resolution of complex issues. Indirect channels, involving authorized distributors, system integrators, and regional representatives, are typically utilized for standard, semi-automatic, or lower-capacity machines, particularly penetrating smaller regional markets or serving niche component manufacturers. These distributors provide localized stock, immediate technical guidance, and credit financing options, acting as critical conduits for market access, especially in emerging economies. The choice between direct and indirect distribution channels heavily influences pricing strategies and service levels.

The downstream segment encompasses the end-users—primarily transformer manufacturers, battery cell producers, and capacitor makers—who utilize the machinery to produce essential electrical components. The effectiveness of the machine dictates the output quality of these end-products, placing significant downstream pressure on machine OEMs for high reliability and low downtime. Furthermore, the downstream activities include maintenance, spare parts provision, and potential machine upgrades or refurbishments. As the market pivots towards sustainable manufacturing, the circular economy model is gaining traction, requiring machine manufacturers to also participate in providing end-of-life solutions or modernization packages to their established customer base, ensuring the long-term sustainability of the installed base.

Foil Winding Machines Market Potential Customers

The primary customers for Foil Winding Machines are large-scale manufacturers operating within the electrical and electronic sectors, necessitating high-precision coil production for their core products. The most prominent consumer segment comprises manufacturers of power and distribution transformers, including global utility suppliers and regional electric equipment providers. These entities require robust, large-format winding machines capable of handling wide foils and heavy loads, often customized for specific voltage classes and insulation systems (e.g., dry-type vs. oil-immersed cores). Demand in this sector is driven by grid modernization, replacement cycles for aging infrastructure, and increasing global electricity demand.

A rapidly expanding and highly strategic customer group consists of Electric Vehicle (EV) battery manufacturers and Giga-factory operators. Companies focused on producing lithium-ion cylindrical, pouch, or prismatic cells require highly specialized, cleanroom-compatible foil winding machines optimized for high-speed, extremely precise assembly of anode and cathode electrode foils. This sub-segment demands machines with superior tension control and environmental monitoring capabilities, often integrating robotics for automated handling of delicate components. Furthermore, manufacturers of industrial capacitors, utilized for power factor correction, filtering, and energy storage in various electronics and heavy machinery, represent another established customer base, demanding specialized machines for film and foil winding processes.

Other significant buyers include Original Equipment Manufacturers (OEMs) specializing in railway traction systems, aerospace electronics, and high-frequency induction heating equipment, all of which require specialized magnetics produced using foil winding techniques for improved efficiency and power density. These customers prioritize machine flexibility, precision, and adherence to stringent quality and certification standards. Procurement decisions across all customer segments are heavily influenced by machine throughput, demonstrated Mean Time Between Failures (MTBF), and the manufacturer's ability to provide localized service and rapid spare parts availability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,440.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aumann AG, ABB Ltd., Siemens AG, Koerner Winding Technology, LAE S.p.A., Nittoku Engineering Co., Ltd., Marsilli S.p.A., Mikrotech, B-W Machinery Inc., Posalux SA, R.M.T. S.r.l., Gorman Machine Corp., SMT Max, Shenzhen Sanhe Automation, Jingxin Automation Equipment Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foil Winding Machines Market Key Technology Landscape

The Foil Winding Machines market is undergoing rapid technological evolution, primarily driven by the need for higher precision, faster cycle times, and enhanced automation to meet the stringent quality demands of modern electrical components. A foundational technology involves sophisticated Tension Control Systems (TCS). Modern machines utilize closed-loop, dynamic TCS employing pneumatic brakes, magnetic particle clutches, or highly responsive servo motors to maintain extremely precise and consistent foil tension throughout the entire winding process, preventing wrinkles, tearing, and non-uniform layer density. This precision is non-negotiable, particularly in transformer manufacturing, where tension directly impacts short-circuit withstand capabilities, and in battery production, where inconsistent winding can lead to safety hazards and reduced cycle life. Furthermore, advanced laser- or vision-based Edge Guiding Systems (EGS) are critical, ensuring the perfect alignment of ultra-thin foils and insulation layers, which is crucial for maximizing space factor and minimizing partial discharge risks in high-voltage applications.

Automation and control technologies form the second pillar of the modern winding landscape. High-performance Programmable Logic Controllers (PLCs) and Computer Numerical Control (CNC) systems manage complex multi-axis synchronization necessary for winding non-circular or highly intricate coil shapes, such as those found in specialty traction transformers. Robotics integration is becoming standard, particularly in high-volume battery giga-factories, where articulated robots handle heavy foil rolls, perform automated loading/unloading, and execute precision cutting and ultrasonic welding of the foil leads. This level of automation significantly reduces labor costs, improves process repeatability, and allows for continuous 24/7 operation, which is paramount for achieving economies of scale in component production.

Finally, the integration of Industry 4.0 concepts, including the Internet of Things (IoT) and data analytics, defines the cutting edge of winding machine technology. Machines are now equipped with extensive sensor arrays that continuously collect operational data on temperature, vibration, energy consumption, and product quality. This data is leveraged for sophisticated monitoring, enabling predictive maintenance schedules and facilitating remote diagnostics and process optimization via cloud-based platforms. The ongoing technological development focuses heavily on integrating self-correcting mechanisms utilizing AI, allowing the machine to instantaneously adjust winding parameters in response to real-time material variations or thermal expansion, thus ensuring zero-defect output and maintaining the market’s technological trajectory toward fully autonomous manufacturing cells.

The transition toward higher power density electrical components necessitates machines capable of handling novel composite materials and ultra-thin foils (sometimes as thin as 5-10 micrometers). This requires extreme environmental control, often incorporating cleanroom specifications (e.g., ISO Class 7 or 8) and sophisticated dust mitigation systems, particularly in battery electrode winding, to prevent micro-contamination that can compromise electrochemical performance. The welding technology integrated into these machines is also evolving, moving towards advanced laser welding and ultrasonic bonding techniques for creating low-resistance electrical connections without compromising the structural integrity of the delicate foil edges, replacing traditional soldering methods in high-specification applications. These technical advancements underscore the market’s dependence on continuous R&D investment to meet evolving electrical engineering demands.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Foil Winding Machines market, dominating both production and consumption. The region’s supremacy is primarily driven by massive government-backed initiatives in China, Japan, and South Korea aimed at securing global leadership in Electric Vehicle (EV) manufacturing and lithium-ion battery production. China, in particular, hosts the largest concentration of battery gigafactories and transformer manufacturing hubs, resulting in robust demand for high-speed, fully automatic winding solutions. Furthermore, increasing urbanization and industrialization in India and Southeast Asian nations necessitate significant investments in power infrastructure, driving the demand for distribution transformer winding machines. The competitive landscape in APAC is intense, characterized by strong domestic players offering highly customized and cost-competitive solutions alongside global technology leaders.

- Europe: The European market is characterized by a strong focus on high-precision, niche applications and adherence to stringent environmental and safety regulations. Demand is robust due to the region's commitment to decarbonization, fueling the production of high-efficiency, specialized transformers for renewable energy integration (e.g., wind turbine converters) and smart grid projects. Western European countries are also rapidly expanding their domestic EV battery supply chain, necessitating significant investment in state-of-the-art automatic foil winding machinery. European manufacturers often lead in integrating advanced automation features, AI-driven quality control, and developing modular systems designed for maximum flexibility and minimal material waste.

- North America: The North American market is poised for accelerated growth, supported by legislative actions like the Infrastructure Investment and Jobs Act and initiatives aimed at strengthening domestic manufacturing, particularly in the semiconductor and EV battery sectors. The demand centers around high-end, automatic machinery for producing sophisticated components, including high-frequency magnetic components for industrial power electronics and traction transformers for high-speed rail and utility upgrades. While the U.S. remains a key consumer, Canadian and Mexican industrial expansion, especially in automotive manufacturing, also contributes significantly to regional market demand for reliable and high-throughput winding solutions.

- Latin America (LATAM): The LATAM market represents an emerging opportunity, driven by necessary investments in power grid expansion and modernization across economies like Brazil, Mexico, and Chile. Demand is largely concentrated in semi-automatic and basic automatic machines for regional transformer manufacturers addressing growing domestic energy needs. Economic volatility and currency fluctuations can sometimes restrain major capital expenditure, but long-term infrastructure projects provide a steady foundational demand. Local partnerships and favorable financing options are key strategies for market penetration in this region.

- Middle East and Africa (MEA): Growth in MEA is primarily propelled by significant infrastructure development projects in the Gulf Cooperation Council (GCC) countries, focusing on utility upgrades, smart city initiatives, and diversification away from oil dependency. Large-scale renewable energy projects (solar parks) require specialized transformer manufacturing capabilities, stimulating demand for modern foil winding equipment. South Africa and specific North African nations, with established manufacturing bases, also contribute to the regional market, focusing on enhancing local power distribution capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foil Winding Machines Market.- Aumann AG

- ABB Ltd.

- Siemens AG

- Koerner Winding Technology

- LAE S.p.A.

- Nittoku Engineering Co., Ltd.

- Marsilli S.p.A.

- Mikrotech

- B-W Machinery Inc.

- Posalux SA

- R.M.T. S.r.l.

- Gorman Machine Corp.

- SMT Max

- Shenzhen Sanhe Automation

- Jingxin Automation Equipment Co. Ltd.

- Hana Technology Co., Ltd.

- Dongguan Zhenghai Machinery Manufacturing Co., Ltd.

- Hangzhou Fuyang Dongda Electrical Machinery Co., Ltd.

- Axismac Co., Ltd.

- Ruhle Winding Technology GmbH

Frequently Asked Questions

Analyze common user questions about the Foil Winding Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for automatic foil winding machines?

The primary driver is the rapid global expansion of Electric Vehicle (EV) battery gigafactories, which require high-speed, ultra-precision automatic machinery for mass production of lithium-ion electrode assemblies and efficient traction transformers.

How do modern winding machines ensure high precision and defect reduction?

High precision is ensured through dynamic, closed-loop Tension Control Systems (TCS), advanced laser-guided edge alignment systems (EGS), and integrated vision inspection utilizing AI/ML for real-time quality monitoring and self-correction during the winding process.

Which application segment holds the greatest growth potential in the foil winding market?

The battery application segment, specifically for lithium-ion electrode winding, holds the highest growth potential due to unprecedented global investment and scaling in electric mobility manufacturing capacity.

What are the main technical challenges associated with foil winding?

Key technical challenges include maintaining consistent tension across ultra-thin foils (preventing tearing or telescoping), ensuring perfect edge alignment of wide foils, and integrating seamless ultrasonic or laser welding for terminal connections at high production speeds.

Which geographic region dominates the consumption of foil winding equipment?

Asia Pacific (APAC), particularly driven by manufacturing hubs in China, South Korea, and Japan, dominates consumption due to its control over global EV battery production and extensive regional investments in power grid infrastructure.

The Foil Winding Machines market continues to evolve significantly, marked by advancements aimed at increasing operational efficiency and precision, thereby serving the increasingly demanding specifications of energy storage and transmission infrastructure globally. The market's resilience is strongly linked to non-cyclical energy demand and the irreversible trend towards electrification in transportation. Continuous technological upgrades, including advanced motion control and material handling automation, are expected to keep investment high, particularly in regions committed to green energy transition and domestic component manufacturing. The shift from semi-automatic to fully integrated automatic lines represents the core commercial strategy for manufacturers aiming to capture market share in high-growth segments like EV batteries. The competitive landscape will likely consolidate around vendors capable of offering comprehensive software and hardware solutions that integrate effectively into large-scale, digitally managed production environments. Future growth hinges on the ability of machine builders to rapidly adapt their designs to accommodate next-generation materials and higher throughput requirements for sustainable manufacturing processes.

In analyzing the strategic implications for market participants, several factors stand out. Firstly, diversification of application portfolio beyond traditional transformers into the high-growth battery sector is crucial for long-term viability. Companies that successfully optimize winding processes for electrode foils—addressing issues like material handling in clean environments and precision welding—are gaining a competitive edge. Secondly, enhancing global service networks and providing extensive training for local technicians are essential for maintaining uptime, given the complexity and cost of these machines. This focus on after-sales support mitigates the restraint associated with the high skill requirement. Lastly, strategic acquisitions or partnerships focused on integrating sensor technology, industrial AI, and advanced robotics will determine market leadership, enabling providers to offer truly autonomous and self-optimizing winding solutions that reduce operational variance and ensure maximum quality output, thereby aligning with the stringent requirements of high-value electrical component manufacturing worldwide. The convergence of material science, mechanical engineering, and software intelligence dictates the technological trajectory of the industry for the foreseeable future, making innovation in machine control systems a central theme for stakeholder investment and product development.

The regulatory environment also plays a pivotal role, particularly standards related to energy efficiency in transformers (such as IEC and DOE standards) which directly promote the adoption of high-performance foil-wound designs due to their superior efficiency characteristics compared to wire-wound alternatives. Furthermore, safety standards governing battery manufacturing necessitate rigorous process control, pushing machine builders to incorporate failsafe mechanisms and advanced quality inspection features directly into the winding process. Geopolitical shifts, particularly related to the localization of critical supply chains, are prompting significant capital expenditures in North America and Europe to establish domestic winding capacity for both transformers and battery cells, thereby creating robust regional demand pockets independent of traditional Asian manufacturing dominance. This localization trend favors manufacturers capable of providing quick deployment and customized solutions tailored to regional infrastructure and regulatory compliance requirements, fostering a fragmented yet highly competitive global market structure centered on precision engineering.

The evolution of foil material characteristics presents ongoing challenges and opportunities. As end-users seek to reduce weight and size, the demand for handling extremely thin copper and aluminum foils, coupled with specialized insulation materials, increases the technical complexity of the machines. Winding machines must compensate for the reduced mechanical strength of these thin materials while maintaining high speed. Machine developers are responding by incorporating air bearing systems and highly sophisticated damping mechanisms to minimize vibration and prevent foil damage. Similarly, the trend toward amorphous metal cores in high-efficiency transformers requires specialized machine adjustments to handle the unique magnetic and physical properties of these materials, ensuring optimal core geometry. This constant need for technological adaptation underscores the market's dynamism and the necessity for continuous innovation in machine tooling, tension control, and material feeding systems to remain relevant in this rapidly evolving industrial segment.

In conclusion, the Foil Winding Machines market is positioned for sustainable high growth, primarily catalyzed by the global energy storage revolution and crucial grid infrastructure upgrades. The market’s sophistication is continually increasing, marked by the integration of advanced technologies like AI/ML for process optimization and fault prediction. While the initial investment remains a restraint, the long-term benefits of superior component quality, increased automation, and reduced operational costs outweigh the capital expenditure for major industrial players. Asia Pacific remains the dominant manufacturing powerhouse, yet strategic regionalization efforts in North America and Europe are creating significant secondary growth vectors. Successful market strategy involves deep collaboration with end-users to provide tailored, highly automated, and maintenance-optimized winding solutions that meet the specialized needs of modern electrical component manufacturing.

Furthermore, the long-term sustainability of the market is tied closely to the maintenance and refurbishment market. Given the significant capital investment, end-users prioritize machines with long operational lifespans and modular designs that allow for easy upgrades rather than complete replacement. This preference creates opportunities for machine manufacturers to offer comprehensive life-cycle management services, including predictive maintenance contracts, software updates, and hardware retrofits to improve speed and precision of older models. This service-oriented segment ensures revenue stability and strengthens customer loyalty. The competitive differentiation increasingly relies not just on the raw speed of the machine but on the overall Total Cost of Ownership (TCO) calculated over a 15-20 year operational cycle, factoring in energy consumption, waste rates, and maintenance costs. Therefore, machines engineered for high energy efficiency and minimal material scrap gain a substantial commercial advantage, reflecting the industry's commitment to both economic and environmental performance metrics.

The increasing complexity of product designs, particularly in high-power density applications like aviation or high-speed rail, drives demand for machines capable of handling non-standard coil geometries and multi-layered foil structures with exceptional accuracy. This pushes machine builders towards developing highly flexible and software-driven systems that can switch quickly between different product specifications with minimal retooling time. The concept of "smart tooling" – utilizing easily swappable, electronically optimized component sets – is becoming critical. This flexibility addresses the market volatility inherent in consumer electronics and automotive sectors, where product cycles are relatively short and production volumes can fluctuate rapidly. Manufacturers who can deliver versatile, high-mix, low-volume capabilities alongside established high-volume production efficiency are best positioned to capture a broader client base and mitigate risks associated with reliance on a single, massive end-user sector. The future of foil winding technology is intrinsically linked to its adaptability and digital intelligence.

In terms of upstream supply chain risks, the availability and cost stability of high-precision electronic components, such as specialized servo drives and high-resolution sensors, pose ongoing challenges. Global semiconductor shortages and geopolitical tensions can disrupt lead times and escalate manufacturing costs for machine builders. To mitigate these risks, leading manufacturers are adopting dual-sourcing strategies and increasing inventory buffers for critical components, or engaging in closer collaboration with key component suppliers to ensure supply continuity. Furthermore, intellectual property protection remains a major competitive element, particularly in APAC, where rapid imitation of advanced European and North American designs is prevalent. Manufacturers invest heavily in securing patents for proprietary winding algorithms and specialized tensioning mechanisms, ensuring their technological advantage remains protected and distinct in the global marketplace. The long-term success in the Foil Winding Machines Market is therefore a balancing act between continuous technological innovation, operational efficiency, robust supply chain management, and strategic market defense against unauthorized replication.

The market for refurbishment and retrofitting of older winding machines presents a sustainable revenue stream and addresses the capital expenditure constraints faced by smaller players. Many existing machines, especially those used for standard distribution transformers, have robust mechanical frames but outdated control systems. Upgrading these machines with modern PLCs, servo motors, and advanced software significantly extends their life, enhances precision, and integrates them into modern digital factories without the need for prohibitive full replacement costs. This trend not only supports smaller businesses but also aligns with global sustainability goals by promoting the circular economy within industrial manufacturing. Providers specializing in these retrofit services are gaining prominence, bridging the gap between legacy infrastructure and Industry 4.0 capabilities, thereby contributing significantly to the overall market ecosystem and sustaining the installed base of foil winding technology globally.

Finally, skilled labor development is paramount. Even with increased automation, operating and maintaining these complex, multi-million-dollar machines requires specialized engineering expertise. Market leaders are investing heavily in augmented reality (AR) and virtual reality (VR) training simulations to rapidly upskill technicians, particularly in high-growth regions like Southeast Asia and Eastern Europe. Remote diagnostic and support capabilities, often facilitated by AI, reduce the need for constant on-site vendor support, making the machines more operationally feasible in remote industrial locations. The integration of digital twins allows operators to simulate production runs and troubleshoot issues in a virtual environment before affecting physical production, thereby minimizing material waste and maximizing first-pass yield. This focus on human-machine interaction and specialized workforce development is an indispensable strategic element for long-term growth in the highly automated foil winding machinery sector.

The ongoing global emphasis on grid stability and energy security, especially following recent geopolitical events, further reinforces the demand for high-reliability components, manufactured using precision equipment. This regulatory and strategic environment favors manufacturers of foil winding machines that can demonstrate proven track records in minimizing defects and maximizing component longevity. Furthermore, as battery technology rapidly advances, incorporating solid-state electrolytes or new anode materials, winding machine suppliers must be technologically agile to handle these novel materials and potentially new winding processes. This requirement for continuous, application-specific R&D keeps the market highly competitive and innovation-driven. The market is thus poised not just for growth in volume, but significant qualitative technological advancement over the forecast period.

One critical emerging application area driving specialized machine demand is in high-voltage direct current (HVDC) transmission systems. HVDC transformers and smoothing reactors require extremely robust and highly customized foil windings to manage very high voltages and minimize partial discharges. Machines catering to this specialized, high-margin niche must meet unparalleled levels of precision and quality assurance, often involving complex insulation schemes and large coil sizes. Similarly, the growing adoption of GaN (Gallium Nitride) and SiC (Silicon Carbide) power electronics in industrial and automotive sectors demands high-frequency transformers that are compact and highly efficient, further emphasizing the need for ultra-precise foil winding capabilities adapted for high-frequency magnetic materials. This diversification into highly technical, specialty applications ensures that the market remains technologically segmented and provides high barriers to entry for new competitors who lack the necessary precision engineering expertise and control system know-how. This segment is expected to exhibit premium pricing and strong profitability margins for the specialized equipment vendors.

In addition to technological factors, sustainability requirements are becoming increasingly important in procurement decisions. End-users are scrutinizing the manufacturing process of the winding machines themselves, looking for lower energy consumption per coil produced and machines built with environmentally friendly materials. Machine manufacturers are responding by optimizing machine weight, using regenerative braking systems for servo drives, and implementing smart energy management features. The ability to minimize material scrap, achieved through precise tension control and superior cutting mechanisms, is also a significant selling point, as material waste, especially copper and specialized insulation film, represents a major cost component for end-users. Demonstrating superior environmental, social, and governance (ESG) performance throughout the product life cycle—from design to end-of-life—is becoming a differentiator, particularly when supplying to large multinational corporations with strict sustainability targets, influencing procurement decisions beyond mere price and performance metrics.

Finally, the strategic focus on localized manufacturing necessitates robust regional sales and technical support infrastructure. Due to the size and complexity of automatic foil winding machines, shipping and installation are substantial logistical challenges. Offering localized installation, commissioning, and immediate access to regional spare parts inventory reduces delivery times and minimizes the risk of extended production halts, a critical concern for large-scale production facilities. This emphasis on regional presence favors global players with established footprint or encourages strategic alliances between Western technology providers and local fabrication houses in high-growth regions like APAC and LATAM. This localized approach not only enhances customer service but also often allows manufacturers to bypass import tariffs and comply more easily with local content requirements, creating a more cost-effective and resilient supply strategy in volatile markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager