Food Supplement Cooking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432862 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Food Supplement Cooking Market Size

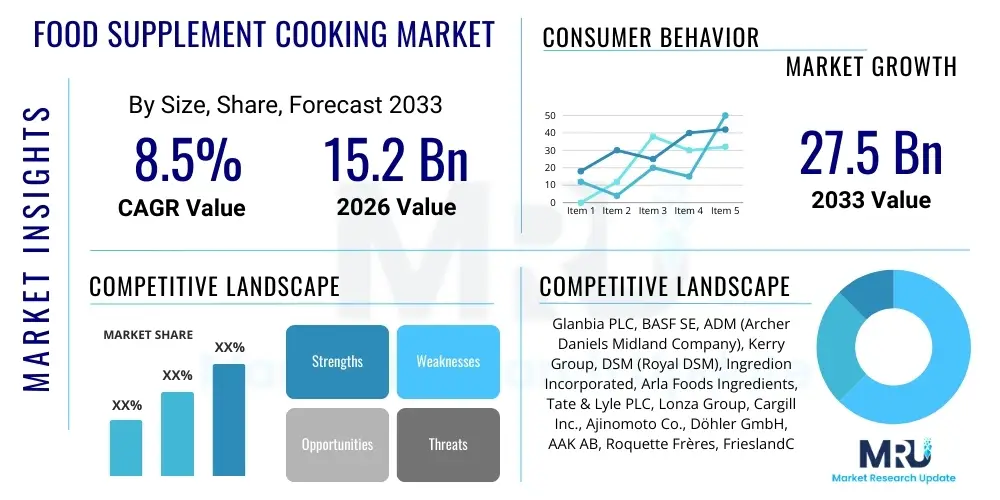

The Food Supplement Cooking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a global shift towards proactive health management, where consumers increasingly incorporate specialized nutritional additives directly into their daily food preparation routines. The integration of high-value supplements—ranging from specialized proteins to microencapsulated vitamins—into home cooking and industrial food production is transforming traditional dietary practices, positioning the market as a key beneficiary of the functional food movement.

The calculation of market size incorporates revenue generated from the sale of raw, semi-processed, or formulated nutritional ingredients specifically designed for thermal stability and functional integration into cooked or baked applications. Key revenue streams originate from B2B sales to industrial food manufacturers formulating enhanced ready meals and bakery products, as well as B2C sales of cooking-grade supplement powders and liquids used directly by consumers. Factors such as advanced ingredient science, which ensures nutritional potency is maintained despite heat exposure, and robust supply chain logistics supporting high-volume distribution contribute significantly to the market's verifiable valuation and sustained upward trajectory during the forecast period.

Food Supplement Cooking Market introduction

The Food Supplement Cooking Market encompasses the manufacturing, distribution, and utilization of nutrient-dense ingredients formulated specifically to be incorporated into standard cooking, baking, or food preparation processes without significant degradation of their inherent nutritional value or detrimental impact on the final product's sensory attributes, such as taste, texture, or aroma. These specialized products include fortified protein powders, heat-stable vitamins (like Vitamin C and B-complex derivatives), advanced mineral complexes, and fiber or probiotic inclusions designed to enhance the nutritional profile of common meals. This market serves both the consumer seeking convenience in dietary fortification and the industrial sector aiming to develop functional food products that meet growing consumer demands for health and wellness attributes.

Major applications span across staple foods, including baking mixes for enhanced breads and muffins, beverage formulations such as fortified smoothies and nutritional hot drinks, and prepared meal components like soups, sauces, and performance snacks. The primary benefit derived from these supplements is the seamless integration of essential nutrients into everyday consumption patterns, alleviating the need for separate pill consumption or specialized meal planning. Driving factors include the escalating prevalence of chronic lifestyle diseases, increasing nutritional gaps observed in modern diets, rising disposable incomes in emerging economies enabling premium ingredient purchases, and significant technological breakthroughs in ingredient encapsulation and thermal stabilization, making nutrient incorporation practical and effective even under high-temperature cooking conditions.

The current market environment is characterized by intense innovation focused on bio-availability and solubility, ensuring that supplements not only survive the cooking process but are also effectively absorbed by the human body. This technological focus, combined with strong consumer advocacy for clean-label and natural ingredients, dictates the development trajectory. Furthermore, regulatory bodies across North America and Europe are establishing clearer guidelines for functional claims related to cooked supplements, bolstering consumer trust and encouraging wider commercial adoption across both retail and foodservice sectors.

Food Supplement Cooking Market Executive Summary

The Food Supplement Cooking Market is positioned for robust growth, driven by key business trends emphasizing personalized nutrition and the mainstreaming of functional food preparation. Business trends highlight strategic partnerships between supplement manufacturers and major food processors to scale up the production of fortified staple goods, coupled with high investment in research for novel heat-stable ingredients, particularly advanced plant-based proteins and omega-3 fatty acids protected by microencapsulation technologies. Regional trends indicate that North America and Europe currently dominate market share due to mature regulatory frameworks and high consumer awareness regarding preventative health. However, the Asia Pacific region is forecast to exhibit the fastest growth, propelled by the rising urbanization, adoption of Western dietary habits requiring nutrient supplementation, and increasing market accessibility via expanding e-commerce platforms specializing in niche nutritional products.

Segment trends reveal that the Protein Supplements segment holds the largest revenue share, primarily driven by the versatility of protein isolates (whey, soy, pea) in various cooking applications, from baking to savory dish enhancement. Simultaneously, the Vitamin and Mineral Supplements segment is demonstrating accelerating growth, benefiting from innovations that minimize nutrient loss during thermal processing. Distribution channels are undergoing transformation, with online retail gaining substantial traction due to its ability to offer a broader range of specialized, cooking-grade ingredients directly to the consumer, complete with detailed usage instructions and recipe ideas, circumventing traditional supermarket limitations on shelf space for niche products.

Overall, the market dynamic is shifting from reactive supplementation toward proactive dietary fortification. The executive summary confirms that successful market penetration hinges on demonstrating tangible functional benefits while ensuring seamless integration into the culinary experience. Companies prioritizing transparency regarding ingredient sourcing and processing methods, alongside rigorous third-party testing for heat stability, are expected to secure a competitive advantage in this rapidly evolving consumer goods and health sector intersection. The integration of digital tools for customized recipe generation based on individual nutritional needs represents a pivotal future strategy.

AI Impact Analysis on Food Supplement Cooking Market

Common user questions regarding AI's impact typically center on how technology can guarantee nutrient delivery, personalize dietary solutions, and optimize the supply chain efficiency for specialized, often costly, ingredients. Users are concerned about whether AI can accurately model nutrient degradation under diverse cooking methods and temperatures, ensuring the end-user receives the claimed nutritional value. They also frequently inquire about AI-driven recipe generation that balances taste preference with optimal nutritional profiles derived from integrated supplements. Furthermore, industry stakeholders question AI's role in predictive demand forecasting for niche supplements and optimizing ingredient mixing processes to maintain product homogeneity and stability. The key thematic summary suggests high user expectation for AI to fundamentally resolve current industry pain points related to efficacy verification, personalized consumer experience, and enhanced operational efficiency in the complex manufacturing of fortified foods.

The integration of Artificial Intelligence and Machine Learning (ML) is rapidly becoming a transformative force within the Food Supplement Cooking Market, particularly in formulation science and consumer interaction. AI algorithms are being deployed to predict the thermal stability and chemical interaction of various nutrient compounds, allowing R&D teams to fast-track the development of novel heat-resistant supplement forms. By simulating hundreds of cooking scenarios, AI minimizes expensive and time-consuming physical laboratory testing, accelerating the launch of products guaranteed to retain their efficacy when used in home or industrial kitchens. This predictive capability ensures higher quality control and enables manufacturers to provide accurate usage instructions regarding optimal cooking temperatures and duration for minimal nutrient loss.

Moreover, AI is pivotal in driving the hyper-personalization trend within this sector. Machine learning models analyze vast datasets encompassing individual genetic profiles, microbiome data, existing dietary habits, and fitness goals to recommend highly customized food supplement blends specifically tailored for cooking. These AI-driven platforms can also generate complex recipes that seamlessly incorporate these specialized ingredients while adhering to individual caloric, macronutrient, and micronutrient targets. This level of precision moves the market beyond generalized fortification towards truly individualized nutritional enhancement, creating significant value for consumers willing to invest in tailored health solutions and presenting a high barrier to entry for non-technologically advanced competitors.

- AI-Powered Formulation Optimization: Predictive modeling of nutrient stability and interaction under diverse thermal conditions (baking, frying, boiling).

- Personalized Recipe Generation: Algorithms creating tailored recipes incorporating required supplement dosages based on user health data and taste preferences.

- Supply Chain Efficiency: Utilizing ML for demand forecasting of niche supplements, optimizing inventory management, and reducing waste due to short shelf lives.

- Quality Control Automation: Vision systems and sensors monitored by AI ensuring consistent blending and dispersal of powdered supplements in industrial food matrices.

- Consumer Feedback Loop Analysis: Sentiment analysis using NLP to rapidly identify performance issues (e.g., altered taste, poor solubility) for immediate product refinement.

DRO & Impact Forces Of Food Supplement Cooking Market

The Food Supplement Cooking Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers center on the global epidemic of lifestyle-related diseases, which necessitates dietary interventions and increased fortification awareness, alongside rapid advancements in food technology that solve historical issues of nutrient degradation during cooking. Conversely, regulatory complexities surrounding the distinction between 'food additive,' 'functional ingredient,' and 'dietary supplement' present significant restraints, especially concerning permissible health claims and dosage limits. Opportunities abound in the realm of sustainable sourcing, plant-based innovation, and the use of digital tools to offer personalized, subscription-based supplement cooking kits. The collective impact forces—including intense price competition, rapid technological obsolescence, and shifting global dietary guidelines—dictate the speed and direction of market evolution, rewarding agility and penalizing outdated formulation techniques.

Drivers include the widespread recognition among consumers that modern diets often lack essential micronutrients, prompting proactive measures like fortifying home-cooked meals. This awareness is amplified by social media influence and health professional endorsements emphasizing the ease of incorporating cooking supplements compared to traditional pills. Furthermore, the industrial sector is driven by the desire to differentiate standard products (like bread or pasta) by offering enhanced nutritional value, leading to increased B2B demand for cooking-grade specialty ingredients. The innovation in microencapsulation, which protects sensitive nutrients such as vitamins and probiotics from heat, acid, and mechanical stress, acts as a primary technological catalyst for market expansion, overcoming a major historical barrier to widespread adoption.

Restraints primarily involve the capital-intensive nature of advanced formulation and processing equipment required to create stable supplements, which can inflate end-product prices and limit accessibility. Consumer skepticism regarding the actual bio-availability of nutrients post-cooking, often fueled by conflicting information or insufficient third-party testing, also acts as a constraint. Regulatory hurdles remain substantial, particularly in multinational markets where ingredient definitions and permitted health claims vary significantly, complicating global product rollouts and requiring costly country-specific labeling adjustments. However, the overarching opportunities lie in targeting specific demographic niches, such as the aging population requiring bone and muscle support, or the athletic community needing enhanced recovery nutrients seamlessly integrated into their daily caloric intake, utilizing clean-label ingredients to build long-term consumer trust.

Segmentation Analysis

Segmentation analysis of the Food Supplement Cooking Market provides critical insights into the varied consumer needs and industry requirements, allowing manufacturers to strategically focus their product development and marketing efforts. The market is primarily segmented based on the type of supplement, the application in which it is used, and the distribution channel through which it is sold. Analyzing these segments helps identify high-growth areas, such as specialty supplements like functional fibers and customized botanical extracts, and clarifies preferred purchasing pathways, particularly the accelerating dominance of online retail for niche nutritional ingredients. This detailed breakdown highlights the necessity of formulating distinct products for industrial applications (requiring high stability and volume) versus direct consumer use (requiring ease of measurement and appealing sensory properties).

By dissecting the market along these lines, stakeholders can observe that while protein supplements hold foundational volume due to their wide acceptance and functional properties (e.g., texturizing agents), the fastest growth is often concentrated in high-value, specialized segments. For instance, the demand for cooking-stable Omega-3 fatty acids, crucial for cardiovascular health, is rapidly increasing, necessitating complex stabilization techniques. Similarly, the Application segmentation reveals significant investment potential in functional beverages and fortified bakery products, driven by their status as common daily consumption items. Understanding these segmented dynamics is essential for accurate forecasting and successful competitive positioning within the broader functional ingredients landscape.

- By Type:

- Protein Supplements (Whey Protein Isolates, Casein, Soy Protein, Pea Protein, Rice Protein)

- Vitamin Supplements (Heat-stable Vitamin C, B-Complex Derivatives, Vitamin D, Vitamin E)

- Mineral Supplements (Calcium fortified powders, Magnesium, Zinc complexes)

- Specialty Supplements (Omega-3 Fatty Acids, Probiotics, Prebiotic Fibers, Adaptogens)

- By Application:

- Baked Goods (Breads, Muffins, Cookies, Energy Bars)

- Beverages (Smoothies, Hot Drinks, Juices, Protein Shakes)

- Confectionery (Gummies, Chocolates, Nutritional Candies)

- Soups & Sauces (Ready-to-eat meals, Fortified Broths, Dressings)

- Dairy Products and Alternatives (Yogurts, Milk Alternatives, Cheeses)

- By Distribution Channel:

- Online Retail (E-commerce, Direct-to-Consumer Websites)

- Supermarkets/Hypermarkets (Mass Market Retailers)

- Specialty Stores (Health Food Stores, Pharmacies)

Value Chain Analysis For Food Supplement Cooking Market

The value chain for the Food Supplement Cooking Market is complex, involving specialized upstream sourcing, technologically advanced midstream processing, and diverse, multi-channel downstream distribution. Upstream analysis focuses on securing high-quality, traceable raw materials—such as specific amino acid sources, botanical extracts, or fermentation-derived ingredients—which requires stringent quality control to ensure purity and freedom from contaminants, crucial for human consumption and regulatory compliance. The midstream processing stage is the most critical, involving specialized synthesis, purification, and, most importantly, encapsulation or matrix embedding technologies to confer thermal stability to sensitive nutrients. Success in this stage often requires substantial R&D investment and proprietary know-how.

Downstream analysis highlights the complexity of reaching both industrial B2B clients and individual B2C consumers. The industrial route involves selling bulk, customized formulations to large food manufacturers via dedicated sales teams and technical support, focusing on consistent supply and integration consulting. The B2C route, conversely, relies heavily on branding, marketing health benefits, and managing both indirect channels (supermarkets, specialty stores) and direct channels (e-commerce platforms). Direct sales via online platforms are increasingly important as they offer greater control over product messaging, enable direct consumer interaction, and facilitate the sale of highly niche or personalized supplements, bypassing traditional retail gatekeepers and providing higher margin opportunities.

Distribution channel dynamics are bifurcated: traditional retail (indirect) benefits from high foot traffic and immediate availability for staple supplements, while online retail (direct/indirect) excels in delivering specialized products and detailed educational content necessary for complex cooking supplements. Effective value chain management, particularly optimizing the logistics for temperature-sensitive ingredients and maintaining rigorous traceability from farm to table, is paramount for minimizing risk, ensuring product integrity, and sustaining consumer confidence in the efficacy of cooking supplements.

Food Supplement Cooking Market Potential Customers

The potential customers and primary end-users of Food Supplement Cooking Market products are diverse, spanning both the industrial food sector and various segments of the individual consumer base. Industrial buyers include major food and beverage manufacturers, catering companies specializing in institutional nutrition (hospitals, schools), and quick-service restaurant chains looking to enhance the nutritional profile of their menu offerings. These industrial customers purchase large volumes of specialized, highly stable ingredients, often requiring customized formulations to meet specific production constraints and legislative requirements related to fortification levels. Their purchasing decisions are primarily driven by cost-effectiveness, consistency, and verifiable thermal stability performance guarantees provided by the supplement manufacturer.

On the consumer side, the market targets several key demographic segments. First are the proactive health enthusiasts and individuals focused on performance nutrition (athletes, bodybuilders) who seek convenient, daily ways to meet high macro- and micronutrient targets without resorting to excessive pill consumption. Second are families and parents seeking to covertly fortify the diets of fussy eaters or individuals with specific dietary restrictions (e.g., vegan or gluten-free diets) by incorporating supplements seamlessly into everyday meals. Third are the elderly population, who often face challenges with appetite and nutrient absorption, making fortified, easy-to-consume meals an attractive health solution. Ultimately, the successful capture of these segments requires differentiated products that balance high nutritional efficacy with superior culinary integration, ensuring that the act of fortification does not compromise the enjoyment of food.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glanbia PLC, BASF SE, ADM (Archer Daniels Midland Company), Kerry Group, DSM (Royal DSM), Ingredion Incorporated, Arla Foods Ingredients, Tate & Lyle PLC, Lonza Group, Cargill Inc., Ajinomoto Co., Döhler GmbH, AAK AB, Roquette Frères, FrieslandCampina Ingredients, Givaudan SA, Chr. Hansen Holding A/S, Novozymes A/S, Kemin Industries, NutriScience Innovations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Supplement Cooking Market Key Technology Landscape

The technological landscape of the Food Supplement Cooking Market is characterized by innovations focused primarily on enhancing ingredient stability, bio-availability, and seamless integration into food matrices without negatively affecting sensory characteristics. The paramount technology in this sector is microencapsulation, which involves coating sensitive nutrients (like heat-sensitive vitamins, probiotics, or Omega-3 oils) with a protective matrix (often polymers or lipids). This protective layer shields the core ingredient from heat, oxidation, and moisture during cooking and storage, only releasing the nutrient under specific digestive conditions, thereby maximizing efficacy and extending shelf life. Advanced techniques, such as spray-drying and fluid-bed coating, are crucial for industrial scaling of these encapsulated ingredients, ensuring consistent particle size and distribution across large batches of manufactured foods.

Beyond encapsulation, developments in protein processing, particularly hydrolysis and isolation techniques, are essential for creating neutral-tasting, highly soluble protein powders that can be integrated into beverages and baked goods without altering texture or flavor profile. Enzymatic modifications are frequently employed to improve the functional properties of natural fibers and starches, enabling them to act as superior carriers for nutritional compounds while also improving the mouthfeel of the final cooked product. Furthermore, the adoption of proprietary blending technologies and high-shear mixers ensures that supplements are uniformly dispersed within complex recipes, preventing sedimentation or clumping, which is critical for maintaining product quality and accurate dosage delivery in home cooking environments.

The emerging technological frontier involves applying computational chemistry and AI modeling to predict molecular behavior. Manufacturers are using these tools to screen novel ingredient combinations and predict degradation pathways before costly physical experimentation begins, leading to faster, more effective product development cycles. This computational approach, combined with ongoing research into next-generation food-grade stabilizers and antioxidants, is continually raising the standard for heat-stable, functional food ingredients, positioning the technology landscape as a primary driver of competitive differentiation and market growth.

Regional Highlights

- North America: North America commands a leading share of the Food Supplement Cooking Market, characterized by high consumer awareness regarding preventative health, robust disposable incomes supporting premium supplement purchases, and a well-established regulatory pathway (FDA guidelines). The region sees significant demand for protein fortification, driven by the sports nutrition and active lifestyle segments, and rapid adoption of specialty supplements like cooking-stable CBD and personalized vitamin blends. The advanced presence of functional food manufacturers and strong e-commerce infrastructure facilitates the widespread availability and marketing of innovative culinary supplement products.

- Europe: Europe represents a mature but dynamically growing market, heavily influenced by strict clean-label trends and sustainable sourcing demands. The market is primarily driven by regulatory environments (EFSA) that emphasize safety and clear health claims, pushing manufacturers toward rigorously tested, naturally sourced ingredients. Germany, the UK, and France are key contributors, demonstrating high adoption rates of fortified bakery goods and functional dairy alternatives. Innovation often centers around botanical extracts and plant-based protein sources tailored for traditional European culinary applications, such as enhanced pasta or fortified sauces.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, increasing middle-class populations adopting Western dietary habits, and growing awareness of nutritional deficiencies, particularly in countries like China and India. The market growth is substantial for convenience foods fortified with essential micronutrients (Vitamins A, D, Iron) addressing public health concerns. Key drivers include expanding cold chain logistics, penetration of international supplement brands, and the rising popularity of online shopping platforms, making specialized ingredients accessible across diverse geographic areas.

- Latin America (LATAM): The LATAM market is nascent but shows potential, driven by public health initiatives focusing on reducing malnutrition and a cultural willingness to integrate supplements into traditional beverages and meal preparation. Brazil and Mexico are primary markets where protein and mineral supplements are gaining traction, often targeting functional dairy products and cost-effective fortification solutions for staple foods. Price sensitivity and inconsistent regulatory harmonization across different countries remain factors influencing the pace of market expansion.

- Middle East and Africa (MEA): The MEA market is characterized by diverse consumer needs, high reliance on imported ingredients, and growing government investment in health infrastructure. The Gulf Cooperation Council (GCC) countries show high demand for high-end, specialized functional foods tailored for specific dietary needs (e.g., performance nutrition during religious fasting periods). Challenges include extreme climate conditions affecting ingredient stability and a need for local manufacturing capabilities to reduce dependence on costly imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Supplement Cooking Market.- Glanbia PLC

- BASF SE

- ADM (Archer Daniels Midland Company)

- Kerry Group

- DSM (Royal DSM)

- Ingredion Incorporated

- Arla Foods Ingredients

- Tate & Lyle PLC

- Lonza Group

- Cargill Inc.

- Ajinomoto Co.

- Döhler GmbH

- AAK AB

- Roquette Frères

- FrieslandCampina Ingredients

- Givaudan SA

- Chr. Hansen Holding A/S

- Novozymes A/S

- Kemin Industries

- NutriScience Innovations

Frequently Asked Questions

Analyze common user questions about the Food Supplement Cooking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using cooking-grade food supplements?

The primary benefit is the seamless integration of essential nutrients—such as proteins, vitamins, and fibers—directly into everyday meals without altering taste or requiring separate consumption. This method enhances daily nutritional intake conveniently, supporting proactive health management and dietary adherence.

How do manufacturers ensure supplements maintain nutritional value during high-temperature cooking?

Manufacturers utilize advanced encapsulation technologies, such as microencapsulation, which coats sensitive nutrients in heat-resistant barriers (polymers or lipids). This prevents degradation from heat, oxidation, and moisture, ensuring high bio-availability upon consumption.

Which segments of the Food Supplement Cooking Market are experiencing the fastest growth?

The Specialty Supplements segment, including cooking-stable Omega-3 fatty acids, targeted probiotics, and adaptogenic botanicals, is seeing the fastest expansion, driven by high consumer demand for functional, customized ingredients beyond basic protein and vitamin fortification.

What is the impact of Artificial Intelligence on food supplement formulation?

AI models are used to predict the thermal stability and chemical interactions of novel ingredients, significantly accelerating R&D by simulating diverse cooking scenarios, thereby ensuring nutrient efficacy and optimizing formula consistency before large-scale production.

Where is the highest demand for Food Supplement Cooking products concentrated geographically?

While North America and Europe currently hold the largest market shares due to high maturity and consumer awareness, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) due to expanding middle classes and increasing focus on public health fortification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager