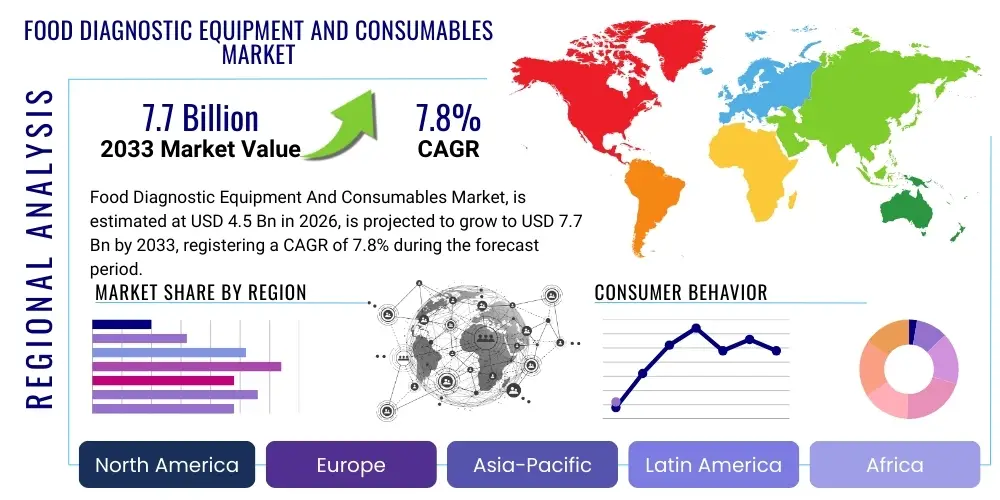

Food Diagnostic Equipment And Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436231 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food Diagnostic Equipment And Consumables Market Size

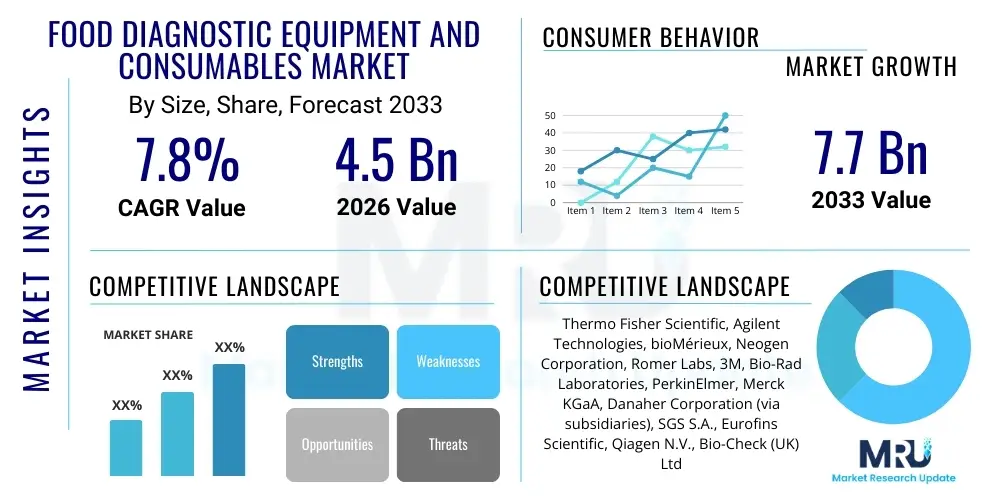

The Food Diagnostic Equipment And Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.7 billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by increasing global food safety regulations, heightened consumer awareness regarding foodborne illnesses, and the continuous innovation in rapid testing technologies designed to enhance traceability and reduce recall events across complex supply chains. The indispensable nature of consumables, such as reagents, test kits, and sampling media, which account for a substantial portion of the recurring revenue, ensures sustained market expansion as testing volumes increase globally.

Food Diagnostic Equipment And Consumables Market introduction

The Food Diagnostic Equipment and Consumables Market encompasses a broad range of instruments, systems, and disposable materials utilized for the detection and quantification of contaminants, pathogens, allergens, toxins, and adulterants in food and beverage products throughout the supply chain, from farm to fork. These diagnostic tools are critical for ensuring public health protection, maintaining brand integrity for manufacturers, and facilitating compliance with increasingly stringent domestic and international regulatory frameworks imposed by bodies such as the U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), and local governmental agencies. The primary product categories include analytical instruments like PCR machines, mass spectrometers, and chromatography systems, alongside essential consumables such as immunoassay kits, microbial culture media, rapid test strips, and genetically modified organism (GMO) detection kits.

Major applications of these diagnostic solutions span several critical areas within the food industry, including routine quality control testing conducted by processing facilities, confirmation testing performed by accredited third-party laboratories, and regulatory surveillance carried out by government entities. The market is seeing a pivotal shift from traditional, time-consuming microbiological culture methods toward advanced molecular diagnostic techniques, specifically real-time Polymerase Chain Reaction (RT-PCR), Next-Generation Sequencing (NGS), and highly sensitive immunoassay platforms like ELISA (Enzyme-Linked Immunosorbent Assay). This technological evolution is primarily driven by the need for quicker results, higher throughput, and enhanced specificity, which are vital for mitigating the financial and reputational damage associated with widespread foodborne disease outbreaks or large-scale product recalls.

The core benefits derived from utilizing sophisticated food diagnostic equipment include minimized time-to-result, which allows for faster decision-making regarding batch release or quarantine, and increased precision in identifying specific contaminants, thereby reducing false positive rates. Key factors driving market growth are the globalization of food trade, which increases the complexity and potential contamination points within the supply chain; the rising incidence of antibiotic-resistant bacteria demanding better detection methods; and elevated consumer demand for detailed information regarding product contents, including allergens and origin verification. Furthermore, continuous investment in R&D is leading to the commercialization of portable, easy-to-use, and highly automated diagnostic solutions suitable for decentralized testing environments, further propelling market adoption across developing economies and small-to-medium enterprises (SMEs).

Food Diagnostic Equipment And Consumables Market Executive Summary

The Food Diagnostic Equipment and Consumables Market is characterized by robust business trends centered on automation and integration, regulatory harmonization efforts across major trading blocs, and intense focus on supply chain transparency solutions. Leading diagnostic companies are aggressively investing in developing multiplexed assays capable of simultaneously detecting multiple targets (e.g., several pathogens or toxins) from a single sample, dramatically improving laboratory efficiency. Furthermore, there is a pronounced trend toward digitalization, integrating laboratory information management systems (LIMS) with diagnostic equipment to ensure seamless data handling, automated reporting, and enhanced compliance auditing. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical footprint and diversifying technological portfolios, particularly in molecular diagnostics and high-throughput screening technologies, are central to the competitive landscape, pushing the market toward consolidated technological platforms.

Regionally, the market exhibits varied maturity levels and growth rates. North America and Europe currently represent the largest revenue generators, attributed to mature regulatory frameworks, mandatory compliance requirements (such as HACCP and FSMA), and high technological penetration in both commercial and governmental testing facilities. However, the Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate over the forecast period, fueled by rapid urbanization, significant expansion of the processed food sector, increasing consumer spending power leading to demand for higher quality standards, and intensified governmental efforts in countries like China and India to modernize food safety infrastructure and align with international export standards. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by increasing foreign direct investment in food processing and gradual but steady adoption of standardized testing protocols, particularly for export-oriented businesses.

Segment trends highlight the persistent dominance of the consumables segment, which includes reagents, kits, and media, driven by their recurring purchase cycle tied directly to testing volume. In terms of target contaminants, pathogen testing, particularly for Salmonella, E. coli, Listeria, and Campylobacter, remains the highest revenue generator due to mandatory regulatory screening and high associated public health risks. Technologically, molecular diagnostics (PCR and derivatives) is experiencing explosive growth, displacing traditional culture methods owing to superior speed and accuracy, making it the preferred technology for rapid release testing and outbreak investigation. The shift towards non-invasive, quick detection methods for food allergens (e.g., gluten, nuts) is also driving significant investment in highly sensitive immunoassay kits, responding to the growing prevalence of allergies and stricter labeling laws.

AI Impact Analysis on Food Diagnostic Equipment And Consumables Market

User queries regarding Artificial Intelligence (AI) in food diagnostics frequently revolve around its potential to revolutionize predictive food safety, automate complex data interpretation, and improve outbreak response times. Users are keen to understand how AI algorithms can analyze vast datasets—including environmental factors, supply chain logistics, historical contamination patterns, and real-time sensor data—to predict potential contamination hotspots before they manifest as public health crises. Key concerns center on the reliability of AI models in handling complex food matrices, the initial investment required for integrating AI-enabled diagnostic equipment, and the standardization of data collection protocols necessary for effective machine learning. Additionally, there is significant interest in AI's role in image analysis for traditional microbiological testing, automating colony counting, and classifying microbial species, thereby drastically reducing manual labor and subjective interpretation errors in laboratory settings.

The primary expectations surrounding AI integration involve enhancing diagnostic throughput and precision. AI-powered platforms are anticipated to dramatically accelerate the interpretation of complex genomic data generated by Next-Generation Sequencing (NGS) for whole-genome sequencing (WGS) traceability during outbreak investigations, allowing epidemiologists to link contamination sources much faster than traditional methods. Furthermore, the application of machine learning in optimizing instrument calibration, predicting maintenance needs, and managing vast inventories of consumables based on predictive demand models is expected to reduce operational costs and improve laboratory uptime. Users expect AI to transcend simple data logging and move toward real-time, actionable insights integrated directly into quality assurance workflows.

This integration of AI is not limited to high-end molecular labs; it is also expected to enhance the utility of simpler diagnostic tools. For instance, smart readers for lateral flow devices (LFDs) use AI to interpret faint lines or ambiguous results reliably, minimizing human error in field testing. This democratization of high-level analytical capability via AI is a crucial expectation. Regulatory bodies and food industry stakeholders are cautiously optimistic, seeking clarity on validation frameworks for AI-driven diagnostic results to ensure they meet mandatory compliance standards. Ultimately, AI is viewed as the cornerstone for transitioning from reactive contamination testing to proactive, preventative food safety management, fundamentally changing the operational landscape of diagnostic laboratories worldwide.

- AI enables predictive modeling of foodborne outbreaks by analyzing epidemiological, environmental, and supply chain data.

- Automated interpretation of complex diagnostic results, including NGS data and chromatographic profiles, significantly reducing time-to-result.

- Machine learning algorithms optimize laboratory workflows, resource allocation, and quality control processes.

- Enhances precision in image analysis for microbiological enumeration and morphological identification.

- Facilitates real-time integration of diagnostic results into digital traceability systems (blockchain and IoT).

- Improves decision support systems for rapid quarantine and recall management actions.

DRO & Impact Forces Of Food Diagnostic Equipment And Consumables Market

The Food Diagnostic Equipment and Consumables Market is propelled by several robust drivers, primarily the escalating global awareness and regulatory enforcement surrounding food safety and quality assurance. The continuous occurrence of high-profile food contamination incidents, coupled with the increasingly globalized and complex nature of the food supply chain, necessitate mandatory, high-frequency testing across all processing stages. Regulations such as the U.S. Food Safety Modernization Act (FSMA) and rigorous European Union regulations place significant responsibility on food producers and importers to implement preventative controls, driving consistent demand for validated diagnostic tools. Furthermore, rapid technological advancements, especially in molecular biology and immunoassays, are providing quicker, more reliable, and lower detection limit testing solutions, enhancing accessibility and efficiency for end-users, thereby serving as a major growth catalyst. This demand is amplified by shifting consumer preferences towards transparency regarding allergens, GMOs, and organic verification, requiring specialized diagnostic tests.

However, the market faces significant restraints. A major impediment is the high initial capital investment required for sophisticated diagnostic equipment, such as Mass Spectrometry (MS) systems and automated PCR platforms, which often limits adoption, especially among smaller food processors and laboratories in developing regions. Operational complexities, including the requirement for highly skilled personnel to operate and maintain these advanced instruments and interpret the complex data outputs, also pose a constraint. Furthermore, the inherent difficulty of testing complex food matrices, where sample preparation can be cumbersome and matrix effects can interfere with assay sensitivity and specificity, remains a technical hurdle. Regulatory variations and the lack of globally harmonized testing standards across different jurisdictions occasionally create challenges for manufacturers who operate internationally, leading to duplicated testing and inefficiency.

Opportunities abound in the development of highly integrated, portable, and user-friendly diagnostic systems suitable for on-site, farm-level, and retail testing, moving testing out of centralized laboratories. There is a burgeoning market for rapid detection kits specifically targeting emerging contaminants, such as novel toxins, microplastics, and viral pathogens (e.g., Norovirus), which are not typically covered by standard testing panels. The trend towards digitalization and the integration of diagnostic results with blockchain technology offers a substantial opportunity to enhance food traceability and authenticity verification, particularly in combating food fraud. The impact forces acting on the market are high, driven by the intense legislative pressure from governmental health agencies (high positive force) and the subsequent demand for immediate, reliable testing solutions by major food processors. These forces ensure that investments in R&D for faster, more accurate diagnostics remain a top priority, mitigating the negative impact of high costs over the long term through efficiency gains and risk reduction.

Segmentation Analysis

The Food Diagnostic Equipment and Consumables Market is comprehensively segmented based on several critical parameters, including the type of product, the specific target tested, the underlying technology utilized, and the end-user application. This detailed segmentation facilitates precise market analysis, enabling stakeholders to focus R&D efforts and market entry strategies on high-growth areas. The consumables segment, encompassing reagents, test kits, sampling supplies, and culture media, consistently holds the largest market share due to its high volume usage and necessity for repetitive testing cycles. Conversely, the equipment segment, which includes sophisticated instruments like real-time PCR systems, chromatographs, and biosensors, commands a significant portion of the initial investment, driving technological innovation and high-value transactions. Analyzing these segments is crucial for understanding the market dynamics, distinguishing between capital expenditure and operational expenditure trends within the food safety industry.

Target-based segmentation, focusing on the analyte being detected, reveals that pathogen testing dominates the market due to the severe public health and regulatory consequences associated with microbial contamination (e.g., Salmonella, Listeria). However, non-microbial testing segments, particularly those focusing on allergens (e.g., peanut, soy, dairy), food authenticity/adulteration (e.g., species identification, origin verification), and toxins (e.g., mycotoxins, heavy metals), are experiencing accelerated growth driven by specific consumer health concerns and increasing incidents of economically motivated adulteration (EMA). The technology landscape segmentation highlights the growing preference for rapid methods. While traditional culture methods remain foundational for certain applications, the shift towards molecular diagnostics (PCR) and advanced analytical chemistry techniques (LC-MS/MS) is unmistakable, reflecting the industry’s need for speed, sensitivity, and confirmation capability, especially in outbreak scenarios where timely results are paramount.

End-user analysis confirms that food processing and manufacturing companies constitute the largest segment of demand, as they are legally responsible for quality control throughout production and need in-house diagnostic capabilities for rapid product release. Government laboratories and reference labs, while fewer in number, represent high-value customers, requiring complex, gold-standard confirmation technologies and participating heavily in surveillance programs. Contract Research Organizations (CROs) and third-party testing laboratories represent the fastest-growing end-user segment, driven by the increasing outsourcing of food safety compliance testing by smaller companies that cannot afford the capital investment or highly specialized labor for in-house testing. Understanding these user requirements—whether high throughput for processors or high sensitivity for regulatory labs—is essential for product positioning and sales strategies in this multifaceted market.

- By Type:

- Equipment (e.g., Spectrophotometers, PCR Systems, Chromatography, Mass Spectrometry)

- Consumables (e.g., Reagents, Media, Kits, Disposables, Control Materials)

- By Target:

- Pathogens (e.g., Salmonella, E. coli, Listeria, Campylobacter)

- Toxins (e.g., Mycotoxins, Bacterial Toxins)

- GMOs (Genetically Modified Organisms)

- Allergens (e.g., Gluten, Nuts, Soy, Dairy)

- Chemical Residues (e.g., Antibiotics, Pesticides)

- Food Authenticity/Adulteration Markers

- By Technology:

- Molecular Diagnostics (PCR, RT-PCR, Isothermal Amplification)

- Immunoassays (ELISA, Lateral Flow Devices)

- Traditional Culture Methods

- Spectroscopy & Chromatography

- Biosensors & Microarrays

- By End-User:

- Food Processing & Manufacturing Companies

- Contract Testing Organizations (CTOs)

- Government & Academic Research Laboratories

- Retail and Catering Establishments

Value Chain Analysis For Food Diagnostic Equipment And Consumables Market

The value chain for the Food Diagnostic Equipment and Consumables Market begins with upstream activities involving the sourcing and production of critical raw materials, including specialized enzymes, high-purity chemicals, antibodies, plastics, and electronic components. Key upstream players include manufacturers of core diagnostic components such as thermal cyclers, specific DNA polymerases for PCR applications, and high-quality antibodies required for immunoassay kits. The quality and stability of these raw materials are paramount, as they directly influence the sensitivity, specificity, and shelf-life of the final diagnostic products. Manufacturers of diagnostic equipment rely on sophisticated technology suppliers for automation modules, sensors, and computing hardware, emphasizing supply chain resilience and adherence to rigorous quality standards (e.g., ISO 13485, although applied to IVD, principles carry over to diagnostics).

The midstream segment is dominated by the Food Diagnostic Equipment and Consumables manufacturers themselves, which involves intensive R&D, sophisticated design, validation, and large-scale manufacturing processes. This phase is highly regulated, requiring extensive validation studies to prove assay performance against standardized reference methods. Companies focus on manufacturing user-friendly, robust instruments and generating ready-to-use, stable consumable kits. Distribution channels are complex, involving both direct sales models for high-value equipment and sophisticated indirect channels, such relying on specialized third-party distributors for temperature-sensitive consumables and kits, particularly in geographically fragmented markets. Specialized distributors provide necessary services like installation, technical support, and localized calibration, adding significant value to the overall product offering.

Downstream activities center on the end-users—food manufacturers, contract labs, and governmental agencies—who utilize these products for quality control, regulatory compliance, and investigation. The final part of the value chain involves the essential feedback loop, where end-users report performance data and emerging contamination threats back to manufacturers, driving continuous product improvement and the development of new assays tailored to current safety risks. Direct sales are often preferred for major accounts, facilitating better technical engagement and service contracts for expensive machinery. Conversely, consumables, due to their volume and fast turnover, are frequently managed through indirect channels to ensure broad market access and efficient logistics management, maintaining the cold chain where necessary to preserve reagent efficacy.

Food Diagnostic Equipment And Consumables Market Potential Customers

The primary potential customers and end-users of food diagnostic equipment and consumables are clustered within segments that possess a high regulatory burden or a significant vested interest in maintaining brand safety and product quality. Large multinational food processing and manufacturing corporations, such as global meat processors, dairy companies, and packaged goods giants, represent the largest and most frequent buyers. These entities require high-throughput, automated systems for continuous, mandatory batch testing of raw materials and finished goods to comply with internal quality standards and external governmental mandates (e.g., microbiological screening, allergen control plans). Their purchasing decisions are heavily influenced by analytical sensitivity, speed of results, and the cost-per-test efficiency, favoring integrated systems that reduce labor costs and potential human error.

Another crucial customer segment comprises Contract Testing Organizations (CTOs) and third-party commercial laboratories. Driven by the increasing trend of outsourcing food safety testing, these labs serve a vast clientele, including smaller food producers, importers, and restaurant chains that lack in-house testing facilities. CTOs prioritize flexibility, accreditation (e.g., ISO 17025), and the ability to handle a wide variety of sample matrices and test panels simultaneously. Their purchasing is volume-driven, leading to high consumption of consumables and a demand for flexible, multi-technology equipment capable of both screening (e.g., LFDs, basic PCR) and confirmation (e.g., LC-MS/MS, advanced molecular techniques).

Governmental and regulatory agencies, including national public health laboratories and customs and border control departments, form a third significant customer base. These entities focus heavily on surveillance, reference testing, and enforcing trade regulations. They demand the most rigorous, validated, and often proprietary diagnostic technologies, prioritizing accuracy and traceability over speed in confirmation scenarios, particularly during widespread contamination events or legal disputes. Furthermore, the retail sector, encompassing major grocery chains and Quick Service Restaurants (QSRs), is increasingly investing in diagnostic solutions, particularly rapid, on-site testing for vendor verification and quality assurance checks at the distribution or receiving level, signifying a decentralization of diagnostic adoption within the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Agilent Technologies, bioMérieux, Neogen Corporation, Romer Labs, 3M, Bio-Rad Laboratories, PerkinElmer, Merck KGaA, Danaher Corporation (via subsidiaries), SGS S.A., Eurofins Scientific, Qiagen N.V., Bio-Check (UK) Ltd., Charm Sciences Inc., LGC Group, FOSS, Bruker Corporation, Randox Laboratories, and Shimadzu Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Diagnostic Equipment And Consumables Market Key Technology Landscape

The Food Diagnostic Equipment and Consumables market is defined by a dynamic technological landscape shifting rapidly towards faster, more sensitive, and highly automated testing methodologies. The current leading technologies are Real-Time Polymerase Chain Reaction (RT-PCR) and Enzyme-Linked Immunosorbent Assay (ELISA). RT-PCR is the gold standard for rapid, specific detection and quantification of microbial pathogens and GMOs, offering superior sensitivity and a significantly reduced time-to-result compared to traditional culture methods, enabling faster product release decisions. ELISA remains dominant in high-throughput screening for allergens and mycotoxins due to its cost-effectiveness and robustness, especially when handling a large volume of routine samples. High-performance liquid chromatography coupled with mass spectrometry (LC-MS/MS) and gas chromatography coupled with mass spectrometry (GC-MS/MS) are critical confirmatory technologies, particularly for analyzing chemical residues such as pesticides, antibiotics, and heavy metals, due to their unparalleled accuracy and ability to test for multiple analytes simultaneously.

Emerging technologies are focusing heavily on point-of-care (POC) testing and genomic analysis. Next-Generation Sequencing (NGS), especially Whole-Genome Sequencing (WGS), is revolutionizing outbreak investigation and traceability. WGS provides highly detailed genetic fingerprints of pathogens, enabling rapid source attribution and sophisticated epidemiological analysis, a functionality increasingly mandated by regulatory bodies like the FDA for real-time tracking of foodborne outbreaks. Furthermore, biosensors and microfluidic devices are gaining traction; these technologies leverage miniaturization to enable portable, fast, and simple on-site testing, significantly lowering the barrier to entry for smaller users and enabling critical testing closer to the source of production or processing. These new platforms aim to integrate sample preparation, detection, and data interpretation onto a single chip or device, accelerating turnaround time dramatically.

Further technological advancements include the integration of diagnostic equipment with the Internet of Things (IoT) and centralized data management systems. IoT-enabled diagnostics allow for remote monitoring, automated data capture, and immediate data transmission to cloud platforms, enhancing traceability and facilitating immediate regulatory reporting. Automated sample preparation systems are also crucial, addressing the historically labor-intensive and error-prone step of preparing complex food matrices for analysis. Future innovations are expected to concentrate on multiplexing capabilities across all technologies—molecular, immunological, and chemical—to maximize the information extracted from a single sample, reducing testing costs, and improving efficiency in modern, high-volume testing facilities globally. This technological convergence towards integrated, smart systems is the main driver of long-term equipment upgrades.

Regional Highlights

North America maintains a dominant position in the Food Diagnostic Equipment and Consumables market, largely driven by the stringent regulatory environment established by the FDA and the USDA, notably enforced through the Food Safety Modernization Act (FSMA). This legislation shifts the industry focus from reactive response to preventative controls, mandating high levels of testing and validation throughout the supply chain. The region benefits from high adoption rates of advanced, automated diagnostic technologies, particularly NGS and sophisticated LC-MS/MS systems, fueled by strong R&D investment and the presence of major key market players. High consumer awareness regarding food allergens, GMOs, and organic verification also mandates routine specialized testing, ensuring continuous demand for sensitive diagnostic kits and consumables.

Europe represents another key region, characterized by robust regulatory oversight managed by the European Food Safety Authority (EFSA) and the implementation of comprehensive traceability rules. Europe leads in the adoption of standardized testing for contaminants like mycotoxins and veterinary drug residues, reflecting strict limits placed on food imports and domestically produced goods. The market here is highly competitive, focusing heavily on validation and certification, demanding diagnostic tools that adhere strictly to international ISO standards. Furthermore, the strong emphasis on combating food fraud and ensuring origin authenticity—especially for high-value products like olive oil, wine, and fish—drives the steady uptake of advanced chemical analysis and molecular identification techniques. Germany, France, and the UK are primary contributors to the European market revenue.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to rapid economic development, industrialization of the food processing sector, and rising per capita income, leading to higher consumer expectations for food quality. Governments in large economies such as China, India, and Southeast Asian nations are actively modernizing their food safety infrastructures, investing heavily in state-of-the-art diagnostic equipment to meet domestic safety goals and comply with international export standards. The sheer volume of food production and processing in this region, coupled with fragmented supply chains, mandates the widespread deployment of rapid testing solutions, offering substantial opportunities for both equipment manufacturers and consumable suppliers focusing on pathogen and chemical residue detection.

- North America: Market leader due to stringent FSMA regulations, high technological adoption, and robust R&D infrastructure. Focus on automation and NGS for traceability.

- Europe: High demand driven by EFSA directives, strong emphasis on food authenticity and fraud detection, and mandatory testing for chemical contaminants (mycotoxins, residues).

- Asia Pacific (APAC): Highest growth rate projected, fueled by urbanization, expanding processed food industry, governmental modernization of safety standards, and increasing exports.

- Latin America: Emerging market characterized by increasing foreign investment in agriculture and processing; growing demand for cost-effective, rapid pathogen testing solutions.

- Middle East & Africa (MEA): Growth driven by expanding international trade requirements and gradual adoption of standardized testing protocols, particularly in the UAE and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Diagnostic Equipment And Consumables Market.- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- bioMérieux SA

- Neogen Corporation

- Romer Labs Division Holding GmbH

- 3M Company

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Merck KGaA

- Danaher Corporation (including Beckman Coulter Life Sciences)

- SGS S.A.

- Eurofins Scientific SE

- Qiagen N.V.

- Bio-Check (UK) Ltd.

- Charm Sciences Inc.

- LGC Group

- FOSS A/S

- Bruker Corporation

- Randox Laboratories Ltd.

- Shimadzu Corporation

Frequently Asked Questions

Analyze common user questions about the Food Diagnostic Equipment And Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Food Diagnostic Equipment Market?

The market growth is primarily accelerated by increasingly strict global food safety regulations (such as the US FSMA and EU directives), the rising incidence of foodborne illnesses, heightened consumer demand for product transparency (allergens, GMOs), and continuous technological advancements favoring rapid, automated molecular diagnostics over traditional testing methods.

Which diagnostic technology is currently considered the most effective for rapid pathogen detection?

Real-Time Polymerase Chain Reaction (RT-PCR) is generally considered the most effective technology for rapid pathogen detection in food matrices. It offers high sensitivity, superior specificity, and a dramatically reduced turnaround time, allowing food processors to make crucial product release decisions within hours rather than days required by traditional culture methods.

How significant is the role of consumables compared to equipment in the overall market value?

Consumables (reagents, kits, media) represent the largest segment of the market by revenue. While equipment sales involve high initial capital expenditure, consumables generate continuous, recurring revenue, directly proportional to the testing volume performed by food processors, contract labs, and governmental surveillance programs worldwide.

What is the main challenge faced by smaller food processing companies in adopting advanced diagnostics?

The principal challenge for smaller food processors is the high initial capital investment required for advanced diagnostic equipment like automated PCR systems and Mass Spectrometers, coupled with the necessity for highly skilled technical personnel for operation and data interpretation. This often leads them to rely on outsourcing testing to Contract Testing Organizations (CTOs).

Which geographical region is expected to exhibit the highest growth rate, and why?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization of its food sector, increasing urbanization, rising middle-class disposable income driving demand for safer food, and significant governmental investment in upgrading food safety infrastructure to meet international export standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager