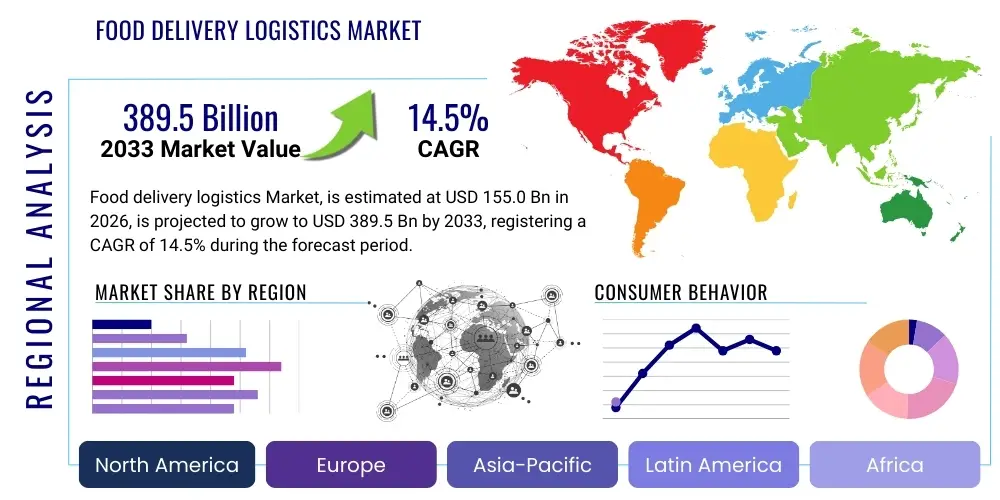

Food delivery logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438139 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Food delivery logistics Market Size

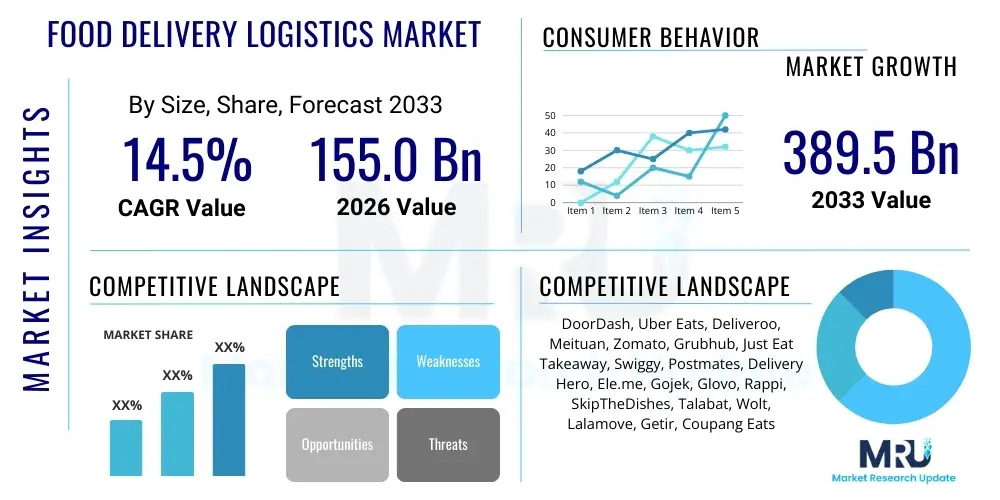

The Food delivery logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $155.0 billion in 2026 and is projected to reach $389.5 billion by the end of the forecast period in 2033.

Food delivery logistics Market introduction

The Food delivery logistics Market encompasses the complex systems and processes involved in transporting prepared meals and grocery items from a source (restaurants, dark kitchens, grocery stores) to the end consumer. This sophisticated ecosystem relies heavily on advanced technological platforms, optimized route planning, cold chain maintenance, and last-mile delivery efficiency. The logistics framework spans order aggregation, kitchen fulfillment, inventory management, and the final dispatch and handoff. Key components include fleet management systems, temperature-controlled packaging solutions, and robust digital platforms that connect all stakeholders: consumers, delivery personnel, and retailers/restaurants. The efficiency of these logistics operations directly dictates consumer satisfaction, operational costs, and the overall profitability of the food delivery ecosystem.

The fundamental expansion of this market is driven by rapidly shifting consumer behaviors, characterized by a preference for convenience and on-demand services, particularly in urban and peri-urban areas. Urbanization patterns, coupled with higher disposable incomes and the proliferation of smartphone usage, have established a stable foundation for market growth. Furthermore, the strategic expansion of delivery aggregators, alongside the rise of proprietary delivery fleets utilized by large Quick Service Restaurants (QSRs), intensifies competition and drives continuous technological innovation in logistics. The market is strategically moving toward integrating autonomous delivery solutions and predictive analytics to manage demand volatility and minimize delivery times.

Major applications of specialized food delivery logistics include hot prepared meals from full-service and limited-service restaurants, delivery of ready-to-eat (RTE) meals, and rapid grocery delivery services (often termed quick commerce or q-commerce). The primary benefits derived from these advanced logistics systems include reduced operational bottlenecks for restaurants, expanded market reach for retailers, significantly improved consumer experience through speed and reliability, and enhanced food safety through specialized handling and monitoring. Driving factors center on the expansion of dark stores and cloud kitchens, increasing investment in electric vehicle (EV) fleets for sustainability, and the continuous refinement of algorithmic dispatch and real-time tracking capabilities.

Food delivery logistics Market Executive Summary

The Food delivery logistics Market is undergoing transformative growth, propelled by the convergence of digitalization and immediate consumer gratification demands. Business trends indicate a strong move toward platform consolidation, where major global aggregators are acquiring smaller regional players to achieve economies of scale and optimize cross-border logistics capabilities. There is a noticeable trend in vertical integration, with aggregators investing in cloud kitchens or partnering extensively with logistics-as-a-service (LaaS) providers to gain greater control over the supply chain quality and cost structure. Furthermore, sustainability is becoming a key business differentiator, driving investments in bicycle, scooter, and electric vehicle fleets, particularly in densely populated metropolitan areas, aligning operations with stringent urban environmental regulations.

Regional trends highlight that Asia Pacific (APAC) currently dominates the market, driven by high population density, advanced mobile technology penetration, and the prevalence of established delivery cultures in countries like China, India, and Southeast Asia. However, North America and Europe are exhibiting significant maturity and high average order values, focusing intensely on optimizing labor costs through automation and enhancing the safety of perishable goods transit via specialized cold chain solutions. Emerging markets in Latin America and the Middle East & Africa (MEA) are seeing accelerated growth due to increasing smartphone adoption and rising urbanization, though they often face challenges related to fragmented infrastructure and less standardized address systems, necessitating bespoke logistical mapping solutions.

In terms of segments, the quick commerce (grocery/convenience delivery) segment is experiencing explosive growth, outpacing the traditional restaurant meal delivery segment, particularly post-2020. Logistics providers are differentiating services based on vehicle type, with motorbikes and scooters dominating dense urban environments due to maneuverability and low operating costs, while vans and trucks remain essential for bulk grocery and catering deliveries. Technology integration segments, such as real-time tracking and route optimization software, are witnessing substantial investment, indicating that efficiency derived from advanced algorithms is now the primary competitive battleground for logistics providers.

AI Impact Analysis on Food delivery logistics Market

Analysis of common user questions reveals strong interest in how Artificial Intelligence (AI) can alleviate the persistent logistical challenges of speed, cost, and reliability in food delivery. Users frequently inquire about the practical implementation of AI in route optimization—specifically, whether AI can handle dynamic, real-time adjustments necessary during peak traffic or unexpected weather events. Concerns center on the ethical implications and job displacement potential related to automated dispatch and autonomous delivery vehicles. Expectations are high regarding AI's ability to predict demand spikes, manage inventory effectively in cloud kitchens, and personalize delivery windows, thereby drastically improving customer satisfaction while simultaneously lowering the operational cost per delivery (CPD). The consensus is that AI is essential for moving the industry from reactive logistics management to proactive, predictive orchestration.

AI's role transcends simple route finding; it is crucial for establishing intelligent warehousing and micro-fulfillment centers, especially for q-commerce. By leveraging machine learning models trained on historical order data, weather patterns, local events, and traffic flows, AI systems can accurately forecast localized demand, allowing platforms to strategically preposition inventory or allocate rider capacity ahead of anticipated spikes. This predictive capability minimizes downtime for riders and drastically reduces food wastage, addressing critical economic and sustainability pressures faced by the industry.

Furthermore, AI is instrumental in enhancing the customer experience. AI-powered chatbots handle routine customer inquiries, resolving issues instantaneously and freeing human agents for complex problems. In logistics specifically, AI algorithms power dynamic pricing models that adjust delivery fees based on real-time driver availability and demand density, ensuring market efficiency. For autonomous delivery, computer vision and deep learning are non-negotiable for safe navigation, obstacle detection, and secure order handoff verification, forming the technological backbone of the next generation of delivery infrastructure.

- AI-driven Predictive Demand Forecasting (PDC): Optimizing rider and inventory allocation based on location, time, and external factors.

- Dynamic Route Optimization (DRO): Real-time adjustments to delivery paths considering traffic, construction, and multiple stops for maximum efficiency.

- Automated Dispatch and Fleet Management: Algorithmically assigning orders to the most suitable delivery agent based on location, vehicle, and current workload.

- Warehouse Robotics and Inventory Management: AI-guided automated retrieval and packaging systems in dark stores and cloud kitchens.

- Enhanced Customer Service: Utilization of AI chatbots and virtual assistants for instant order status updates and issue resolution.

- Quality Control Monitoring: Machine learning models analyzing sensor data (temperature, time) to ensure compliance with food safety standards during transit.

- Autonomous Delivery Systems (UAVs/Ground Vehicles): AI for navigation, obstacle avoidance, and safe execution of last-mile delivery protocols.

DRO & Impact Forces Of Food delivery logistics Market

The dynamics of the Food delivery logistics Market are shaped by powerful forces categorized as Drivers, Restraints, and Opportunities. Key drivers include the pervasive trend of digital transformation coupled with unprecedented convenience expectations from consumers, particularly the younger demographic. The market is also heavily influenced by continuous venture capital investment in logistics technology and the proliferation of dark kitchens, which centralize preparation and optimize delivery radii. However, growth is significantly constrained by high operational costs associated with last-mile delivery, regulatory hurdles concerning rider employment status (gig economy labor laws), and infrastructural limitations such as traffic congestion and inadequate cold chain facilities in developing regions. These constraints necessitate continuous innovation in operational models and regulatory engagement.

The primary opportunities lie in the swift expansion of quick commerce (q-commerce), covering non-perishable grocery and convenience items, which leverages existing food delivery networks. Opportunities are also abundant in integrating advanced technologies like drone delivery in specific terrains and implementing blockchain for enhanced traceability and transparency in the cold chain. Furthermore, market consolidation provides opportunities for players to standardize fragmented logistics protocols and achieve greater pricing power and operational efficiency through shared infrastructure. The shift towards sustainable urban logistics, driven by government incentives and consumer demand for eco-friendly services, presents a significant long-term growth avenue for companies adopting EV fleets and optimized packaging.

Impact forces acting upon the market include intense competition leading to perpetual price wars and margin compression, forcing companies to seek efficiency gains through scale and automation. Regulatory scrutiny regarding labor practices and urban planning (e.g., dedicated delivery zones, emission standards) significantly influences operating models. Finally, external shocks, such as pandemics or geopolitical events, demonstrate the vulnerability and volatility of the complex supply chain, simultaneously driving demand for quick delivery but also straining capacity and increasing labor reliance. Balancing the demand for speed with profitability, while navigating stringent regulatory environments, remains the central challenge for market participants.

Segmentation Analysis

The Food delivery logistics Market is comprehensively segmented based on various operational characteristics, service types, and technological implementations. Segmentation is crucial for market players to tailor their logistical strategies and resource allocation efficiently. The primary service type segmentation distinguishes between Meal Delivery and Grocery/Q-commerce Delivery, with the latter rapidly gaining traction due to the high frequency and broader margin potential of grocery items. Operational segment analysis focuses on the type of logistics execution, dividing the market into Platform-to-Consumer (P2C) delivery, wherein third-party aggregators handle the full logistical process, and Restaurant-to-Consumer (R2C) delivery, managed directly by the restaurant's proprietary fleet.

Further granularity is achieved by segmenting based on the vehicle used for delivery, reflecting infrastructural constraints and urban density. Motorbikes and scooters dominate high-density Asian and European cities, offering agility and cost-effectiveness. E-bikes and bicycles are favored in ultra-urban, short-radius zones, aligning with sustainability goals. Conversely, temperature-controlled vans and trucks are essential for catering services and large-volume grocery orders, ensuring cold chain integrity. Analyzing these segments helps logistics providers optimize their fleet mix and investment strategies based on geographic and service-specific requirements, ensuring timely and quality service delivery across diverse order profiles.

- Service Type:

- Meal Delivery (Hot/Prepared Food)

- Grocery Delivery (Q-Commerce)

- Catering and Bulk Order Delivery

- Operational Model:

- Platform-to-Consumer (P2C) Delivery (Third-Party Logistics)

- Restaurant/Retailer-to-Consumer (R2C) Delivery (Proprietary Fleet)

- Vehicle Type:

- Motorbikes and Scooters

- Bicycles and E-Bikes

- Vans and Trucks (Refrigerated/Standard)

- Drones and Autonomous Ground Vehicles (Emerging)

- Logistics Component:

- Warehousing and Fulfillment (Dark Stores/Cloud Kitchens)

- Last-Mile Delivery Services

- Supply Chain Management Software

Value Chain Analysis For Food delivery logistics Market

The value chain of the Food delivery logistics Market is complex, beginning with upstream activities focused on sourcing and preparation and concluding with critical downstream consumer interaction. Upstream analysis involves the procurement of ingredients by restaurants and dark kitchens, followed by food preparation and packaging, where efficiency is dictated by kitchen design and automation levels. Key upstream inputs also include specialized temperature-controlled packaging materials and logistics software licenses. Efficiency in this stage significantly impacts the subsequent cost of delivery, as poorly packaged or slow-to-prepare food creates delays in the dispatch process, directly influencing rider utilization rates.

The midstream of the value chain is dominated by logistics operations and distribution channels. This involves the critical role of aggregation platforms that utilize sophisticated algorithms for order matching, dispatch, and route optimization. Distribution channels are largely bifurcated: direct channels involve the restaurant managing its own fleet (R2C), offering greater control over branding and service quality, but requiring substantial internal investment. Indirect channels rely on third-party aggregators (P2C) or specialized logistics partners, which provide scale and network reach but introduce platform fees and potential loss of control over the customer interface. The choice between direct and indirect distribution heavily influences market share and profitability for the restaurant partner.

Downstream activities focus entirely on the last-mile execution and the final consumer experience. This includes real-time tracking, secure handoff, and post-delivery customer support. Success downstream is predicated on minimizing delivery time, ensuring product integrity (temperature control), and managing high customer expectations regarding reliability. Investment in advanced last-mile technology, such as optimized dispatch software and GPS monitoring, is critical to ensuring competitive advantage and high repeat order rates, ultimately completing the value cycle by generating positive consumer feedback and brand loyalty for both the restaurant and the logistics provider.

Food delivery logistics Market Potential Customers

The potential customer base for the Food delivery logistics Market is broad and expanding, primarily comprising entities requiring efficient, reliable, and scalable last-mile transport solutions for prepared meals and perishable goods. The largest segment of end-users is the Quick Service Restaurant (QSR) sector and the larger Full-Service Restaurant (FSR) industry. These establishments rely on logistics providers and aggregators to extend their geographic reach beyond immediate dine-in patrons, accessing new revenue streams without incurring the massive capital expenditure required for maintaining a proprietary delivery fleet. For many smaller, independent restaurants, relying on third-party logistics is the sole viable path to offering delivery services.

Another rapidly growing customer segment consists of virtual kitchen operators, often referred to as cloud kitchens or dark kitchens. These businesses are entirely delivery-only models, making efficient, low-cost logistics their core operational requirement. They serve as ideal, high-volume clients for centralized logistics providers, often entering into long-term contracts for optimized dispatch services and proximity fulfillment. Furthermore, the retail sector, specifically supermarkets, hypermarkets, and specialized convenience stores, are increasingly leveraging these logistics networks to support their quick commerce (q-commerce) initiatives, requiring specialized logistical capabilities for high-frequency, low-volume grocery orders within tight time frames.

Finally, institutional clients and corporate catering services represent a significant, high-value customer base. Offices, educational institutions, hospitals, and large event organizers frequently require bulk delivery services that demand refrigerated transport and precise scheduling, necessitating specialized logistics partners capable of handling large payloads and complex delivery instructions. The strategic acquisition of these high-value accounts often requires logistics providers to offer tailored fleet configurations and dedicated account management, highlighting the diverse needs within the overall customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155.0 billion |

| Market Forecast in 2033 | $389.5 billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DoorDash, Uber Eats, Deliveroo, Meituan, Zomato, Grubhub, Just Eat Takeaway, Swiggy, Postmates, Delivery Hero, Ele.me, Gojek, Glovo, Rappi, SkipTheDishes, Talabat, Wolt, Lalamove, Getir, Coupang Eats |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food delivery logistics Market Key Technology Landscape

The technological landscape of the Food delivery logistics Market is characterized by a rapid evolution toward automation, predictive analytics, and sustainability-focused solutions. Central to this landscape is advanced route optimization software, which utilizes sophisticated algorithms (often leveraging AI and machine learning) to calculate the most efficient path for multiple drop-offs in real-time, drastically reducing transit times and fuel consumption. Geographic Information Systems (GIS) and high-definition mapping are foundational, providing the precise location data necessary for micro-logistics planning and enabling features like live tracking, which has become a baseline customer expectation. Furthermore, the integration of API endpoints allows for seamless data flow between restaurant POS systems, logistics platforms, and rider applications, ensuring rapid order fulfillment and minimizing data latency.

Another critical area of technological investment is in fleet digitalization and control systems. The shift towards electric vehicles (EVs) and smart containers necessitates specialized technology for battery management, charging infrastructure optimization, and temperature monitoring throughout the delivery cycle. IoT sensors embedded in insulated delivery bags and vehicles provide continuous data on temperature and humidity, crucial for maintaining food safety and regulatory compliance (cold chain integrity). This real-time telemetry not only serves quality assurance but also provides valuable operational data for predictive maintenance and vehicle scheduling.

Looking ahead, the technological frontier is dominated by automation and autonomous systems. This includes the development and testing of delivery drones (UAVs) for suburban or geographically challenging regions and autonomous ground vehicles (AGVs) for contained urban environments. While regulatory frameworks are still catching up, the technology involves advanced computer vision, sensor fusion, and highly localized navigation systems. Additionally, warehouse automation technologies, such as robotic picking systems and automated conveyor belts within dark kitchens and micro-fulfillment centers, are essential for accelerating the preparation and handoff process, transitioning the market toward hyper-efficiency.

Regional Highlights

The Food delivery logistics Market exhibits significant regional variation in terms of maturity, consumer behavior, and technological adoption. Asia Pacific (APAC) stands out as the largest and fastest-growing market globally, primarily due to the vast population density in major urban centers and a highly competitive landscape dominated by tech giants like Meituan and Zomato. Consumers in APAC are highly accustomed to frequent mobile ordering and expect extremely fast, low-cost delivery, often necessitating dense networks of motorbike and scooter fleets. Government support for digital infrastructure, coupled with the high prevalence of cloud kitchens, reinforces APAC's leading position, driving massive volumes but often yielding tight profit margins due to intense competition.

North America (NA) and Europe represent mature markets characterized by higher average order values (AOVs) and a stronger focus on convenience and diverse options, particularly in specialty foods and quick commerce groceries. Logistics providers in these regions, such as DoorDash and Uber Eats, focus heavily on optimizing labor costs through AI and sophisticated gig economy management systems. Europe, in particular, is witnessing a strong regulatory push towards sustainable logistics, leading to rapid adoption of EV fleets and cargo bikes for urban deliveries. The high labor cost structure in NA and Europe is the primary driver for investments in autonomous delivery systems and drone technology testing, aiming for long-term operational expense reduction.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging growth markets, characterized by rapid urbanization and increasing digital penetration. LATAM, led by markets like Brazil and Mexico, relies on complex logistical solutions to navigate high traffic and rapidly expanding, sometimes less standardized urban layouts. MEA benefits from significant technological investment, particularly in the Gulf Cooperation Council (GCC) countries, where high disposable incomes support premium delivery services and rapid grocery models. Challenges in these regions often relate to infrastructure limitations, requiring creative solutions for last-mile access and address verification, making local market knowledge essential for logistical success.

- Asia Pacific (APAC): Market leader, driven by density, high mobile penetration, rapid adoption of dark kitchens, and intense price competition. Focus on volume and speed.

- North America (NA): Mature market with high AOVs, focusing on advanced AI optimization, driver efficiency, and pioneering autonomous delivery trials.

- Europe: Strong regulatory focus on sustainable logistics, high adoption of e-bikes and EVs, strong q-commerce presence, and sensitivity to labor regulations.

- Latin America (LATAM): High growth potential fueled by urbanization, reliance on agile motorbike fleets, and necessity for robust mapping solutions to navigate complex city structures.

- Middle East & Africa (MEA): Emerging market with strong investment in premium services and rapid grocery, particularly in urban hubs like Dubai and Riyadh; infrastructure development remains key.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food delivery logistics Market.- DoorDash

- Uber Eats (including Postmates)

- Deliveroo

- Meituan (Meituan Waimai)

- Zomato

- Grubhub

- Just Eat Takeaway

- Swiggy

- Delivery Hero (including various global brands)

- Ele.me (Alibaba Group)

- Gojek

- Glovo

- Rappi

- SkipTheDishes

- Talabat

- Wolt (Acquired by DoorDash)

- Lalamove (Focusing on logistics support)

- Getir

- Coupang Eats

- Yandex.Eats

Frequently Asked Questions

Analyze common user questions about the Food delivery logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Food delivery logistics Market?

The primary driver is the accelerating consumer demand for immediate gratification and convenience, coupled with extensive digitalization. The proliferation of smartphones and high-speed internet enables instant ordering, while the operational efficiency provided by third-party aggregators satisfies the logistical need for speed and reliability, particularly in dense urban environments.

How is quick commerce (q-commerce) influencing food delivery logistics?

Q-commerce, focusing on rapid grocery and convenience item delivery, is significantly intensifying the need for micro-fulfillment and ultra-fast last-mile logistics. This requires specialized infrastructure like dark stores and highly optimized short-radius delivery networks, challenging traditional meal delivery models and driving investment in agile, short-haul vehicle fleets.

What are the main technological challenges facing food delivery logistics providers?

The key challenges include achieving highly accurate real-time dynamic route optimization under volatile traffic conditions, managing the integrity of the cold chain across varying distances, and effectively integrating AI-driven demand forecasting to minimize labor costs and prevent delivery delays during peak hours.

Which region currently holds the largest market share in food delivery logistics?

Asia Pacific (APAC) currently holds the largest market share, driven by high population density, established delivery culture, and highly successful localized platforms. The sheer volume of transactions and consumer adoption rates in countries like China and India contribute significantly to its market dominance.

How does the shift towards Electric Vehicles (EVs) impact last-mile delivery operations?

The adoption of EVs and e-bikes in last-mile delivery primarily serves sustainability goals and reduces long-term operational fuel costs. However, it necessitates substantial investment in charging infrastructure, optimized battery management systems, and specialized logistics planning to maximize delivery range and minimize vehicle downtime for recharging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager