Foramen Ovale Electrodes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434891 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Foramen Ovale Electrodes Market Size

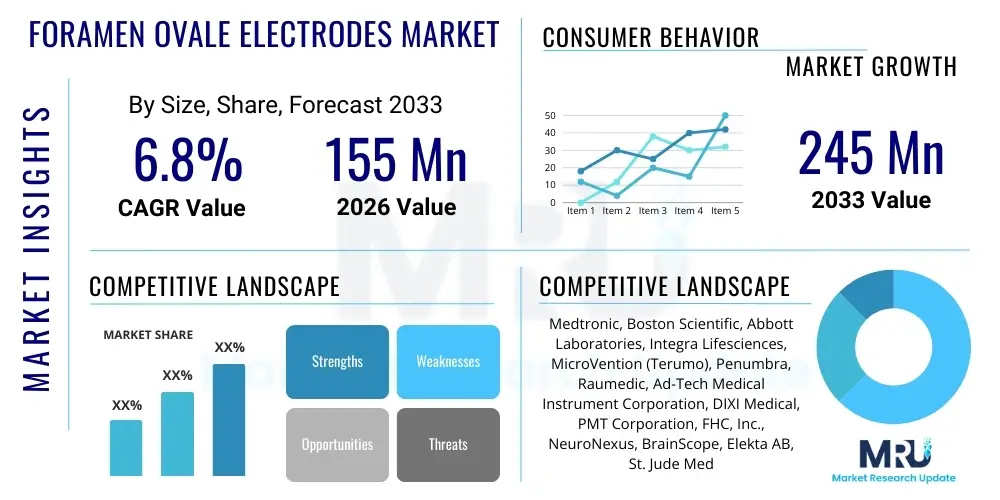

The Foramen Ovale Electrodes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $155 Million USD in 2026 and is projected to reach $245 Million USD by the end of the forecast period in 2033.

Foramen Ovale Electrodes Market introduction

The Foramen Ovale Electrodes (FOE) market encompasses specialized medical devices crucial for invasive neurophysiological monitoring and diagnosis, primarily utilized in treating intractable epilepsy. These electrodes are precisely introduced through the foramen ovale—an anatomical opening at the base of the skull—to access and record electrical activity from the mesial temporal lobe structures, particularly the hippocampus and amygdala. The primary objective is to accurately localize the seizure focus in patients where non-invasive methods, such as surface electroencephalography (EEG) or magnetic resonance imaging (MRI), have yielded ambiguous or contradictory results. The clinical efficacy of FOEs lies in their ability to provide high-fidelity, highly localized intracranial EEG recordings, which are indispensable for planning curative surgical resections, especially in cases of mesial temporal lobe epilepsy (MTLE).

The product landscape is characterized by disposable and reusable electrodes, varying in material composition, contact density, and flexibility. Technological advancements focus heavily on miniaturization, enhanced biocompatibility of materials (such as platinum-iridium alloys), and improved insertion mechanisms to minimize procedural risks and patient discomfort. Major applications span diagnostic procedures, pre-surgical planning for epilepsy, and, increasingly, guidance for deep brain stimulation (DBS) target localization. The intrinsic benefit of FOEs—precise localization of epileptogenic zones—dramatically improves the prognosis for surgical candidates, driving demand in specialized neuroscience centers globally. As surgical techniques become minimally invasive, the demand for highly specialized, small-gauge electrodes optimized for accurate placement continues to accelerate.

Key driving factors propelling market expansion include the rising global incidence and prevalence of refractory epilepsy, particularly in adult and pediatric populations unresponsive to pharmaceutical interventions. Furthermore, substantial improvements in neuronavigation and imaging technologies, such as fusion imaging (combining MRI and CT scans), have enhanced the safety and accuracy of electrode placement, making the procedure more feasible in a broader range of clinical settings. Increased investment in neurosurgical research and the establishment of dedicated comprehensive epilepsy centers, especially in emerging economies, are also critical drivers stimulating market growth. Regulatory bodies, while stringent, are increasingly streamlining the approval process for innovative monitoring devices that demonstrate superior diagnostic capabilities, thereby supporting commercialization efforts.

Foramen Ovale Electrodes Market Executive Summary

The Foramen Ovale Electrodes market is navigating a phase of steady, technology-driven expansion, primarily fueled by the increasing requirement for highly accurate pre-surgical localization of epileptic foci and neurological mapping. Business trends indicate a strong move toward consolidated product offerings, where manufacturers integrate electrodes with compatible monitoring systems and sophisticated software for signal processing and visualization, enhancing clinical workflow efficiency. Strategic partnerships between specialized medical device manufacturers and leading neurosurgical institutions are becoming prevalent, focusing on clinical validation and training, which is essential given the complexity of the insertion procedure. The competitive landscape emphasizes product differentiation through material innovation, aiming for extended lifespan (for reusable types) and reduced invasiveness, alongside robust supply chain management to ensure the availability of these critical, specialized components.

Regionally, North America and Europe maintain market dominance, attributed to well-established healthcare infrastructure, high awareness regarding advanced epilepsy treatments, and favorable reimbursement policies supporting complex neurodiagnostic procedures. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment. This rapid growth is underpinned by expanding healthcare expenditure, increasing incidence of neurological disorders in densely populated nations like China and India, and significant investments in developing neurosurgery departments equipped with state-of-the-art diagnostic tools. Market trends within APAC also reflect a growing willingness to adopt advanced, albeit costly, diagnostic technologies to improve patient outcomes in complex neurological cases.

Segmentation trends highlight the disposable electrode segment's market leadership, driven by ease of use, reduced risk of cross-contamination, and minimizing reprocessing burdens on hospitals, which aligns with modern infection control protocols. In terms of application, the Epilepsy Monitoring segment remains the largest consumer, reflecting the fundamental purpose of FOEs in refractory epilepsy diagnostics. The End-User analysis shows hospitals, particularly large academic medical centers housing Level 4 Epilepsy Centers, as the primary consumers, due to the requirement for highly skilled neurosurgeons and specialized electrophysiology laboratory capabilities necessary for safe and effective FOE deployment. The market structure suggests continued technological refinement focused on reducing the learning curve associated with insertion and enhancing electrode stability post-implantation.

AI Impact Analysis on Foramen Ovale Electrodes Market

User queries regarding the impact of Artificial Intelligence (AI) on the Foramen Ovale Electrodes Market predominantly revolve around two central themes: enhancing diagnostic precision and streamlining the surgical planning process. Users are keenly interested in whether AI algorithms can analyze the vast datasets generated by FOE monitoring—potentially days or weeks of continuous intracranial EEG—to automatically detect subtle epileptiform discharges, localize seizure onset zones with higher accuracy than human review, and predict the progression of neurological activity. The primary concern is focused on data integration challenges, standardization of proprietary FOE signal formats, and the clinical validation of AI-driven localization tools. Expectations are high regarding AI’s potential to reduce the time from diagnosis to treatment, thus optimizing resource utilization and significantly improving prognostic outcomes for epilepsy patients receiving FOE-guided surgery.

AI's influence is anticipated across the entire workflow, from pre-operative planning to post-operative analysis. In the planning phase, machine learning (ML) algorithms, integrated with advanced imaging like fMRI and PET, could optimize the trajectory and depth of the FOE insertion, minimizing damage to critical structures and maximizing the probability of capturing the seizure focus. During the monitoring phase, AI tools can prioritize clinically significant events for the epileptologist, reducing the monumental task of manually reviewing hours of noise-contaminated EEG data. The long-term impact involves developing predictive models that can assess the likelihood of seizure freedom following resection guided by AI-enhanced FOE data, pushing the market towards greater automation in complex neurodiagnostics.

This integration demands collaborative development between medical device manufacturers (producing the electrodes and acquisition hardware) and AI software developers. While AI will not replace the physical electrode or the need for the procedure itself, it transforms the value proposition of the data derived from the FOEs, turning raw electrical signals into actionable clinical intelligence. Regulatory scrutiny for these AI-driven diagnostic tools will be a key determinant of market adoption speed, ensuring that the software models are robust, unbiased, and capable of functioning reliably across diverse patient populations and hardware platforms.

- AI algorithms facilitate automated analysis of continuous intracranial EEG data generated by FOEs.

- Enhanced localization of epileptogenic zones, exceeding traditional manual review capabilities.

- Optimization of surgical trajectories and planning using ML integrated with neuroimaging (CT/MRI).

- Reduction in diagnostic latency, accelerating the transition from monitoring to definitive treatment.

- Development of predictive models assessing post-surgical seizure outcome based on FOE data analysis.

- Improved signal processing and noise reduction in real-time monitoring sessions.

DRO & Impact Forces Of Foramen Ovale Electrodes Market

The Foramen Ovale Electrodes Market is shaped by a critical balance of clinical necessity, technological complexity, and regulatory overhead. The primary Drivers stem from the escalating global incidence of drug-resistant epilepsy, necessitating invasive monitoring for surgical candidacy, coupled with continuous refinement in neurosurgical navigation techniques that enhance procedural safety and precision. Restraints include the highly specialized nature of the procedure, requiring significant capital investment in Level 4 Epilepsy Centers, the inherent risks associated with invasive intracranial procedures, and the high cost of the electrodes and associated monitoring equipment, leading to potential access barriers in resource-limited settings. Opportunities are abundant in integrating smart technology (AI, advanced materials) into electrode design for better signal acquisition, expanding applications into non-epilepsy neuromodulation (like DBS refinement), and penetrating high-growth emerging economies by providing focused training and infrastructure support. These forces collectively dictate the adoption curve and market trajectory, emphasizing quality, safety, and diagnostic efficacy as core competitive factors.

Impact forces are heavily concentrated around regulatory changes and advancements in competitive non-invasive technologies. The increasing stringency of FDA and CE Mark approvals, particularly concerning implantable devices and reusable components requiring sterilization protocols, significantly influences the product development lifecycle and time-to-market. Simultaneously, the success of less invasive diagnostic tools, such as Magnetoencephalography (MEG) or advanced high-density surface EEG (HD-EEG), poses a continuous competitive threat. If these non-invasive methods achieve accuracy levels comparable to FOEs, the demand for invasive monitoring could plateau. However, for the most complex cases, the direct signal acquisition capability of FOEs remains unmatched, reinforcing their niche but critical market position. Manufacturer viability depends heavily on demonstrating superior signal quality, long-term stability, and minimizing complication rates, which directly impact clinician preference and hospital purchasing decisions.

Furthermore, socioeconomic factors, including fluctuating healthcare reimbursement rates and global supply chain vulnerabilities for specialized materials (e.g., platinum, iridium), exert constant pressure on pricing and profitability. The educational factor is also an invisible, yet powerful impact force; widespread adoption is reliant upon specialized training programs ensuring that neurosurgeons and epileptologists are proficient in the intricate placement and interpretation required for FOE studies. Investment in education and establishing standardized operating procedures (SOPs) across institutions are critical to mitigating procedural risks and maximizing the diagnostic yield of the technology, thus supporting sustained market growth.

Segmentation Analysis

The Foramen Ovale Electrodes Market is systematically segmented based on product type, application, and end-user, providing a granular view of market dynamics and adoption patterns across various clinical settings. Analyzing these segments helps stakeholders understand areas of highest demand and identify critical technological preferences. Segmentation by type differentiates between disposable and reusable FOEs, a distinction driven primarily by operational costs, infection control protocols, and the frequency of use within a medical center. The application segmentation clearly demonstrates the market's dependence on refractory epilepsy monitoring, while also highlighting emerging uses in other neurosurgical procedures. Understanding end-users confirms the centralized nature of FOE utilization within specialized tertiary care centers, which possess the necessary expertise and infrastructure for these complex procedures.

The Disposable segment currently captures the largest market share due to the clear advantages they offer in minimizing sterilization concerns, which is paramount in invasive monitoring. While reusable electrodes offer a lower cost per use over their lifespan, the labor costs and stringent regulatory requirements for reprocessing often tilt the balance toward disposable alternatives, especially in high-volume settings. Future technological innovations are expected to further solidify this trend by making disposable units even more cost-effective and structurally robust. Concurrently, the application segmentation reveals that while Epilepsy Monitoring dominates, the small but expanding segment of Deep Brain Stimulation (DBS) guidance represents a critical area for diversification. FOEs can assist in precisely locating target nuclei or verifying lead placement in complex neuromodulation surgeries, opening avenues beyond traditional diagnostic roles.

Geographically, market segmentation reflects disparities in neurological care infrastructure. Developed markets show higher penetration across all segments due to early adoption of neuro-monitoring standards, whereas emerging markets are witnessing rapid growth, often driven initially by the disposable segment due to ease of implementation and training compared to the rigorous maintenance protocols required for reusable systems. The strategic importance of the end-user segmentation lies in targeting specific institutional procurement channels; manufacturers must tailor their sales strategies to meet the stringent quality and volume requirements of academic hospitals and specialized neurology centers, which dictate purchasing decisions based on clinical outcomes and long-term cost-effectiveness.

- By Product Type

- Disposable Foramen Ovale Electrodes

- Reusable Foramen Ovale Electrodes

- By Application

- Epilepsy Monitoring and Diagnostics

- Deep Brain Stimulation (DBS) Guidance

- Other Neurophysiological Procedures

- By End-User

- Hospitals (Level 4 Epilepsy Centers)

- Specialty Clinics and Research Institutes

- Ambulatory Surgical Centers (Limited Use)

Value Chain Analysis For Foramen Ovale Electrodes Market

The value chain for the Foramen Ovale Electrodes market begins with upstream material procurement, focusing on highly specialized, biocompatible components such as medical-grade plastics, platinum-iridium alloys, and specialized wires for signal transmission. This phase is characterized by stringent quality control and reliance on a limited number of specialized raw material suppliers who meet ISO standards for implantable devices. Manufacturing is a highly precise process, often involving micro-fabrication techniques and cleanroom environments, where specialized expertise in electrode design and sterilization is paramount. Companies must heavily invest in R&D to ensure the electrodes offer optimal signal-to-noise ratios and structural integrity under clinical conditions. Packaging and final sterilization mark the end of the upstream phase, ensuring the product is ready for clinical use, often requiring ethylene oxide or gamma radiation processes.

The distribution channel represents the transition from manufacturer to end-user. Given the niche and high-value nature of FOEs, distribution frequently utilizes both direct sales forces and specialized medical device distributors who have established relationships with neurosurgery departments and epilepsy centers. Direct distribution is favored by larger key players for maintaining control over specialized installation support, technical training, and high-margin sales, ensuring that complex inventory management and product specific handling requirements are met. Indirect distribution, leveraging regional partners, helps manufacturers achieve broader geographical coverage, particularly in fragmented or rapidly emerging markets where local market knowledge is crucial for successful penetration and logistics management.

Downstream activities center around the end-users—primarily neurosurgeons, epileptologists, and specialized electrophysiology technologists. Key downstream elements include the provision of comprehensive training and technical support, especially for first-time adopters or when new product iterations are launched. Post-sale support, addressing issues related to signal quality, system compatibility, and sterilization protocols for reusable units, is critical for customer retention. The effectiveness of the value chain is ultimately measured by the diagnostic success rate and the safety profile of the procedures performed using the electrodes. Efficient logistics and robust technical support are essential to minimize downtime in critical epilepsy monitoring units, directly impacting patient care scheduling and center profitability.

Foramen Ovale Electrodes Market Potential Customers

The primary and most critical segment of potential customers for Foramen Ovale Electrodes are comprehensive Level 4 Epilepsy Centers located within large academic or tertiary care hospitals. These centers specialize in the diagnosis and surgical treatment of refractory epilepsy, possessing the necessary multidisciplinary team—including neurosurgeons, epileptologists, neuropsychologists, and specialized nursing staff—required for performing complex intracranial monitoring procedures like FOE implantation. These customers prioritize devices that offer high diagnostic yield, minimal procedural risk, and seamless integration with existing neuro-monitoring hardware and data analysis software. Purchasing decisions in these institutions are typically governed by clinical validation data, peer-reviewed evidence, and long-term cost-effectiveness, favoring durable, high-precision instruments.

A secondary, yet significant, customer base includes specialized neuroscience research institutions and university hospitals involved in advanced neurological studies. These facilities often utilize FOEs for mapping brain function, understanding the origins of complex neurological disorders beyond epilepsy, and developing new therapeutic interventions, such as optimizing targets for experimental neuromodulation techniques. These customers often require highly customizable electrode configurations and collaborate closely with manufacturers to design bespoke solutions for specific research protocols. Their purchasing criteria often lean towards technological innovation, data accessibility, and the capacity for high-density recordings, making them key opinion leaders and early adopters of new technological iterations within the FOE market.

Furthermore, an emerging customer segment consists of major private hospital chains and specialty clinics in developing economies that are actively expanding their neurosurgical capabilities. As global wealth increases and access to advanced medical technology improves, these facilities are investing in infrastructure to handle complex epilepsy cases previously referred overseas. While cost sensitivity is higher in this segment, the demand for reliable, often disposable, FOEs is rapidly accelerating, driven by the desire to meet rising domestic demand for state-of-the-art neurological care and reduce medical tourism outflow. Manufacturers targeting this segment must focus on robust product training and providing scalable monitoring solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155 Million USD |

| Market Forecast in 2033 | $245 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Boston Scientific, Abbott Laboratories, Integra Lifesciences, MicroVention (Terumo), Penumbra, Raumedic, Ad-Tech Medical Instrument Corporation, DIXI Medical, PMT Corporation, FHC, Inc., NeuroNexus, BrainScope, Elekta AB, St. Jude Medical (now Abbott), Livanova, Nihon Kohden, Compumedics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foramen Ovale Electrodes Market Key Technology Landscape

The technology landscape of the Foramen Ovale Electrodes market is defined by continuous innovation focused on improving signal quality, minimizing tissue trauma, and ensuring compatibility with advanced imaging systems. Key technological trends center on the composition and design of the electrode contacts. Modern FOEs utilize high-performance materials, typically platinum-iridium alloys, which offer superior conductivity, stability, and radiopacity, enabling clear visualization under fluoroscopy and MRI/CT during and after implantation. The design evolution includes reducing the diameter and increasing the flexibility of the catheter body to facilitate easier, safer insertion through the foramen ovale, a structurally sensitive area, while optimizing the spacing and configuration of the contacts to maximize localized electrical activity detection with high precision.

Furthermore, integration with sophisticated neuro-navigation platforms, such as stereotactic planning software and robotic assistance systems, is a hallmark of the advanced technological landscape. These systems utilize pre-operative imaging to create a 3D model of the patient's brain, allowing the surgeon to precisely map the insertion trajectory and predict the final location of the electrode contacts relative to the targeted mesial temporal structures. This technology significantly reduces procedural time and minimizes the risk of complications, making the procedure safer and more reproducible. The connectivity technology is also evolving, with electrodes designed to interface seamlessly with high-channel count EEG monitoring systems, ensuring minimal signal degradation and reliable data acquisition over several days of monitoring.

The most recent technological advancements involve the incorporation of smart sensors and enhanced insulation techniques. Some next-generation FOEs are being developed with micro-sensors that could potentially measure localized physiological parameters, such as temperature or oxygen levels, providing additional context to the recorded electrical activity. Moreover, there is an increasing shift towards standardized connectors and acquisition hardware that are compatible with various vendor systems, addressing the interoperability challenges often faced by hospital IT and electrophysiology departments. These technological strides underscore the market's commitment to transforming FOE placement from a largely manual, image-guided procedure into a highly digitized, precision-engineered neurodiagnostic intervention.

Regional Highlights

The global distribution and growth profile of the Foramen Ovale Electrodes market exhibit distinct regional characteristics, reflecting disparities in healthcare spending, technological adoption rates, and neurological disease prevalence.

- North America: This region holds the largest market share, driven by a high prevalence of refractory epilepsy, extensive insurance coverage, robust infrastructure (specifically the concentration of Level 4 Epilepsy Centers), and rapid adoption of advanced neurosurgical technologies, including robotic-assisted navigation systems. The U.S. remains the primary revenue generator due to significant R&D investment and favorable regulatory pathways for innovative medical devices. The emphasis here is on premium, high-fidelity electrodes and comprehensive data analysis platforms.

- Europe: Characterized by mature markets in Western economies (Germany, UK, France), Europe exhibits steady growth. Market expansion is supported by government funding for neurological research and well-established clinical guidelines emphasizing invasive monitoring for surgical epilepsy planning. The region shows a strong preference for devices that comply strictly with CE mark requirements and demonstrate long-term cost-effectiveness, favoring both disposable options and high-quality reusable systems with established sterilization protocols.

- Asia Pacific (APAC): APAC is the fastest-growing regional market. This explosive growth is fueled by increasing disposable incomes, massive expansion of healthcare infrastructure in populous nations like China and India, and a growing recognition of the need for specialized neurological care. While pricing sensitivity remains a factor, the large patient pool and government initiatives promoting medical technological modernization are rapidly accelerating the adoption of specialized devices like FOEs, particularly in tertiary care centers establishing their first comprehensive epilepsy programs.

- Latin America (LATAM): Market penetration is moderate, constrained by economic instability and variable public health investment across countries. Growth is concentrated in major urban centers (e.g., Brazil, Mexico) where private hospitals adopt high-end technology. The market here relies heavily on indirect distribution channels and is often highly price-sensitive, leading to a strong demand for cost-effective or reusable FOE options.

- Middle East and Africa (MEA): This region presents a nascent market with pockets of high investment, particularly in Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which prioritize establishing world-class medical facilities. FOE adoption is highly localized to specialized neurosurgical hubs serving both the local and medical tourism populations. Political stability and consistent investment in healthcare infrastructure are key determinants of market expansion potential within MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foramen Ovale Electrodes Market.- Medtronic

- Boston Scientific

- Abbott Laboratories

- Integra Lifesciences

- MicroVention (Terumo)

- Penumbra

- Raumedic

- Ad-Tech Medical Instrument Corporation

- DIXI Medical

- PMT Corporation

- FHC, Inc.

- NeuroNexus

- BrainScope

- Elekta AB

- Nihon Kohden

- Compumedics

- Technomed

- NeuroSigma

- Livanova

- G.tec medical engineering GmbH

Frequently Asked Questions

Analyze common user questions about the Foramen Ovale Electrodes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Foramen Ovale Electrodes in neurosurgery?

The primary function of Foramen Ovale Electrodes (FOEs) is the invasive neurophysiological monitoring and precise localization of the seizure onset zone within the mesial temporal lobe. This is critical for pre-surgical evaluation and planning for patients with drug-resistant temporal lobe epilepsy.

Are Foramen Ovale Electrodes typically disposable or reusable, and which segment dominates?

FOEs are available in both disposable and reusable formats. The disposable segment currently holds the dominant market share due to enhanced infection control protocols, reduced reprocessing costs and complexity, and alignment with modern hospital hygiene standards.

What are the major technological advancements driving the Foramen Ovale Electrodes market?

Key technological advancements include the use of biocompatible platinum-iridium alloys for optimal signal quality, miniaturization for less invasive insertion, and integration with advanced neuronavigation and robotic systems to ensure highly accurate, reproducible electrode placement.

Which geographical region exhibits the fastest growth rate for FOE adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by significant increases in healthcare investment, expanding neurological care infrastructure, and the rising prevalence of epilepsy in highly populated emerging economies.

How does AI impact the clinical utility and future of FOE monitoring?

AI significantly impacts FOE monitoring by enabling automated, high-speed analysis of complex intracranial EEG data, improving the accuracy of seizure focus localization, optimizing surgical planning, and developing predictive models for treatment outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager