Food Packaging Barrier Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433812 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Food Packaging Barrier Film Market Size

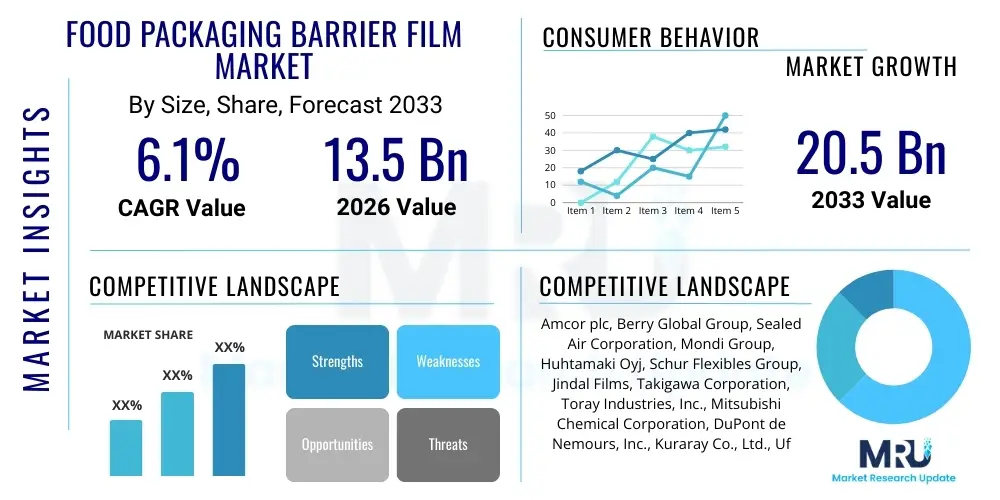

The Food Packaging Barrier Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 20.5 Billion by the end of the forecast period in 2033.

Food Packaging Barrier Film Market introduction

Food packaging barrier films are specialized polymer structures designed to significantly restrict the permeation of gases, moisture, light, and aroma, thereby extending the shelf life of perishable food products. These films are critical components in modern food preservation, particularly for products utilizing Modified Atmosphere Packaging (MAP) techniques, ensuring product integrity from production to consumption. The fundamental function of a barrier film is to maintain the desired internal environment, minimizing oxidation, microbial growth, and moisture loss, which are key drivers of food spoilage.

The product portfolio encompasses various material types, including specialized resins such as Ethylene Vinyl Alcohol (EVOH), Polyvinylidene Chloride (PVDC), and advanced co-extruded nylons, often integrated into multilayer flexible packaging systems. Major applications span high-value segments such as processed meats, dairy products, fresh produce, bakery items, and ready-to-eat meals, where maintaining freshness and flavor is paramount. These films are indispensable in retail and foodservice sectors due to their lightweight nature, transparency, and high performance in maintaining oxygen and moisture barrier properties.

Market growth is predominantly driven by the escalating global demand for packaged and convenience foods, rising urbanization, and the strict regulatory frameworks mandating food safety and minimizing food waste. Furthermore, advancements in barrier technology, particularly in developing sustainable, recyclable, and bio-based barrier materials, are opening new avenues for market expansion, catering to the increasing consumer focus on environmental responsibility and the circular economy within the packaging industry.

Food Packaging Barrier Film Market Executive Summary

The Food Packaging Barrier Film Market is characterized by robust growth, driven primarily by the shift towards smaller, single-serving, and high-convenience food formats, alongside significant technological investment in sustainable barrier solutions. Business trends indicate a strong move toward co-extruded and laminated multilayer films that offer superior barrier properties (low Oxygen Transmission Rate, or OTR) while optimizing material usage. Strategic mergers, acquisitions, and collaborations focused on integrating recycling infrastructure and developing mono-material barrier structures are defining the competitive landscape. Furthermore, heightened regulatory focus on food preservation and safety standards globally compels food manufacturers to adopt high-performance barrier packaging, reinforcing market stability and growth.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, fueled by rapid expansion of the organized retail sector, substantial population growth, and increasing disposable incomes leading to higher consumption of packaged and frozen foods. North America and Europe, while mature, maintain dominant market shares due to stringent food quality regulations, high adoption rates of Modified Atmosphere Packaging (MAP), and advanced recycling initiatives pushing the demand for recyclable EVOH and silica oxide (SiOx) coated films. These regions are prioritizing the transition from conventional PVDC barriers to more environmentally friendly alternatives.

Segment trends reveal that the plastic segment, specifically polyethylene terephthalate (PET) and polyolefins combined with high-barrier resins like EVOH, remains the largest material category due to its versatility and cost-effectiveness. Application-wise, processed meat and seafood packaging continues to dominate owing to the critical requirement for long shelf-life and protection against spoilage. The rising popularity of retort packaging and microwaveable food products further elevates the demand for heat-resistant and high-performance barrier films across all major segments.

AI Impact Analysis on Food Packaging Barrier Film Market

User queries regarding the intersection of AI and barrier films generally center on optimizing material consumption, predicting shelf-life variability, and enhancing manufacturing efficiency. Users frequently ask how AI can refine multilayer film design, specifically inquiring about minimizing the thickness of expensive barrier layers (like EVOH) without compromising OTR performance. Concerns also relate to using machine learning algorithms for predictive maintenance on complex co-extrusion lines and leveraging AI-driven sensor technology to monitor package integrity and environmental conditions in real-time throughout the supply chain. The overarching user expectation is that AI will introduce unprecedented precision in quality control and lead to the rapid development of sustainable, cost-effective, high-performance barrier structures, significantly reducing production waste and optimizing material science research.

- AI-Driven Material Optimization: Algorithms analyze large datasets of polymer characteristics (permeability, strength, thermal properties) to design optimal multilayer film structures, reducing material wastage and cost.

- Predictive Shelf-Life Modeling: Machine learning predicts precise spoilage rates based on food type, film OTR, storage temperature, and humidity, allowing manufacturers to tailor barrier levels exactly to product requirements.

- Quality Control and Defect Detection: Computer vision systems powered by AI monitor high-speed film production lines, instantly identifying micro-perforations or inconsistencies in barrier coating thickness, ensuring zero-defect output.

- Smart Packaging Integration: AI interprets data transmitted from embedded sensors within smart packaging barrier films, providing real-time alerts regarding temperature breaches or package integrity issues during transit.

- Supply Chain Efficiency: Optimization of inventory management for raw barrier resins (EVOH, PVDC) and scheduling of specialized co-extrusion and lamination processes based on predictive demand forecasting.

DRO & Impact Forces Of Food Packaging Barrier Film Market

The dynamics of the Food Packaging Barrier Film Market are shaped by powerful drivers, strict restraints, and promising opportunities, which collectively define the impact forces influencing market trajectories. A primary driver is the accelerating consumer preference for extended shelf-life convenience foods, coupled with global efforts to mitigate food waste, which necessitates superior preservation capabilities provided by high-barrier films. Additionally, technological advancements resulting in new generations of high-performance barrier materials, such as bio-based or highly recyclable polymers, are continuously propelling market innovation and adoption, particularly in highly regulated Western markets.

However, significant restraints temper the market’s expansion potential. The complex nature of multilayer barrier films, which often combine incompatible polymers (e.g., PET, EVOH, PE), poses immense challenges for mechanical recycling infrastructure, creating a sustainability hurdle. Furthermore, the volatility in raw material prices, specifically for specialized barrier resins like EVOH and PVDC, coupled with high initial investment costs associated with advanced co-extrusion and coating equipment, can impede adoption, particularly for smaller market players. Strict regulations regarding material migration and food contact safety also add complexity to product development and validation processes.

Opportunities in this market are strongly concentrated around the development and commercialization of easily recyclable, mono-material barrier solutions, often utilizing advanced coating technologies (e.g., AlOx, SiOx) to achieve high-barrier performance within a single-polymer structure. The burgeoning demand for barrier films in medical and pharmaceutical packaging, leveraging similar protective requirements, offers lucrative diversification opportunities. Furthermore, the penetration of barrier packaging into emerging applications such as pet food, coffee, and powdered beverages, where aroma retention is critical, provides substantial avenues for growth and market expansion across diverse geographical regions.

Segmentation Analysis

The Food Packaging Barrier Film Market is comprehensively segmented based on material type, product form, application, and geography, providing granular insights into market dynamics and growth potential across various dimensions. Material segmentation highlights the dominance of established polymer resins and the rapid growth of sustainable alternatives. Product form differentiation examines whether the barrier material is used as a standalone film, a shrink film, or integrated into pouches or bags. Application segmentation is crucial as performance requirements vary dramatically, from high oxygen barriers required for processed meats to moderate moisture barriers needed for dry goods.

Material segmentation primarily includes plastic polymers such as Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), specialized co-polymers like Ethylene Vinyl Alcohol (EVOH) and Polyvinylidene Chloride (PVDC), and increasingly, bio-plastics and coatings. The EVOH segment is experiencing strong growth due to its outstanding oxygen barrier properties and suitability for retort applications, while PVDC usage is gradually being phased out in some regions due to environmental concerns, driving innovation towards high-barrier PET/PE blends. Understanding these material preferences is key to assessing supply chain dependencies and sustainability compliance.

Application-wise, the market is broadly divided into meat, poultry, and seafood, dairy products, bakery, fruits and vegetables, and confectionery. The meat and seafood segment demands the highest barrier levels to prevent oxidation and spoilage, driving the consumption of high-grade EVOH and metallized films. Conversely, the fresh produce segment utilizes breathable barrier films (modified atmosphere) that balance gas transmission to maintain respiration rates, demonstrating the tailored nature of product solutions within this complex market structure.

- By Material Type:

- Plastic Films

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyamide (PA) / Nylon

- Other Plastics (e.g., PVC, PS)

- High-Barrier Resins

- Ethylene Vinyl Alcohol (EVOH)

- Polyvinylidene Chloride (PVDC)

- Coatings and Others

- Silica Oxide (SiOx)

- Aluminum Oxide (AlOx)

- Metallized Films

- Bio-based/Compostable Films

- By Product Form:

- Flexible Films

- Lidding Films

- VFFS (Vertical Form-Fill-Seal) Films

- HFFS (Horizontal Form-Fill-Seal) Films

- Shrink Films and Stretch Films

- Pouches and Bags

- Stand-up Pouches (SUPs)

- Retort Pouches

- Trays and Containers (Rigid/Semi-rigid with barrier layers)

- By Application:

- Meat, Poultry, and Seafood

- Dairy Products (Cheese, Yogurt, Creamers)

- Bakery and Confectionery

- Fruits and Vegetables (Fresh Produce and Processed)

- Convenience and Ready-to-Eat (RTE) Meals

- Pet Food

- Beverages and Liquids

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Food Packaging Barrier Film Market

The value chain for the Food Packaging Barrier Film Market begins with the upstream sourcing of raw materials, primarily petrochemical derivatives and specialized polymer resins such as polyethylene, PET, and high-performance barrier resins like EVOH and PVDC. Resin manufacturers, often large chemical companies, supply these polymers to film converters. Pricing volatility and sustainability credentials (e.g., availability of recycled content or bio-based precursors) at this stage critically influence the final cost structure and environmental profile of the barrier film product. Strategic long-term contracts with resin suppliers are essential for converters to ensure stability in supply and cost management.

The midstream stage involves sophisticated manufacturing processes, including co-extrusion, lamination, and coating, performed by specialized film converters. Co-extrusion allows for the creation of multilayer structures where different resins (e.g., high-barrier EVOH sandwiched between structural polyolefins) are fused together without adhesives, offering high structural integrity. Lamination is used when combining substrates like foil or paper with barrier films. The efficiency and quality control implemented during these conversion processes, particularly concerning barrier uniformity (OTR and MVTR consistency), are paramount to meeting food safety specifications. Innovation focus here is on reducing the number of layers while maintaining performance.

Downstream activities involve distribution channels leading to the end-users: food manufacturers and processors. Direct distribution often occurs for large food conglomerates requiring customized, high-volume film orders, ensuring technical support and tailored solutions. Indirect distribution involves working through specialized packaging distributors, who cater to smaller or regional food processors. The final step involves the food processor utilizing the barrier film in automated Form-Fill-Seal (FFS) or thermoforming equipment. The effectiveness of the barrier film is ultimately validated by its ability to perform optimally on high-speed packaging lines and ensure the desired shelf life for the packaged food product.

Food Packaging Barrier Film Market Potential Customers

The primary consumers and end-users of food packaging barrier films are large-scale food processors and manufacturers across various sectors, where product shelf-life extension and preservation of sensory qualities are non-negotiable operational requirements. Major customers include multinational meat and dairy producers who rely heavily on vacuum packaging and Modified Atmosphere Packaging (MAP) techniques enabled by high-barrier films to transport and sell perishable goods across extended geographies. These clients demand films with certified low oxygen transmission rates (OTR) and robust puncture resistance to withstand rigorous supply chain conditions, often requiring custom film specifications for specific machinery.

Another significant customer segment includes manufacturers of processed, ready-to-eat (RTE) meals, frozen foods, and microwaveable products. These applications necessitate films capable of withstanding high-temperature processes like retort sterilization or extreme cold storage, often requiring specialized PET/EVOH/PP structures. The trend toward urbanization and busy lifestyles is driving the consumption of convenience foods, making RTE meal manufacturers critical volume buyers of thermoforming barrier films and lidding films with easy-peel functionalities.

Furthermore, specialized segments such as coffee roasters, snack manufacturers (nuts, chips), and baby food companies represent growing potential customers. Coffee and snack producers prioritize high barrier properties against both oxygen and moisture to retain aroma and crunch, typically utilizing metallized or high-EVOH containing pouches. The growing focus on food safety in the organic and specialty food sectors also increases the penetration of certified high-barrier, non-migrating films among these premium brand customers seeking maximum product differentiation and brand protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 20.5 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Group, Sealed Air Corporation, Mondi Group, Huhtamaki Oyj, Schur Flexibles Group, Jindal Films, Takigawa Corporation, Toray Industries, Inc., Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., Kuraray Co., Ltd., Uflex Ltd., Innovia Films, CCL Industries Inc., Winpak Ltd., Bischof + Klein, Cosmo Films Ltd., ProAmpac, Charter NEX Films. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Packaging Barrier Film Market Key Technology Landscape

The technology landscape for food packaging barrier films is highly dynamic, centered on achieving ultra-low permeability targets while adhering to stringent sustainability mandates. Key manufacturing technologies include advanced multi-layer co-extrusion, which precisely layers up to eleven different materials in a single, cost-effective process, maximizing the synergistic barrier properties while minimizing overall film thickness. This technique is crucial for combining structural polymers like PE and PP with high-performance barrier layers such as EVOH, ensuring both mechanical strength and exceptional oxygen barrier. Recent technological advancements focus on melt strength enhancement to facilitate higher line speeds and thinner gauges, optimizing production economics.

Another crucial technological area is vacuum deposition coating, which involves applying ultra-thin layers of inorganic materials like Aluminum Oxide (AlOx) or Silicon Oxide (SiOx) onto flexible substrates (PET, BOPP). These coatings offer transparency, excellent barrier against both oxygen and moisture (MVTR), and are highly sought after as they enable the creation of high-barrier mono-material films, significantly enhancing recyclability compared to traditional multi-layer laminates. SiOx coatings are particularly favored for demanding applications, including retortable pouches, due to their thermal stability and superior adhesion properties.

Innovation is also highly concentrated in the sphere of bio-based and compostable barrier materials. Companies are investing in developing Polylactic Acid (PLA) and other bio-polymers combined with specialized barrier coatings (nanocomposites or plant-based extracts) to meet consumer demand for sustainable packaging without sacrificing shelf life. Furthermore, the integration of active packaging elements, such as oxygen scavengers or antimicrobial agents embedded within the barrier film matrix, represents an emerging technology that offers an additional layer of protection, moving packaging from a passive container to an active preservation tool, thus enhancing food safety and extending market reach for packaged goods.

Regional Highlights

Geographical market dynamics reveal distinct growth patterns influenced by regulatory environments, consumer purchasing power, and the maturity of the retail sector. North America, encompassing the United States and Canada, represents a substantial market share, driven by high consumption rates of processed and frozen foods and stringent food safety regulations that mandate the use of high-barrier packaging, particularly in meat and dairy sectors. The focus in this region is increasingly shifting toward high-performance, flexible barrier films that support automation and offer superior oxygen transmission rate (OTR) control, especially those designed for high-end ready-to-eat meals and specialty medical nutrition products. Continuous innovation in sustainable packaging alternatives is a major regional investment priority.

Europe holds a significant position, characterized by highly advanced packaging standards and early adoption of sustainability goals, notably the push towards circular economy models. European regulations, particularly concerning plastics use and recycling mandates, are strongly influencing film innovation, favoring mono-material films with SiOx/AlOx coatings and highly recyclable EVOH structures over conventional, hard-to-recycle PVDC. Western European nations, such as Germany, the UK, and France, are driving demand for barrier films used in MAP applications for fresh produce and artisan dairy, while Eastern Europe presents a developing market with increasing modern retail penetration.

Asia Pacific (APAC) is projected to be the fastest-growing region globally, driven by surging urbanization, rising middle-class disposable income, and the rapid expansion of organized retail chains and e-commerce platforms, particularly in China, India, and Southeast Asia. This region exhibits massive demand for affordable, high-volume barrier packaging for snacks, instant noodles, and frozen seafood. Investment in new manufacturing capabilities and the transition from traditional rigid packaging to flexible barrier pouches are key trends in APAC, although infrastructure challenges regarding cold chain logistics and recycling still present areas for improvement and technological integration.

- North America: Dominant market for high-barrier films in premium processed meats and ready-to-eat meals; strong regulatory emphasis on food safety; pioneering sustainable, recyclable EVOH solutions.

- Europe: Leading the transition to circular packaging economies; high demand for mono-material barrier structures and bio-based films; strict migration standards influence material selection.

- Asia Pacific (APAC): Highest growth trajectory fueled by urbanization and retail expansion; massive volume consumption in snack, dairy, and seafood packaging; significant investment in new film conversion plants.

- Latin America (LATAM): Growing market driven by expanding modern retail and export needs (especially for meat and agricultural products); characterized by increasing adoption of MAP technology.

- Middle East and Africa (MEA): Emerging market focused on shelf-life extension due to challenging climate conditions and logistics; increasing demand for barrier films in basic food staples and perishable imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Packaging Barrier Film Market.- Amcor plc

- Berry Global Group

- Sealed Air Corporation

- Mondi Group

- Huhtamaki Oyj

- Schur Flexibles Group

- Jindal Films

- Takigawa Corporation

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- Kuraray Co., Ltd.

- Uflex Ltd.

- Innovia Films

- CCL Industries Inc.

- Winpak Ltd.

- Bischof + Klein

- Cosmo Films Ltd.

- ProAmpac

- Charter NEX Films

- Coveris Holdings S.A.

- SABIC (Saudi Basic Industries Corporation)

- ExxonMobil Chemical Company

- BASF SE

- Polymer Films, Inc.

Frequently Asked Questions

Analyze common user questions about the Food Packaging Barrier Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for high-barrier food packaging films?

The demand is primarily driven by global efforts to minimize food waste, increased consumption of convenience and processed foods requiring extended shelf-life, and stringent food safety regulations. Technological advances in multilayer co-extrusion and the adoption of Modified Atmosphere Packaging (MAP) techniques also necessitate superior barrier protection against oxygen and moisture.

How is the complexity of recycling multilayer barrier films being addressed by the industry?

The industry is actively addressing recycling challenges by investing in mono-material solutions, such as high-barrier polyethylene (PE) or polypropylene (PP) films enhanced with thin inorganic coatings (SiOx or AlOx). These structures maintain barrier performance while being compatible with existing recycling streams, adhering to circular economy principles mandated in regions like Europe.

Which material provides the best oxygen barrier properties in food packaging?

Ethylene Vinyl Alcohol (EVOH) typically provides the best oxygen barrier properties (low OTR) among common barrier resins, especially when used in co-extruded structures. While its performance is sensitive to humidity, EVOH remains critical for applications like processed meats, dairy, and retort pouches where preventing oxygen ingress is paramount for shelf-life extension.

What is the role of coatings (SiOx/AlOx) in the future of sustainable barrier packaging?

Silicon Oxide (SiOx) and Aluminum Oxide (AlOx) coatings are vital for sustainability as they offer excellent transparent barrier properties when applied in ultra-thin layers onto single-polymer substrates like PET or BOPP. This allows manufacturers to create highly recyclable, high-performance packaging that avoids the complexity and contamination issues associated with traditional multilayer laminates.

In which application segment is the growth of barrier films most pronounced?

The application segment showing the most pronounced growth is convenience and ready-to-eat (RTE) meals. Driven by changes in consumer lifestyles and urbanization, these products require reliable, high-temperature resistant barrier films (often suitable for retort or microwave use) that ensure safety, freshness, and structural integrity throughout the complex distribution and heating processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager