Folder And Gluer Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438153 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Folder And Gluer Machines Market Size

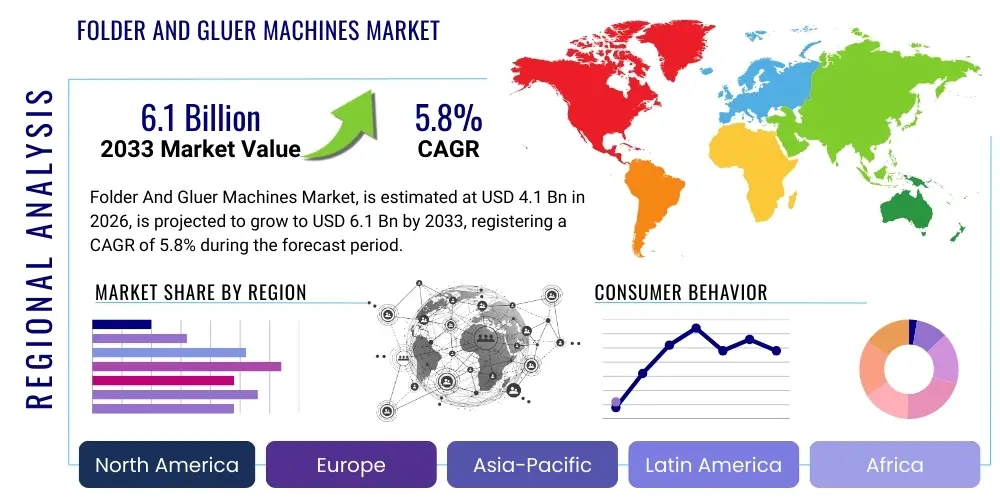

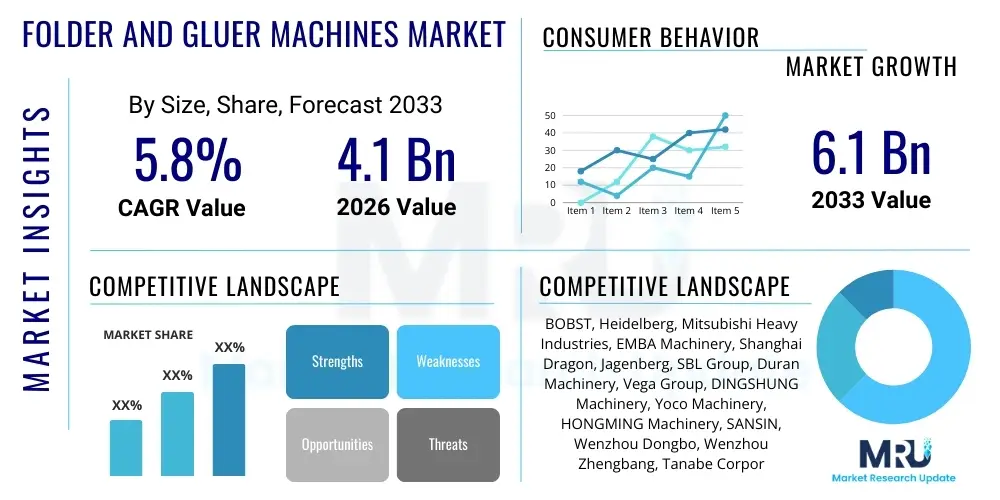

The Folder And Gluer Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Folder And Gluer Machines Market introduction

The Folder And Gluer Machines Market encompasses specialized industrial equipment designed for the automated and semi-automated production of finished packaging products, primarily folding cartons and corrugated boxes. These sophisticated machines perform precise folding and gluing operations on die-cut blanks, converting them into three-dimensional structures ready for filling. The product description highlights machinery that integrates advanced feeding systems, precise alignment mechanisms, various gluing technologies (hot melt, cold glue), and highly efficient folding sections, culminating in accurate accumulation and pressing stations. Technological advancements, such as servo control and modular designs, are continually enhancing operational flexibility and reducing setup times, catering to the increasing demand for short-run, customized packaging solutions across various industrial sectors globally.

Major applications for folder and gluer machines span high-volume consumer goods packaging, including the food and beverage industry, pharmaceutical sector, cosmetics and personal care, and the rapidly expanding e-commerce logistics domain. These machines are crucial for producing standard straight-line boxes, complex crash-lock bottoms, four/six-corner trays, and specialized envelopes, requiring high precision to ensure structural integrity and aesthetic quality. The primary benefits derived from adopting these machines include significant increases in production speed, enhanced gluing accuracy, substantial reduction in labor costs, and consistent quality output necessary for brand compliance and efficient automated downstream packaging processes. The ability to handle diverse substrates, from micro-flute corrugated board to high-density carton stock, reinforces their essential role in modern converting operations.

The market is predominantly driven by the relentless expansion of the global packaging industry, stimulated by population growth, urbanization, and rising disposable incomes in emerging economies. The surging demand for sustainable, convenient, and aesthetically pleasing packaging solutions necessitates faster and more versatile converting equipment. Furthermore, the stringent quality requirements in high-value industries, particularly pharmaceuticals, push manufacturers toward fully automated folder and gluer systems that offer robust traceability and minimal potential for human error. Regulatory pressures related to food safety and sustainable packaging materials also compel converters to invest in modern machines capable of processing recycled and biodegradable substrates effectively, thus underpinning the market’s steady growth trajectory through the forecast period.

Folder And Gluer Machines Market Executive Summary

The Folder And Gluer Machines Market is characterized by robust business trends centered on automation, digitization, and sustainability. Key business trends include the strong shift towards fully automated, high-speed machinery capable of handling complex carton geometries at speeds exceeding 60,000 boxes per hour, driven by the need for operational efficiency and throughput maximization in large converting plants. Manufacturers are increasingly integrating IoT capabilities and advanced diagnostics, allowing for predictive maintenance and real-time performance monitoring, transforming traditional machinery into smart production assets. Sustainability trends dictate the demand for equipment optimized for thinner materials and alternative adhesives, reducing waste and energy consumption in line with corporate environmental goals.

Regionally, the Asia Pacific (APAC) region dominates the market and is projected to exhibit the highest growth, fueled by massive industrialization, the proliferation of large-scale packaging hubs in China and India, and the explosive growth of e-commerce across Southeast Asia, necessitating tremendous volumes of corrugated and folding carton packaging. North America and Europe, while mature markets, maintain strong demand, particularly for high-end, highly automated, and specialized machines (e.g., those serving the pharmaceutical sector) where precision and compliance are paramount. Rest of the World (RoW) regions, including Latin America and the Middle East, are accelerating their adoption of advanced folder and gluer technology as they modernize their domestic manufacturing and packaging infrastructure to cater to local demand.

Segmentation trends highlight the increasing preference for fully automatic machines due to their inherent efficiency benefits over semi-automatic and manual counterparts. By application, the folding cartons segment remains crucial, driven by fast-moving consumer goods (FMCG), but the corrugated boxes segment is experiencing rapid expansion, directly linked to the booming global logistics and e-commerce sectors. End-user analysis shows that Food & Beverage and E-commerce represent the primary growth engines, requiring machines that offer rapid changeovers and flexibility to accommodate diverse product shapes and sizes. The integration of specialty segments, such as micro-flute handling capabilities, is becoming a key differentiator among leading machinery providers, enabling converters to serve niche high-value markets effectively.

AI Impact Analysis on Folder And Gluer Machines Market

User queries regarding the impact of Artificial Intelligence (AI) on folder and gluer machines primarily focus on three areas: efficiency optimization, fault prediction, and the feasibility of autonomous operation. Users are keen to understand how AI-driven machine learning algorithms can improve throughput by optimizing feeder speeds and folding timing based on material variation (stock thickness, glue viscosity) in real-time, thereby minimizing downtime and material waste. Another significant theme is the implementation of predictive maintenance; users seek assurance that AI can analyze sensor data (vibration, temperature, current draw) to forecast component failure long before operational disruption occurs, reducing costly emergency repairs and enhancing overall equipment effectiveness (OEE). Finally, there is burgeoning interest in highly autonomous systems where AI assists operators with rapid job setup, automated quality checks via vision systems, and dynamic adjustment of operational parameters, reducing reliance on highly skilled technical staff and enhancing manufacturing agility in a labor-constrained environment.

- AI integration enables real-time optimization of gluing patterns and folding speeds based on material characteristics, maximizing throughput.

- Machine learning models utilize sensor data for advanced predictive maintenance, drastically reducing unexpected machine downtime and optimizing spare parts inventory.

- AI-powered vision systems provide 100% inline quality control, identifying defective gluing or folding at high speeds, improving end-product reliability.

- AI facilitates automated, rapid job changeovers by learning previous optimal setup configurations, significantly enhancing operational flexibility for short runs.

- AI algorithms contribute to energy efficiency by dynamically adjusting motor speeds and heating elements based on actual production load and environmental conditions.

DRO & Impact Forces Of Folder And Gluer Machines Market

The Folder And Gluer Machines Market is significantly shaped by a confluence of driving factors (D) centered on global packaging growth, restraining factors (R) related to high capital investment, and emerging opportunities (O) arising from technological innovation and sustainability mandates, all coalescing to create specific impact forces. The dominant driving force remains the increasing consumption of packaged goods worldwide, specifically catalyzed by the expansion of e-commerce, which requires enormous volumes of durable and precisely constructed corrugated and folding cartons. This escalating demand provides a continuous impetus for converting facilities to upgrade or expand their operational capacity with high-speed, automated gluers. Concurrently, the increasing complexity of carton design, driven by marketing requirements for shelf appeal and specialized functions like tamper-evidence, pushes the technical envelope for machine performance, favoring investments in sophisticated, multi-functional equipment.

However, the market faces notable restraints, primarily the substantial initial capital expenditure required for acquiring advanced, high-capacity folder and gluer systems. This financial hurdle often limits adoption among smaller packaging companies or those in developing economies, leading to a market dichotomy where high-end equipment is concentrated among multinational packaging conglomerates. Furthermore, the specialized nature of these machines necessitates a highly trained workforce for complex maintenance and setup operations. The shortage of skilled technicians capable of servicing sophisticated servo-driven machinery presents a persistent operational restraint, impacting OEE and prompting manufacturers to focus on user-friendly interfaces and remote diagnostic capabilities to mitigate this labor gap.

Opportunities for market expansion are strongly tied to the global sustainability movement and the adoption of Industry 4.0 principles. The opportunity lies in developing machinery optimized for emerging sustainable substrates, such as biodegradable films and lighter-weight recycled fibers, without compromising structural integrity or speed. Moreover, the integration of advanced automation features, including robotics for feeding and palletizing, and enhanced connectivity (IoT, cloud integration) offers a substantial opportunity to boost efficiency and create highly flexible manufacturing cells. These combined impact forces—high demand met by capital intensity and technological opportunity—drive innovation toward specialized, intelligent, and highly efficient machines capable of navigating the changing demands of modern packaging production while maintaining high margins for equipment providers.

Segmentation Analysis

The Folder And Gluer Machines Market segmentation provides a granular view of product utilization and market dynamics, primarily classified by automation type, application, and end-user industry. This structured division helps in understanding specific demand pockets within the global packaging conversion landscape. By Type, the distinction between fully automatic, semi-automatic, and manual machinery reflects the differing production requirements and investment capabilities of converters, with automatic machines commanding the largest and fastest-growing share due to their superior speed and reduced operational cost per unit. By Application, the segmentation differentiates between the production of standard corrugated boxes, intricate folding cartons (used heavily in FMCG and pharmaceuticals), specialty packaging like micro-flute and window patching, and niche products, each requiring distinct machine configurations and functionalities.

- By Type:

- Automatic

- Semi-Automatic

- Manual

- By Application:

- Corrugated Boxes

- Folding Cartons

- Specialty Packaging (e.g., crash-lock, 4/6 corner)

- Others (e.g., envelopes, sleeves)

- By End-User Industry:

- Food & Beverage

- Pharmaceuticals & Healthcare

- Cosmetics & Personal Care

- E-commerce & Logistics

- Consumer Goods & Household Products

Value Chain Analysis For Folder And Gluer Machines Market

The value chain for the Folder And Gluer Machines Market begins with upstream activities involving the sourcing of high-precision components, including specialized servo motors, advanced electrical controls (PLCs), high-speed sensors, and machine tooling (folding hooks, belts). Key upstream suppliers are global leaders in automation technology, emphasizing reliability and technological superiority, as these components dictate the performance and longevity of the final machinery. Strong relationships with reliable component providers are critical for machinery manufacturers to ensure system integration compatibility and maintain the necessary speed and accuracy specifications expected in modern packaging lines. Intellectual property protection for proprietary folding and gluing techniques also represents a crucial upstream asset managed by leading equipment suppliers.

The midstream phase involves the core manufacturing, assembly, testing, and system integration of the folder and gluer machines. Manufacturers often specialize in specific formats (e.g., high-speed corrugated gluers versus highly flexible cosmetic carton gluers). Distribution channels are segmented into direct sales, especially for large, customized, and high-value installations requiring extensive pre-sales consultation and after-sales support, and indirect channels, utilizing regional distributors or agents who manage sales, installation, and localized servicing for smaller or standardized models. The decision between direct and indirect distribution often depends on the market maturity and the complexity of the machinery being sold, with direct sales dominating high-growth, high-value regions like North America and Western Europe.

Downstream activities focus on the end-users, which are the converting companies that operate these machines to produce finished packaging for brands and retailers. After-sales service forms a crucial, high-margin component of the downstream value chain, encompassing maintenance contracts, spare parts supply, technical training, and software upgrades. This support is essential because machine uptime is directly linked to the converter's profitability. The increasing demand for remote diagnostics and support, often delivered via cloud connectivity, is transforming downstream service delivery. The ultimate buyers, or end-users, include major multinational packaging corporations and large integrated printers whose investment decisions are driven by ROI, OEE, machine flexibility, and commitment to long-term service agreements offered by the machinery supplier.

Folder And Gluer Machines Market Potential Customers

The primary potential customers and end-users of folder and gluer machines are large-scale commercial printing companies and specialized packaging converters that operate in high-volume production environments. These customers require high-speed, reliable equipment to process millions of carton and box blanks annually across diverse material types. Integrated packaging companies, which manage everything from design and printing to die-cutting and gluing, represent a critical segment, seeking maximum automation and seamless integration between different stages of the production line. Their purchasing decisions are heavily influenced by the ability of the machinery to handle diverse job complexities efficiently, minimizing downtime associated with changeovers and maintenance, thereby ensuring optimal productivity and low unit costs essential for winning competitive supply contracts.

Another significant customer segment is multinational Fast-Moving Consumer Goods (FMCG) brand owners, particularly those who have vertically integrated their packaging operations or demand specific, high-quality standards from their suppliers. The pharmaceutical sector is also a high-value customer base, prioritizing folder and gluer machines that incorporate rigorous quality inspection systems (vision systems for code reading and glue detection) and comply with regulatory standards for traceability and validation. These customers seek machines offering extremely precise folding and robust gluing to ensure product protection and regulatory compliance, making reliability and advanced quality control features paramount over initial capital cost. The expanding e-commerce sector acts as a powerful catalyst, driving intense demand among logistics packaging providers for high-speed corrugated gluers specialized in producing robust shipping boxes and mailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BOBST, Heidelberg, Mitsubishi Heavy Industries, EMBA Machinery, Shanghai Dragon, Jagenberg, SBL Group, Duran Machinery, Vega Group, DINGSHUNG Machinery, Yoco Machinery, HONGMING Machinery, SANSIN, Wenzhou Dongbo, Wenzhou Zhengbang, Tanabe Corporation, Xiamen Xinlian Machinery, Wuxi Huada, Acme International, Lamina System AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Folder And Gluer Machines Market Key Technology Landscape

The Folder And Gluer Machines Market is undergoing a rapid technological evolution, driven primarily by the need for higher production speeds, greater precision, and unparalleled flexibility. A cornerstone technology is the widespread adoption of advanced Servo Drive Systems. Unlike traditional mechanical drives, servo systems offer independent control over different machine sections (feeders, folding belts, delivery), allowing for extremely precise positioning and dynamic speed adjustments in real-time. This level of control is crucial for handling complex carton styles, ensuring highly accurate register, and facilitating near-instantaneous, automated job changeovers, which is vital for the modern packaging environment characterized by smaller batch sizes and personalized runs. Furthermore, high-resolution vision systems, integrated with AI, are becoming standard features, enabling continuous quality inspection and automatic rejection of defective blanks, ensuring zero-defect output, particularly critical in pharmaceutical and food packaging.

Another pivotal technological development involves the sophistication of Gluing Technology itself. While traditional cold glue systems remain prevalent, the use of high-pressure hot melt systems is expanding, especially for difficult substrates and specialized applications requiring immediate bonding strength. Modern gluers incorporate highly reliable, non-contact glue application systems, such as spray or jetting nozzles, which ensure minimal adhesive consumption and precise bead placement, further supported by electronic glue checking systems for verification. Material optimization technology is also gaining traction, where machines are specifically engineered to handle lighter-weight and recycled board stocks with minimal deflection or warping, maintaining structural integrity even at high operational speeds, addressing the industry's sustainability goals.

The integration of Industry 4.0 elements represents the future technological landscape. This includes comprehensive connectivity via Industrial IoT (IIoT), allowing machines to communicate performance data to central management systems and cloud platforms. This data is used for OEE calculation, predictive diagnostics, and remote technical support, drastically reducing maintenance response times and improving overall machine utilization. Additionally, modular machine design is a crucial innovation, allowing converters to easily upgrade or reconfigure their folder and gluer lines with new modules (e.g., specialized section for tape application, window patching, or complex locking mechanisms) without replacing the entire machine, thus future-proofing the investment and enhancing flexibility to address evolving packaging requirements.

Regional Highlights

Regional dynamics play a crucial role in shaping the Folder And Gluer Machines Market, influenced by varying levels of industrial maturity, consumer demand, and regulatory landscapes. Asia Pacific (APAC) currently holds the dominant market share and is expected to record the highest CAGR during the forecast period. This growth is underpinned by rapid economic expansion in countries like China, India, and Indonesia, which are experiencing massive growth in manufacturing output, infrastructure development, and consumer spending power. The immense scaling of local and international e-commerce operations throughout APAC generates unprecedented demand for corrugated and folding cartons, driving massive investment in high-volume, automated converting equipment. Government initiatives supporting manufacturing modernization further accelerate the adoption of advanced machinery in this region.

North America and Europe represent mature, yet highly technologically advanced markets. Demand in these regions is less focused on volume expansion and more concentrated on specialized capabilities, superior automation, and high OEE. European markets, driven by strict environmental regulations, prioritize folder and gluer machines optimized for sustainable materials and energy efficiency. North America shows high adoption of servo-driven, modular machines capable of handling highly specialized packaging formats required by the premium food, pharmaceutical, and high-tech electronics sectors. The installed base in these regions is stable, with growth largely driven by replacement cycles, technological upgrades (Industry 4.0 integration), and regulatory compliance requirements related to pharmaceutical serialization and security packaging.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting strong potential for growth. In LATAM, countries like Brazil and Mexico are modernizing their packaging industries to meet local consumer demands and support export markets, leading to increased investment in semi-automatic and entry-level automatic gluers. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in food processing and manufacturing diversification away from oil, fueling demand for reliable packaging solutions. While these regions often prioritize cost-effectiveness, the move towards higher quality standards and localized production necessitates the eventual shift toward more sophisticated folder and gluer technology, positioning them as significant future growth contributors, particularly for mid-range equipment and service contracts.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by explosive e-commerce adoption, industrialization, and major packaging hubs in China and India.

- North America: Focus on high-end, specialized, servo-controlled machinery for pharmaceuticals and premium goods; demand concentrated on technological upgrades and OEE maximization.

- Europe: Strong emphasis on sustainable technology, energy-efficient operations, and compliance with stringent environmental and safety regulations; significant market for modular and flexible systems.

- Latin America (LATAM): Emerging market with increasing adoption of automated machinery driven by regional economic growth and modernization of food and beverage packaging sectors.

- Middle East and Africa (MEA): Growth fueled by investments in food processing and manufacturing diversification; steady demand for reliable, foundational folder and gluer machines to support local supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Folder And Gluer Machines Market.- BOBST

- Heidelberg

- Mitsubishi Heavy Industries

- EMBA Machinery

- Shanghai Dragon

- Jagenberg

- SBL Group

- Duran Machinery

- Vega Group

- DINGSHUNG Machinery

- Yoco Machinery

- HONGMING Machinery

- SANSIN

- Wenzhou Dongbo

- Wenzhou Zhengbang

- Tanabe Corporation

- Xiamen Xinlian Machinery

- Wuxi Huada

- Acme International

- Lamina System AB

Frequently Asked Questions

Analyze common user questions about the Folder And Gluer Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for folder and gluer machines?

The foremost driver is the global expansion of the packaging industry, particularly the exponential growth in e-commerce and logistics requiring high volumes of durable and precisely manufactured corrugated boxes and folding cartons, necessitating high-speed automation in converting operations.

How are Folder and Gluer machines utilizing Industry 4.0 technologies?

Modern folder and gluer machines incorporate IoT sensors, cloud connectivity, and advanced HMI (Human-Machine Interface) systems to enable real-time OEE monitoring, remote diagnostics, predictive maintenance scheduling, and automated job setups, aligning them with Industry 4.0 smart factory principles.

Which application segment holds the largest share in the Folder And Gluer Machines Market?

The Folding Cartons application segment currently commands the largest market share due to its widespread use across high-volume sectors like Food & Beverage, Cosmetics, and Pharmaceuticals, which require intricate, high-quality, and structurally precise packaging.

What are the key technical differences between automatic and semi-automatic gluers?

Automatic gluers feature continuous high-speed feeding, fully automated folding sections, and integrated quality control, minimizing operator intervention. Semi-automatic machines require manual feeding or setup for specific stages, resulting in lower throughput and higher reliance on labor.

How does the sustainability trend impact the Folder And Gluer Machines Market?

Sustainability drives demand for machines capable of effectively handling lighter, recycled, and alternative biodegradable substrates without compromising structural integrity or production speed. Furthermore, machines are being optimized for energy efficiency and reduced glue consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager