Food Delivery Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434777 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Food Delivery Service Market Size

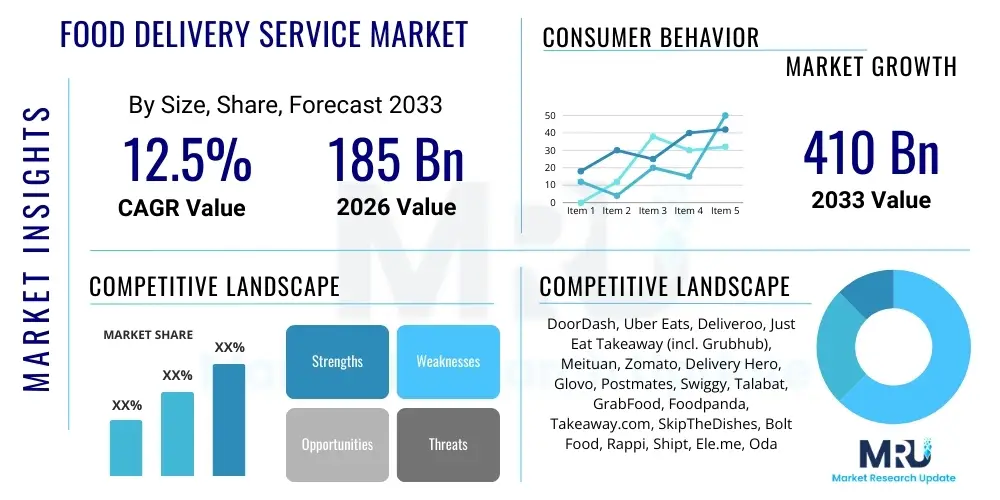

The Food Delivery Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 185 Billion in 2026 and is projected to reach USD 410 Billion by the end of the forecast period in 2033.

Food Delivery Service Market introduction

The Food Delivery Service Market encompasses platforms and logistical operations that facilitate the ordering, preparation, and delivery of prepared meals from restaurants or ghost kitchens directly to consumers. This sector has fundamentally reshaped the culinary landscape, moving dining experiences beyond physical restaurant premises. The core product is convenience, enabling consumers to access diverse culinary options through seamless digital interfaces, often via mobile applications. The major applications span residential consumption, corporate catering, and specific event delivery, driven primarily by the need for quick, reliable, and personalized meal solutions in increasingly urbanized and time-constrained lifestyles.

The primary benefits driving this market include unparalleled convenience, access to a wider variety of dining options than locally available, and transparent tracking capabilities that enhance consumer trust. Furthermore, the ecosystem provides restaurants, particularly small and medium-sized enterprises, with extended reach and access to digital revenue streams without necessitating significant upfront investment in expanded dining capacity. This dual-sided benefit structure ensures sustained growth, even as market dynamics shift toward sustainability and operational efficiency. The industry continuously innovates, integrating advanced logistics and data analytics to optimize delivery routes and minimize wait times, thereby maximizing customer satisfaction and operational throughput.

Key driving factors fueling market expansion are pervasive smartphone penetration, the continuous improvement of digital payment infrastructure, and shifts in consumer behavior favoring instant gratification and high-quality convenience. Urbanization trends globally create dense customer bases, making logistics economically viable, while demographic changes, such as the rise of younger generations who prioritize digital interaction, reinforce the demand for app-based services. Moreover, external shocks, such as global health crises experienced recently, accelerated the adoption of these services, permanently shifting consumer habits towards off-premise dining models. The convergence of efficient technology and evolving consumer needs forms the foundation for the market's robust projected growth.

Food Delivery Service Market Executive Summary

The Food Delivery Service Market is currently defined by intense competition and rapid technological integration, marking a transition from volume-driven growth to profitability-focused strategies. Business trends highlight strategic consolidation, with major global players acquiring regional competitors to solidify market share and achieve operational scale, crucial for mitigating rising labor and fuel costs. Furthermore, there is a pronounced pivot towards vertical integration, where platform providers invest in commissary kitchens (ghost kitchens) and supply chain efficiencies to control quality and margins, reducing reliance solely on traditional restaurant partners. Subscription models are emerging as critical tools for enhancing customer loyalty, stabilizing recurring revenue streams, and improving the long-term lifetime value of users.

Regional trends exhibit high divergence based on infrastructural maturity and regulatory environments. Asia Pacific (APAC), particularly Southeast Asia and India, remains the dominant growth engine, characterized by extremely high order frequency, intense competition between super-apps, and rapid adoption of two-wheeler logistics solutions. Conversely, North America and Europe demonstrate a focus on service refinement, faster delivery speeds, and integration with innovative technologies like autonomous vehicles and drone delivery in highly regulated urban corridors. Latin America and the Middle East and Africa (MEA) are experiencing accelerated growth spurred by increasing mobile internet access and rising disposable incomes, though infrastructural challenges often necessitate localized logistics solutions.

Segmentation trends reveal significant shifts across various service models and payment types. The Platform-to-Consumer segment, facilitating independent logistics for restaurants, is gaining traction due to the demand for specialized delivery services tailored to specific cuisine types or premium experiences. Furthermore, the integration of non-food items (e.g., groceries, pharmaceuticals) into food delivery ecosystems—the 'Q-Commerce' model—is blurring traditional boundaries, turning delivery platforms into comprehensive convenience providers. Digital payment methods dominate, driven by consumer preference for contactless transactions and the superior integration capabilities offered by platform applications, simultaneously reducing cash handling risks for delivery personnel.

AI Impact Analysis on Food Delivery Service Market

User inquiries regarding AI's impact on the Food Delivery Service Market heavily center on three themes: enhancing logistical efficiency, personalizing the customer experience, and automating operational tasks. Common questions address how AI can reduce delivery times, whether dynamic pricing models will lead to fairer or more optimized costs for consumers and restaurants, and the potential displacement of human labor through robotic or autonomous delivery systems. Users are also keen to understand how AI algorithms manage fluctuating demand, especially during peak hours, and how data analytics derived from machine learning inform restaurant placement and menu optimization strategies. The overall expectation is that AI will be the primary catalyst for achieving profitability in this historically margin-thin industry by minimizing waste and maximizing routing effectiveness.

AI's immediate impact is most visible in optimizing complex logistical challenges. AI-powered route planning systems process real-time data on traffic, weather, order volume, and driver availability to dynamically assign orders and generate the most efficient delivery paths. This not only significantly reduces delivery latency but also lowers fuel consumption and labor costs, directly improving the unit economics of each delivery. Furthermore, machine learning models are indispensable for sophisticated demand forecasting, allowing platforms to preemptively position drivers in high-demand areas, reducing pickup and drop-off delays and improving the predictability of service fulfillment, a key metric for customer retention.

Beyond logistics, AI is transforming the front-end user experience and commercial relationships with partners. Recommendation engines, leveraging collaborative filtering and deep learning, offer hyper-personalized menu suggestions, increasing conversion rates and average order value. For restaurants, AI tools provide invaluable business intelligence regarding consumer preferences, menu profitability, and operational bottlenecks. Additionally, the increasing reliance on AI for customer service, primarily via sophisticated chatbots and voice assistants, manages routine inquiries, freeing human agents to handle complex issues, thereby scaling customer support while maintaining quality. This widespread deployment solidifies AI's role as a core competitive differentiator.

- AI-powered Dynamic Route Optimization (DRO) minimizes delivery time and operational cost.

- Machine learning enables highly accurate demand forecasting and driver pre-positioning.

- Personalized recommendation engines drive higher average order values (AOV) and customer engagement.

- Advanced chatbots and conversational AI streamline customer service operations.

- AI aids ghost kitchen location selection and menu optimization based on geographical demand patterns.

- Computer vision and sensor data integration enhance quality control and autonomous delivery safety protocols.

DRO & Impact Forces Of Food Delivery Service Market

The market is defined by several intertwined Dynamics, Restraints, and Opportunities (DRO) which collectively shape the competitive landscape and growth trajectory. The major drivers include the relentless global push toward digitalization, heightened consumer demand for convenience, and the successful adaptation of third-party logistics to complex urban environments. These drivers propel market expansion, making delivery an indispensable part of urban life. However, significant restraints challenge sustained profitability, notably high commission rates charged by platforms that squeeze restaurant margins, the pervasive issue of driver turnover due to precarious employment structures, and the increasing regulatory scrutiny worldwide regarding labor practices and data privacy. These factors create operational friction that platforms must address to achieve long-term financial sustainability.

Opportunities for growth are largely centered on technological innovation and market penetration into underserved sectors. The integration of advanced logistics technologies, such as drone and robotic delivery systems, particularly in suburban or less dense areas, presents a chance to dramatically reduce operational costs and delivery times. Furthermore, the expansion into adjacent markets, such as grocery, retail, and pharmacy delivery (Q-Commerce), leverages existing logistical infrastructure and increases customer wallet share. Addressing the profitability constraint through innovative subscription models that lock in high-frequency users and reduce reliance on promotional discounts offers a clear path toward financial stability and higher investor confidence. The focus is shifting from simple market share acquisition to profitable market execution.

Impact forces currently reshaping the industry include fierce price competition, which forces platforms to maintain large promotional budgets despite the need for profitability, and the accelerating integration of environmental, social, and governance (ESG) factors. Consumers and regulators increasingly expect platforms to prioritize sustainable packaging and fair labor practices, impacting operational decisions and public relations. Furthermore, the potential disruption from vertically integrated restaurant chains developing their own proprietary, commission-free delivery fleets poses a significant threat to third-party aggregators. These forces necessitate continuous adaptation, requiring platforms to balance aggressive expansion with ethical and sustainable business practices to maintain relevance and regulatory compliance in dynamic global markets.

Segmentation Analysis

The Food Delivery Service Market segmentation provides a granular view of consumer behavior and operational models across various dimensions. Key segmentation criteria include the type of service provider (defining the logistics relationship), the core service model (determining aggregation vs. integrated logistics), the end-user base (residential versus commercial needs), and the payment methods utilized. This analytical approach helps platforms tailor their offerings, optimize pricing strategies, and allocate resources effectively across distinct consumer groups and geographic regions. Understanding these divisions is crucial for identifying niches and achieving localized competitive advantage in a globally fragmented yet digitally interconnected marketplace.

The delineation between Platform-to-Consumer (P2C) and Restaurant-to-Consumer (R2C) models highlights the shift in market control. While P2C, where third-party aggregators manage all logistics, dominates globally due to convenience and scale, the R2C model (in-house delivery) persists, particularly for high-end restaurants seeking complete control over the customer experience and maintaining higher margins. Analysis of the end-user base shows the residential segment remains the largest volume driver, fueled by routine weekday ordering, whereas the corporate segment, despite lower frequency, offers high average transaction values (ATV) and specific catering requirements, presenting a lucrative target for specialized services and subscription packages.

Future segmentation trends suggest increasing emphasis on factors such as delivery speed (standard vs. quick commerce/Q-Commerce), product category inclusion (meal vs. grocery/non-food items), and sustainability features (eco-friendly packaging, carbon-neutral delivery options). These specialized segmentations allow platforms to cater to evolving consumer values and regulatory pressures. The complexity inherent in balancing high customer expectation with logistical feasibility ensures that segmentation analysis remains central to strategic planning, enabling targeted investments in technology and infrastructure that deliver differentiated value propositions.

- By Type:

- Platform-to-Consumer (P2C)

- Restaurant-to-Consumer (R2C)

- By Service Model:

- Aggregator Services

- Logistics/Integrated Delivery Services

- By End-User:

- Residential

- Corporate/Institutional

- By Payment Method:

- Online Payment

- Cash on Delivery (COD)

Value Chain Analysis For Food Delivery Service Market

The Food Delivery Service value chain is a complex ecosystem spanning multiple stages, commencing with upstream activities focused on food preparation and procurement, progressing through platform aggregation and order management, and culminating in the critical downstream process of physical delivery to the customer. Upstream analysis involves assessing relationships with restaurants, including contract negotiation, menu digitization, and increasingly, the operation of ghost kitchens which streamlines preparation and reduces reliance on existing restaurant infrastructure. Efficient upstream processes are paramount for quality control and minimizing preparation time, which directly impacts customer satisfaction metrics.

The midstream segment is dominated by the digital platforms, which act as sophisticated intermediaries. This phase encompasses core activities such as customer acquisition through marketing and application interface development, order processing, secure payment handling, and the application of complex algorithmic logistics to match orders with available drivers. The competitive edge in the midstream resides in the superiority of the platform's technology stack—its ability to handle high volumes, provide reliable real-time tracking, and offer effective customer support. Failure in the midstream, such as app outages or inaccurate tracking, results in immediate customer churn and reputational damage.

Downstream analysis focuses heavily on the logistical network and distribution channel efficiency. Delivery execution, whether direct (R2C) or indirect (P2C via third-party fleets), is the final and often most challenging stage. The dominance of indirect distribution, characterized by fleets of independent contractors utilizing bikes, scooters, or cars, requires significant investment in driver management, safety protocols, and incentive structures to ensure reliability and speed. The integration of advanced technologies like geo-fencing, AI routing, and digital identity verification for both drivers and customers is essential for optimizing this final mile, which remains the highest cost component and the primary determinant of customer experience quality.

Food Delivery Service Market Potential Customers

The primary End-Users/Buyers of food delivery services are broadly categorized based on their ordering frequency, demographic profile, and motivation for using the service. The largest segment comprises urban dwellers, especially millennials and Generation Z, characterized by high digital literacy, disposable income, and a strong preference for convenience over traditional cooking or dining out. These customers typically place small, frequent orders, driving the daily volume and necessitating high service reliability and competitive pricing. Platforms primarily target this group through personalized promotions, loyalty programs, and expansive restaurant selections tailored to local tastes and affordability expectations.

A secondary, high-value segment includes busy working professionals and families, who utilize the service as a routine time-saving measure, particularly during peak weekday evenings. Although their order frequency might be slightly lower than the core urban demographic, their average order value (AOV) is often higher, including complex meal combinations or catering for multiple individuals. Addressing this segment requires providing seamless group ordering features, transparent dietary labeling, and robust delivery windows that align with typical dinner times. Subscription services are highly appealing to this segment, offering perceived value and predictable savings on delivery fees.

Furthermore, a growing niche includes the corporate sector and institutions, which use delivery platforms for internal meetings, client entertainment, or large-scale event catering. These B2B customers prioritize reliability, ability to handle large and complex orders, and invoicing transparency. Platforms are increasingly developing specialized corporate accounts and dedicated fulfillment channels to meet the demanding requirements of this segment. As the ecosystem matures, potential customers are continuously expanding to include less digitally native populations through simplified ordering interfaces and improved accessibility, ensuring broader market penetration beyond the early adopter demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Billion |

| Market Forecast in 2033 | USD 410 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DoorDash, Uber Eats, Deliveroo, Just Eat Takeaway (incl. Grubhub), Meituan, Zomato, Delivery Hero, Glovo, Postmates, Swiggy, Talabat, GrabFood, Foodpanda, Takeaway.com, SkipTheDishes, Bolt Food, Rappi, Shipt, Ele.me, Oda |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Delivery Service Market Key Technology Landscape

The Food Delivery Service market relies heavily on a sophisticated technological landscape built around mobile connectivity, cloud computing, and advanced data science. Core technologies include geo-location services (GPS/GIS) for accurate address mapping and real-time tracking, cloud infrastructure for scalable platform hosting, and robust payment gateways ensuring secure, rapid transaction processing. The adoption of mobile application technology provides the critical interface for both consumer ordering and driver management, requiring continuous updates to maintain user experience and integrate new features like personalized recommendation engines and advanced filtering options. Technology serves as the backbone facilitating the seamless orchestration of high-frequency, low-latency transactions across disparate geographic areas.

Logistical efficiency is driven by algorithmic routing software, which leverages machine learning and optimization models to manage dynamic variables such as traffic congestion, weather anomalies, and simultaneous pickup/drop-off requirements (batching). Furthermore, the integration of Application Programming Interfaces (APIs) allows platforms to seamlessly connect with restaurant Point-of-Sale (POS) systems, automating order transmission and reducing manual errors. The ongoing development of ‘Ghost Kitchen’ management software is also crucial, enabling platforms or their restaurant partners to optimize kitchen layouts, inventory, and production based on predictive demand analytics, ensuring meals are prepared just in time for driver arrival.

The future technology landscape is focused on automation and enhanced data security. Investments are escalating in autonomous delivery vehicles, including sidewalk robots and drones, aimed at reducing reliance on human labor in select high-density or low-density environments. Blockchain technology is also being explored to enhance supply chain transparency and payment security, particularly concerning compliance with food safety standards. Crucially, Big Data analytics are fundamental for strategic decision-making, providing insights into competitive pricing, promotional effectiveness, and identifying optimal locations for market expansion, ensuring technology remains the key differentiator in a fiercely competitive environment.

Regional Highlights

Regional dynamics play a crucial role in shaping the Food Delivery Service Market, dictated by unique consumer preferences, infrastructure levels, and regulatory frameworks. North America, dominated by established players like DoorDash and Uber Eats, shows high average order values (AOV) but faces significant pressure regarding driver compensation and regulatory compliance regarding contractor status. The focus in this region is on expanding into adjacent quick commerce sectors and utilizing advanced logistics to serve suburban sprawl efficiently, moving beyond core metropolitan areas. Competition is concentrated, leading to strategic acquisitions and intense promotional activity aimed at locking in customer loyalty through exclusive restaurant partnerships.

Asia Pacific (APAC) represents the largest and most dynamically growing market, characterized by immense population density, high smartphone penetration, and intense rivalry among "super-apps" such as Meituan, GrabFood, and Zomato. The prevalence of two-wheeler logistics makes delivery highly cost-effective, resulting in much higher order frequency compared to Western markets. However, the regulatory environment is fragmented, requiring localized strategies to navigate diverse labor laws and public health standards. China and India are the primary growth accelerators, where speed and affordability are paramount competitive factors, often achieved through extensive use of dark stores and cloud kitchens to ensure hyper-localized service fulfillment.

Europe presents a mature but highly fragmented market, driven primarily by Deliveroo and Just Eat Takeaway. Key markets like the UK, Germany, and France face strict scrutiny over labor practices, leading platforms to invest heavily in shifting contractor models toward more formalized employment arrangements, which impacts operational costs. The European focus is shifting towards sustainability, requiring platforms to prioritize electric vehicle use and eco-friendly packaging solutions. Meanwhile, Latin America (LatAm) and the Middle East and Africa (MEA) are emerging hotspots, propelled by rapid urbanization and digitalization, with regional leaders like Rappi and Talabat capitalizing on rapidly growing digital adoption and addressing the high demand for convenience across increasingly connected populations.

- North America: Focus on suburban expansion, high AOV, and addressing regulatory challenges regarding driver classification (e.g., California's AB5 law).

- Asia Pacific (APAC): Highest volume and growth rate, dominated by super-apps, leveraging efficient two-wheeler logistics, with market density driving high frequency.

- Europe: Highly competitive and mature, driven by strict labor regulation (gig economy reform) and increasing demand for sustainable delivery practices.

- Latin America (LatAm): High growth potential due to rapid digitalization and young demographic; characterized by complex urban logistics challenges.

- Middle East and Africa (MEA): Accelerated growth fueled by rising disposable incomes and high mobile connectivity, with strong investment in logistics infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Delivery Service Market.- DoorDash

- Uber Eats

- Deliveroo

- Just Eat Takeaway (incl. Grubhub)

- Meituan

- Zomato

- Delivery Hero

- Glovo

- Postmates

- Swiggy

- Talabat

- GrabFood

- Foodpanda

- Takeaway.com

- SkipTheDishes

- Bolt Food

- Rappi

- Shipt

- Ele.me

- Oda

Frequently Asked Questions

Analyze common user questions about the Food Delivery Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Food Delivery Service Market?

The primary drivers are ubiquitous smartphone penetration, the cultural shift towards convenience and instant gratification, increasing urbanization which supports dense logistics networks, and significant technological advancements in AI-driven route optimization and demand forecasting, making services faster and more reliable.

How are food delivery platforms addressing the challenges of profitability and high commission rates?

Platforms are focusing on achieving economies of scale through consolidation, implementing efficiency measures via AI logistics, expanding high-margin services like Quick Commerce (Q-Commerce), and promoting subscription models (e.g., DashPass, Uber One) to stabilize recurring revenue and increase customer lifetime value, thereby reducing dependency on high commission fees.

What role do 'Ghost Kitchens' play in the future of food delivery services?

Ghost kitchens, or cloud kitchens, are crucial for future growth by allowing platforms and restaurants to operate optimized, delivery-only facilities in strategic, high-demand areas without the overhead of dining spaces. They facilitate menu experimentation, reduce preparation times, and significantly improve logistical efficiency, supporting the aggressive expansion of virtual brands.

Which regions demonstrate the highest potential for market expansion in the near future?

Asia Pacific (APAC), specifically emerging economies within Southeast Asia and India, holds the highest potential due to massive population bases, rapid digital adoption rates, and high frequency of ordering. Latin America and the MEA region are also projected for accelerated growth as digital infrastructure improves and urbanization increases consumer demand for convenience.

How will autonomous and robotic technologies impact delivery operations?

Autonomous and robotic technologies are anticipated to revolutionize last-mile delivery by reducing labor costs, increasing operational hours, and enhancing safety in specific urban or campus environments. While full implementation is pending regulatory approval, these technologies promise to optimize the unit economics of delivery, particularly for short-distance, repeatable routes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager