Food Smokehouse Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432619 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Food Smokehouse Market Size

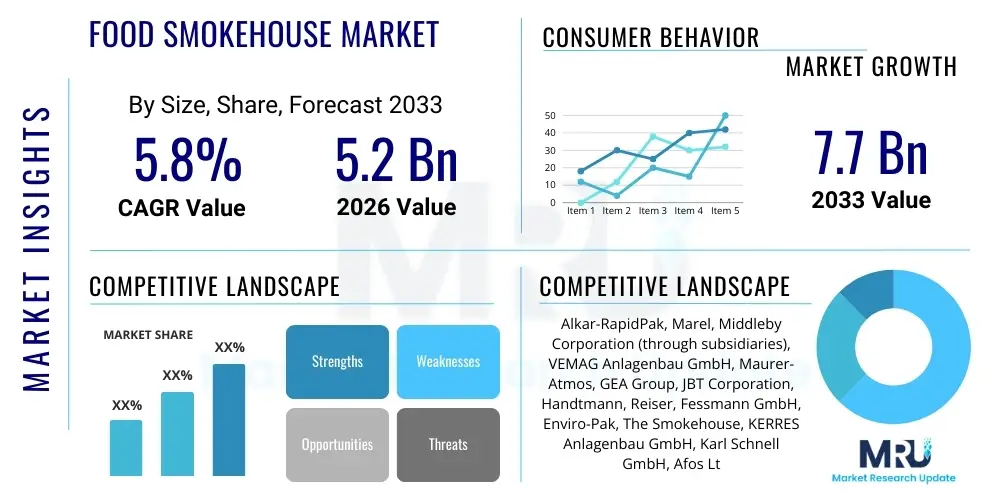

The Food Smokehouse Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Food Smokehouse Market introduction

The Food Smokehouse Market encompasses the manufacturing, distribution, and maintenance of specialized industrial equipment designed for the preservation and flavoring of food products through controlled exposure to smoke. These systems, ranging from traditional stick-frame smokehouses to modern, fully automated thermal processing chambers, are critical for achieving distinct flavor profiles and extending the shelf life of perishable goods. The core product involves sophisticated temperature, humidity, and airflow control mechanisms necessary to safely and consistently produce smoked items such as meats, poultry, seafood, dairy products (like smoked cheeses), and increasingly, plant-based alternatives. Technological advancements are focusing on integrating automated cleaning systems and enhancing energy efficiency to meet global sustainability standards.

Food smokehouses play a vital role across the food processing industry, with major applications spanning large commercial meat packing facilities, specialized artisan food production, and institutional catering operations. The primary benefit derived from smokehouse utilization is flavor enhancement, imparting desirable smoky, savory, or sweet notes depending on the type of wood or smoking agent utilized. Furthermore, the smoking process, often combined with curing or drying, acts as a traditional method of food preservation by inhibiting microbial growth, thereby reducing reliance on chemical preservatives and meeting growing consumer demand for minimally processed foods.

Driving factors propelling market expansion include the sustained global demand for convenience foods with rich, gourmet flavors, particularly in developed economies where ready-to-eat and ready-to-cook smoked products are highly valued. Regulatory changes concerning food safety and traceability necessitate the adoption of modern, precise smokehouse technology, pushing older, less controlled manual systems out of the market. Additionally, the rapid growth of the seafood processing sector, coupled with increasing disposable incomes in emerging markets driving premium food consumption, significantly contributes to the installation of new, high-capacity smokehouse units globally.

Food Smokehouse Market Executive Summary

The Food Smokehouse Market is currently characterized by robust investment in automation, driven by the need for labor efficiency and stringent quality control. Key business trends include the shift towards hybrid smokehouse systems capable of utilizing both natural wood smoke and liquid smoke application technologies, offering processors flexibility in flavor profiles and regulatory compliance. Market consolidation is evident among equipment manufacturers as larger firms acquire smaller, specialized technology providers to integrate advanced IoT and sensor technologies, ensuring end-to-end monitoring of the smoking cycle. Furthermore, sustainability is becoming a major competitive differentiator, with manufacturers focusing intensely on reducing energy consumption through optimized thermal insulation and improved heat recovery systems, directly impacting operating costs for end-users.

Geographically, North America and Europe maintain dominance, primarily due to established meat and seafood processing industries and high consumer appreciation for traditionally smoked products. These regions are early adopters of advanced, high-throughput industrial smokehouses featuring sophisticated programmable logic controllers (PLCs) for process management. The Asia Pacific region, however, is emerging as the fastest-growing market segment, fueled by rapid urbanization, changing dietary habits that incorporate more processed meat and fish, and significant government investments in modernizing the domestic food supply chain infrastructure. Investment in cold chain logistics across South East Asia is intrinsically linked to the demand for reliable food preservation equipment like smokehouses.

Segmentation analysis highlights the increasing dominance of large industrial-scale smokehouses (capacity >2,000 lbs per batch) within the product type segment, reflecting the industrialization of the food sector. By application, the meat and poultry segment remains the largest consumer, although the seafood processing application is exhibiting superior growth rates due to surging global aquaculture production and demand for smoked salmon and herring. Trends within the end-user segment indicate a growing market for smaller, highly versatile commercial units catering to specialty butchers, gourmet restaurants, and craft producers focusing on unique, high-margin smoked goods, demanding flexible, smaller batch processing capabilities.

AI Impact Analysis on Food Smokehouse Market

Common user questions regarding AI's impact on the Food Smokehouse Market primarily revolve around enhancing process precision, ensuring food safety compliance, and optimizing operational costs. Users frequently inquire about how AI can predict optimal smoking times based on raw product characteristics (e.g., fat content, moisture), minimize product loss due to inconsistent smoking, and automate recipe development for new products. Concerns center on the complexity of integrating AI models into legacy equipment and the required data infrastructure investment. These concerns underscore a clear expectation that AI will transition smoking from an art relying on expert judgment to a highly reproducible, science-driven process, fundamentally altering quality assurance and production scale-up methodologies in food processing.

AI deployment is moving beyond simple process monitoring to sophisticated predictive analytics within smokehouse operations. By utilizing machine learning algorithms trained on historical batch data—including parameters like wood type, temperature ramp rates, humidity levels, and resulting product quality indices (e.g., color, moisture content, smoke penetration depth)—AI systems can provide real-time recommendations for critical process adjustments. This level of optimization allows processors to achieve a superior level of consistency across batches, significantly reducing instances of under- or over-smoked products and improving overall yield. The focus is on creating ‘digital twins’ of the smoking process, enabling virtual testing and calibration before physical implementation.

Furthermore, the integration of AI-driven vision systems and sensors within smokehouse chambers is revolutionizing quality control. These systems can monitor the surface color and texture of products during the smoking cycle, instantly identifying deviations from the established quality parameters. In terms of maintenance, predictive AI models analyze sensor data from motors, heaters, and ventilation components to forecast potential equipment failures, facilitating proactive, condition-based maintenance schedules rather than reactive repairs. This shift minimizes unplanned downtime, which is highly costly in large-scale food manufacturing, and maximizes the operational lifespan and efficiency of the smokehouse assets.

- AI-driven Predictive Quality Control: Real-time analysis of smoke color, density, and product surface attributes to ensure batch consistency.

- Optimized Energy Consumption: Machine learning algorithms dynamically adjust heating and ventilation cycles based on load size, minimizing fuel usage.

- Predictive Maintenance Scheduling: Analysis of mechanical vibration and temperature data to forecast component failure, reducing unplanned downtime.

- Automated Recipe Development: AI modeling suggests optimal time-temperature-humidity profiles for new raw materials or desired flavor outcomes.

- Enhanced Traceability: AI platforms link specific smoking parameters to final product batches, ensuring compliance with evolving food safety and traceability regulations.

DRO & Impact Forces Of Food Smokehouse Market

The Food Smokehouse Market is primarily driven by the expanding global consumer preference for distinct, authentic, and savory flavors, specifically the smoky profile associated with traditional preparation methods, coupled with the increasing demand for convenience and ready-to-eat (RTE) smoked food products. These drivers are tempered by significant restraints, chiefly the substantial initial capital investment required for high-capacity, automated smokehouse equipment and the complex, often conflicting, global regulatory environment regarding polycyclic aromatic hydrocarbons (PAHs) and smoke emissions. However, these challenges generate substantial opportunities, particularly the development and commercialization of next-generation hybrid smoking technologies that meet both flavor demands and strict environmental regulations, and the expansion into the rapidly growing segment of plant-based smoked protein alternatives.

Impact forces within the market are exerted strongly by regulatory bodies, particularly in Europe and North America, where rules governing airborne contaminants and food safety standards necessitate continuous innovation in smoke generation and filtration technologies. Economic forces, including volatility in commodity prices (especially meat and seafood) and fluctuating energy costs, impact operational expenses and drive demand for highly energy-efficient equipment. Technological advancement is a core force, pushing manufacturers towards advanced PLC interfaces, superior air circulation designs for uniformity, and integration with broader Industry 4.0 standards for seamless factory integration. Societal forces, such as the increasing consumer focus on clean label products and sustainability, are also compelling processors to utilize cleaner smoking techniques and ethically sourced wood chips or liquid smoke components.

A crucial factor transforming the market landscape is the high level of competition and product differentiation among equipment manufacturers. Vendors are continually introducing proprietary smoke generation systems (e.g., friction smoke, steam smoke, electrostatic smoking) aimed at offering unique texture and flavor characteristics while simultaneously maximizing yield and throughput. The interplay between raw material costs (Restraint), consumer demand for premium products (Driver), and technological solutions addressing environmental concerns (Opportunity) dictates the pace of market penetration and innovation. The overall trend indicates a strong shift towards closed-loop systems that prioritize efficiency, safety, and precise control over traditional, less predictable methods, solidifying the market’s reliance on advanced, industrial-grade smokehouse technology.

Segmentation Analysis

The Food Smokehouse Market is strategically segmented across several critical dimensions, allowing for a detailed understanding of procurement patterns and technological focus areas within the food processing industry. The primary segmentation revolves around Product Type (defining the smokehouse capacity and automation level), Application (identifying the specific food category processed), and End-User (distinguishing between large industrial facilities and smaller commercial operations). This structure ensures that market players can target specific processing needs, whether it involves high-volume throughput for commodity meat products or specialized, customizable processing for gourmet seafood items.

Segmentation by technology is also increasingly relevant, differentiating between traditional smoking methods (relying solely on wood combustion) and modern systems utilizing liquid smoke application, which offers greater control over carcinogenic compounds (PAHs) and ensures better regulatory compliance, particularly in European markets. The largest segment by value continues to be the industrial smokehouse category, driven by the massive scale requirements of global meat processors. However, the fastest growth is observed in the segment utilizing advanced monitoring and control systems, which promise superior process validation and reduced operational risk, aligning perfectly with global food safety initiatives.

Understanding these segments is crucial for strategic business planning. For instance, manufacturers targeting the North American market would focus heavily on industrial, high-capacity, batch-style smokehouses for meat and poultry, emphasizing speed and efficiency. Conversely, targeting European or artisan markets requires offering smaller, flexible, high-precision units that prioritize flavor diversity and adherence to strict smoke emission standards. The sustained shift towards ready-to-eat meals further reinforces the demand for reliable and continuous smoking processes that maintain consistent quality across large production volumes, making automation a key purchasing criterion across all geographic segments.

- By Type:

- Industrial Smokehouse (Capacity > 2000 lbs)

- Commercial Smokehouse (Capacity 500 – 2000 lbs)

- Artisan/Small Scale Smokehouse (Capacity < 500 lbs)

- By Technology:

- Traditional Wood Smoke Systems

- Liquid Smoke Application Systems

- Hybrid Systems (Combining smoke generation and liquid application)

- Electrostatic Smokehouses

- By Application:

- Meat and Poultry Processing

- Seafood and Fish Processing

- Dairy (Cheese) Processing

- Pet Food Production

- Plant-Based Products

- By End-User:

- Food Processing Plants (Large Scale)

- Hotels, Restaurants, and Catering (HORECA)

- Specialty Retailers and Butcher Shops

Value Chain Analysis For Food Smokehouse Market

The Value Chain of the Food Smokehouse Market begins with the upstream suppliers responsible for raw materials and highly specialized components. This includes suppliers of high-grade, food-safe stainless steel and alloys (essential for maintaining hygiene and resisting corrosion), advanced thermal insulation materials, and sophisticated electronic control systems (PLCs, sensors, and actuators). The quality and reliability of these upstream inputs directly determine the durability, energy efficiency, and operational accuracy of the final smokehouse unit. Strong relationships with suppliers capable of providing certified, compliant materials are critical, as substandard materials can lead to regulatory non-compliance and catastrophic equipment failure within high-temperature, high-humidity environments.

The central manufacturing stage involves complex engineering, assembly, and rigorous testing of the smokehouse units. This stage includes designing highly efficient airflow and heat distribution systems to ensure uniform smoking, integrating sophisticated smoke generators (e.g., friction smokers, clean wood chip burners), and installing advanced Human-Machine Interface (HMI) systems for ease of operation and monitoring. Manufacturers either operate through direct distribution channels, especially for large, custom industrial installations requiring specialized setup and maintenance, or utilize a network of certified equipment dealers and distributors for standard commercial units. Direct sales often provide higher margins and better control over customer relationships and post-sale services, which are critical given the high capital expenditure nature of the equipment.

The downstream analysis focuses on the end-users: primarily large-scale meat packers, international seafood processors, and commercial food manufacturers. The indirect channel involves distributors and food equipment consultants who specify and integrate smokehouses as part of larger processing lines. The ultimate value delivery is realized when the smokehouse consistently produces high-quality, safe, and flavorful smoked products efficiently, maximizing yield and minimizing energy and labor costs for the food processor. Maintenance, parts replacement, and ongoing technical support form a crucial part of the downstream revenue stream, ensuring long-term operational viability and compliance for the user.

Food Smokehouse Market Potential Customers

Potential customers for Food Smokehouse technology are predominantly concentrated within the industrial food manufacturing sector, specifically large-scale protein processing operations that require high-throughput, repeatable, and compliant smoking capabilities. These include multinational meat and poultry corporations (such as those producing sausages, bacon, hams, and deli meats) and major seafood processing companies that specialize in preparing smoked fish varieties like salmon, trout, and herring for global distribution. These industrial buyers prioritize capacity, automation, energy efficiency, and the ability to integrate the smokehouse seamlessly into existing automated processing and packaging lines, often requiring continuous-feed or high-volume batch units with advanced PLC controls.

A secondary, yet rapidly expanding, segment of potential customers comprises the specialized and gourmet food producers, including artisan cheese makers, craft charcuterie businesses, and manufacturers focusing on ethnic or regional smoked delicacies. This customer base typically seeks smaller to medium-sized commercial smokehouses that offer flexibility, precise temperature control for delicate products, and the ability to experiment with different smoke sources (e.g., specific fruitwoods or hardwoods) to create unique flavor profiles. For these buyers, customization and the smokehouse's ability to handle smaller, high-value batches efficiently are primary deciding factors, often favoring units that are easier to clean and maintain with less specialized technical staff.

Furthermore, the institutional food service segment, encompassing large-scale hotel chains, cruise lines, and high-volume catering businesses (HORECA), represents another key customer group, particularly for mid-sized commercial units. These entities often use smokehouses to produce signature smoked ingredients in-house, ensuring freshness and quality control for their culinary operations. The emerging market of plant-based food manufacturers is also a critical, high-growth potential customer base, requiring specialized smokehouses engineered to handle alternative protein textures and binding agents, applying smoke flavor without compromising the structural integrity of the plant-based product, driving innovation in smoking cycle adjustments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alkar-RapidPak, Marel, Middleby Corporation (through subsidiaries), VEMAG Anlagenbau GmbH, Maurer-Atmos, GEA Group, JBT Corporation, Handtmann, Reiser, Fessmann GmbH, Enviro-Pak, The Smokehouse, KERRES Anlagenbau GmbH, Karl Schnell GmbH, Afos Ltd., Marlen International, PolyScience Culinary, Pro Smoker, Koch Equipment, and Schroeder Smokehouse Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Smokehouse Market Key Technology Landscape

The technological landscape of the Food Smokehouse Market is rapidly evolving, moving far beyond simple combustion chambers to incorporate complex, integrated thermal processing systems optimized for flavor, safety, and efficiency. A core technological advancement is the sophisticated control over smoke generation. Modern industrial smokehouses utilize highly regulated smoke sources, such as electrically heated friction smokers (which generate smoke via friction with wood logs, offering precise control over temperature and density without combustion byproducts) or highly filtered wood chip burners designed to minimize the creation of harmful polycyclic aromatic hydrocarbons (PAHs). The parallel rise of liquid smoke application systems, which inject atomized smoke condensate into the chamber, allows for superior consistency and regulatory compliance, particularly advantageous in regions with strict health standards.

Another crucial area of innovation involves the control and monitoring infrastructure within the smokehouse chamber itself. Advanced smokehouses are equipped with multi-point temperature and humidity sensors, coupled with high-performance ventilation and air circulation systems, often using complex baffle and fan arrangements to ensure perfect uniformity across a large batch. This guarantees that every product, regardless of its position in the chamber, receives the exact same treatment, thereby maximizing yield consistency and minimizing product shrinkage. The integration of Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems enables operators to program complex, multi-stage smoking and cooking cycles, log detailed batch data for traceability, and interface with central plant management systems, supporting Industry 4.0 initiatives.

Furthermore, technology is focused on asset performance and sustainability. Energy consumption, traditionally high in thermal processing, is being mitigated through innovations such as high-density thermal insulation, closed-loop heat recovery systems that reuse heat generated during the drying or cooking phase, and automated Clean-In-Place (CIP) systems. The adoption of IoT connectivity is enabling remote monitoring, real-time diagnostic analysis, and predictive maintenance, significantly enhancing the reliability and reducing the Total Cost of Ownership (TCO) of these critical pieces of processing machinery. The shift towards electrostatic smoking is also gaining traction, particularly in seafood applications, as it allows for smoke deposition at lower temperatures, preserving the delicate texture of the product while reducing processing time.

Regional Highlights

- North America (USA and Canada): North America represents the largest and most mature market for Food Smokehouse equipment, driven by the colossal meat and poultry processing industry and high consumer demand for bacon, ham, and ready-to-eat smoked snacks. The region is characterized by high adoption rates of large-scale industrial smokehouses featuring advanced automation, high-speed batch processing capabilities, and complete integration with conveyor systems. Manufacturers in this region focus on robustness, maximum throughput, and comprehensive post-sale service. Food safety requirements necessitate equipment that can meet USDA regulations regarding pathogen reduction and traceability, driving demand for technologically superior, validated smoking and cooking chambers. The market is also heavily influenced by continuous innovation in poultry and plant-based protein sectors requiring adaptable smokehouse solutions.

- Europe (Germany, UK, France, Scandinavia): Europe is a highly fragmented market distinguished by strong regulatory pressures, particularly concerning PAHs (Polycyclic Aromatic Hydrocarbons), which are restricted under EU law. This regulation has spurred significant technological innovation, leading to a high penetration of liquid smoke systems and advanced filtered wood smoke generators designed for clean label compliance. The market is defined by high consumer appreciation for traditional, artisanal smoked products (especially in Germany and Scandinavia for fish and sausage) alongside strong demand for high-quality, efficient industrial equipment. Germany, specifically, remains a central manufacturing and technological hub for sophisticated thermal processing machinery. Focus areas include energy recovery and reduced environmental footprint.

- Asia Pacific (APAC, led by China, Japan, and Australia): APAC is the fastest-growing market region, propelled by surging urbanization, rising disposable incomes, and the modernization of domestic food supply chains, particularly in China and India. The rapid expansion of quick-service restaurants and prepared food manufacturers necessitates investment in commercial and industrial smokehouses. While traditional smoking methods are prevalent in smaller operations, large multinational food processors establishing regional hubs are driving demand for state-of-the-art, high-capacity, and fully automated units. Australia and Japan exhibit high demand for advanced seafood smoking technology, while China's massive meat and poultry sector requires continuous investment in large-scale industrial equipment to meet domestic demand.

- Latin America (LATAM, led by Brazil and Mexico): The LATAM market exhibits moderate growth, fundamentally linked to the region’s strong beef and poultry production sectors. Brazil is a major global exporter, driving internal investment in processing efficiency, including modern smokehouse equipment for standardized product quality. The market primarily seeks cost-effective, durable, and reliable equipment, often prioritizing basic automation features over the highly specialized technology seen in European models. The expansion of regional food processing companies aiming for export quality is slowly pushing the adoption of better regulatory-compliant smoking systems.

- Middle East and Africa (MEA): The MEA region is characterized by nascent market development, focused mainly on meeting localized demand and improving food security infrastructure. Growth is concentrated in key areas like the UAE and Saudi Arabia, driven by high-end HORECA sector demand for premium smoked meats and cheeses. The adoption rate of industrial smokehouses is lower but growing steadily, often through imports from European and North American suppliers who can guarantee compliance with strict hygiene and halal standards. Challenges include limited infrastructure and reliance on imported expertise and parts for maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Smokehouse Market.- Marel (through various acquisitions and subsidiaries)

- The Middleby Corporation (Integrating solutions across processing subsidiaries)

- GEA Group AG

- JBT Corporation

- VEMAG Anlagenbau GmbH

- Maurer-Atmos GmbH

- Alkar-RapidPak Inc. (A brand known for high-capacity smokehouses)

- Handtmann Group (Primarily focusing on filling and linking but integrates with smoking lines)

- Fessmann GmbH

- Enviro-Pak

- KERRES Anlagenbau GmbH

- Marcos Machinery

- Afos Ltd.

- Karl Schnell GmbH

- Marlen International (A Duravant Company)

- Reiser (Distributor of key European brands and associated equipment)

- Schroeder Smokehouse Equipment

- Pro Smoker

- Koch Equipment

- PolyScience Culinary (Focusing on smaller, high-precision units)

Frequently Asked Questions

Analyze common user questions about the Food Smokehouse market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Industrial Food Smokehouse Market?

The primary driver is the escalating global consumer demand for ready-to-eat and convenience foods featuring consistent, rich smoked flavors, coupled with the necessity for large food processors to achieve high-volume throughput and strict adherence to international food safety and quality standards via automated equipment.

How do regulatory restraints, particularly concerning PAHs, influence smokehouse technology?

Stringent regulations, especially those imposed by the European Union regarding polycyclic aromatic hydrocarbons (PAHs), necessitate the adoption of advanced technologies like filtered wood smoke generators, sophisticated combustion controls, and liquid smoke application systems to ensure final products meet required safety thresholds and maintain a "clean label" status.

Which geographical region holds the largest market share for Food Smokehouse equipment?

North America currently holds the largest market share, predominantly due to its highly industrialized and established meat and poultry processing sectors, high automation levels, and significant capital investment capacity within the food manufacturing infrastructure.

What role does Artificial Intelligence (AI) play in modern smokehouse operations?

AI is increasingly used for predictive quality control by optimizing smoking parameters in real-time, reducing batch inconsistency, and enabling predictive maintenance by analyzing equipment sensor data, thereby minimizing unplanned downtime and maximizing operational efficiency and yield.

What are the key technological differences between traditional and modern industrial smokehouses?

Modern industrial smokehouses feature closed-loop thermal control, advanced programmable logic controllers (PLCs), high-efficiency air circulation for uniformity, and often utilize friction or liquid smoke systems for precise flavor delivery and regulatory compliance, contrasting sharply with the less controlled, often manual operations of traditional combustion-based units.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager