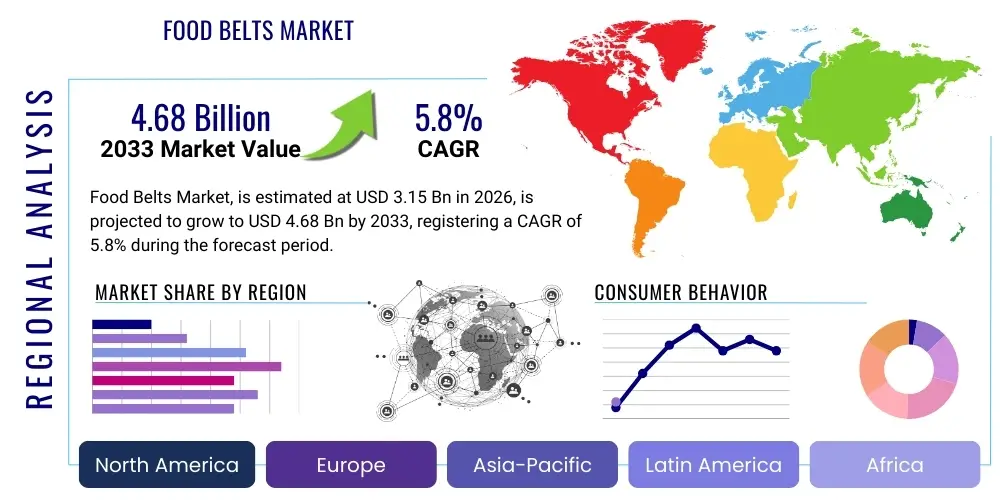

Food Belts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436619 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Food Belts Market Size

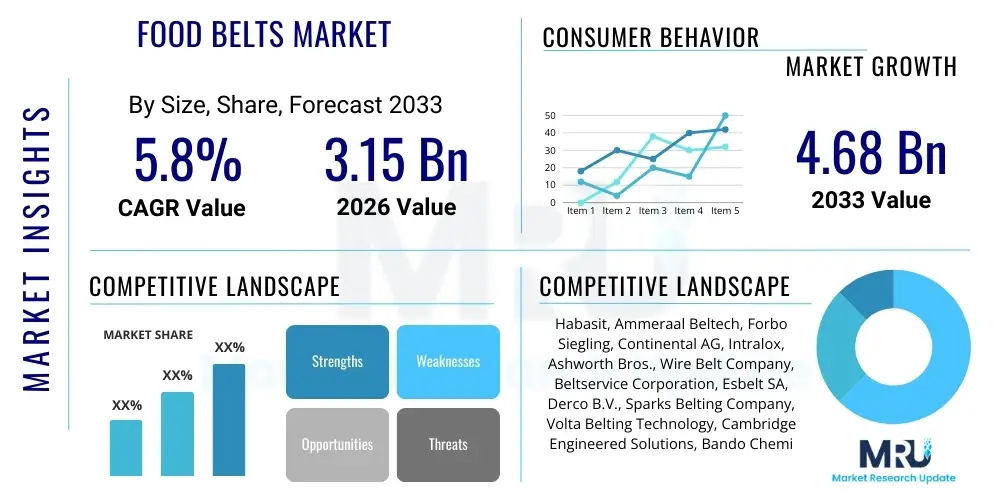

The Food Belts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.15 billion in 2026 and is projected to reach USD 4.68 billion by the end of the forecast period in 2033.

Food Belts Market introduction

The Food Belts Market encompasses conveyor belting systems specifically designed and engineered for use in food processing, handling, and packaging operations. These belts are crucial components within the food and beverage industry, facilitating the movement of raw ingredients, semi-finished goods, and final packaged products through various stages of production, including washing, cutting, baking, freezing, and inspection. Given the stringent regulatory environment governed by bodies like the FDA and EFSA, food belts must adhere to high standards of hygiene, sanitation, and safety, meaning they are often manufactured using specialized materials such as thermoplastic polyurethane (TPU), polyvinyl chloride (PVC), silicone, or modular plastics, which are non-toxic, resistant to oils, fats, and cleaning agents, and easy to sanitize effectively.

The core product description revolves around conveying solutions that minimize contamination risks. Key attributes include antimicrobial properties, resistance to extreme temperatures (both cryogenic freezing and high-heat baking), chemical stability, and minimal wear particles. These belts are essential in applications ranging from transporting delicate confectionery items to handling heavy meat carcasses, requiring diverse designs, including solid flat belts, modular plastic belts (often used for wash-down applications), and wire mesh belts (suitable for draining or high-temperature processes). The efficiency and reliability of these belts directly impact throughput, energy consumption, and product yield in food manufacturing facilities globally.

Major applications span across all food processing verticals, including bakery and confectionery, meat and poultry, dairy processing, beverage filling, and fruits and vegetable preparation. The primary benefits driving market demand include enhanced food safety through improved cleanability and reduced bacterial harborage, operational efficiency gains from minimized downtime due to belt failures, and compliance assurance with rigorous global hygiene standards. Furthermore, advancements in belt technology, such as the introduction of homogeneous belts and positive drive systems, address critical industry demands for superior hygiene performance and lower total cost of ownership (TCO), serving as significant driving factors for market expansion.

Food Belts Market Executive Summary

The Food Belts Market is experiencing robust growth fueled by intensifying global demand for processed foods, increasing automation in manufacturing facilities, and non-negotiable regulatory pressure favoring hygienic solutions. Business trends indicate a strong shift towards thermoplastic polyurethane (TPU) and modular plastic belts, moving away from traditional fabric-based options, due to their superior resistance to harsh chemicals, excellent durability, and ease of sanitation, directly addressing manufacturers' needs for reduced cross-contamination risk. Key market players are focusing heavily on product innovation, specifically in developing positive drive technology and antimicrobial additives, positioning their offerings as critical enablers of HACCP and FSMA compliance, which significantly influences procurement decisions across all food segments.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market due to rapid industrialization, massive investments in cold chain infrastructure, and the expansion of domestic food processing capabilities, particularly in emerging economies like China and India, where per capita consumption of packaged food is escalating. North America and Europe, characterized by highly mature and regulated markets, continue to dominate in terms of adoption of premium, high-specification belts, driven primarily by replacement cycles and the persistent push for higher levels of factory automation utilizing robotic pick-and-place systems which necessitate precise belt tracking and reliability. The Middle East and Africa (MEA) and Latin America are showing steady growth, primarily focused on establishing foundational processing capacities that require entry-level and standard hygienic conveyor solutions.

Segmentation trends highlight that the application segment is dominated by the meat and poultry sector, requiring extremely robust, chemical-resistant belts for heavy-duty washdown cycles, followed closely by the bakery and confectionery sector, which demands non-stick and temperature-resistant materials. Material-wise, modular belts are gaining substantial traction due to their versatility and segmented nature, allowing for rapid repairs and superior hygiene, whereas lightweight homogeneous TPU belts are increasingly preferred in delicate, high-hygiene applications like dairy and ready-to-eat meals. The aftermarket services segment, encompassing belt repair, maintenance, and replacement, represents a significant and stable revenue stream for key market participants, often tied to long-term service contracts ensuring operational continuity for end-users.

AI Impact Analysis on Food Belts Market

User inquiries regarding AI's impact on the Food Belts Market frequently center on predictive maintenance, contamination detection, and optimization of processing lines. Common questions revolve around how AI can extend belt lifespan, whether AI-powered vision systems can detect microbial biofilms on belt surfaces before human eyes, and how optimization algorithms can minimize belt wear by fine-tuning conveyor speeds and loads based on real-time production flow. There is a clear user expectation that AI integration should transform the belt from a passive component into a smart, data-generating asset. Key concerns involve the cost and complexity of integrating necessary sensors (such as acoustic or vibration sensors) and the need for standardized communication protocols (IIoT) to effectively feed data from the belts into centralized AI platforms for actionable insights regarding belt health, cleaning efficacy, and overall equipment efficiency (OEE).

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on sensor data (vibration, temperature, tension) embedded in or near the belt to anticipate failures, thereby maximizing uptime and reducing unplanned maintenance costs.

- Optimized Cleaning Protocols: AI analyzes real-time data on product type, residue buildup, and cleaning cycle effectiveness, recommending adjustments to water temperature, pressure, or chemical dosage to ensure complete sanitation of belt surfaces.

- Quality Control and Contamination Detection: AI-powered vision systems integrated above the belt utilize sophisticated algorithms to detect minute imperfections, foreign objects, or early stages of microbial contamination on the product and the belt itself, improving food safety margins.

- Process Optimization: Machine learning determines the optimal speed and flow rates for conveyor belts based on upstream and downstream bottlenecks, reducing unnecessary friction, energy consumption, and belt wear caused by erratic operation.

- Inventory Management: AI models forecast replacement schedules with high accuracy, optimizing spare parts inventory for specific belt types and ensuring necessary components are available immediately upon predicted failure or scheduled maintenance.

DRO & Impact Forces Of Food Belts Market

The Food Belts Market is primarily driven by the imperative need for enhanced food safety and hygiene protocols mandated by global regulatory bodies, coupled with continuous technological innovation aimed at improving operational efficiencies in processing plants. Restraints include the high initial investment required for advanced homogeneous and modular plastic belts compared to conventional options, alongside the challenge of frequent replacement cycles necessitated by the harsh operating conditions, which includes exposure to aggressive cleaning chemicals and high pressures. Opportunities are abundant in emerging markets focusing on cold chain logistics and the adoption of smart belting solutions integrated with IoT sensors. The cumulative impact of these forces strongly favors market growth, as the benefits of reduced contamination risk and increased automation substantially outweigh the initial capital expenditure concerns for major food processors.

Drivers: Intensification of global food safety regulations, particularly FSMA (USA) and similar mandates in Europe and Asia, compels processors to upgrade older, unsanitary belting systems to compliant, clean-in-place (CIP) friendly materials. The increasing global consumption of packaged and ready-to-eat foods necessitates higher throughput and continuous processing lines, requiring highly reliable and durable belting solutions. Furthermore, the pervasive trend of automation and integration of robotics in processing lines demands precision-engineered belts with high tracking accuracy and minimal slippage, thereby fostering demand for positive drive and homogenous belt technologies.

Restraints: The primary restraint involves the comparatively high procurement cost of specialized hygienic belts (e.g., thermoplastic polyurethane homogeneous belts) and modular plastic systems relative to traditional fabric-ply belts, creating resistance among smaller processors or those in cost-sensitive regions. Additionally, despite advancements, the operational lifespan of belts in certain highly abrasive or high-temperature environments (like commercial baking or freezing tunnels) remains limited, leading to significant recurring costs associated with frequent maintenance and replacement. Regulatory complexity across different regions regarding approved materials and cleaning chemical interactions also poses a challenge for manufacturers operating globally.

Opportunities: Significant growth potential exists in the development and proliferation of antimicrobial and antifungal belt materials that actively inhibit microbial growth, addressing a critical industry pain point. The burgeoning need for enhanced traceability and digitalization in the food supply chain opens opportunities for smart belts equipped with integrated sensors and RFID tags for real-time monitoring of operational parameters and location tracking. Furthermore, expanding penetration in developing economies, coupled with increased focus on plant efficiency and waste reduction, drives demand for optimized, high-performance belting tailored to specific food segments like seafood and specialty produce.

Segmentation Analysis

The Food Belts Market segmentation provides a granular view of demand dynamics across materials, construction types, and specific application areas within the food industry. Segmentation by material is critical as it dictates the belt's suitability for specific processing environments, ranging from water-intensive washdowns to dry, abrasive handling. Material choice directly impacts hygiene scores, chemical resistance, and temperature tolerance. The core segments highlight a dichotomy between traditional, lower-cost belts and advanced, premium solutions, reflecting the varied technological maturity and regulatory compliance levels of end-user facilities globally.

Analysis of the construction type segment reveals a continuous migration towards homogeneous and modular technologies. Homogeneous belts, free of fabric plies, eliminate potential harborage points for bacteria, making them ideal for high-risk applications like raw meat and dairy. Modular plastic belts offer unmatched versatility, ease of repair, and superior drainage capabilities, making them predominant in cooling, freezing, and heavy washdown zones. Conversely, traditional layered (fabric) belts, primarily PVC and PU-coated variants, maintain a strong market share in general conveying and packaging areas where hygiene demands are slightly less severe or cost constraints are paramount, yet they face increasing pressure from advanced materials.

The application segment clearly dictates the volume and type of belts required. The meat, poultry, and seafood sectors demand robust, chemical-resistant belts capable of enduring rigorous sanitation cycles and heavy loading, often favoring modular designs. The bakery and confectionery sector requires non-stick surfaces and extreme temperature tolerance (both heat and cold), leaning towards specialized PU and silicone belts. Dairy and beverage segments, demanding the highest level of hygiene, predominantly utilize homogeneous TPU belts to mitigate all cross-contamination risks. Understanding these application-specific material preferences is crucial for market participants positioning their product lines effectively.

- By Type:

- Lightweight Conveyor Belts (Up to 10 mm thickness)

- Heavy-Duty Conveyor Belts (Above 10 mm thickness)

- Flat Belts

- Modular Belts (Plastic, Stainless Steel)

- Positive Drive Belts

- By Material:

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Silicone

- Thermoplastic Elastomers (TPE)

- Modular Plastics (Polypropylene, Polyethylene, Acetal)

- Metal/Wire Mesh Belts (Stainless Steel)

- Fabric/Rubber Belts (Decreasing market share)

- By Application/End-Use:

- Meat, Poultry, and Seafood Processing

- Dairy Processing

- Bakery and Confectionery

- Fruits and Vegetables

- Beverages (Bottling and Packaging)

- Ready-to-Eat (RTE) Meals and Prepared Foods

- Grain and Milling

Value Chain Analysis For Food Belts Market

The Food Belts Market value chain begins with upstream activities focused on the procurement and processing of raw materials, primarily polymers (TPU, PVC, PP, PE, Acetal), fabric reinforcements, and specialized additives (antimicrobial, non-stick agents). Key raw material suppliers, predominantly chemical and plastics manufacturers, significantly influence the cost and quality of the final product. Strong research and development activities at this stage focus on enhancing material properties—such as improving hydrolysis resistance, increasing flexibility in cold environments, and ensuring compliance with global food contact standards (e.g., EU 10/2011, FDA). Price volatility of petroleum-derived polymers can impact manufacturing costs, forcing belt producers to manage sourcing risks actively.

Midstream processes involve the core manufacturing, including compounding, extrusion, fabrication, and finishing of the belts. Major belt manufacturers perform complex processes like homogeneous belt extrusion, molding of modular components, and application of specialized coatings. Distribution channels form the crucial link to the end-users. Distribution is typically multimodal, involving direct sales to large, multinational food processors (who often require highly customized and integrated solutions), and indirect sales through extensive networks of specialized industrial distributors, maintenance providers (MRO), and equipment integrators (OEMs). Distributors play a vital role in providing local stock, fabrication services (cutting, splicing), and immediate technical support, which is critical in maintaining operational uptime for processors.

Downstream analysis focuses on installation, maintenance, and the crucial aftermarket services. End-users (food processing plants) prioritize reliability and service contracts, often opting for suppliers who can provide rapid replacement and preventive maintenance expertise. Direct sales allow manufacturers to control the service quality and capture higher margins, particularly for complex modular systems requiring proprietary tools. The value chain is increasingly influenced by stringent regulatory requirements, pushing the entire chain—from polymer selection to final installation—to adhere to sanitary design principles. The transition toward smart factories necessitates tighter integration between belt suppliers and automation technology providers, creating opportunities for joint value propositions focused on predictive maintenance and real-time food safety monitoring.

Food Belts Market Potential Customers

The primary potential customers for the Food Belts Market are large-scale industrial food and beverage processors and manufacturers who operate continuous production lines. These entities include multinational corporations specializing in meat, poultry, and seafood processing, which require heavy-duty, highly cleanable modular and homogeneous belts to handle raw products and endure frequent, aggressive washdown cycles involving high-pressure water and caustic chemicals. The rigorous environment in these facilities necessitates durable, specialized belts that offer superior drainage and antimicrobial resistance to comply with stringent HACCP protocols and minimize bacterial contamination risks throughout the slaughtering, cutting, and packaging phases.

Secondary significant buyers include the dairy and prepared foods sectors, encompassing large dairies, cheese manufacturers, and producers of ready-to-eat meals and frozen foods. These customers prioritize homogeneous, non-fabric belts made from TPU or specialized TPEs, as their processes demand the absolute highest level of hygiene to prevent product spoilage and maintain traceability. The clean design of these belts reduces product recall risks, justifying the premium cost. Additionally, packaging and logistics companies that handle final packaged food products also represent a vital customer segment, though their requirements tend towards general conveying materials like PVC and standard PU, focusing more on speed, reliability, and cost-effectiveness for bulk item movement.

Furthermore, small and medium-sized enterprises (SMEs) in the bakery and confectionery segment, along with regional beverage bottlers and fruit/vegetable processing facilities, form a broad base of potential customers. While SMEs may be more cost-sensitive, the increasing regulatory pressure is gradually forcing them to upgrade their equipment, creating a growing demand for cost-effective, yet hygienic, mid-range belting solutions. Original Equipment Manufacturers (OEMs) who build processing machinery (e.g., industrial ovens, freezers, metal detectors) are also crucial buyers, integrating belts into their machinery before selling to end-users, thereby serving as a critical indirect channel for market penetration and technology adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.15 Billion |

| Market Forecast in 2033 | USD 4.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Habasit, Ammeraal Beltech, Forbo Siegling, Continental AG, Intralox, Ashworth Bros., Wire Belt Company, Beltservice Corporation, Esbelt SA, Derco B.V., Sparks Belting Company, Volta Belting Technology, Cambridge Engineered Solutions, Bando Chemical Industries, KVP (Regal Rexnord), Chiorino S.p.A, Sampla Belting S.r.l., Gates Industrial Corporation, Tsubakimoto Chain Co., and Ravti Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Belts Market Key Technology Landscape

The technology landscape of the Food Belts Market is dominated by continuous innovation aimed at enhancing hygiene, durability, and operational efficiency, moving significantly beyond traditional multi-ply fabric belts. A major technological shift involves the transition to homogeneous belts, primarily made of thermoplastic polyurethane (TPU), which are manufactured without internal fabric reinforcements. This design eliminates potential crevices where bacteria can harbor and prevents moisture ingress, which typically degrades conventional belts. Homogeneous belts are easier to clean-in-place (CIP), support aggressive sanitation cycles, and offer superior lifespan in demanding, wet environments such as meat and dairy processing. These materials often incorporate specialized chemical formulations to enhance resistance to hydrolysis and cleaning agents, ensuring compliance with evolving standards for food contact materials.

Another crucial technological advancement lies in positive drive systems, exemplified prominently by modular plastic belts and newer positive-drive homogeneous systems. Modular belts, constructed from interconnected plastic modules and rods, offer inherent benefits like quick repair, side flexing capabilities, and excellent drainage, making them standard for freezing tunnels and washdown areas. The positive drive mechanism—where the belt is driven by sprockets engaging with teeth or holes in the belt—eliminates friction drive slippage and mistracking, leading to energy savings, reduced wear, and precise product positioning, critical for robotic integration and high-speed packaging lines. Material science advancements in modular plastics, particularly focusing on engineering polymers like Acetal and Polypropylene with enhanced strength and reduced coefficient of friction, continue to drive performance improvements.

The emerging technological frontier is the integration of Smart Belting capabilities enabled by the Industrial Internet of Things (IIoT). This involves embedding or mounting sensors (e.g., acoustic sensors, vibration monitors, temperature probes) to gather real-time data on the belt's health and operational status. These sensors monitor parameters like belt tension, tracking accuracy, slip rate, and overall vibration patterns, feeding data into predictive maintenance platforms. This shift enables processors to move from reactive or time-based maintenance to condition-based monitoring, dramatically extending belt service life, reducing unexpected downtime, and validating cleaning effectiveness by monitoring residual moisture or temperature post-sanitation. Furthermore, advancements in specialized coatings, such as permanent anti-microbial surfaces and extremely low-friction materials, continue to optimize throughput and energy usage across the processing floor.

Regional Highlights

- North America (USA and Canada): North America represents a mature market characterized by the highest adoption rate of premium, technologically advanced belting solutions, driven primarily by the strict enforcement of the Food Safety Modernization Act (FSMA) and high labor costs necessitating intense automation. The region is a pioneer in implementing homogeneous TPU and sophisticated modular positive drive systems, particularly in the meat and RTE meal sectors. Replacement demand is strong, fueled by continuous upgrades to ensure maximum sanitary design and predictive maintenance integration. The USA remains the dominant consumer, leveraging large investments in modernized, automated processing facilities.

- Europe (Germany, UK, France, Italy): Europe is a highly regulated market, with demand driven by EU directives (e.g., HACCP, EU 10/2011) that emphasize material safety and traceability. Countries like Germany and the Netherlands, home to major conveyor technology providers, lead in innovation, especially in developing energy-efficient and custom-engineered belts for high-volume bakery and dairy operations. The region exhibits a strong preference for PVC and PU belts in non-critical applications but is rapidly adopting homogeneous belts for high-risk zones, seeking superior hygiene performance and lifecycle management under robust environmental regulations.

- Asia Pacific (APAC) (China, India, Japan, Australia): APAC is the fastest-growing market globally, characterized by massive growth in packaged food consumption and substantial government investments in food processing infrastructure. China and India are experiencing a boom in greenfield processing plant constructions, leading to high volume demand for both standard PVC/PU belts and increasingly sophisticated modular belts to handle diverse products from seafood to grains. Japan and Australia, with mature, high-value markets, mirror North American trends in prioritizing hygiene and automation. The challenge here is meeting the diverse regulatory landscape across individual countries while managing supply chain logistics.

- Latin America (LATAM) (Brazil, Mexico): LATAM is characterized by strong meat and poultry exports (especially Brazil), driving demand for robust, high-performance modular systems capable of handling heavy loads and rigorous cleaning. Market growth is stable but often constrained by economic volatility and reliance on imported materials. There is a growing trend toward automation in larger facilities, but many smaller processors still rely on cost-effective, durable, standard belting solutions. Mexico's large food manufacturing base makes it a central hub for demand in the region.

- Middle East and Africa (MEA): MEA is an emerging market with steady growth concentrated in Gulf Cooperation Council (GCC) countries investing heavily in domestic food production and processing to enhance food security. Demand is focused on imported technology and reliable, temperature-resistant belts suitable for diverse climates, often favoring solutions that offer high resistance to degradation in hot, dusty environments. Infrastructure development, particularly in cold chain logistics, drives moderate but consistent demand for mid-to-high-tier belting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Belts Market.- Habasit

- Ammeraal Beltech

- Forbo Siegling

- Continental AG

- Intralox

- Ashworth Bros.

- Wire Belt Company

- Beltservice Corporation

- Esbelt SA

- Derco B.V.

- Sparks Belting Company

- Volta Belting Technology

- Cambridge Engineered Solutions

- Bando Chemical Industries

- KVP (Regal Rexnord)

- Chiorino S.p.A

- Sampla Belting S.r.l.

- Gates Industrial Corporation

- Tsubakimoto Chain Co.

- Ravti Group

Frequently Asked Questions

Analyze common user questions about the Food Belts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between homogeneous and conventional fabric food belts?

Homogeneous food belts are single-layer belts lacking fabric plies, eliminating internal spaces where bacteria and moisture can harbor, offering superior hygiene and ease of cleaning compared to conventional multi-ply belts reinforced with fabric, which are prone to delamination and contamination risks.

Which material is most recommended for high-hygiene applications like dairy processing?

Thermoplastic Polyurethane (TPU) homogeneous belts are generally the most recommended material for high-hygiene applications, such as dairy and ready-to-eat meals, due to their non-porous surface, excellent chemical resistance, hydrolysis stability, and ability to undergo rigorous clean-in-place (CIP) sanitation protocols.

How do positive drive systems improve food processing line efficiency?

Positive drive systems use sprockets to engage directly with the belt structure (e.g., modular links or holes), ensuring precise belt tracking, eliminating slippage, minimizing edge wear, and requiring less tension than friction-driven belts, leading to lower energy consumption and significantly reduced risk of unexpected downtime.

What impact do strict regulatory standards like FSMA have on belt purchasing decisions?

Strict regulatory standards like FSMA necessitate purchasing decisions that prioritize sanitary design, validation, and traceability. Processors are driven to adopt FDA/USDA/EU-compliant materials, opting for easy-to-clean belts (homogeneous or open-hinge modular designs) that minimize pathogen harboring points and support stringent validation protocols.

Is investment in smart belting technology justifiable for small food processing operations?

While the initial cost is higher, investment in smart belting (IIoT integration) can be justifiable for small operations by drastically reducing unplanned maintenance costs and minimizing the risk of product loss due to belt failure or contamination. Predictive insights can optimize cleaning schedules and extend asset lifespan, improving long-term operational cost-effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager