Food Safety Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439946 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Food Safety Insurance Market Size

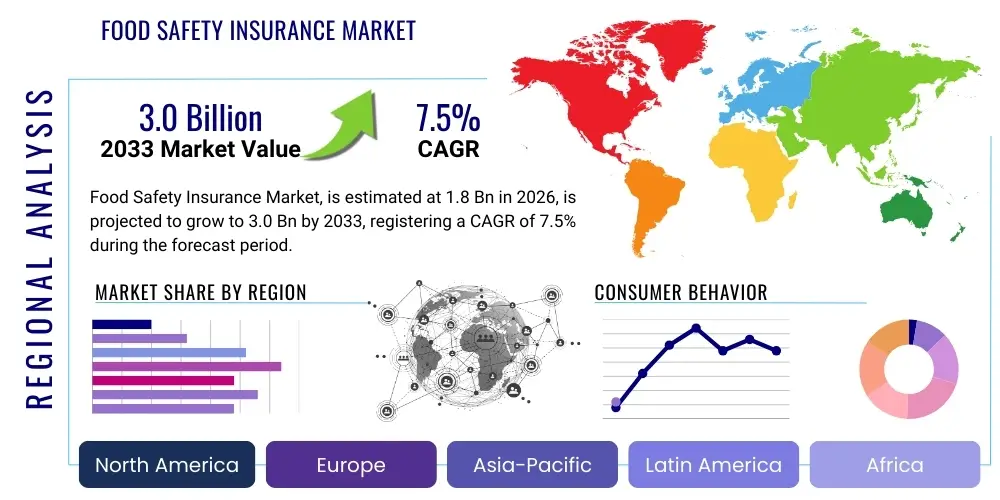

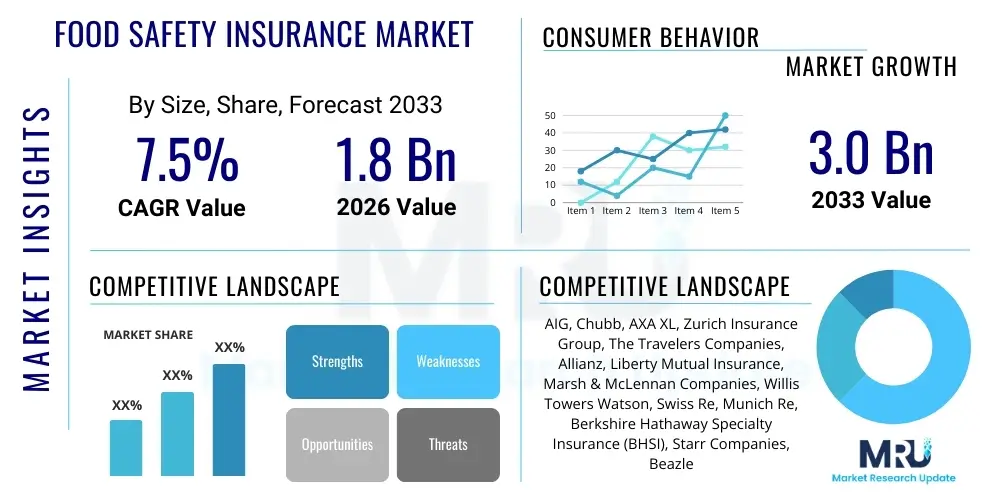

The Food Safety Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033. This growth is primarily driven by an increased global focus on food safety regulations, a rising incidence of foodborne illnesses, and the intricate complexities of global food supply chains, which amplify the risk exposure for businesses across the food industry value chain.

The market expansion is also propelled by heightened consumer awareness regarding food quality and safety, leading to stronger demand for accountability from food manufacturers and retailers. As businesses seek to mitigate substantial financial losses associated with product recalls, contamination events, and potential litigation, the adoption of comprehensive food safety insurance policies has become a critical risk management strategy. This proactive approach ensures financial stability and protects brand reputation in an increasingly scrutinized operational environment.

Food Safety Insurance Market introduction

The Food Safety Insurance Market provides specialized coverage designed to protect businesses in the food and beverage industry from financial losses stemming from food contamination, product recalls, foodborne illness outbreaks, and associated legal liabilities. These policies are critical for entities ranging from agricultural producers and food manufacturers to distributors, retailers, and foodservice operators, offering a vital safety net against unforeseen events that can severely impact operations and profitability. The core product offering typically includes coverage for recall expenses, business interruption, legal defense costs, and third-party claims for bodily injury or property damage resulting from unsafe food products. As the global food supply chain becomes more interconnected and complex, the risks associated with food safety incidents escalate, making such insurance indispensable.

Major applications for food safety insurance span the entire food value chain. Food manufacturers, including those producing dairy, meat, baked goods, and processed foods, utilize these policies to safeguard against large-scale contamination events that could necessitate extensive recalls and lead to significant financial and reputational damage. Restaurants, hotels, and catering services also rely on this insurance to cover liabilities arising from foodborne illnesses impacting consumers. Furthermore, food distributors and retailers seek coverage to protect against the costs associated with handling and selling contaminated products, including inventory loss and potential claims from consumers.

The benefits of adopting food safety insurance are multifaceted, extending beyond mere financial protection. It offers risk mitigation by transferring a significant portion of potential financial burdens to an insurer, thereby stabilizing a company's balance sheet. Moreover, it provides a crucial layer of brand reputation protection, as businesses can quickly and effectively manage crises without being overwhelmed by immediate financial constraints. Key driving factors for market growth include the increasingly stringent food safety regulations imposed by governments worldwide, the escalating frequency and cost of product recalls, greater consumer demand for transparency and safety, and the intricate, globalized nature of modern food supply chains which inherently introduce more points of potential contamination and risk.

Food Safety Insurance Market Executive Summary

The Food Safety Insurance Market is experiencing robust growth, driven by a confluence of escalating food safety risks, tightening regulatory landscapes, and increased consumer awareness. Business trends indicate a shift towards more comprehensive and customized insurance solutions, moving beyond basic recall coverage to include preventative services, risk assessment tools, and integrated crisis management support. Insurers are increasingly leveraging data analytics and technology to offer tailored policies that better reflect the specific risk profiles of diverse food industry segments, from small craft producers to large multinational corporations. The emphasis is on proactive risk management, with policies designed not just to cover losses but also to help mitigate the likelihood of incidents occurring, fostering a more resilient and responsible food industry ecosystem.

Regionally, mature markets in North America and Europe continue to dominate the food safety insurance landscape, characterized by well-established regulatory frameworks and a high degree of awareness among food businesses regarding the importance of such coverage. These regions exhibit steady growth, with innovation focusing on specialized niche offerings and enhanced policy features. Conversely, the Asia Pacific, Latin America, and Middle East & Africa regions are emerging as high-growth markets. This surge is fueled by rapid urbanization, expanding middle classes, increasing foreign investment in their food sectors, and the gradual adoption of international food safety standards. These emerging economies present significant untapped potential, as many local businesses are yet to fully integrate comprehensive food safety risk management strategies into their operations.

Segmentation trends reveal a particular surge in demand for product recall insurance, reflecting the significant financial and reputational damage that high-profile recalls can inflict. Concurrently, there is growing interest in third-party liability coverage, as consumers and legal systems become more assertive in seeking compensation for damages caused by unsafe food products. The market is also seeing increased penetration among small and medium-sized enterprises (SMEs) as they become more aware of their vulnerabilities and the catastrophic impact a single food safety incident can have on their survival. Distribution channels are evolving, with a growing reliance on specialized brokers who possess deep industry knowledge, while direct and online channels are also gaining traction, particularly for more standardized policy offerings.

AI Impact Analysis on Food Safety Insurance Market

User questions regarding the impact of Artificial Intelligence (AI) on the Food Safety Insurance Market frequently center on how AI can enhance risk assessment, improve prediction of foodborne incidents, and potentially lower insurance costs. Users are keen to understand the specific applications of AI in supply chain monitoring, early detection of contamination, and the automation of claims processing. Concerns often arise about the accuracy of AI models, data privacy, and the ethical implications of using AI for underwriting. Ultimately, the market expects AI to usher in an era of more precise risk quantification, proactive prevention strategies, and streamlined operational efficiencies for both insurers and insured entities, leading to more dynamic and responsive insurance products.

- AI enhances predictive analytics by processing vast datasets from supply chains, climate, and historical incidents to forecast contamination risks.

- Automated claims processing reduces administrative overhead and expedites payout times following a food safety event.

- AI-powered IoT sensors provide real-time monitoring of food storage conditions, transit temperatures, and production environments, flagging anomalies before they escalate.

- Improved fraud detection capabilities through AI algorithms analyze claims patterns and identify suspicious activities, minimizing illegitimate payouts.

- Personalized risk assessment allows insurers to offer highly customized policies and premiums based on an individual business's specific operational risks, leveraging granular data.

- Facilitates proactive risk mitigation advice by identifying potential vulnerabilities in a food business's operations through continuous data analysis.

- Supports rapid incident response by providing data-driven insights to quickly pinpoint the source of contamination and streamline recall logistics.

DRO & Impact Forces Of Food Safety Insurance Market

The Food Safety Insurance Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the increasing stringency of food safety regulations globally, compelling businesses to adopt robust risk management strategies that include insurance. Coupled with this, the rising incidence of foodborne illnesses and high-profile product recalls has heightened awareness among businesses about their potential liabilities and the catastrophic financial and reputational damage a single incident can cause. The inherent complexities of modern, globalized food supply chains, which introduce numerous points of potential contamination and make traceability challenging, further amplify the demand for comprehensive insurance coverage. Moreover, growing consumer awareness and demand for safe food products place immense pressure on businesses to ensure quality and safety, making insurance a vital safeguard.

Despite these strong drivers, the market faces several restraints. One significant barrier is the relatively high premium costs associated with comprehensive food safety insurance, which can be prohibitive for smaller businesses and startups, especially those operating with tight margins. There is also a notable lack of awareness among many small and medium-sized enterprises (SMEs) regarding the specific risks they face and the availability and benefits of specialized food safety insurance products, leading to underinsurance. Furthermore, standardized policy offerings often fail to adequately address the diverse and nuanced risk profiles of different segments within the food industry, making it challenging for businesses to find perfectly tailored coverage. Complex and protracted claim processes can also deter some businesses, undermining confidence in the value of such policies.

Opportunities for market growth are abundant, particularly in emerging markets where food safety standards are evolving, and the food industry is rapidly expanding, creating new demand for insurance solutions. The integration of advanced data analytics, artificial intelligence, and IoT into risk assessment and policy customization presents a substantial opportunity for insurers to offer more precise, preventative, and value-added services, potentially making policies more attractive and affordable. There is also a growing scope for developing highly customizable policies that cater to niche segments within the food industry, addressing specific risks associated with organic foods, allergens, or novel food technologies. Impact forces such as ongoing regulatory pressures, continuous technological advancements in food production and monitoring, the increasing globalization of food trade, and broader macroeconomic factors like economic stability and consumer purchasing power, constantly influence the market's trajectory, requiring insurers and businesses to remain agile and adaptive.

Segmentation Analysis

The Food Safety Insurance Market is segmented across various critical dimensions to provide tailored solutions that address the diverse risk profiles and operational needs of businesses within the food industry. These segmentations allow for a granular understanding of market demand, helping insurers to design and price policies more effectively while enabling businesses to select coverage that precisely matches their exposure. The market's structure reflects the multifaceted nature of food safety risks, from the type of incident to the characteristics of the insured entity and the channels through which policies are distributed.

- By Type:

- Product Contamination Insurance (Accidental, Malicious)

- Product Recall Insurance (First-party and Third-party costs)

- Third-Party Liability (Bodily injury, Property damage, Reputation harm)

- Business Interruption Coverage

- Crisis Management & Public Relations Coverage

- By End-User:

- Food Manufacturers (Dairy, Meat, Seafood, Bakery & Confectionery, Processed Foods, Beverages)

- Restaurants & Foodservice (Cafes, Hotels, Catering)

- Retailers (Supermarkets, Grocery Stores, Online Retailers)

- Food Distributors & Wholesalers

- Agricultural Producers & Farms (Specific produce, livestock)

- By Coverage:

- Single Event Policy

- Annual Policy

- Multi-year Policy

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Distribution Channel:

- Brokers & Agents

- Direct Sales

- Online Platforms/Insurtech

Value Chain Analysis For Food Safety Insurance Market

The value chain for the Food Safety Insurance Market encompasses a series of interconnected activities and stakeholders, each contributing to the delivery and management of insurance products, from initial risk assessment to claims settlement. This chain begins upstream with entities like data providers and risk modeling firms, which supply crucial information on food safety trends, supply chain vulnerabilities, and historical incident data. Reinsurers also play a vital upstream role, providing capacity and financial backing to primary insurers, enabling them to underwrite larger and more complex risks within the food industry. These upstream components are foundational to accurate risk assessment and the sustainable structuring of insurance policies.

Midstream, the primary insurance carriers are at the core of the value chain, responsible for product development, underwriting, policy issuance, and managing customer relationships. They synthesize the data and insights from upstream partners to create tailored food safety insurance products. Their internal teams of actuaries, underwriters, and product developers are crucial in designing policies that balance coverage breadth with affordability. This stage also involves extensive marketing and sales efforts to reach potential clients within the diverse food industry landscape, ensuring that businesses are aware of the available protective measures.

Downstream, the value chain extends to distribution channels, which include independent brokers, agents, direct sales teams, and increasingly, online platforms and insurtech solutions. Brokers and agents act as intermediaries, leveraging their expertise to match businesses with appropriate policies and provide advisory services. Post-sale, claims adjusters and legal professionals form a critical part of the downstream process, handling incident investigations, claim assessments, and legal disputes. Additionally, crisis management consultants and PR firms often partner with insurers or are integrated into policy offerings to help insured businesses navigate the complex aftermath of a food safety incident, protecting their brand and reputation. The efficiency and effectiveness of these downstream components directly impact customer satisfaction and the overall utility of the insurance product.

Food Safety Insurance Market Potential Customers

The potential customers for Food Safety Insurance span the entire breadth of the food and beverage industry, reflecting the ubiquitous nature of food safety risks across the supply chain. At the forefront are food and beverage manufacturers, including large-scale producers of dairy products, meat, poultry, seafood, baked goods, confectioneries, processed foods, and various beverages. These entities face significant exposure due to the volume of products they handle and distribute, making them prime candidates for comprehensive coverage against contamination, spoilage, and recall events. Their complex manufacturing processes and reliance on extensive supply chains magnify the need for robust insurance protection.

Further down the value chain, the foodservice sector represents another substantial customer base. This includes restaurants, cafes, hotels, catering companies, and institutional food providers (e.g., schools, hospitals). These businesses are directly responsible for preparing and serving food to consumers, making them highly susceptible to foodborne illness outbreaks and associated liability claims. Food safety insurance helps them manage the financial and reputational fallout from such incidents, ensuring business continuity and consumer trust. The dynamic nature of their operations, with diverse ingredient sourcing and varied preparation methods, underscores their vulnerability.

Additionally, food distributors, wholesalers, and retailers, encompassing supermarkets, grocery stores, convenience stores, and online food retailers, are crucial potential customers. While they may not manufacture products, they are responsible for their safe storage, transport, and sale. Contamination at any point in the distribution chain can lead to massive inventory losses, recall expenses, and customer lawsuits, making insurance a vital component of their risk management strategy. Even agricultural producers, particularly those dealing with highly perishable goods or significant volumes, increasingly recognize the value of food safety insurance to mitigate risks associated with harvest contamination or disease outbreaks affecting their produce or livestock before it even enters the processing stream.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Chubb, AXA XL, Zurich Insurance Group, The Travelers Companies, Allianz, Liberty Mutual Insurance, Marsh & McLennan Companies, Willis Towers Watson, Swiss Re, Munich Re, Berkshire Hathaway Specialty Insurance (BHSI), Starr Companies, Beazley Group, QBE Insurance Group, Tokio Marine Holdings, Sompo Holdings, HDI Global SE, Fairfax Financial Holdings, Generali Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Safety Insurance Market Key Technology Landscape

The Food Safety Insurance Market is rapidly evolving through the adoption of various advanced technologies, fundamentally transforming how risks are assessed, managed, and mitigated across the food supply chain. Artificial Intelligence (AI) and Machine Learning (ML) are paramount, utilized for sophisticated predictive analytics. These technologies process vast datasets, including historical recall data, weather patterns, supplier performance, and genetic sequencing of pathogens, to identify potential contamination risks proactively. This enables insurers to offer more accurate risk assessments and tailor policies, while also empowering insured businesses with early warning systems to prevent incidents before they occur. The integration of AI also streamlines claims processing by automating verification and assessment, reducing processing times and operational costs.

Blockchain technology is another transformative force, offering unparalleled transparency and traceability within complex food supply chains. By creating an immutable, decentralized ledger of every transaction and movement of food products from farm to fork, blockchain can pinpoint the exact origin of a contamination quickly and efficiently. This capability significantly reduces the scope and cost of product recalls, as affected batches can be isolated with precision, minimizing waste and brand damage. For insurers, blockchain provides verifiable data for underwriting and claims, enhancing trust and accuracy. It allows for a more granular understanding of a business's supply chain integrity, potentially leading to lower premiums for companies demonstrating superior traceability.

Furthermore, the Internet of Things (IoT) plays a crucial role in real-time monitoring and data collection. IoT sensors deployed in farming, processing facilities, transportation vehicles, and storage units can continuously track critical parameters such as temperature, humidity, pH levels, and even pathogen presence. These sensors provide continuous data streams that can be analyzed by AI systems to detect deviations from optimal conditions, signaling potential risks. Telematics, a specific application of IoT, is used in logistics to monitor transit conditions of food products, ensuring temperature control and minimizing spoilage risks during transportation. These technologies collectively enable a shift from reactive claim handling to proactive risk prevention, making food safety insurance more effective, efficient, and ultimately, a more valuable proposition for the food industry.

Regional Highlights

- North America: This region holds a significant share of the food safety insurance market, driven by highly stringent food safety regulations, a mature food industry, and high consumer awareness regarding product quality and safety. The U.S. and Canada, with their complex supply chains and frequent recalls, demonstrate strong demand for comprehensive coverage. Innovation in policy customization and risk management services is also prominent here.

- Europe: Europe represents a robust market, characterized by stringent regulatory bodies like the European Food Safety Authority (EFSA) and the implementation of robust traceability systems. Countries such as Germany, the UK, and France are leading in adopting sophisticated food safety insurance products due to high food safety standards and a proactive approach to risk mitigation among food businesses.

- Asia Pacific (APAC): The APAC region is poised for rapid growth, fueled by increasing urbanization, a growing middle class, and rising awareness of food safety issues. Emerging economies like China and India are witnessing significant investments in food processing and manufacturing, coupled with evolving regulatory frameworks, creating substantial untapped market potential for food safety insurance.

- Latin America: This region is an emerging market with increasing foreign investment in its agricultural and food processing sectors. As local industries integrate into global supply chains, there is a growing need for international standard food safety practices and corresponding insurance coverage, albeit from a relatively lower base of adoption compared to developed regions.

- Middle East and Africa (MEA): The MEA market is currently in its nascent stage but shows promising growth potential. Increased focus on food security, diversification of economies away from oil, and growing tourism sectors are driving investments in food processing and hospitality, gradually fostering a need for specialized food safety insurance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Safety Insurance Market.- AIG

- Chubb

- AXA XL

- Zurich Insurance Group

- The Travelers Companies

- Allianz

- Liberty Mutual Insurance

- Marsh & McLennan Companies

- Willis Towers Watson

- Swiss Re

- Munich Re

- Berkshire Hathaway Specialty Insurance (BHSI)

- Starr Companies

- Beazley Group

- QBE Insurance Group

- Tokio Marine Holdings

- Sompo Holdings

- HDI Global SE

- Fairfax Financial Holdings

- Generali Group

Frequently Asked Questions

What is food safety insurance?

Food safety insurance is a specialized type of commercial insurance designed to protect businesses in the food and beverage industry from financial losses and liabilities arising from food contamination, product recalls, foodborne illness outbreaks, and related incidents. It covers expenses such as recall costs, business interruption, legal defense, and third-party claims for damages or bodily injury.

Who needs food safety insurance?

Virtually any business involved in the food supply chain can benefit from food safety insurance. This includes agricultural producers, food and beverage manufacturers (e.g., dairy, meat, bakery, processed foods), food distributors, wholesalers, retailers (supermarkets, grocery stores), and foodservice establishments (restaurants, hotels, caterers). Any entity responsible for the safety of food products reaching consumers faces significant risks that this insurance mitigates.

What does food safety insurance typically cover?

Coverage generally includes costs associated with product recall (e.g., notification, transportation, disposal, replacement), business interruption losses due to a shutdown or slowdown, third-party liability for bodily injury or property damage caused by unsafe products, legal defense expenses, and often, crisis management and public relations support to protect brand reputation following an incident. Policies can be customized to cover accidental contamination, malicious tampering, or even specific allergens.

How is the premium for food safety insurance determined?

Premiums are determined based on several factors, including the type and volume of food products handled, the complexity of the supply chain, a company's historical claims record, implemented food safety protocols and certifications, geographic reach, and the desired coverage limits and deductibles. Businesses with robust food safety management systems and a strong track record may qualify for lower premiums due as they present lower risk to insurers.

How does AI impact the food safety insurance market?

AI significantly impacts food safety insurance by enhancing risk assessment through predictive analytics, identifying potential contamination sources in real-time, and streamlining claims processing. It leverages vast datasets to forecast risks, aids in fraud detection, and supports the creation of highly customized policies based on granular operational data. This leads to more precise underwriting, proactive risk mitigation advice, and more efficient incident response for both insurers and insured businesses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager