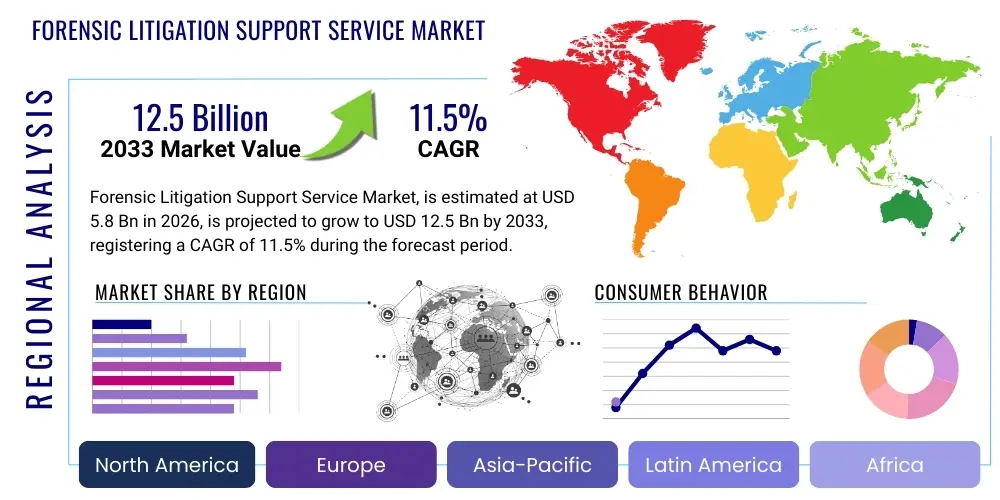

Forensic Litigation Support Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435249 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Forensic Litigation Support Service Market Size

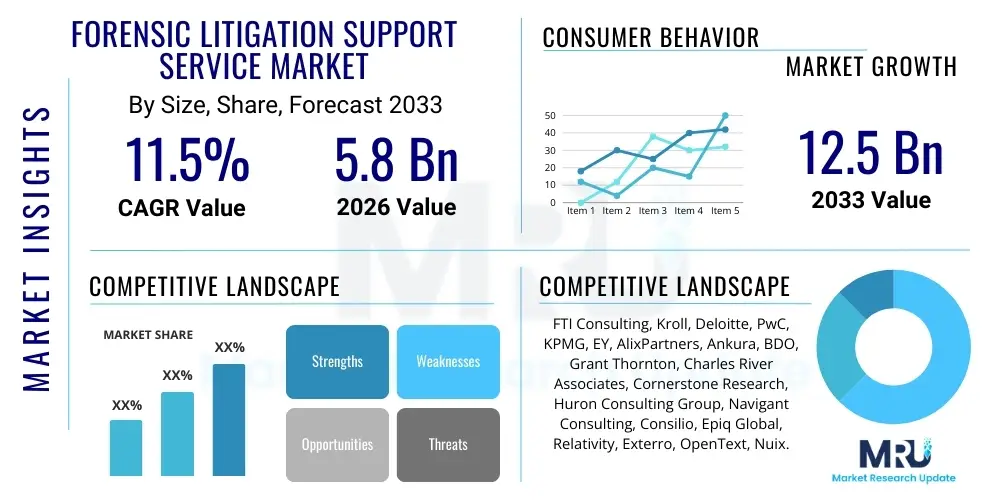

The Forensic Litigation Support Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $12.5 Billion by the end of the forecast period in 2033.

Forensic Litigation Support Service Market introduction

The Forensic Litigation Support Service Market encompasses specialized professional services designed to assist legal teams, corporations, and government entities in preparing for, responding to, and resolving complex legal disputes. These services leverage expertise in digital forensics, accounting, financial investigation, data analysis, and expert testimony to uncover, preserve, analyze, and present evidence critical to litigation success. As the volume and complexity of electronically stored information (ESI) continue to surge, coupled with increasingly stringent regulatory environments, the demand for sophisticated forensic support has become indispensable across sectors globally.

The core offering in this market involves meticulous handling of evidence, primarily through electronic discovery (eDiscovery), ensuring data integrity and chain of custody are maintained under legal scrutiny. Key applications include commercial disputes, intellectual property theft cases, regulatory inquiries (such as SEC or DOJ investigations), white-collar crime defense, and complex fraud investigations. The specialized product—the final evidence, report, or expert testimony—provides the factual foundation necessary for informed legal strategy and court presentation.

Major driving factors fueling this market include the global expansion of cross-border litigation, the necessity for compliance with evolving data privacy regulations (like GDPR and CCPA), and the intrinsic risk associated with enterprise data breaches and internal corporate misconduct. Benefits derived by utilizing these services range from reducing litigation risk and financial exposure to enhancing the credibility of factual arguments presented in court, thereby streamlining the overall legal process and achieving favorable outcomes.

Forensic Litigation Support Service Market Executive Summary

The Forensic Litigation Support Service Market is experiencing robust expansion driven primarily by rapid technological integration, notably in artificial intelligence (AI) and machine learning (ML) applied to eDiscovery workflows. Business trends indicate a strong shift towards comprehensive, end-to-end solutions that combine legal consulting, digital forensics, and data hosting into unified platforms, allowing major firms to offer highly scalable and defensible services globally. Corporations are increasingly engaging proactive forensic support for internal investigations and risk management, rather than solely reacting to external litigation, positioning the market evolution towards preventative legal technology adoption.

Regionally, North America maintains market dominance due to its highly litigious environment, mature regulatory landscape, and the presence of major legal tech innovators and top-tier service providers. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by increasing foreign direct investment, tightening regional data protection laws, and rising incidences of corporate fraud and cybercrime requiring sophisticated investigative capabilities. European growth is sustained by complex GDPR enforcement actions and cross-border regulatory harmonization efforts demanding advanced eDiscovery solutions.

Segment trends reveal that the Electronic Discovery (eDiscovery) segment continues to hold the largest market share, though forensic accounting and investigative services are demonstrating accelerated growth, particularly in mitigating financial misconduct and assessing damages in complex commercial disputes. The adoption of cloud-based forensic solutions is accelerating across all segments, favored for their flexibility, reduced infrastructure costs, and enhanced capabilities in handling massive, disparate datasets typical of modern litigation. This transition highlights a move away from legacy, on-premise solutions towards integrated, scalable cloud architectures for data processing and review.

AI Impact Analysis on Forensic Litigation Support Service Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Forensic Litigation Support Service Market primarily center on efficiency gains, accuracy, and the ethical implications of automating sensitive legal tasks. Common questions address how AI tools, such as predictive coding and technology-assisted review (TAR), can reduce the voluminous costs associated with manual document review, whether AI algorithms introduce bias into evidence identification, and the necessary balance between automation and human legal judgment. There is significant expectation that AI will standardize evidence collection protocols and enhance the speed of internal investigations, but concurrently, concern exists regarding data security when using third-party AI platforms and maintaining judicial acceptance of AI-derived findings. Users are looking for clarity on how AI enhances forensic accounting practices, particularly in fraud detection and anomaly identification within vast financial transaction records.

The impact of AI is fundamentally transforming the market by shifting the focus from high-volume manual labor to expert technological strategy. AI and machine learning are enabling service providers to handle exponentially larger data volumes with greater precision and speed than previously possible, democratizing complex analytical capabilities that were once prohibitive due to cost. This technological integration is forcing litigation support firms to recruit data scientists and specialized engineers alongside legal and accounting professionals, ensuring that the methodologies employed are statistically defensible and comply with evolving legal precedent regarding technological assistance in evidence presentation.

Furthermore, AI is crucial for optimizing early case assessment (ECA), allowing legal teams to quickly determine the relevance and risk profile of a case by rapidly analyzing initial data subsets. This preemptive analytical capability minimizes unnecessary data processing and storage costs, providing significant strategic advantages. While the integration presents challenges concerning data governance and algorithmic transparency, the overall consensus is that AI is an essential driver of future market growth, improving both the cost-effectiveness and efficacy of forensic support services globally, particularly in areas susceptible to human error like pattern recognition and classification.

- AI-driven Predictive Coding and Technology Assisted Review (TAR) significantly reduce document review costs and timeframes.

- Machine learning algorithms enhance fraud detection and anomaly identification in forensic accounting investigations.

- Natural Language Processing (NLP) improves evidence identification accuracy across multilingual and unstructured data sources.

- Automation streamlines data processing, ingestion, and early case assessment (ECA) protocols.

- AI necessitates specialized training for legal professionals to ensure defensibility of automated evidence methodologies.

- The adoption of advanced AI tools raises requirements for stringent data security and ethical compliance in data handling.

DRO & Impact Forces Of Forensic Litigation Support Service Market

The Forensic Litigation Support Service Market is shaped by powerful drivers and constraints, synthesized into critical impact forces that determine market trajectory. Key drivers include the exponential increase in the volume of Electronically Stored Information (ESI) across enterprises, compelling the need for specialized eDiscovery solutions, and the escalating frequency and sophistication of cyberattacks and corporate fraud, necessitating robust forensic investigations. Opportunities arise from the global expansion into untapped emerging markets and the increasing adoption of cloud-based forensic platforms that offer scalability and remote access, crucial for modern, geographically dispersed litigation teams. However, the market faces restraints, primarily high initial investment costs for advanced forensic technology and a persistent shortage of skilled professionals capable of bridging the gap between legal expertise and technological proficiency.

Impact forces illustrate how these elements interact to influence market dynamism. Regulatory scrutiny, driven by strict data protection laws (like GDPR, CCPA, and sector-specific regulations), acts as a primary external driver, making forensic readiness a mandatory component of corporate governance rather than an optional expense. Conversely, the market is constrained by the inherent sensitivity of litigation data, demanding absolute security and adherence to complex jurisdictional data residency requirements, which can impede the global standardization of service offerings. The rapid pace of technological obsolescence also necessitates continuous capital expenditure on software licenses and hardware upgrades, challenging smaller service providers.

Despite the high barrier to entry related to technological investment and regulatory compliance, the market's trajectory remains strongly positive. The growing realization that effective litigation support minimizes potential multi-million dollar liabilities for organizations outweighs the immediate costs associated with implementation. Furthermore, the trend toward globalized business operations ensures a steady stream of cross-border disputes, where forensic services are crucial for navigating disparate legal systems and collecting evidence across multiple jurisdictions. The interplay between sophisticated digital crime and rigorous legal enforcement provides a sustained, long-term growth environment for specialized litigation support services.

Segmentation Analysis

The Forensic Litigation Support Service Market is highly fragmented and segmented based on the nature of the service provided, the technology utilized, and the specific end-user industry requiring support. Understanding these segmentations is crucial for identifying areas of highest growth potential and competitive specialization. The market structure reflects the complexity of modern legal disputes, which often require a convergence of technical, financial, and investigative expertise. Segmentation analysis allows service providers to tailor bespoke solutions, ranging from high-volume data processing for large corporate litigation to specialized expert testimony in niche financial fraud cases.

The primary axes of segmentation include Service Type, which distinguishes between the technical processing of electronic data (eDiscovery) and the subjective analysis required for financial misconduct or witness preparation (Forensic Accounting, Expert Testimony). Furthermore, segmentation by End-User identifies the varying needs of law firms (which often outsource technical work), corporations (which require internal investigative support), and government agencies (which handle massive regulatory and criminal cases). Technological segmentation underscores the shift toward specialized software platforms, highlighting the growing market for sophisticated AI/ML-driven analytical tools.

Growth trends within segmentation suggest that integrated segments offering both legal consulting and technical implementation are gaining preference, particularly among large corporate clients seeking single-vendor accountability. While eDiscovery remains the foundational revenue driver, the forensic accounting segment is experiencing significant acceleration due to the global crackdown on illicit financial activities and complex corporate governance issues. These intricate segment dynamics underscore a market maturing towards holistic, technologically intensive service offerings that address the full lifecycle of a legal dispute, from initial risk assessment through final court judgment.

- By Service Type:

- Electronic Discovery (eDiscovery)

- Forensic Accounting

- Expert Witness Testimony

- Investigative Services

- Consulting and Litigation Readiness

- By End-User:

- Law Firms

- Corporations and Enterprises

- Government Agencies and Regulators

- Financial Institutions

- Insurance and Healthcare Providers

- By Technology:

- Data Analytics Software

- Artificial Intelligence and Machine Learning Tools

- Cloud-based Forensic Platforms

- Cybersecurity and Data Preservation Tools

- Review Platforms (TAR/Predictive Coding)

Value Chain Analysis For Forensic Litigation Support Service Market

The value chain for the Forensic Litigation Support Service Market is fundamentally defined by the specialized processes required to transform raw, digital, and financial data into legally defensible evidence. The chain begins with Upstream activities, involving the core technology developers—software vendors providing forensic imaging tools, eDiscovery processing engines, and review platforms. These developers invest heavily in research and development to ensure their tools comply with legal standards (such as defensible preservation and collection methodologies) and can handle emerging data types (e.g., mobile device data, social media, ephemeral messaging).

Midstream activities constitute the core service delivery, managed by litigation support firms. This stage involves data collection and preservation, forensic processing (including deduplication, filtering, and analysis), and document review. The distribution channel is crucial here, typically involving direct engagement between the service provider and the client (Law Firms or Corporate Legal Departments). Direct engagement ensures high levels of communication, customized strategic advice, and strict adherence to the client's case strategy and jurisdictional rules. Indirect channels, although less common, involve partnerships where large consulting firms may outsource highly technical processing tasks to niche forensic technology vendors.

Downstream activities focus on the final output—the provision of expert analysis and presentation in legal proceedings. This includes generating detailed forensic reports, providing testimony through expert witnesses, and offering strategic consulting to legal counsel. The efficacy of the entire value chain is measured by the defensibility and persuasive quality of the final evidence presented in court. The integration of high-level human expertise (legal and financial) with sophisticated technological tools defines success in this market, establishing a feedback loop where courtroom outcomes influence upstream technology development and downstream service protocols.

Forensic Litigation Support Service Market Potential Customers

The primary potential customers and end-users of Forensic Litigation Support Services are entities engaged in, or preparing for, complex legal disputes, regulatory investigations, or internal risk assessments that involve significant volumes of data. The largest customer base remains large law firms, particularly those specializing in corporate litigation, intellectual property, and white-collar defense, who rely heavily on outsourced technical expertise for efficient eDiscovery and secure data management. Law firms act as intermediaries, channeling the services toward their end clients but requiring the highest standards of technical execution and adherence to court deadlines.

Corporations, particularly those operating in highly regulated industries like banking, pharmaceuticals, energy, and technology, form the second critical customer segment. These corporations utilize forensic support not just in reactive litigation but increasingly for proactive compliance and internal investigations related to fraud, employee misconduct, and regulatory audits. The growth in this segment is driven by the mandate for robust governance and the need to protect sensitive intellectual property and trade secrets, often requiring discrete, rapid response forensic services directly in-house.

Furthermore, government agencies and financial regulators constitute a substantial and specialized customer group. Agencies such as the Securities and Exchange Commission (SEC), Department of Justice (DOJ), and various antitrust bodies require expert forensic accounting and eDiscovery services to manage complex, large-scale regulatory enforcement actions and criminal prosecutions. Their unique needs often involve handling classified information and processing massive archives of public and private sector data, making them consistent buyers of advanced, secure forensic solutions tailored for governmental mandates and institutional integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $12.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FTI Consulting, Kroll, Deloitte, PwC, KPMG, EY, AlixPartners, Ankura, BDO, Grant Thornton, Charles River Associates, Cornerstone Research, Huron Consulting Group, Navigant Consulting, Consilio, Epiq Global, Relativity, Exterro, OpenText, Nuix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forensic Litigation Support Service Market Key Technology Landscape

The technological landscape of the Forensic Litigation Support Service Market is characterized by continuous innovation aimed at handling the immense scale and diversity of modern data sources. Core technology relies on forensic imaging tools (like EnCase and FTK) used for the defensible collection and preservation of data from computers, servers, and mobile devices, ensuring the chain of custody remains intact. Following collection, data processing is heavily reliant on specialized eDiscovery platforms (such as Relativity and Nuix), which perform functions like indexing, metadata extraction, culling, and early case assessment. These platforms are increasingly shifting to cloud-native architectures (e.g., Azure or AWS) to manage large datasets flexibly and securely, minimizing latency and infrastructure overhead for global investigations.

The most transformative technology in recent years is the integration of Artificial Intelligence and Machine Learning (AI/ML). AI-based tools, particularly Technology Assisted Review (TAR) and predictive coding, are essential for filtering irrelevant information from complex document sets, significantly reducing the human effort required for review. Furthermore, sophisticated data analytics software is deployed in forensic accounting investigations to identify complex financial fraud patterns, anomalous transactions, and potential collusion by visualizing intricate data relationships. These tools move beyond simple keyword searches to complex conceptual and thematic clustering, enhancing the efficiency and effectiveness of the investigative phase.

Cybersecurity tools also form a crucial part of the landscape, especially those designed for rapid incident response and data breach investigations. Litigation support firms must employ advanced endpoint detection and response (EDR) and threat intelligence platforms not only to assist clients in post-breach analysis but also to protect the highly sensitive data they collect and host for litigation purposes. The trend is moving toward consolidated, integrated technology stacks that provide seamless transitions from defensible data collection and preservation through to final document production and expert presentation, necessitating platforms that are interoperable and highly customizable to specific legal requirements and jurisdictional mandates.

Regional Highlights

Regional dynamics heavily influence the demand and deployment of Forensic Litigation Support Services, reflecting differences in legal systems, regulatory maturity, and economic development. North America, encompassing the United States and Canada, remains the largest and most technologically advanced market. The region’s dominance is attributable to its highly formalized and litigious legal system, particularly the strict rules governing eDiscovery under the Federal Rules of Civil Procedure (FRCP), which necessitate constant technological sophistication among service providers. The US is also home to the majority of leading forensic consulting firms and eDiscovery software developers, establishing it as the global benchmark for innovation and best practices in litigation support.

Europe represents a mature but rapidly evolving market, driven significantly by the implementation and enforcement of the General Data Protection Regulation (GDPR) and other EU-wide financial regulations. The market here is characterized by complex cross-border litigation requiring solutions capable of navigating diverse national laws and handling multilingual data sets. Demand is robust in the UK, Germany, and France, where forensic accounting and regulatory investigative services are crucial for compliance and white-collar defense. The challenge in Europe lies in balancing centralized technical efficiency with strict data sovereignty requirements mandated by various member states.

Asia Pacific (APAC) is projected to exhibit the fastest growth over the forecast period. This acceleration is driven by burgeoning commercial activity, rising levels of cross-border corporate fraud, and the recent introduction of comprehensive data protection and privacy laws (such as in China, India, and Australia) that mimic Western standards. Countries like Singapore, Hong Kong, and Australia serve as regional hubs for complex commercial disputes and arbitration, driving demand for technologically advanced eDiscovery and financial investigative support. The Middle East and Africa (MEA) market, though smaller, is showing increasing potential, particularly in financial centers like the UAE and Saudi Arabia, where regulatory frameworks are hardening and corporate governance standards are improving, increasing the need for external forensic expertise.

- North America: Market leader, driven by mandatory eDiscovery requirements (FRCP), high litigation frequency, and concentration of key technology vendors.

- Europe: Growth influenced heavily by GDPR compliance, cross-border regulatory inquiries, and demand for multilingual forensic services.

- Asia Pacific (APAC): Fastest-growing region, fueled by increasing corporate fraud, regional economic expansion, and maturing data protection laws (e.g., in Australia, Singapore, and China).

- Latin America (LATAM): Emerging market characterized by increasing regulatory compliance needs and growth in anti-corruption investigations.

- Middle East and Africa (MEA): Growth concentrated in key financial hubs, focusing primarily on financial investigative services and corporate governance audits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forensic Litigation Support Service Market.- FTI Consulting

- Kroll

- Deloitte

- PwC (PricewaterhouseCoopers)

- KPMG

- EY (Ernst & Young)

- AlixPartners

- Ankura

- BDO

- Grant Thornton

- Charles River Associates (CRA)

- Cornerstone Research

- Huron Consulting Group

- Navigant Consulting (now part of Guidehouse)

- Consilio

- Epiq Global

- Relativity

- Exterro

- Nuix

- OpenText

Frequently Asked Questions

Analyze common user questions about the Forensic Litigation Support Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Forensic Litigation Support Service Market?

The market's primary driver is the exponential growth of electronically stored information (ESI) coupled with increasingly strict global regulatory compliance mandates (like GDPR and CCPA), compelling organizations to utilize sophisticated eDiscovery and forensic investigation techniques to manage legal and regulatory risk efficiently.

How is Artificial Intelligence (AI) fundamentally changing eDiscovery services?

AI, through tools like predictive coding and Technology Assisted Review (TAR), fundamentally changes eDiscovery by automating the review of massive datasets. This reduces manual labor costs, accelerates the evidence identification process, and improves the overall accuracy and defensibility of the legal review phase.

Which service segment holds the largest share in the Forensic Litigation Support Market?

The Electronic Discovery (eDiscovery) segment currently holds the largest market share, driven by the universal need for defensible data preservation, processing, and review in virtually all forms of complex modern litigation and regulatory inquiries.

What are the key restraints affecting the market growth?

Key restraints include the high capital expenditure required for acquiring and maintaining advanced forensic technology platforms, and the persistent global shortage of highly specialized professionals who possess both deep legal knowledge and advanced digital forensic expertise.

Which region is expected to demonstrate the highest growth rate by 2033?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, increased corporate fraud complexity, and the proliferation of new, stringent data protection and privacy regulations across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager