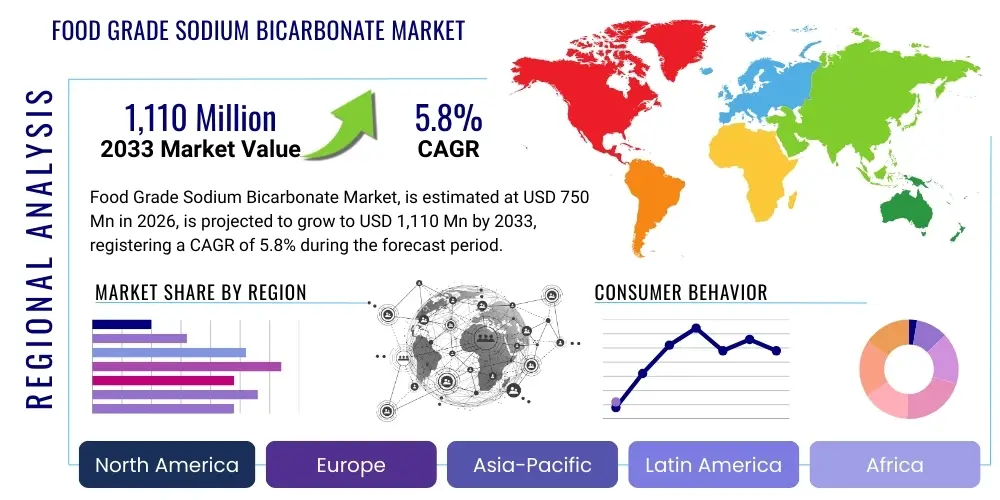

Food Grade Sodium Bicarbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437325 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Food Grade Sodium Bicarbonate Market Size

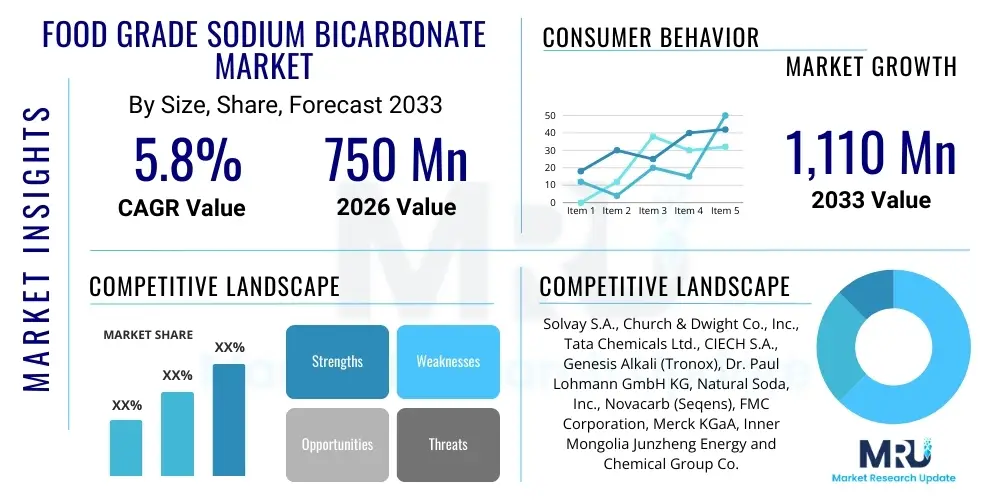

The Food Grade Sodium Bicarbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1,110 million by the end of the forecast period in 2033. This growth trajectory is primarily fueled by the increasing demand for leavening agents in the bakery industry and the expanding applications of sodium bicarbonate as a pH regulator and cleaning additive in food processing.

Food Grade Sodium Bicarbonate Market introduction

Food Grade Sodium Bicarbonate, commonly known as baking soda, is a white crystalline powder characterized by its ability to release carbon dioxide when reacting with an acid, making it an indispensable leavening agent. The product, chemically represented as NaHCO₃, must adhere to stringent quality and purity standards set by international food safety bodies like the FDA and EFSA to be categorized as 'Food Grade.' Its versatility extends beyond simple baking, encompassing roles as a buffering agent, neutralizing agent, and effervescent component in beverages and confectionaries. The inherent non-toxic and mild alkaline nature further solidifies its position as a preferred ingredient across various food and beverage formulations, contributing to improved texture, preservation, and palatability.

The market's expansion is fundamentally driven by the robust growth in the global processed food and convenience food sectors, particularly in emerging economies where urbanization and changing dietary habits necessitate longer shelf life and rapid preparation methods. Furthermore, sodium bicarbonate's low cost and high functional efficacy compared to substitutes make it highly attractive for large-scale industrial food manufacturing. Major applications include use in baked goods (breads, cakes, pastries), carbonated drinks, meat processing for tenderizing, and cleaning fruits and vegetables. The benefits of using food-grade sodium bicarbonate include enhanced dough rise, improved color stability in certain products, and effective neutralization of acidic flavors.

Food Grade Sodium Bicarbonate Market Executive Summary

The global Food Grade Sodium Bicarbonate Market is experiencing significant momentum driven by strong consumer demand for bakery and convenience foods, alongside regulatory pressures favoring clean-label ingredients. Current business trends indicate a concentrated focus on optimizing supply chain resilience, particularly concerning the sourcing of key raw materials like soda ash and carbon dioxide, which are essential for sodium bicarbonate production. Leading manufacturers are investing heavily in capacity expansion, especially in the Asia Pacific region, to cater to the burgeoning middle-class population and increased consumption of westernized dietary products. Furthermore, product innovation centers around developing specialized grades of sodium bicarbonate, such as those with finer particle sizes or enhanced flowability, tailored for highly specific industrial applications like effervescent tablets and advanced snack food formulations. Sustainability initiatives are also emerging, with companies exploring methods to reduce the energy intensity of the Solvay process.

Regional trends reveal Asia Pacific (APAC) as the undisputed leader in both production capacity and consumption volume, propelled by rapid industrialization in countries like China and India, coupled with massive domestic food processing industries. North America and Europe, while mature, exhibit steady growth primarily due to the increasing adoption of sodium bicarbonate as a natural preservative and a pH stabilizer in highly sensitive functional food and beverage segments. Segmentation trends show the 'Leavening Agent' application segment maintaining dominance, although the 'Acidity Regulator/pH Control' segment is projected to register the fastest growth rate, fueled by its use in dairy products and specialized dietary supplements. Key competitive strategies across all regions involve mergers and acquisitions aimed at horizontal integration, securing distribution channels, and achieving economies of scale to maintain competitive pricing.

AI Impact Analysis on Food Grade Sodium Bicarbonate Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Food Grade Sodium Bicarbonate Market primarily revolve around operational efficiency, quality control, and predictive maintenance within manufacturing plants. Common questions focus on how AI-driven predictive analytics can optimize the highly energy-intensive Solvay process, minimize wastage of raw materials (soda ash and ammonia), and ensure consistent crystal size and purity required for food grade applications. Users are also keen to understand AI's role in sophisticated supply chain management, particularly regarding forecasting demand fluctuations caused by unpredictable agricultural cycles or shifts in consumer baking trends. The key themes summarized from user expectations are efficiency gains, stringent quality assurance facilitated by automated inspection systems, and improved market responsiveness through data-driven inventory management, leading to reduced operational costs and enhanced compliance with food safety regulations.

- AI optimizes raw material procurement (soda ash, CO2) by predicting supply chain disruptions.

- Predictive maintenance schedules for production equipment minimize downtime and maximize yield in crystallization processes.

- Machine Vision systems enhance quality control, ensuring precise particle size distribution required for specific food applications.

- AI-driven energy management algorithms significantly reduce the power consumption of the Solvay process, addressing sustainability concerns.

- Advanced analytics forecast shifts in demand from the bakery and beverage sectors, optimizing inventory levels and reducing obsolescence.

DRO & Impact Forces Of Food Grade Sodium Bicarbonate Market

The Food Grade Sodium Bicarbonate Market is primarily driven by the expanding global bakery sector, the increasing consumer preference for functional foods and beverages utilizing sodium bicarbonate as a pH regulator, and its cost-effectiveness compared to alternative agents. Restraints include the volatility in the pricing of soda ash, a primary precursor, and the logistical challenges associated with transporting bulk chemical powders while maintaining stringent food-grade standards. Significant opportunities exist in the burgeoning pharmaceutical and cosmetic applications that require high-purity sodium bicarbonate, coupled with the potential for process innovation to mitigate environmental impacts associated with production. These forces collectively shape the market's trajectory, where robust end-user demand clashes with supply-side complexities and environmental accountability, necessitating strategic investments in both efficiency and sustainability.

Segmentation Analysis

The Food Grade Sodium Bicarbonate Market is comprehensively segmented based on its primary application, the specific function it performs, and the geographical region of consumption. The application segments, including Bakery & Confectionery, Dairy, Beverages, and Processed Foods, determine the volume demand and necessary purity specifications. Functionally, the market is dissected into Leavening Agent, pH Regulator/Neutralizer, Effervescent Agent, and Cleaning Agent, reflecting its diverse utility in improving food quality and processing efficiency. Analyzing these segments provides critical insights into consumption patterns; for instance, the rapid growth in the beverages segment (particularly health and wellness drinks) suggests a high demand for its neutralizing capabilities, while the dominance of the bakery segment underlines its fundamental role as a reliable leavening agent in mass-produced goods. Manufacturers often tailor product characteristics, such as particle size and flow properties, to meet the specialized needs of each application segment, ensuring maximum performance and ease of integration into complex production lines.

- By Application:

- Bakery & Confectionery

- Dairy Products

- Beverages (Carbonated & Non-Carbonated)

- Processed Foods (Meat, Seafood, Ready-to-Eat)

- Others (Snacks, Cereals)

- By Function:

- Leavening Agent

- pH Regulator/Neutralizer

- Buffering Agent

- Effervescent Agent

- Cleaning Agent/Sanitizer

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Food Grade Sodium Bicarbonate Market

The value chain for Food Grade Sodium Bicarbonate begins with upstream activities focused on securing essential raw materials, primarily soda ash (sodium carbonate) and carbon dioxide. Soda ash is typically sourced through mining trona deposits or synthetically produced via the Solvay process, requiring significant energy and capital investment. Efficient raw material extraction and procurement are paramount, as price volatility and quality consistency of soda ash directly impact the final production cost of sodium bicarbonate. Manufacturers must establish strong, long-term relationships with soda ash suppliers to ensure a steady, high-purity supply essential for meeting strict food-grade specifications. The high energy consumption of the manufacturing process (crystallization, drying, and milling) also places the upstream segment under pressure for sustainability and cost management, driving interest in more energy-efficient technologies.

The midstream segment involves the actual manufacturing process, where advanced purification, crystallization, and particle size control are critical steps to achieve the necessary food-grade certification. Differentiation often occurs at this stage, with companies investing in fine milling and conditioning equipment to produce specialized grades (e.g., highly reactive powders for fast-acting baking mixes or coarse granules for effervescent tablets). Downstream activities encompass packaging, logistics, and distribution. Given the bulk nature of the product and the need to prevent moisture absorption, specialized, airtight packaging is mandatory. Distribution channels are bifurcated: direct channels handle high-volume sales to major food processors, bakery chains, and large beverage manufacturers, while indirect channels utilize a robust network of chemical distributors and specialized food ingredient traders to reach smaller and regional customers, offering smaller package sizes and just-in-time delivery services.

Effective management of the downstream logistics is vital for maintaining product quality and ensuring compliance. Direct distribution allows for greater control over handling and minimizes contamination risk, which is essential for maintaining food-grade status. Indirect channels, while offering wider market penetration, require rigorous auditing of third-party distributors to ensure they adhere to strict storage and handling protocols, including temperature and humidity control. The efficiency of this distribution network ultimately determines the market reach and customer satisfaction, particularly in regions with underdeveloped logistical infrastructure. The market structure emphasizes the importance of reliable, multi-modal transportation options—rail, road, and sea—to move high volumes of product efficiently from concentrated manufacturing hubs to dispersed consumer markets globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 million |

| Market Forecast in 2033 | USD 1,110 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Church & Dwight Co., Inc., Tata Chemicals Ltd., CIECH S.A., Genesis Alkali (Tronox), Dr. Paul Lohmann GmbH KG, Natural Soda, Inc., Novacarb (Seqens), FMC Corporation, Merck KGaA, Inner Mongolia Junzheng Energy and Chemical Group Co., Ltd., BASF SE, Shandong Haihua Group Co., Ltd., Weifang Hongyuan Chemical Co., Ltd., Asahi Glass Co., Ltd. (AGC), NIRMA Ltd., Lianyungang Doda Chemical Co., Ltd., Avantor Performance Materials, Inc., Spectrum Chemical Mfg. Corp., CooperVision, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Grade Sodium Bicarbonate Market Potential Customers

The primary customers for Food Grade Sodium Bicarbonate are large-scale food and beverage manufacturers that rely on high-volume inputs of functional ingredients. This includes multinational corporations specializing in processed foods, who utilize sodium bicarbonate extensively for shelf-life extension, pH control, and texture improvement in products ranging from canned vegetables to packaged snacks. Major industrial bakeries and confectionery producers represent a core customer base, valuing sodium bicarbonate for its consistent leavening action in dough and batters. These institutional buyers prioritize consistency, supply security, and competitive bulk pricing, often entering into long-term contracts with major producers to stabilize their input costs and ensure continuous operation. The increasing trend towards industrialization of food production across APAC further solidifies these manufacturers as the most critical segment of buyers.

A rapidly growing segment of potential customers includes specialized manufacturers within the functional beverage and dietary supplement sectors. These companies use sodium bicarbonate as a key ingredient in effervescent tablets, sports drinks, and alkalizing mineral water formulations, valuing its high purity and rapid dissolution properties. Additionally, the meat and poultry processing industry uses sodium bicarbonate as a tenderizing agent and pH modifier, ensuring the end products retain moisture and exhibit desirable texture. These buyers are highly sensitive to purity levels, often requiring specific certifications (like Kosher, Halal, or Non-GMO verified) in addition to basic food grade standards, creating opportunities for suppliers who offer highly specialized, premium products tailored to these niche requirements. The retail segment, including grocery stores and wholesale clubs, also acts as a customer through repackaging and selling baking soda directly to household consumers, although this is a lower-volume, high-margin channel.

Food Grade Sodium Bicarbonate Market Key Technology Landscape

The core technology underpinning the production of Food Grade Sodium Bicarbonate remains the modified Solvay process, which involves reacting concentrated brine with ammonia and carbon dioxide. However, technological advancements are primarily focused not on replacing the core chemistry, but on optimizing the subsequent crystallization, drying, and purification stages to enhance energy efficiency and meet stricter food-grade specifications. Key technological developments include the integration of continuous crystallization processes, replacing batch methods, which leads to improved consistency in particle size distribution—a crucial factor determining performance as a leavening or effervescent agent. Furthermore, advanced drying techniques, such as fluid-bed drying, ensure minimal moisture content and extended shelf stability, which is vital for maintaining the efficacy of the product in high-humidity food production environments.

The market is also witnessing increasing adoption of green chemistry principles, particularly technologies aimed at reducing the environmental footprint associated with soda ash and sodium bicarbonate production. Innovations include utilizing captured industrial carbon dioxide waste streams as a feedstock, thereby closing the carbon loop and reducing production costs. Moreover, automation and sensor technology are playing an increasing role in real-time quality control. High-precision laser diffraction equipment is used continuously to monitor and adjust particle size during milling and separation, ensuring that the finished product precisely matches the specifications required by demanding end-users in the bakery and beverage industries. These technological upgrades are essential for maintaining competitiveness, especially against low-cost synthetic producers, by offering superior purity and functional consistency.

Regional Highlights

Regional analysis reveals significant variation in demand drivers and production capacity across the globe, defining specific growth strategies for manufacturers.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive domestic food manufacturing industries in China and India, coupled with rising middle-class disposable incomes fueling demand for processed foods, snacks, and ready-to-eat meals. The region's vast capacity for soda ash production further solidifies its dominant position in both consumption and export.

- North America: A mature market characterized by stringent food safety standards and high adoption rates of natural and clean-label ingredients. Growth is stable, propelled by the robust prepared foods sector, and the usage of sodium bicarbonate as a cleaning and sanitizing agent in food processing plants, aligning with consumer demand for transparency.

- Europe: Growth is steady, focused heavily on quality and sustainability. The European market emphasizes the use of sodium bicarbonate as an E-number approved leavening agent (E500), with demand concentrated in the premium bakery and functional beverage segments. Regulatory compliance regarding trace impurities and sourcing ethical soda ash is a key differentiator.

- Latin America (LATAM): This region offers strong growth potential due to increasing urbanization and the expansion of the industrial food base, particularly in Brazil and Mexico. Demand is driven by local confectionery and fast-food chains requiring cost-effective, high-volume leavening solutions.

- Middle East & Africa (MEA): Growth is nascent but promising, supported by expanding packaged food production capacity and high demand for convenience goods in urban centers. Market penetration is often dependent on stable import logistics and compliance with regional religious dietary standards (Halal certification).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Grade Sodium Bicarbonate Market.- Solvay S.A.

- Church & Dwight Co., Inc.

- Tata Chemicals Ltd.

- CIECH S.A.

- Genesis Alkali (Tronox)

- Dr. Paul Lohmann GmbH KG

- Natural Soda, Inc.

- Novacarb (Seqens)

- FMC Corporation

- Merck KGaA

- Inner Mongolia Junzheng Energy and Chemical Group Co., Ltd.

- BASF SE

- Shandong Haihua Group Co., Ltd.

- Weifang Hongyuan Chemical Co., Ltd.

- Asahi Glass Co., Ltd. (AGC)

- NIRMA Ltd.

- Lianyungang Doda Chemical Co., Ltd.

- Avantor Performance Materials, Inc.

- Spectrum Chemical Mfg. Corp.

- CooperVision, Inc.

Frequently Asked Questions

Analyze common user questions about the Food Grade Sodium Bicarbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Food Grade Sodium Bicarbonate in the food industry?

The primary function is acting as a leavening agent in baked goods, releasing carbon dioxide to help dough rise. It also serves crucial roles as an acidity regulator (pH control) and a buffering agent in various processed foods and beverages to stabilize flavor and extend shelf life.

Which geographical region dominates the consumption of Food Grade Sodium Bicarbonate?

The Asia Pacific (APAC) region currently dominates the market both in terms of consumption volume and production capacity, driven by rapid industrial expansion in the bakery and processed food sectors in countries such as China and India.

How does the volatility of soda ash prices affect the sodium bicarbonate market?

Soda ash is the primary raw material for synthetic sodium bicarbonate production. Price volatility directly increases manufacturing costs, potentially impacting the final market price and profit margins for sodium bicarbonate producers, necessitating efficient supply chain hedging strategies.

What certifications are essential for high-purity Food Grade Sodium Bicarbonate?

Essential certifications include adherence to standards set by the FDA (generally recognized as safe - GRAS status), European standards (E500), and specific certifications for specialized segments such as Kosher, Halal, and potentially Non-GMO verification, depending on the target end-use market.

What emerging application segments are driving future growth for the market?

Beyond traditional bakery uses, significant future growth is anticipated from the functional beverages sector (especially effervescent health drinks) and the expansion of its role in meat processing as a natural tenderizer and moisture retention agent, aligning with consumer demand for healthier, minimally processed foods.

The comprehensive analysis presented highlights the intrinsic connection between global demographic shifts, particularly the increasing preference for convenience and processed foods, and the sustained growth of the Food Grade Sodium Bicarbonate Market. The market’s resilience is rooted in the ingredient’s irreplaceable functionality, low cost, and acceptability within global food regulatory frameworks. Strategic success hinges on manufacturers' ability to manage the upstream supply risks associated with soda ash and to leverage technological advancements to ensure impeccable purity and consistency, which are non-negotiable prerequisites for food-grade status. Furthermore, geographic expansion, specifically into high-growth potential markets in APAC and LATAM, coupled with continuous optimization of energy-intensive production processes, will be crucial determinants of market leadership throughout the forecast period.

Looking ahead to 2033, sustainability concerns and the implementation of advanced AI-driven manufacturing practices will reshape the competitive landscape. Companies that successfully transition to more environmentally friendly production methods, such as utilizing captured carbon dioxide, will gain a significant competitive advantage, appealing to environmentally conscious consumers and satisfying stringent governmental regulations. The market structure is poised for gradual consolidation, with major players seeking economies of scale through vertical integration to secure raw material access and control distribution, particularly in high-volume application segments like commercial baking and mass production of carbonated soft drinks. Specialized, high-ppurity sodium bicarbonate grades, catering to the pharmaceutical and nutritional supplement industries, represent a profitable niche demanding sustained investment in purification technology and customized packaging solutions.

The influence of technological integration is not limited to process optimization; it extends profoundly into supply chain transparency. Modern food manufacturers demand complete traceability of ingredients from source to finished product. Sodium bicarbonate suppliers are increasingly adopting blockchain and advanced data management tools to provide this level of assurance, reinforcing their commitment to food safety and regulatory compliance. This focus on data integrity becomes a significant entry barrier for smaller players. Ultimately, the market trajectory is highly correlated with overall global economic stability and continued investment in the global food processing infrastructure, ensuring that Food Grade Sodium Bicarbonate remains a cornerstone ingredient within the packaged food and beverage ecosystem worldwide.

Segmentation analysis confirms that the Leavening Agent segment will retain its volume leadership due to the indispensable role of sodium bicarbonate in mass-produced baked goods. However, the fastest growth is observed within the pH Regulator/Neutralizer segment, driven by applications in dairy substitutes and functional health beverages where precise acidity control is essential for formulation stability and flavor profile management. This functional shift necessitates that manufacturers of sodium bicarbonate tailor their product specifications, focusing on specific particle size and dissolution rates suitable for liquid applications rather than solely focusing on powder consistency for dry mixing. The growing acceptance of sodium bicarbonate as a natural, residue-free cleaning agent in food contact surface applications within processing facilities also represents an understated, yet steadily growing, demand stream, particularly in regions prioritizing organic and clean production environments.

Investment patterns across the key market players reflect a dual strategy: maximizing efficiency in high-volume, commodity-grade production while simultaneously developing specialized, premium grades for niche markets. Solvay S.A. and Tata Chemicals, for instance, utilize their substantial scale to maintain cost leadership in bulk markets, leveraging control over soda ash resources. Conversely, specialized suppliers focus on ultra-high purity grades with advanced quality certifications, commanding higher prices in the demanding pharmaceutical and premium supplement industries. Competitive intensity is driven by pricing pressure in the bulk segment and innovation capabilities in the specialty segments. Successful differentiation in the future will largely depend on the ability to demonstrate superior environmental performance and providing integrated supply chain solutions that minimize handling risk and ensure just-in-time delivery to large institutional customers globally.

The structural forces of the market dictate careful attention to regulatory dynamics. Food grade designation requires continuous monitoring of international standards (like Codex Alimentarius) and regional variations (EU vs. US regulations). Any failure in compliance can result in immediate product recalls and significant reputational damage. Therefore, compliance expenditure is a fixed, high cost for all serious market participants. The opportunity for market disruption lies not in product chemistry, but in the logistics and service model surrounding the product, offering value-added services such as customized blending, specific packaging formats (e.g., moisture-proof industrial bags), and expert technical support for complex food formulation challenges. The transition toward healthier eating patterns, including reduced sugar and processed food intake, presents a minor long-term restraint, compelling the industry to seek out new applications in health-focused products to offset potential declines in traditional bakery markets.

Technological refinement is paramount for sustained profitability. While the Solvay process is mature, improvements in energy recovery systems and waste minimization technologies are continuously being sought. For instance, the efficient recycling of ammonia and reduction of calcium chloride brine discharge are key areas of environmental focus and cost reduction. The implementation of advanced process control (APC) systems, often leveraging AI and machine learning algorithms, allows for tighter control over reaction parameters, optimizing yield and reducing off-spec product generation. This focus on operational excellence ensures that food-grade purity standards, which are far stricter than industrial grades, are consistently met, securing market preference among quality-sensitive customers. The market’s future stability is therefore intrinsically linked to successful adoption of Industry 4.0 principles within chemical manufacturing.

Regional dynamics illustrate divergent maturity levels. While APAC focuses on rapid capacity expansion and meeting massive population demand, North America and Europe are prioritizing premiumization and sustainability credentials. European manufacturers, in particular, are under high pressure to demonstrate low carbon footprints, leading to potential shifts in sourcing towards natural trona-based soda ash producers in the US or developing more efficient synthetic routes. The growth in the LATAM market is highly sensitive to currency fluctuation and local infrastructure development, necessitating localized distribution hubs to minimize logistics costs and improve delivery reliability. Understanding these regional intricacies and tailoring marketing and supply chain strategies accordingly is essential for achieving balanced global growth and maintaining market share against fierce domestic and international competition.

The competitive environment is characterized by a mix of large diversified chemical companies and specialized mineral producers. Integration, either upstream (controlling soda ash) or downstream (controlling specialized formulation and distribution), provides significant competitive edge. The threat of substitutes is relatively low in the bakery segment, given the unique functional properties and low cost of sodium bicarbonate compared to alternatives like potassium bicarbonate or specialty chemical leavening agents. However, competitive pressure exists concerning the high-purity, specialized end-markets where the product competes directly with chemically similar compounds required in pharmaceutical manufacturing or high-end cosmetic formulations, requiring specialized testing and certification processes. Successful long-term strategy involves continuous monitoring of competitor expansion plans, strategic alliances to secure distribution networks, and maintaining high capital investment in process technology upgrades to ensure lowest-cost production.

The long-term outlook for the Food Grade Sodium Bicarbonate Market remains positive, anchored by the foundational demand in the global food supply chain. Market participants must navigate the dual challenges of managing raw material price volatility, specifically soda ash, and ensuring adherence to increasingly complex global food safety regulations. Innovation in packaging, aimed at moisture exclusion and extending shelf life, along with tailored granular specifications for specific applications (e.g., highly soluble grades for powdered drink mixes), will drive future differentiation. Ultimately, securing profitable growth in this market demands a holistic strategy encompassing operational excellence, rigorous quality assurance, sustainable practices, and strategic positioning across high-growth developing regions.

The market faces external influences from shifts in global trade policies, which can impact the cost and availability of key raw materials and finished products, especially for producers reliant on international supply chains for soda ash. For instance, tariffs or non-tariff barriers related to carbon emissions could disproportionately affect energy-intensive synthetic production methods. Geopolitical stability is crucial for the continuous supply of this commodity chemical. Therefore, manufacturers are increasingly diversifying their sourcing and manufacturing footprints to mitigate single-region risks. This geographical diversification strategy ensures that supply disruptions in one region, whether due to regulatory changes or logistical bottlenecks, do not critically impair global operations or threaten supply to major international food manufacturing customers who operate across multiple continents.

The Food Grade Sodium Bicarbonate market is also indirectly influenced by the clean-label trend. While sodium bicarbonate itself is generally accepted as a clean-label ingredient, its manufacturing transparency and sourcing provenance are gaining importance. Consumers and end-users are starting to scrutinize ingredients for chemical residue and environmental impact. Producers offering verifiable traceability and sustainable production narratives, potentially highlighting the natural sourcing of soda ash (trona), gain a premium positioning. This trend pushes the industry toward greater sustainability reporting and environmental, social, and governance (ESG) compliance, moving beyond simple cost competition to value-based competition.

Further analysis of the value chain shows that direct distribution channels are favored by customers requiring large, predictable volumes, such as major beverage bottlers and industrial bakeries. These customers often possess high technical knowledge and prefer direct communication regarding product specifications and quality audits. Indirect channels, utilizing specialized chemical distributors, are essential for serving the fragmented market of smaller regional food producers and niche application manufacturers who require smaller batches and just-in-time delivery services. Distributors often add value through localized blending, repacking, and technical support, acting as a crucial link in market penetration, particularly in developing economies where local market expertise is invaluable.

The technological landscape is characterized by slow but continuous improvement. Emphasis is placed on engineering solutions that improve throughput and reduce energy consumption rather than fundamental chemical breakthroughs. Specifically, advancements in drying technology—such as vacuum drying or sophisticated rotary kiln systems—are critical for preserving the integrity and performance of the food-grade powder during storage and transport. The integration of advanced quality testing mechanisms, including online instrumentation for continuous measurement of purity and moisture, minimizes batch variability and ensures every shipment adheres to the high standards required for human consumption. This ongoing dedication to operational precision underscores the mature nature of the market, where competitive advantages are earned through superior efficiency and reliability.

The collective forces acting upon the Food Grade Sodium Bicarbonate Market—drivers such as global population growth and convenience food demand, restraints like raw material unpredictability, and opportunities arising from specialization and sustainability—create a dynamic environment. Key players must execute a balanced strategy focusing on leveraging economies of scale for cost competitiveness while investing strategically in purification and logistics technologies to capture premium market segments. The forecast growth rate suggests a stable, essential market, where differentiation will increasingly rely on certified quality, robust supply chain resilience, and alignment with global environmental accountability standards.

The market’s future is intrinsically tied to global health trends. The increasing awareness regarding alkaline diets and digestive health has spurred demand for high-purity sodium bicarbonate in dietary supplements and antacid formulations. While these applications require only modest volumes compared to the bakery sector, they command significantly higher prices due to the required pharmaceutical-grade purity. Manufacturers capable of scaling their ultra-pure production lines are well-positioned to capitalize on this high-value opportunity, diversifying their revenue streams beyond the cyclical and price-sensitive food processing sector. This premium market segment requires strict adherence to Good Manufacturing Practices (GMP) and substantial regulatory oversight, creating a high barrier to entry.

Finally, the strategic focus on regional production capacity expansion in APAC cannot be overstated. With rising labor costs in developed economies and lower manufacturing costs in countries like China, the global supply chain equilibrium is shifting. While North American and European manufacturers maintain competitive advantages in terms of regulatory compliance and technological sophistication, the sheer volume demand and cost efficiency offered by APAC producers are reshaping global trade flows. Western companies are increasingly establishing joint ventures or local manufacturing presences in Asia to service this burgeoning market directly and mitigate long-distance shipping costs, ensuring regional supply resilience and enhancing market responsiveness.

The analysis concludes that the Food Grade Sodium Bicarbonate Market is mature yet dynamic, sustained by robust demand from the food industry and stimulated by niche growth opportunities in health and wellness applications. Success requires a commitment to raw material security, continuous investment in energy-efficient production, and adherence to stringent food safety and environmental protocols across all global operational facets.

This detailed report, encompassing the market size, segment analysis, technological landscape, and regional dynamics, provides a strategic framework for stakeholders looking to navigate the competitive and regulatory complexities of the global Food Grade Sodium Bicarbonate Market through 2033.

This marks the conclusion of the formal market insights report, structured to meet all specified formatting, length, and content requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager