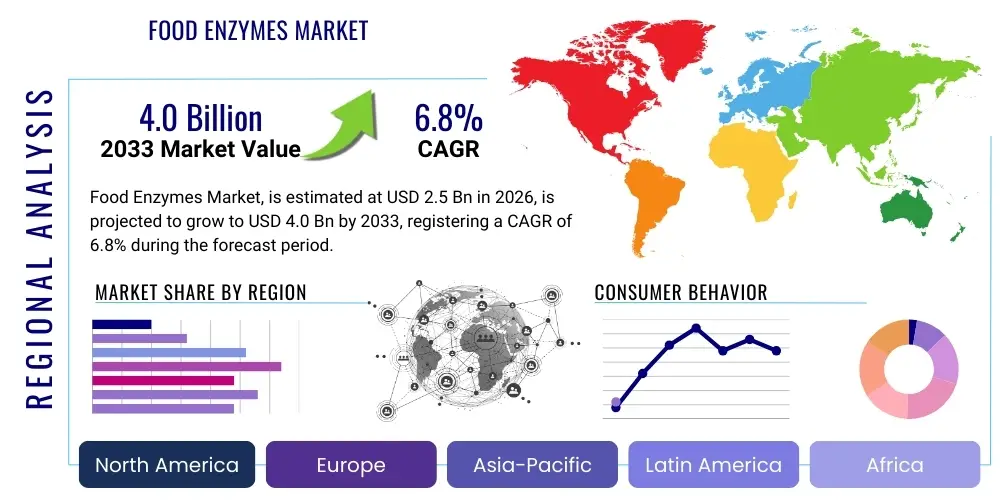

Food Enzymes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435342 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Food Enzymes Market Size

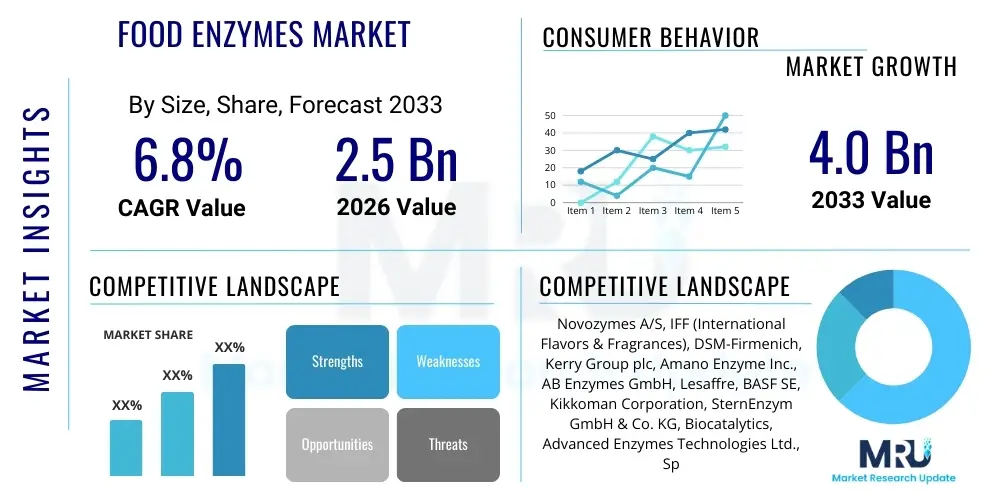

The Food Enzymes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Food Enzymes Market introduction

The Food Enzymes Market encompasses the production and utilization of biological catalysts derived primarily from microorganisms, plants, or animals, employed to enhance food processing efficiency, improve texture, extend shelf life, and modify nutritional profiles. These specialized proteins accelerate specific biochemical reactions without being consumed in the process, making them indispensable in modern food manufacturing. Key products include carbohydrases (amylase, cellulase), proteases, and lipases, each tailored for distinct applications ranging from starch modification to protein hydrolysis and fat emulsification. The inherent efficiency and natural origin of food enzymes position them as critical components in the global shift towards clean-label and minimally processed food products, offering natural alternatives to chemical additives while optimizing resource utilization within the supply chain.

Major applications of food enzymes span across the bakery, dairy, brewing, and beverage industries. In baking, enzymes like amylases and xylanases improve dough handling, increase loaf volume, and reduce staling. In dairy, rennet and lactase are crucial for cheese production and creating lactose-free products, catering to growing consumer health sensitivities. The beverage sector utilizes enzymes for clarification, extraction, and filtration, significantly improving the quality and stability of fruit juices and beer. The primary benefit of integrating food enzymes is the ability to conduct highly specific reactions under mild conditions (lower temperature, less harsh pH), leading to energy savings, reduction in chemical waste, and ultimately, higher quality final products that meet stringent consumer demands for natural ingredients.

The market growth is primarily driven by the increasing global demand for processed foods, fueled by urbanization and changing dietary habits, coupled with regulatory shifts favoring natural processing aids over artificial chemicals. Furthermore, technological advancements in enzyme engineering, specifically the development of thermotolerant and pH-stable enzymes via recombinant DNA technology, are broadening their potential application spectrum. The ongoing search for sustainable, cost-effective methods in food production—including waste valorization and enhanced nutrient extraction—further solidifies the crucial role of food enzymes in shaping the future of food technology and security.

Food Enzymes Market Executive Summary

The global Food Enzymes Market is experiencing robust expansion, fundamentally driven by pervasive business trends focusing on sustainability, clean labeling, and operational efficiency within the food and beverage industry. Key industry trends involve strategic mergers and acquisitions among major enzyme manufacturers, aimed at consolidating intellectual property and broadening application portfolios, particularly in areas addressing food waste and functional ingredients. Technological innovation, including advanced fermentation techniques and genetic engineering, is allowing producers to create highly specific and efficient enzyme variants, minimizing input costs and maximizing yields for food processors. The increasing consumer preference for plant-based proteins and lactose-free dairy alternatives is directly correlating with elevated demand for specific protease and lactase enzymes, creating lucrative niche markets within the larger enzyme ecosystem.

Regionally, the market shows distinct growth patterns. North America and Europe currently dominate the market, characterized by stringent food safety regulations and early adoption of advanced enzyme technology, especially in the bakery and dairy sectors driven by strong clean-label movements. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization of the food processing sector, increasing disposable incomes, and the modernization of traditional food production methods in countries like China and India. This regional shift signifies an expanding need for large-scale, cost-effective enzyme solutions to meet burgeoning demand for packaged and convenience foods across developing economies.

Segmentation analysis reveals that carbohydrases, particularly amylases, maintain market dominance due to their extensive use in the foundational bakery and brewing industries. However, proteases are witnessing accelerated growth, buoyed by the rising acceptance of meat tenderization and the critical role they play in the burgeoning plant-based protein extraction market. By source, microbial enzymes remain the largest and fastest-growing segment, primarily due to the scalability, cost-effectiveness, and ease of genetic modification inherent in microbial fermentation processes, offering superior versatility and consistency compared to traditional plant or animal sources.

AI Impact Analysis on Food Enzymes Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can accelerate the discovery and optimization of novel food enzymes, particularly focusing on reducing the time-to-market and enhancing enzyme stability and specificity. Key themes emerging from these questions center around computational enzyme design, optimization of fermentation parameters, and predictive modeling for quality control. Consumers and industry professionals seek confirmation on whether AI can effectively replace or significantly reduce expensive, time-consuming laboratory screening methods, and how this translates into more cost-effective and functionally superior food ingredients. Concerns often involve the reliability of in silico predictions and the ethical considerations related to using AI in genetic engineering for enzyme production.

AI is fundamentally transforming the R&D pipeline for food enzymes by leveraging vast biological datasets to predict optimal enzyme structures and functions for specific applications, such as improving gluten digestibility or enhancing flavor release. Machine learning algorithms analyze genomic and proteomic data from thousands of microbial strains, rapidly identifying candidates with desirable characteristics—like thermal stability or high catalytic activity—that would take years to discover through traditional high-throughput screening. This predictive power significantly reduces experimental costs and accelerates the pathway from lab discovery to industrial application, particularly benefiting manufacturers seeking highly customized solutions for complex food matrices.

Beyond initial discovery, AI systems are crucial in optimizing the industrial-scale production process. They use real-time sensor data from bioreactors (e.g., pH, temperature, nutrient levels) to predict fermentation outcomes and adjust parameters dynamically, ensuring maximum enzyme yield and consistency. Furthermore, AI-driven quality control systems can analyze spectral data and images to monitor product purity and detect contaminants with greater precision than manual methods. This integration of computational power throughout the enzyme lifecycle—from gene sequence selection to manufacturing—establishes AI as a critical enabling technology for improving both the performance and the economic viability of the Food Enzymes Market.

- Accelerated discovery of novel enzyme variants with enhanced functionality.

- Optimization of microbial strains and fermentation conditions using predictive modeling.

- Reduced R&D costs and time-to-market for specialized enzyme products.

- Enhanced quality control and process consistency through real-time data analysis.

- Computational enzyme design for improved thermal stability and pH resistance.

- Better prediction of enzyme efficacy within complex food systems (in silico testing).

DRO & Impact Forces Of Food Enzymes Market

The Food Enzymes Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively dictate its growth trajectory and structure the competitive landscape. The primary driver is the pervasive trend toward clean-label products, where enzymes are increasingly replacing synthetic chemical additives (like bromate in baking or chemical coagulants in dairy) due to their natural origin and non-residual properties. This trend is strongly supported by heightened consumer awareness regarding food ingredient transparency. Concurrently, the operational efficiency afforded by enzymes—such as reduced processing time, lower energy consumption, and higher product yields—compels manufacturers to adopt enzyme technology across the bakery, brewing, and juice industries to remain competitive. Furthermore, the global rise in chronic health conditions like lactose intolerance and celiac disease drives demand for specific enzymes (lactase, specialized proteases) that enable the creation of functional and allergen-friendly foods.

Despite significant growth potential, the market faces notable restraints, primarily related to the complex and often fragmented regulatory landscape governing the approval and labeling of enzymes in different global regions. The classification of enzymes—as processing aids or food additives—varies by country, creating logistical and compliance hurdles for international players. Additionally, enzymes are inherently sensitive biological molecules; their instability under harsh processing conditions (high heat, extreme pH) often limits their application in certain large-scale industrial processes, requiring significant investment in enzyme immobilization technologies or development of highly robust engineered variants. The high cost associated with advanced fermentation technologies and purification processes for high-purity enzymes also acts as a barrier to entry for smaller manufacturers.

The key opportunities for market expansion lie in the application of enzymes in novel areas, particularly food waste valorization and the burgeoning plant-based protein sector. Enzymes offer sustainable solutions for breaking down complex food byproducts (e.g., cellulose, hemicellulose from fruit peels or grain husks) into valuable compounds, addressing sustainability goals and creating new revenue streams. The explosive growth in demand for alternative proteins necessitates highly efficient, enzymatic extraction and modification methods to improve the texture, flavor, and bioavailability of plant proteins. Further opportunities are emerging in personalized nutrition, where enzymes can be tailored to enhance the digestion or nutrient release of specific food products, promising future customization in food formulation. These dynamic forces suggest a market poised for accelerated growth, contingent upon favorable regulatory harmonization and sustained technological innovation.

Segmentation Analysis

The Food Enzymes Market is highly diversified, segmented comprehensively based on type, source, and application, reflecting the specificity required for industrial utilization. Understanding these segments is crucial for market participants to tailor their offerings and optimize strategic growth. The segmentation by type—Carbohydrase, Protease, and Lipase—is fundamental, as it dictates the primary biochemical function and thus the end-user application, with carbohydrases traditionally holding the largest market share due to their wide use in starch and sugar processing. Segmentation by source—Microorganism, Plant, and Animal—highlights the production methods, where microbial sources dominate due to their scalability, genetic manipulability, and cost-effectiveness. Finally, the application segmentation details where these enzymes are utilized, with the bakery and dairy industries being the most prominent consumers globally.

- By Type:

- Carbohydrase (Amylase, Pectinase, Cellulase, Lactase, others)

- Protease (Rennet, Papain, others)

- Lipase

- Other Enzymes (Isomerases, Glucose Oxidase)

- By Source:

- Microorganism (Bacteria, Fungi)

- Plant (Malt, Papaya, Pineapple)

- Animal (Pancreas, Stomach)

- By Application:

- Beverages (Beer, Wine, Juices)

- Dairy Products (Cheese, Yogurt, Lactose-free milk)

- Bakery Products (Bread, Cakes, Biscuits)

- Confectionery

- Meat & Poultry

- Processed Foods

- Other Applications (Fats & Oils)

Value Chain Analysis For Food Enzymes Market

The Food Enzymes Market value chain begins with the upstream analysis, focusing on the sourcing and preparation of raw materials, predominantly involving specialized microbial strains, fermentation media (sugars, salts, growth factors), and, to a lesser extent, plant or animal tissues. The most critical upstream activity is the R&D phase, where enzyme manufacturers utilize advanced biotechnology, including genetic engineering and bioinformatics, to develop and optimize high-yielding, stable microbial strains (e.g., specific bacteria or fungi like Aspergillus or Bacillus). This phase is capital-intensive and requires specialized intellectual property, determining the quality and cost-effectiveness of the final enzyme product.

The core manufacturing process involves high-volume fermentation in bioreactors, followed by complex downstream processing (purification, concentration, and formulation). These steps ensure the enzyme meets stringent food-grade quality and activity standards. Direct distribution involves enzyme manufacturers selling directly to large, multinational food and beverage corporations (e.g., major brewing companies, global dairy processors) that require customized bulk orders and technical support. Indirect distribution channels primarily utilize specialized distributors and regional agents who handle smaller orders, manage warehousing, and provide logistical support to small and medium-sized food processors across various geographical locations, acting as essential intermediaries in reaching fragmented customer bases.

The downstream analysis focuses on the application and final consumption. End-users, such as bakeries, breweries, and dairy producers, integrate the enzymes into their production lines to achieve specific modifications—such as improving gluten structure, clarifying beer, or coagulating milk. The value added at this stage is significant, as the enzyme enables cost reductions, quality improvements, and the creation of value-added products (e.g., functional or clean-label items). Technical expertise, continuous supply, and application support are vital in the downstream segment, driving long-term customer relationships and emphasizing the consultative role of enzyme suppliers in optimizing customer processes.

Food Enzymes Market Potential Customers

Potential customers, or end-users, of the Food Enzymes Market are diverse, spanning the entire food and beverage manufacturing ecosystem, with a high concentration in sectors that rely on biological transformation for product development. Major buyers include industrial bakeries and milling operations, which utilize amylases and xylanases to standardize flour quality, enhance dough rheology, and extend the shelf life of bread products. Dairy processors represent another significant customer base, demanding rennet for cheese coagulation and lactase for producing lactose-free milk and related products, catering to the large segment of lactose-intolerant consumers globally.

Furthermore, the beverage industry, encompassing breweries, wineries, and fruit juice manufacturers, constitutes a high-volume customer segment. Brewers use glucanases and proteases to improve mash filtration and prevent chill haze, while juice producers rely on pectinases and cellulases for efficient fruit pulp breakdown and clarification. The processed foods sector, including manufacturers of meat products, ready-to-eat meals, and functional foods, increasingly requires enzymes like proteases for meat tenderization and flavor development, and lipases for modifying fats and oils, highlighting the enzymes' versatile utility in enhancing texture, flavor, and processing speed across complex formulations.

A rapidly emerging customer segment includes manufacturers specializing in plant-based alternatives and sustainable food initiatives. Companies developing soy, pea, or rice protein isolates require specific proteases to hydrolyze the proteins, improving their solubility, digestibility, and functionality in meat analogues and dairy alternatives. These customers prioritize enzymes that support clean-label formulations and sustainable sourcing, often seeking customized enzyme blends that can efficiently extract and modify nutritional components from novel raw materials, thereby driving demand for highly specialized biotechnological solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novozymes A/S, IFF (International Flavors & Fragrances), DSM-Firmenich, Kerry Group plc, Amano Enzyme Inc., AB Enzymes GmbH, Lesaffre, BASF SE, Kikkoman Corporation, SternEnzym GmbH & Co. KG, Biocatalytics, Advanced Enzymes Technologies Ltd., Specialty Enzymes & Biotechnologies, Enzyme Development Corporation, Puratos Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Enzymes Market Key Technology Landscape

The technological landscape of the Food Enzymes Market is rapidly evolving, driven primarily by advancements in biotechnology aimed at enhancing enzyme performance, stability, and production efficiency. Recombinant DNA Technology, or genetic engineering, is paramount, allowing manufacturers to modify the genetic code of host organisms (primarily bacteria and fungi) to significantly increase enzyme yield, often by 100 to 1,000 times compared to traditional strains. This technology also facilitates "directed evolution," enabling scientists to engineer enzymes with superior functional properties, such as increased thermostability to withstand high-temperature processing or higher activity levels at lower pH ranges, thus broadening their utility in demanding industrial environments and ensuring cost-effectiveness through lower dosage requirements.

Another crucial technological advancement is Enzyme Immobilization, which involves fixing enzymes onto an inert support material (e.g., resins, polymers, or magnetic nanoparticles). Immobilization enhances the operational stability of the enzymes, making them resistant to denaturation and allowing them to be easily recovered and reused multiple times in continuous flow reactors, drastically reducing overall processing costs. This technology is particularly beneficial in applications where prolonged stability or continuous reaction cycles are required, such as in the production of high-fructose corn syrup using immobilized glucose isomerase, or in continuous milk treatment using immobilized lactase, representing a significant shift towards sustainable and circular enzyme usage practices within the food industry.

Furthermore, advances in fermentation and downstream processing are key differentiators. Submerged fermentation techniques remain the dominant production method, but optimization using advanced sensors and Artificial Intelligence (AI) algorithms ensures precise control over the bioreactor environment, maximizing consistency and minimizing batch-to-batch variation. Simultaneously, innovative purification technologies, including advanced chromatography and ultrafiltration techniques, are vital for achieving the high purity levels required for food-grade applications, particularly critical for allergen control and ensuring compliance with stringent regulatory standards. The synergy between genetic engineering, immobilization, and optimized large-scale production techniques is defining the competitive edge in the modern Food Enzymes Market.

Regional Highlights

- North America: This region holds a leading position in the Food Enzymes Market, characterized by high adoption rates of advanced processing technologies, a mature food manufacturing sector, and strong consumer demand for high-quality, convenient, and functional food products. The United States, in particular, drives demand, propelled by significant investments in R&D, stringent quality standards promoting microbial purity, and a substantial presence of large food and beverage conglomerates utilizing enzymes in baking, brewing, and starch processing. The region also exhibits robust growth in niche applications, such as plant-based proteins and gluten-free products, requiring specialized enzymatic solutions.

- Europe: Europe is a highly sophisticated market, distinguished by strict regulatory frameworks (like those set by the European Food Safety Authority - EFSA) that emphasize product safety and origin transparency. This regulatory environment strongly favors the use of natural processing aids, positioning enzymes as the preferred alternative to chemical additives. The region is a leader in clean-label trends and sustainable food production, driving specific demand for enzymes used in dairy (especially cheese) and functional beverages. Countries like Germany, the Netherlands, and Denmark host major enzyme producers and application centers, facilitating high levels of innovation and technical support for end-users.

- Asia Pacific (APAC): APAC is forecast to be the fastest-growing region, primarily driven by rapid urbanization, substantial growth in the middle-class population, and the accompanying shift from traditional food preparation to large-scale industrial food processing. Countries such as China, India, Japan, and Australia are modernizing their food systems, leading to escalating demand for enzymes in baking, brewing (especially industrial beer production), and oil processing. The need for improved food security and reduced waste also accelerates enzyme adoption, particularly in emerging economies where efficiency improvements yield significant cost savings.

- Latin America (LAMEA): This region shows steady growth, primarily influenced by the expansion of the brewing and sugar processing industries, requiring enzymes like amylases and invertases. Brazil and Mexico are key markets, characterized by large-scale agricultural output and a growing need for modern food preservation and quality enhancement techniques. Regulatory harmonization remains a challenge, but the increasing presence of multinational food companies acts as a catalyst for local enzyme adoption and standardization.

- Middle East and Africa (MEA): Growth in MEA is moderate but promising, largely concentrated in urban centers with high consumption of packaged goods. Key applications include dairy processing (necessitated by high ambient temperatures requiring stable ingredients) and beverage manufacturing. Demand is increasingly linked to foreign direct investment in food manufacturing infrastructure and efforts to reduce reliance on imported food products, necessitating locally optimized enzymatic solutions for staple crops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Enzymes Market.- Novozymes A/S

- IFF (International Flavors & Fragrances Inc.)

- DSM-Firmenich

- Kerry Group plc

- Amano Enzyme Inc.

- AB Enzymes GmbH

- Lesaffre

- BASF SE

- Kikkoman Corporation

- SternEnzym GmbH & Co. KG

- Biocatalytics

- Advanced Enzymes Technologies Ltd.

- Specialty Enzymes & Biotechnologies

- Enzyme Development Corporation

- Puratos Group

- Dyadic International Inc.

- Sunson Industry Group Co., Ltd.

- Adisseo

- Jiangsu Boli Bioproducts Co., Ltd.

- Creative Enzymes

Frequently Asked Questions

Analyze common user questions about the Food Enzymes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of food enzymes in modern food manufacturing?

The primary role of food enzymes is to act as natural, specific biological catalysts that improve processing efficiency, enhance food texture and flavor, and extend shelf life. They are critical for achieving clean-label status and reducing reliance on artificial chemical additives across sectors like dairy, bakery, and beverages.

Which enzyme type dominates the global Food Enzymes Market?

Carbohydrases, which include amylase, pectinase, and lactase, dominate the market. This dominance stems from their extensive and foundational use in large-scale food industries such as bakery (starch modification) and brewing (fermentation and clarification).

How does the clean-label trend affect the demand for food enzymes?

The clean-label trend significantly drives demand for food enzymes as consumers and regulators increasingly favor ingredients perceived as natural processing aids over complex or chemical additives. Enzymes offer effective, natural solutions for quality improvement without compromising ingredient deck simplicity.

What are the key technological advancements driving innovation in enzyme production?

Key technological advancements include Recombinant DNA Technology (genetic engineering) for creating highly specific and stable enzyme variants, and Enzyme Immobilization techniques, which allow enzymes to be reused in continuous industrial processes, significantly reducing operational costs and enhancing stability.

Why is the Asia Pacific region projected to exhibit the highest growth rate?

The Asia Pacific region is expected to grow fastest due to rapid urbanization, increasing per capita income, and the subsequent massive industrialization and modernization of the food processing sector, leading to higher demand for efficient, scalable enzymatic solutions in packaged and convenience foods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager