Food and Beverage Nitrogen Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431458 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food and Beverage Nitrogen Generators Market Size

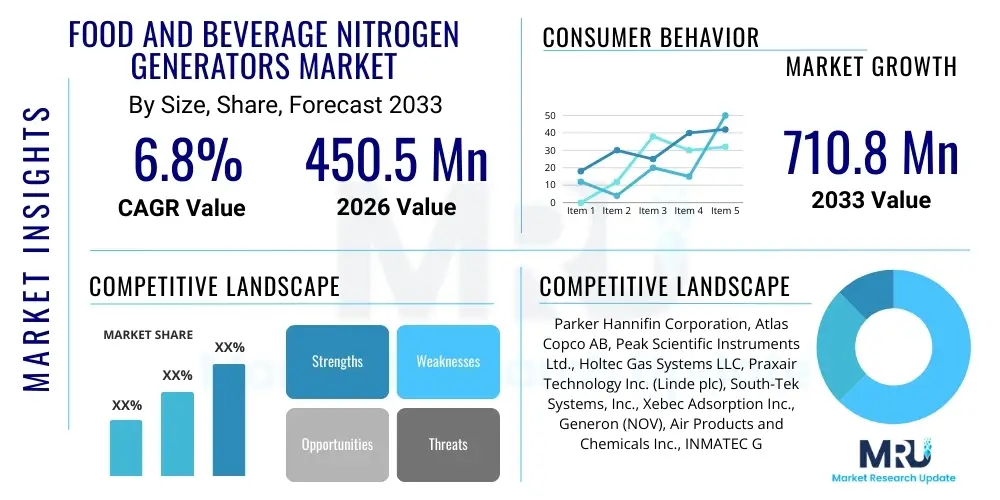

The Food and Beverage Nitrogen Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.8 Million by the end of the forecast period in 2033.

Food and Beverage Nitrogen Generators Market introduction

The Food and Beverage Nitrogen Generators Market encompasses equipment and systems designed to produce high-purity nitrogen gas on-site, specifically tailored for various processes within the food and beverage industry, including modified atmosphere packaging (MAP), inerting, blanketing, sparging, and pressure transfer. These generators, utilizing technologies primarily based on Pressure Swing Adsorption (PSA) or membrane separation, eliminate the reliance on high-pressure cylinders or bulk liquid nitrogen deliveries, offering enhanced supply security, cost efficiencies, and consistent quality crucial for perishable goods. The core benefit derived from adopting nitrogen generation systems is the reliable preservation of product integrity, extending shelf life, and preventing oxidation, thereby maintaining organoleptic properties such as flavor and texture, especially in sensitive product categories like craft beer, ready-to-eat meals, and edible oils. Major applications span across bottling, canning, brewing, wine making, dairy production, and snack food processing, where controlled atmospheres are mandatory for quality assurance and compliance with stringent food safety regulations globally. Driving factors for market expansion include the increasing demand for packaged and processed foods, strict regulatory mandates governing food preservation standards, and the growing focus among manufacturers on reducing operational costs associated with traditional nitrogen supply logistics and energy consumption.

Food and Beverage Nitrogen Generators Market Executive Summary

The Food and Beverage Nitrogen Generators Market is characterized by a definitive shift toward on-site generation, driven by manufacturers seeking greater control over gas quality, improved supply chain resilience, and substantial reductions in long-term operational expenditures compared to traditional bulk supply methods. Business trends highlight increasing investments in PSA technology due to its ability to deliver ultra-high purity nitrogen required for critical applications like precision brewing and highly sensitive MAP applications, alongside significant vendor focus on developing modular, scalable, and IoT-enabled systems for proactive maintenance and optimized energy efficiency. Regionally, Asia Pacific is anticipated to exhibit the fastest growth, fueled by rapid urbanization, burgeoning demand for packaged convenience foods, and escalating adoption of advanced food processing technologies in major economies such as China and India. Conversely, North America and Europe maintain leading market shares owing to stringent governmental food safety regulations and the widespread acceptance of inerting and blanketing techniques across established manufacturing facilities. Segment trends indicate that the beverages segment, particularly craft brewing and non-alcoholic beverages, remains the dominant end-user category, requiring high-volume, continuous supply of medium-to-high purity nitrogen for purging and bottling. The service segment, encompassing maintenance and operational support, is growing rapidly, reflecting the industry’s preference for long-term service contracts that ensure system uptime and regulatory compliance, further solidifying the market’s trajectory toward decentralized gas management solutions.

AI Impact Analysis on Food and Beverage Nitrogen Generators Market

User queries regarding the impact of Artificial Intelligence (AI) on the Food and Beverage Nitrogen Generators Market primarily revolve around operational efficiency, predictive maintenance, and energy optimization. Users are keen to understand how AI algorithms can monitor fluctuating production demands in real-time and automatically adjust nitrogen output flow rates and purity levels to prevent wastage and ensure compliance. Concerns are often raised about the integration complexity of AI systems with legacy industrial control platforms (ICS/SCADA) prevalent in older food processing plants. Expectations center on AI's ability to implement sophisticated predictive maintenance protocols by analyzing generator performance data (e.g., valve cycles, pressure drops, adsorber bed saturation) to forecast component failure before it occurs, drastically minimizing unscheduled downtime which is highly costly in continuous production environments. Furthermore, a major theme is the potential of AI to optimize the energy consumption of Pressure Swing Adsorption (PSA) systems, which are inherently energy-intensive, by learning ideal compressor usage patterns based on dynamic load changes, ensuring the generators operate at peak energy efficiency while maintaining required nitrogen purity.

- AI enables real-time dynamic optimization of nitrogen generation parameters (purity, flow, pressure) based on immediate production requirements, reducing energy waste.

- Predictive maintenance algorithms use sensor data to forecast component failure (e.g., sieve material degradation, valve malfunction), maximizing generator uptime and reducing repair costs.

- Automated fault detection and diagnostics utilizing machine learning accelerate troubleshooting, ensuring rapid recovery from operational deviations.

- AI-driven energy management systems learn optimal compressor cycling and air intake patterns, resulting in significant reduction in overall power consumption for PSA units.

- Enhanced quality assurance through AI monitoring of output purity levels, automatically flagging deviations that could compromise product integrity in MAP applications.

DRO & Impact Forces Of Food and Beverage Nitrogen Generators Market

The Food and Beverage Nitrogen Generators Market is propelled by critical drivers, primarily centered on increasing global scrutiny over food safety and quality, necessitating the use of inert gas for preservation, alongside the economic advantage of self-sufficiency offered by on-site generation systems. The rising demand for packaged goods with extended shelf life, especially refrigerated and chilled products, mandates the adoption of Modified Atmosphere Packaging (MAP) techniques that rely heavily on consistent, high-purity nitrogen supply. Restraints primarily involve the substantial initial capital investment required for purchasing and installing high-capacity generation systems, which can be prohibitive for small and medium-sized enterprises (SMEs), and the energy-intensive nature of PSA technology, which subjects operating costs to volatile electricity prices. Opportunities are emerging from the growing trend of sustainable manufacturing, where nitrogen generators offer a smaller carbon footprint compared to logistics required for cryogenic liquid nitrogen, and the expansion into niche markets like cannabis processing and advanced fermentation where highly specific inerting environments are essential. These factors exert a complex set of impact forces on the market; the compelling economic benefits and regulatory drivers push rapid adoption, while high upfront costs and energy concerns require manufacturers to innovate through modular, energy-efficient designs to overcome market friction and sustain growth.

Segmentation Analysis

The Food and Beverage Nitrogen Generators Market is analyzed based on type, technology, application, and end-user, providing a granular view of market dynamics and adoption patterns across the industry. Segmentation by type differentiates between mobile/portable units designed for flexibility and fixed/stationary units optimized for continuous high-volume production. Technological segmentation is crucial, distinguishing the performance and purity capabilities of Pressure Swing Adsorption (PSA) systems, which offer high purity for specialized applications, from Membrane Separation systems, which are favored for high-flow, lower-purity requirements like purging and tank blanketing. Application analysis covers inerting, packaging, and blanketing, recognizing the differing gas requirements for each process. End-user categorization identifies key demand centers, with the beverage industry, particularly brewing and bottling operations, representing the largest consumer segment due to the extensive use of nitrogen in dispensing and preservation processes.

- By Type:

- Fixed/Stationary Nitrogen Generators

- Mobile/Portable Nitrogen Generators

- By Technology:

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Cryogenic Air Separation

- By Application:

- Packaging (Modified Atmosphere Packaging)

- Blanketing and Inerting

- Pressure Transfer/Dispensing

- Sparging

- Others (e.g., sterilization, hydrogenation)

- By End-User:

- Beverages (Beer, Wine, Soft Drinks, Juices)

- Dairy and Frozen Products

- Oils and Fats

- Fruits and Vegetables

- Processed Meat and Seafood

- Bakery and Confectionery

- Snack Foods

Value Chain Analysis For Food and Beverage Nitrogen Generators Market

The value chain for the Food and Beverage Nitrogen Generators Market commences with upstream activities involving the sourcing of core raw materials and components, most notably high-quality molecular sieves (CMS) for PSA systems and advanced polymer fibers for membrane separation units, alongside specialized valves, compressors, and air pre-treatment filters. Efficiency in the upstream segment relies heavily on maintaining stable supply chains for these specialized components, as their quality directly dictates the generator's output purity and lifespan. Manufacturers invest heavily in R&D to optimize sieve bed design and membrane permeability, ensuring competitive purity levels and reduced energy consumption. The midstream involves the design, manufacturing, assembly, and rigorous testing of the nitrogen generator systems, where integrated software and IoT capabilities are added to facilitate remote monitoring and control, distinguishing premium providers in the market through technological superiority and operational robustness.

Downstream activities center on distribution, installation, and comprehensive after-sales service. Distribution channels are bifurcated into direct sales, predominantly used for large-scale, customized industrial projects where technical consulting is crucial, and indirect channels involving specialized industrial distributors and system integrators who service smaller, localized food and beverage producers. Installation and commissioning require expert technical teams to ensure seamless integration with existing processing lines, adherence to specific facility requirements, and validation against food safety standards like HACCP. Furthermore, the downstream is increasingly focused on offering long-term service contracts, which cover preventive maintenance, part replacement, and purity calibration, creating a significant recurring revenue stream for suppliers and ensuring high operational reliability for end-users.

The complexity of food processing environments dictates that specialized system integrators often play a critical role, bridging the gap between the generator manufacturer and the end-user’s highly specific application needs, such as ensuring explosion-proof certifications or managing gas delivery to multiple points within a large facility. Direct channels are preferred by major multinational food corporations seeking bespoke, integrated gas solutions across multiple global plants, allowing for standardized operational protocols and centralized monitoring. Conversely, indirect channels effectively reach the vast network of craft breweries, specialized food processors, and regional bottling plants that require localized technical support and standardized, readily available modular units, ensuring market penetration across various size categories of potential customers and optimizing the speed of deployment.

Food and Beverage Nitrogen Generators Market Potential Customers

The primary potential customers and end-users of Food and Beverage Nitrogen Generators span the entire spectrum of the food processing and packaging industry, with distinct needs based on their product category, volume requirements, and specific regulatory environment. Breweries, ranging from global giants to small-scale craft producers, represent a cornerstone market, requiring nitrogen for purging tanks, carbonation control, and counter-pressurization during bottling and canning to prevent oxygen pickup, which is detrimental to beer flavor stability. Similarly, wineries utilize nitrogen for tank blanketing and handling sensitive varietals during racking and filtering to avoid oxidation. These customers prioritize high purity (typically 99.9% to 99.999%), reliability, and systems that can handle intermittent yet high-flow demands typical of batch processes.

Another major segment comprises manufacturers of perishable packaged goods, including snack food companies (chips, nuts), ready-to-eat meal producers, and processed meat and seafood suppliers. These entities are intensive users of Modified Atmosphere Packaging (MAP) where precise mixtures of nitrogen and other gases are utilized to displace oxygen, dramatically extending product shelf life and maintaining sensory characteristics. These customers demand consistent, repeatable purity and flow rate control to ensure uniform package quality across millions of units, often necessitating redundant generator systems to eliminate any risk of production interruption. Furthermore, manufacturers of edible oils and fats are critical customers, employing nitrogen blanketing throughout storage and transfer processes to inhibit rancidity caused by exposure to ambient air, thereby preserving the freshness and nutritional quality of high-value oils.

The expanding secondary customer base includes dairy processors, particularly those producing powdered milk and infant formula, where inerting is vital to prevent fire hazards and ensure product stability during storage and transport. Additionally, the growing segment of specialized food ingredient manufacturers, such as those producing high-value extracts or functional foods, requires ultra-pure nitrogen for delicate chemical processes and solvent recovery systems. For all customer categories, the buying decision is increasingly influenced not just by the initial cost, but by the total cost of ownership (TCO), energy efficiency ratings, maintenance requirements, and the generator supplier's proven ability to meet stringent health and safety certifications required for direct contact with food products, prioritizing robust, certified systems that minimize regulatory risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin Corporation, Atlas Copco AB, Peak Scientific Instruments Ltd., Holtec Gas Systems LLC, Praxair Technology Inc. (Linde plc), South-Tek Systems, Inc., Xebec Adsorption Inc., Generon (NOV), Air Products and Chemicals Inc., INMATEC GaseTechnologie GmbH & Co. KG, Oxymat A/S, V-Flow Solutions Ltd., Claind Srl, PCI Gases, Gas Generation Solutions Ltd., SGT Srl, Maziak Compressor Services Ltd., Noxerior Srl. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food and Beverage Nitrogen Generators Market Key Technology Landscape

The technological landscape of the Food and Beverage Nitrogen Generators Market is dominated by two primary non-cryogenic methods: Pressure Swing Adsorption (PSA) and Membrane Separation, with Cryogenic Air Separation being reserved for extremely large-scale industrial applications or when ultra-high purity (>99.999%) is mandatory. PSA technology involves passing pre-treated compressed air through specialized vessels containing Carbon Molecular Sieves (CMS). The CMS preferentially adsorbs oxygen molecules, leaving high-purity nitrogen to pass through as the product gas. Recent technological advancements in PSA focus heavily on optimizing the cycle time and reducing the required purge gas volume, directly enhancing energy efficiency and reducing the size and weight of the units. Manufacturers are integrating advanced flow control valves and proprietary sieve bed geometries to maximize nitrogen yield and rapidly respond to fluctuating demands inherent in batch food processing operations.

Membrane Separation technology, conversely, relies on semi-permeable hollow fiber membranes. Compressed air is forced through these membranes, and based on molecular size and permeability, oxygen and water vapor pass rapidly through the fiber walls and are vented, while nitrogen gas is retained and collected at the outlet. Membrane systems are favored for high-flow, low-to-medium purity requirements (typically 95% to 99.5%), particularly in applications like tire inflation, tank purging, or pressure transfer where consistent purity is less critical than volume and stability. Key innovations in membrane technology center around developing new polymer chemistries that enhance selectivity and durability, improving performance under high temperature and pressure conditions, thereby broadening their applicability in complex or remote processing environments.

The overarching trend across both PSA and Membrane technologies is the integration of Industry 4.0 concepts, particularly the deployment of smart sensors and connectivity solutions (IoT). These technological enhancements allow for real-time monitoring of generator performance metrics such as power consumption, operational pressures, and output gas purity, facilitating condition-based maintenance and remote diagnostic capabilities. Furthermore, modular design is a significant feature, enabling end-users to scale their nitrogen generation capacity incrementally as production demands increase, providing a highly flexible and future-proof gas supply solution that avoids the over-investment associated with centralized, fixed gas supply infrastructure. This technological convergence ensures higher operational transparency, maximum uptime, and enhanced regulatory compliance through automated data logging and reporting.

Regional Highlights

North America

North America holds a substantial market share, driven by stringent regulatory frameworks enforced by bodies like the FDA and USDA, which necessitate controlled atmosphere usage for safety and preservation across the food supply chain. The region is characterized by high adoption rates of automated packaging technologies and a mature beverage industry, particularly the booming craft beer sector, which relies extensively on on-site nitrogen generation for purging, bottling, and dispensing operations. Demand is focused on high-performance PSA units capable of achieving 99.999% purity for high-sensitivity applications. The competitive landscape is mature, with strong emphasis on energy efficiency, maintenance contracts, and customizable systems that integrate seamlessly with sophisticated production line management software, making reliability and service quality critical purchasing criteria for large processing corporations.

The market growth in the United States and Canada is further bolstered by the increasing consumer preference for natural, less-processed foods with fewer artificial preservatives. This trend mandates the use of modified atmosphere packaging (MAP) featuring nitrogen to naturally extend shelf life without chemical intervention. Investment is also significant among third-party logistics providers (3PLs) and co-packing facilities that require flexible, mobile nitrogen generation solutions to cater to diverse client needs and variable production schedules. Technological preferences lean toward sophisticated monitoring and control systems, often leveraging AI integration for optimizing gas flow and purity based on fluctuating manufacturing schedules, ensuring optimal operational expenditure management in a high labor cost environment.

Europe

Europe represents a highly concentrated market, distinguished by advanced regulatory standards, particularly from the European Food Safety Authority (EFSA), and a strong commitment to sustainability. The widespread presence of sophisticated food manufacturing centers, especially in Germany, the UK, and France, drives consistent demand for high-quality nitrogen generation equipment. The regional market is technologically forward-looking, exhibiting high demand for energy-efficient generators that comply with increasingly strict environmental mandates regarding power consumption and CO2 footprint reduction. Adoption rates are particularly high in the dairy sector for powdered products, the wine industry for inerting, and the processed meat sector utilizing MAP technologies extensively.

Market expansion is also supported by the trend toward decentralized production and localized food chains, encouraging smaller producers to invest in modular, smaller-capacity generators to achieve self-sufficiency and reduce dependency on large industrial gas suppliers. The regulatory environment strongly favors systems that offer verifiable purity and traceability, leading to a preference for manufacturers providing detailed operational data logging capabilities. Furthermore, the region is witnessing a steady uptake of generator lease and rental models, particularly among SMEs, allowing them to access advanced technology without the burden of heavy upfront capital investment, accelerating market penetration across various economic scales of food producers.

Asia Pacific (APAC)

The Asia Pacific region is forecast to be the fastest-growing market globally, primarily due to rapid industrialization, burgeoning population growth, and a dramatic shift towards packaged and processed foods fueled by urbanization and rising disposable incomes in countries like China, India, and Southeast Asia. The modernization of cold chain logistics and the establishment of large-scale food processing zones are creating unprecedented demand for inerting and MAP technologies. While price sensitivity remains a factor in certain sub-regions, the critical need for extending shelf life in high-humidity, temperature-variable environments drives the necessity for reliable nitrogen supply.

Growth drivers include massive expansion in the beverage industry, specifically soft drinks, ready-to-drink (RTD) beverages, and an increasing penetration of Western-style convenience foods. Unlike mature Western markets, APAC often sees a greater mix of both PSA and membrane technologies, with membrane separation gaining traction in applications requiring higher flow volumes at slightly lower purity specifications, offering a better cost-to-volume ratio. Challenges include navigating diverse regulatory landscapes across various nations and the need for generators capable of operating robustly under fluctuating utility supplies and challenging ambient conditions, necessitating customized, heavy-duty industrial designs from international suppliers.

Latin America

The Latin American market is characterized by increasing foreign direct investment in food processing infrastructure and the consolidation of regional food and beverage conglomerates. Key markets like Brazil, Mexico, and Argentina show strong growth in areas such as meat processing, fruit juices, and brewing, necessitating reliable gas supply solutions to meet export quality standards. The primary driver here is the shift from low-cost, high-risk gas cylinder dependence to the superior safety and economic consistency offered by on-site nitrogen generation systems. While adoption started slower than in North America or Europe, the rapid modernization of export-oriented production facilities is accelerating the uptake of high-quality generators.

The market often favors cost-effective and easy-to-maintain solutions, although demand for high-purity nitrogen is rising as local producers seek to comply with international quality certifications to access lucrative global markets. Service support and local presence of manufacturers are paramount in this region due to logistical complexities and the need for rapid maintenance response. Manufacturers entering this market must prioritize establishing strong local partnerships for distribution and technical support, offering financing options to overcome initial capital expenditure barriers prevalent among smaller and mid-sized regional food producers aiming for modernization.

Middle East and Africa (MEA)

The MEA market presents unique opportunities driven by large-scale government investments in food security and the establishment of massive, state-of-the-art agricultural and food production centers, particularly in the Gulf Cooperation Council (GCC) countries. Nitrogen generators are vital in these regions for preserving imported raw materials and protecting sensitive high-value processed foods in often extreme climatic conditions. The demand for packaged goods is expanding rapidly, fueled by expatriate populations and high disposable incomes in oil-rich nations. Specific applications driving the market include bottling purified water, processing dates, and advanced food packaging in logistics hubs.

The African segment, though currently smaller, is emerging with growing demand in South Africa and Nigeria as industrialization progresses, particularly in brewing and snack food manufacturing. Challenges include infrastructure deficits and reliance on external expertise for installation and maintenance. Consequently, the market prefers robust, durable systems designed for remote monitoring and minimal hands-on intervention. Suppliers focused on modular, scalable solutions that minimize transportation costs and offer comprehensive training programs for local technicians are best positioned to capitalize on the region’s long-term growth potential in establishing self-sufficient food production capabilities.

- North America: Focus on high-purity PSA systems, driven by stringent FDA regulations and the thriving craft brewing industry.

- Europe: High demand for energy-efficient, sustainable generators, driven by EFSA standards and large-scale dairy and wine processing.

- Asia Pacific: Fastest growth market, fueled by urbanization, massive growth in packaged food consumption, and establishment of new food processing infrastructure.

- Latin America: Rising modernization and investment in export-oriented facilities (meat, beverages), prioritizing reliable and cost-effective generation solutions.

- Middle East and Africa: Growth stimulated by food security initiatives, investment in large-scale processing centers, and demand for robust systems suited for harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food and Beverage Nitrogen Generators Market.- Parker Hannifin Corporation

- Atlas Copco AB

- Linde plc (formerly Praxair Technology Inc.)

- Air Products and Chemicals Inc.

- Generon (NOV)

- Peak Scientific Instruments Ltd.

- South-Tek Systems, Inc.

- Holtec Gas Systems LLC

- Xebec Adsorption Inc.

- INMATEC GaseTechnologie GmbH & Co. KG

- Oxymat A/S

- V-Flow Solutions Ltd.

- Claind Srl

- PCI Gases

- Gas Generation Solutions Ltd.

- SGT Srl

- Maziak Compressor Services Ltd.

- Noxerior Srl

- FS-Curtis/FS-Elliott

- Domnick Hunter (Parker Hannifin)

Frequently Asked Questions

Analyze common user questions about the Food and Beverage Nitrogen Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from bulk nitrogen supply to on-site nitrogen generation in the food industry?

The shift is primarily driven by the significant reduction in the total cost of ownership (TCO), enhanced supply reliability, and greater control over nitrogen purity required for critical applications like Modified Atmosphere Packaging (MAP). On-site generation eliminates recurring delivery costs, rental fees, and the logistical risks associated with traditional cylinder or bulk liquid supply.

Which nitrogen generation technology, PSA or Membrane Separation, is generally preferred by brewers and beverage manufacturers?

Pressure Swing Adsorption (PSA) technology is typically preferred by brewers and beverage manufacturers. PSA systems can consistently deliver ultra-high purity nitrogen (up to 99.999%), which is essential for purging tanks, bottling, and canning operations to effectively minimize oxygen content, crucial for maintaining product flavor and shelf stability.

How does the implementation of nitrogen generators impact the shelf life and quality of packaged food products?

Nitrogen generators provide the inert gas necessary for Modified Atmosphere Packaging (MAP), which displaces oxygen and inhibits microbial growth and oxidative rancidity. This process dramatically extends the shelf life of perishable items, preserves their natural color, flavor, and texture, and ensures regulatory compliance for food safety.

What are the main financial hurdles associated with adopting nitrogen generation systems for small and medium-sized enterprises (SMEs)?

The main financial hurdle for SMEs is the high initial capital expenditure (CAPEX) required for the purchase, installation, and associated infrastructure (e.g., dedicated compressors and air treatment). Suppliers often address this barrier by offering modular units, flexible financing, or leasing options to improve accessibility and manage cash flow.

In the context of the Food and Beverage market, what role does digitalization play in modern nitrogen generator systems?

Digitalization, via IoT and smart sensors, enables advanced remote monitoring, data logging of purity and flow rates, and AI-driven predictive maintenance. This ensures maximum operational uptime, optimizes energy consumption in real-time based on production load, and facilitates automated compliance reporting to meet stringent food safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager