Footwear Sole Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437858 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Footwear Sole Material Market Size

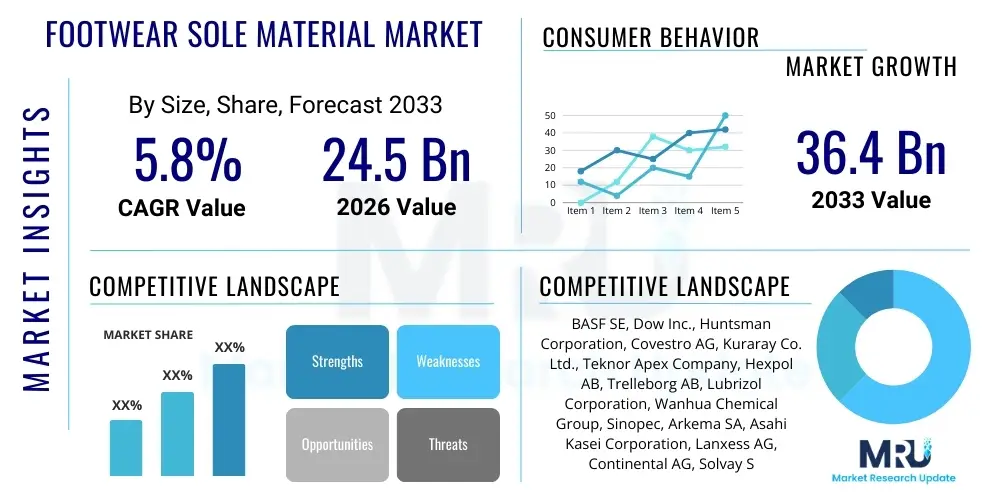

The Footwear Sole Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $24.5 billion in 2026 and is projected to reach $36.4 billion by the end of the forecast period in 2033.

Footwear Sole Material Market introduction

The Footwear Sole Material Market encompasses the production and supply of various compounds and substrates utilized in manufacturing the outer, middle, and inner soles of footwear across diverse applications, including athletic, casual, formal, and industrial segments. Key materials driving innovation include specialized rubbers, thermoplastic elastomers (TPEs), ethylene-vinyl acetate (EVA), polyurethane (PU), and advanced composite materials, all designed to optimize performance characteristics such as durability, flexibility, weight reduction, and cushioning. The fundamental product description revolves around materials that provide essential functional attributes—traction, shock absorption, insulation, and stability—which are critical for user comfort and safety, directly influencing consumer purchasing decisions globally.

Major applications of sole materials span across high-performance athletic shoes, where lightweight and energy return properties (like specialized EVA foams or TPU derivatives) are paramount, to durable industrial safety boots demanding oil resistance and puncture protection (often using highly robust rubber and PU blends). The primary benefits driving market expansion include continuous advancements in material science leading to enhanced longevity and reduced environmental impact through recyclable options. Furthermore, consumer demand for personalized comfort and specific technical performance in niche sports contributes significantly to the market’s technological evolution, pushing manufacturers towards bio-based and sustainable material alternatives.

Driving factors propelling this market forward include the rapid urbanization and increasing disposable incomes in emerging economies, leading to higher consumption of branded and performance-oriented footwear. The global emphasis on health and wellness has spurred tremendous growth in the athletic and athleisure segments, necessitating high volumes of specialized sole materials optimized for various activities like running, hiking, and court sports. Regulatory pressures focusing on sustainability and chemical safety also compel material suppliers to invest heavily in research and development, particularly for non-toxic, lightweight, and recyclable solutions, fundamentally reshaping the supply chain dynamics within the global footwear industry.

Footwear Sole Material Market Executive Summary

The Footwear Sole Material Market is currently characterized by significant business trends focused on sustainability, digitalization of material development, and strategic regional expansion into high-growth Asian markets. Major material manufacturers are actively pursuing partnerships with footwear brands to co-develop exclusive, performance-enhancing compounds, particularly those offering superior energy return and lightweight profiles, addressing the intense competition within the athletic footwear sector. A crucial business trend involves the shift from traditional rubber and PVC to advanced polymers like bio-based polyurethane and recycled EVA, driven by stringent environmental targets and growing consumer preference for eco-friendly products. This pivot demands substantial capital investment in new manufacturing technologies capable of handling complex, next-generation materials while maintaining cost-efficiency and large-scale production capabilities.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth trajectory, dominated by its pivotal role as the global manufacturing hub for footwear, alongside rapidly increasing domestic consumption driven by burgeoning middle classes in countries like China and India. North America and Europe, while mature, remain critical markets characterized by high Average Selling Prices (ASPs) for performance footwear and strong consumer willingness to pay a premium for technological innovations, particularly in customization and material traceability. Regional trends indicate a divergence in material preference; while APAC focuses on high-volume, cost-effective polymers for mass-market production, Western markets emphasize proprietary, high-performance materials engineered for athletic excellence and sophisticated casual wear, necessitating localized supply chain expertise to manage diverse requirements efficiently.

Segment trends highlight the dominance of the polyurethane (PU) segment in terms of value, owing to its versatility in cushioning (midsole) and durability (outsole), making it ideal for both high-end athletic and safety footwear. However, the Ethylene-Vinyl Acetate (EVA) segment maintains leadership in volume due to its use in mass-market and athleisure footwear, benefiting from its lightweight nature and cost-effectiveness. A key trend within segmentation is the rapid adoption of composite materials, blending polymers with fillers or fibers to achieve specific performance metrics—such as enhanced grip on wet surfaces or increased flexibility without compromising impact resistance. This segmentation evolution reflects the broader market's move away from singular material solutions toward customized, multi-material systems designed for specific functional environments and user experiences.

AI Impact Analysis on Footwear Sole Material Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Footwear Sole Material Market primarily revolve around how AI can accelerate material discovery, optimize complex manufacturing processes, and enable hyper-personalized product development. Users frequently ask if AI can predict the performance and durability of novel polymer formulations before physical prototyping, reducing R&D costs and time-to-market. Concerns also center on the integration complexity of AI models within existing traditional manufacturing ecosystems and whether AI can effectively address sustainability challenges, such as optimizing material usage to minimize waste and identifying the most efficient recycling pathways for end-of-life footwear components. The key themes summarized from user inquiries point toward high expectations for AI to revolutionize material science by enabling predictive modeling, enhancing supply chain resilience through optimized forecasting, and facilitating the creation of truly customized sole geometries and compositions tailored to individual biomechanics, thereby driving the next wave of innovation in foot comfort and athletic performance.

- AI accelerates the discovery of novel polymer compositions and blends by simulating chemical interactions and predicting physical properties (e.g., resilience, abrasion resistance) based on input parameters.

- Machine learning algorithms optimize the polymer injection molding and foaming processes, ensuring material consistency, reducing defects, and minimizing energy consumption in large-scale sole production.

- AI-driven generative design tools enable the creation of complex, lattice-structured midsole geometries (like 3D-printed soles), optimizing cushioning and weight distribution based on specific biomechanical data.

- Predictive maintenance analytics, powered by AI, monitor sole material production machinery to prevent unplanned downtime, enhancing operational efficiency across the supply chain.

- AI enhances sustainability initiatives by optimizing material traceability from source to final product and developing sorting and recycling strategies for multi-material sole assemblies at the end of their lifecycle.

- Demand forecasting models utilize AI to predict material volume needs based on fashion trends and regional consumer demand, improving inventory management and reducing overstocking of raw sole materials.

DRO & Impact Forces Of Footwear Sole Material Market

The Footwear Sole Material Market is principally driven by relentless consumer demand for high-performance and aesthetically appealing footwear, coupled with significant technological advancements that improve material properties, creating a constant cycle of innovation. Key drivers include the global expansion of the athletic and sports segments, where specialized materials providing lightweight cushioning and superior energy return are mandatory, driving up the consumption of advanced polyurethanes, EVA derivatives, and specialized rubber compounds. The opportunity landscape is vast, specifically within sustainable materials, as companies strive to meet corporate social responsibility goals and capitalize on the premium market segment willing to pay for bio-based or fully recycled sole components. Restraints, however, include the volatility of raw material prices (especially crude oil derivatives used in many polymers), the complexity of recycling multi-layered sole structures, and increasingly stringent environmental regulations regarding the use of certain chemical additives, posing cost and compliance hurdles for global manufacturers.

Impact forces within this market are categorized into supplier power, buyer power, threat of new entrants, threat of substitutes, and intensity of competitive rivalry. Supplier power is high, particularly for specialty polymer producers who hold proprietary technology over advanced compounds critical for high-performance soles, allowing them to dictate pricing and terms for unique materials. Buyer power, represented by major global footwear brands (like Nike, Adidas, etc.), is also significantly high due to their massive procurement volumes and ability to influence material specifications and pricing negotiations. This dual high-power dynamic leads to highly specific contractual agreements and intense focus on material uniqueness and cost-efficiency simultaneously.

The threat of new entrants is moderate; while the initial investment in polymer manufacturing and specialized foaming/molding equipment is high, the increasing accessibility of 3D printing technologies and localized manufacturing models allows smaller, specialized material innovators to enter niche markets focusing on customization or bio-materials. The threat of substitutes is continuous, driven by the replacement of conventional materials (like PVC or standard rubber) with advanced, high-specification polymers (like thermoplastic polyurethanes or specialized foams) that offer superior performance-to-weight ratios. Finally, the intensity of competitive rivalry is extremely high, characterized by constant material litigation, rapid product innovation cycles, and aggressive pricing strategies among major material suppliers vying for long-term supply contracts with leading footwear manufacturers, ensuring the market remains dynamically innovative and price-sensitive.

Segmentation Analysis

The Footwear Sole Material Market is comprehensively segmented based on material type, application, and end-use, providing a granular view of market dynamics and growth pockets. The analysis across these dimensions reveals distinct demand patterns: material type segmentation, including polymers like PU, EVA, and rubber, is fundamental as performance attributes are intrinsically linked to the chemical structure of the raw material. Application segmentation differentiates between the functional requirements of athletic footwear (demanding resilience and low weight) and non-athletic footwear (prioritizing durability and aesthetic finish). This structure allows stakeholders to tailor their product offerings and R&D investments toward segments exhibiting the highest growth potential or requiring specific material innovation to solve inherent performance challenges.

The polyurethane (PU) segment dominates the value share due to its excellent abrasion resistance, shock absorption, and ability to be molded into complex midsole shapes, making it indispensable in modern athletic and safety footwear. Concurrently, the increasing focus on sustainable manufacturing drives significant growth within the natural rubber and bio-based polymer segments, although they currently command a smaller market share by volume. Geographic and end-use segmentation (Adults vs. Children) further refines the market view, where adult athletic footwear remains the primary revenue generator globally, demanding continuous material upgrades and fueling the demand for premium, high-cost polymer solutions. Understanding these segment interactions is crucial for strategic market positioning and identifying underserved or emerging material needs within the global footwear supply chain.

- Material Type:

- Polyurethane (PU)

- Ethylene-Vinyl Acetate (EVA)

- Rubber (Natural, Synthetic, SBR)

- Thermoplastic Elastomers (TPEs)

- Polyvinyl Chloride (PVC)

- Composites and Others (Bio-based, Recycled materials)

- Application:

- Athletic Footwear (Running, Training, Hiking, Court Sports)

- Non-Athletic Footwear (Casual, Formal, Safety/Industrial)

- End-Use:

- Adults

- Children

Value Chain Analysis For Footwear Sole Material Market

The value chain for the Footwear Sole Material Market begins with the upstream segment, dominated by petrochemical and chemical companies that supply core raw materials, such as crude oil derivatives (isocyanates, polyols for PU), ethylene, and specialized additives. This upstream stage is characterized by high capital intensity and reliance on global commodity prices. The second stage involves material processing and compounding, where specialized chemical firms and polymer manufacturers convert basic petrochemicals into application-specific sole compounds (e.g., highly customized EVA foams, specific rubber formulations, or ready-to-mold PU systems). Innovation at this stage is crucial, focusing on enhancing material performance properties like density, resilience, and anti-slip characteristics, fundamentally influencing the final footwear quality.

The downstream segment involves specialized sole manufacturers and integrated footwear Original Equipment Manufacturers (OEMs). Sole manufacturers receive compounded materials and use advanced molding (injection or compression), foaming, or 3D printing techniques to produce the actual sole units (outsole and midsole). These units are then supplied directly to footwear brands for final assembly. Distribution channels are varied: direct sales dominate high-volume transactions between large polymer suppliers and major integrated footwear brands, ensuring tight control over quality specifications and logistics. Indirect distribution, involving specialized material distributors or agents, services smaller footwear manufacturers or specific regional markets, facilitating easier access to diverse material portfolios and smaller batch quantities.

The shift towards customization and speed-to-market has intensified the importance of direct relationships between material compounders and global footwear brands. This direct channel fosters co-development, allowing brands to quickly integrate novel materials into seasonal collections and maintain proprietary technical advantages over competitors. However, the reliance on indirect channels for logistics, localized technical support, and managing diverse geographical demands remains critical, especially in the fragmented Asian manufacturing landscape. The ultimate success in this value chain hinges on efficient coordination between upstream commodity suppliers and downstream molding experts, ensuring both cost competitiveness and adherence to increasingly complex sustainability and performance metrics mandated by the end-user brands.

Footwear Sole Material Market Potential Customers

The primary potential customers and end-users of the Footwear Sole Material Market are global footwear brands and Original Equipment Manufacturers (OEMs) specializing in mass production. These buyers require materials in vast volumes and demand strict adherence to technical specifications related to durability, weight, cushioning, and regulatory compliance. Major customers include established athletic brands such as Nike, Adidas, Puma, and New Balance, which focus heavily on performance metrics and frequently enter into exclusive supply agreements for proprietary foam and rubber technologies. The buying behavior of these large customers is heavily influenced by R&D collaborations, supply chain stability, and the capacity of material suppliers to innovate new sustainable or lighter-weight solutions that can provide a competitive edge in product design.

Beyond the athletic sector, significant customer segments include manufacturers of casual and dress footwear (e.g., Clarks, ECCO), who prioritize comfort, leather integration, and aesthetic finishes, often requiring specialized PU and rubber compounds with specific hardness and molding capabilities. Industrial and safety footwear manufacturers form another crucial end-user group, demanding materials compliant with rigorous safety standards (e.g., anti-static, oil-resistant, puncture-resistant soles), predominantly utilizing heavy-duty rubber and durable PU formulations. These safety-focused buyers prioritize functional longevity and compliance over lightweight considerations. Furthermore, private label manufacturers and regional small-to-midsize enterprises (SMEs) across Asia and Latin America represent a large volume-driven customer base, primarily seeking cost-effective EVA and standard rubber solutions for mass-market shoes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 billion |

| Market Forecast in 2033 | $36.4 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., Huntsman Corporation, Covestro AG, Kuraray Co. Ltd., Teknor Apex Company, Hexpol AB, Trelleborg AB, Lubrizol Corporation, Wanhua Chemical Group, Sinopec, Arkema SA, Asahi Kasei Corporation, Lanxess AG, Continental AG, Solvay SA, Michelin, Intertek Group, ExxonMobil Chemical, China Petroleum & Chemical Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Footwear Sole Material Market Key Technology Landscape

The technology landscape of the Footwear Sole Material Market is rapidly evolving, driven primarily by the need for enhanced material performance, faster manufacturing cycles, and ecological sustainability. A key technological focus is the advancement in foam molding techniques, particularly supercritical fluid foaming (SCF) technology, which allows for the creation of ultra-lightweight, resilient midsoles (often using TPU or PEBA) with superior energy return capabilities, crucial for elite athletic footwear. SCF eliminates the use of traditional chemical blowing agents, aligning with environmental regulations and allowing for highly precise control over foam cell structure, thereby optimizing cushioning and responsiveness dynamically. This technology represents a significant barrier to entry for smaller manufacturers due to the high capital investment required for specialized high-pressure processing equipment, concentrating innovation among major material suppliers and integrated footwear OEMs.

Another transformative technology is Additive Manufacturing, specifically 3D printing utilizing materials like flexible TPU (thermoplastic polyurethane). 3D printing enables the creation of complex lattice structures, allowing designers to precisely tune the stiffness, flexibility, and impact absorption characteristics of a sole component at different points, leading to hyper-customized sole designs tailored to individual biomechanics. While currently expensive and primarily utilized for high-end limited-edition products or prototyping, advancements in material extrusion speed and cost reduction are pushing 3D printing closer to mass-market viability. This technology radically impacts the traditional molding process, potentially shortening lead times and facilitating on-demand, localized sole production, fundamentally disrupting the logistics heavy, centralized supply chains traditionally associated with footwear manufacturing.

Furthermore, sustainable material technology is gaining prominence, specifically the commercialization of bio-based polymers derived from renewable feedstocks (e.g., castor beans, algae, sugarcane) and advanced recycling technologies for reclaiming materials like EVA and PU from end-of-life footwear. Chemical recycling techniques, which break down polymers into their original monomers for reuse, are critical for overcoming the challenge of processing multi-material soles. This technological push is not merely compliance-driven; it is becoming a core competitive advantage, with brands marketing their commitment to circular economy principles. Innovations in surface treatment and bonding agents are also vital, ensuring multi-material soles—such as those combining durable rubber outsoles with cushioned foam midsoles—maintain structural integrity and long-term performance under extreme conditions without relying on hazardous volatile organic compounds (VOCs) for adhesion.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global footwear manufacturing, holding the largest volume share of the Footwear Sole Material Market, driven by vast production capabilities in China, Vietnam, and Indonesia. These nations serve as the primary global supply base for both cost-effective mass-market footwear and specialized athletic shoes. The region’s growth is further augmented by rapidly increasing domestic consumer demand, particularly for athleisure and branded performance wear in India and Southeast Asia. The focus here is balanced between maintaining cost efficiencies in material procurement and rapidly adopting specialized, lightweight polymer technologies driven by export demand.

- North America: North America represents a mature, high-value market, characterized by sophisticated consumer preferences for performance, branding, and sustainability. The region is a key innovation hub, driving demand for premium, proprietary sole materials such as advanced TPEs and highly resilient foamed polymers (e.g., PEBAX, advanced TPUs). While manufacturing presence is smaller compared to APAC, R&D investment and material specification creation originate heavily from U.S.-based footwear headquarters, emphasizing quick material cycles and high ASPs.

- Europe: Europe mirrors North America in its demand for high-performance and luxury materials but places significantly greater emphasis on strict regulatory compliance, especially concerning chemical safety (REACH regulations) and circular economy principles. This region is a leader in adopting bio-based and recycled sole materials, often driven by government mandates and strong consumer environmental awareness. Key markets like Germany and Italy showcase a strong focus on high-quality technical footwear (hiking, industrial) and luxury leather goods, respectively, requiring specific, durable PU and high-grade rubber compounds.

- Latin America (LATAM): LATAM is characterized by strong regional manufacturing bases, particularly in Brazil and Mexico, catering largely to internal and regional consumer demand. The market here is sensitive to price, leading to a higher usage share of cost-effective materials like standard EVA and PVC, although demand for branded athletic footwear is steadily increasing, pulling in demand for more sophisticated polymer systems. Economic volatility remains a key factor influencing procurement strategies and material inventory levels across the region.

- Middle East and Africa (MEA): The MEA market is highly diverse. The Middle East segment, fueled by high disposable incomes, shows robust demand for luxury and international branded footwear, driving niche demand for high-quality sole materials. Africa is primarily a volume-driven, emerging market, focused on basic functional footwear, with increasing opportunities in the industrial safety segment due to growing infrastructure projects, necessitating specialized oil- and heat-resistant rubber compounds.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Footwear Sole Material Market.- BASF SE

- Dow Inc.

- Huntsman Corporation

- Covestro AG

- Kuraray Co. Ltd.

- Teknor Apex Company

- Hexpol AB

- Trelleborg AB

- Lubrizol Corporation

- Wanhua Chemical Group

- Sinopec

- Arkema SA

- Asahi Kasei Corporation

- Lanxess AG

- Continental AG

- Solvay SA

- Michelin

- Intertek Group

- ExxonMobil Chemical

- China Petroleum & Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Footwear Sole Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sustainable alternatives replacing traditional sole materials?

The primary sustainable alternatives include bio-based polyurethanes derived from castor oil, recycled EVA and rubber compounds, and innovative materials utilizing natural fillers like algae or sugarcane derivatives. These materials focus on reducing reliance on fossil fuels and improving end-of-life circularity.

How is 3D printing technology influencing the design and production of footwear soles?

3D printing, specifically using flexible thermoplastic polyurethanes (TPU), allows for the creation of intricate lattice sole structures that are otherwise impossible to manufacture via traditional molding. This enables hyper-customization, optimized weight distribution, and rapid prototyping, driving performance innovation in high-end athletic footwear.

Which material segment currently holds the highest market value in the footwear sole industry?

The Polyurethane (PU) segment holds the highest market value due to its superior performance attributes, including excellent cushioning, high abrasion resistance, and versatility, making it the material of choice for both premium athletic midsoles and durable safety footwear.

What is the most significant restraint challenging the growth of the Footwear Sole Material Market?

The most significant restraint is the sustained volatility and fluctuation in the price of crude oil and related petrochemical feedstocks, which directly impacts the manufacturing cost and pricing stability of key polymer sole materials like EVA, PU, and synthetic rubber.

Why is the Asia Pacific region dominating the global Footwear Sole Material Market?

APAC dominates primarily because it serves as the global manufacturing and supply hub for the vast majority of the world’s footwear production. This high volume of production, coupled with increasing domestic consumption rates in large economies like China and India, secures its leading position in material demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager