Force Gauge and Torque Meters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435189 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Force Gauge and Torque Meters Market Size

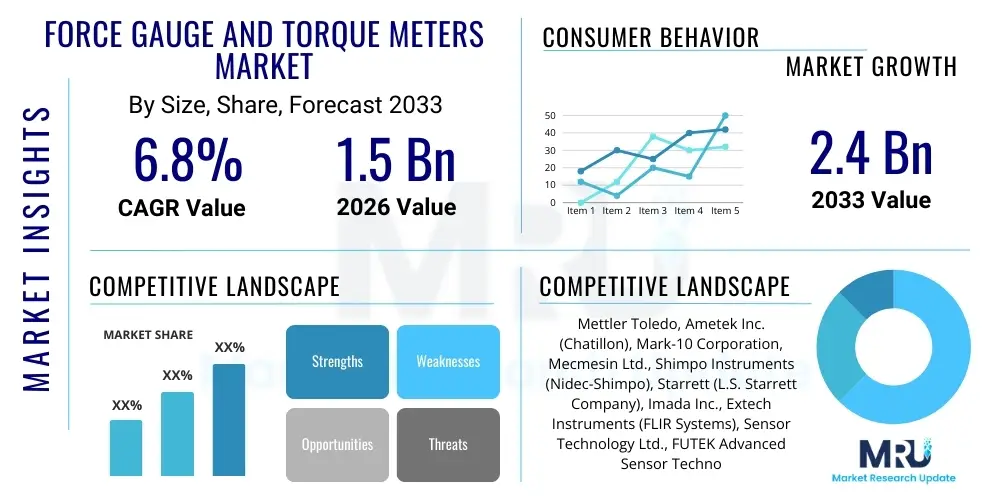

The Force Gauge and Torque Meters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Force Gauge and Torque Meters Market introduction

Force gauges and torque meters are precision measuring instruments essential for quantifying mechanical forces such as tension, compression, and rotational force (torque). These devices are critical components in quality control, R&D, and manufacturing processes across various industries, ensuring products meet specified performance and safety standards. Force gauges typically measure linear force, ranging from handheld digital models used for quick inspections to highly integrated systems for precise load testing. Torque meters, conversely, measure the twisting force applied to an object, vital for assessing fastener tightening, engine performance, and material strength.

The core application domains for these instruments span automotive testing, aerospace manufacturing, medical device assembly, packaging integrity evaluation, and consumer electronics production. In the automotive sector, force gauges are used for pedal force testing, while torque meters verify bolt tightness in critical components like engine blocks and wheel assemblies. The ongoing emphasis on zero-defect manufacturing and regulatory compliance, particularly in highly regulated fields such as medical and aerospace, drives the continuous demand for high-accuracy, reliable measuring equipment. Furthermore, the integration of digital interfaces and data logging capabilities enhances their utility, enabling seamless integration into modern industrial automation and quality management systems.

Key benefits derived from the utilization of advanced force gauges and torque meters include enhanced product reliability, reduced material waste through optimized process control, and compliance with international standards (like ISO and ASTM). Driving factors for market expansion include the global resurgence in manufacturing activities, the increasing complexity of engineered materials requiring precise testing, and the pervasive trend towards industrial digitalization (Industry 4.0). The continuous introduction of wireless and smart sensors that offer greater portability and real-time data analysis is also fueling adoption across diverse operational environments.

Force Gauge and Torque Meters Market Executive Summary

The Force Gauge and Torque Meters Market is characterized by robust growth, primarily propelled by escalating demand for quality assurance and precision manufacturing across highly industrialized economies in North America and Europe, alongside rapid industrial expansion in the Asia Pacific region. Business trends are moving towards the adoption of networked, smart measurement devices capable of integration into the Industrial Internet of Things (IIoT), facilitating remote monitoring and predictive maintenance. This shift emphasizes software solutions accompanying the hardware, focusing on data analytics, calibration management, and enhanced user interfaces. Competition remains intense, with key players focusing on product diversification, offering specialized high-capacity torque measurement systems and highly sensitive, miniature force gauges tailored for intricate tasks like testing micro-electronics and surgical devices. Strategic mergers and acquisitions are common as companies seek to expand technological portfolios and regional footprints, particularly targeting emerging markets.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth trajectory, driven by massive investments in automotive manufacturing, electronics assembly, and burgeoning infrastructure development in countries such as China, India, and South Korea. North America and Europe, while mature, maintain their dominance in terms of value generation due to stringent regulatory frameworks mandating certified, high-end precision equipment in aerospace, defense, and pharmaceutical sectors. The Middle East and Africa (MEA) and Latin America represent emerging markets, where growth is currently linked to oil and gas infrastructure expansion and initial phases of localized industrialization. The variance in growth rates reflects differing levels of industrial maturity and regulatory enforcement globally.

Segmentation analysis reveals that the digital force gauge and rotary torque meter segments are witnessing substantial expansion compared to their analog counterparts, driven by superior accuracy, data logging capabilities, and ease of integration. By application, the quality control and inspection segment holds the largest market share, essential for ensuring zero defects in high-value components. Furthermore, the automotive industry remains the primary end-user, although the medical and pharmaceutical sector is rapidly increasing its proportional usage, demanding ultra-precise measurement devices for critical applications like syringe force testing and surgical instrument calibration. The market's structural evolution is fundamentally tied to global quality mandates and technological advancements favoring automation and high-resolution data capture.

AI Impact Analysis on Force Gauge and Torque Meters Market

User inquiries regarding AI's influence on the Force Gauge and Torque Meters market frequently center on how machine learning algorithms can enhance measurement accuracy, automate calibration processes, and interpret complex data patterns generated by sensor arrays. Common concerns revolve around the integration cost, the required data infrastructure for effective AI deployment, and the potential for AI-driven systems to predict equipment failure or optimize operational efficiency without human intervention. Users are actively seeking solutions that leverage AI for anomaly detection in testing results, ensuring immediate flagging of production errors that might be missed by conventional statistical process control methods. They also anticipate AI optimizing the lifespan and calibration cycles of the measurement instruments themselves, moving from scheduled maintenance to predictive maintenance, thereby minimizing downtime and operational costs.

The integration of Artificial Intelligence and machine learning (ML) is fundamentally transforming the utility of force and torque measurement data. Instead of merely recording measurements, AI-powered systems can analyze vast datasets collected over time to identify subtle shifts in manufacturing quality, predict material fatigue, and optimize testing parameters dynamically. This paradigm shift moves the function of these gauges from simple monitoring tools to integral components of a proactive quality intelligence network. AI algorithms can compensate for environmental factors, sensor drift, and subtle operator variances, significantly boosting the overall reliability and objectivity of the measurements recorded, which is crucial in sectors demanding extremely tight tolerances.

Ultimately, AI enables force gauge and torque meter manufacturers to offer "Measurement as a Service" (MaaS) solutions, providing end-users with actionable insights rather than raw data. By learning the acceptable range of variability for specific processes, AI systems can automatically adjust control loops in automated manufacturing lines based on real-time force or torque readings. This capability is paramount in high-speed assembly and robotics, ensuring continuous process optimization and rapid adjustment to fluctuating material characteristics or machine wear. This enhanced analytical capability addresses user demand for instruments that contribute directly to efficiency gains and improved quality yields.

- AI-driven Predictive Calibration: Utilizing ML models to anticipate sensor drift and schedule necessary maintenance before measurement accuracy degrades.

- Real-time Anomaly Detection: Employing algorithms to instantly flag deviations in force or torque profiles indicating manufacturing defects or material inconsistencies.

- Data Pattern Interpretation: Analyzing large volumes of measurement data to identify complex correlations between input factors and resulting quality metrics.

- Optimized Test Procedures: AI adjusting test speeds, load application rates, and frequency based on material properties and desired outcome.

- Integration with Robotics: Enabling autonomous adjustment of robotic tooling based on force feedback measured by integrated gauges.

DRO & Impact Forces Of Force Gauge and Torque Meters Market

The Force Gauge and Torque Meters market is primarily driven by escalating global standards for product quality and safety, demanding rigorous testing procedures across all stages of manufacturing, from R&D to final inspection. The rapid expansion and modernization of critical end-use industries—specifically automotive, aerospace, and medical devices—significantly boost demand, as these sectors require certified, high-precision measurement tools to comply with zero-defect policies and strict regulatory mandates (e.g., FAA, FDA, ISO standards). Furthermore, the continuous trend towards automation and digitization (Industry 4.0) necessitates measurement devices that offer seamless integration, real-time data logging, and networking capabilities, favoring digital and smart instrument adoption over traditional analog options. The development of advanced materials, such as composites and miniaturized electronic components, also fuels demand for specialized, high-sensitivity, and custom-engineered force and torque measurement solutions capable of testing micro-level forces and torques accurately. This focus on precision and regulatory adherence serves as a powerful foundational driver for sustained market growth.

Conversely, the market faces constraints primarily related to the high initial investment cost associated with advanced digital and calibrated measurement systems, particularly for Small and Medium Enterprises (SMEs) in emerging economies. Moreover, the complexity involved in operating and maintaining these high-precision instruments, requiring skilled technical personnel for accurate calibration and data interpretation, poses a restraint on widespread adoption in less industrialized regions. The market is also susceptible to economic cyclicality; downturns in major manufacturing sectors, such as automotive production or capital expenditure reductions in R&D, can temporarily suppress demand for new equipment purchases. The availability of reliable, certified calibration services and the adherence to traceable standards (like NIST or local equivalents) remains a necessary yet sometimes challenging requirement for users, influencing purchasing decisions.

Significant opportunities lie in developing highly portable, wireless, and cloud-connected measurement solutions that cater to field service applications and decentralized quality control processes. The emerging markets, especially in Asia Pacific, present fertile ground for growth, driven by massive foreign direct investment in manufacturing infrastructure and the gradual implementation of stricter local quality standards. The ongoing shift toward electric vehicles (EVs) creates a specialized niche for high-capacity torque measurement tailored for battery assembly and powertrain testing. Furthermore, manufacturers can capitalize on offering comprehensive service packages that include integrated software for data management, remote diagnostics, and automated calibration scheduling, moving beyond mere hardware sales. Addressing the complexity restraint through intuitive user interfaces and augmented reality (AR) guided maintenance protocols also offers a pathway for market differentiation and penetration.

The competitive forces within the market are intensified by the presence of a few dominant global players and numerous specialized regional niche providers. Buyer power is moderate to high, as instruments often require long-term contracts for calibration and servicing, but purchasing decisions are heavily influenced by reputation, precision ratings, and certifications. Supplier power is generally low for generic components but high for specialized sensor technologies (e.g., thin-film strain gauges). Substitute threats are low, as physical force and torque measurement remains essential and cannot be entirely replaced by simulation, although advanced non-contact measurement techniques offer limited substitution in highly specialized instances. New entrants face high barriers related to required precision manufacturing capabilities, quality certifications, and the established long-term trust required by high-stakes end-user industries like aerospace and medical devices.

Segmentation Analysis

The Force Gauge and Torque Meters Market is broadly segmented based on product type (Force Gauges vs. Torque Meters), operating mechanism (Digital vs. Analog), capacity range (Low, Medium, High), sensor technology, and crucially, by end-use industry. This granularity in segmentation allows for targeted market strategies, recognizing the highly specific requirements across different industrial applications. For instance, the demand drivers and technology preferences for a pharmaceutical company requiring ultra-low force measurement for tablet hardness testing differ significantly from an aerospace company needing high-capacity torque meters for structural component assembly. The evolution within these segments is characterized by a strong shift toward digital, networked devices that minimize human error and facilitate centralized data management compliant with modern quality control protocols like those mandated by ISO 9001 and specific industry regulations.

Within the product segmentation, the digital category continues to dominate market value, primarily due to its inherent advantages in accuracy, repeatability, and sophisticated data processing features. Digital force gauges and torque meters often include memory storage, statistical analysis functions, and connectivity options (USB, Bluetooth, Wi-Fi), making them indispensable for automated testing environments. Further breakdown within torque meters distinguishes between reaction torque sensors (measuring stationary torque) and rotary torque sensors (measuring dynamic torque), with rotary sensors experiencing heightened demand driven by powertrain testing in the automotive and energy sectors. Capacity segmentation reflects the breadth of applications, from micro-newton measurement in materials science to kilonewton applications in construction and heavy industry, ensuring that technology development is optimized for specific load requirements.

The end-use industry segmentation provides the most critical market insight, detailing where the spending power resides and identifying future growth clusters. While traditional manufacturing remains a core consumer, the most dynamic growth is observed in high-precision, high-regulation sectors. The increased complexity and miniaturization in electronics demand specialized micro-force measurement, while the rapid growth of the electric vehicle market creates an unprecedented need for precision torque measurement systems for automated battery module assembly and quality assurance. Understanding these specific application needs drives product innovation, such as developing explosion-proof meters for the oil and gas industry or ergonomically designed handheld meters for remote field testing, confirming that customization and industry-specific certifications are key differentiators in this market.

- By Product Type:

- Force Gauges (Compression, Tension, Universal)

- Torque Meters (Rotary, Reaction, Inline, Handheld)

- By Operating Mechanism:

- Digital

- Analog (Mechanical)

- By Capacity:

- Low Capacity (up to 500 N / 50 Nm)

- Medium Capacity (500 N to 10 kN / 50 Nm to 1 kNm)

- High Capacity (Above 10 kN / Above 1 kNm)

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Medical Devices and Pharmaceutical

- Electronics and Semiconductors

- Construction and Infrastructure

- Oil and Gas / Energy

- Research and Development / Academia

Value Chain Analysis For Force Gauge and Torque Meters Market

The value chain for the Force Gauge and Torque Meters market commences with upstream activities centered on the procurement of highly specialized raw materials and components, most critically, precision sensor technology. This includes acquiring high-grade metals (e.g., stainless steel, aluminum alloys) for durable housing and, most importantly, sourcing or manufacturing high-accuracy strain gauges, load cells, and piezoelectric components which form the core measurement element. Upstream suppliers hold significant leverage, especially those providing proprietary sensor technology or integrated circuit boards necessary for digital signal processing and communication interfaces. Manufacturers must maintain robust relationships with these specialized component suppliers to ensure quality consistency and continuous supply, which is critical given the stringent requirements for metrological traceability and accuracy in the final product. Dependence on specific micro-electronic components for digital instruments has recently introduced supply chain risks, prompting market players to dual-source key parts.

The midstream involves the core manufacturing, assembly, software integration, and most critically, calibration and certification processes. Force gauge and torque meter manufacturers invest heavily in sophisticated manufacturing facilities capable of producing robust, stable mechanical structures and cleanroom environments for electronic assembly. A vital differentiator at this stage is the ability to offer certified calibration services, often accredited by international bodies, ensuring the instruments provide traceable measurements. Software development is increasingly integrated into this stage, focusing on features like advanced data logging, trend analysis, networking capabilities (IIoT), and user-friendly human-machine interfaces (HMIs). The ability of a manufacturer to provide rapid, certified calibration and repair services determines long-term customer satisfaction and retention, making after-sales support an integral part of the production value.

Downstream activities focus on distribution, sales, and end-user support. Distribution channels are typically segmented into direct sales channels for major industrial clients (e.g., large aerospace manufacturers) requiring customization and technical consultation, and indirect channels relying on specialized industrial distributors, technical sales representatives, and increasingly, e-commerce platforms for standardized, off-the-shelf models. Technical expertise among the sales force is paramount, as customers often require consultation regarding instrument selection, integration, and compliance requirements. Post-sales support, including software updates, technical troubleshooting, and regular calibration services, often represents a significant revenue stream. The trend towards direct manufacturer-to-customer relationships is growing, allowing better control over branding, pricing, and service quality while bypassing traditional distributor margins, especially for high-end, customized measurement systems.

Force Gauge and Torque Meters Market Potential Customers

Potential customers for force gauges and torque meters span the entire spectrum of high-value manufacturing and industrial testing, united by the fundamental need for verifiable quality and operational safety. The primary buying centers are quality control departments, manufacturing engineers, and research & development laboratories. In the automotive industry, customers include OEMs (Original Equipment Manufacturers) who use these devices to ensure compliance in critical fastening applications (e.g., engine assembly, chassis components) and Tier 1 suppliers verifying material strength and structural integrity. The shift toward electric vehicles is generating a new cohort of customers focused on battery pack assembly quality and electric motor performance testing, demanding high-precision, dynamic torque measurements.

The aerospace and defense sector represents a highly lucrative, albeit smaller volume, customer base, where the non-negotiable requirement for absolute precision and certification (e.g., NADCAP accreditation) drives demand for the highest-tier, most robust, and frequently customized instruments. These customers utilize force gauges for fatigue testing of airframe structures and engine components, while torque meters verify fastener integrity in life-critical assemblies. Purchasing decisions here are heavily weighted toward longevity, metrological traceability, and vendor reputation. Furthermore, the medical device industry, encompassing manufacturers of implants, surgical tools, and drug delivery systems (e.g., syringes, auto-injectors), requires ultra-sensitive force gauges for functional testing and regulatory compliance (FDA clearance processes), forming a fast-growing customer segment prioritizing miniaturization and specialized sterile-environment compatibility.

Beyond these highly regulated sectors, the general manufacturing, packaging, and electronics industries form a broad base of consistent demand. Electronics companies utilize micro-force gauges for tactile testing of buttons, connectors, and solder joint strength, crucial for consumer satisfaction and product durability. Packaging companies rely on force and torque meters to test seal strength, cap removal torque, and container integrity, directly impacting shelf life and consumer accessibility. Additionally, academic and independent research laboratories constitute a steady customer stream, requiring versatile, high-accuracy instruments for materials science, mechanical engineering research, and fundamental scientific investigation, often valuing comprehensive data output and flexibility in testing procedures over sheer industrial robustness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Ametek Inc. (Chatillon), Mark-10 Corporation, Mecmesin Ltd., Shimpo Instruments (Nidec-Shimpo), Starrett (L.S. Starrett Company), Imada Inc., Extech Instruments (FLIR Systems), Sensor Technology Ltd., FUTEK Advanced Sensor Technology Inc., ZwickRoell GmbH & Co. KG, HBM (Hottinger Baldwin Messtechnik GmbH), Testometric Company Ltd., PCE Instruments, Magtrol Inc., Kistler Group, Interface Inc., Tovey Engineering Inc., Dillon/Cardinal Scale, S. Himmelstein and Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Force Gauge and Torque Meters Market Key Technology Landscape

The technological evolution of force gauges and torque meters is intrinsically linked to advancements in sensor physics, digital signal processing, and material science, all geared toward achieving higher accuracy, repeatability, and robustness. The strain gauge remains the foundational technology for most contemporary force and torque measurement devices. However, modern implementation involves sophisticated thin-film deposition techniques and advanced semiconductor manufacturing to create highly stable, miniature, and sensitive sensors integrated onto custom flexures. Recent innovations focus on multi-axis sensors capable of simultaneously measuring forces and torques in complex configurations (e.g., Fx, Fy, Fz, Tx, Ty, Tz), crucial for robotics, biomechanics, and detailed component testing where complex loading conditions exist. Furthermore, the use of contactless measurement technologies, particularly magnetic or optical systems for rotary torque measurement, is growing, offering advantages in high-speed, maintenance-free applications where traditional slip rings are impractical or introduce friction-based errors.

Digitalization represents the second major pillar of the technology landscape. Modern instruments incorporate high-resolution Analog-to-Digital Converters (ADCs) and powerful microprocessors to ensure rapid data acquisition rates and minimal noise interference, translating into more precise and stable readings. Connectivity standards, including Industrial Ethernet protocols (e.g., EtherCAT, PROFINET), Bluetooth Low Energy (BLE), and proprietary wireless standards, are now standard features, facilitating integration into automated production lines and allowing for remote monitoring. This digital evolution is enabling manufacturers to embed advanced software features directly into the devices, such as temperature compensation algorithms, automated peak capture, advanced filtering capabilities, and built-in statistical functions (e.g., standard deviation, CpK analysis), transforming the instruments into intelligent testing tools rather than just measurement hardware.

Future technological trends are heavily influenced by the demands of Industry 4.0 and IIoT integration. Manufacturers are deploying miniature, low-power sensors specifically designed for embedding into machinery and fixtures, enabling continuous, non-intrusive force and torque monitoring throughout the production cycle. This capability supports predictive quality control and machine health diagnostics. Advanced calibration technologies, including automated calibration rigs and sophisticated software that tracks sensor history and drift using AI, are minimizing the total cost of ownership and ensuring consistent metrological integrity over the life cycle of the instrument. Furthermore, the development of robust, sealed instruments certified for hazardous environments (e.g., IP68 rating, ATEX certification) continues to be a technological focus to penetrate sectors like oil & gas and specialized chemical processing, expanding the instruments' operational envelope beyond traditional laboratory settings.

Regional Highlights

- North America: This region maintains a high-value market share driven by stringent quality standards, particularly in the aerospace and defense sectors, which demand instruments of the highest metrological quality and certification. The United States is the primary consumer, supported by a strong R&D infrastructure and significant domestic manufacturing in medical devices and complex automotive components. The early and widespread adoption of smart manufacturing principles and IIoT integration ensures that demand is focused on high-end digital, networked instruments capable of complex data analysis and seamless automation integration. Furthermore, robust regulatory frameworks compel continuous investment in certified testing equipment for compliance assurance.

- Europe: Europe represents a mature but highly dynamic market, characterized by strong commitments to high-precision engineering and sustainable manufacturing practices, especially in Germany (automotive, machinery) and Switzerland/Ireland (medical devices, pharmaceuticals). European demand is heavily influenced by quality mandates (e.g., European Union directives) and a strong focus on automation and industrial robotics. The market growth here is driven less by capacity expansion and more by the replacement cycle for older analog equipment with modern, highly accurate, and wirelessly enabled digital systems. Investment in renewable energy sectors also spurs demand for high-capacity torque measurement tools for wind turbine and power generation component testing.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive foreign direct investment and indigenous expansion across manufacturing sectors, notably in China, India, and Southeast Asia. The region’s growth is characterized by large-volume purchases of instruments for production line quality control in electronics, automotive mass production, and general industrial machinery. While pricing sensitivity exists, there is a clear trend toward adopting mid-to-high capacity digital instruments as local standards and export quality expectations increase. Japan and South Korea, however, represent highly sophisticated markets similar to North America, focusing on advanced R&D and high-precision testing for semiconductors and specialized machinery.

- Latin America: This market is generally developing, with demand primarily concentrated in major economies like Brazil and Mexico, heavily influenced by their respective automotive and resource extraction industries. Market growth is sporadic and often tied to local government infrastructure spending or major international manufacturing partnerships. The adoption tends to favor cost-effective, durable instruments, though the need for certified testing equipment is rising due to increasing integration into global supply chains.

- Middle East and Africa (MEA): Growth in MEA is largely dependent on the oil and gas sector, which requires robust, certified, explosion-proof torque measurement devices for pipeline and drilling equipment maintenance. Initial industrialization and infrastructure projects across the UAE and Saudi Arabia also create specialized demand. The market for general manufacturing is still nascent, but long-term potential exists as governments focus on economic diversification away from primary resource dependence, which will necessitate the establishment of broader quality control infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Force Gauge and Torque Meters Market.- Mettler Toledo

- Ametek Inc. (Chatillon)

- Mark-10 Corporation

- Mecmesin Ltd.

- Shimpo Instruments (Nidec-Shimpo)

- Starrett (L.S. Starrett Company)

- Imada Inc.

- Extech Instruments (FLIR Systems)

- Sensor Technology Ltd.

- FUTEK Advanced Sensor Technology Inc.

- ZwickRoell GmbH & Co. KG

- HBM (Hottinger Baldwin Messtechnik GmbH)

- Testometric Company Ltd.

- PCE Instruments

- Magtrol Inc.

- Kistler Group

- Interface Inc.

- Tovey Engineering Inc.

- Dillon/Cardinal Scale

- S. Himmelstein and Company

Frequently Asked Questions

Analyze common user questions about the Force Gauge and Torque Meters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between digital and analog force gauges?

Digital force gauges offer superior accuracy, repeatability, and sophisticated data logging capabilities, including connectivity for automated systems. Analog gauges are typically less expensive, simpler to operate, and suitable for basic, non-critical measurements, lacking the data analysis features required for modern quality control compliance.

Which industry drives the highest demand for precision torque meters?

The Automotive and Transportation industry is the primary driver, specifically for verifying the correct tightening torque of critical fasteners in engine blocks, chassis, and increasingly, battery assemblies in electric vehicles (EVs), ensuring operational safety and structural integrity.

How does Industry 4.0 influence the design of new measurement instruments?

Industry 4.0 mandates instruments with integrated wireless connectivity, real-time data streaming, and standardized communication protocols (like EtherCAT). This enables seamless integration into IIoT networks for remote diagnostics, predictive maintenance, and centralized quality assurance systems.

What is the Compound Annual Growth Rate (CAGR) projected for this market?

The Force Gauge and Torque Meters Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by global manufacturing investments and stricter regulatory requirements for product quality.

What role does calibration play in the market and how often is it required?

Calibration is critical as it ensures metrological traceability and measurement accuracy, vital for maintaining quality standards (ISO/ASTM compliance). While frequency varies by usage and industry, typical intervals range from six months to annually, often necessitating certified, traceable recalibration services provided by manufacturers or accredited laboratories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager