Footstool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433683 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Footstool Market Size

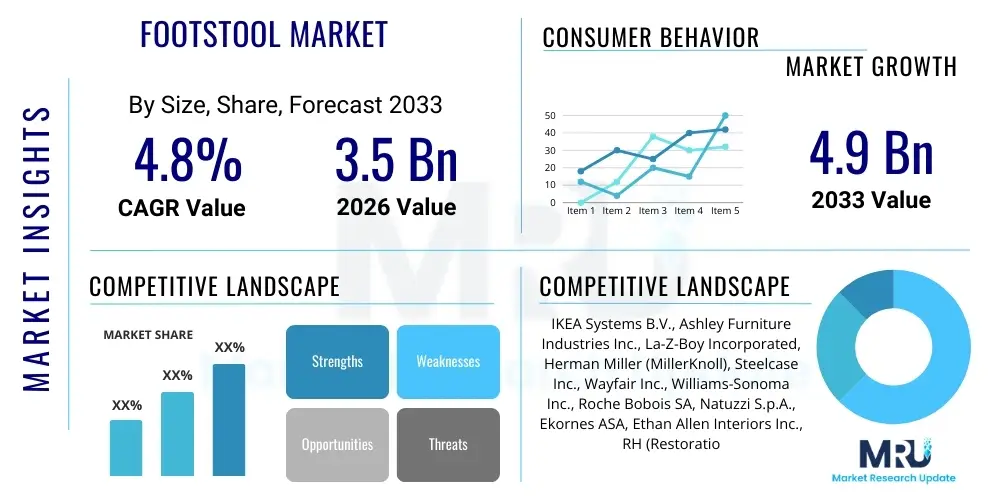

The Footstool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by increasing consumer disposable income, a global emphasis on home décor aesthetics, and the rising demand for versatile, multi-functional furniture pieces, particularly in urban residential settings where space optimization is paramount. The increasing popularity of ergonomic design and the integration of footstools as key elements of comfort-driven seating arrangements contribute significantly to this stable market expansion.

Footstool Market introduction

The Footstool Market encompasses the global trade of small, low seating or resting furniture pieces designed primarily for elevating the feet, often utilized in conjunction with sofas, armchairs, or standalone seating arrangements. Functionally, footstools, also known interchangeably with ottomans or poufs, serve both practical purposes—such as aiding circulation and providing ergonomic support—and decorative roles, enhancing interior design aesthetics. The primary applications span across residential environments, including living rooms, bedrooms, and studies, as well as commercial sectors suchs as hospitality (hotels, resorts), corporate lounges, and healthcare facilities seeking to improve patient comfort. The benefits derived from footstools include superior relaxation, storage capacity in specialized models, and acting as temporary seating solutions, making them highly desirable furnishing components.

Driving factors propelling market expansion include the ongoing shift towards modular and customizable furniture, enabling consumers to tailor their interior spaces dynamically. Furthermore, the robust growth in the global real estate and construction sectors, coupled with rising middle-class expenditure on luxury and comfort items, sustains market demand. Product innovation centered on sustainable materials, smart features (e.g., integrated charging ports), and novel designs catering to various aesthetic preferences—from minimalist Scandinavian to rich traditional styles—are key trends influencing purchasing decisions. The necessity for ergonomic solutions in home offices, triggered by the widespread adoption of remote work models, has further solidified the footstool's status as an essential item for maximizing comfort during extended periods of sitting.

The market environment is characterized by intense competition among both specialized furniture manufacturers and large global retail chains. Differentiation is achieved through material quality (e.g., premium leather versus eco-friendly fabrics), design complexity, and pricing strategy. As consumer awareness regarding health and wellness increases, the therapeutic benefits associated with elevating the legs—reducing swelling and improving blood flow—are increasingly highlighted in marketing campaigns, positioning footstools not just as luxury items but as essential elements of a healthy living space. This blend of functional necessity, ergonomic benefits, and aesthetic versatility underpins the strong foundational demand in the global Footstool Market.

Footstool Market Executive Summary

The Footstool Market is experiencing robust business trends driven by digitalization in retail and shifting consumer preferences towards sustainable and multi-functional home furnishings. E-commerce platforms, offering expansive catalogs and virtual reality visualization tools, have become critical distribution channels, streamlining the consumer journey from selection to delivery. Key business trends include the emphasis on supply chain resiliency, focusing on local sourcing and just-in-time manufacturing to mitigate geopolitical and logistical risks. Furthermore, brands are increasingly collaborating with interior designers and influencers to drive premiumization and establish trendsetting designs, maximizing Average Order Value (AOV) and brand visibility in highly competitive online spaces. The pursuit of certification for environmentally friendly materials and ethical production processes represents a significant competitive advantage in mature Western markets.

Regional trends indicate that Asia Pacific (APAC) is poised for the fastest growth, primarily fueled by rapid urbanization, substantial investment in housing infrastructure, and the emergent purchasing power of the middle-class populations in China and India. North America and Europe, while mature, maintain dominance in terms of market value, driven by high consumer spending on high-end, designer, and customized footstools, reflecting sophisticated taste and high standards for home comfort. In these developed regions, the replacement cycle for home furnishings is stable, supported by continuous aesthetic updates and seasonal trends. Conversely, Latin America and the Middle East & Africa (MEA) are characterized by potential growth opportunities, contingent upon improved political stability and expanding modern retail penetration, particularly focusing on value-for-money and durable fabric options.

Segment trends underscore the dominance of the residential application sector, where footstools are integral to modern living room sets. Within product types, storage ottomans are capturing significant market share due to their inherent utility in space-constrained apartments, aligning perfectly with the minimalist and organizational movements prevalent globally. Material segmentation shows a strong consumer inclination towards eco-friendly fabrics and sustainably sourced wood, although leather options maintain a premium position reflecting longevity and classic luxury. The synergy between functional design and aesthetic appeal dictates the success of new product launches across all segments, ensuring that utility does not compromise the overall interior design objective. The push for personalization is also vital, allowing buyers to select specific dimensions, fabrics, and finishes.

AI Impact Analysis on Footstool Market

User queries regarding AI's influence in the Footstool Market primarily revolve around three key themes: how AI is utilized in personalized furniture design recommendations, its role in optimizing manufacturing and supply chain efficiency, and the potential for AI-driven virtual staging and visualization tools to enhance the online buying experience. Consumers are interested in predictive analytics that suggest materials and styles based on their existing furniture inventory or preferred aesthetic mood boards. Manufacturers are concerned with implementing machine learning for demand forecasting, inventory management, and maximizing the efficiency of cutting and assembly processes, particularly for custom orders, to minimize material waste and labor costs. Overall expectations are high regarding AI's ability to seamlessly bridge the gap between digital interaction and physical product customization and delivery.

The implementation of Artificial Intelligence and related technologies is transforming the operational landscape of the footstool industry, moving beyond simple retail recommendations into complex logistical optimization and design generation. AI-powered algorithms analyze vast datasets related to customer purchasing behavior, current interior design trends, social media sentiment, and regional climate data to accurately predict demand spikes for specific designs or materials. This predictive capability allows manufacturers to optimize raw material procurement and production schedules, significantly reducing warehousing costs and mitigating the risks associated with overstocking or stockouts. Furthermore, Generative Design AI is being explored by high-end brands to rapidly prototype novel footstool shapes and ergonomic configurations that satisfy specific biomechanical requirements or unique architectural constraints, thus accelerating product development cycles.

From the consumer perspective, AI enhances engagement through sophisticated virtual try-on applications and augmented reality (AR) features. These tools allow potential buyers to digitally place a selected footstool—complete with accurate textures and dimensions—into their actual living space using a smartphone, minimizing uncertainty regarding scale and color matching. This reduction in purchase hesitation directly contributes to higher conversion rates and lower return rates, which is crucial for bulky furniture items. Moreover, AI-driven chatbots and recommendation engines provide 24/7 customer support and hyper-personalized styling advice, effectively replacing the need for an in-person sales associate and scaling the personalization experience across mass-market digital platforms.

- AI-driven personalization engines offer tailored footstool recommendations based on user style, existing furniture, and room dimensions.

- Machine Learning optimizes supply chain logistics, including raw material sourcing, inventory forecasting, and final mile delivery routing.

- Generative Design algorithms accelerate the creation of novel ergonomic and complex structural footstool designs.

- Augmented Reality (AR) tools powered by AI improve customer confidence by enabling virtual placement of products in the home environment.

- Predictive maintenance analytics monitor manufacturing equipment to minimize downtime and ensure continuous production capacity.

DRO & Impact Forces Of Footstool Market

The market dynamics of the Footstool Market are dictated by a sophisticated interplay of Drivers (D), Restraints (R), and Opportunities (O), which together shape the Impact Forces determining future market trajectory. The primary drivers include the consistent global growth in real estate investments, particularly in the residential sector, coupled with escalating consumer expenditure on aesthetic home improvements. The shift towards multi-functional furniture, where a footstool doubles as storage or an occasional table, appeals significantly to urban populations facing spatial limitations. This utility, combined with growing awareness of ergonomic benefits for health, provides a strong, sustainable foundation for demand, particularly in North America and Europe where aging populations prioritize comfort and accessibility. These driving forces create an environment where premium, ergonomic, and multi-utility products command high valuations, pushing the market towards sophisticated design and material innovation.

However, the market faces notable restraints, chiefly involving volatility in the price of raw materials, such as wood, steel, and high-quality textiles, often linked to global commodity market fluctuations and geopolitical instability. Furthermore, the sheer bulk and variability in size of footstools pose substantial logistical challenges, leading to high shipping and warehousing costs, which are difficult to absorb, especially by small and medium-sized enterprises (SMEs). In certain developing economies, the footstool is still considered a luxury item rather than a necessity, limiting its mass-market adoption when compared to essential seating furniture. Regulatory scrutiny concerning flammability standards and sustainable sourcing certifications also imposes compliance costs that can restrain production capacity and market entry for new, smaller players, creating barriers to entry focused heavily on certified materials and ethical labor practices.

Opportunities for growth are abundant, primarily through the expansion of e-commerce channels, which offer unprecedented reach into previously untapped rural and international markets, mitigating the constraints of traditional brick-and-mortar retail footprint limitations. A crucial opportunity lies in product diversification, focusing on high-tech footstools integrated with smart home features, such as wireless charging pads, climate control fabrics, or adjustable heights. Moreover, the increasing adoption of sustainable and recycled materials, driven by heightened consumer environmental consciousness, presents a significant avenue for differentiation and premium pricing. Strategic partnerships between furniture manufacturers and technology providers, along with tailored marketing strategies targeting the commercial hospitality sector (e.g., bespoke hotel lounge ottomans), will be vital for unlocking niche market value and maximizing the overall market potential over the forecast period, positioning sustainability and smart functionality as key competitive differentiators that align with modern consumer values.

- Drivers:

- Rising disposable income and increased consumer spending on home comfort and décor.

- Growing preference for multi-functional and modular furniture solutions, maximizing spatial utility.

- Strong emphasis on ergonomic design and health benefits derived from proper foot elevation.

- Restraints:

- Volatile pricing of raw materials (wood, leather, and high-grade fabric).

- High logistical and shipping costs associated with bulky furniture items.

- Market saturation and intense competition leading to pricing pressures in mass-market segments.

- Opportunity:

- Rapid expansion of the e-commerce and digital retail channel for furniture sales.

- Innovation in smart footstools incorporating technology like wireless charging or heating elements.

- Increasing consumer demand for sustainable, recycled, and ethically sourced material options.

- Impact Forces:

- Supplier Power: Moderate to High, influenced by the specialized nature and volatility of material costs, particularly premium leather and certified sustainable wood.

- Buyer Power: High, due to product similarity and abundance of choice facilitated by global e-commerce, driving demands for customization and competitive pricing.

- Threat of New Entrants: Moderate, as initial capital investment for design, manufacturing, and logistics infrastructure is substantial, yet minimized somewhat by agile, digital-first retailers.

- Threat of Substitutes: Moderate, as alternative seating (e.g., floor cushions, small benches) exists, but specialized ergonomic function minimizes direct substitution threat.

- Industry Rivalry: High, characterized by aggressive marketing, continuous product launches, and strategic acquisitions among major global players.

Segmentation Analysis

The Footstool Market is comprehensively segmented based on Type, Material, Application, and Distribution Channel to provide a granular view of market dynamics and consumer preferences. This detailed segmentation helps businesses tailor their product development, pricing strategies, and marketing efforts to specific demographic and functional requirements. The classification by Type, differentiating between standard, storage, and ottoman styles, highlights the growing demand for items that solve real-world problems like space constraint. Material segmentation reveals key trends in consumer choices, reflecting a movement towards durable, low-maintenance, and aesthetically pleasing surfaces, alongside a pronounced inclination towards environmentally responsible sourcing.

Application analysis clearly distinguishes between the high-volume Residential sector, driven by cyclical redecorating and necessity, and the highly specific Commercial sector, which demands bespoke, robust, and highly durable pieces suitable for high traffic areas like hotel lobbies and corporate offices. Understanding the nuances within these segments allows manufacturers to prioritize investments in materials and design longevity pertinent to each end-use environment. Furthermore, the segmentation by Distribution Channel is crucial, underscoring the shift from traditional furniture stores to the dominant influence of dedicated online platforms and specialized e-commerce marketplaces, demanding sophisticated digital merchandising and efficient last-mile delivery services tailored for bulky goods.

The inherent versatility of the footstool allows for significant overlap across segments, especially in the premium category where consumers expect high-quality materials, customizable options, and multi-functionality. Strategic market positioning requires aligning product features—such as integrated smart technology or ergonomic enhancements—with the needs of specific target demographics, whether they are young urban apartment dwellers prioritizing storage or older consumers seeking medical-grade ergonomic support. This multi-layered segmentation approach is essential for accurate market forecasting and strategic planning across the competitive landscape.

- By Type:

- Standard Footstools

- Storage Ottomans/Footstools

- Poufs and Bean Bags (Modern Adaptations)

- Recliner Footrests (Integrated and Detached)

- By Material:

- Wood (Solid Wood, Engineered Wood)

- Fabric (Linen, Cotton, Velvet, Microfiber)

- Leather (Genuine Leather, Faux Leather)

- Metal/Rattan and Woven Materials

- By Application:

- Residential (Living Rooms, Bedrooms, Home Offices)

- Commercial (Hotels, Restaurants, Corporate Offices, Healthcare Facilities)

- By Distribution Channel:

- Offline Stores (Furniture Chain Stores, Department Stores, Independent Retailers)

- Online Stores (E-commerce Marketplaces, Company-owned Websites, Specialty Online Furniture Platforms)

Value Chain Analysis For Footstool Market

The Footstool Market value chain begins with upstream activities, primarily involving the sourcing and processing of raw materials. This stage is critical, requiring secure access to high-quality timber (often certified FSC), specialized textiles, leather, and metal components necessary for frames and structural integrity. Upstream efficiency dictates overall production costs and speed, requiring robust supplier relationship management to mitigate risks associated with material price volatility and supply chain disruptions. Key activities at this stage include lumber milling, textile manufacturing, and the production of specialized foam or filling materials that meet safety standards, such as fire resistance. Manufacturers often seek localized or regional suppliers to minimize transportation costs and improve control over material quality and ethical sourcing.

The midstream phase focuses on core manufacturing, encompassing design, prototyping, fabrication of frames, upholstery, assembly, and quality control. This is where proprietary technology and craftsmanship differentiate products. Mass-market manufacturers rely on automated cutting and assembly lines for cost efficiency, while high-end or custom manufacturers emphasize skilled labor for detailed tailoring and finishing of complex designs. The shift towards modular design principles has improved manufacturing flexibility. Quality assurance at this stage ensures durability, adherence to ergonomic standards, and compliance with diverse international safety regulations, a critical factor given the global nature of furniture trade.

Downstream activities include storage, distribution, marketing, and sales, moving the finished product to the end consumer. Distribution channels are bifurcated into Direct and Indirect models. Direct sales increasingly rely on company-owned e-commerce platforms, offering better profit margins and direct customer relationship management. Indirect sales flow through large retail chains, online marketplaces (like Amazon or Wayfair), and specialized interior design channels. Logistics management for bulky, fragile items is complex and critical in this stage, necessitating specialized packaging and efficient, integrated delivery networks. Successful downstream execution depends heavily on high-impact digital marketing and effective Answer Engine Optimization (AEO) to capture consumer intent during the research phase, ensuring visibility across competitive online platforms.

Footstool Market Potential Customers

The primary end-users and buyers of footstools fall into two major categories: residential consumers and commercial enterprises. Residential consumers represent the largest customer base, driven by the need for enhanced comfort, interior decor upgrades, and practical utility, especially storage solutions in smaller living spaces. This segment includes young professionals furnishing their first homes, families upgrading their living room aesthetics, and older adults prioritizing comfort and ergonomic support for health reasons. Targeting residential customers requires diverse product offerings catering to various price points, from affordable, mass-produced poufs to high-end, custom-upholstered ottomans that serve as statement pieces in luxury homes, with purchasing decisions heavily influenced by prevailing interior design trends and social media inspiration.

The commercial sector serves as a significant secondary market, comprising hospitality (hotels, serviced apartments), corporate environments (executive lounges, collaboration spaces), and healthcare facilities (waiting areas, patient rooms). Commercial buyers typically prioritize durability, stain resistance, ease of cleaning, fire safety compliance, and the ability to order in large, uniform quantities. Footstools in these settings are often custom-designed to align with specific brand aesthetics or functional requirements, such as heavy-duty frames and commercial-grade fabrics. The increasing focus on creating comfortable, home-like environments in corporate and hospitality settings further drives demand for stylish, yet robust, footstools, positioning them as essential components for modern, inviting public spaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA Systems B.V., Ashley Furniture Industries Inc., La-Z-Boy Incorporated, Herman Miller (MillerKnoll), Steelcase Inc., Wayfair Inc., Williams-Sonoma Inc., Roche Bobois SA, Natuzzi S.p.A., Ekornes ASA, Ethan Allen Interiors Inc., RH (Restoration Hardware), Flexsteel Industries, Bassett Furniture Industries, Hooker Furniture Corporation, Kuka Home, Man Wah Holdings Limited, Vitra International AG, Godrej & Boyce Mfg. Co. Ltd., and Inter IKEA Holding B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Footstool Market Key Technology Landscape

The technological landscape within the Footstool Market is increasingly focused on smart integration, advanced manufacturing processes, and the utilization of digital tools to enhance the consumer experience. In manufacturing, Computer Numerical Control (CNC) machinery is standard for precise cutting of wooden frames and metal components, ensuring high-quality output and minimizing material wastage, which is crucial for maximizing profit margins in high-volume production. Furthermore, sophisticated 3D scanning and printing technologies are employed during the design and prototyping phases, allowing designers to quickly iterate on complex ergonomic shapes and custom fittings before committing to mass production, significantly compressing the time-to-market for new designs.

Material science innovation is also a core technology driver. Research and development efforts are concentrated on creating sustainable, recycled, and highly durable performance fabrics that are resistant to stains, fading, and wear, suitable for both residential and demanding commercial applications. The development of specialized foams that offer superior long-term resilience and ergonomic support, often incorporating gel or memory foam technologies, elevates the comfort level of premium footstools and ottomans. These advancements position the footstool not merely as a decorative accessory but as a scientifically engineered component of a seating system designed for long-term health and wellness, aligning with therapeutic and medical furniture standards.

On the consumer-facing side, the integration of smart technology is emerging as a critical differentiator. This includes footstools equipped with discreetly integrated wireless charging pads for mobile devices, subtle LED lighting systems, and in some high-end models, climate control features for temperature regulation. The most impactful technology, however, remains software-driven: Augmented Reality (AR) applications and 3D visualization tools powered by high-resolution digital twins of the products. These tools allow consumers to accurately measure and visualize the footstool within their own living spaces, fundamentally transforming the online purchasing environment and setting new standards for digital engagement and personalized furniture shopping, directly addressing the traditional uncertainty associated with large online furniture purchases.

Regional Highlights

The global Footstool Market exhibits significant regional variations in terms of growth rates, consumer preferences, and market maturity, necessitating tailored strategic approaches for manufacturers and retailers. North America, encompassing the United States and Canada, represents a high-value, mature market characterized by robust consumer spending on large, comfort-focused furniture pieces. Demand here is dominated by large, plush storage ottomans and custom-designed footstools that complement expansive sectional sofas. Key drivers include stable housing markets, high disposable incomes, and a strong cultural emphasis on home entertainment and comfort. The region is highly sensitive to interior design trends disseminated through social media and design publications, favoring rapid adoption of premium materials like genuine leather and velvet, and is a leading adopter of e-commerce channels for furniture purchases, demanding sophisticated logistics and fast delivery times.

Europe stands as the second-largest market, distinguished by a preference for minimalist, space-saving designs, particularly in dense urban centers like London, Paris, and Berlin. Consumer behavior in countries such as Sweden and Germany is heavily influenced by sustainability concerns, driving significant demand for footstools made from certified sustainable wood and recycled or organic textiles. While traditional furniture retailers retain a strong presence, the penetration of high-quality online specialists is accelerating. Southern European markets, like Italy and France, emphasize craftsmanship and designer collaborations, focusing on the footstool as an elegant, sculptural element of interior design. Strict regional regulations concerning fire safety and material provenance profoundly impact the supply chain and product development cycle within the European Union.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period, driven by rapid urbanization, significant government investment in infrastructure and housing, and the exponential growth of the middle class in populous nations such as China, India, and Southeast Asian countries. The demand here is highly diversified: China dominates production volume and increasingly consumes premium, imported brands, while India presents a vast, price-sensitive market where value and multi-utility are prioritized. Given the typically smaller apartment sizes across APAC cities, compact, stackable, and highly functional storage footstools and poufs are extremely popular. The retail landscape is shifting rapidly, with local e-commerce giants playing a pivotal role in market penetration, often outpacing the establishment of traditional large-format retail stores, necessitating a strong digital focus for international brands seeking market share.

Latin America and the Middle East & Africa (MEA) offer nascent yet promising growth opportunities. In Latin America, economic volatility remains a challenge, but urbanization and increasing foreign direct investment in retail infrastructure support market growth, with a focus on durable, practical, and aesthetically vibrant designs. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is witnessing a boom in luxury residential and hospitality construction. This sector demands high-end, custom-upholstered footstools and ottomans, often sourced internationally, aligning with opulent design aesthetics typical of high-net-worth consumers. Growth in Africa, while slower, is concentrated in major economic hubs, focusing primarily on affordable, foundational home furnishings. In both regions, market entry success is highly dependent on navigating local customs, establishing efficient distribution networks capable of handling logistical complexities, and offering products that resonate with regional cultural preferences regarding color, material, and form, positioning the footstool as a marker of domestic or commercial luxury.

- North America: High-value market, driven by large storage ottomans, premium materials (leather), strong e-commerce adoption, and emphasis on home comfort and large-scale furnishings.

- Europe: Focus on sustainability (certified wood, organic fabrics), preference for minimalist and space-saving designs, and strict regulatory adherence to safety standards.

- Asia Pacific (APAC): Highest growth potential, fueled by urbanization, strong demand for compact and multi-functional storage solutions, and rapid expansion of localized e-commerce platforms.

- Middle East & Africa (MEA): Luxury and hospitality sector focus, driven by new construction projects, demand for opulent custom designs, and dependence on international sourcing for high-end goods.

- Latin America: Emerging market characterized by price sensitivity, increasing urbanization, and reliance on functional, durable furniture options amidst economic fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Footstool Market.- IKEA Systems B.V.

- Ashley Furniture Industries Inc.

- La-Z-Boy Incorporated

- Herman Miller (MillerKnoll)

- Steelcase Inc.

- Wayfair Inc.

- Williams-Sonoma Inc.

- Roche Bobois SA

- Natuzzi S.p.A.

- Ekornes ASA

- Ethan Allen Interiors Inc.

- RH (Restoration Hardware)

- Flexsteel Industries

- Bassett Furniture Industries

- Hooker Furniture Corporation

- Kuka Home

- Man Wah Holdings Limited

- Vitra International AG

- Godrej & Boyce Mfg. Co. Ltd.

- Inter IKEA Holding B.V.

Frequently Asked Questions

Analyze common user questions about the Footstool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Footstool Market globally?

Market growth is primarily driven by rising consumer disposable income, global urbanization leading to higher demand for multi-functional and storage-integrated furniture, and the increasing focus on ergonomic home setups for health and comfort, particularly in home office environments. The robust expansion of the e-commerce distribution channel further facilitates widespread product availability.

How does the segmentation by material impact manufacturing trends in the Footstool industry?

Material segmentation dictates manufacturing trends by requiring supply chain adaptation towards sustainable sourcing. There is a noticeable shift towards certified solid wood and high-performance, eco-friendly fabrics. This trend influences R&D towards durable, stain-resistant textiles and advanced foam technologies that meet both regulatory and consumer demands for quality and environmental responsibility.

Which regional market is expected to show the highest growth rate for footstools, and why?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to rapid population growth, accelerating urbanization, and substantial increases in middle-class purchasing power in key markets like China and India. The demand in APAC is predominantly for compact, versatile, and storage-enabled footstools to maximize utility in smaller residential spaces.

What role does technology play in the modern Footstool Market?

Technology enhances both the production and retail experiences. Manufacturing utilizes CNC and 3D printing for precision and rapid prototyping. In retail, Augmented Reality (AR) tools allow consumers to virtually place footstools in their homes before purchase, reducing returns. Furthermore, smart footstools incorporating wireless charging or environmental controls represent a growing niche for differentiation.

What is the current consumer preference regarding footstool functionality?

Current consumer preference strongly favors multi-functional footstools, particularly storage ottomans, which address spatial constraints in modern residences by offering hidden storage alongside seating or resting utility. Beyond storage, ergonomic design that supports circulatory health and adjustable features are highly valued by buyers in mature Western markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager