Foot Creams and Lotions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434008 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Foot Creams and Lotions Market Size

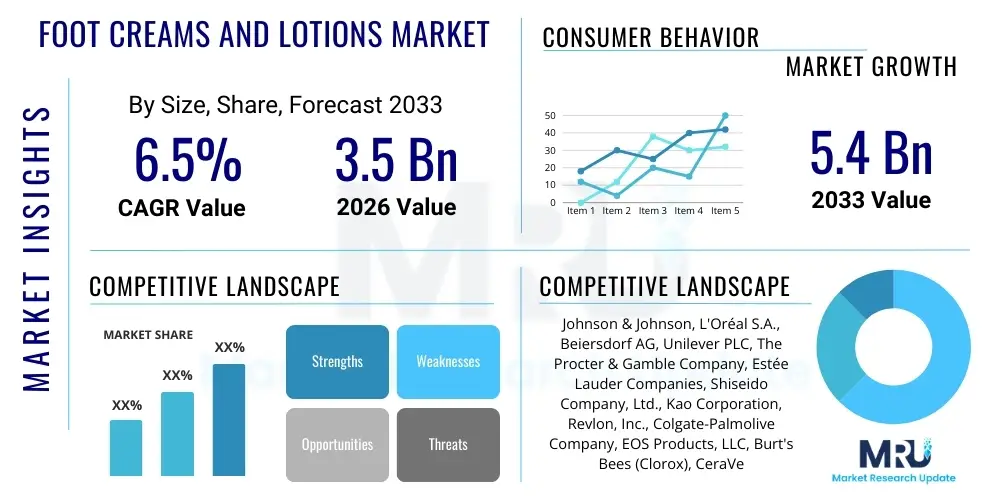

The Foot Creams and Lotions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by demographic shifts, specifically the global rise in chronic diseases requiring dedicated foot health maintenance, alongside a pervasive trend of increased consumer expenditure on holistic wellness and preventive care products. Market maturation in developed regions ensures a stable demand base for premium, therapeutic solutions, while emerging economies contribute significantly through volume growth in the mass-market segments.

Foot Creams and Lotions Market introduction

The Foot Creams and Lotions Market encompasses various topical products designed for moisturizing, softening, healing, and addressing specific dermatological conditions of the feet, such as severe dryness, cracking (fissures), scaling, fungal infections, and fatigue. These essential personal care items are formulated with a diverse range of functional ingredients, including heavy occlusives like petrolatum and lanolin, powerful humectants such as urea and glycerin, and specialized active ingredients like salicylic acid for exfoliation or essential oils for antifungal and deodorizing properties. The products serve a dual purpose: providing cosmetic enhancement through skin smoothing and offering critical therapeutic benefits necessary for maintaining dermal integrity, especially in high-stress areas like the heels and soles. The market structure reflects a continuum, stretching from basic, daily-use moisturizing lotions to highly specialized, medicated creams often recommended by healthcare professionals, catering to a broad spectrum of consumer needs and price points. The formulations are continuously evolving to manage both aesthetic outcomes and clinical necessity, a key factor distinguishing this segment within the broader personal care industry.

Major applications of foot care products include general daily moisturizing routines, targeted intensive treatment of cracked heels, specialized diabetic foot care management, prevention of common dermatological issues such as athlete's foot, and relief from foot fatigue through cooling or circulation-boosting ingredients like peppermint or camphor. The escalating global awareness regarding the linkage between foot health and overall mobility, particularly among an increasingly health-conscious and aging population, significantly amplifies the demand for these specialized preparations. Key benefits driving market adoption include the alleviation of pain associated with severe dryness and cracking, improved physical comfort and mobility, essential maintenance of skin hygiene, and the critical prevention of secondary infections that can arise from compromised foot skin barriers. This focus on preventive healthcare transforms foot creams from optional luxuries into necessary wellness staples for numerous consumer groups, driving consistent, non-cyclical demand.

Driving factors propelling market expansion involve several macroeconomic and consumer behavior changes. Firstly, the global aging population presents a massive consumer base requiring consistent foot care due to age-related skin thinning, reduced circulation, and conditions like diabetes and arthritis, which dramatically increase susceptibility to foot problems. Secondly, rising consumer disposable income, particularly in high-growth regions like Asia Pacific and Latin America, facilitates the transition from multi-purpose body lotions to dedicated, specialized foot care formulations. Furthermore, sustained innovation in product science, incorporating advanced ingredients like high-molecular-weight hyaluronic acid for intensive hydration and specialized anti-inflammatory agents, contributes significantly to enhanced product efficacy and consumer satisfaction, effectively stimulating repeat purchases and broadening the market base. Manufacturers are also successfully leveraging digital platforms and social media campaigns to normalize and integrate specialized foot care into mainstream personal grooming routines, further cementing its essential status. The increasing demand for non-greasy, fast-absorbing formulas utilizing microencapsulation technology further ensures high consumer compliance and daily usage, solidifying the market’s steady revenue growth trajectory.

Foot Creams and Lotions Market Executive Summary

The Foot Creams and Lotions Market demonstrates dynamic evolution characterized by strong consumer demand for therapeutic efficacy and clean ingredient profiles. Business trends underscore a substantial shift towards direct-to-consumer (D2C) sales models, facilitated by robust e-commerce capabilities, allowing brands to forge deeper customer relationships and gather proprietary data on usage patterns. Consolidation within the market is observed through strategic acquisitions, as large multinational corporations integrate smaller, specialized brands focusing on niche segments like organic, medical-grade, or CBD-infused foot care, thereby rapidly acquiring innovative formulations and expanding their market presence. Sustainability has transitioned from a niche concern to a core operational mandate; companies are investing in certified sustainable sourcing for natural emollients and implementing recyclable or minimal-waste packaging solutions, aligning with global environmental, social, and governance (ESG) reporting standards, which increasingly influence consumer purchasing decisions and investor confidence in the sector.

From a geographical perspective, regional trends confirm the robust trajectory of the Asia Pacific (APAC) region, driven by unparalleled economic expansion and increased consumer education regarding personal hygiene standards, which previously lagged behind Western markets. Countries like China, India, and South Korea are witnessing significant growth in both mass-market and premium segments, heavily influenced by localized beauty rituals and high urbanization rates. North America and Europe, while growing at more moderate paces, remain the epicenters for innovation and premium product consumption. These regions are defined by high consumer expectations for clinical validation, leading to intense competition among brands vying for endorsements from dermatologists and podiatrists. The Middle East and Africa (MEA) are emerging due to high disposable income in GCC nations and a strong preference for efficacious, high-quality, often imported, specialized moisturizing products to combat harsh regional climates, providing substantial untapped potential for specialized imports.

Analysis of segment trends reveals a decisive pivot toward therapeutic applications, particularly treatments for cracked heels and diabetic foot management, which are growing faster than general moisturizing products. This reflects consumers’ readiness to invest in solutions backed by medical science for genuine health problems rather than mere cosmetic benefits. Ingredient segmentation highlights the accelerating dominance of natural and functional ingredients like high-concentration urea (above 10%), ceramides, and specialized blends of plant oils known for deep penetrating properties. Distribution channel analysis shows a polarization: while online platforms capture speed and variety, the pharmacy and specialized drug store channel maintains critical importance for highly efficacy-driven products, as consumers often seek professional advice before purchasing medicated or intense-repair foot care solutions. This segmented demand requires manufacturers to implement highly customized marketing and distribution strategies tailored to specific channel dynamics and consumer behavior patterns.

AI Impact Analysis on Foot Creams and Lotions Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Foot Creams and Lotions Market is fundamentally transforming the product lifecycle, from initial concept development to personalized retail delivery. User questions frequently focus on how AI can enhance the diagnostic accuracy of at-home foot care routines, particularly concerning early detection of issues like fungal infections or pre-ulcerative conditions in diabetic patients. Users are keen to know if AI can recommend product combinations, not just single items, tailored to complex factors such as daily activity level, regional climate humidity, and specific underlying health data obtained via wearables or health applications. The synthesis of this complex data through AI allows for the creation of predictive models that anticipate consumer needs before they manifest, moving the market toward true proactive care, which is a major expectation driving consumer technology engagement in this sector.

In manufacturing and supply chain management, AI's impact is quantifiable through enhanced operational efficiency and reduced time-to-market. AI algorithms are deployed to analyze vast datasets regarding ingredient stability, compatibility, and sourcing vulnerabilities, enabling R&D teams to optimize formulations for efficacy and cost simultaneously. For example, AI can predict the exact shelf-life impact of specific natural preservatives, ensuring the successful scaling of clean-label products without compromising safety or stability. Moreover, sophisticated ML models are used for granular demand forecasting across thousands of SKUs and geographical micro-segments, significantly minimizing overstocking and understocking, particularly for highly seasonal or condition-specific treatments. This technological optimization ensures that therapeutic products are available when and where medically necessary, thus improving overall market responsiveness and minimizing inventory holding costs.

The consumer-facing application of AI is primarily concentrated on personalized recommendation engines and immersive retail experiences. Online retailers and brands are employing AI chatbots and virtual foot analyzers—often using smartphone camera input—to provide immediate, customized product recommendations that mimic the advice traditionally offered by a pharmacist or podiatrist. This democratization of expert guidance breaks down barriers to access for specialized foot care products. Looking forward, the integration of generative AI is expected to revolutionize marketing content creation, enabling rapid, customized, and culturally relevant advertising copy and imagery for diverse global audiences, ensuring brand messaging resonates instantly and effectively across different demographic and regional platforms, leading to significantly higher conversion rates for specialized products.

- AI-driven optimization of ingredient sourcing and sustainable material selection for ethical production.

- Machine learning models used for predictive demand forecasting, minimizing inventory risk across global supply chains.

- Development of personalized digital diagnostic tools for at-home assessment of foot skin conditions (e.g., dryness severity, fungal indicators).

- AI chatbots provide real-time, evidence-based recommendations for therapeutic foot care routines.

- Accelerated R&D and formula testing using AI to ensure stability and compatibility of complex natural ingredients.

- Enhanced customer experience through virtual try-ons or augmented reality labeling for product transparency and educational content.

- Optimization of retail placement and pricing strategies based on localized consumer behavior analyzed by AI.

DRO & Impact Forces Of Foot Creams and Lotions Market

The market's trajectory is primarily propelled by undeniable demographic tailwinds, most notably the significant expansion of the global elderly population and the corresponding surge in chronic conditions, primarily Type 2 diabetes, which necessitates diligent and specialized foot care to prevent severe complications like neuropathy and amputations. This urgent medical need acts as a powerful driver, cementing the market's resilience even during economic fluctuations. Furthermore, increasing consumer emphasis on holistic wellness, extending personal care routines to include specialized foot treatments, coupled with aggressive marketing campaigns emphasizing preventative care, collectively stimulates demand for both cosmetic and therapeutic products. These factors ensure a constantly replenishing base of first-time users and increasing consumption frequency among established users.

However, the market faces inherent restraints that temper its overall expansion rate. A significant restraint is the prevalent consumer perception, particularly in younger demographics and certain emerging markets, that foot care products are secondary or luxury items compared to facial or body care, often leading to budget prioritization away from specialized creams. This is compounded by the high cost associated with advanced therapeutic formulations, particularly those containing high concentrations of pharmaceutical-grade urea or complex ceramide mixtures, making them inaccessible to lower-income segments. Additionally, the challenge of achieving effective transdermal absorption through the thick skin of the feet requires complex, often greasy, formulations, which can negatively impact consumer compliance and product satisfaction, thereby hindering repeat purchases. Overcoming the initial apathy toward specialized foot care requires significant investment in consumer education.

Opportunities for exponential growth reside primarily in the untapped potential of niche segmentation. The male grooming segment represents a significant avenue, as gender-neutral branding and a focus on highly functional products (e.g., anti-sweat, odor control, athletic recovery) are attracting a traditionally underserved consumer group. There is also considerable opportunity in blending pharmaceutical efficacy with cosmetic appeal, creating "cosmeceutical" foot care lines that are professional-grade yet aesthetically packaged and marketed. The increasing penetration of digital health technologies provides a robust impact force, allowing manufacturers to leverage direct-to-consumer models for product education and sale, bypassing traditional retail gatekeepers and offering personalized consultation, dramatically shortening the path to purchase and establishing strong brand loyalty based on perceived expertise and customized solutions. Regulatory changes, particularly standardization in labeling for diabetic-safe products, also provide a positive impact force by increasing consumer trust and reducing market confusion, enhancing overall market efficiency and consumer safety.

Segmentation Analysis

The comprehensive segmentation of the Foot Creams and Lotions Market is essential for strategic planning, revealing diverse product preferences, purchasing behaviors, and geographic nuances. Segmenting by product type clarifies the differential demand between Creams, which typically offer thicker, more occlusive moisture for intensive repair (e.g., cracked heels), and Lotions, characterized by lighter texture and rapid absorption for daily maintenance. Balms and Gels, often containing cooling ingredients or specialized polymer structures, represent the smaller but fast-growing segment focused on immediate relief and targeted therapeutic action. Manufacturers must meticulously align their formulation development with these textural preferences to maximize user compliance and cater to specific environmental needs, such as non-greasy applications required in humid climates, ensuring product differentiation is based on tangible performance benefits.

Application-based segmentation is critical for market value analysis, distinguishing the high-volume, lower-value general moisturizing segment from the critical, high-value specialized segments. Cracked Heel Repair and Diabetic Foot Care represent the premium, non-discretionary segments where efficacy, validated ingredients (like 25% urea or high ceramides), and professional recommendation drive purchase decisions, yielding higher average selling prices. The rising emphasis on foot health as part of athletic recovery also creates a distinct sub-segment, necessitating products with anti-inflammatory, muscle-soothing, and anti-friction properties. Furthermore, the segmentation by ingredient type clearly demonstrates the accelerating trend towards natural, certified organic, and synthetic-free products, forcing mass-market brands to reformulate their core offerings to meet the rising consumer demand for transparency and minimal chemical exposure, particularly in products used daily for maintenance routines.

The segmentation by distribution channel reflects evolving consumer habits and product credibility requirements. While Supermarkets and Hypermarkets are volume drivers for daily-use, familiar brands, the growth of Online Retail offers crucial advantages in terms of selection depth, price comparison, and access to international niche brands that cannot afford traditional retail shelf space. However, Pharmacies and Drug Stores retain vital importance for the distribution of medicated, therapeutic, and diabetic-safe foot creams, as consumers associate this channel with professional validation and expert guidance. This channel-specific trust matrix dictates tailored marketing strategies—digital engagement for online sales, and medical detailing and pharmacist training for pharmacy distribution—optimizing market reach and establishing brand authority in respective product categories while maximizing customer satisfaction and repeat sales volumes across all segments.

- By Product Type:

- Creams (Intensive moisture and repair)

- Lotions (Daily maintenance and light hydration)

- Balms and Gels (Targeted therapeutic relief and cooling effects)

- Specialty Treatments (Foot Masks, Peels, and Overnight Repair Boosters)

- By Application:

- General Moisturizing and Hydration

- Cracked Heel Repair (Fissure treatment)

- Diabetic Foot Care and Protection (Low-irritant, non-occlusive)

- Antifungal/Odor Control (Medicated and deodorizing agents)

- Exfoliation and Smoothing (AHA/BHA based treatments)

- By Ingredient Type:

- Natural and Organic (Shea butter, essential oils, plant extracts)

- Synthetic/Chemical Based (Petroleum, Mineral Oil, High Urea Concentrations)

- Cosmeceutical/Active Ingredient Focus (Ceramides, Hyaluronic Acid, Salicylic Acid)

- By Distribution Channel:

- Pharmacies and Drug Stores (High trust for medical lines)

- Supermarkets and Hypermarkets (Mass-market volume sales)

- Online Retail (E-commerce platforms, brand websites, subscription services)

- Specialty Stores (Beauty supply stores, organic retailers)

- By Region:

- North America (High value, strong therapeutic segment)

- Europe (Regulatory stringent, strong focus on natural ingredients)

- Asia Pacific (APAC) (Fastest growth, rising disposable income)

- Latin America (LATAM) (Growing middle class, aesthetic focus)

- Middle East & Africa (MEA) (Luxury segment growth, high demand for intensive hydration)

Value Chain Analysis For Foot Creams and Lotions Market

The upstream segment of the Foot Creams and Lotions value chain is intrinsically linked to agricultural and chemical industries, necessitating robust sourcing strategies for both natural and synthetic raw materials. Specialized ingredients like high-purity urea, medical-grade lanolin, and specific botanical extracts (e.g., tea tree oil for antifungal properties) often have limited global suppliers, making supply chain resilience and multi-sourcing critical risk mitigation strategies. Quality control at this initial stage is paramount, especially for active ingredients requiring precise concentration levels for therapeutic claims, demanding stringent supplier qualification processes and frequent auditing to ensure compliance with international cosmetic and pharmaceutical quality standards (ISO and GMP). For brands emphasizing sustainability, the upstream complexity is heightened by the need for verifiable ethical sourcing and fair-trade certifications, increasing transparency demands for the consumer and adding layers of operational complexity.

The midstream involves manufacturing, packaging, and logistics. High-tech manufacturing facilities are required to manage diverse formulations—from thick anhydrous balms to light water-based lotions—often requiring specialized equipment to maintain emulsion stability and homogeneity under sterile conditions. Packaging technology, including the use of airless pumps, tubes, and specific plastic grades, contributes significantly to the final product cost and its environmental footprint. The logistical network must be efficient, accommodating products with varied shelf lives and temperature sensitivities, especially those containing highly volatile natural oils or high water content susceptible to microbial growth. Effective midstream operations focus on leveraging automation to reduce labor costs and minimizing batch-to-batch variation, which is essential for maintaining brand consistency across global markets and ensuring cost efficiency at scale.

The downstream component encompasses distribution, marketing, and final sales, where successful differentiation hinges on channel strategy. Direct distribution through proprietary e-commerce platforms allows brands maximum control over customer data, pricing, and personalized communication, fostering high lifetime customer value. Indirect distribution, leveraging large pharmacy chains and mass retailers, focuses on volume sales and broad market visibility, relying heavily on merchandising effectiveness and cooperative advertising campaigns. Marketing activities are highly segment-specific: therapeutic lines utilize peer-reviewed data and healthcare endorsements to build credibility, while moisturizing lines focus on sensory benefits, influencer partnerships, and aesthetically pleasing branding. Consumer education, particularly for specialized conditions like diabetic foot care, remains a continuous downstream imperative to ensure appropriate product selection and usage, ultimately driving long-term market acceptance and establishing brand authority in specialized niches.

Foot Creams and Lotions Market Potential Customers

The core potential customer group consists of individuals requiring regular therapeutic intervention for chronic or recurring foot ailments, specifically targeting the aging demographic and the 500 million plus global population affected by diabetes. For these critical customers, the purchase decision is based almost entirely on medical efficacy, safety profile (e.g., suitability for neuropathic skin), and professional recommendation, making them highly loyal to brands validated by podiatrists and specialized medical associations. This segment represents the highest value per transaction, favoring specialized, often prescription-strength formulations containing high concentrations of active ingredients like high-dose urea, requiring specific regulatory adherence and distribution through controlled channels such as pharmacies and healthcare clinics, where trust is paramount.

A second expansive segment is the proactive wellness consumer, comprising middle-aged individuals (30-55 years old) focused on preventative health and overall aesthetic maintenance. This group uses foot creams as part of their regular grooming routine, seeking products that offer light moisturization, pleasant textures, and added benefits like odor control or gentle exfoliation. These customers are driven by brand image, ingredient novelty (e.g., CBD, exotic botanicals), and convenience, primarily purchasing through online retailers and mass supermarkets. Their buying behavior is influenced by social media trends and consumer reviews, demanding a blend of efficacy with sensory pleasure, favoring products with appealing fragrances and rapid absorption rates, indicating a readiness to upgrade from general body lotions to dedicated foot care items.

The third major segment includes high-performance athletes and physically active professionals who subject their feet to extreme stress, leading to unique needs such as friction prevention, rapid muscle soothing, and targeted callus management. This group demands high-functionality products—often balms or gels—with cooling agents, anti-chafing properties, and ingredients that support tissue recovery. Purchasing decisions are driven by performance claims, endurance sports endorsements, and non-greasy application that supports immediate return to activity. Finally, a growing segment includes the economically empowered urban youth who are integrating foot masks and specialty aesthetic treatments (e.g., exfoliating foot peels) into their holistic self-care regimes. Addressing the specific, intense requirements of these distinct customer profiles through targeted product development and channel strategy is key to unlocking maximum market potential and sustaining premium pricing power across various product lines globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, L'Oréal S.A., Beiersdorf AG, Unilever PLC, The Procter & Gamble Company, Estée Lauder Companies, Shiseido Company, Ltd., Kao Corporation, Revlon, Inc., Colgate-Palmolive Company, EOS Products, LLC, Burt's Bees (Clorox), CeraVe (L'Oréal), Eucerin (Beiersdorf), O'Keeffe's Company, Pedifix, Inc., Kariderm, AmLactin (Sandoz), Gold Bond (Sanofi), Footlogix, Apothecary Products, Blissful Feet, Dr. Scholl's (Scholl's Wellness Company), Gehwol, Flexitol. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foot Creams and Lotions Market Key Technology Landscape

The foundational technological advancements shaping the Foot Creams and Lotions Market focus intensely on enhancing the delivery systems for active ingredients across the highly variable and often thick stratum corneum of the feet. State-of-the-art formulation techniques involve advanced nanotechnology, specifically the use of nanoemulsions and liposomal encapsulation, which dramatically improve the bioavailability of key therapeutic compounds like highly concentrated urea, salicylic acid, and essential vitamins. These technologies create ultra-fine dispersions that penetrate deep into the dense skin layers of the heel and sole, ensuring prolonged and consistent release of the active ingredients, which is essential for sustained therapeutic effect in treating chronic conditions such as deep fissures and hyperkeratosis. This innovative approach addresses the traditional challenge of achieving deep moisturization and targeted treatment without leaving an undesirable, heavy residue, thereby significantly boosting consumer acceptance and compliance across all market segments.

Beyond ingredient delivery, significant technological investment is directed toward developing advanced bio-mimetic ingredients and skin barrier repair technologies. Manufacturers are increasingly incorporating synthetic ceramides, patented lipid complexes, and specialized peptides that precisely mimic the skin's natural barrier components. These components are critical for rapidly repairing damage caused by severe dehydration and external friction, particularly important for maintaining the integrity of the diabetic foot. Furthermore, the convergence of cosmetics and pharmaceuticals is evident in the development of sophisticated polymer matrices used to create durable, invisible, and breathable protective films on the skin surface. These films offer prolonged protection against external irritants and moisture loss, acting as a secondary skin barrier while allowing the underlying skin to heal, especially beneficial in environments prone to friction or fungal exposure, offering a unique value proposition to active consumers.

The technological landscape also incorporates significant advancements in packaging and consumer interaction. Innovations include smart packaging solutions, such as temperature-sensitive indicators that signal product degradation, and high-precision dispensing systems that ensure hygienic, measured application, optimizing product usage and minimizing waste. Crucially, digital technology platforms, including proprietary mobile applications, are being leveraged to offer value-added services such as personalized skin hydration assessments using external sensors or photodiagnostics. This technological integration transforms the purchase into a personalized service experience, allowing brands to gather vital data for future R&D cycles while offering consumers a sophisticated, performance-driven product backed by quantifiable metrics, moving the market towards a diagnostic-led retail strategy and enhancing long-term brand equity and customer loyalty through superior, measurable efficacy.

Regional Highlights

- North America: This region maintains its position as a powerhouse in the Foot Creams and Lotions Market, driven by high consumer spending power and a mature healthcare system prioritizing preventative foot care, particularly for the large diabetic population. The market is defined by a strong emphasis on evidence-based, therapeutic formulations, leading to high sales volumes through specialized pharmacy and podiatry channels. Leading players focus on intellectual property protection for novel formulations and strategic marketing that leverages endorsements from medical professionals. The swift adoption of e-commerce platforms and sophisticated digital marketing campaigns further amplifies the reach of premium and niche brands across the United States and Canada, reflecting advanced consumer engagement models and a preference for proven clinical efficacy over low-cost alternatives.

- Europe: Characterized by stringent regulatory oversight (EU Cosmetic Regulation), the European market shows robust demand for products that are certified organic, natural, and free from common irritants such as parabens and synthetic fragrances. Western European countries, particularly Germany, the UK, and France, exhibit a strong cultural preference for dermatologically tested and high-quality pharmacy brands, emphasizing safety and clinical validation. The aging population across the continent significantly contributes to the high and stable demand for intensive repair creams and products targeting mobility-related foot discomfort, while sustainability mandates are increasingly influencing packaging and ingredient sourcing decisions, promoting innovation in eco-friendly and ethical formulations that command a premium price point.

- Asia Pacific (APAC): APAC is the global engine of growth, witnessing exponential market expansion due to burgeoning urbanization, a rapid increase in disposable incomes, and the widespread adoption of Western-style grooming habits. The market dynamic is two-fold: high-volume, affordable lotions dominate the emerging tier-2 and tier-3 cities, while major metropolitan centers like Seoul, Tokyo, and Shanghai drive the luxury and specialty segments, demanding advanced, multifunction products often inspired by localized beauty trends. The rising incidence of lifestyle diseases, particularly diabetes in countries like India and China, is rapidly translating into an urgent, unmet demand for specialized, accessible diabetic foot care products, representing a key strategic investment area for multinational corporations seeking significant future revenue streams in preventative medicine.

- Latin America (LATAM): Market expansion in LATAM is closely linked to economic stability and the growing middle class, particularly in large economies such as Brazil and Mexico. Consumer purchasing behavior is highly sensitive to price and focuses significantly on sensory experience, favoring products with appealing textures, strong fragrances, and attractive packaging. While general moisturizing products are prevalent, there is increasing acceptance of specialized antifungal and deodorizing foot treatments due to regional climate conditions. Distribution relies heavily on hypermarkets, local retail chains, and direct sales models, requiring local market expertise to manage complex tax and import regulations efficiently and tailor marketing materials to local cultural preferences and specific dermatological needs influenced by high humidity levels.

- Middle East and Africa (MEA): The MEA region presents a fragmented but opportunity-rich landscape. The Gulf Cooperation Council (GCC) nations (Saudi Arabia, UAE) are characterized by high per capita spending on luxury goods and a preference for high-quality, international therapeutic brands designed to combat the dehydrating effects of extreme heat and air conditioning. In contrast, the African subcontinent is rapidly developing, with growth concentrated in basic hygiene and affordable moisturizing products. The presence of large expatriate populations in the GCC influences brand popularity and creates unique demand for both highly specialized and imported luxury foot care items, often distributed through high-end malls and specialized beauty retailers, requiring precise logistical execution for product stability and delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foot Creams and Lotions Market.- Johnson & Johnson

- L'Oréal S.A.

- Beiersdorf AG

- Unilever PLC

- The Procter & Gamble Company

- Estée Lauder Companies

- Shiseido Company, Ltd.

- Kao Corporation

- Revlon, Inc.

- Colgate-Palmolive Company

- EOS Products, LLC

- Burt's Bees (Clorox)

- CeraVe (L'Oréal)

- Eucerin (Beiersdorf)

- O'Keeffe's Company

- Pedifix, Inc.

- Kariderm

- AmLactin (Sandoz)

- Gold Bond (Sanofi)

- Footlogix

- Apothecary Products

- Blissful Feet

- Dr. Scholl's (Scholl's Wellness Company)

- Gehwol

- Flexitol

Frequently Asked Questions

Analyze common user questions about the Foot Creams and Lotions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Foot Creams and Lotions Market?

Market growth is predominantly driven by the increasing global prevalence of diabetes and aging populations, both requiring specialized foot care. Furthermore, heightened consumer awareness regarding hygiene, preventative health, and the continuous introduction of innovative, therapeutic formulations significantly contribute to market expansion, transforming foot care from a luxury to a necessity.

Which segmentation, product type or application, shows the highest potential growth?

While general moisturizing products dominate volume, the Diabetic Foot Care application segment is projected to show the highest potential growth rate. This is due to the rising necessity for medical-grade products in preventing serious diabetic complications, securing sustained investment and innovation in this therapeutic niche across all major geographical regions, especially in APAC.

How is the preference for natural ingredients influencing formulation trends?

The demand for natural ingredients is compelling manufacturers to introduce 'clean beauty' lines, emphasizing organic essential oils, plant extracts, and vegan certifications. This trend is shifting focus away from synthetic petroleum-based ingredients, requiring supply chain transparency, sustainable sourcing practices, and the utilization of advanced preservation technologies.

Which distribution channel is experiencing the most significant shift in market share?

Online retail is experiencing the most significant shift, offering convenience, wider product selections (including international niche brands), and direct-to-consumer access. While pharmacies remain critical for therapeutic products, e-commerce is rapidly gaining share across all product categories due to sophisticated digital marketing, AEO optimization, and competitive pricing strategies.

What role does Artificial Intelligence (AI) play in the Foot Creams market?

AI's role centers on hyper-personalization, utilizing machine learning for predictive formulation testing and recommending specific products based on real-time consumer skin data and environmental factors. AI also optimizes supply chain logistics, ensuring product freshness, efficient inventory management globally, and enhancing consumer diagnostics through digital analysis tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager