Food Grade Erythritol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432049 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Food Grade Erythritol Market Size

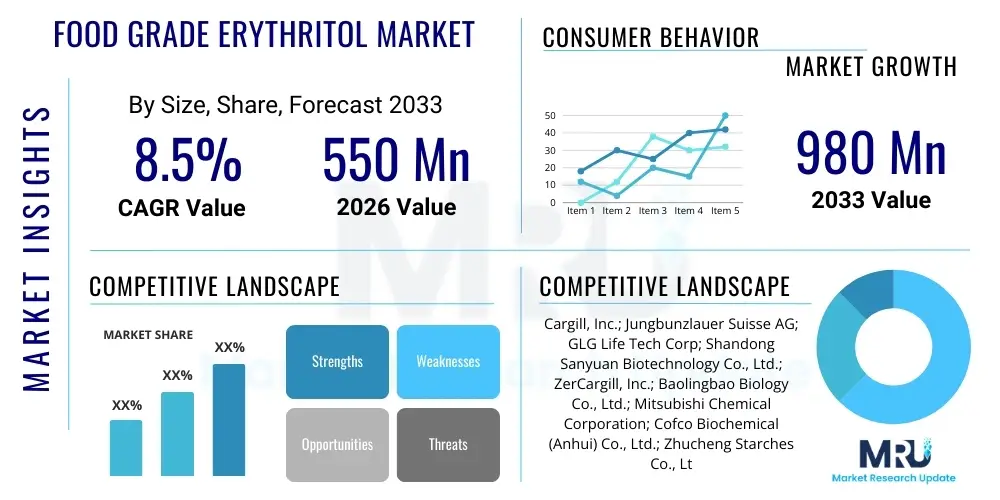

The Food Grade Erythritol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033.

Food Grade Erythritol Market introduction

The Food Grade Erythritol Market encompasses the global production, distribution, and consumption of erythritol, a natural polyol (sugar alcohol) primarily used as a high-intensity, zero-calorie bulk sweetener in the food and beverage industry. Erythritol is gaining widespread traction due to its excellent digestive tolerance, high stability, and mouthfeel similarity to sucrose, making it a preferred choice for formulations targeting health-conscious consumers. The increasing global epidemic of obesity and diabetes is fundamentally driving the demand for healthier sugar substitutes, positioning erythritol as a crucial functional ingredient in clean-label and low-sugar products across various categories, including confectionery, bakery, beverages, and dairy. Technological advancements in fermentation processes, particularly utilizing yeast strains like Moniliella pollinis or Yarrowia lipolytica, are continually improving yield and purity, thus supporting market expansion and accessibility. The product's non-cariogenic properties further solidify its use in oral care and specialized dietary applications.

Food grade erythritol is commercially produced through the fermentation of glucose or fructose, often sourced from corn or wheat starch, resulting in a crystalline powder. Its primary function is to replace sucrose, providing sweetness and bulk without contributing significant calories or affecting blood glucose levels, a critical attribute for diabetic and ketogenic diets. Major applications span from carbonated soft drinks and fruit juices to nutritional bars, chewing gums, and tabletop sweeteners. The ingredient is valued not only for its low caloric value (approximately 0.2 kcal/g compared to 4 kcal/g for sugar) but also for its high digestive threshold compared to other polyols like xylitol or sorbitol, minimizing the common gastrointestinal discomfort associated with sugar alcohols. This favorable metabolic profile and regulatory approval across key global regions, including the FDA, EFSA, and WHO, bolster its adoption rates, particularly in developed markets where health and wellness trends are deeply entrenched in consumer purchasing behavior.

The market growth is primarily fueled by compelling macroeconomic and behavioral factors. A burgeoning consumer focus on preventive healthcare and weight management necessitates constant innovation in reduced-sugar product development. Furthermore, supportive regulatory landscapes that classify erythritol as generally recognized as safe (GRAS) facilitate its integration into complex food matrices. The driving factors include the clean-label movement, increasing availability of cost-effective production techniques, and robust marketing by major food manufacturers promoting low-calorie alternatives. Benefits of erythritol include enhanced flavor profiles in low-sugar applications, excellent blending capabilities with other high-intensity sweeteners (like stevia and monk fruit) for synergistic sweetening, and its antioxidant properties. These attributes collectively position the Food Grade Erythritol Market for sustained, strong growth through the forecast period, emphasizing its role in the transformation towards functional and healthier food systems.

Food Grade Erythritol Market Executive Summary

The Food Grade Erythritol Market is characterized by intense innovation centered around optimizing fermentation efficiency and expanding application scope across mainstream food and beverage categories. Key business trends indicate a strategic focus among major players on securing raw material supply chains (primarily corn starch derivatives) and integrating backward to control production costs, thereby enhancing competitive pricing strategies. Regional trends are bifurcated, with North America and Europe representing mature markets driven by established health consciousness and regulatory support, while the Asia Pacific (APAC) region, particularly China and India, exhibits the fastest growth due to rapid urbanization, increasing disposable incomes, and the nascent adoption of Western dietary habits that favor sugar reduction. This expansion is leading to significant investments in new production facilities in APAC to serve both local demand and global export requirements, fundamentally shifting the geographical center of gravity for manufacturing capabilities. Furthermore, partnerships between ingredient suppliers and large CPG companies are accelerating market penetration and the standardization of erythritol use in mass-market products.

Segment trends highlight the significant dominance of the powdered erythritol segment, which is most widely utilized in baking, confectionery, and as a tabletop sweetener, valued for its ease of incorporation and solubility. However, the granular form is experiencing parallel growth, especially in direct-to-consumer retail channels targeting home baking and coffee applications. Application-wise, the beverage sector remains the largest consumer, driven by the proliferation of zero-sugar soft drinks, flavored waters, and sports drinks, responding directly to public health campaigns against excessive sugar intake. The confectionery segment, including sugar-free gums, candies, and chocolates, also represents a robust growth avenue, leveraging erythritol’s ability to mimic the textural properties of sugar without the associated dental health risks. Future growth is strongly anticipated in the pharmaceutical and nutraceutical sectors, where erythritol is employed as an excipient and flavor enhancer in lozenges, syrups, and functional supplements, capitalizing on its negligible impact on blood sugar levels and pleasant taste profile.

In summary, the market is poised for expansion fueled by demand elasticity in response to rising global health awareness and the imperative for sugar reduction mandated by both consumers and public health policies. Regulatory clarity concerning labeling and safety further de-risks investment in erythritol production. The critical challenges revolve around maintaining price stability amidst fluctuating raw material costs (glucose) and managing consumer perception regarding the ‘artificial’ nature of sugar alcohols, despite erythritol being derived naturally. Successful market participants are those strategically investing in proprietary fermentation technologies to achieve higher yields, purity, and lower manufacturing footprints, simultaneously engaging in consumer education to differentiate erythritol based on its superior gastrointestinal tolerance and clean-label compatibility compared to older artificial sweeteners.

AI Impact Analysis on Food Grade Erythritol Market

Common user questions regarding AI's impact on the Food Grade Erythritol Market often focus on how advanced analytics can optimize fermentation processes, predict supply chain disruptions, and accelerate the discovery of novel production methods or applications. Users are concerned about the cost implications of implementing large-scale AI systems in manufacturing and whether AI can enhance the sustainability profile of current production methods, which rely heavily on corn derivatives. Key expectations center around AI's ability to minimize waste, optimize energy consumption in bioreactors, and improve yield predictability. There is also significant interest in how AI-driven market intelligence can identify emerging application niches (e.g., in personalized nutrition) and fine-tune formulation strategies to create synergistic blends of erythritol with other natural sweeteners that meet complex consumer taste demands while maintaining regulatory compliance and cost efficiency. The overarching theme is utilizing AI to move from reactive optimization to predictive, efficient, and sustainable production cycles.

The deployment of Artificial Intelligence and machine learning (ML) models is fundamentally transforming the upstream production landscape of food grade erythritol. AI algorithms are being integrated into bioreactor management systems to monitor, analyze, and automatically adjust critical fermentation parameters such as temperature, pH levels, agitation speed, and nutrient concentrations in real-time. This level of precision control significantly minimizes batch variability, maximizes the yield of the desired polyol, and reduces energy consumption associated with unnecessary process cycles. Furthermore, predictive maintenance models utilizing ML analyze sensor data from pumps, mixers, and filtration units to anticipate equipment failure, drastically reducing downtime and the associated operational expenditure (OPEX). These digital transformation efforts enhance overall manufacturing efficiency, lower the cost per kilogram of erythritol produced, and allow manufacturers to respond more flexibly to market demand fluctuations, particularly crucial in a commodity-driven ingredient sector.

Downstream, AI is playing a pivotal role in market analysis, demand forecasting, and consumer trend identification. Large language models (LLMs) and predictive analytics are used to rapidly process vast datasets related to consumer sentiment, social media trends, and competitive product launches globally. This intelligence helps CPG companies and ingredient suppliers design innovative product formulations featuring erythritol, ensuring that new products align precisely with regional taste preferences (e.g., specific sweetness levels) and clean-label requirements. AI also assists in complex regulatory compliance checks, ensuring that new erythritol-containing products adhere to diverse global food safety standards and labeling laws efficiently. The ability of AI to model complex sensory interactions between erythritol and other sweeteners or flavor compounds is enabling the creation of superior-tasting, zero-sugar products, thereby mitigating the common issue of off-tastes often associated with synthetic substitutes, further accelerating consumer adoption.

- AI-driven optimization of bioreactor parameters (temperature, pH, nutrients) for maximum fermentation yield and purity.

- Machine learning models implemented for predictive maintenance of manufacturing equipment, reducing operational downtime and costs.

- Advanced analytics utilized for precise demand forecasting and inventory management across complex global supply chains.

- AI-powered market intelligence identifying emerging consumer preferences for specific low-sugar product categories.

- Use of generative AI for rapid formulation discovery, optimizing synergistic blends with other natural sweeteners (e.g., stevia, monk fruit) to enhance flavor profiles.

- Implementation of AI for monitoring and ensuring stringent regulatory compliance and traceability from raw material to finished product.

- Energy consumption modeling using AI to improve the sustainability and reduce the carbon footprint of industrial-scale production processes.

DRO & Impact Forces Of Food Grade Erythritol Market

The Food Grade Erythritol Market is propelled by powerful drivers centered around public health priorities and consumer demand for natural, low-calorie alternatives, while facing restraints primarily related to production economics and lingering consumer skepticism toward sugar alcohols. Opportunities abound in leveraging erythritol’s superior qualities—such as minimal digestive impact and high thermal stability—to penetrate emerging functional food segments and geographically unsaturated markets. The combined impact of these forces creates a highly dynamic environment: the robust push from public health concerns (Driver) heavily outweighs the competitive pressures and cost volatility (Restraints), leading to sustained positive market growth, particularly as technological improvements (Opportunity) continually mitigate production cost barriers. The regulatory landscape (Impact Force) serves as a critical enabler, providing the necessary safety assurances that translate consumer interest into commercial demand.

Key drivers include the dramatic rise in non-communicable diseases (NCDs) linked to sugar consumption, such as type 2 diabetes and cardiovascular issues, compelling governments and healthcare providers worldwide to promote sugar reduction strategies. This macro trend is seamlessly aligned with the strong consumer preference for natural sweeteners over artificial chemicals, positioning naturally derived erythritol favorably. Restraints primarily involve the high relative cost of erythritol compared to standard high-fructose corn syrup or sucrose, which can limit its use in price-sensitive, high-volume food categories. Furthermore, while erythritol has better digestive tolerance than many polyols, large-scale consumption can still lead to mild laxative effects, generating occasional negative perception which must be managed through appropriate serving size guidelines and consumer education efforts. Addressing the sourcing of raw materials, predominantly corn starch, also presents an inherent vulnerability to agricultural commodity price fluctuations, impacting the input costs for manufacturers.

The market is rich with opportunities, particularly in expanding beyond mainstream food and beverage into specialized nutritional areas like medical nutrition, geriatric foods, and personalized dietary supplements, leveraging its zero glycemic index. Furthermore, the development of integrated, continuous fermentation processes promises significant reductions in manufacturing complexities and scaling costs, making erythritol increasingly price competitive. Impact forces include the stringent enforcement of nutritional labeling laws, which compels manufacturers to clearly display sugar content, thus making erythritol an attractive reformulation option. Competitive intensity among key producers, driven by the race for higher-purity, premium-grade erythritol, also shapes market dynamics. The synergistic effect of these forces ensures that while competition remains fierce, the overall market trajectory remains upward, driven by non-negotiable global health trends and continuous technological scaling.

Segmentation Analysis

The Food Grade Erythritol Market is systematically segmented based on form, application, and source, reflecting the diverse end-user requirements and varied production techniques utilized globally. Analyzing these segments provides crucial insights into market penetration rates and growth pockets. The segmentation by form—powdered versus granular—reflects usage patterns, with powder typically preferred in industrial applications requiring high dissolution rates (e.g., beverages and sauces) and granular forms dominating direct retail and bulk substitutions in baking. Source segmentation, distinguishing between fermentation from corn/wheat starch (dominant) and potentially bioengineered sources (emerging), speaks to regulatory compliance and the growing consumer demand for non-GMO or specific origin verification. This detailed breakdown allows companies to tailor their product offerings, packaging, and distribution strategies to meet the specific technical and consumer needs of each identified sub-market effectively.

Segmentation by application is particularly critical as it illustrates where the bulk of the market value resides and where future growth is concentrated. Beverages (both carbonated and non-carbonated) consistently represent the largest segment due to the inherent challenge of replacing large volumes of sugar in liquid formulations without compromising mouthfeel or stability. The confectionery and chewing gum segment follows closely, driven by the non-cariogenic nature of erythritol, making it essential for dental health products. Emerging segments, such as dietary supplements (e.g., protein powders, pre-workouts) and functional dairy products (low-sugar yogurts, ice creams), are experiencing high growth rates, reflecting the shift towards fortified and health-oriented food items. Understanding these application kinetics is essential for manufacturers planning capacity expansion and R&D efforts aimed at enhancing erythritol’s functionality in complex matrices such as frozen desserts or high-protein matrices where crystallization control is key.

Geographic segmentation is equally vital, distinguishing the high-consumption, mature markets of North America and Western Europe from the rapidly expanding, investment-heavy regions of Asia Pacific. Within each region, the interaction between segment types varies; for instance, in North America, the use of erythritol in ketogenic and specialty diet foods is pronounced, whereas in APAC, its application in mass-market beverages addressing burgeoning diabetic populations often dominates. The interplay between sourcing methods, price points, and application versatility ultimately defines the competitive landscape within each segment, driving innovation toward achieving both purity and cost efficiency. The granular level of segmentation analysis supports targeted marketing and resource allocation, ensuring that investments are made in the segments demonstrating the highest potential return on investment (ROI) based on current market trends and future health projections.

- By Form:

- Powdered Erythritol (Finely ground, high solubility)

- Granular Erythritol (Crystalline structure, used as direct sugar substitute)

- Liquid/Syrup Blends (Used in industrial beverage processing)

- By Application:

- Beverages (Soft drinks, juices, energy drinks, functional waters)

- Food & Confectionery (Chewing gum, candies, chocolates, baked goods)

- Tabletop Sweeteners (Retail packets, bulk containers)

- Pharmaceuticals & Personal Care (Excipients, toothpaste, mouthwash)

- Dairy Products (Yogurt, ice cream, flavored milk)

- By Source:

- Corn Starch Fermentation (Dominant commercial source)

- Wheat Starch Fermentation

- Other Starch Derivatives (e.g., cassava)

- By End-Use Industry:

- Food and Beverage Industry

- Nutraceutical and Supplement Industry

- Pharmaceutical Industry

- Cosmetics and Personal Care Industry

Value Chain Analysis For Food Grade Erythritol Market

The value chain for Food Grade Erythritol is intricate, starting with the upstream sourcing of agricultural raw materials and culminating in the downstream distribution to diverse end-use sectors. Upstream analysis focuses predominantly on the cultivation and processing of starch-rich crops, primarily corn and wheat, which are hydrolyzed to produce glucose feedstock. The stability and quality of this glucose supply directly influence the efficiency and cost structure of erythritol production. Manufacturers heavily rely on specialized biotechnology providers for high-performance yeast strains (like Moniliella species) and optimizing fermentation processes, which are capital and technology-intensive. Controlling the cost and consistent supply of glucose is a critical factor determining the competitive advantage of primary erythritol producers, leading many large players to integrate backward or establish long-term procurement contracts with major agricultural processors to stabilize input costs.

The midstream stage involves the core manufacturing process: fermentation, followed by purification, crystallization, and drying. This stage is marked by significant intellectual property related to bioreactor design and crystallization techniques aimed at achieving high purity (typically >99.5%) and desired particle size distribution (powdered vs. granular). High energy consumption during purification (especially evaporation and filtration) and waste management are key cost components. Downstream analysis focuses on packaging, marketing, and distribution. Erythritol is distributed through two main channels: direct sales to major multinational food and beverage corporations that require bulk quantities and specialized specifications, and indirect sales via an extensive network of ingredient distributors and brokers who cater to smaller manufacturers, bakeries, and retail markets (tabletop sweeteners). The choice between direct and indirect channels is often dictated by volume, geographic reach, and the complexity of technical support required by the client.

Distribution logistics must account for the handling of a crystalline bulk ingredient, requiring robust quality assurance to prevent contamination and ensure traceability. Direct distribution enables tighter control over pricing, quality, and relationship management with strategic accounts, crucial for large global suppliers. Indirect distribution, leveraging local ingredient distributors, provides broader market reach, particularly in emerging markets where local presence is essential. The value chain is heavily influenced by quality control standards—cGMP (current Good Manufacturing Practices) and HACCP (Hazard Analysis Critical Control Point)—at every stage, ensuring the final product meets the stringent requirements for food safety globally. The optimization of this chain—from efficient sourcing of glucose to minimizing purification energy—is paramount for maintaining the competitive pricing necessary to compete against established artificial sweeteners and sucrose.

Food Grade Erythritol Market Potential Customers

The primary customer base for food grade erythritol is highly diversified across the global food and beverage manufacturing ecosystem, encompassing multinational conglomerates and niche specialty food producers dedicated to wellness and diet segments. Major potential customers include global beverage giants requiring high volumes of zero-calorie sweeteners for their flagship soft drink lines and innovative functional beverage portfolios (e.g., enhanced waters, low-sugar teas, and sports recovery drinks). These corporations are driven by mandatory internal targets for sugar reduction and external pressure from health advocates. Similarly, large confectionery and baking companies represent substantial demand, relying on erythritol to produce sugar-free gums, hard candies, chocolate bars, and various baked goods, where its superior thermal stability and ability to mimic sugar’s bulk are indispensable functional attributes for successful reformulation.

A rapidly expanding segment of high-potential customers includes nutraceutical and dietary supplement manufacturers. These companies integrate erythritol into powdered supplements (like protein powders, meal replacements, and pre-workout mixes) and flavored liquid supplements, valued for its zero glycemic index and clean taste profile, which appeals directly to consumers following strict low-carbohydrate or ketogenic diets. Furthermore, direct-to-consumer (D2C) brands specializing in tabletop sweeteners and home baking ingredients form a critical customer segment. These buyers prioritize packaging, solubility, and branding that emphasizes the ingredient's natural derivation and health benefits, often sold under premium health and wellness labels in grocery and online retail channels. The growth in the D2C segment reflects the increasing individual consumer demand for personalized dietary control.

Beyond traditional food manufacturing, pharmaceutical companies utilize erythritol as a non-caloric excipient, bulk agent, or flavor masker in oral medications, lozenges, and syrups, particularly for pediatric and diabetic patient populations where sugar intake must be strictly controlled. The appeal here lies in its non-cariogenic properties and high tolerance. The common thread among all potential customers is the strategic need to replace sugar without compromising taste, texture, or regulatory compliance. Therefore, key buyers seek suppliers who can demonstrate consistent purity, scalability, and adherence to global food safety certifications, making long-term supply contracts based on quality assurance and competitive bulk pricing essential components of customer acquisition and retention strategies in the Food Grade Erythritol Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc.; Jungbunzlauer Suisse AG; GLG Life Tech Corp; Shandong Sanyuan Biotechnology Co., Ltd.; ZerCargill, Inc.; Baolingbao Biology Co., Ltd.; Mitsubishi Chemical Corporation; Cofco Biochemical (Anhui) Co., Ltd.; Zhucheng Starches Co., Ltd.; Shandong Futian Pharmaceutical Co., Ltd.; Tate & Lyle PLC; Ingredion Incorporated; ADM (Archer Daniels Midland); Now Foods; Zibo Zhongshi Chemical Co., Ltd.; Batory Foods; Zhejiang Huakang Pharmaceutical Co., Ltd.; Shandong Lujian Biological Technology Co., Ltd.; O-I Foods, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Erythritol Market Key Technology Landscape

The technological landscape of the Food Grade Erythritol Market is dominated by advancements in industrial biotechnology, specifically optimizing microbial fermentation and subsequent purification processes. Historically, batch fermentation has been the standard, but the key trend is the transition towards continuous fermentation systems. Continuous processes, often employing immobilized cell technology or high-density cell recycling, significantly improve volumetric productivity, reduce operational labor, and dramatically lower the cost of goods sold (COGS) by achieving economies of scale and minimizing downtime. Furthermore, R&D efforts are heavily focused on strain engineering, utilizing advanced genetic modification techniques to enhance the erythritol yield from common yeast or bacterial strains (such as Yarrowia lipolytica or Candida magnoliae), enabling producers to use less feedstock per unit of finished product, thereby addressing input cost volatility and improving sustainability metrics.

Post-fermentation technology, particularly in purification and crystallization, is equally critical for commercial success. Achieving the required high purity (typically >99.5%) demands efficient filtration, ion-exchange chromatography, and specialized crystallization techniques. Advanced membrane filtration systems, including ultrafiltration and nanofiltration, are being adopted to efficiently separate microbial biomass and residual impurities from the fermentation broth before crystallization, reducing the reliance on energy-intensive evaporation steps. The crystallization process itself is being fine-tuned using seed crystal technology and precise temperature control systems to produce erythritol crystals with uniform size and morphology, crucial for controlling bulk density, dissolution rate, and textural quality, especially important for direct-to-consumer tabletop sweetener products which must dissolve quickly without leaving a gritty residue.

Emerging technologies include exploring alternative, non-GMO feedstock sources, moving beyond conventional corn starch to utilize agricultural waste streams or cheaper biomass derivatives, addressing both supply security and sustainability goals. Furthermore, digitalization and automation, supported by AI and IoT sensors (as detailed in the AI analysis section), are integrating these complex processes. This allows for real-time monitoring and adaptive control, ensuring optimal process conditions are maintained 24/7. The integration of advanced process analytical technology (PAT) facilitates immediate quality checks during production, reducing the reliance on post-production lab testing and improving overall batch release speed. This technological evolution is pivotal, transforming erythritol production from a high-cost specialty process into a scalable, high-volume industrial biotechnology application capable of meeting surging global demand at competitive price points.

Regional Highlights

Regional dynamics play a crucial role in shaping the Food Grade Erythritol Market, driven by varying regulatory environments, public health initiatives, and consumer adoption rates. North America and Europe currently dominate the market in terms of value, primarily due to high consumer awareness regarding sugar reduction, the prevalence of diet and ketogenic trends, and supportive regulatory frameworks (e.g., GRAS status in the US). These regions exhibit mature consumption patterns, with robust penetration across beverages, baked goods, and specialized dietary products.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is fueled by the escalating incidence of diabetes and lifestyle diseases in countries like China, India, and Southeast Asian nations, coupled with increasing disposable incomes and a growing alignment with Western dietary preferences for convenience and health-conscious food products. China, in particular, is both a major consumer and the largest global producer of erythritol, benefiting from cost-effective fermentation processes and significant export capabilities. This dual role makes APAC the strategic center for future manufacturing investment.

Latin America (LATAM) and the Middle East & Africa (MEA) represent nascent but promising markets. LATAM's growth is often spurred by government taxation on sugar-sweetened beverages (e.g., Mexico, Chile), which accelerates industrial reformulation efforts using erythritol. In MEA, market uptake is slower but accelerating, driven by the increasing presence of global food chains and rising awareness of health and wellness, particularly in the UAE and Saudi Arabia. Strategic market entry in these regions often involves navigating fragmented distribution networks and adapting product positioning to address local taste profiles and cost sensitivities.

- North America: Market leader driven by robust demand from keto/low-carb consumers and large CPG manufacturers focused on sugar-free formulations. US leads in both consumption and stringent quality adherence.

- Europe: High market penetration, particularly in Germany, the UK, and France, supported by clear clean-label preferences and strong regulatory endorsement (EFSA approval). Innovation concentrated on bakery and dairy alternatives.

- Asia Pacific (APAC): Highest projected CAGR, led by manufacturing hubs in China and rapidly growing consumption in India and Southeast Asia due to rising health consciousness and diabetes prevalence.

- Latin America (LATAM): Growth catalyzed by punitive sugar taxes and local health campaigns, driving rapid adoption in the beverage sector (e.g., Mexico and Brazil).

- Middle East & Africa (MEA): Emerging market with increasing adoption linked to urbanization, rising incomes, and the influx of Western health food concepts, primarily focusing on premium diet products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Erythritol Market.- Cargill, Inc.

- Jungbunzlauer Suisse AG

- GLG Life Tech Corp

- Shandong Sanyuan Biotechnology Co., Ltd.

- Baolingbao Biology Co., Ltd.

- Mitsubishi Chemical Corporation

- Cofco Biochemical (Anhui) Co., Ltd.

- Zhucheng Starches Co., Ltd.

- Shandong Futian Pharmaceutical Co., Ltd.

- Tate & Lyle PLC

- Ingredion Incorporated

- ADM (Archer Daniels Midland)

- Now Foods

- Zibo Zhongshi Chemical Co., Ltd.

- Batory Foods

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Shandong Lujian Biological Technology Co., Ltd.

- O-I Foods, Inc.

- Sanxinyuan Biotechnology Co., Ltd.

- PureCircle (a subsidiary of Ingredion)

Frequently Asked Questions

Analyze common user questions about the Food Grade Erythritol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Food Grade Erythritol and why is it preferred over other sweeteners?

Food Grade Erythritol is a polyol (sugar alcohol) naturally produced via the fermentation of glucose, typically from corn starch. It is preferred due to its near-zero calorie count (0.2 kcal/g), zero glycemic index (making it safe for diabetics), superior digestive tolerance compared to xylitol or sorbitol, and high flavor similarity to sucrose, supporting clean-label formulation strategies.

How does the production process for Erythritol impact its cost and market price?

Erythritol production relies on energy-intensive microbial fermentation and subsequent complex purification and crystallization steps. While the raw material (glucose) is relatively inexpensive, the high energy demand for crystallization and technological requirements for maintaining purity drive up the cost, making it generally more expensive than synthetic sweeteners but competitive with high-purity natural sugar alternatives.

Which application segment accounts for the largest share of the Food Grade Erythritol Market?

The Beverage segment consistently holds the largest market share. Erythritol is an essential ingredient in formulating zero-sugar carbonated soft drinks, juices, and functional beverages because it provides necessary bulk and sweetness stability without contributing calories or negatively impacting blood sugar levels, addressing the core consumer demand for healthier drink options.

What role does China play in the global Food Grade Erythritol supply chain?

China is the dominant global supplier and a massive production hub for food grade erythritol. Chinese manufacturers benefit from high production capacity and competitive input costs, enabling them to supply large quantities to global markets, making China critical for maintaining global price stability and accessibility of the ingredient.

What are the key regulatory approvals that validate the safety of Erythritol?

The safety of erythritol is validated by key global regulatory bodies, including the U.S. FDA, which grants it Generally Recognized As Safe (GRAS) status, and the European Food Safety Authority (EFSA), which has thoroughly evaluated its safety, facilitating its widespread adoption and consumer trust across major international food markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager