Food Grade Hoses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434018 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Food Grade Hoses Market Size

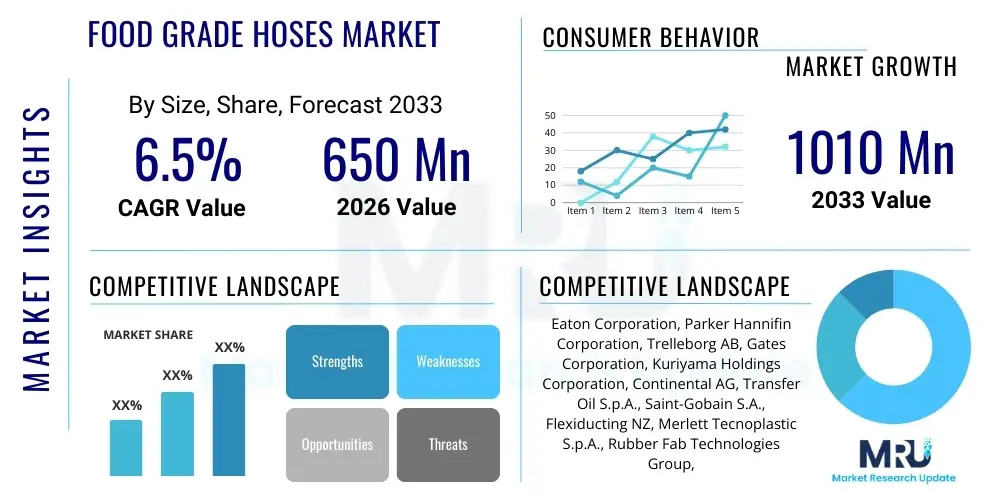

The Food Grade Hoses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1010 Million by the end of the forecast period in 2033.

Food Grade Hoses Market introduction

The Food Grade Hoses Market encompasses the manufacturing and distribution of specialized fluid conveyance systems designed explicitly for transferring liquid and semi-liquid food products, beverages, pharmaceuticals, and cosmetics, ensuring strict adherence to global sanitary and quality standards such as FDA, USDA, and 3-A regulations. These hoses are critical components in processing environments, required to be non-toxic, non-contaminating, and highly resistant to chemical attack from cleaning agents (CIP/SIP processes) as well as the conveyed media, ranging from high-fat dairy products and alcoholic beverages to abrasive sugar syrups and fine powders. The fundamental distinction of food-grade hoses lies in the materials used—primarily high-purity elastomers, silicones, PTFE, and specialized polymer compounds—which prevent leaching of harmful substances into the product stream and facilitate complete hygiene management. This stringent material requirement drives up manufacturing complexity but is essential for maintaining consumer health and regulatory compliance across the food and beverage value chain.

Major applications of these specialized hoses span across various critical stages of food production, including raw material intake, transfer between processing vessels (mixing, heating, cooling), filling and packaging lines, and effluent handling. Key sectors relying heavily on this technology include dairy processing, brewery and winemaking, non-alcoholic beverage production, edible oil handling, and bulk food transfer operations. The adoption rate is significantly influenced by global population growth, rising demand for packaged and processed foods, and the continuous globalization of supply chains, which mandates consistent quality standards regardless of geographic location. Furthermore, the inherent benefits of using certified hoses, such as minimized risk of product recall, reduced downtime due to equipment failure, and optimized sanitation cycles, serve as powerful economic incentives for producers to invest in premium food-grade solutions rather than general industrial alternatives.

Driving factors propelling the expansion of the Food Grade Hoses Market include intensified regulatory scrutiny regarding food safety worldwide, especially concerning allergen control and hygienic design (EHEDG principles). There is a growing trend towards automation and closed-loop processing systems (CIP/SIP), which necessitate hoses capable of withstanding extreme temperatures and pressures associated with aggressive sterilization cycles. Additionally, technological advancements in material science, particularly the development of high-flexibility, anti-kinking, and lightweight hose structures utilizing advanced fluoropolymers and pharmaceutical-grade silicone, are making these products more efficient and easier to handle for operators, thereby enhancing adoption rates across both large-scale multinational corporations and small-to-midsize enterprises (SMEs) focused on high-quality niche products.

Food Grade Hoses Market Executive Summary

The Food Grade Hoses Market demonstrates robust growth driven primarily by structural shifts in global food safety regulations and increasing complexity in processed food manufacturing. Business trends indicate a strong move toward specialized, application-specific hose solutions rather than general-purpose products, reflecting the diverse needs across segments like dairy (high-fat resistance), brewing (odorless, taste-neutral compounds), and pharmaceuticals (extreme purity requirements). Key manufacturers are concentrating R&D efforts on enhancing chemical and abrasion resistance, improving flexibility, and embedding traceability features (e.g., RFID tags) into hose assemblies to facilitate rapid identification during audit and inventory management. This emphasis on smart manufacturing integration and compliance verification is defining the competitive landscape, pushing smaller players to specialize or integrate through M&A activity to maintain relevance against market leaders offering comprehensive product portfolios and global certification capabilities.

Regional trends highlight significant expansion potential in Asia Pacific (APAC), spurred by rapidly industrializing food processing sectors in countries like China, India, and Southeast Asian nations, coupled with increasing consumer awareness regarding packaged food safety standards previously dominated by Western markets. North America and Europe, characterized by highly mature regulatory frameworks (FDA, EFSA), continue to drive demand for premium, high-performance materials, focusing heavily on sustainability and reduction of plasticizers. Europe, in particular, exhibits strong growth in pharmaceutical and biotechnology applications requiring highly sophisticated validation protocols for hose integrity. Manufacturers are strategically expanding production capacity within APAC to meet localized demand and navigate complex regional certification requirements, signaling a shift in global manufacturing footprint towards high-growth areas while maintaining stringent quality control dictated by international compliance standards.

Segmentation trends reveal that the silicone material segment is poised for the fastest growth, largely due to its superior temperature tolerance, excellent flexibility, and inert nature, making it ideal for pharmaceutical, dairy, and high-temperature CIP applications. PTFE (Polytetrafluoroethylene) lined hoses also hold a crucial position, especially in acidic, abrasive, or extremely high-purity applications where chemical resistance is paramount. By type, the reinforced hoses segment—incorporating textile braids, wire helix, or synthetic yarn—dominates the market size, providing the necessary pressure resistance and structural integrity for demanding industrial environments. Furthermore, the beverage segment continues to be a major revenue contributor, driven by the expansion of craft brewing, distilled spirits production, and the massive scale of non-alcoholic beverage bottling operations globally, all requiring specialized taste and odor-neutral transfer solutions.

AI Impact Analysis on Food Grade Hoses Market

User inquiries regarding AI's influence on the Food Grade Hoses Market typically revolve around optimizing manufacturing efficiency, enhancing predictive maintenance capabilities, and ensuring automated compliance verification. Users are keenly interested in how machine learning algorithms can analyze data streams from embedded sensors—monitoring pressure, temperature, flow rates, and vibration—to predict the end-of-life of a hose assembly before catastrophic failure occurs, thereby drastically reducing unplanned downtime and mitigating product contamination risks. Concerns also surface regarding the integration cost and the necessary data infrastructure required to leverage AI in traditional manufacturing settings. The consensus expectation is that AI will revolutionize quality control by automating visual inspection processes for surface integrity, identifying microscopic flaws, and ensuring perfect coupling alignment during assembly, thus elevating overall product reliability above current industry standards, especially concerning traceability and batch quality assurance.

- AI-powered predictive maintenance models analyzing real-time operational metrics (e.g., thermal mapping, stress cycles) to forecast hose failure and optimize replacement schedules.

- Implementation of deep learning algorithms for automated visual inspection of inner and outer hose surfaces, detecting minute defects that manual inspection misses, ensuring hygienic integrity.

- Optimization of complex polymerization and curing processes during manufacturing using AI to ensure material consistency, chemical resistance, and uniformity in critical layers.

- Enhanced supply chain management through AI, predicting material demand fluctuations, optimizing raw material procurement (e.g., high-purity polymers), and reducing inventory holding costs.

- Automated compliance reporting systems leveraging AI to cross-reference usage data (CIP cycles, temperatures, duration) against regulatory limits (FDA, 3-A) for faster audit trails and simplified validation.

- Integration of AI-driven robotics in handling and assembling heavy or complex reinforced hose structures, improving manufacturing precision and worker safety.

DRO & Impact Forces Of Food Grade Hoses Market

The Food Grade Hoses Market is subject to a complex interplay of Drivers, Restraints, and Opportunities, collectively forming potent Impact Forces that dictate market dynamics. Primary drivers are rooted in the rigorous enforcement of global food safety standards, particularly the FDA’s Food Safety Modernization Act (FSMA) in the US and equivalent directives in Europe and Asia, compelling processors to upgrade all fluid contact equipment, including hoses, to certified sanitary grades. This regulatory environment is synergistically supported by a global consumer demand for high-quality, traceable, and safe food products, which translates into increased investment by manufacturers in hygienic infrastructure. Simultaneously, the accelerating growth of specialized sectors like high-purity chemicals and biopharma, which require hoses meeting even stricter purity standards than standard food applications, provides significant upward momentum for technological innovation and market valuation. These combined drivers create a persistent need for high-performance, validated fluid transfer solutions across the processing spectrum.

Restraints largely center on the high initial capital investment associated with premium, certified food-grade hoses, particularly those incorporating advanced materials like PTFE or platinum-cured silicone, which can deter smaller or budget-constrained food processing operations. Furthermore, the complexities surrounding standardization across diverse international regulatory bodies—while 3-A standards are widely recognized, regional nuances exist—can create logistical challenges for global suppliers. A critical operational restraint is the finite lifespan of hoses, which must be regularly replaced due to mechanical stress, degradation from aggressive CIP/SIP chemicals, or physical abrasion, contributing to high maintenance expenditure for end-users. The market also faces competition from robust, non-certified industrial hoses in developing regions where regulatory oversight is less stringent, occasionally hindering the adoption of certified solutions.

Opportunities are predominantly emerging through the development of highly specialized composite materials that offer lighter weight, greater flexibility, and extended service life, such as novel thermoplastic elastomers (TPEs) that bridge the cost gap between rubber and silicone while maintaining superior chemical resistance. The expanding focus on sustainable manufacturing presents an opportunity for manufacturers developing recyclable or biodegradable food-grade materials, appealing to environmentally conscious companies and aligning with corporate sustainability goals. Furthermore, the proliferation of digital integration, specifically embedding sensors and connectivity features (Internet of Things or IoT) into hose assemblies for condition monitoring and traceability, represents a major avenue for value creation, allowing manufacturers to offer sophisticated asset management services alongside the physical product. These impact forces collectively push the market toward higher performance, stricter compliance, and enhanced data integration.

Segmentation Analysis

The Food Grade Hoses Market is meticulously segmented based on Material Type, Media Type, Structure Type, and End-use Application, allowing manufacturers to address highly specific requirements for purity, pressure handling, and chemical compatibility. Material innovation remains pivotal, with silicone and PTFE representing the high-end, while rubber (primarily EPDM and Nitrile) and PVC cater to bulk and cost-sensitive applications. Structure segmentation highlights the critical need for robust, reinforced assemblies, essential for maintaining integrity under continuous high-pressure pumping and aggressive thermal cycling during sterilization. The segmentation by end-use application underscores the market’s reliance on the beverage and dairy industries, where sanitation and material inertness are non-negotiable prerequisites for operational success.

- By Material Type:

- Silicone

- PTFE (Polytetrafluoroethylene)

- Rubber (EPDM, Nitrile, Butyl)

- PVC (Polyvinyl Chloride)

- Thermoplastic Elastomers (TPE)

- By Media Type:

- Dry/Bulk Transfer (Powders, Granulates)

- Liquid Transfer (Water, Juices, Syrups)

- Viscous/Semi-Liquid Transfer (Dairy, Oils, Pastes)

- Alcohol/Beverage Transfer (Beer, Wine, Spirits)

- By Structure Type:

- Reinforced Hoses (Wire or Textile Braided)

- Non-Reinforced Hoses (Suction and Delivery)

- By End-use Application:

- Dairy Processing

- Beverage Processing (Alcoholic and Non-Alcoholic)

- Food Processing (Meat, Fruits, Vegetables, Confectionery)

- Pharmaceutical and Biotechnology

- Cosmetics and Personal Care

Value Chain Analysis For Food Grade Hoses Market

The Food Grade Hoses value chain begins with specialized upstream suppliers who provide high-purity raw materials crucial for non-toxic and compliant manufacturing. This includes highly specialized chemical companies supplying pharmaceutical-grade elastomers (e.g., platinum-cured silicone), fluoropolymers (PTFE), and specific chemical compounds for rubber formulation (Nitrile, EPDM) that meet FDA contact requirements. Upstream processes are characterized by rigorous quality control and batch testing, as the performance and compliance of the final hose product are entirely dependent on the purity and consistency of these primary materials. Manufacturers often secure long-term contracts with certified material providers to ensure supply chain stability and material traceability, which is non-negotiable for 3-A compliance. Innovation at this stage focuses on developing new materials that offer improved flexibility, higher temperature tolerance, and better resistance to highly concentrated CIP cleaning solutions without compromising product safety.

The core manufacturing stage involves extrusion, braiding, winding (for helical reinforcement), vulcanization (for rubber), and assembly of specialized fittings and couplings, often utilizing sanitary stainless steel (e.g., 316L). Direct distribution channels involve large global manufacturers selling directly to major multinational food and beverage corporations (e.g., Coca-Cola, Nestlé) or large Engineering, Procurement, and Construction (EPC) firms responsible for setting up new processing plants. These direct relationships facilitate customized product design, technical support, and comprehensive documentation required for regulatory validation. The shift towards highly customized hose assemblies, often cut to exact lengths and fitted with specific end connections (Tri-Clamp, DIN, SMS), further necessitates strong vertical integration or close collaboration between the manufacturer and the end-user engineering teams.

Downstream analysis focuses heavily on the role of specialized industrial distributors, which often serve as the indirect channel, catering primarily to SMEs and providing localized inventory, quick replacement services, and application expertise. These distributors are critical in the aftermarket and maintenance segments, supplying replacement hoses and ensuring the availability of certified spare parts. The end-users—dairy, brewery, and pharma plants—are highly sensitive to downtime, making rapid delivery and accessible local support paramount. The final part of the value chain involves certified third-party testing and calibration services, which regularly audit the hoses in use to ensure ongoing compliance, leakage prevention, and integrity. This downstream service component is increasingly valued, driving manufacturers to offer training and certification programs to their distribution network to maintain quality service standards globally.

Food Grade Hoses Market Potential Customers

The primary customers for food-grade hoses are large-scale food and beverage processors and manufacturers who operate continuous flow production lines where fluid transfer systems are critical to throughput and hygiene. This segment encompasses the major dairy producers requiring specialized hoses for milk, yogurt, and cheese handling; global brewing and winery operations demanding taste-neutral and highly flexible hoses; and non-alcoholic beverage giants needing high-volume, pressure-resistant solutions for water, syrup, and finished product transfer. These customers prioritize compliance (FDA, 3-A), longevity under harsh CIP/SIP regimens, and material inertness to prevent flavor or color transfer. Procurement decisions in these large organizations are often influenced by total cost of ownership (TCO), favoring premium hoses with extended service life, reducing replacement frequency and associated labor costs.

A rapidly growing customer base includes the pharmaceutical and biotechnology sectors, which demand hoses meeting exceptionally high standards, often referred to as pharmaceutical or bio-grade, surpassing typical food safety requirements. These applications—involving sterile media transfer, fermenter inputs/outputs, and cleanroom operations—require ultra-smooth bore surfaces (often PTFE-lined) for zero particle entrapment, complete traceability, and validated batch consistency. The purchasing criteria here are dominated by validation capabilities, comprehensive documentation (e.g., Certificates of Analysis, Material Safety Data Sheets), and the ability of the hose supplier to support rigorous quality management systems (QMS). The increasing global production of vaccines and biopharmaceuticals is significantly elevating the demand for these specialized, high-purity transfer systems.

Additionally, the market serves numerous niche but critical end-users, including producers of edible oils and fats (requiring hoses resistant to degradation from high lipid content), industrial bakeries handling abrasive flours and granular ingredients, and manufacturers in the cosmetic and personal care industries. Cosmetic producers, particularly those dealing with high-purity creams, lotions, and fragrances, mandate hoses that prevent any leaching or contamination, similar to pharmaceutical standards. For these diverse end-users, the specification of the hose is dictated by the specific viscosity, temperature, and abrasiveness of the media being transferred, requiring suppliers to offer highly diversified product lines ranging from lightweight suction hoses for dry bulk to heavy-duty, jacketed hoses for heated viscous liquids.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1010 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin Corporation, Trelleborg AB, Gates Corporation, Kuriyama Holdings Corporation, Continental AG, Transfer Oil S.p.A., Saint-Gobain S.A., Flexiducting NZ, Merlett Tecnoplastic S.p.A., Rubber Fab Technologies Group, NewAge Industries, Alfagomma, Reinflex, Peraflex Hose, Swagelok Company, Texcel Inc., Hoses UK. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Hoses Market Key Technology Landscape

The technological landscape of the Food Grade Hoses Market is dominated by advancements in material science and specialized manufacturing techniques designed to meet increasing demands for hygiene, durability, and operational efficiency. A core technology involves the development of proprietary compounds of high-ppurity elastomers, particularly in platinum-cured silicone and specialized EPDM grades, which provide superior flexibility and exceptional resistance to extreme temperatures (both hot and cold) encountered during processing and aggressive steam sterilization (SIP). The application of smooth-bore, corrugated, or convoluted PTFE liners is another foundational technology, essential for products requiring absolute chemical inertness and easy, complete cleanability, minimizing the risk of bacterial harboring and cross-contamination. Furthermore, composite construction techniques, including the use of multi-ply textile reinforcement and embedded high-tensile wire helixes, are critical for maintaining structural integrity under high working pressures and vacuum conditions, preventing kinking and collapse during high-flow transfer operations.

A significant area of innovation lies in coupling and connection technology, which is intrinsically linked to the hygienic performance of the entire assembly. Manufacturers are increasingly utilizing crimping technology that ensures a seamless, gap-free transition between the hose liner and the sanitary end fitting (e.g., crimp collars and permanently attached sanitary fittings) to eliminate dead zones where bacteria can proliferate. This reliance on permanent fittings, often made from certified 316L stainless steel, is superseding older, clamped connections in critical applications, enhancing operational safety and streamlining compliance checks. Another emerging technology involves advanced non-destructive testing methods, such as ultrasonic or pressure decay testing, used during both manufacturing and in-service maintenance to verify the integrity of the inner liner and detect pinholes or micro-cracks before they lead to product contamination or line failure, thereby extending the safe service interval.

The integration of digital technology is rapidly transforming the market, driven by the demand for enhanced traceability and predictive maintenance (Condition Monitoring). Modern food-grade hose assemblies are increasingly incorporating passive or active identification technologies, such as embedded RFID tags or specialized QR codes, allowing processing plants to log usage data, sterilization cycles, and pressure history directly into plant management systems (MES/SCADA). This technological integration facilitates automated asset tracking, streamlines compliance audits by providing immediate historical data, and is foundational for future AI-driven predictive failure analysis. Furthermore, manufacturers are investing in specialized cleanroom manufacturing environments for ultra-high-purity hoses (especially for pharma/bio applications) to prevent external particulate contamination during the assembly process, demonstrating a commitment to advanced cleanliness standards beyond conventional industrial practices.

Regional Highlights

The global Food Grade Hoses Market exhibits distinct consumption and growth patterns across major geographic regions, primarily influenced by local regulatory stringency, maturity of the food and beverage sector, and investment in pharmaceutical manufacturing capabilities.

- North America (NA): Characterized by the presence of large multinational food and beverage corporations and extremely rigorous regulatory oversight (FDA, USDA, 3-A Sanitary Standards). This region is a major consumer of high-performance and premium hoses, particularly silicone and PTFE, driven by a strong focus on automation (CIP/SIP) and minimizing product recall risks. The US and Canada are pioneers in adopting smart hose assemblies with traceability features.

- Europe: Exhibits high demand, fueled by stringent standards set by the European Food Safety Authority (EFSA) and strong growth in the craft brewing, dairy, and biotechnology sectors. Germany, France, and the UK are key markets, prioritizing sustainability, high-purity materials, and hoses compliant with EHEDG (European Hygienic Engineering & Design Group) guidelines for ease of cleaning.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to rapid urbanization, increasing per capita income, and the massive scale-up of modern, industrialized food processing facilities, particularly in China and India. While price sensitivity remains a factor, regulatory harmonization and rising consumer demand for packaged food safety are pushing adoption towards certified food-grade hoses, moving away from cheaper, non-compliant alternatives.

- Latin America (LATAM): Growth is steady, primarily driven by exports of agricultural and processed food products, requiring compliance with US and European import standards. Brazil and Mexico are primary markets, balancing cost considerations with the need for reliable, high-volume transfer hoses in beverage and meat processing.

- Middle East and Africa (MEA): Represents a nascent but growing market, propelled by investments in local food security, establishment of modern dairy and bottling plants, and government initiatives to improve local food safety infrastructure. Demand is concentrated in the Gulf Cooperation Council (GCC) countries, focusing on robust hoses capable of handling high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Hoses Market.- Eaton Corporation

- Parker Hannifin Corporation

- Trelleborg AB

- Gates Corporation

- Kuriyama Holdings Corporation

- Continental AG

- Transfer Oil S.p.A.

- Saint-Gobain S.A.

- Flexiducting NZ

- Merlett Tecnoplastic S.p.A.

- Rubber Fab Technologies Group

- NewAge Industries

- Alfagomma

- Reinflex

- Peraflex Hose

- Swagelok Company

- Texcel Inc.

- Hoses UK

- Holmbury Inc.

- PIRTEK USA

Frequently Asked Questions

Analyze common user questions about the Food Grade Hoses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory standards governing food-grade hoses globally?

The key governing standards include the US Food and Drug Administration (FDA) regulations (specifically 21 CFR 177.2600 for rubber and 21 CFR 177.1550 for PTFE), the 3-A Sanitary Standards (crucial for dairy and sanitary applications), and European regulations (such as Regulation 1935/2004/EC). Compliance with these standards ensures the hose materials are non-toxic and suitable for direct food contact.

Why are silicone and PTFE materials preferred over traditional rubber in critical food processing applications?

Silicone and PTFE (Polytetrafluoroethylene) are preferred for critical applications due to their superior chemical inertness, excellent temperature resistance (making them ideal for CIP/SIP sterilization), and ultra-smooth non-porous surfaces. PTFE offers the highest level of chemical resistance and zero contamination risk, while silicone provides superior flexibility and thermal stability, crucial properties that minimize product absorption and bacterial growth.

What is the typical lifespan of a food-grade hose, and how is it monitored?

The lifespan varies significantly (typically 1 to 5 years) based on media type, operating pressure, temperature cycling (CIP/SIP frequency), and handling abuse. Monitoring is critical and involves visual inspection for kinking or cracking, pressure testing, and increasingly, using asset management systems integrated with embedded RFID tags to track the total number of sterilization cycles and operational hours, enabling proactive replacement before failure.

How does the adoption of Clean-in-Place (CIP) technology affect the demand for food-grade hoses?

CIP technology drastically increases the demand for high-performance hoses capable of withstanding aggressive chemicals (acids, alkalis) and high thermal shock associated with repeated sterilization cycles. This necessity drives the market towards premium materials like EPDM, silicone, and PTFE, which maintain structural integrity and liner purity under prolonged exposure to harsh cleaning environments, ensuring operational longevity and safety.

What are the latest technological trends in food-grade hose manufacturing?

Key technological trends include the integration of IoT and RFID for enhanced traceability and predictive maintenance, the use of advanced thermoplastic elastomers (TPEs) for lighter weight and cost-effective alternatives, and innovations in coupling technology (permanent crimped sanitary fittings) to eliminate leak points and bacterial entrapment, aligning with strict hygienic design principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager