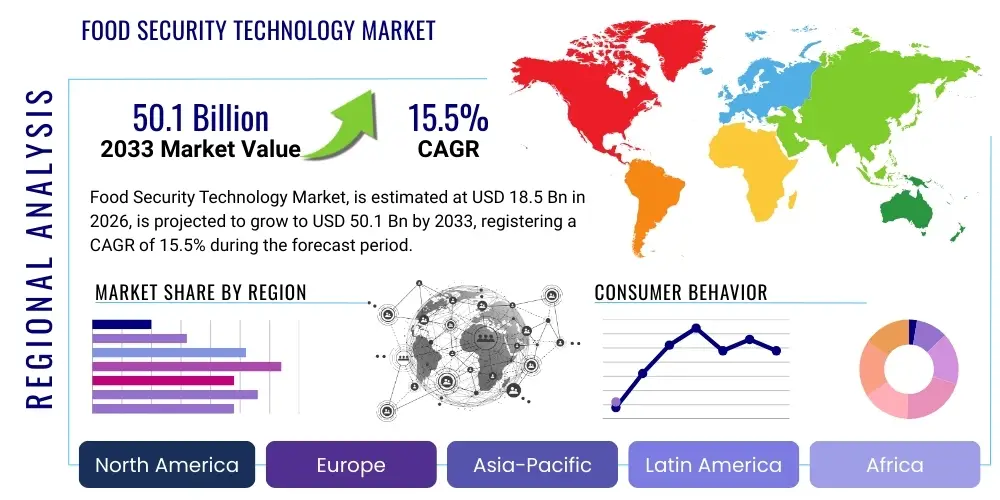

Food Security Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438772 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food Security Technology Market Size

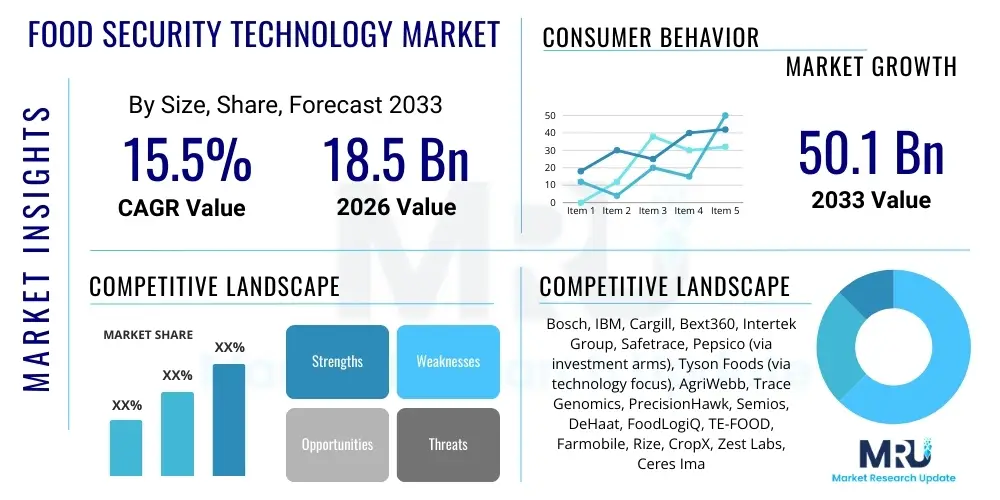

The Food Security Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 50.1 Billion by the end of the forecast period in 2033.

Food Security Technology Market introduction

The Food Security Technology (FST) Market encompasses a diverse range of technological solutions designed to address systemic vulnerabilities across the global food supply chain, ensuring that populations have reliable, consistent access to safe and nutritious food. This market segment is crucial for mitigating risks associated with climate change, geopolitical instability, supply chain disruption, and foodborne illnesses. FST solutions integrate advanced hardware—such as remote sensing drones, IoT devices, and specialized sensors—with sophisticated software platforms utilizing artificial intelligence (AI) and blockchain technology to enhance transparency, traceability, and predictive capabilities from farm to fork. The primary objective is to optimize resource utilization in agriculture, improve food quality assurance during processing, and streamline logistics to reduce post-harvest losses, thereby strengthening global resilience against hunger and food insecurity. The convergence of these technologies defines the modern FST landscape.

Key technological products driving this market include advanced precision agriculture platforms that utilize satellite imagery and sensor data for optimized irrigation and fertilization, sophisticated cold chain monitoring systems that ensure perishable goods maintain integrity during transit, and distributed ledger technologies (DLT), specifically blockchain, which provide immutable records of product provenance and handling. These applications extend beyond primary production, covering complex areas like food authenticity testing, rapid contamination detection in processing facilities, and managing regulatory compliance across multiple international jurisdictions. The increasing complexity of global supply chains necessitates these technological interventions to maintain consumer trust and meet stringent safety standards imposed by governing bodies worldwide.

The benefits derived from the adoption of Food Security Technology are multifaceted, fundamentally addressing both economic efficiency and societal well-being. Economic benefits include significantly reduced operational costs due to resource optimization, decreased food waste, and enhanced supply chain efficiency, which translates into better profitability for producers and lower prices for consumers. Societally, these technologies combat food insecurity by improving yield predictability, strengthening food safety protocols, and ensuring equitable distribution. Major driving factors propelling this market forward include unprecedented global population growth, which strains existing food production capabilities; escalating impacts of climate variability leading to unpredictable crop yields; and growing regulatory mandates focused on traceability, allergen control, and sustainable sourcing practices. These factors collectively establish a compelling demand structure for innovative FST solutions over the forecast period.

Food Security Technology Market Executive Summary

The Food Security Technology Market is characterized by robust technological integration and significant investment inflows, primarily driven by urgent global requirements for resilient and sustainable food systems. Business trends indicate a marked shift toward integrated platform solutions that combine hardware (IoT sensors) and advanced analytics software (AI/ML) to offer end-to-end supply chain visibility, moving away from disparate, siloed systems. Strategic collaborations between AgTech firms, major food processors, and logistics companies are accelerating market penetration, particularly in developing economies facing severe food logistics challenges. Furthermore, venture capital funding is increasingly targeting startups specializing in novel contamination detection techniques and climate-resilient farming technologies, underscoring the market's focus on innovation and scalability. Consolidation among technology providers is also anticipated as larger entities seek to acquire specialized data analytics and blockchain capabilities.

Regionally, North America and Europe maintain dominance owing to high adoption rates of precision agriculture, stringent regulatory frameworks demanding full traceability, and substantial research and development expenditure in advanced biotechnologies and sensing equipment. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by immense population size, rapid urbanization, significant pressure on arable land, and government initiatives—such as those in China and India—aimed at modernizing traditional agricultural practices and securing domestic food supplies. The demand in APAC is particularly strong for scalable, affordable monitoring solutions suitable for smallholder farms, leading to high growth in cloud-based software-as-a-service (SaaS) models tailored for food safety and traceability.

Segmentation analysis highlights that the Software segment, encompassing analytics, farm management systems, and traceability platforms, holds the largest market share and exhibits the fastest growth trajectory, primarily due to the ongoing digital transformation within the agricultural and food processing industries. Within technology segmentation, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) is critical, transforming processes from yield prediction and pest management to real-time risk assessment in logistics. Trends within the Application segment show that Farm Monitoring and Supply Chain Management applications are the primary revenue generators, reflecting the immediate need to optimize production efficiency and assure transparency to consumers. The shift towards automation and data-driven decision-making across all segments reinforces the market's strong potential for sustained double-digit growth.

AI Impact Analysis on Food Security Technology Market

User inquiries regarding the role of AI in Food Security Technology frequently revolve around predictive capabilities (e.g., "How accurately can AI forecast yield failures or disease outbreaks?"), ethical considerations ("How can AI ensure equitable food distribution and support smallholder farmers?"), and the practical implementation barriers ("What are the data requirements for training effective food safety AI models?"). Key themes emerging from these concerns underscore expectations that AI should move beyond simple automation to provide sophisticated, context-aware decision support systems. Users are deeply interested in AI's capacity for complex environmental modeling, its ability to integrate disparate datasets (weather, soil, satellite imagery, supply chain logs) for holistic risk assessment, and the potential for deep learning algorithms to detect subtle signs of contamination or quality degradation that human inspection might miss. The central consensus is that AI is not merely an improvement tool but a fundamental paradigm shift towards preventative and highly responsive food security management.

- AI enhances yield predictability and optimization through sophisticated analysis of hyperlocal environmental data, satellite imagery, and historical performance metrics.

- Machine learning models enable highly accurate, real-time detection of foodborne pathogens and contaminants in processing and packaging environments, significantly reducing recall incidents.

- AI-driven optimization of logistics and cold chain management minimizes post-harvest losses by dynamically routing shipments and adjusting cooling parameters based on predictive decay models.

- Natural Language Processing (NLP) is used for regulatory compliance monitoring, rapidly scanning and interpreting global food safety standards and ensuring producer adherence.

- Computer vision systems deployed via drones and automated ground vehicles provide precise monitoring of crop health, pest infestations, and irrigation needs, dramatically improving operational efficiency.

- Predictive maintenance for agricultural equipment and processing machinery, managed by AI, reduces downtime and ensures consistent operation critical for timely harvest and processing.

DRO & Impact Forces Of Food Security Technology Market

The Food Security Technology market dynamics are shaped by powerful forces of opportunity and constraint, categorized into Drivers, Restraints, and Opportunities (DRO). Major drivers include the existential threat posed by climate change, necessitating rapid shifts to resilient farming models; the global imperative to reduce the approximately one-third of all food produced that is lost or wasted annually; and increasingly strict government regulations, particularly in developed regions, demanding comprehensive supply chain transparency and verifiable safety standards. The combination of population growth and diminishing arable land acts as a sustained pressure point, pushing stakeholders toward adopting resource-efficient technologies. These drivers create a compelling, non-negotiable demand for technological solutions that can secure and optimize the food supply.

Conversely, significant restraints impede the rapid widespread adoption of FST solutions. High initial investment costs associated with advanced hardware (e.g., IoT sensors, DLT implementation) and complex analytical software platforms represent a major barrier, particularly for small- and medium-sized enterprises (SMEs) and farmers in emerging economies. Furthermore, the lack of standardized protocols and data interoperability across diverse agricultural and logistics systems creates integration challenges, limiting the effectiveness of end-to-end traceability solutions. Skilled labor shortages required to manage and interpret complex data streams generated by FST systems also pose a critical operational restraint in many key agricultural regions globally. Addressing these financial and technical hurdles is essential for realizing the full potential of this market.

Opportunities within the FST market are strongly centered around technological convergence and addressing sustainability goals. The rapid advancement and declining cost of connectivity technologies (5G, low-orbit satellites) are creating massive opportunities for widespread deployment of real-time monitoring devices, even in remote agricultural areas. The growing consumer demand for certified sustainable and ethically sourced food products drives opportunity for technologies like blockchain to provide verifiable provenance and fair trade documentation. Impact forces acting upon this market—such as regulatory pressures and climate volatility—accelerate technological adoption, while competitive pressures among major food corporations to minimize recall events and protect brand reputation further amplify the need for robust, proactive security technologies.

Segmentation Analysis

The Food Security Technology market is segmented based on the component type, the specific technology utilized, and the application area within the food supply chain. This segmentation provides a structured view of market dynamics, revealing where investment is concentrated and which technological solutions are achieving the highest market penetration. The overall structure is dominated by the integration of sophisticated software platforms with granular data collection hardware, enabling actionable insights across agricultural production and processing. The growth differential across these segments highlights the industry’s shift from traditional farming methods toward data-centric, preventative security measures. The analysis below details the key market divisions.

- By Component:

- Hardware (Sensors, RFID Tags, Drones, Monitoring Devices)

- Software (Data Analytics Platforms, Farm Management Systems, Traceability Software)

- Services (Consulting, Integration, Maintenance, Managed Services)

- By Technology:

- Internet of Things (IoT)

- Blockchain

- Artificial Intelligence (AI) and Machine Learning (ML)

- Geographic Information System (GIS) and Remote Sensing

- Biometrics and Forensics

- By Application:

- Farm Monitoring and Production (Precision Agriculture)

- Processing and Manufacturing

- Storage and Warehousing

- Distribution and Logistics (Cold Chain Management)

- Retail and Consumer Interaction

Value Chain Analysis For Food Security Technology Market

The value chain for Food Security Technology begins at the upstream stage with the foundational suppliers of critical hardware and enabling infrastructure. This includes manufacturers of highly specialized sensors (temperature, humidity, pH), semiconductor and chip providers for IoT devices, and developers of cloud computing infrastructure necessary for data aggregation and processing. The increasing sophistication of FST depends heavily on the quality and miniaturization of these components. Strong competition among upstream suppliers drives innovation in durable, low-power, and cost-effective sensing technologies, which directly influences the affordability and accessibility of FST solutions for end-users globally. Establishing resilient supplier relationships is crucial for maintaining a competitive edge in the integrated technology layer.

The core value creation stage involves the midstream actors: software developers, data analytics providers, and system integrators. These entities take raw data collected upstream and transform it into actionable security insights using AI, ML, and blockchain platforms. System integrators play a vital role in customizing these complex platforms to fit the unique operational requirements of farms, processors, and logistics firms, ensuring seamless data flow and regulatory compliance reporting. This stage is where intellectual property and proprietary algorithms concerning predictive risk modeling and rapid detection methods are developed, representing the highest value addition in the chain. The adoption of open-source standards for data exchange is an ongoing trend intended to streamline this integration process.

The downstream segment encompasses the distribution and end-user adoption phases. Distribution channels are typically hybrid, involving both direct sales models—where major technology vendors contract directly with large food processing corporations or governmental bodies—and indirect channels relying on third-party logistics (3PL) providers and specialized agricultural distributors. The end-users, including commercial farms, food manufacturers, retailers, and regulatory agencies, drive demand for solutions that offer demonstrable ROI, such as reduction in product recalls or improvement in crop yields. Efficient post-sales support and maintenance services are vital in the downstream segment, especially for ensuring the continued reliability of remote monitoring and complex software platforms deployed in diverse operational environments.

Food Security Technology Market Potential Customers

The potential customer base for Food Security Technology is diverse, spanning the entire food supply ecosystem from primary producers to regulatory bodies, all unified by the need to mitigate risks and enhance operational efficiency. Large commercial farming operations and multinational agribusinesses represent key buyers, as they require large-scale, automated solutions for precision agriculture, optimizing resources, and ensuring compliance across vast geographical footprints. These entities invest heavily in technologies like GIS mapping, AI-driven yield prediction, and automated irrigation systems to maintain economies of scale and secure high-quality input materials for processing.

Food processing and manufacturing companies constitute another major customer segment, driven primarily by the stringent necessity of preventing foodborne illnesses and managing complex allergen control. Their demand centers around real-time contamination detection, advanced sanitation monitoring, and sophisticated traceability software that can instantaneously isolate the source of a potential safety breach, thereby minimizing product recalls and associated litigation risks. Retail giants and major grocery chains are increasingly becoming central customers, utilizing FST to assure consumers of product freshness, verified sourcing (ethical and sustainability claims), and transparent cold chain integrity for highly perishable items. Their focus is on consumer trust and inventory optimization.

Government agencies and international regulatory bodies are significant indirect customers, often mandating the adoption of specific FST standards or directly investing in national-level early warning systems and monitoring infrastructure. For instance, national food safety authorities purchase data analytics services to monitor compliance, track disease outbreaks, and manage import/export certifications. Furthermore, non-governmental organizations (NGOs) focused on humanitarian aid and climate resilience are potential buyers of scalable FST solutions designed for deployment in vulnerable or developing regions, focusing on improving local resilience and data-driven disaster preparedness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 50.1 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, IBM, Cargill, Bext360, Intertek Group, Safetrace, Pepsico (via investment arms), Tyson Foods (via technology focus), AgriWebb, Trace Genomics, PrecisionHawk, Semios, DeHaat, FoodLogiQ, TE-FOOD, Farmobile, Rize, CropX, Zest Labs, Ceres Imaging |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Security Technology Market Key Technology Landscape

The technological landscape of the Food Security Market is rapidly evolving, driven by the integration of four primary pillars: pervasive connectivity (IoT/5G), decentralized record-keeping (Blockchain/DLT), cognitive computing (AI/ML), and advanced geospatial mapping (GIS/Remote Sensing). IoT forms the bedrock, providing the millions of data points essential for monitoring every stage of the supply chain, from soil moisture levels and warehouse temperature logs to final retail display conditions. The expansion of 5G and satellite broadband connectivity ensures that this immense volume of data can be transmitted and processed in near real-time, enabling immediate intervention in case of security threats or impending product loss. This reliance on continuous, high-fidelity data input differentiates modern FST from previous generation monitoring systems.

Artificial Intelligence and Machine Learning algorithms are the principal architects of proactive food security strategies. These technologies process heterogeneous data sets—including weather patterns, historical pathogen outbreaks, soil chemistry reports, and economic forecasts—to generate complex predictive models. For example, AI is utilized to forecast optimal harvest times, predict the probability of a localized pest outbreak weeks in advance, and identify anomalies in large batch processing that suggest contamination risk long before standard laboratory tests could confirm it. Furthermore, AI optimizes resource allocation, such as calculating the precise application rate of pesticides or fertilizers, thereby maximizing yield and minimizing environmental impact, which is integral to long-term food security.

Blockchain technology, specifically Distributed Ledger Technology (DLT), addresses the critical market need for tamper-proof traceability and transparency, offering an immutable record of a food item’s journey. This technology is particularly transformative in high-value or highly regulated markets where provenance and authenticity are paramount. When combined with forensic technologies like spectral analysis or stable isotope ratio analysis, DLT provides a complete digital passport for food, dramatically shortening the time required for recall investigations from weeks to minutes, thereby protecting public health and reducing financial exposure for companies. The convergence of secure data storage via blockchain and intelligent analysis via AI establishes a high barrier to entry for new market players, consolidating the position of technologically advanced incumbents.

Regional Highlights

Regional dynamics within the Food Security Technology market are heavily influenced by local regulatory stringency, existing agricultural infrastructure, and consumer purchasing power. North America, encompassing the United States and Canada, represents a mature but highly innovative market. Adoption here is characterized by high penetration of sophisticated precision agriculture tools, robust corporate investments in supply chain digitalization, and an environment of strict regulatory oversight (e.g., FDA requirements). The region leads in the application of advanced technologies such as predictive analytics for commodity trading and large-scale blockchain implementations for high-volume retail supply chains. The market growth, while steady, is driven by continuous technological upgrades and addressing labor scarcity through automation in farming and processing.

Europe stands out due to its leadership in establishing stringent food safety standards and an intense focus on sustainability and ethical sourcing. European market growth is propelled by regulations like the EU’s Farm to Fork strategy, which mandates higher levels of traceability and transparency concerning environmental impact and animal welfare. Consequently, there is strong demand for FST solutions that verify organic certifications, manage complex international trade compliance, and optimize resource use in line with circular economy principles. Germany, the Netherlands, and the UK are primary hubs for FST innovation, concentrating particularly on advanced sensor technology for cold chain management and sophisticated authentication techniques to combat food fraud, a major concern across the continent.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, experiencing explosive demand fueled by a convergence of modernization efforts, severe climate impacts, and the need to feed over half of the global population. Countries like China, India, and Southeast Asian nations are rapidly transitioning from traditional farming to integrated smart agriculture systems supported by government subsidies. The key drivers are enhancing local productivity, minimizing the vast post-harvest losses common in fragmented supply chains, and establishing better quality control for export markets. While cost sensitivity remains a factor, the scalable, cloud-based software models are achieving rapid adoption, making APAC the key growth frontier for FST solutions focusing on localized disease monitoring and smallholder farmer integration into formal supply chains. The region’s technological leapfrogging capability, often skipping older technologies to adopt cutting-edge solutions like 5G-enabled IoT, ensures its market vitality.

- North America: High early adoption of AI and blockchain, driven by large commercial farms and rigorous FDA/USDA compliance requirements. Focus on operational efficiency and risk mitigation.

- Europe: Growth led by regulatory pressures emphasizing sustainability, ethical sourcing, and detailed traceability mandates. Strong investment in anti-food fraud technology.

- Asia Pacific (APAC): Highest CAGR expected, fueled by massive government investment in AgTech modernization, addressing post-harvest losses, and managing volatile climate conditions affecting staple crops.

- Latin America (LATAM): Emerging growth driven by modernization of export-oriented agriculture (e.g., Brazil, Argentina). Focus on IoT for efficient water management and logistics optimization for global trade.

- Middle East and Africa (MEA): Growth centered on controlled environment agriculture (CEA) technology and addressing water scarcity challenges. Demand for robust, resilient technology solutions essential for local food security initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Security Technology Market.- IBM (Supply Chain Solutions and Blockchain)

- Cargill (Agricultural Technology and Data Analytics)

- Bayer Crop Science (Digital Farming Solutions)

- Bosch (Sensor Technology and IoT Integration)

- Intertek Group (Testing and Certification Services)

- Safetrace (Traceability Software)

- PrecisionHawk (Drone Imagery and Remote Sensing)

- Semios (Precision Agriculture Platform)

- Trace Genomics (Soil Intelligence)

- FoodLogiQ (Food Safety and Traceability Software)

- TE-FOOD International (Blockchain Traceability)

- Farmobile (Data Collection and Management)

- 3M Company (Food Safety Testing Solutions)

- Purdue Pharma (through AgTech investments)

- AgriWebb (Farm Management Software)

- CropX Technologies (Soil Sensor and Data Platform)

- Zest Labs (Post-Harvest Quality Management)

- Ceres Imaging (Aerial Ag Analytics)

- Rize (Satellite Data Solutions)

- DeHaat (Integrated AgTech Platform in India)

Frequently Asked Questions

Analyze common user questions about the Food Security Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Blockchain in Food Security Technology?

Blockchain’s primary role is to provide immutable, secure traceability records (digital passports) for food products. This capability drastically reduces the time needed for product recalls, validates sustainability claims, and ensures transparency regarding product origin and handling throughout the complex supply chain, thereby significantly boosting consumer trust and safety.

How is climate change influencing the demand for Food Security Technology?

Climate change is a major driver, creating volatility in traditional farming. It increases demand for FST by necessitating predictive AI models for forecasting extreme weather impacts, remote sensing technologies for early detection of crop stress, and resilient agricultural systems (like vertical farming technologies) to ensure stable and consistent production despite environmental shifts.

Which component segment (Hardware, Software, or Services) is growing the fastest?

The Software segment, encompassing advanced data analytics, AI platforms, and cloud-based traceability software, is exhibiting the fastest growth rate. This rapid expansion is driven by the industry's need to generate actionable insights from the massive amounts of data collected by hardware components (IoT sensors).

What are the main financial barriers to FST adoption in emerging markets?

The main financial barriers include the high initial capital expenditure required for purchasing and installing sophisticated IoT hardware and sensors, coupled with the lack of access to affordable financing and the recurrent costs associated with complex software subscriptions and technical integration services.

What are the key applications of FST at the retail level?

At the retail level, key FST applications include real-time inventory management to minimize spoilage (waste reduction), smart shelving sensors that monitor product temperature and freshness, and consumer-facing blockchain QR codes that verify product provenance, enhancing transparency and maintaining brand reputation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager