Food Ingredients Sterilization Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435842 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Food Ingredients Sterilization Market Size

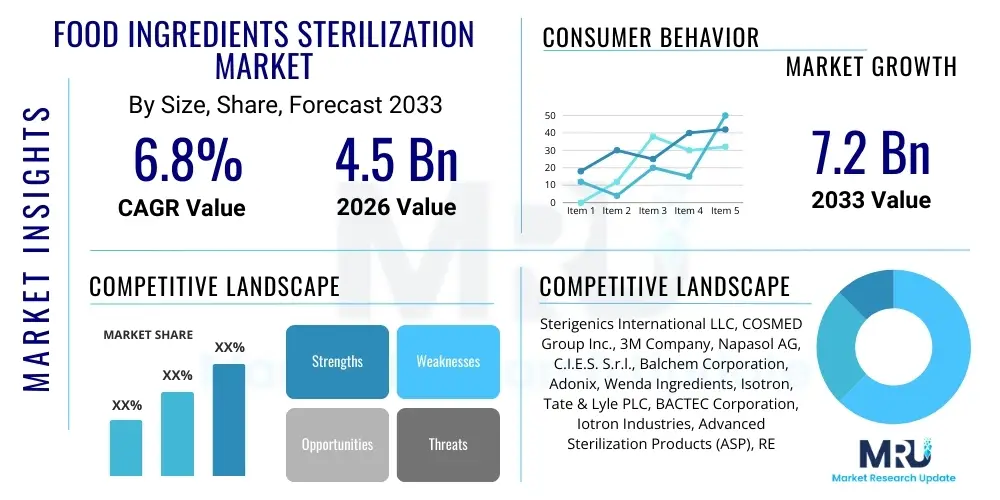

The Food Ingredients Sterilization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Food Ingredients Sterilization Market introduction

The Food Ingredients Sterilization Market encompasses all processes utilized to eliminate pathogenic microorganisms, spores, and spoilage agents from raw and processed food components before their integration into final food products. This critical process ensures food safety, extends shelf life, and maintains the nutritional and sensory quality of ingredients such as spices, herbs, nuts, dried vegetables, and functional additives. Product descriptions range from traditional heat-based methods (steam sterilization) to highly advanced, non-thermal technologies like irradiation (gamma, E-beam) and high-pressure processing (HPP), each tailored to the specific chemical and physical characteristics of the ingredient being treated.

Major applications for ingredient sterilization span the entire food industry, including bakery and confectionery, beverages, processed meat and poultry, dairy products, and ready-to-eat meals, where microbiologically clean ingredients are non-negotiable for consumer safety and regulatory compliance. The primary benefits of effective sterilization include significant reduction in foodborne illness risks, adherence to stringent global import/export standards (especially concerning microbial load limits), and preservation of flavor profiles that might otherwise be compromised by spoilage organisms. Furthermore, as the demand for clean-label, natural ingredients increases, ensuring their microbial safety without excessive chemical intervention becomes paramount, driving the adoption of advanced, residue-free sterilization technologies.

Driving factors for market growth are strongly correlated with increasing global regulatory oversight, particularly from bodies like the FDA, EFSA, and regional standards organizations, which mandate zero tolerance for key pathogens in food ingredients. Coupled with this is the escalating consumer awareness regarding food safety and traceability, prompting food manufacturers to invest heavily in verifiable sterilization protocols. The globalization of the food supply chain also necessitates standardized sterilization practices to prevent cross-border contamination, further cementing the market's importance. Innovations in low-impact sterilization technologies that preserve organoleptic properties while ensuring high lethality rates are key catalysts fueling expansion.

Food Ingredients Sterilization Market Executive Summary

The Food Ingredients Sterilization Market is experiencing robust expansion, fundamentally driven by stringent governmental food safety regulations and the sustained growth in international trade of specialty ingredients, particularly spices, herbs, and nutraceutical components. Key business trends indicate a shift towards outsourcing sterilization services, as ingredient processors seek specialized facilities capable of deploying high-capital, complex technologies like E-beam or proprietary steam sterilization systems, optimizing cost efficiency and compliance. Furthermore, strategic mergers and acquisitions among leading service providers are consolidating market expertise and expanding geographical footprints, enabling a comprehensive service portfolio covering diverse ingredient types and microbial targets.

Regionally, North America and Europe currently dominate the market due to mature regulatory frameworks, advanced processing infrastructure, and high consumer expectations regarding product quality. However, the Asia Pacific region (APAC) is projected to exhibit the fastest growth rate, fueled by rapid urbanization, increasing processed food consumption, and improving local food safety standards in key economies like China and India. Regional trends also highlight significant investment in establishing localized irradiation facilities in APAC and Latin America to minimize transportation costs and logistical risks associated with ingredient sterilization.

Segmentation trends reveal that the irradiation segment (specifically E-beam and Gamma) is gaining traction, largely due to its superior efficiency against spores and low impact on the ingredient’s physical structure, making it highly preferred for delicate or high-value ingredients like natural colors and functional proteins. Concurrently, the application segment of spices, herbs, and seasonings maintains the largest market share, given their inherent high microbial load and widespread use across various food categories. Technological advancements focus heavily on developing non-thermal methods, such as cold plasma or supercritical fluid sterilization, to cater to the growing demand for clean-label and minimally processed food ingredients, driving future growth opportunities within specific niche segments.

AI Impact Analysis on Food Ingredients Sterilization Market

Common user questions regarding AI’s impact on food ingredients sterilization primarily revolve around enhancing process precision, optimizing energy consumption, and improving real-time compliance reporting. Users seek confirmation on whether AI can accurately predict microbial load pre-sterilization, adjust treatment parameters dynamically (e.g., radiation dose or steam exposure time) to maximize lethality while minimizing ingredient damage, and automate complex validation processes. There is significant interest in using AI for predictive maintenance of sterilization equipment, reducing downtime, and ensuring the consistency of treatment across large batches. The key themes summarized from user queries highlight expectations that AI will transition sterilization from a standardized batch process to a highly precise, adaptive, and energy-efficient operation, thereby guaranteeing higher food safety metrics and operational cost savings.

- AI-driven Predictive Analytics: Utilizing sensor data and historical trends to forecast microbial levels in incoming raw materials, allowing for proactive, optimized treatment parameter setting before the sterilization cycle begins.

- Real-Time Process Optimization: Employing machine learning algorithms to monitor critical control points (CCP) during sterilization (e.g., temperature uniformity, gas concentration, radiation dose distribution) and automatically fine-tuning parameters for maximum efficacy and minimal quality degradation.

- Automated Compliance and Traceability: Generating immutable digital records of sterilization processes, cross-referenced with ingredient origin and finished product quality checks, facilitating instantaneous regulatory audits and enhancing supply chain transparency (AEO focus on traceability).

- Equipment Health Monitoring: Implementing AI for predictive maintenance on complex sterilization machinery (irradiators, pressure chambers, ETO systems), thereby minimizing unplanned downtime and maximizing asset utilization rates.

- Quality Assurance Enhancement: Using computer vision and AI classifiers to inspect ingredient batches post-sterilization for physical damage or changes induced by the treatment, ensuring consistent ingredient quality.

DRO & Impact Forces Of Food Ingredients Sterilization Market

The Food Ingredients Sterilization Market is characterized by a strong interplay of regulatory drivers and technological constraints. The primary driver stems from stringent global food safety standards, particularly concerning high-risk ingredients such as dried spices, which are often heavily contaminated at harvest. This regulatory pressure forces manufacturers across the supply chain to adopt validated sterilization methods. Concurrently, increasing consumer demand for exotic and globally sourced ingredients, coupled with rising instances of global food recalls due to microbial contamination, amplifies the need for reliable sterilization services. The major restraint, however, remains the high capital investment required for advanced technologies like E-beam irradiation facilities and High-Pressure Processing (HPP) units, alongside the public perception challenges surrounding irradiation, despite its safety validation by international health organizations. Furthermore, certain treatments, such as steam or EtO, can negatively impact the volatile flavor compounds or nutritional profiles of sensitive ingredients, posing a trade-off challenge for manufacturers.

Opportunities for market growth are primarily concentrated in the development and commercialization of novel non-thermal sterilization techniques, including cold plasma, pulsed electric field (PEF), and advanced UV systems, which promise microbial reduction with minimal impact on ingredient quality—a critical factor for the burgeoning functional food and nutraceutical sectors. These emerging technologies offer a pathway to address the clean-label trend by eliminating chemical residues and reducing heat stress. The expansion of third-party contract sterilization services, particularly in developing economies, presents a lucrative opportunity as smaller ingredient processors opt to outsource complex, high-cost compliance requirements rather than investing in proprietary equipment.

The market impact forces are categorized by high buyer power due to consolidated food manufacturers demanding cost-effective, high-volume sterilization, and moderate supplier power, as technology providers (for E-beam accelerators or EtO chambers) operate within a specialized, technically complex niche. Substitutes, though limited, include strict controls on sourcing and upstream decontamination processes, but these rarely meet end-product microbial specifications independently. The threat of new entrants is low due to significant regulatory hurdles, large required capital expenditure, and the necessity for specialized expertise in microbiology and radiation safety. Overall, the market remains highly driven by non-discretionary regulatory compliance, ensuring sustained demand regardless of economic cycles.

Segmentation Analysis

The Food Ingredients Sterilization Market is extensively segmented based on the type of sterilization technology employed, the specific food ingredient being treated, the method of operation (batch or continuous), and the target microorganisms. This detailed segmentation allows market participants to tailor their offerings to precise industry needs, balancing microbial efficacy with ingredient quality preservation. Technology segmentation highlights the operational differences and capital costs associated with irradiation versus thermal or chemical treatments. Ingredient segmentation reflects the varied sensitivity and microbial loads inherent in different raw materials, demanding specialized sterilization protocols to maintain nutritional and organoleptic integrity.

The key driver within segmentation is the ongoing regulatory emphasis on hazard analysis and critical control points (HACCP), which necessitates robust validation for each ingredient-method combination. For instance, the treatment of delicate, high-value nutraceutical ingredients often mandates non-thermal methods (e.g., E-beam), while bulk commodities like flours might still utilize large-scale steam sterilization. Understanding these distinct segment needs is crucial for service providers aiming for optimal operational efficiency and regulatory compliance across diverse ingredient types. The complexity introduced by varying international standards further fragments the market, requiring global operators to manage multiple validated sterilization processes.

- By Type:

- Steam Sterilization (Moist Heat)

- Ethylene Oxide (EtO) Sterilization

- Irradiation (Gamma, E-beam, X-ray)

- Other Advanced Methods (HPP, Cold Plasma, UV)

- By Application (Ingredient):

- Spices, Herbs, and Seasonings

- Dried Fruits and Vegetables

- Nuts and Seeds

- Flours and Grains

- Dairy and Protein Ingredients

- Natural Colors and Additives

- By Method of Operation:

- Batch Sterilization

- Continuous Sterilization

- By Target Microorganism:

- Bacteria (Salmonella, E. coli, Listeria)

- Molds and Yeasts

- Viruses

- Spores

- By End-User:

- Food Processing Facilities (In-house)

- Contract Sterilization Services (Outsourcing)

Value Chain Analysis For Food Ingredients Sterilization Market

The value chain for Food Ingredients Sterilization begins with upstream sourcing and processing of raw ingredients (spices, herbs, nuts) which are often heavily contaminated post-harvest. Upstream analysis focuses on the quality and microbial load control applied at the farm and initial drying stages. Key upstream players include agricultural cooperatives and ingredient traders who determine the initial quality profile requiring sterilization. Effective pre-cleaning and handling at this stage can significantly reduce the required severity of downstream sterilization treatment. Innovation upstream, such as rapid testing kits for pathogens, helps in segmenting batches based on risk assessment.

The midstream is dominated by the sterilization service providers and technology developers. Service providers (Contract Sterilization Organizations or CSO) utilize high-capital technologies like E-beam accelerators or large-scale steam chambers. Technology developers supply and maintain this specialized equipment. The main value addition in this stage is the transformation of a high-risk ingredient into a compliant, shelf-stable material. Efficiency, validation integrity, and quick turnaround times are crucial metrics for success in this segment. Due to the high investment required, CSOs often represent bottlenecks but also highly specialized expertise.

The downstream involves the distribution channel, which moves the sterilized ingredients to the end-use food manufacturers (e.g., bakery, meat processing, ready-to-eat producers). Distribution can be direct, where large CSOs deliver straight to major food corporations, or indirect, involving specialized ingredient distributors who handle smaller volumes and niche ingredients. Direct distribution is preferred for bulk, highly standardized ingredients, offering better traceability. Indirect channels cater to smaller producers and specialty manufacturers, emphasizing speed and smaller batch sizes. The final consumption point is the integration of these microbiologically sound ingredients into the final processed food product, ensuring consumer safety.

Food Ingredients Sterilization Market Potential Customers

The primary potential customers and buyers of food ingredients sterilization services or equipment are large-scale food processors who utilize ingredients known to harbor high microbial loads, particularly those ingredients sourced from high-risk environments. This includes manufacturers of processed meats, dairy substitutes, seasoning blends, and functional food bars where high safety standards are mandatory and ingredients cannot undergo intense cooking processes. These end-users demand sterilization solutions that provide a high log reduction of pathogens (e.g., 5-log reduction) while minimally affecting sensitive attributes like texture, color, and volatile organic compounds critical for flavor.

A significant customer segment comprises ingredient suppliers and traders specializing in high-value components such as organic spices, certified non-GMO ingredients, or exotic herbs destined for export markets, particularly North America and Europe. For these customers, sterilization is not just a safety measure but a necessary step for regulatory market access and premium pricing justification. They often rely on third-party contract sterilization organizations (CSOs) due to the prohibitive cost and regulatory complexity of owning and operating proprietary sterilization units, preferring flexible, verified service contracts to ensure supply chain continuity and compliance reporting.

Beyond traditional food manufacturing, the burgeoning nutraceutical and pharmaceutical industries represent a high-growth segment of potential customers. These sectors utilize highly specific, sensitive ingredients (e.g., probiotics, functional extracts, botanical ingredients) where chemical residues or heat damage are unacceptable. This customer group drives the demand for non-thermal, high-precision sterilization methods, such as E-beam and HPP, focusing intensely on preserving bioactivity and potency. Their stringent quality control requirements make them willing to pay a premium for validated, residue-free sterilization processes that integrate seamlessly into their complex quality management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sterigenics International LLC, COSMED Group Inc., 3M Company, Napasol AG, C.I.E.S. S.r.l., Balchem Corporation, Adonix, Wenda Ingredients, Isotron, Tate & Lyle PLC, BACTEC Corporation, Iotron Industries, Advanced Sterilization Products (ASP), REV Tech, Valley Processing, Safesteril, Synergy Health, Hi-Q, FMB, Future Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Ingredients Sterilization Market Key Technology Landscape

The technological landscape of food ingredients sterilization is highly dynamic, marked by a gradual shift away from traditional chemical and intense thermal methods towards clean, efficient, and residue-free processes. Steam sterilization, a common thermal method, remains dominant for bulk ingredients like grains and flours due to its cost-effectiveness, but its use is restricted for heat-sensitive materials that suffer quality degradation. Ethylene Oxide (EtO) is also prevalent, particularly for sensitive spices and low-moisture products, yet its use faces increasing scrutiny globally due to concerns over regulatory limits for EtO residues and the necessary aeration periods, prompting manufacturers to seek alternatives.

The most transformative technologies currently gaining prominence are irradiation methods, specifically E-beam and Gamma irradiation. E-beam sterilization, in particular, offers significant advantages due to its high speed, directional energy, and ability to minimize thermal effects, making it suitable for a wide range of ingredients including seeds and nuts where germination capacity must be preserved. While Gamma irradiation is highly effective and penetrates densely packed ingredients, E-beam is favored for its "clean" nature (no radioactive material transport required) and precise dose control, aligning with modern industrial safety standards and traceability demands. Investment in E-beam infrastructure is a major strategic focal point for leading contract sterilization organizations.

Emerging and niche technologies, such as High-Pressure Processing (HPP) and Cold Plasma Sterilization (CPS), are set to revolutionize the market for highly delicate ingredients, especially those used in the rapidly growing fresh and functional food sectors. HPP uses extreme pressure rather than heat to inactivate pathogens, perfectly preserving flavor and nutrients but is primarily utilized for ingredients with high moisture content. CPS, still largely in pilot stages for ingredients, utilizes reactive species to destroy microorganisms at near-ambient temperatures, promising a residue-free, non-thermal alternative optimized for organic and clean-label ingredient compliance, representing the future direction of low-impact microbial reduction.

Regional Highlights

The global food ingredients sterilization market exhibits significant regional variation dictated by regulatory environments, ingredient consumption patterns, and industrial infrastructure capabilities.

- North America (Dominant Market Share): Driven by extremely strict regulatory enforcement by the FDA and USDA, particularly concerning pathogens like Salmonella in low-moisture foods (e.g., peanut butter ingredients, spices). High market maturity and widespread availability of advanced sterilization technologies, especially E-beam and EtO contract services. The region leads in adopting third-party outsourcing models to ensure compliance and scalability.

- Europe (Strong Growth and Innovation): Characterized by stringent, precautionary regulations (EFSA), leading to a high demand for residue-free sterilization methods. Europe is a major importer of spices and dried ingredients, mandating certified sterilization upon entry. The region shows strong investment in HPP and other non-thermal technologies to meet the clean-label trend and reduce EtO reliance.

- Asia Pacific (Fastest Growing Market): Experiencing rapid growth due to increasing domestic consumption of processed and packaged foods, rising food safety awareness among consumers, and expanding regulatory frameworks in countries like China, India, and Australia. Significant opportunities exist for establishing new irradiation and steam sterilization facilities to localize processing and reduce import reliance on pre-sterilized ingredients.

- Latin America (Developing Infrastructure): Growth is steady, primarily focused on meeting export standards for agricultural commodities (coffee, cocoa, spices). Investment is concentrating on basic, high-volume steam sterilization and increasing reliance on global CSOs for advanced techniques to ensure access to lucrative North American and European markets.

- Middle East and Africa (Niche Market Development): Market penetration is lower but accelerating, spurred by urbanization and dependence on imported ingredients. Focus is on establishing robust initial sterilization protocols, often supported by international aid or major global food manufacturers expanding their operational footprint in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Ingredients Sterilization Market.- Sterigenics International LLC

- COSMED Group Inc.

- 3M Company

- Napasol AG

- C.I.E.S. S.r.l.

- Balchem Corporation

- Adonix

- Wenda Ingredients

- Isotron

- Tate & Lyle PLC

- BACTEC Corporation

- Iotron Industries

- Advanced Sterilization Products (ASP)

- REV Tech

- Valley Processing

- Safesteril

- Synergy Health

- Hi-Q

- FMB

- Future Foods

Frequently Asked Questions

Analyze common user questions about the Food Ingredients Sterilization market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between E-beam and Gamma sterilization for food ingredients?

E-beam sterilization uses accelerated electrons and requires no radioactive material, offering high speed and directional treatment, making it ideal for low-density or shallow ingredient layers. Gamma sterilization uses Cobalt-60, penetrating deep into dense, bulk materials, but requires more stringent safety and handling protocols. Both are effective for microbial reduction without thermal degradation.

How do regulatory standards influence investment in ingredient sterilization technologies?

Stringent regulatory requirements, especially pathogen control standards set by the FDA and EFSA, are the primary drivers compelling food manufacturers to invest in verifiable, validated sterilization technologies. These mandates necessitate high capital investment in methods that guarantee specific log reductions, thereby favoring third-party contract services or highly advanced in-house units.

Which food ingredient segment drives the highest demand for sterilization services?

The Spices, Herbs, and Seasonings segment generates the highest demand for sterilization services globally. These ingredients inherently carry high microbial loads from harvesting and drying processes, necessitating mandatory post-processing sterilization (like steam or irradiation) to meet international food safety standards before inclusion in final food products.

What is the market outlook for non-thermal sterilization methods like HPP and Cold Plasma?

Non-thermal methods are poised for substantial growth, driven by the clean-label trend and demand for preserving the nutritional integrity of sensitive ingredients. HPP is expanding rapidly for high-moisture ingredients, while Cold Plasma is emerging as a promising, residue-free solution for dry, delicate ingredients, though commercial application remains specialized and less prevalent than irradiation.

Is Ethylene Oxide (EtO) sterilization still utilized in the food ingredients market?

Yes, EtO is still utilized, particularly for low-moisture, heat-sensitive ingredients like specialty spices where alternative non-thermal methods may be cost-prohibitive or unavailable. However, its use is declining in major markets due to growing regulatory concerns about carcinogenic residues and the preference for cleaner methods like E-beam irradiation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager