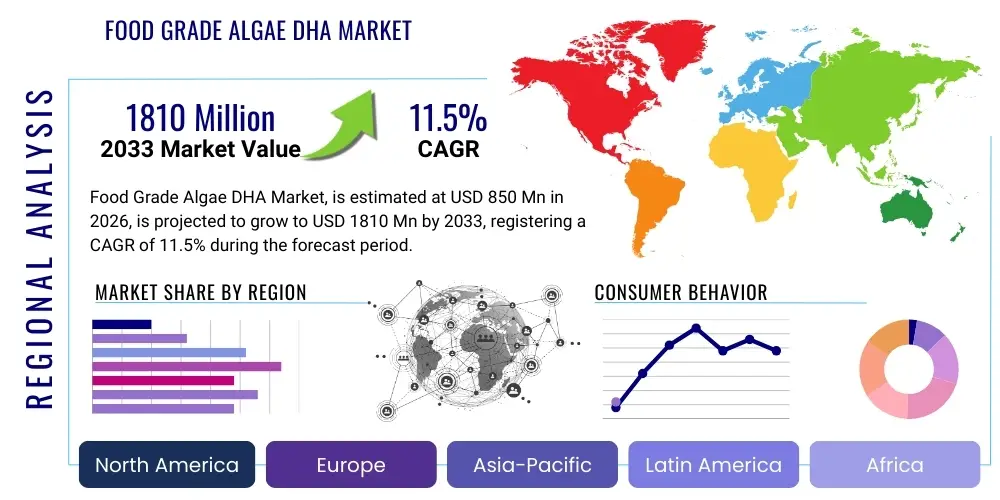

Food Grade Algae DHA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438055 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food Grade Algae DHA Market Size

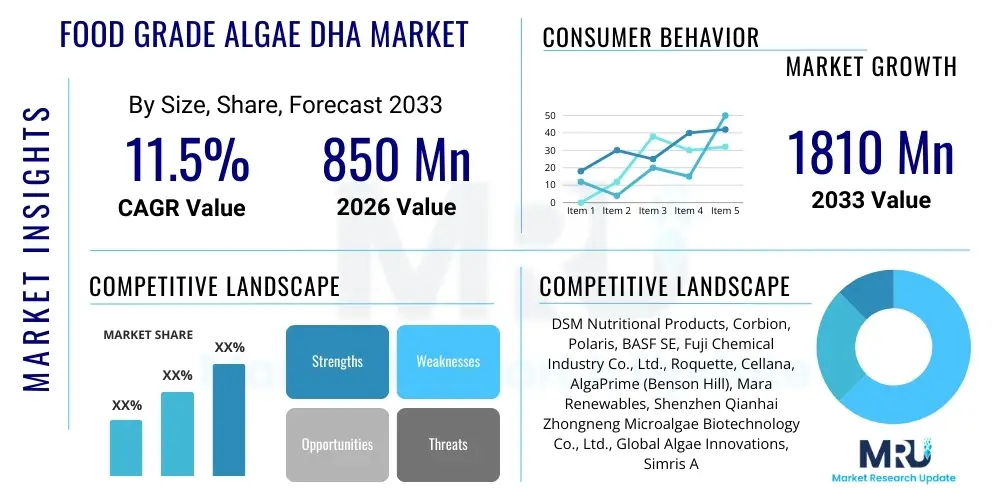

The Food Grade Algae DHA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. This robust growth trajectory is driven by increasing global demand for sustainable, plant-based Omega-3 sources, particularly in the functional food and infant nutrition sectors. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1810 Million by the end of the forecast period in 2033, reflecting substantial investment in large-scale fermentation facilities and advancements in microalgae cultivation technologies.

The valuation reflects the premium positioning of algae-derived DHA compared to conventional fish oil alternatives. Consumers are increasingly prioritizing product purity, driven by concerns regarding heavy metal contamination and ocean pollution inherent in traditional marine sources. Furthermore, the inherent stability and high concentration achievable through controlled fermentation processes contribute to the higher market value of food-grade algal DHA. This accelerated growth rate indicates a significant shift in the dietary supplement and food fortification industries towards environmentally conscious sourcing methods.

Food Grade Algae DHA Market introduction

The Food Grade Algae DHA Market encompasses the production and distribution of docosahexaenoic acid (DHA) derived from microalgae strains, primarily for human consumption applications. DHA is a crucial long-chain polyunsaturated fatty acid (PUFA) vital for cognitive function, retinal health, and cardiovascular wellness. Traditionally sourced indirectly through fish oil, direct extraction from microalgae (such as Schizochytrium sp. and Crypthecodinium cohnii) provides a clean, sustainable, and vegan-friendly alternative, bypassing the marine food chain and minimizing environmental impact. This market segment addresses the growing consumer desire for traceable and contaminant-free nutritional ingredients, offering superior purity compared to some fish-derived alternatives.

The primary applications of food-grade algae DHA span across several high-value sectors, including infant formula, dietary supplements (softgels, liquid drops), and fortification of functional foods (dairy alternatives, baked goods). The market's growth is fundamentally driven by the established health benefits of Omega-3s combined with strict regulatory requirements mandating DHA inclusion in infant nutrition products globally. Moreover, the accelerating adoption of plant-based and flexitarian diets across North America and Europe has significantly bolstered the demand for sustainable, non-animal-sourced Omega-3 ingredients.

Key benefits associated with algae DHA include its superior sensory profile (lack of fishy aftertaste), inherent purity (free from ocean contaminants like PCBs and mercury), and enhanced stability due to controlled production environments. Driving factors include favorable regulatory landscapes promoting sustainability, rising consumer awareness regarding brain and eye health, and continuous technological advancements in heterotrophic fermentation, which improve yield and reduce production costs, making algae DHA increasingly competitive against traditional sources.

Food Grade Algae DHA Market Executive Summary

The Food Grade Algae DHA market is characterized by robust commercial trends focusing on capacity expansion and strategic vertical integration among leading bio-tech and ingredient manufacturers. Key business trends include substantial investments in large-scale fermentation facilities, particularly in Asia Pacific, aiming to achieve economies of scale and reduce the current price premium over fish oil. Consolidation activities, such as acquisitions of specialized microalgae technology firms by major food ingredient players, are common, driven by the need to secure proprietary strains and advanced downstream processing capabilities essential for high-quality product delivery. Furthermore, the market is witnessing an intensified focus on research and development (R&D) to enhance DHA yield and stability through genetic engineering and optimized fermentation protocols, thereby unlocking new applications in challenging food matrices.

Regionally, the Asia Pacific (APAC) market is emerging as the dominant growth engine, fueled by rapidly increasing population density, improving economic conditions, and stringent government regulations in countries like China and India emphasizing DHA fortification in infant and maternal nutrition. While North America and Europe remain mature markets, they continue to drive innovation, particularly in the vegan supplement and functional food categories, leveraging high consumer willingness to pay for premium, certified sustainable ingredients. Regulatory harmonization efforts, particularly within the EU regarding Novel Foods status, are accelerating market entry for new algae-derived ingredients, solidifying regional market structure.

Segmentation trends indicate that the infant formula application segment retains the largest market share due to mandatory fortification requirements and high usage volumes, providing a stable foundation for market revenue. However, the dietary supplements segment is experiencing the highest CAGR, propelled by the shift towards high-concentration algae oil softgels and personalized nutrition trends. In terms of form, oil is the dominant segment, favored by manufacturers for its high concentration, though the powder form is gaining traction rapidly, especially in dry functional food fortification and tablet manufacturing, owing to its superior handling properties and extended shelf life.

AI Impact Analysis on Food Grade Algae DHA Market

Common user questions regarding AI's influence in the Food Grade Algae DHA market frequently center on how Artificial Intelligence and machine learning (ML) can optimize the notoriously complex and sensitive microalgae cultivation process. Key themes include the potential for AI to dramatically increase biomass yield, predict and prevent contamination events, and streamline downstream processing for cost reduction. Users are highly interested in AI-driven strain selection and genomic optimization to develop strains with higher DHA content and faster growth rates. Furthermore, manufacturers are exploring AI integration to manage global supply chains, forecast raw material demands (like fermentation feedstocks), and ensure real-time quality control and regulatory compliance, addressing concerns about consistency and purity that are critical for food-grade ingredients.

- AI-driven optimization of fermentation parameters (temperature, pH, light exposure) to maximize DHA yield and biomass production efficiency.

- Machine learning algorithms applied to genomic data for accelerated identification and engineering of high-yield, robust microalgae strains.

- Predictive maintenance analytics used in large bioreactors to prevent operational downtime and ensure sterile cultivation environments, minimizing batch contamination risks.

- Enhanced quality control systems utilizing computer vision and spectral analysis for real-time monitoring of product purity and concentration during extraction and refining.

- Supply chain optimization using AI to forecast ingredient demand, manage inventory levels, and optimize logistics for global distribution, reducing waste and lead times.

DRO & Impact Forces Of Food Grade Algae DHA Market

The dynamics of the Food Grade Algae DHA market are primarily shaped by the interplay of stringent regulatory demands, pervasive consumer desire for sustainable sourcing, and the persistent challenge of high production economics. The central driver is the scientifically backed evidence confirming DHA's essential role in neurological and cardiovascular health, which is continuously reinforced by health organizations globally. This scientific underpinning, coupled with mandatory inclusion in essential food categories like infant formula, creates a non-discretionary demand base. However, the high capital expenditure required for building and maintaining aseptic, large-scale fermentation facilities acts as a significant restraint, limiting the number of new entrants and maintaining a relatively high price point compared to commoditized fish oil, despite the purity advantages.

The primary opportunities lie in capitalizing on two major global trends: the growth of veganism/vegetarianism and the push for ocean sustainability. Algae DHA is uniquely positioned to capture the sustainable Omega-3 segment, allowing companies to command premium pricing. Furthermore, opportunities exist in developing novel delivery systems, such as microencapsulated powder forms that are highly stable, expanding applications into broader functional food segments that currently face stability challenges with liquid oil. Impact forces manifest as fluctuating costs of feedstocks (like glucose or molasses) necessary for heterotrophic fermentation, intense competition from concentrated fish oil derivatives, and evolving public perception regarding genetically modified (GM) or highly engineered microalgae strains, which requires meticulous communication and transparency from manufacturers.

The market faces external pressure from evolving governmental regulations concerning aquaculture and marine resource management; as environmental regulations tighten, the relative attractiveness and competitive edge of land-based algae production increases. Conversely, technological breakthroughs in yeast or fungal oil production for Omega-3s pose an indirect competitive restraint. Successful market participants strategically mitigate production restraints through vertical integration, ensuring control over the entire process from strain development to final formulation, thereby maximizing efficiency and assuring compliance with the complex global food safety standards required for high-volume trade.

Segmentation Analysis

The Food Grade Algae DHA market is meticulously segmented based on key structural variables including Source, Application, and Form, which collectively define the product offering and target markets. Understanding these segmentations is critical for manufacturers to tailor production capabilities and for marketers to target specific end-user needs, whether prioritizing high-purity oil for premium supplements or stable powders for industrial food fortification. The Application segment, particularly Infant Formula, dictates significant revenue flows due to non-negotiable regulatory requirements, while the Form segment highlights the crucial technological capabilities required for producing either high-concentration oils or easy-to-handle powders suitable for diverse manufacturing processes. The underlying Source segment dictates the proprietary technology and initial investment required for cultivation and extraction.

- By Source

- Schizochytrium sp.

- Crypthecodinium cohnii

- Other Microalgae Strains

- By Application

- Infant Formula

- Dietary Supplements

- Functional Food and Beverages

- Pharmaceuticals

- Animal Nutrition (Pet Food/Aquaculture Feed)

- By Form

- Oil

- Powder

Value Chain Analysis For Food Grade Algae DHA Market

The value chain for Food Grade Algae DHA is complex and capital-intensive, starting with upstream activities focused on strain isolation, optimization, and cultivation. Upstream analysis involves R&D labs selecting and engineering microalgae strains (e.g., Schizochytrium) for maximum DHA productivity and growth rate. This stage requires significant investment in proprietary bio-technology and aseptic fermentation infrastructure. The cultivation phase, often using heterotrophic fermentation in large bioreactors, relies heavily on securing consistent, high-quality feedstock (glucose or molasses). Success at this stage depends on meticulous process control to prevent contamination, which can destroy entire batches of high-value product.

Midstream activities involve the crucial steps of harvesting the biomass, cell disruption, and oil extraction. Modern extraction techniques, such as solvent-free or supercritical CO2 extraction, are preferred for food-grade products to ensure residue-free, high-purity oil. This crude oil then undergoes downstream refining, including deodorization, winterization, and standardization, resulting in the final concentrated DHA oil or, through microencapsulation, the stable powder form. Companies specializing in vertical integration often gain a competitive advantage by controlling quality across these complex processing steps, essential for meeting demanding certifications like Kosher, Halal, and various organic standards required by end-users.

Distribution channels are categorized into direct and indirect sales. Direct sales are prevalent for high-volume, B2B transactions, particularly with major infant formula manufacturers, where long-term contracts and tailored specifications are mandatory. Indirect channels utilize specialized nutraceutical and food ingredient distributors who provide regional market access, technical support, and smaller batch sizes to diverse supplement and functional food manufacturers. The choice of channel depends on the customer's size and geographic location, but both rely heavily on certified cold chain logistics to maintain the oxidative stability and efficacy of the final DHA product until it reaches the formulator.

Food Grade Algae DHA Market Potential Customers

The primary customer base for Food Grade Algae DHA is centered within the highly regulated industries of nutrition and pharmaceuticals, where ingredient purity and guaranteed supply are paramount. Infant Formula Manufacturers represent the largest and most critical segment of potential customers. These companies require vast, reliable supplies of DHA that adhere to the most rigorous international standards (e.g., FDA, EFSA) for newborn and early-childhood nutrition. The shift towards algae DHA by these manufacturers is driven by the ingredient's inherently clean label status, which appeals directly to parental concerns regarding the safety and origin of food ingredients, differentiating it from traditional marine oils.

Another major segment comprises Nutraceutical and Dietary Supplement Companies. These customers are highly sensitive to market trends, focusing on product differentiation through claims of sustainability, purity, and vegan certification. They utilize algae DHA in premium products such as prenatal supplements, cognitive support softgels, and general wellness formulations marketed towards vegetarian, vegan, and environmentally conscious consumers. The demand from this sector is characterized by a need for flexibility in both oil and powder forms to accommodate various delivery formats like gummies, capsules, and drink mixes.

Additionally, Functional Food and Beverage Producers represent a rapidly expanding customer group. These companies incorporate algae DHA into everyday food items like dairy-free yogurts, breakfast cereals, nutritional bars, and juices to enhance their health profile. Their requirement often leans towards highly stable, microencapsulated powder forms that can withstand processing temperatures and maintain a neutral sensory profile, ensuring the final product retains its integrity and consumer appeal without introducing a "fishy" flavor or odor. Furthermore, the specialized Pet Food and Aquaculture Feed industries are emerging buyers, utilizing algae DHA to fortify premium feed products, recognizing its superior bioavailability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1810 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM Nutritional Products, Corbion, Polaris, BASF SE, Fuji Chemical Industry Co., Ltd., Roquette, Cellana, AlgaPrime (Benson Hill), Mara Renewables, Shenzhen Qianhai Zhongneng Microalgae Biotechnology Co., Ltd., Global Algae Innovations, Simris Alg, Fenchem, Qualitas Health, Kemin Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Algae DHA Market Key Technology Landscape

The technological landscape of the Food Grade Algae DHA market is defined by advancements in microalgae cultivation and highly selective oil extraction processes aimed at maximizing DHA yield while ensuring maximum purity and food safety. The dominant cultivation method is Heterotrophic Fermentation, which involves growing microalgae in closed, sterile bioreactors using an external carbon source (typically glucose or molasses). This method offers significant advantages over open pond or phototrophic systems, including higher biomass density, reduced risk of contamination, and independence from climate conditions, allowing for predictable, year-round production essential for high-volume food grade contracts. Key innovations in this area focus on optimizing bioreactor design and process control using sophisticated sensor technology to maintain optimal nutrient delivery and gas exchange conditions, thereby boosting productivity and reducing operational time.

Following cultivation, downstream processing relies heavily on advanced extraction and refinement technologies. Solvent-free extraction methods, particularly Supercritical Carbon Dioxide (SC-CO2) Extraction, are gaining prominence. SC-CO2 extraction is highly valued in the food-grade sector because it eliminates the use of harsh organic solvents, resulting in a cleaner, residue-free product that meets stringent regulatory requirements for infant formula and organic labels. This technology allows for the selective separation of DHA from other lipids and compounds at relatively low temperatures, which preserves the nutritional integrity and oxidative stability of the fragile Omega-3 molecule, a crucial factor in shelf-life and efficacy. Ongoing R&D is also exploring enzymatic extraction techniques as a highly sustainable, non-thermal alternative.

Further technological differentiation is achieved through Stabilization and Encapsulation techniques. Due to the high susceptibility of PUFAs to oxidation, leading to rancidity and loss of efficacy, effective stabilization is critical. Manufacturers utilize proprietary antioxidant blends (e.g., natural tocopherols, ascorbyl palmitate) and microencapsulation technologies to create highly stable powder forms. Microencapsulation involves embedding the DHA oil within a protective matrix (often starch, protein, or maltodextrin), converting the oil into a free-flowing powder that is easier to handle, blend into dry mixes, and possesses a significantly extended shelf life under normal atmospheric conditions. The success of these technologies directly correlates with market penetration into the functional food sector where stability in complex matrices is non-negotiable.

Regional Highlights

Regional dynamics in the Food Grade Algae DHA market are heavily influenced by regulatory policies regarding infant nutrition and the local prevalence of vegetarian and vegan lifestyle trends. North America (NA) represents a significant established market characterized by high consumer awareness of Omega-3 benefits and robust demand for premium, certified sustainable ingredients. The U.S. market drives innovation in the dietary supplement and functional food sectors, capitalizing on clear labeling requirements and a high willingness among consumers to pay a premium for certified non-GMO, vegan, and environmentally responsible DHA sources. Regulatory agencies in the region, such as the FDA, have streamlined the approval process for microalgae-derived oils, fostering a competitive and technologically advanced manufacturing landscape.

Europe stands out due to its stringent Novel Food regulations, which, while historically providing an entry barrier, now ensure high levels of consumer trust in approved ingredients. The European market exhibits strong demand for vegan and organic certified products, spurred by influential ethical consumer movements, particularly in Germany, the UK, and Scandinavian countries. European manufacturers prioritize sustainability and traceability throughout the supply chain, often investing in local production to minimize carbon footprint. The harmonization of regulatory standards across the European Union further facilitates cross-border trade and application in infant formula and medical foods, solidifying Europe's position as a key innovation hub for clean label ingredients.

Asia Pacific (APAC) is projected to be the fastest-growing region globally, primarily driven by China and India. This growth is fueled by increasing disposable incomes, massive population bases requiring nutritional supplementation, and, most critically, governmental policies emphasizing the importance of DHA in early life nutrition. China's rapidly expanding infant formula market and robust regulatory oversight requiring DHA inclusion are key demand accelerators. Local producers in APAC are rapidly scaling up domestic fermentation capabilities to meet this soaring regional demand, often leveraging lower operating costs, although they must simultaneously meet the high quality standards set by international customers to participate in the global supply chain, positioning the region as both a critical consumer and a burgeoning production center.

- North America (NA): Focus on high-value dietary supplements, vegan consumers, and stringent quality certifications; robust R&D activity.

- Europe: Driven by strict Novel Food requirements, strong demand for certified sustainable and organic products, and influential vegan movements.

- Asia Pacific (APAC): Highest growth rate, dominated by the infant formula sector, supported by favorable government policies in China and India and increasing domestic production capacity.

- Latin America (LATAM): Emerging market potential linked to increasing awareness of nutritional deficiencies and gradual adoption of DHA fortification standards.

- Middle East and Africa (MEA): Growth driven by expanding pharmaceutical sector and rising health expenditure, particularly in the UAE and Saudi Arabia, seeking high-quality, import-dependent ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Algae DHA Market. These companies are instrumental in defining the market's technological trajectory, capacity expansion, and global distribution network, competing primarily on purity, sustainability certifications, and price competitiveness.- DSM Nutritional Products

- Corbion

- Polaris

- BASF SE

- Fuji Chemical Industry Co., Ltd.

- Roquette

- Cellana

- AlgaPrime (Benson Hill)

- Mara Renewables

- Shenzhen Qianhai Zhongneng Microalgae Biotechnology Co., Ltd.

- Global Algae Innovations

- Simris Alg

- Fenchem

- Qualitas Health

- Kemin Industries

- Algamo

- Keyto Corporation

- Solazyme (TerraVia - acquired by Corbion)

- Runke Biological Engineering Co., Ltd.

- Nisshin Oillio Group, Ltd.

Frequently Asked Questions

Analyze common user questions about the Food Grade Algae DHA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Food Grade Algae DHA over traditional fish oil?

Algae DHA is produced sustainably using controlled fermentation, ensuring it is a vegan-friendly source free from common ocean contaminants like heavy metals (mercury) and PCBs often found in traditional fish oils, offering superior purity and stability.

How is Food Grade Algae DHA produced commercially?

It is primarily produced through heterotrophic fermentation in large, sterile bioreactors, where microalgae strains such as Schizochytrium sp. are fed a carbon source (sugar) to synthesize DHA, followed by extraction, typically using solvent-free or supercritical CO2 methods.

Which application segment accounts for the largest share of the Algae DHA market?

The Infant Formula application segment holds the largest market share due to global regulatory requirements mandating the inclusion of DHA for infant cognitive and visual development, driving consistently high-volume demand.

What is the main restraint impacting the expansion of the Algae DHA market?

The primary restraint is the high initial capital expenditure required for sophisticated, aseptic fermentation infrastructure and the associated high operating costs, which result in a higher final ingredient price compared to standard refined marine oils.

Is Algae DHA typically available in oil or powder form, and what are the uses?

Algae DHA is available as highly concentrated oil (used in softgels and liquid supplements) and as a microencapsulated powder (used for fortification of dry functional foods, tablets, and baking, due to its enhanced stability and easy handling).

How does technological advancement in extraction methods affect product purity?

Advanced extraction methods, particularly supercritical CO2 (SC-CO2) extraction, utilize high pressure rather than harsh chemical solvents. This non-solvent process ensures a cleaner, residue-free final product, meeting the highest food safety standards required for sensitive applications like infant nutrition and organic labeling.

Which geographical region is expected to exhibit the fastest growth for Algae DHA?

The Asia Pacific (APAC) region, driven by countries like China and India, is forecasted to show the fastest market growth, fueled by rapid urbanization, rising health expenditure, and mandatory government initiatives concerning nutritional fortification, especially in infant products.

What role does regulatory approval play in the European Algae DHA market?

Regulatory approval under the European Union’s Novel Food Regulation is essential. Once approved, it signifies safety and legitimacy, dramatically facilitating market entry and consumer trust for new algae-derived ingredients across all EU member states.

Are there significant concerns regarding the oxidative stability of Algae DHA products?

Yes, like all PUFAs, Algae DHA is susceptible to oxidation. Manufacturers utilize specialized stabilization techniques, including high-purity antioxidants and microencapsulation technology, to significantly extend shelf life and prevent rancidity, ensuring product efficacy until consumption.

How is AI being leveraged to improve microalgae production efficiency?

AI and machine learning are applied to optimize complex fermentation parameters in real-time, predict optimal harvest timing, analyze genomic data for strain improvement, and manage inventory, leading to higher DHA yields and reduced operational costs.

What is the role of Schizochytrium sp. in the current Algae DHA production landscape?

Schizochytrium sp. is the most commonly utilized microalgae strain for commercial DHA production due to its naturally high lipid content and its suitability for large-scale, cost-effective heterotrophic fermentation, making it the industry standard source.

How do vegan consumer trends specifically impact the market demand for Algae DHA?

Vegan and vegetarian consumer trends drive demand because Algae DHA offers the only direct, non-animal-sourced long-chain Omega-3 option, satisfying the ethical and dietary requirements of this rapidly expanding consumer segment that actively seeks alternatives to fish oil.

What kind of investments are characterizing the market's business trends?

Key business trends involve substantial capital investments in building large-scale, dedicated fermentation plants, strategic mergers and acquisitions (M&A) to acquire proprietary strain technology, and increased R&D spending focused on genetic optimization and cost reduction strategies.

Which key factor determines the competitiveness between various Algae DHA manufacturers?

Competitiveness is primarily determined by a company's ability to achieve economies of scale through high-yield production, ensuring exceptional purity (contaminant-free), and securing key certifications (vegan, non-GMO, organic) that align with premium consumer expectations.

Can Algae DHA be used in aquaculture or animal feed applications?

Yes, Algae DHA is increasingly used in aquaculture feed (to enrich farmed fish with beneficial Omega-3s without relying on wild-caught fish feed) and in premium pet food formulations, expanding the market scope beyond human consumption.

What is the difference in handling between Algae DHA oil and powder forms for food manufacturers?

Oil forms require strict temperature and oxygen control during transport and formulation, suitable for softgels or liquids. Powder forms, due to encapsulation, are easier to handle, measure, and blend into dry mixes, offering improved stability for complex food matrices.

How does the value chain address quality control from cultivation to distribution?

Quality control is maintained through vertical integration, aseptic cultivation in closed bioreactors, stringent testing during supercritical extraction, and certified cold chain logistics during distribution to ensure the purity and oxidative stability of the final food-grade product.

Why is the purity of Algae DHA considered a major selling point?

Purity is paramount because algae are grown in controlled, land-based systems, entirely bypassing the oceanic environment. This eliminates the risk of accumulating toxins like heavy metals and persistent organic pollutants (POPs) common in marine sources.

What are the emerging market opportunities in functional foods for Algae DHA?

Emerging opportunities include the fortification of plant-based dairy and meat alternatives, personalized nutrition products, and beverages, leveraging the stable powder form to seamlessly integrate DHA into new consumer-friendly food formats.

How do fluctuations in feedstock prices affect the overall market economics?

Feedstock (like glucose or cane molasses) constitutes a major variable cost in heterotrophic fermentation. Price fluctuations directly impact the final production cost of Algae DHA, putting pressure on manufacturers to optimize conversion efficiency and secure long-term supply contracts.

What technological hurdles remain in scaling up Algae DHA production?

Key technological hurdles include achieving consistent, high-density fermentation at massive industrial scale, reducing energy consumption associated with bioreactor operation and harvesting, and improving the cost-effectiveness of solvent-free extraction techniques.

What distinguishes food-grade Algae DHA from feed-grade Algae DHA?

Food-grade Algae DHA requires significantly higher standards of purity, lower limits for contaminants, and adherence to human consumption safety regulations (like Novel Food approvals), contrasting with less stringent quality controls typical for feed-grade products.

How do major players maintain market competitiveness against smaller entrants?

Major players maintain competitiveness through substantial intellectual property related to proprietary high-yield microalgae strains, established global distribution networks, superior quality assurance certifications, and the financial ability to absorb high capital costs for facility expansion.

What is the strategic importance of vertical integration in this industry?

Vertical integration is strategically important as it grants companies full control over the complex production chain, from proprietary strain engineering and cultivation parameters to final extraction and stabilization, thereby guaranteeing quality, consistency, and supply chain security for B2B customers.

Does the production of Algae DHA contribute to ocean conservation efforts?

Yes, by providing a sustainable, land-based alternative to fish oil, Algae DHA reduces the reliance on wild-caught fish (menhaden, anchovies) that are typically used for fish oil production, thus alleviating fishing pressure on marine ecosystems and supporting ocean conservation.

What is the expected long-term impact of regulatory harmonization on global trade?

Regulatory harmonization, particularly across major trading blocks, is expected to standardize safety and quality benchmarks, significantly lowering trade barriers, facilitating smoother ingredient export/import, and accelerating global market adoption.

How are consumer perceptions of genetic engineering affecting strain development?

While genetic engineering can drastically increase DHA yield, strong consumer preference in North America and Europe for Non-GMO ingredients often restricts manufacturers to utilizing traditional strain optimization methods or maintaining strict Non-GMO certification for their food-grade products.

What is the significance of the 11.5% CAGR projected for the market?

The projected 11.5% CAGR signifies that the market is transitioning from a niche category to a mainstream ingredient solution, indicating strong confidence in the scalability of production technology and sustained, growing consumer demand for sustainable and pure Omega-3 sources.

Are there significant regional differences in the demand for Algae DHA versus other Omega-3s?

In North America and Europe, demand is strongly driven by ethical and vegan considerations, prioritizing Algae DHA. In contrast, APAC demand is often fueled more by regulatory mandates for general Omega-3 inclusion in staple foods, although the purity benefit of algae is increasingly recognized.

What role does the 'clean label' movement play in purchasing decisions by manufacturers?

The 'clean label' movement is critical, pushing manufacturers to choose Algae DHA because its production in controlled environments and the use of solvent-free extraction align perfectly with consumer desire for ingredients that are minimally processed, traceable, and free from synthetic additives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager