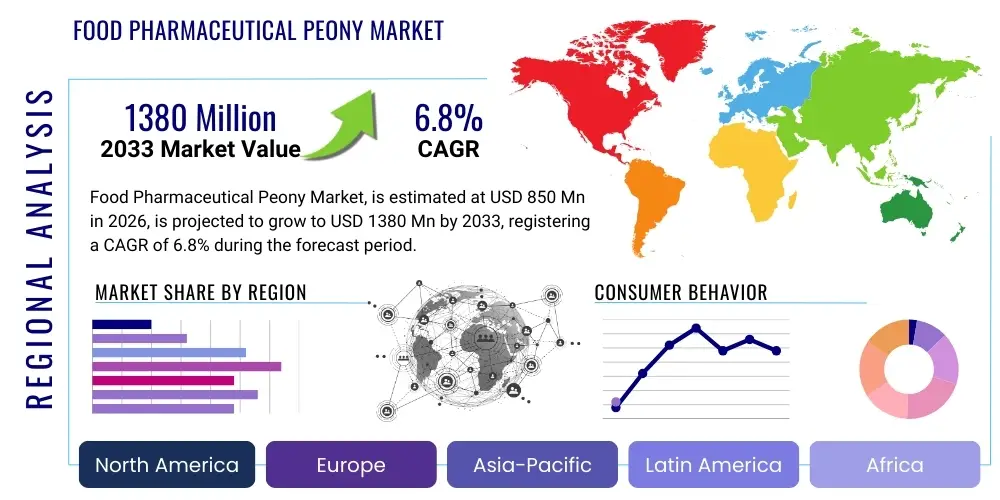

Food Pharmaceutical Peony Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431469 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Food Pharmaceutical Peony Market Size

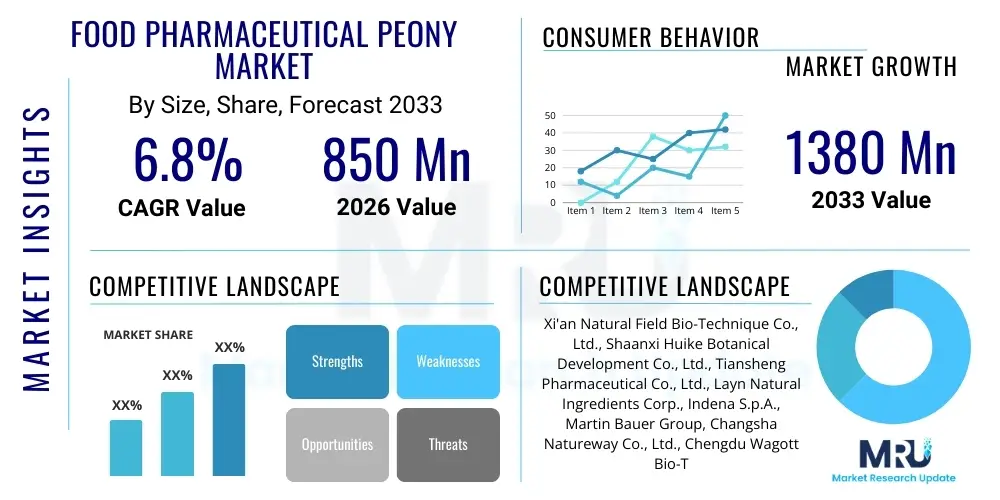

The Food Pharmaceutical Peony Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1380 million by the end of the forecast period in 2033.

Food Pharmaceutical Peony Market introduction

The Food Pharmaceutical Peony Market encompasses ingredients derived primarily from the roots of Paeonia lactiflora (White Peony) and Paeonia suffruticosa (Moutan Peony), which are extensively utilized in traditional medicine, nutraceuticals, and functional food development globally. The core value of these derivatives lies in their rich content of bioactive compounds, particularly paeoniflorin, albiflorin, and paeonol, which exhibit scientifically validated anti-inflammatory, antioxidant, and potent immunomodulatory properties. Historically rooted in Traditional Chinese Medicine (TCM) for addressing ailments such as menstrual disorders, muscle cramps, and inflammatory conditions, the modern market is experiencing robust expansion driven by increasing clinical validation confirming these traditional therapeutic applications in areas such as rheumatoid arthritis management, dermatological health, and cardiovascular support.

The product segmentation within this sophisticated market generally involves standardized hydroalcoholic extracts, fine powders derived from dried roots, and essential oils, all of which are tailored for specific application sectors. The pharmaceutical grade products require the highest concentration of key markers, such as paeoniflorin, and are often incorporated into combination therapies, particularly dominant across Asian markets where herbal pharmacopoeias are integrated into national healthcare systems. Conversely, the nutraceutical segment focuses on extracts designed for dietary supplements, where market growth is rapidly accelerating due to Western consumers' growing propensity for preventative and natural health interventions, specifically targeting joint health, immune function balance, and stress reduction through adaptogenic support.

Key driving factors accelerating the adoption and commercial scale of peony derivatives include the prevailing macro trend toward preventative healthcare and the pronounced preference among consumers for efficacious natural remedies over synthetic alternatives, especially in managing chronic conditions. Furthermore, intensive research and development efforts are continuously focused on maximizing the purity, enhancing the stability, and improving the bioavailability of active compounds like paeoniflorin, often involving complex formulation science to ensure systemic delivery. This scientific investment is opening new regulatory and commercial avenues in Western therapeutic applications, while the undeniable demographic force of a rising geriatric population, intrinsically linked to the increasing prevalence of age-related inflammatory and autoimmune diseases, further solidifies the foundational, long-term demand for high-quality, standardized peony-based ingredients worldwide. Stringent adherence to GMP standards and the pursuit of advanced cultivation techniques are becoming essential for companies aiming for international market penetration.

Food Pharmaceutical Peony Market Executive Summary

The Food Pharmaceutical Peony Market is characterized by robust commercial activity and significant innovation, with the Asia Pacific region, led overwhelmingly by China, maintaining its supremacy in both the production capacity and the volume of consumption due to the region's strong cultural foundation in Traditional Chinese Medicine (TCM) and supportive governmental policies favoring herbal pharmaceutical development. Current business trends indicate a decisive shift in procurement preference among global formulators, moving away from simple, raw material powders toward high-purity, scientifically validated, standardized extracts. This change is fundamentally driven by global regulatory pressures demanding ingredient consistency and verifiable potency claims, particularly crucial for export-oriented nutraceuticals and supplements destined for rigorous European and North American markets. Strategic collaboration and vertical integration between raw material cultivators, specialized extract manufacturers, and large-scale global nutraceutical corporations are emerging as vital competitive strategies for securing a stable, quality-assured supply chain and mitigating the inherent commercial risks associated with agricultural commodity price volatility and unpredictable seasonal harvest yields.

From a regional perspective, while APAC solidifies its market leadership with established infrastructures for cultivation and processing, the burgeoning markets of Europe and North America are registering the highest growth trajectories. This acceleration is largely attributed to the increasing cultural integration of traditional botanicals and adaptogenic ingredients into Western consumer diets and mainstream wellness programs. However, market entry and sustained growth in these Western markets are heavily dependent upon meticulous compliance with complex regulatory frameworks, such as the European Food Safety Authority's (EFSA) Novel Food Regulation in the EU. This necessitates substantial investment by industry participants into generation of extensive toxicological data and robust clinical trial evidence to scientifically substantiate safety and efficacy claims. This high level of regulatory scrutiny acts as a significant, albeit necessary, barrier to entry, simultaneously elevating the perceived value and trustworthiness of the ingredients that successfully gain approval and consumer acceptance in these jurisdictions.

Segment analysis reveals that the pharmaceutical application segment, despite accounting for a smaller total market volume compared to the expansive food and supplement segment, consistently commands significantly higher premium pricing due to the stringent purity specifications, mandatory certification requirements, and intense therapeutic focus associated with drug manufacturing. This segment is forecasted to experience an accelerated rate of growth, contingent upon the successful completion and positive outcome of ongoing clinical trials aimed at validating peony extracts for specific chronic disease indications. Furthermore, product innovation trends within the industry demonstrate a clear increase in specialized finished dosage forms. These include technologically advanced systems like enteric-coated tablets, which protect the sensitive compounds from stomach acid degradation, and sophisticated liposomal formulations, engineered specifically to enhance the systemic absorption and ultimately improve the therapeutic effectiveness of the primary bioactive molecules, thereby actively resolving historical product stability and low bioavailability challenges.

AI Impact Analysis on Food Pharmaceutical Peony Market

Analysis of common user questions related to AI’s influence indicates a pronounced industry focus on three key themes: ensuring ingredient consistency and quality control at scale, accelerating the complex process of clinical validation for novel applications, and optimizing sustainable and traceable sourcing methods to counter supply chain fragmentation. Stakeholders are deeply concerned about the inherent batch-to-batch variability common in botanical sourcing and the regulatory hurdle of generating compelling efficacy data. The consensus emerging from the industry suggests that AI and Machine Learning (ML) are not merely efficiency tools but transformative technologies essential for achieving pharmaceutical-grade precision across the entire value chain. AI-driven models are expected to drastically improve extraction yield predictability, leverage multivariate data to precisely forecast optimal harvesting windows based on chemical composition, and automate sophisticated analytical chemistry required for verifying standardized extract profiles, ushering the market into an era of unprecedented reliability and scientific rigor. This predictive and analytical capability directly addresses the core challenges of scalability and standardization facing the widespread global adoption of peony derivatives.

- AI-driven Predictive Agriculture: Utilizing advanced machine learning algorithms to analyze real-time environmental data (climate, soil moisture, nutrient profiles) and historical chemotype patterns, optimizing cultivation protocols and precisely predicting the ideal harvest timing to maximize the yield of specific bioactive compounds, such as paeoniflorin.

- Enhanced Quality Control (QC) and Standardization: Implementing automated spectral analysis techniques (Near-Infrared, Raman Spectroscopy, or advanced HPLC data interpretation) powered by AI and computer vision to rapidly and non-destructively verify the purity, standardization, and absence of contaminants (e.g., heavy metals, pesticide residues) in every batch, thereby minimizing batch-to-batch variability.

- Accelerated Drug Discovery and Therapeutic Modeling: Employing AI/ML algorithms to perform high-throughput virtual screening of thousands of natural peony compounds and their metabolites. This enables rapid identification of potential novel therapeutic targets (e.g., neuroprotection, enhanced immunomodulation) and predicts optimal complex formulation stability and drug-likeness parameters, speeding up the research pipeline.

- Supply Chain Transparency and Anti-Counterfeiting: Integrating blockchain systems, with data quality and anomaly detection managed by AI, to establish immutable, end-to-end traceability of peony roots from the certified farm to the final ingredient manufacturer. This addresses critical concerns about geographic origin authenticity, ethical sourcing, and product adulteration crucial for regulatory compliance and consumer trust.

- Market Trend and Regulatory Forecasting: Applying sophisticated Natural Language Processing (NLP) techniques to continuously monitor and analyze vast volumes of unstructured data, including global regulatory updates, scientific literature databases, competitor product launches, and social media consumer sentiment, allowing companies to anticipate shifts in demand for specific peony derivatives and proactively navigate potential regional regulatory challenges.

DRO & Impact Forces Of Food Pharmaceutical Peony Market

The operational and strategic trajectory of the Food Pharmaceutical Peony Market is fundamentally governed by a complex interplay between powerful growth catalysts and persistent supply-side constraints. The core drivers generating strong upward market momentum include the rapidly escalating global consumer focus on preventative health strategies and the accumulating volume of rigorous scientific literature validating the traditional anti-inflammatory, antioxidant, and analgesic properties of peony extracts, thereby bolstering consumer and clinician confidence. This proactive health movement is continually expanding the addressable market across supplements and functional foods. Conversely, the market is severely restricted by several key inherent vulnerabilities, most notably the inherent instability and inconsistency in the supply of high-quality raw material, the agricultural sector’s susceptibility to localized climate variability and disease, and the significant administrative burden imposed by disparate and often conflicting international regulatory requirements concerning botanical quality, encompassing standards for heavy metals and stringent residue testing.

Opportunities for strategic expansion and value creation are heavily concentrated in the application of technological innovation to enhance product differentiation and efficacy. Specifically, advancements in developing specialized delivery systems, such as nano-carriers and microencapsulation, offer the potential to dramatically improve the compound's bioavailability and therapeutic impact, moving beyond traditional limitations. Additionally, the diversification of peony derivatives into high-value market segments, particularly specialized veterinary applications focusing on companion animal health and bespoke, high-end cosmeceutical lines leveraging the skin-soothing and brightening attributes of paeonol, present lucrative pathways for market expansion and revenue generation. These opportunities necessitate investment in intellectual property protection and sophisticated clinical data generation to establish clear market leadership and premium positioning.

The collective internal market dynamics and external pressures constitute the impact forces determining the long-term competitive landscape. The bargaining power of upstream raw material suppliers, particularly the specialized cultivation cooperatives in key growing regions, remains significantly high due to geographical concentration and the crucial impact of raw material quality on the final extract specifications. Rivalry among midstream extract manufacturers is intense but primarily based on technological sophistication and certified quality rather than simple pricing, pushing companies to invest heavily in advanced extraction and quality assurance protocols. Moreover, the increasing compliance costs associated with achieving global regulatory approvals (e.g., EFSA, FDA) act as a substantial economic barrier to entry, effectively consolidating market power among established, financially robust companies capable of managing extensive data submission and quality management systems, ensuring sustainable growth is tied intrinsically to adherence to global quality standards.

- Drivers: Increasing global acceptance of natural botanicals and Traditional Chinese Medicine (TCM) compounds; continuous accumulation of clinical evidence supporting efficacy in chronic disease management; robust expansion of the nutraceutical and preventative health sectors globally.

- Restraints: High volatility and inconsistency in raw material supply and associated pricing due directly to agricultural dependence; complex, stringent regulatory barriers and high cost associated with Novel Food approval in major Western markets; critical lack of universally accepted global standardization for extract purity, dosage, and concentration markers.

- Opportunities: Significant technological advancements in extraction methods (e.g., Supercritical CO2) enhancing yield and purity; successful market penetration into highly profitable cosmeceuticals and personalized medicine applications; expanding clinical focus on immune support, cognitive health enhancement, and targeted anti-aging formulations.

- Impact Forces: High bargaining power of specialized raw material suppliers due to quality sensitivity; moderate to high rivalry among scientifically advanced extract manufacturers; increasing regulatory complexity driving up compliance costs, acting as a major entry barrier for new players.

Segmentation Analysis

A comprehensive understanding of the Food Pharmaceutical Peony Market necessitates detailed analysis across its primary segmentation axes, which include the specific type of derivative processed, its intended therapeutic or functional application across diverse end-user industries, and the geographic regions dictating consumption patterns and regulatory requirements. Segmentation by product type inherently reflects the complexity of the processing and the resultant purity profile, which directly governs its suitability: highly refined extracts target stringent pharmaceutical uses, whereas coarse powders might be used in bulk functional food preparations. This differentiation compels stakeholders to meticulously tailor their production processes and quality assurance methodologies to meet the precise demands of the designated market segment.

Segmentation by application further reveals the divergent market requirements. The Pharmaceutical segment places absolute priority on ingredient consistency, documented stability, and toxicological clearance, often requiring custom, high-concentration preparations. Conversely, the Nutraceuticals and Dietary Supplements segment demands ingredients that balance proven efficacy with cost-effectiveness and scalability for mass market consumption, often favoring extracts standardized for a defined percentage range of paeoniflorin. The fast-growing Cosmeceutical segment, while requiring purity, places additional emphasis on the material's aesthetic compatibility, water solubility, and demonstrable topical benefits, such as soothing properties and skin brightening effects, driving demand for specific oil and low-molecular-weight derivatives.

Finally, segmentation by source distinguishes between White Peony (Paeonia lactiflora) and Moutan Peony (Paeonia suffruticosa), each containing unique chemical profiles and traditional applications, guiding formulators toward the appropriate source material based on the desired therapeutic outcome. This granular segmentation allows manufacturers to focus R&D resources effectively, secure targeted regulatory approvals, and develop focused marketing campaigns that resonate with the specific needs and regulatory landscape of key consumer demographics across global markets.

- By Product Type:

- Peony Root Extract (Standardized Paeoniflorin Content): High-value ingredient for pharmaceutical and premium nutraceuticals.

- Peony Root Powder (Raw Material): Lower cost, used in traditional formulations and bulk functional foods.

- Peony Essential Oil: Used primarily in aromatherapy and high-end cosmeceutical applications for fragrance and topical benefits.

- Purified Paeonol and Albiflorin: Highly refined marker compounds used for specific clinical studies and targeted high-purity formulations.

- By Application:

- Pharmaceuticals (TCM formulations, prescription botanical drugs for anti-inflammation and immunology)

- Nutraceuticals and Dietary Supplements (Joint support, immune modulation, stress and anxiety relief)

- Functional Foods and Beverages (Health teas, fortified liquid supplements, natural colorants)

- Cosmeceuticals and Personal Care (Anti-aging serums, skin brightening creams, sensitive skin formulations)

- By Source:

- White Peony (Paeonia lactiflora): Known for high paeoniflorin content, favored in anti-inflammatory and blood tonifying TCM applications.

- Moutan Peony (Paeonia suffruticosa): Bark derivative containing paeonol, often used for clearing heat and regulating blood.

- By Region:

- North America (US, Canada)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (APAC) (China, Japan, South Korea, India)

- Latin America (LATAM) (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Food Pharmaceutical Peony Market

The Food Pharmaceutical Peony value chain is extensive and begins with the upstream phase: highly specialized cultivation, sustainable harvesting, and initial processing, predominantly centralized in specific Chinese provinces and regions of Japan, which possess the necessary climate, soil conditions, and generations of agricultural expertise. This cultivation stage is critically sensitive, as variables such as irrigation methods, fertilizer use, soil quality, and the precise timing of the root harvest directly determine the eventual concentration and quality of bioactive compounds like paeoniflorin and albiflorin. Upstream actors, consisting of specialized farmers and regional agricultural cooperatives, face inherent challenges in ensuring consistent quality, navigating volatile commodity pricing, and adopting global certifications (e.g., GAP or organic standards) required to meet the increasingly stringent safety and residue testing mandated by international buyers.

The midstream phase focuses on the complex industrial transformation of the raw dried root into standardized ingredients suitable for human consumption and therapeutic use. Specialized ingredient manufacturers invest heavily in state-of-the-art extraction and purification technologies, including highly efficient solvent extraction, sophisticated Supercritical CO2 extraction, and advanced membrane filtration systems, all aimed at achieving the ultra-high purity profiles required for pharmaceutical applications while minimizing residual solvents. This manufacturing stage encompasses rigorous, multi-layered quality assurance protocols, including comprehensive analytical testing (HPLC/GC-MS) for batch potency and contaminant detection, securing necessary GMP (Good Manufacturing Practice) certification, and compiling detailed technical dossiers for regulatory submission. Distribution channels at this level bifurcate: Direct sales channels involve large pharmaceutical companies or high-volume contract manufacturers purchasing large lots directly from extractors, whereas indirect channels rely on specialized international ingredient distributors who manage smaller volumes, inventory, logistics, and technical support for fragmented markets such as smaller nutraceutical start-ups.

The final downstream segment involves the formulation, specialized packaging, branding, and comprehensive global distribution of the finished products. End-product manufacturers, ranging from large multinational corporations to niche supplement brands, transform the extracts into various consumer-ready formats, including encapsulated supplements, functional liquid concentrates, topical creams, or traditional herbal decoctions. Marketing and sales are executed through diverse channels, including licensed pharmacies, dedicated health food retailers, specialty clinical practitioners, and, increasingly, through high-growth e-commerce platforms and sophisticated digital marketing campaigns focused on transparent sourcing narratives and scientifically backed claims. The successful navigation of this value chain demands a unique combination of deep agricultural procurement expertise, leading-edge chemical processing capabilities, and advanced understanding of global regulatory compliance and consumer trends. Companies that achieve significant vertical integration—controlling the process from seed to finished dose—are strategically positioned to maximize profit margins and provide unparalleled quality assurance and supply stability to the end consumers and regulatory bodies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1380 million |

| Growth Rate | CAGR 6.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xi'an Natural Field Bio-Technique Co., Ltd., Shaanxi Huike Botanical Development Co., Ltd., Tiansheng Pharmaceutical Co., Ltd., Layn Natural Ingredients Corp., Indena S.p.A., Martin Bauer Group, Changsha Natureway Co., Ltd., Chengdu Wagott Bio-Tech Co., Ltd., Nanjing Plant Extract Co., Ltd., Hunan NutraMax Inc., Shanghai Tian Tian Cai Natural Products Co., Ltd., Novoherb Technologies, Bio-Botanica Inc., Kunda Industrial Co., Ltd., Herbstandard, Sichuan Xianzhong Food Co., Ltd., Qingdao Yuanhang Biotechnology Co., Ltd., BOC Sciences, Herbal BioSolutions, and Fuji Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Pharmaceutical Peony Market Key Technology Landscape

The technological evolution within the Food Pharmaceutical Peony Market is intensely focused on achieving two primary objectives: maximizing the sustainable yield of core active ingredients, particularly paeoniflorin, and ensuring the exceptional purity levels required for pharmaceutical-grade applications while adhering to stringent international safety standards. Traditional maceration and percolation methods involving ethanol or water are increasingly being phased out or refined, giving way to advanced, environmentally sound 'green chemistry' techniques. Supercritical Fluid Extraction (SFE), especially utilizing non-toxic carbon dioxide (CO2), is rapidly gaining industry favor because it provides highly precise control over parameters like temperature and pressure. This precision enables the selective isolation of desirable, temperature-sensitive bioactive compounds without the risk of generating residual toxic organic solvents, significantly elevating the safety profile and purity of the resulting extract for sensitive food and drug end-uses.

Furthermore, specialized separation and purification technologies are indispensable for reaching the stringent standardization requirements globally imposed on botanical extracts. Advanced chromatographic methods, such as preparative High-Performance Liquid Chromatography (HPLC) and High-Performance Countercurrent Chromatography (HPCCC), are strategically employed downstream of the initial bulk extraction process to effectively isolate, concentrate, and remove trace impurities from individual marker compounds like paeonol and albiflorin. These technologies are instrumental in producing highly standardized ingredients with narrow concentration ranges, which are essential for securing regulatory acceptance, especially concerning the complex registration requirements set forth by major Western regulatory bodies like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). The reliance on cutting-edge analytical chemistry, exemplified by techniques such as Ultra-Performance Liquid Chromatography coupled with Quadrupole Time-of-Flight Mass Spectrometry (UPLC-QTOF-MS), ensures rigorous quality assurance, allows for detailed compositional fingerprinting, and provides unparalleled sensitivity for the detection of low-level contaminants, thereby building necessary credibility for suppliers operating on a global scale.

A parallel stream of innovation is dedicated to solving the functional challenges associated with the compound once it is ingested or applied. Bioavailability enhancement technologies are crucial for improving the efficacy and commercial competitiveness of peony-based finished products. These formulation breakthroughs include sophisticated techniques such as microencapsulation (protecting the active compound from environmental degradation), liposomal delivery systems (which facilitate efficient transport across biological membranes), and phytosome technology (complexing the extract with phospholipids to enhance absorption). These systems are scientifically engineered to protect sensitive bioactive molecules from degradation within the hostile environment of the gastrointestinal tract, significantly boosting systemic absorption rates. By moving peony derivatives beyond simple powder formats into these highly efficacious, patent-protected delivery systems, the industry successfully overcomes historical limitations related to low absorption and stability, expanding both the clinical relevance and the consumer appeal of the market segment.

- Supercritical Fluid Extraction (SFE): Utilized for non-toxic, highly efficient extraction under mild conditions, allowing for maximized yield and purity of specific compounds like paeoniflorin without solvent residues.

- High-Performance Liquid Chromatography (HPLC) and UPLC: Essential standard techniques for precise quantitative analysis, standardization verification, and comprehensive quality control of all key active markers in the final ingredient.

- Bioavailability Enhancement Techniques: Including Liposomal Delivery and Nanoemulsions, which are used to protect active peony compounds from degradation and significantly increase their systemic absorption and ultimate therapeutic effectiveness in the human body.

- Ultrasound-Assisted Extraction (UAE) and Microwave-Assisted Extraction (MAE): Green chemistry technologies that substantially improve extraction kinetics, reduce overall processing time, and minimize energy consumption compared to conventional, energy-intensive solvent methods.

- Advanced Analytical Chemistry (LC-MS/MS and NMR): Employed for complex profile fingerprinting, metabolite identification, and highly sensitive contaminant detection, ensuring comprehensive pharmaceutical-grade safety compliance and robust batch traceability.

Regional Highlights

The Food Pharmaceutical Peony Market exhibits pronounced regional asymmetries, fundamentally shaped by differential regulatory environments, deep-seated traditional usage patterns, and the critical global distribution of cultivation infrastructure. Asia Pacific (APAC) retains its undisputed position as the market leader, predominantly driven by the People's Republic of China, which commands the largest share in both raw material production and final consumption. This market strength is underpinned by the historical and ongoing cultural reliance on Traditional Chinese Medicine (TCM), combined with substantial governmental policy support for the modernization and global expansion of botanical pharmaceutical companies. Other influential APAC markets, notably Japan and South Korea, exhibit high demand, characterized by a preference for highly refined, premium extracts used extensively in scientifically advanced functional foods and sophisticated cosmeceutical product lines that integrate traditional wisdom with modern formulation science.

Europe and North America collectively represent the fastest-growing market segments, spurred by a fundamental shift in consumer behavior toward preventative wellness and the surging adoption of natural botanicals as complementary or alternative therapeutic options. In Europe, market penetration for new ingredients is highly regulated; successful entry necessitates rigorous compliance with the European Food Safety Authority (EFSA) Novel Food Regulation, which demands comprehensive toxicological profiles and often requires evidence of significant traditional consumption history within the EU. This regulatory landscape fosters an environment where only established extract suppliers capable of providing extensive scientific dossiers and consistent adherence to EU pharmaceutical GMP standards can thrive, lending credibility to ingredients that successfully secure approval. The North American market is highly receptive to innovation within the booming dietary supplement sector, demonstrating strong demand for peony ingredients marketed specifically for joint pain management, immune balancing, and cognitive health support, with success heavily reliant on transparent labeling and effective direct-to-consumer digital marketing strategies.

The emerging markets of Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller, yet increasingly important, shares of the global peony market, demonstrating promising growth tied to increasing urbanization, rising middle-class disposable incomes, and the gradual Westernization of dietary and wellness habits. Market establishment in LATAM is concentrated in urban centers like São Paulo and Mexico City, focusing on premium, imported nutraceutical products, though local regulatory landscapes often present logistical challenges due to varied import restrictions and complex registration processes. In the MEA region, consumption is generally low but is expanding within the high-end retail segment, particularly in the Gulf Cooperation Council (GCC) countries where consumers are drawn to luxury personal care products and specialized wellness supplements. Strategic local partnerships and customized packaging that adheres to regional requirements are essential for manufacturers aiming to successfully penetrate and scale within these nascent but potentially lucrative geographical areas.

- Asia Pacific (APAC): Dominates the global market volume and production capacity; driven by the cultural ubiquity of TCM and strong governmental backing for herbal medicine research and development; China and Japan are key manufacturing and consuming hubs.

- North America: Exhibits rapid growth in the high-value dietary supplement and functional beverage sectors; demand is high for clinically substantiated anti-inflammatory and adaptogenic peony products; market success hinges on sophisticated e-commerce presence and clear scientific messaging.

- Europe: High-growth region constrained by stringent Novel Food (EFSA) and botanical drug regulations (EMA); market demand is focused on high-specification, standardized ingredients with complete traceability and toxicological documentation; strong integration into natural cosmetics.

- Latin America (LATAM): Emerging consumer base primarily focused on high-quality imported finished nutraceuticals; initial market penetration occurs through specialty health food stores and high-end pharmacies in metropolitan areas.

- Middle East and Africa (MEA): Limited consumption focused on premium, imported finished goods; growing interest in natural health and wellness products, particularly in the UAE and Saudi Arabia, providing opportunity for niche cosmeceutical market entry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Pharmaceutical Peony Market.- Xi'an Natural Field Bio-Technique Co., Ltd.

- Shaanxi Huike Botanical Development Co., Ltd.

- Tiansheng Pharmaceutical Co., Ltd.

- Layn Natural Ingredients Corp.

- Indena S.p.A.

- Martin Bauer Group

- Changsha Natureway Co., Ltd.

- Chengdu Wagott Bio-Tech Co., Ltd.

- Nanjing Plant Extract Co., Ltd.

- Hunan NutraMax Inc.

- Shanghai Tian Tian Cai Natural Products Co., Ltd.

- Novoherb Technologies

- Bio-Botanica Inc.

- Kunda Industrial Co., Ltd.

- Herbstandard

- Sichuan Xianzhong Food Co., Ltd.

- Qingdao Yuanhang Biotechnology Co., Ltd.

- BOC Sciences

- Herbal BioSolutions

- Fuji Chemical Industry Co., Ltd.

- Jiaherb, Inc.

- Naturex (Givaudan)

- Euromed S.A.

- Sabinsa Corporation

- Shaanxi Pioneer Biotech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Food Pharmaceutical Peony market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary bioactive compound responsible for the health benefits and pharmaceutical value of Peony Root?

The most important and frequently standardized bioactive compound is Paeoniflorin, a monoterpene glycoside isolated from the root of Paeonia lactiflora. Paeoniflorin is extensively studied for its powerful anti-inflammatory, analgesic, and critical immunomodulatory effects, making it the key marker for both pharmaceutical and high-grade nutraceutical applications.

How is the global Food Pharmaceutical Peony Market typically segmented by its end-user application?

The market is critically segmented into Pharmaceuticals (TCM and modern botanical drugs), Nutraceuticals and Dietary Supplements (largest volume segment, focusing on anti-inflammation and joint health), Functional Foods and Beverages, and the rapidly growing Cosmeceuticals and Personal Care sector.

Which geographical region exerts the greatest influence over the production and consumption of standardized Peony derivatives?

The Asia Pacific (APAC) region, dominated overwhelmingly by China, maintains market leadership. This is attributable to the region's vast, specialized cultivation infrastructure, its deep cultural integration of Traditional Chinese Medicine (TCM), and robust governmental policies actively supporting herbal pharmaceutical development and commercialization.

What technological advancements are most critical for ensuring the high quality of pharmaceutical-grade Peony extracts?

Key critical technologies include Supercritical Fluid Extraction (SFE) for superior purity and yield, Advanced Analytical Chemistry (e.g., UPLC-MS/MS) for precise standardization and contamination analysis, and Bioavailability Enhancement techniques like liposomal encapsulation to improve therapeutic efficacy upon consumption.

What major restraints impede the expansion and stability of the Food Pharmaceutical Peony Market?

The primary restraints include high volatility and inconsistency in the supply of high-quality raw materials due to agricultural dependence, coupled with the high cost and complexity associated with meeting disparate international regulatory standards, such as the stringent Novel Food approvals required in Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager