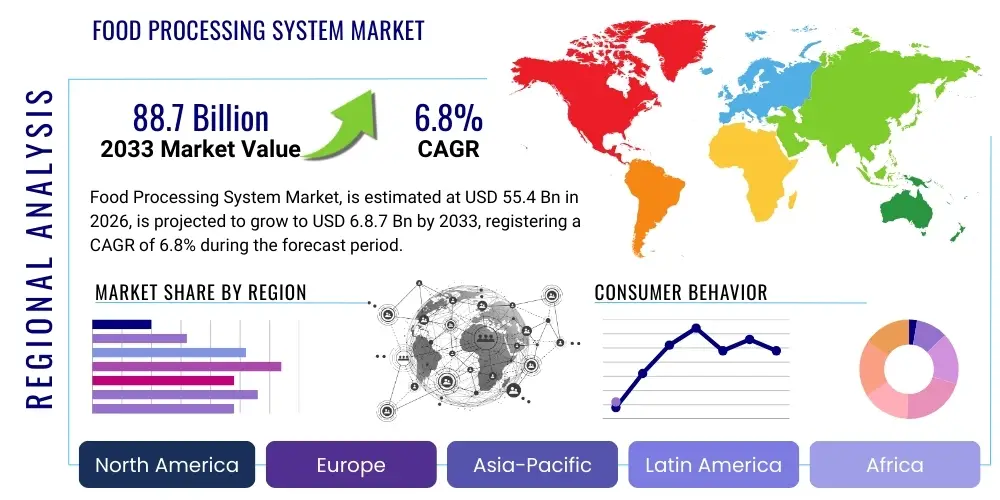

Food Processing System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438118 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Food Processing System Market Size

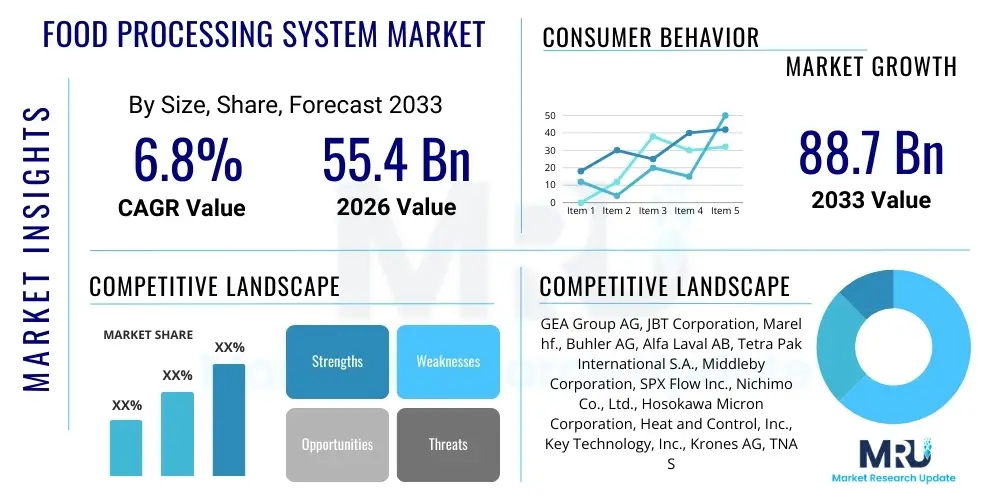

The Food Processing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 55.4 Billion in 2026 and is projected to reach USD 88.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing global demand for processed and packaged foods, coupled with stringent food safety regulations compelling manufacturers to upgrade their existing infrastructure with advanced, automated processing technologies. Furthermore, emerging economies are rapidly adopting large-scale food production techniques, necessitating investment in high-throughput and energy-efficient processing systems to meet burgeoning consumer needs.

Food Processing System Market introduction

The Food Processing System Market encompasses the technologies, equipment, and integrated systems utilized across the entire food supply chain, from raw material handling to final product packaging. These systems are crucial for transforming agricultural outputs into marketable food and beverage products, ensuring quality, safety, and extended shelf life. Key functional areas include preparation (washing, peeling, cutting), mechanical processing (mixing, blending, grinding), preservation (thermal treatment, freezing, drying), and separation (filtration, centrifugation). The complexity of modern diets and the increasing globalization of food trade necessitate highly sophisticated, automated, and customizable processing solutions to handle diverse ingredients and complex formulations efficiently.

The product description spans various sophisticated machinery categories, including industrial ovens, extruders, mixers, high-pressure processing (HPP) units, aseptic filling systems, and advanced sorting equipment utilizing optical and sensor technologies. These systems are defined by their capacity for continuous operation, precision control over parameters like temperature and pressure, and compliance with hygienic design standards (e.g., EHEDG). The shift toward clean label products and plant-based alternatives is fueling innovation, requiring processors to invest in equipment capable of handling delicate ingredients while maintaining nutritional integrity and texture profiles demanded by consumers.

Major applications of these systems are pervasive across the food and beverage industry, including dairy processing, meat and poultry, fruits and vegetables, bakery and confectionery, beverages, and convenience foods. Benefits derived from adopting advanced food processing systems include significantly improved operational efficiency through automation, reduced manual labor costs, enhanced consistency and quality of the final product, and, critically, adherence to complex international food safety standards (such as HACCP and ISO 22000). Driving factors include population growth, urbanization leading to higher demand for ready-to-eat meals, technological advancements in sensor-based monitoring, and the imperative for sustainability through waste reduction and energy optimization in production.

Food Processing System Market Executive Summary

The Food Processing System Market is characterized by intense technological evolution, shifting regulatory landscapes, and profound consumer behavior changes driving innovation toward automation and sustainability. Current business trends indicate a strong focus on modular and flexible processing lines that can rapidly switch between different products or formulations, addressing the consumer preference for variety and customization. Mergers and acquisitions are common among equipment manufacturers seeking to consolidate specialized technology, particularly in high-growth areas like aseptic processing and ultra-high temperature (UHT) treatment, ensuring vertically integrated offerings for major food producers. Furthermore, digitalization, integration of Industrial Internet of Things (IIoT), and cloud-based monitoring systems are becoming standard, enabling predictive maintenance and real-time quality assurance.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive industrialization, increasing disposable incomes, and the modernization of traditional food production practices in countries like China and India. North America and Europe, while mature, maintain strong market share due to stringent food safety laws driving continuous upgrades and high adoption rates of premium technologies such as robotics and sophisticated sorting equipment. Latin America and the Middle East & Africa (MEA) are emerging markets, witnessing significant investment in basic infrastructure and cold chain logistics, leading to steady demand for foundational processing machinery and packaging systems.

Segment trends highlight the dominance of thermal processing and mixing/blending equipment, essential for shelf-stable and prepared foods. However, the fastest growth is anticipated in emerging technologies, particularly high-pressure processing (HPP), which aligns with the demand for minimally processed, clean label foods without chemical preservatives. Furthermore, the segmentation by application shows convenience food and beverage processing maintaining the largest share due to changing consumer lifestyles. Sustainability requirements are strongly influencing the material segment, with manufacturers increasingly favoring hygienic stainless steel, ceramic components, and systems designed for optimized water and energy consumption, leading to higher initial equipment costs but long-term operational savings.

AI Impact Analysis on Food Processing System Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the Food Processing System Market predominantly revolve around three critical themes: efficiency enhancement, predictive food safety, and personalized production capabilities. Users frequently ask about the practical applications of machine learning in optimizing process variables (e.g., cook times, mixing speeds), minimizing raw material waste through advanced computer vision sorting, and predicting equipment failure before it occurs (predictive maintenance). A major concern often raised is the implementation complexity and the required investment in training data and sensor infrastructure. Overall, the expectation is that AI will move the industry toward truly autonomous processing facilities, characterized by enhanced throughput, superior quality consistency, and an unprecedented level of traceability from farm to fork, ensuring rapid compliance with regulatory audits.

- AI-driven computer vision systems enhance quality control by identifying foreign materials or product defects at speeds and accuracies far beyond human capability.

- Machine learning algorithms optimize processing parameters, such as controlling fermentation curves or oven temperatures, minimizing energy usage and maximizing yield.

- Predictive maintenance schedules are generated by analyzing real-time sensor data from processing equipment (IIoT), drastically reducing unplanned downtime and maintenance costs.

- AI supports advanced traceability and supply chain transparency, rapidly pinpointing the source of contamination or quality issues, thereby improving public health response.

- Robotics and AI coordination facilitate complex tasks like precise cutting, portioning, and handling of delicate food items, increasing operational flexibility and hygiene.

DRO & Impact Forces Of Food Processing System Market

The dynamics of the Food Processing System Market are shaped by a powerful interplay of Driving factors, Restraints, Opportunities, and inherent Impact Forces, dictating investment strategies and technological adoption rates across the globe. Key drivers center on demographic shifts, particularly the global population expansion and rapid urbanization, which accelerate the demand for mass-produced, safe, and convenient food products. This demand necessitates higher automation levels and larger capacity processing lines. Concurrently, stringent global food safety regulations, championed by bodies like the FDA and EFSA, force continuous technological upgrades, driving market growth despite associated compliance costs.

Restraints primarily involve the substantial initial capital investment required for high-tech processing systems, which often acts as a barrier to entry for smaller enterprises and those in developing nations. Furthermore, the complexity associated with integrating sophisticated technologies, such as IIoT sensors, robotics, and complex software interfaces, demands a highly skilled workforce, leading to ongoing labor skill gaps in the operational environment. Volatility in raw material prices and energy costs also poses a significant restraint, forcing manufacturers to constantly seek energy-efficient, yet expensive, processing solutions to maintain profitability margins.

Opportunities are abundant in sustainable processing, focusing on water conservation, energy recovery systems, and waste valorization techniques (turning processing byproducts into valuable co-products). The burgeoning market for plant-based proteins, cell-based meat alternatives, and functional foods requires entirely new, specialized processing equipment, presenting a greenfield opportunity for innovative manufacturers. Impact forces include intense competition among global equipment suppliers, the high negotiating power of large multinational food producers demanding customized, large-scale turnkey solutions, and the critical societal force of consumer demand for transparency and ethical sourcing, influencing processing methods and equipment design.

Segmentation Analysis

The Food Processing System Market is extensively segmented based on the type of equipment, the specific application area, and the level of operation required, offering a granular view of market dynamics and specialized demand pockets. Segmentation allows market stakeholders to identify specialized growth sectors, such as aseptic processing machinery gaining traction due to extended shelf-life requirements for beverages, or the increasing customization within the mixing and blending segment to handle viscous plant-based matrices. Analyzing these segments is essential for understanding where investment capital is flowing, particularly into highly automated preparation and sorting equipment which promise significant labor savings and quality improvements.

The application-based segmentation (e.g., Dairy, Meat, Bakery) reveals sector-specific needs. For instance, the meat processing segment emphasizes cold chain integrity, high hygiene standards (clean-in-place systems), and precise cutting technologies, while the bakery segment focuses on high-capacity kneading, forming, and continuous baking ovens. The sheer diversity of food products, from high-moisture fruits to low-moisture snack foods, necessitates equipment designed for specific physical and chemical properties, driving the variety observed in the equipment type segment.

Further analysis of the operational mode, such as batch versus continuous processing, indicates a market preference shift toward continuous systems, especially among large global food corporations. Continuous systems offer superior consistency, higher throughput, and reduced energy consumption per unit of output compared to traditional batch methods. This segmentation underscores the prevailing trend toward industrial scale and efficiency as manufacturers attempt to leverage economies of scale in the face of competitive pricing pressures globally.

- By Equipment Type:

- Thermal Processing (Ovens, Heat Exchangers, Freezers, Pasteurizers)

- Mixing and Blending

- Separation (Filtration, Centrifugation, Sieving)

- Cutting, Peeling, and Grinding

- Extrusion Systems

- Homogenizers and Emulsifiers

- Aseptic and High-Pressure Processing (HPP) Equipment

- By Application:

- Meat, Poultry, and Seafood Processing

- Dairy Processing

- Fruits and Vegetables Processing

- Bakery and Confectionery

- Beverages (Alcoholic and Non-Alcoholic)

- Convenience Foods and Ready Meals

- Grains and Cereals

- By Operation Mode:

- Batch Processing

- Continuous Processing

- By End-User:

- Small and Medium Enterprises (SMEs)

- Large Scale Food Manufacturers

Value Chain Analysis For Food Processing System Market

The value chain of the Food Processing System Market begins with the upstream suppliers of core components, including specialized steel manufacturers (stainless steel grade 316 and 304 for hygiene), control system manufacturers (PLCs, sensors, automation components), and specialized engineering firms providing custom solutions. Upstream analysis indicates that component sourcing is highly sensitive to global supply chain disruptions and commodity price fluctuations, particularly for critical electronic components and high-grade metals. Strategic relationships between equipment manufacturers and component suppliers focused on precision, durability, and compliance with sanitary standards are crucial for maintaining the quality and performance of the final processing systems.

The central segment of the value chain involves the Food Processing System Original Equipment Manufacturers (OEMs) and system integrators. OEMs focus on designing, assembling, and testing individual machines (e.g., industrial fryers, spiral freezers). System integrators play a vital role by combining disparate machines into a unified, automated processing line, often providing customized software and connectivity solutions (IIoT integration). Differentiation at this stage relies heavily on intellectual property, technical expertise in hygienic design, and the ability to offer comprehensive service packages, including installation, commissioning, and long-term maintenance contracts.

Downstream analysis focuses on the distribution channels and end-users. Distribution is typically handled through a mix of direct sales forces (especially for large, complex, and customized turnkey projects) and indirect channels utilizing regional distributors or agents, particularly for standardized or smaller equipment sales in geographically dispersed markets. Direct sales enable stronger customer relationships and better post-sale support crucial for complex machinery. The end-users—large multinational food manufacturers and regional food processors—drive demand by prioritizing high reliability, low total cost of ownership (TCO), and systems capable of rapid regulatory compliance. The effectiveness of the after-sales support channel, including spares availability and technician response time, significantly impacts customer retention.

Food Processing System Market Potential Customers

Potential customers for food processing systems span the entirety of the food and beverage production ecosystem, ranging from multinational conglomerates with massive, automated production facilities to specialized regional co-operatives focusing on niche markets. The primary buyers are large scale food manufacturers (LMFs) such as global giants in packaged goods, demanding integrated, high-throughput, continuous processing lines that maximize efficiency and minimize operational waste. These customers seek vendor partnerships that offer global installation capabilities, robust supply chain resilience for spares, and state-of-the-art automation and data analytics platforms to monitor performance across multiple geographies.

Medium and small-sized enterprises (SMEs), while representing a smaller volume per transaction, constitute a large number of potential buyers, particularly in emerging markets or specialized artisanal sectors. These customers often prioritize modular, semi-automated, and cost-effective solutions that allow for scalable growth without excessive initial capital expenditure. Their purchasing decisions are heavily influenced by ease of operation, maintenance simplicity, and local vendor support. The increasing prevalence of contract manufacturing organizations (CMOs) in the food sector also creates a significant customer base, as CMOs require versatile equipment capable of handling diverse client formulations and rapid product changeovers.

Furthermore, specialized segments such as ingredient manufacturers, nutraceutical producers, and beverage bottlers form distinct customer groups. Nutraceutical companies require highly precise and sterile processing systems (e.g., specific drying or encapsulation technologies) to preserve the efficacy of active ingredients. Beverage bottlers are major consumers of filtration, mixing, and high-speed aseptic filling equipment. In essence, any organization involved in the industrial transformation of raw agricultural products into marketable, safe, and packaged food items is a core potential customer, with purchasing motivations tied to quality assurance, regulatory mandates, and profitability enhancement through automation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.4 Billion |

| Market Forecast in 2033 | USD 88.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group AG, JBT Corporation, Marel hf., Buhler AG, Alfa Laval AB, Tetra Pak International S.A., Middleby Corporation, SPX Flow Inc., Nichimo Co., Ltd., Hosokawa Micron Corporation, Heat and Control, Inc., Key Technology, Inc., Krones AG, TNA Solutions Pty Ltd., Illinois Tool Works Inc. (ITW), Dover Corporation, Big Dutchman International GmbH, Bizerba SE & Co. KG, Multivac Sepp Haggenmueller SE & Co. KG, Reading Bakery Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Processing System Market Key Technology Landscape

The technological landscape of the Food Processing System Market is rapidly evolving, moving away from simple mechanical processes toward smart, integrated, and minimally invasive preservation techniques. A core technological trend is the pervasive adoption of automation and robotics, not just for material handling but for sophisticated tasks like quality inspection and precision cutting. Modern processing systems heavily rely on advanced sensor technology (e.g., hyperspectral imaging, chemical sensors) coupled with IIoT connectivity to gather massive amounts of real-time data. This data is critical for closed-loop control systems, ensuring optimal processing parameters are maintained consistently, thus maximizing yield and minimizing human error in complex environments.

Another pivotal area is the advancement in preservation and sterilization techniques designed to maintain the nutritional and sensory characteristics of food products better than traditional methods. High-Pressure Processing (HPP) has gained substantial momentum as a non-thermal method that effectively inactivates pathogens while preserving vitamins, color, and flavor, appealing directly to the clean label trend. Similarly, pulsed electric field (PEF) technology is being explored for microbial inactivation and cell disintegration in juice and dairy applications. Continuous flow microwave and radio-frequency heating are also gaining traction as more energy-efficient alternatives to conventional thermal processing, offering faster and more uniform heating profiles.

Furthermore, technology related to hygiene and sustainability is paramount. Clean-in-Place (CIP) and Sterilize-in-Place (SIP) systems have become highly sophisticated, using optimized flow dynamics and chemical dosing monitored by smart sensors to reduce water consumption and cleaning time. Equipment design is increasingly focusing on features that eliminate harbors for bacterial growth (e.g., fully welded construction, sloped surfaces, minimal exposed threads) to comply with evolving sanitary standards. The integration of augmented reality (AR) for remote diagnostics and maintenance is also emerging, allowing OEMs to provide expert technical support to food producers globally without requiring immediate physical presence, improving operational uptime significantly.

Regional Highlights

Regional variations in the Food Processing System Market are strongly correlated with economic development levels, population density, regulatory strictness, and local dietary preferences, creating distinct investment cycles and demand profiles across continents. North America, characterized by high labor costs and advanced infrastructural maturity, leads in the adoption of cutting-edge automation, robotics, and advanced sorting technologies, driving demand for systems that offer unparalleled throughput and labor reduction. The focus here is on efficiency and the integration of sophisticated supply chain management tools with processing data.

Europe mirrors the emphasis on technological sophistication but is further differentiated by its exceptionally stringent environmental and safety regulations, pushing innovation in waste reduction, energy efficiency, and high-hygiene design (e.g., aseptic processing). Western European countries prioritize retrofitting and modernization of existing facilities with smart technologies, while Eastern Europe is seeing growth driven by new facility construction and market entry by global food producers aiming for local sourcing and reduced logistical costs.

Asia Pacific (APAC) represents the largest and fastest-growing regional market. This massive growth is underpinned by rapid urbanization, substantial investments in cold chain infrastructure, and the industrialization of food production to meet the needs of a huge and growing middle class. Countries like China and India are transforming traditional, decentralized processing methods into centralized, industrial operations, creating explosive demand across all equipment segments, particularly high-volume processing lines for staples like rice, grains, and prepared ethnic foods. Latin America and MEA are focused on foundational systems, modernization of meat and dairy sectors, and equipment that supports export standards, often driven by government initiatives to improve food security and trade capabilities.

- North America: Dominant in high-level automation, HPP, and robotics integration; driven by labor cost reduction and sophisticated consumer demands for variety.

- Europe: Focus on sustainability, energy optimization, and compliance with strict hygiene standards (CIP/SIP); strong market for advanced thermal and filtration systems.

- Asia Pacific (APAC): Highest growth region; large investments in infrastructure modernization, cold chain development, and high-capacity processing systems for mass production.

- Latin America: Emerging market with increasing demand for basic and semi-automated systems, driven by expanding middle class and focus on improving food safety standards for local consumption and export.

- Middle East & Africa (MEA): Growing focus on dairy, meat, and packaged beverage production; driven by food security concerns and foreign direct investment in large processing plants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Processing System Market.- GEA Group AG

- JBT Corporation

- Marel hf.

- Buhler AG

- Alfa Laval AB

- Tetra Pak International S.A.

- Middleby Corporation

- SPX Flow Inc.

- Nichimo Co., Ltd.

- Hosokawa Micron Corporation

- Heat and Control, Inc.

- Key Technology, Inc.

- Krones AG

- TNA Solutions Pty Ltd.

- Illinois Tool Works Inc. (ITW)

- Dover Corporation

- Big Dutchman International GmbH

- Bizerba SE & Co. KG

- Multivac Sepp Haggenmueller SE & Co. KG

- Reading Bakery Systems

Frequently Asked Questions

Analyze common user questions about the Food Processing System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary trends are driving the demand for advanced food processing systems?

The primary drivers include the shift towards automated, continuous processing to meet high global demand for convenience foods, stringent regulatory requirements necessitating better traceability and hygiene, and consumer preference for minimally processed foods, favoring technologies like High-Pressure Processing (HPP).

How is sustainability impacting investment in new food processing equipment?

Sustainability is crucial, driving investment in processing systems designed for reduced water and energy consumption, optimized waste reduction, and enhanced utilization of by-products. Manufacturers are increasingly seeking equipment with high energy efficiency ratings and superior Clean-in-Place (CIP) capabilities to minimize resource use.

Which segment of the Food Processing System Market is projected to experience the fastest growth?

The segment related to non-thermal preservation technologies, particularly High-Pressure Processing (HPP) and Pulsed Electric Field (PEF), is anticipated to show the fastest growth. This is due to their ability to extend shelf life while maintaining the nutritional and sensory qualities required by the clean label movement.

What role does the Industrial Internet of Things (IIoT) play in modern food processing operations?

IIoT enables real-time monitoring and data collection from equipment sensors, facilitating predictive maintenance to avoid unexpected downtime, optimizing operational parameters for energy savings, and ensuring comprehensive digital traceability for quality and regulatory compliance throughout the processing line.

What are the key challenges facing smaller food processors when upgrading their systems?

Smaller processors face significant challenges primarily related to the high initial capital expenditure required for sophisticated, automated systems and the difficulty in acquiring and retaining the skilled technical personnel necessary to operate and maintain complex, integrated machinery effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager