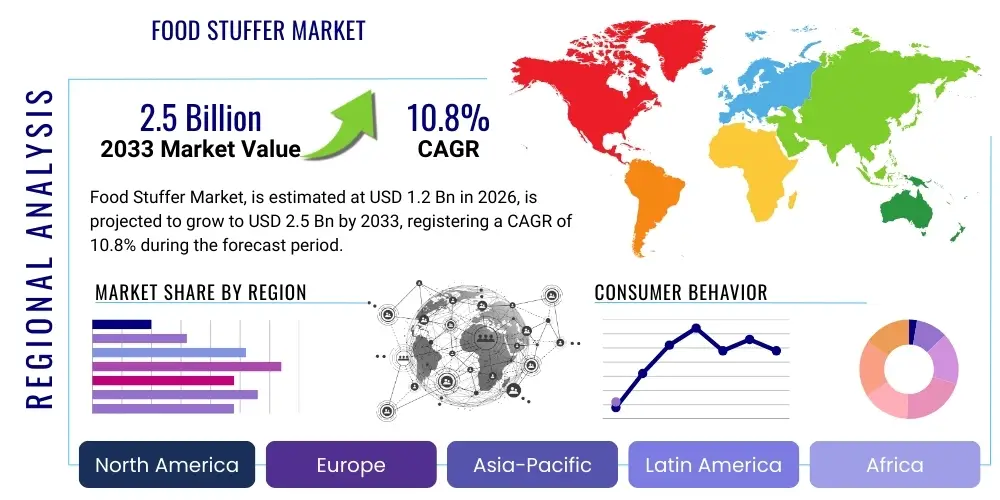

Food Stuffer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437950 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food Stuffer Market Size

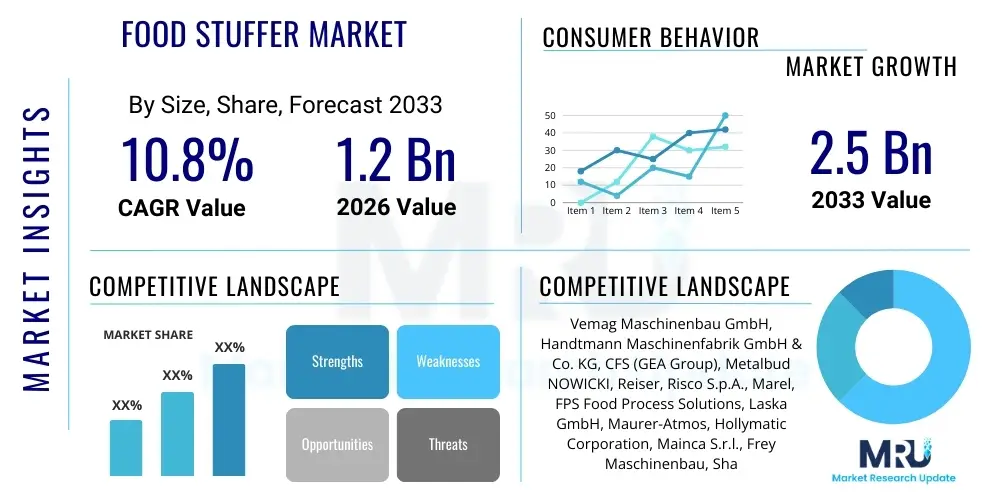

The Food Stuffer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Food Stuffer Market introduction

The Food Stuffer Market encompasses a diverse range of machinery, ingredients, and processing solutions utilized for filling, encasing, or incorporating ingredients into a final food product, spanning sectors such as meat processing (sausages, deli products), bakery (filled pastries, dumplings), and confectionary. This market is fundamentally driven by the global consumer demand for convenient, ready-to-eat, and highly standardized processed food items. Key products include hydraulic and pneumatic stuffing machines, vacuum fillers, and specialized high-throughput injection systems designed to maximize efficiency and maintain hygienic standards in high-volume production environments. The technological evolution focuses heavily on increasing automation capabilities, improving sanitation features, and enhancing flexibility to handle various textures and viscosities of stuffing materials, addressing the complexity introduced by dietary trends like plant-based alternatives.

The primary applications of Food Stuffers are concentrated in large-scale industrial food manufacturing where precision, speed, and consistency are critical operational parameters. Benefits derived from adopting advanced stuffing technologies include significant reductions in labor costs, minimized product waste through precise portion control, and enhanced food safety due to reduced human contact during the stuffing process. Furthermore, modern equipment allows manufacturers to rapidly adapt product lines to seasonal demand shifts or emerging flavor trends, contributing directly to supply chain resilience and competitive advantage. The market dynamics are characterized by intense competition among machinery manufacturers focusing on integration capabilities with upstream preparation units and downstream packaging systems.

Major driving factors sustaining the market expansion include the accelerating urbanization trend worldwide, leading to increased reliance on packaged and convenience foods, particularly in developing economies. Additionally, stringent food safety regulations globally necessitate the adoption of reliable, sanitary equipment that minimizes contamination risks, pushing older, less sophisticated machinery out of the market. The continuous innovation in stuffing technology, driven by the need for higher speeds and greater versatility—especially concerning complex, multi-textured fillings—further fuels investment. The shift towards automation, aimed at mitigating rising operational expenses and labor shortages in the food production sector, remains a crucial catalyst for market growth throughout the forecast period.

Food Stuffer Market Executive Summary

The Food Stuffer Market is poised for substantial growth, primarily influenced by shifting global dietary patterns favoring high-convenience, protein-rich foods and the necessity for industrial efficiency. Business trends highlight a strong emphasis on automation and the integration of IoT sensors within stuffing equipment to enable predictive maintenance and real-time quality control, thereby reducing downtime and operational expenditures for manufacturers. Mergers and acquisitions are becoming increasingly common among machinery providers seeking to consolidate technological expertise, particularly in areas concerning hygienic design and robotic integration. Furthermore, the rise of niche markets, such as the surging demand for plant-based sausages and meat analogues, requires specialized stuffing apparatus capable of handling new ingredient matrices, presenting lucrative opportunities for innovators in machinery design.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, driven by rapid industrialization of the food processing sector, rising per capita income, and an expanding cold chain infrastructure facilitating the distribution of processed meats and ready meals. North America and Europe, while mature, maintain dominance in terms of technology adoption and regulatory compliance, focusing on upgrading existing infrastructure with high-efficiency, sustainable equipment that minimizes energy consumption. Regulatory harmonization efforts, particularly within the European Union, are streamlining standards for equipment hygiene, impacting sales strategies and product development cycles across global vendors. Investment in local manufacturing capabilities in regions like Latin America and MEA is also gaining traction, addressing localized demand for traditional processed food types.

Segmentation trends reveal that the machinery segment, particularly automated vacuum stuffers, accounts for the largest market share due to their superior precision and sanitation capabilities necessary for meat and poultry processing. However, the ingredient segment (comprising casings, binders, and flavor inclusions used alongside stuffing) is projected to experience accelerated growth, correlating with product diversification and the incorporation of functional ingredients aimed at improving texture or shelf life. Within applications, the meat and seafood processing sector remains paramount, yet the emerging ready-to-eat meals and snack sectors are exhibiting the highest growth trajectory, fueled by consumer lifestyle changes. High-speed, continuous processing technology segments are favored across all end-user categories due to the unrelenting pressure to optimize production throughput.

AI Impact Analysis on Food Stuffer Market

Common user questions regarding AI’s impact on the Food Stuffer Market frequently revolve around three core themes: How AI can optimize complex filling processes to handle new ingredient types (like plant proteins), the application of machine learning in predictive maintenance to prevent costly equipment failures, and the use of computer vision for real-time quality control regarding stuffing consistency and portioning accuracy. Users are concerned about the integration costs, the necessity for specialized data scientists, and the potential displacement of skilled labor. The underlying expectation is that AI integration should lead to unprecedented operational efficiencies, reduce variability in the final product, and enhance traceability throughout the processing line. These expectations push equipment manufacturers to develop AI-ready hardware platforms capable of seamless data collection and analysis.

AI is fundamentally transforming the operational paradigm of food stuffing by moving processing lines from reactive monitoring to predictive optimization. Algorithms can analyze input material characteristics (viscosity, temperature, moisture content) in real-time and dynamically adjust stuffer pressures, speeds, and dosing volumes, ensuring consistent output even with natural variations in raw ingredients. This level of adaptive control is crucial for maintaining product integrity in complex fillings, such as those combining solid particulates with viscous binders. Furthermore, AI-driven process optimization minimizes raw material giveaway and waste, offering significant cost savings, directly addressing the thin profit margins typical in high-volume food processing.

The implementation of machine learning in quality assurance is another significant impact area. High-definition cameras and sensors integrated into the stuffing line, coupled with AI vision systems, can identify subtle defects in casing integrity, filling distribution, or trapped air pockets instantly, much faster and more reliably than manual inspection. This immediate identification allows for automated rejection or adjustment, ensuring compliance with strict quality specifications. Although initial deployment costs can be high, the long-term benefits in reduced recalls, improved regulatory compliance, and consistent product quality justify the investment, establishing AI as a core component of future stuffing technology architecture.

- Enhanced Predictive Maintenance: AI analyzes sensor data (vibration, temperature, current draw) to forecast equipment failure, minimizing unplanned downtime.

- Dynamic Recipe Adjustment: Machine learning algorithms automatically modify stuffing parameters based on real-time ingredient properties, optimizing consistency.

- Automated Quality Control: Computer vision systems verify stuffing integrity and portion accuracy at high speeds, reducing human error.

- Optimized Throughput: AI simulations determine the ideal combination of speed and pressure settings to maximize production capacity while preserving product texture.

- Improved Traceability: Blockchain integration, managed by AI, provides granular tracking of raw ingredients through the stuffing process for enhanced food safety audits.

DRO & Impact Forces Of Food Stuffer Market

The Food Stuffer Market is shaped by a powerful interplay of drivers, restraints, and opportunities, collectively categorized as Impact Forces. Key drivers include the overwhelming global demand for convenient, ready-to-eat food options, which necessitates high-speed, reliable stuffing machinery, and the accelerating trend of replacing manual labor with automation to manage rising wages and skill shortages. The mandatory adherence to strict global food safety and hygiene standards (such as HACCP and GFSI guidelines) compels continuous investment in advanced, sanitary equipment designs. Conversely, the market faces significant restraints, including the high capital expenditure required for purchasing and integrating advanced stuffing systems, particularly prohibitive for smaller and mid-sized food processors, and the growing consumer scrutiny and regulatory pushback against heavily processed foods, which might cap demand growth in certain mature segments.

Opportunities within the market center on technological diversification and geographical expansion. The burgeoning market for plant-based and alternative protein products requires specialized filling technology capable of handling novel textures and high-fiber content, creating a fresh development avenue for manufacturers. Furthermore, leveraging sustainable manufacturing practices, such as developing energy-efficient stuffing equipment and designing machines for easier component recycling, appeals to environmentally conscious corporations and provides a competitive differentiation. Emerging economies in Asia and Africa present vast, untapped markets where the transition from traditional, manual processing methods to automated industrial stuffing is accelerating, driven by population growth and changing consumer lifestyles.

The primary impact forces driving strategic decisions include economic factors, such as fluctuating commodity prices impacting raw material costs for both ingredients and machinery construction, and socio-cultural shifts, particularly the consumer desire for cleaner labels and transparency in food production, pushing manufacturers toward more natural fillings and precise ingredient dosing. Regulatory forces compel constant technological upgrades, particularly around equipment sanitation and ease of cleaning (Clean-in-Place systems). These forces dictate that successful market participants must not only offer efficiency but also demonstrable compliance and flexibility, ensuring that their equipment supports both mass production and customized, short-run specialty product manufacturing demanded by dynamic consumer preferences.

Segmentation Analysis

The Food Stuffer Market is comprehensively segmented based on machine type, stuffing material, application, and processing capacity, offering granular insights into the varied demands of the food processing industry. Understanding these segments is critical as it highlights where technological investment and market growth are concentrated. For instance, the differentiation between continuous vacuum stuffers and piston stuffers addresses distinct needs concerning product consistency and processing volume, with the former dominating high-volume production lines requiring air-free product integrity, especially in premium cured meats. The market’s complexity is further illustrated by the material segmentation, where natural casings, though expensive, cater to artisan and high-end markets, while synthetic and collagen casings serve the mass-market segments requiring high throughput and standardized sizing.

Application-based segmentation is the most impactful, reflecting the diverse requirements across meat, bakery, dairy, and confectionery sectors. The meat industry, including sausages, luncheon meats, and poultry products, remains the dominant application due to the inherent nature of processing these foods. However, segments like prepared meals and snacks are experiencing rapid technological investment, requiring flexible stuffers that can handle heterogeneous materials like rice, vegetables, and viscous sauces for products such as ready-to-heat burritos or filled pasta. This diversification pushes equipment developers to engineer multi-functional machines that minimize changeover time and maximize versatility across different product forms.

Analyzing segmentation by processing capacity reveals a distinct market dichotomy: high-capacity industrial machines are optimized for continuous 24/7 operations and dominate the competitive landscape, catering to major multinational food corporations. Conversely, smaller, semi-automatic stuffers target local butchers, specialty food producers, and research and development kitchens, focusing on modularity and ease of use rather than sheer speed. The future growth is expected to be highest in the ultra-high capacity, fully automated segment, fueled by global capacity expansion projects undertaken by leading food processors striving for economies of scale.

- By Type:

- Vacuum Stuffers

- Piston Stuffers

- Hydraulic Stuffers

- Hand Stuffers (Low Capacity)

- By Operating Mode:

- Automatic

- Semi-Automatic

- By Application:

- Meat and Seafood Processing (Sausages, Deli Meats, Poultry Injection)

- Bakery and Confectionery (Filled Donuts, Pastries, Pies)

- Ready-to-Eat Meals (Dumplings, Filled Pasta, Convenience Foods)

- Dairy and Alternative Protein Processing

- By Material Handled:

- Viscous Pastes

- Particulate Mixtures

- Liquids and Sauces

- By End-User:

- Industrial Food Processors

- Commercial Food Service (Butchers, Restaurants)

Value Chain Analysis For Food Stuffer Market

The value chain for the Food Stuffer Market begins with upstream activities dominated by raw material suppliers providing specialized metals, high-grade polymers, and electronic components essential for manufacturing robust and hygienic machinery. Key upstream considerations include ensuring the quality and traceability of stainless steel (often 304 or 316 grade) used for contact parts to prevent corrosion and facilitate sterilization. Machinery manufacturers then engage in design, engineering, and precision fabrication, where intellectual property related to pumping mechanisms, air separation technology (for vacuum stuffers), and control systems creates significant value differentiation. Efficiency at this stage is measured by adherence to hygienic design principles and the successful integration of advanced automation components like PLCs and servo motors.

The midstream involves the distribution and sales channels, which are bifurcated into direct sales and indirect representation through specialized distributors or system integrators. Direct channels are typically utilized for large, bespoke industrial installations requiring extensive consultation, installation supervision, and maintenance contracts. Indirect channels leverage regional distributors who possess deep knowledge of local regulatory requirements and provide localized after-sales support. System integrators play a crucial role by combining the stuffing machinery with other processing equipment, such as grinders, mixers, clippers, and packaging lines, offering a complete, turnkey production solution to the end-user. Effective distribution relies heavily on global logistics networks capable of handling large, delicate capital equipment.

Downstream activities center on the end-users—the food processors—and the long-term lifecycle management of the equipment. Value capture in the downstream is maximized through comprehensive after-sales services, including preventative maintenance, immediate access to spare parts, and continuous software updates, especially for automated and AI-integrated systems. The profitability of machinery manufacturers is increasingly tied to recurring revenue generated from service contracts and consumables (such as specialized seals, gaskets, or proprietary cutting blades). The final consumption involves the products created by the stuffer (e.g., sausages, filled pastries), where the consistency and quality delivered by the machine directly influence consumer perception and brand loyalty for the food producer.

Food Stuffer Market Potential Customers

Potential customers for Food Stuffer technology are primarily defined by their scale of operation and the type of product they manufacture. The largest and most significant customer segment comprises industrial meat and poultry processors. These enterprises, which include global giants and large regional players, require high-capacity, fully automated, continuous vacuum stuffers with advanced monitoring capabilities to maintain massive throughputs (often exceeding several tons per hour) while strictly adhering to stringent sanitation standards. Their purchasing decisions are driven by total cost of ownership (TCO), reliability, speed, and the ability to integrate seamlessly into existing high-speed production lines, making them buyers of premium, technologically advanced equipment.

A rapidly expanding customer base includes manufacturers specializing in non-traditional or alternative protein products. As the market for plant-based sausages, vegan burgers, and meat substitutes accelerates, these producers require stuffers capable of handling highly variable, often sticky or difficult-to-handle, fibrous mixtures. They seek flexible, modular equipment that allows for rapid formulation changes and experimentation, often prioritizing versatility over sheer volume initially. This segment places a high value on equipment manufacturers who can provide customized technical support and adaptation services to solve unique processing challenges associated with novel ingredients.

The third major customer segment consists of commercial food service entities and artisan processors, such as local butcher shops, specialized delicatessens, mid-sized bakeries, and small-scale ready-meal producers. These customers typically opt for smaller, semi-automatic or hydraulic piston stuffers. Their purchasing criteria emphasize ease of cleaning, user-friendliness, durability, and a lower initial investment. Although their individual volume of purchase is smaller, their sheer number makes them crucial for maintaining sales in lower-capacity equipment ranges. Furthermore, this segment often represents early adopters of niche, specialty equipment designed for specific regional or gourmet food applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vemag Maschinenbau GmbH, Handtmann Maschinenfabrik GmbH & Co. KG, CFS (GEA Group), Metalbud NOWICKI, Reiser, Risco S.p.A., Marel, FPS Food Process Solutions, Laska GmbH, Maurer-Atmos, Hollymatic Corporation, Mainca S.r.l., Frey Maschinenbau, Shandong Zhonghui Machinery, Tecnobel srl |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Stuffer Market Key Technology Landscape

The technology landscape of the Food Stuffer Market is rapidly evolving, driven by the need for increased speed, precision, and adherence to hygienic standards. A crucial technological shift involves the transition from traditional piston-driven mechanical systems to advanced continuous vacuum stuffing technology. Vacuum stuffing removes air from the product mixture before it is stuffed, leading to superior product appearance, reduced oxidation, and extended shelf life, essential factors for modern retail chains. The integration of high-precision servo motor drives and sophisticated PLC control systems allows for unparalleled accuracy in portioning and weight control, often resulting in "zero-giveaway" production lines, which is highly valued in the cost-sensitive food processing sector. Furthermore, modular design principles are being applied to facilitate faster changeover times between different product runs, enhancing operational flexibility.

Connectivity and smart manufacturing represent the next frontier. Key manufacturers are incorporating Industrial Internet of Things (IIoT) sensors into their equipment to monitor operational parameters such as motor load, pressure, temperature, and wear patterns in real-time. This data is leveraged for predictive maintenance scheduling, reducing the reliance on fixed maintenance cycles and preventing catastrophic failures, thereby significantly improving overall equipment effectiveness (OEE). Data generated by these smart stuffers is often cloud-connected, allowing manufacturers to remotely diagnose issues, optimize recipes based on performance metrics, and ensure full compliance with regulatory documentation requirements regarding batch processing records. Cybersecurity measures are also becoming critical to protect proprietary recipe data and operational integrity.

Another dominant technological trend focuses on enhanced hygiene and sanitation features. Clean-in-Place (CIP) and Sterilization-in-Place (SIP) compatibility are now standard requirements, pushing machinery design towards smooth surfaces, minimal horizontal ledges, and easy access to internal components for thorough cleaning without extensive disassembly. New materials, such as specialized antimicrobial plastics and ceramics, are being researched and deployed in non-contact parts to further reduce contamination risks. Additionally, the development of sophisticated robotic loading and unloading systems that interface directly with the stuffer is reducing reliance on human operators in critical hygiene zones, reinforcing automated sanitation protocols and contributing to a safer food supply chain across all applications, from highly viscous cheese fillings to coarse meat emulsions.

Regional Highlights

- North America: This region holds a significant market share, characterized by high automation levels and stringent food safety regulations. The demand is heavily skewed towards high-throughput vacuum stuffers utilized in large meat and poultry processing facilities. Key drivers include the mature market for ready-to-eat meals and aggressive investment in technology upgrades to address labor shortages. Canada and the U.S. are focused on adopting AI-driven quality control systems.

- Europe: Europe is a mature market known for its emphasis on quality, precision engineering, and sustainable manufacturing practices. Germany, Italy, and Spain are manufacturing hubs for advanced stuffing machinery. Regulatory adherence to EU hygiene directives (e.g., EHEDG standards) drives replacement cycles. The growth here is supported by strong consumer demand for high-quality cured meats, specialty bakery products, and the fastest adoption of plant-based filling technologies.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by expanding populations, rising disposable incomes, and the rapid industrialization of food production, particularly in China, India, and Southeast Asian nations. The region is transitioning quickly from manual labor to automation to meet massive domestic and export demand. Investments focus on establishing large-scale, automated facilities, driving sales of mid-to-high capacity automatic stuffers.

- Latin America (LATAM): Growth in LATAM is driven by the expansion of the meat processing sector, particularly in Brazil and Argentina, which are major global exporters. The market shows a mixed preference, adopting both highly automated European and North American machinery for export-focused plants, alongside more cost-effective hydraulic and piston stuffers for domestic consumption-oriented facilities. Economic instability remains a key factor impacting long-term capital investment decisions.

- Middle East and Africa (MEA): This region is characterized by nascent but fast-developing food processing industries. Growth is concentrated in urban centers and oil-rich nations. Demand is tied to increasing modern retail penetration and reliance on imported processing technology. Key investments are observed in cold chain infrastructure development and establishing local production of convenience foods, often requiring reliable, medium-capacity machinery that can withstand demanding operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Stuffer Market.- Vemag Maschinenbau GmbH

- Handtmann Maschinenfabrik GmbH & Co. KG

- Marel

- CFS (GEA Group)

- Risco S.p.A.

- Reiser

- Metalbud NOWICKI

- Laska GmbH

- Frey Maschinenbau

- Hollymatic Corporation

- Tecnobel srl

- Mainca S.r.l.

- Maurer-Atmos

- Shandong Zhonghui Machinery

- FPS Food Process Solutions

- Dixie Union

- KOCH Pac-Systeme GmbH

- Niro-Soavi (GEA Group)

- Jarvis Products Corporation

- Talsabell S.A.

Frequently Asked Questions

Analyze common user questions about the Food Stuffer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using vacuum stuffers over traditional piston stuffers?

Vacuum stuffers significantly improve product quality by removing air from the product mixture before filling. This process prevents air pockets, reduces oxidation, enhances color stability, and ensures consistent density and improved shelf life, making them superior for high-quality, high-volume operations.

How is the growth of the plant-based food industry influencing the Food Stuffer Market?

The surging demand for plant-based sausages and meat analogues requires specialized stuffing equipment. These alternative protein mixtures often have different viscosity and fiber content than meat, driving innovation toward flexible, high-pressure stuffers designed to handle non-traditional, heterogeneous ingredient matrices while maintaining texture integrity.

What is the typical lifespan and required maintenance frequency for industrial Food Stuffers?

Industrial stuffers, built from high-grade stainless steel, typically have a lifespan of 15 to 25 years with proper maintenance. Required maintenance often includes daily cleaning, weekly lubrication, and major preventative services (seals, hoses, pumps) scheduled annually, increasingly managed through AI-driven predictive maintenance systems.

Which geographical region represents the largest growth opportunity for new Food Stuffer manufacturers?

The Asia Pacific (APAC) region, driven by rapid urbanization and the industrialization of the food sector, offers the most significant growth opportunity. Investment in automation is accelerating dramatically in countries like China and India to meet surging domestic consumption of processed and convenient food items.

What role does automation play in mitigating food safety risks in the stuffing process?

Automation minimizes human contact with food products, drastically reducing the risk of cross-contamination inherent in manual handling. Advanced stuffing machines feature Clean-in-Place (CIP) systems and hygienic designs that ensure thorough, automated sanitation, thus upholding stringent global food safety standards like HACCP.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager