Food Tray Sealer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434533 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Food Tray Sealer Market Size

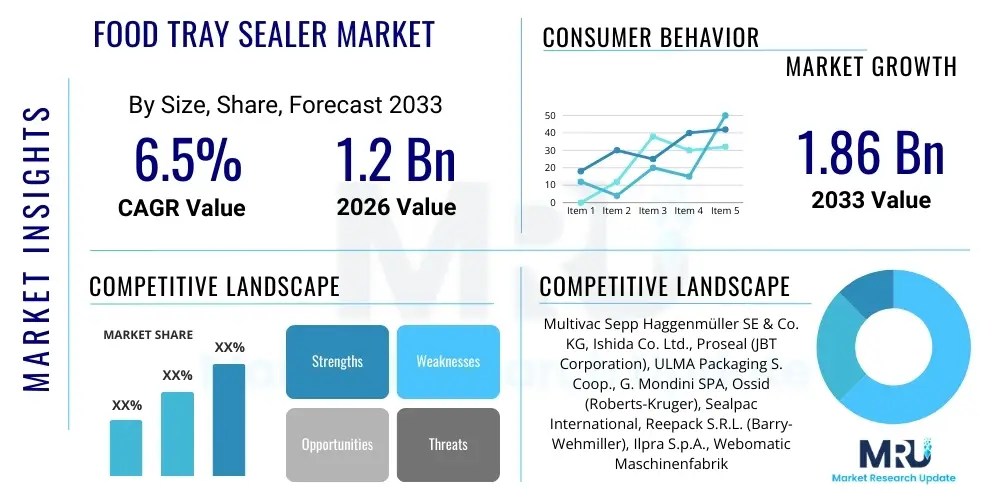

The Food Tray Sealer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.86 Billion by the end of the forecast period in 2033.

Food Tray Sealer Market introduction

The Food Tray Sealer Market encompasses equipment designed to hermetically seal food trays, primarily utilized in the processed food, ready-meal, and fresh produce sectors to extend shelf life, maintain product integrity, and enhance presentation. These machines operate by applying heat and pressure to a film, bonding it securely to the rim of the tray, often employing technologies like Modified Atmosphere Packaging (MAP) or vacuum sealing. Product description includes a range from compact, manually operated benchtop sealers suitable for small-scale catering to fully automated, high-throughput inline systems integrated into large industrial production lines. The fundamental function remains consistent: ensuring an airtight seal to protect the contents from contamination and spoilage, thereby facilitating safe distribution across complex supply chains.

Major applications of food tray sealers span crucial segments of the modern food industry, including sealing ready-to-eat (RTE) meals, fresh or processed meats, poultry, seafood, dairy products, and specialized medical foods. The increasing consumer demand for convenience, coupled with stringent food safety regulations globally, significantly drives the adoption of these sealing solutions. Benefits derived from using advanced tray sealing equipment include superior barrier properties, reduced food waste due to extended preservation times, improved aesthetics for retail display, and enhanced operational efficiency through automated processes. These systems are pivotal in enabling manufacturers to meet high standards of hygiene and quality control necessary for international trade and domestic distribution.

Driving factors for market expansion include the globalization of the food supply chain, necessitating robust packaging solutions to withstand long transit times, and the rapid urbanization trends leading to increased consumption of packaged and prepared foods. Furthermore, technological advancements focusing on sustainable packaging materials, such as compostable or recyclable films and trays, are stimulating market growth. Manufacturers are continuously investing in equipment that can handle diverse tray materials and formats efficiently, addressing the industry's shift towards environmental responsibility while maintaining the critical function of food preservation. The ability of modern sealers to quickly switch between different sealing parameters (e.g., MAP versus standard seal) adds flexibility essential for varied production demands.

Food Tray Sealer Market Executive Summary

The Food Tray Sealer Market is experiencing robust growth fueled by shifting global dietary habits towards convenience foods and a heightened focus on reducing food waste throughout the supply chain. Key business trends indicate a strong move toward automation, particularly the integration of high-speed, fully automatic inline sealers, driven by escalating labor costs and the need for standardized, repeatable sealing quality. Manufacturers are also heavily focused on developing machines compatible with sustainable and mono-material packaging, responding directly to consumer preference and legislative pressures across major economic regions. Strategic partnerships between packaging material suppliers and equipment manufacturers are becoming commonplace to optimize sealing efficiency for novel barrier films, ensuring seamless transition to eco-friendly solutions without compromising shelf life.

Regional trends reveal that Asia Pacific (APAC) is emerging as the fastest-growing market, largely due to rapid expansion in the organized retail sector, increasing disposable income, and the modernization of food processing infrastructure, particularly in developing economies like China and India. North America and Europe, representing mature markets, maintain dominance in value terms, characterized by high penetration of Modified Atmosphere Packaging (MAP) technology, driven by strict cold chain requirements and established consumer demand for long-shelf-life fresh products. Investment in smart factory technologies, including IoT integration and predictive maintenance capabilities for sealing equipment, is a defining trend across these developed regions, aiming to maximize uptime and operational throughput.

Segment trends emphasize the superior growth rate of the automatic tray sealer segment, reflecting the industrial scale-up requirements of major food producers seeking efficiency gains. By application, the Ready-to-Eat (RTE) meals segment holds the largest market share and exhibits significant future potential, driven by changing demographics and the appeal of prepared, portion-controlled meals. Furthermore, material trends show increasing sophistication in the utilization of recyclable PET and paper-based trays, necessitating precision temperature control and sealing mechanisms in modern tray sealers to handle these delicate substrates effectively while achieving high integrity seals crucial for food safety.

AI Impact Analysis on Food Tray Sealer Market

Common user questions regarding AI’s impact on the Food Tray Sealer Market frequently revolve around how artificial intelligence can enhance quality control, optimize operational efficiency, and facilitate predictive maintenance of complex sealing machinery. Users are keen to understand if AI-driven vision systems can replace traditional quality checks entirely, ensuring zero defective seals leave the production floor, a critical concern given the high financial and reputational cost of food recalls. Furthermore, there is significant interest in utilizing machine learning algorithms to analyze real-time operational data, allowing machines to dynamically adjust sealing parameters (such as temperature, pressure, and dwell time) based on ambient conditions, material variations, or line speed changes, thereby maximizing film utilization and minimizing energy consumption. The adoption of AI is expected to move beyond simple fault detection towards comprehensive process optimization, leading to highly autonomous and resilient packaging lines capable of self-correction and continuous improvement in seal integrity.

The integration of Artificial Intelligence is poised to revolutionize the operational landscape of the Food Tray Sealer Market by introducing unparalleled levels of precision and preventative capability. AI algorithms are instrumental in analyzing multivariate datasets generated by sensors embedded in high-speed sealing equipment, enabling accurate prediction of component failure before downtime occurs. This transition from reactive maintenance to prescriptive maintenance significantly boosts Overall Equipment Effectiveness (OEE). Moreover, advanced AI visual inspection systems, powered by deep learning models, are far more effective than conventional systems at identifying subtle defects like pinholes, wrinkles, or contamination along the seal periphery, which are often invisible or difficult to detect consistently by human operators or rudimentary sensors. These systems learn from massive datasets of perfect and defective seals, constantly refining their detection accuracy.

Beyond maintenance and quality assurance, AI is increasingly influencing supply chain resilience and production scheduling within the food packaging sector. By integrating tray sealing data with Enterprise Resource Planning (ERP) systems and broader supply chain data, AI can optimize film and tray inventory levels, forecast optimal production runs based on anticipated retail demand, and even suggest necessary adjustments to packaging formats (e.g., switching from standard seal to MAP) to meet evolving shelf-life requirements for specific export destinations or seasonal produce. This level of data synthesis allows food manufacturers using tray sealers to achieve significant cost savings, reduce material wastage, and respond dynamically to market changes, establishing AI as a core strategic asset rather than merely an operational tool.

- AI-powered Vision Systems: Real-time, high-precision detection of seal integrity defects (e.g., wrinkles, contamination, non-uniform seals) exceeding human capability.

- Predictive Maintenance: Machine learning models analyze vibrational and thermal data to forecast component failure (e.g., heating element degradation, wear on mechanical parts), maximizing uptime.

- Dynamic Parameter Optimization: Algorithms automatically adjust sealing temperature, pressure, and time based on film/tray material variation and environmental factors for optimal sealing quality.

- Operational Efficiency: Integration with production planning software to optimize batch changes, minimizing material waste and speeding up changeover times.

- Autonomous Troubleshooting: AI diagnosing and suggesting immediate corrective actions for minor operational deviations, reducing reliance on specialized technicians.

DRO & Impact Forces Of Food Tray Sealer Market

The dynamics of the Food Tray Sealer Market are fundamentally shaped by a confluence of powerful forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). A primary driver is the accelerating global demand for convenience and ready-to-eat meals, especially in urban areas where consumers seek quick, safe, and easily prepared food options, necessitating robust, high-quality sealing solutions to ensure freshness and longevity. Simultaneously, stringent food safety and hygiene regulations mandated by governing bodies like the FDA and EFSA compel food processors to adopt advanced sealing technologies, particularly MAP systems, to guarantee product safety and compliance. These market expansion factors create strong positive momentum for automated machinery sales.

However, the market faces significant restraints, including the high initial capital investment required for purchasing and integrating advanced, high-speed automated tray sealing lines, which presents a barrier to entry for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity and the need for specialized training to manage sophisticated MAP and vacuum sealing systems can constrain widespread adoption in regions lacking skilled labor resources. Supply chain volatility, particularly concerning the cost and availability of specialized sealing films and barrier materials, also introduces operational friction, occasionally leading to delays or increased input costs for manufacturers.

The primary opportunities for growth are strongly linked to sustainability and technological integration. The global shift towards eco-friendly packaging materials—such as biodegradable, compostable, or recyclable mono-materials—opens significant opportunities for manufacturers who can develop sealers optimized for these novel substrates. This requires precise control over heat and pressure, often more complex than traditional plastic sealing. Furthermore, the integration of Industry 4.0 technologies, including IoT, sophisticated sensors, and remote monitoring capabilities, presents an opportunity to deliver 'smart' sealers that offer superior operational data, predictive diagnostics, and seamless integration into smart factory ecosystems, providing a competitive edge through improved efficiency and lower total cost of ownership (TCO).

Impact forces in this sector include competitive intensity, where established European and North American manufacturers compete fiercely on technology differentiation (speed, sealing quality, flexibility) against Asian manufacturers who often focus on cost-effectiveness. Regulatory impact remains high; any change in food packaging material mandates or shelf-life standards directly influences technology adoption. Societal forces, particularly consumer concern over food waste and plastic pollution, exert continuous pressure on companies to innovate materials and sealing processes. Technological impact is perhaps the strongest, with continuous advancements in servo motor technology, rapid tool change systems, and enhanced thermal controls constantly improving machine performance metrics like speed and reliability.

- Drivers:

- Rising global consumption of ready-to-eat and processed food products.

- Increasing governmental regulation and consumer demand for superior food safety and extended shelf life (e.g., MAP technology).

- Focus on reducing food waste throughout the supply chain, requiring reliable, hermetic sealing.

- Advancements in automation and integration of high-speed inline systems to lower labor dependency.

- Restraints:

- High initial investment cost for fully automated, sophisticated sealing machinery.

- Technical challenges associated with achieving reliable seals on certain sustainable, compostable, or paper-based tray materials.

- Operational complexities and the requirement for highly skilled maintenance technicians, particularly for complex MAP systems.

- Opportunities:

- Development of machinery optimized for handling new sustainable and recyclable packaging formats (mono-materials).

- Integration of IoT, AI, and advanced sensor technology for predictive maintenance and enhanced quality control (Industry 4.0).

- Expansion into emerging markets (APAC and LATAM) driven by the growth of organized retail and cold chain infrastructure.

- Specialization in niche applications like medical/nutritional foods requiring ultra-hygienic sealing standards.

- Impact Forces:

- Regulatory Compliance (High): Mandates on food safety and packaging sustainability directly affect design.

- Technological Advancement (High): Continuous innovation in servo drives and sealing head designs increases speed and precision.

- Environmental Pressure (Medium to High): Consumer and regulatory pressure for sustainable material compatibility.

- Competitive Intensity (High): Global competition drives down prices for standard machinery and accelerates innovation for specialized systems.

Segmentation Analysis

The Food Tray Sealer Market is comprehensively segmented based on Type, Application, Material Compatibility, and Packaging Format, reflecting the diverse operational scales and specific preservation requirements across the food industry. Understanding these segments is crucial for manufacturers to tailor machinery design and features to specific end-user needs, whether prioritizing high throughput (Automatic) for large processors or flexibility (Manual/Semi-automatic) for co-packers and smaller operations. The segmentation by Application highlights the dominance of the Ready-to-Eat sector, driven by lifestyle changes, although specialized markets like Seafood and Meat continue to require the most sophisticated sealing technologies, typically utilizing MAP to maintain product color and inhibit microbial growth effectively.

Segmentation by Type reveals a clear market trajectory towards automation. While manual and semi-automatic sealers remain vital for small-scale, start-up, or specialized batch operations due to their lower initial cost and space requirements, the majority of market value growth is concentrated in the automatic inline segment. These advanced machines offer continuous sealing processes, often integrated with automated tray denesting, filling, and coding systems, significantly boosting operational throughput and minimizing human error—a critical factor for high-volume producers of perishable goods like fresh poultry or RTE meals. The efficiency and reliability offered by automatic systems justify the higher capital expenditure for large food corporations seeking economies of scale.

Further granularity is provided by Material Compatibility and Packaging Format segments, which address critical technological challenges and preservation strategies. The ability of a sealer to effectively handle diverse materials—from traditional PET and PP trays to newer molded fiber and paperboard options—is a major determinant of market appeal in the current sustainability-focused environment. Packaging Format segmentation, especially the Modified Atmosphere Packaging (MAP) category, is key, as MAP requires extremely precise gas flushing and a guaranteed hermetic seal to maintain the specified gas mixture (e.g., nitrogen, carbon dioxide) necessary for extended shelf life. The growing adoption of MAP across meat, produce, and baked goods segments confirms its status as a high-growth segment within the overall market.

- By Type:

- Automatic Tray Sealers

- Semi-Automatic Tray Sealers

- Manual Tray Sealers

- By Application:

- Ready-to-Eat (RTE) Meals and Convenience Foods

- Meat, Poultry, and Seafood Products

- Dairy and Desserts

- Fresh Produce (Fruits and Vegetables)

- Baked Goods and Confectionery

- Others (Pet Food, Medical/Nutritional Packs)

- By Material Compatibility:

- Plastic Trays (PP, PET, CPET, APET)

- Aluminum Trays

- Paperboard and Pulp Trays

- Foam Trays

- By Packaging Format/Technology:

- Modified Atmosphere Packaging (MAP) Sealing

- Vacuum Skin Packaging (VSP)

- Standard Heat Sealing (Lidding Film)

- Snap-on/Clipping Sealing

Value Chain Analysis For Food Tray Sealer Market

The Value Chain for the Food Tray Sealer Market is complex, beginning with the upstream suppliers of core components and culminating in the end-users who integrate these machines into their food processing lines. Upstream analysis focuses on the suppliers of highly specialized components, including precision-engineered tooling and die sets (which determine the seal shape and cut), advanced pneumatic and servo systems, high-accuracy temperature controllers, and integrated software platforms. The competitive advantage often lies here, as component quality dictates the machine's speed, sealing consistency, and longevity. Manufacturers rely heavily on maintaining robust relationships with key technology providers to ensure the supply of cutting-edge, durable parts, particularly regarding gas mixing technology for MAP systems.

Midstream activities involve the core competencies of the tray sealer manufacturers themselves, encompassing R&D, design optimization, assembly, and rigorous testing. Manufacturers differentiate themselves through innovation in quick tool change systems, minimizing downtime, improving hygienic design (ease of cleaning), and developing energy-efficient sealing heads. Distribution channels are critical, determining how the machinery reaches the diverse global customer base. Direct sales channels are often employed for complex, custom-built automatic systems, allowing manufacturers to provide bespoke installation, training, and long-term maintenance contracts. Indirect channels, involving third-party distributors, agents, and local system integrators, are predominantly used for manual and semi-automatic models, leveraging local market knowledge and support networks, particularly in emerging markets where direct manufacturer presence is limited.

Downstream analysis centers on the end-users—the food processors and packaging houses that utilize the equipment. The performance and maintenance support provided post-sale heavily influence customer retention and future upgrade sales. Aftermarket services, including the supply of replacement parts, regular calibration, and upgrades to accommodate new packaging materials or regulatory changes, form a significant revenue stream. The trend towards integrated solutions means that tray sealer manufacturers must increasingly collaborate with tray and film suppliers (often separate entities) to ensure guaranteed sealing performance across all specified packaging combinations, thereby cementing their position within the wider food packaging ecosystem.

Food Tray Sealer Market Potential Customers

The primary purchasers and end-users of food tray sealer technology are entities within the food processing and packaging industry that require high-integrity, hygienic packaging solutions for perishable goods. The largest segment of potential customers comprises large-scale, multinational food manufacturers specializing in high-volume production of convenience meals, poultry, and dairy products. These companies require fully automatic, high-speed inline systems, often equipped with MAP capabilities, to handle continuous operations and stringent quality assurance standards necessary for global distribution and large retail chain contracts. Their purchasing decisions are driven by TCO, throughput rates, and advanced automation features.

A second major customer category includes smaller to mid-sized co-packers and regional food processors, including those focused on niche or specialty foods, ready-to-bake items, and artisanal products. These customers typically opt for semi-automatic or medium-throughput automatic sealers that offer flexibility for handling smaller batch sizes and frequent product changeovers. For this segment, ease of operation, minimal footprint, and rapid change parts are key selling points. Furthermore, the growing institutional and catering sector, supplying hospitals, airlines, and schools, represents a steady customer base for benchtop or manual sealers for low-volume, on-demand sealing of portion packs.

Emerging and specialized customers include meal kit delivery services and vertically integrated agricultural producers (e.g., fresh produce growers) who are increasingly packaging their own goods at the source. Meal kit providers demand flexible sealing solutions that can handle diverse, often compartmented, trays for various ingredients, while fresh produce packers prioritize sealers capable of delicate handling and precise gas mixtures (MAP) to control respiration rates and prevent spoilage. These buyers prioritize reliability, compliance with international hygiene standards, and the ability to seamlessly integrate the sealing process with existing upstream preparation equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.86 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Multivac Sepp Haggenmüller SE & Co. KG, Ishida Co. Ltd., Proseal (JBT Corporation), ULMA Packaging S. Coop., G. Mondini SPA, Ossid (Roberts-Kruger), Sealpac International, Reepack S.R.L. (Barry-Wehmiller), Ilpra S.p.A., Webomatic Maschinenfabrik GmbH, Orved S.p.A., Belca S.A., Ciro Pack, Starview Packaging Machinery, Inc., Packaging Automation Ltd., The Samco Group, Audion Packaging Machines, Harland Machine Systems, Linco Food Systems, Packaging Machines International (PMI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Tray Sealer Market Key Technology Landscape

The technological evolution within the Food Tray Sealer Market is primarily centered on enhancing speed, ensuring seal integrity, maximizing flexibility, and improving sustainability integration. A core technological shift involves the transition from traditional pneumatically driven systems to advanced servo-motor technology. Servo-driven sealers offer superior control over the sealing cycle, allowing for precise synchronization of movement, pressure application, and dwell time. This precision is vital when sealing lightweight or sustainable materials that are sensitive to excessive heat or pressure, simultaneously boosting throughput rates significantly beyond those achievable with older mechanical designs. Furthermore, modern machines incorporate rapid tool change systems, often facilitated by automated clamping mechanisms, allowing operators to switch between different tray sizes or sealing formats in minutes rather than hours, thereby increasing operational flexibility and minimizing costly changeover downtime.

Modified Atmosphere Packaging (MAP) technology remains a defining feature of high-end tray sealers. Recent advancements in MAP focus on developing highly accurate gas flushing and residual oxygen monitoring systems. Precise gas mixing control ensures the optimal gas composition within the packaged tray, which is crucial for extending the shelf life of highly perishable goods like fresh meat or delicate salads. Another rapidly advancing area is Vacuum Skin Packaging (VSP), which involves drawing a second skin film tightly over the product and tray, providing an aesthetically pleasing presentation while offering excellent barrier properties. VSP requires highly specialized heating and vacuum application systems integrated directly into the sealing machinery, demanding complex vacuum pump and film heating controls for a perfect result.

The integration of digital technology is another pivotal trend. Key technology includes integrated high-resolution cameras for visual inspection (often AI-enhanced for defect detection), HMI (Human-Machine Interface) systems offering intuitive control panels, and the implementation of IoT sensors for data collection. These sensors continuously monitor critical operational parameters like sealing temperature uniformity across the sealing head, power consumption, and equipment vibration. This data is leveraged for sophisticated predictive maintenance models, allowing food processors to maximize equipment utilization and reduce unforeseen breakdowns. The focus is increasingly on providing connectivity and diagnostics capabilities that integrate seamlessly into wider factory automation architectures, supporting the overarching goals of Industry 4.0 adoption in food processing.

Regional Highlights

The global Food Tray Sealer Market exhibits distinct growth patterns and maturity levels across different geographical regions, heavily influenced by regulatory environments, consumer purchasing power, and the development status of the organized retail and cold chain infrastructure. North America, encompassing the United States and Canada, represents a highly mature market characterized by a dominant presence of major global food processors and a high degree of automation. Demand here is driven by the need for high-speed, integrated packaging lines and a strong focus on high-quality preservation technologies such as MAP and VSP for meat and convenience foods. The region is a significant adopter of advanced, AI-enabled sealing equipment and sustainable packaging formats, necessitating continuous investment in flexible, high-precision machinery.

Europe stands as the largest market in terms of value, largely due to stringent food safety regulations (e.g., EU food labeling and hygiene laws) that mandate high-integrity packaging. Western European nations, including Germany, the UK, and France, are pioneers in sustainable packaging materials, fueling demand for tray sealers capable of sealing paperboard and mono-material plastic trays reliably. Southern and Eastern Europe are rapidly catching up, modernizing their food processing lines and adopting automated systems to improve export competitiveness. The European market leads in the adoption of standardized tray sizes and sophisticated traceability features integrated into the sealing equipment, driven by regulatory compliance and consumer preference for transparency.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This exponential growth is underpinned by demographic factors—rapid urbanization, rising middle-class disposable income, and the corresponding shift from unpackaged goods to safe, convenient packaged meals. Countries like China, India, and Southeast Asian nations are heavily investing in organized retail chains and cold storage facilities, creating massive opportunities for both semi-automatic sealers (for emerging SMEs) and large-scale automatic sealers (for multinational entrants). The focus in APAC is initially on capacity expansion and operational reliability, although sustainability trends are rapidly gaining traction, particularly in high-GDP countries like Japan and Australia. The sheer volume of food consumed and packaged in this region ensures its long-term dominance in volume growth.

Latin America (LATAM) and the Middle East and Africa (MEA) represent evolving markets. LATAM's growth is concentrated in economically stable countries like Brazil and Mexico, driven by the expansion of local food processing industries and increasing penetration of supermarket chains. The demand is often bifurcated, with large processors adopting full automation while smaller local producers rely on affordable semi-automatic solutions. In the MEA region, market growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, where high dependency on imported packaged food and significant investment in domestic food security projects (e.g., poultry and dairy farms) necessitate reliable, often heavy-duty tray sealing machinery suitable for hot climates and complex logistical challenges. The adoption of MAP in MEA is growing steadily as cold chain infrastructure improves.

- North America: Market maturity, high automation rates, strong demand for VSP/MAP, driven by large meat/poultry processors and RTE meal producers. Early adopter of AI integration and sustainable packaging solutions.

- Europe: Largest market value, driven by strict regulatory standards (HACCP, EU directives) and strong pressure for sustainability. Focus on high-precision sealing of paperboard and mono-materials; high penetration of advanced servo-driven machines.

- Asia Pacific (APAC): Fastest-growing region, fueled by urbanization, retail modernization, and increasing consumer affluence in China, India, and Southeast Asia. Significant demand for both high-speed automatic systems and reliable semi-automatic models.

- Latin America (LATAM): Moderate growth, driven by expansion of organized retail and local food processing industries in Brazil and Mexico. Demand focuses on balancing cost-effectiveness with operational reliability.

- Middle East and Africa (MEA): Emerging market, primarily driven by food security initiatives and high demand for packaged goods in GCC states. Requires robust machinery suitable for challenging climatic conditions and long transit supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Tray Sealer Market.- Multivac Sepp Haggenmüller SE & Co. KG

- Ishida Co. Ltd.

- Proseal (JBT Corporation)

- ULMA Packaging S. Coop.

- G. Mondini SPA

- Ossid (Roberts-Kruger)

- Sealpac International

- Reepack S.R.L. (Barry-Wehmiller)

- Ilpra S.p.A.

- Webomatic Maschinenfabrik GmbH

- Orved S.p.A.

- Belca S.A.

- Ciro Pack

- Starview Packaging Machinery, Inc.

- Packaging Automation Ltd.

- The Samco Group

- Audion Packaging Machines

- Harland Machine Systems

- Linco Food Systems

- Packaging Machines International (PMI)

Frequently Asked Questions

Analyze common user questions about the Food Tray Sealer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of automatic food tray sealers?

The primary driver is the need for enhanced operational efficiency and reduction of labor costs in high-volume food processing environments. Automatic sealers provide significantly higher throughput rates, superior sealing consistency crucial for food safety compliance, and minimize human intervention, leading to lower operating expenses and reduced human error in packaging.

How is sustainability impacting the technology requirements of new tray sealing machines?

Sustainability is forcing manufacturers to innovate machinery that can reliably seal new, difficult-to-handle materials, such as compostable films, molded fiber trays, and mono-material plastics. New sealers require highly precise temperature control and pressure application systems to ensure a secure, hermetic seal without compromising the structural integrity of these eco-friendly substrates, which are often less tolerant of heat variations than traditional plastics.

What are the benefits of Modified Atmosphere Packaging (MAP) sealing compared to standard heat sealing?

MAP sealing offers significantly extended product shelf life by replacing the ambient air inside the tray with a specific gas mixture (e.g., CO2, N2) tailored to inhibit microbial growth and oxidation, which is essential for preserving the freshness, color, and texture of perishable items like fresh meat, poultry, and salads, thereby reducing food waste across the supply chain.

Which geographic region demonstrates the highest growth potential for the Food Tray Sealer Market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, driven by rapid urbanization, substantial growth in the organized retail sector, increasing consumer disposable income, and significant investment in modernizing food processing and cold chain infrastructure across countries like China and India, creating immense demand for packaged convenience foods.

How does the integration of AI improve the quality assurance process for tray sealing?

AI improves quality assurance through the deployment of sophisticated vision systems powered by deep learning. These systems analyze images of sealed trays in real-time, detecting microscopic defects, wrinkles, or contamination on the seal line with greater accuracy and consistency than conventional sensors or human inspectors, ensuring optimal seal integrity and compliance with stringent food safety standards before products leave the production line.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager