Forestry and Agricultural Tractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435376 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Forestry and Agricultural Tractor Market Size

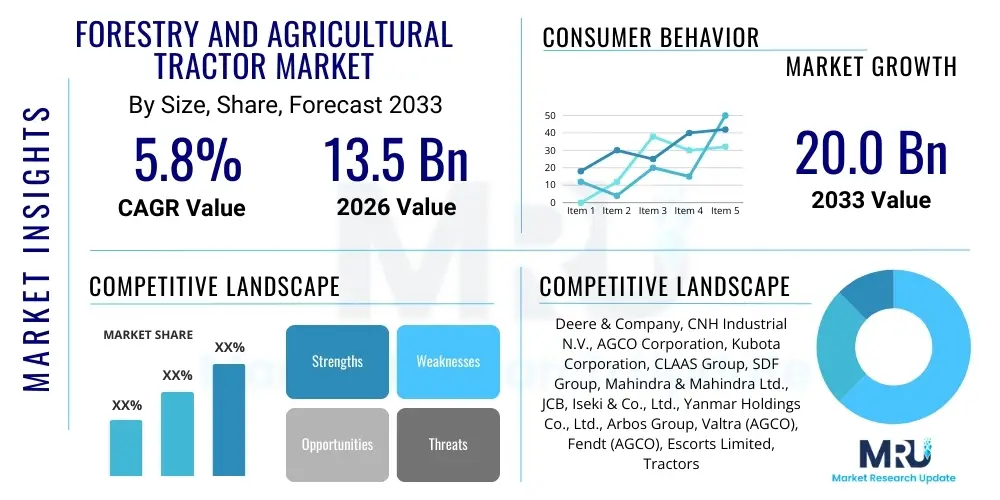

The Forestry and Agricultural Tractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

Forestry and Agricultural Tractor Market introduction

The Forestry and Agricultural Tractor Market encompasses a diverse range of heavy-duty motorized equipment specifically designed for specialized tasks in crop cultivation, livestock management, and timber harvesting operations. These tractors are engineered to handle rugged terrain, demanding workloads, and integrate advanced implements necessary for modern farming and forestry practices. The agricultural segment dominates the market, driven by the necessity for enhanced mechanization to meet global food security demands and improve operational efficiencies across farms of varying sizes. Key products include utility tractors, row-crop tractors, articulated four-wheel-drive tractors, and specialized vineyard or orchard tractors, each optimized for specific environments and tasks, thereby facilitating high levels of productivity in land preparation, planting, harvesting, and material handling.

The core function of modern agricultural tractors extends far beyond simple plowing or towing; they serve as intelligent, connected platforms for precision agriculture. Equipped with sophisticated systems such as GPS guidance, telemetry, and advanced hydraulic controls, these machines are integral to optimizing input use, minimizing waste, and maximizing yield. Benefits associated with adopting advanced agricultural tractors include substantial reductions in labor costs, improved accuracy in seeding and fertilization, and better soil health management through reduced compaction and precise tilling. Furthermore, the forestry sector utilizes heavy-duty tracked and wheeled skidders, forwarders, and harvesters, which are specialized tractors designed for robust movement and efficient logging operations in challenging forest environments while adhering to increasing sustainability standards.

Market growth is predominantly driven by the accelerating global trend towards farm consolidation and the subsequent adoption of high-horsepower, technologically integrated machinery, particularly in developing economies transitioning from manual labor to mechanization. Government subsidies and favorable policies promoting agricultural modernization in regions like Asia Pacific and Latin America further stimulate demand. Additionally, stringent emissions standards necessitate manufacturers to invest heavily in engine technology, propulsion systems, and alternative fuels, pushing the market towards more fuel-efficient and environmentally compliant tractors. The continuous integration of digital technologies, connectivity features, and automation capabilities is transforming these traditional machines into sophisticated data-gathering and executing systems, fundamentally redefining the future of farming and forestry.

Forestry and Agricultural Tractor Market Executive Summary

The global Forestry and Agricultural Tractor market is poised for robust expansion, primarily fueled by the imperative to increase crop yields to support a growing global population and the concurrent push for sustainable resource management in the forestry sector. Current business trends indicate a strong focus on merging traditional heavy machinery manufacturing with digital solution providers, resulting in highly automated and data-centric equipment offerings. Manufacturers are prioritizing product differentiation through features such as autonomous operation capabilities, telematics for predictive maintenance, and seamless integration with farm management information systems (FMIS). The market is highly competitive, characterized by strategic acquisitions and partnerships aimed at strengthening regional supply chains and accelerating the deployment of electric and hybrid powertors, which represent a significant shift toward cleaner energy sources in agricultural applications.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market expansion, driven by massive investments in agricultural infrastructure, widespread government support for mechanization, and the presence of a vast smallholder farm base that is rapidly adopting smaller, utility-focused tractors. North America and Europe, while representing mature markets, are characterized by high demand for premium, high-horsepower tractors equipped with the latest precision farming technologies, reflecting the trend toward large-scale corporate farming operations and stringent environmental regulations. Emerging markets in Latin America and Africa are exhibiting high growth potential, attributed to expanding arable land use and initiatives aimed at improving productivity and reducing post-harvest losses, making them crucial targets for global manufacturers seeking sustained long-term growth.

Segment trends highlight the growing dominance of high-horsepower (over 100 HP) tractors in developed economies, necessary for operating large implements across extensive land areas efficiently. Conversely, the utility tractor segment (30-100 HP) remains crucial in APAC and Latin America. Technology segmentation shows a rapid increase in the adoption rate of autonomous and semi-autonomous systems, driven by labor shortages and the desire for 24/7 operational capability. Furthermore, the component market is witnessing a surge in demand for sophisticated sensors, advanced hydraulic systems, and specialized tire technologies optimized for reduced soil compaction and improved traction, indicating a market-wide commitment to technical sophistication and enhanced field performance across all vehicle types.

AI Impact Analysis on Forestry and Agricultural Tractor Market

User inquiries regarding AI's influence in the Forestry and Agricultural Tractor Market primarily revolve around its role in achieving autonomous operation, optimizing input usage (like seeds, fertilizers, and pesticides), and enhancing predictive maintenance schedules. Key themes include concerns about the reliability and security of AI-driven systems in harsh field conditions, the necessity for robust connectivity infrastructure in remote agricultural areas, and the potential impact on labor requirements and skills training. Users are keenly interested in how machine learning algorithms analyze real-time data from sensors (vision, LiDAR, thermal) to make split-second operational decisions, such as path planning, implementing variable rate applications, and diagnosing equipment faults before catastrophic failure. Expectations are high regarding AI’s ability to significantly boost efficiency, reduce environmental impact, and enable true "hands-off" farming, thus addressing critical challenges like climate change variability and rising operational costs.

Artificial Intelligence is transforming tractors from simple mechanical workhorses into sophisticated robotic systems capable of complex decision-making. AI-driven vision systems, utilizing deep learning models, allow tractors to differentiate between crops and weeds, enabling targeted herbicide application, reducing chemical usage, and improving sustainability scores. Furthermore, predictive maintenance powered by AI analyzes complex telematics data—engine performance metrics, vibration levels, fluid temperatures—to anticipate component failure with high accuracy, minimizing unplanned downtime and maximizing the operational lifespan of high-value machinery. This shift is not just about automation but about leveraging data to achieve unprecedented levels of operational intelligence and efficiency in every phase of the agricultural and forestry cycles.

The integration of AI also significantly impacts the design and functionality of agricultural software ecosystems. Farmers now rely on platforms that use AI to merge satellite imagery, weather data, soil sample analysis, and in-field sensor readings to generate actionable insights and prescription maps. Tractors, utilizing edge computing capabilities, execute these AI-generated prescriptions with precision. For forestry, AI algorithms optimize logging routes, monitor tree health, and improve the safety of heavy equipment operation in hazardous environments. This level of technological integration necessitates substantial investments in digital infrastructure, specialized data scientists, and training programs to ensure the effective deployment and utilization of these next-generation intelligent tractors.

- AI-powered autonomous navigation and path optimization dramatically reduces operator error and fuel consumption.

- Machine learning enables variable rate technology (VRT), optimizing input distribution based on localized field needs and real-time data analysis.

- Predictive maintenance schedules, driven by AI algorithms analyzing sensor data, reduce costly unexpected equipment failures and maximize uptime.

- Advanced computer vision and deep learning models facilitate precise weed identification and targeted spraying, promoting sustainable farming practices.

- AI enhances operational safety by monitoring the environment and making real-time adjustments to tractor behavior in challenging terrain.

DRO & Impact Forces Of Forestry and Agricultural Tractor Market

The Forestry and Agricultural Tractor Market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities, which collectively exert significant Impact Forces on industry growth trajectory. The primary driver remains the increasing global population, necessitating substantial growth in agricultural productivity, particularly in emerging economies where food demand is escalating rapidly. This demand pushes the need for higher yield per acre, which is fundamentally achievable only through advanced mechanization and the adoption of high-performance tractors. However, this growth is significantly constrained by the substantial initial capital investment required for these sophisticated machines, especially for small and medium-sized farmers who often lack access to favorable financing or sufficient operational scale to justify the high cost of technologically advanced equipment.

Key opportunities within this market stem from the rapid technological evolution towards precision agriculture and smart farming. The development of electric and hybrid tractors presents a major market avenue, driven by global mandates to reduce carbon footprints and lower reliance on fossil fuels. Furthermore, the integration of IoT (Internet of Things) and sophisticated data analytics offers manufacturers an opportunity to shift toward service-based business models, providing subscription services for software, maintenance, and data interpretation, thereby creating recurring revenue streams. The rising incidence of labor shortages in developed agricultural regions also fuels the opportunity for fully autonomous tractors, offering a viable solution to operational continuity and efficiency, fundamentally restructuring labor economics in farming.

The impact forces shaping the market involve intense regulatory pressures, particularly surrounding engine emissions (Tier 4 Final/Stage V standards), which compel continuous technological innovation and R&D investment by manufacturers. Competitive intensity is high, forcing companies to constantly innovate and differentiate products based on fuel efficiency, operator comfort, and integration capabilities. Furthermore, macroeconomic instability, including fluctuating commodity prices and global supply chain disruptions (e.g., semiconductor shortages), acts as a pervasive impact force, affecting production capacity and pricing strategies across the industry. Successful navigation of these forces requires resilience in supply chain management and a proactive approach to adopting sustainable and digitally integrated solutions.

Segmentation Analysis

The Forestry and Agricultural Tractor market is meticulously segmented based on horsepower, drive type, application, and equipment type, reflecting the varied operational requirements across global agricultural and forestry landscapes. Understanding these segmentations is critical for manufacturers to tailor their product offerings and marketing strategies effectively, addressing the nuanced needs of commercial farms, smallholder operations, and specialized forestry outfits. The segmentation by horsepower is arguably the most influential differentiator, as it directly correlates with the size of the farm operation and the type of implements the tractor can effectively utilize. Low-to-mid horsepower tractors (under 100 HP) are favored in Asia and Africa for small-to-medium landholdings, while high-horsepower models (above 100 HP) dominate large-scale corporate farming in North America and Europe, driving significant revenue due to their advanced feature sets and higher price points.

The segmentation by drive type—two-wheel drive (2WD) and four-wheel drive/mechanical front-wheel drive (4WD/MFWD)—highlights differences in operational terrains and tractive effort requirements. MFWD tractors are increasingly preferred globally due to their superior traction, stability, and versatility across diverse soil conditions, making them suitable for heavy-duty tasks like plowing and subsoiling. Conversely, 2WD tractors maintain a market share due to their lower maintenance cost and suitability for lighter tasks and road transport. Application segmentation clearly delineates the specialized nature of the equipment, dividing the market into agriculture (the largest share, including row cropping, vineyard, orchard, and utility) and forestry (including skidders, forwarders, and loaders), each requiring distinct design specifications concerning durability, ground clearance, and attachment integration.

Future growth will be disproportionately driven by the technology segment, specifically the adoption of smart tractors equipped with telematics, GPS, and advanced automation systems. This technological adoption cuts across all other segments, enhancing the value proposition of even mid-range tractors. Furthermore, the specialized tractor segment, particularly electric and hybrid variants, is anticipated to accelerate rapidly as regulations tighten and operational costs associated with conventional diesel engines increase. Manufacturers are thus focusing R&D efforts on modular designs that allow seamless integration of advanced components regardless of the tractor's core horsepower or application focus, aiming for maximum compatibility and future-proofing in a digitally integrated agricultural ecosystem.

- By Horsepower (HP)

- Below 40 HP (Compact and Small Utility)

- 40 HP – 100 HP (Mid-range Utility)

- 101 HP – 200 HP (Row Crop and High-End Utility)

- Above 200 HP (High Horsepower/Articulated)

- By Drive Type

- Two-Wheel Drive (2WD)

- Four-Wheel Drive (4WD/MFWD)

- By Application

- Agriculture (Plowing, Tillage, Harvesting, Planting)

- Forestry (Skidding, Loading, Harvesting)

- By Equipment Type

- Wheeled Tractors

- Tracked Tractors

- Specialty Tractors (Orchard, Vineyard)

- Articulated Tractors

Value Chain Analysis For Forestry and Agricultural Tractor Market

The value chain for the Forestry and Agricultural Tractor Market is complex and highly structured, starting with upstream suppliers of raw materials and sophisticated components, moving through manufacturing and assembly, and concluding with robust downstream distribution channels and post-sale services. Upstream analysis involves major industries supplying critical components, including high-grade steel and alloys for chassis and frames, advanced engine components (meeting stringent emission standards), hydraulic systems, and sophisticated electronics (ECUs, sensors, telematics hardware). The efficiency and stability of these upstream suppliers directly influence the final product quality and the manufacturer’s ability to meet production quotas. Any volatility or technological lag in the component supply chain, such as shortages of semiconductors or specific powertrain parts, can significantly disrupt the core manufacturing phase, highlighting the importance of resilient supply contracts and supplier diversity.

The manufacturing and assembly phase involves complex integration processes where major Original Equipment Manufacturers (OEMs) assemble these diverse components into the final tractor unit. This stage is highly capital-intensive, requiring advanced robotics, precision machining, and specialized labor. Differentiation at this stage is achieved through proprietary technology integration, such as advanced transmission systems, intelligent hydraulic controls, and specialized cab designs emphasizing operator comfort and safety. Following manufacturing, the distribution channel is bifurcated into direct and indirect routes. Direct sales often cater to large governmental or corporate clients, offering customized fleet solutions. However, the indirect channel, relying on an extensive network of independent dealerships, is the predominant method for reaching end-users globally, providing localized sales, credit facilities, and critical after-sales support.

Downstream analysis focuses heavily on the dealership network and the critical role of aftermarket services, parts supply, and digital support infrastructure. Tractors are durable goods requiring ongoing maintenance, making the reliability of the dealership network a significant factor in customer satisfaction and brand loyalty. Dealers provide essential services, including warranty repairs, preventative maintenance, and increasingly, technical support for precision agriculture software and telematics systems. The shift towards connected machinery has elevated the importance of digital distribution channels for software updates and data services. This comprehensive value chain ensures that the high costs associated with tractor ownership are justified by long operational lifespans and continuous technological support throughout the machine's lifecycle, creating a high barrier to entry for new competitors.

Forestry and Agricultural Tractor Market Potential Customers

The primary potential customers and end-users of the Forestry and Agricultural Tractor Market span across four major categories: large commercial farming enterprises, small and medium-sized farm operators, forestry companies, and agricultural equipment rental providers. Large commercial farms, especially those operating in North America, Europe, and Australia, represent the most lucrative segment for high-horsepower, technologically advanced tractors. These customers require equipment capable of covering vast acreages quickly and precisely, demanding features such as full autonomy, advanced telematics, and high fuel efficiency. Their purchasing decisions are driven by ROI calculations, emphasizing reduced operational costs, maximum yield optimization, and the integration of machinery into comprehensive farm management information systems (FMIS).

Small and medium-sized farm operators, particularly prevalent in developing economies across Asia Pacific, Latin America, and Africa, constitute a huge volume market for compact and utility tractors (typically under 100 HP). These buyers prioritize affordability, durability, ease of maintenance, and versatility, often needing tractors that can perform multiple tasks beyond basic field work, such as transportation and material handling. Government subsidies and microfinance schemes play a vital role in enabling these customers to access essential mechanization. Manufacturers target this segment by focusing on robust, simple designs and establishing widespread, accessible service networks, making equipment ownership feasible for first-time mechanization adopters.

Specialized customers, including large-scale timber harvesting companies and municipal organizations, require highly specialized tracked and wheeled tractors, such as skidders, forwarders, and dozers, designed for extreme durability and environmental compliance in rugged terrain. These customers are focused on machine robustness, high lift capacity, and adherence to sustainability certifications. Furthermore, equipment rental and leasing companies represent a rapidly growing customer base, especially for mid-range and high-end equipment. These rental services allow smaller farms access to capital-intensive machinery without the upfront financial burden, acting as an important conduit for disseminating modern technology and influencing future purchasing decisions across the broader agricultural community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, CLAAS Group, SDF Group, Mahindra & Mahindra Ltd., JCB, Iseki & Co., Ltd., Yanmar Holdings Co., Ltd., Arbos Group, Valtra (AGCO), Fendt (AGCO), Escorts Limited, Tractors and Farm Equipment Limited (TAFE), Versatile, Kirovets, Zoomlion Heavy Industry Science and Technology Co., Ltd., Lovol Heavy Industry Co., Ltd., TYM Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forestry and Agricultural Tractor Market Key Technology Landscape

The technology landscape of the Forestry and Agricultural Tractor Market is rapidly transitioning toward digitally integrated and environmentally sustainable solutions, moving away from purely mechanical operations. A central technological focus is precision farming, enabled by Global Navigation Satellite Systems (GNSS) and advanced sensor technologies. GNSS allows for sub-inch accuracy in field operations, supporting automated steering systems and minimizing overlap, thereby saving fuel and optimizing input use. Furthermore, sophisticated hydraulic systems, including closed-center load-sensing hydraulics (CCLS), provide highly responsive and energy-efficient control over complex implements, crucial for high-speed planting and harvesting operations. Engine technology is also evolving, with common rail fuel injection and exhaust after-treatment systems (Selective Catalytic Reduction, Diesel Particulate Filters) dominating to comply with Tier 4 Final/Stage V emission standards, significantly impacting engine design complexity and manufacturing costs.

Connectivity and data management represent another critical technological pillar. Modern tractors are now equipped with telematics devices that continuously transmit operational data, allowing farmers and fleet managers to monitor performance, fuel consumption, and maintenance requirements remotely. The integration of IoT sensors throughout the machine and its implements allows for real-time diagnostics and predictive maintenance, transitioning service models from reactive repair to proactive intervention. The standardization of communication protocols, such as ISOBUS, ensures interoperability between tractors and implements from different manufacturers, maximizing flexibility for farmers. This data-centric approach is vital for the development of AI and machine learning algorithms that refine operational efficiency and inform agronomic decisions.

Looking ahead, the development of alternative propulsion systems, specifically electric and hybrid tractors, is gaining momentum, particularly in the lower-to-mid horsepower segment. Electric powertrains offer advantages in torque delivery, reduced noise, and zero tailpipe emissions, addressing both sustainability concerns and operational efficiency in enclosed spaces like barns or specialized orchards. Additionally, advancements in human-machine interface (HMI) technology are improving operator experience through intuitive touchscreen displays, augmented reality diagnostics, and ergonomic cab designs. The synergy between autonomous guidance systems, advanced connectivity, and cleaner power sources is defining the next generation of smart tractors, where data intelligence is as valuable as horsepower, positioning technology as the central competitive battleground in the industry.

Regional Highlights

Geographically, the Forestry and Agricultural Tractor Market exhibits distinct growth patterns and maturity levels across major global regions, reflecting variations in farm size, government support, and technological adoption rates. Asia Pacific (APAC) is projected to maintain its position as the largest and fastest-growing regional market. This robust growth is primarily attributable to large-scale government initiatives in countries like India and China, aimed at modernizing agricultural practices, providing subsidies for small tractors, and improving farm productivity to feed dense populations. The demand is heavily skewed toward low-to-mid HP utility tractors that suit the region’s fragmented landholdings. Increasing disposable incomes among farmers and the shift from traditional farming methods to mechanization further cement APAC’s crucial role in global market expansion.

North America and Europe represent highly mature markets characterized by replacement demand and a strong focus on high-horsepower and high-specification equipment, essential for large commercial operations. In North America, the market is driven by large-scale corporate farming, demanding autonomous capabilities, highly efficient engines, and integrated precision agriculture solutions (GPS, telematics). European demand is uniquely shaped by stringent environmental regulations (Stage V emissions) and a strong emphasis on sustainability, leading to higher penetration of advanced clean engine technologies and specialized equipment for niche markets like vineyards and horticulture. These regions are the global leaders in adopting cutting-edge technologies, acting as early adopters for electrification and autonomous vehicle trials.

Latin America and the Middle East & Africa (MEA) are defined as emerging markets with significant untapped potential. Latin America, particularly Brazil and Argentina, shows strong demand for powerful, durable tractors necessary for cultivating vast areas of staple crops, driven by the expanding global demand for agricultural commodities. The MEA region is at an earlier stage of mechanization, with high growth potential fueled by large-scale government agricultural development projects and efforts to enhance food security. Growth in Africa is often supported by international development aid and focuses on cost-effective, durable utility models. Navigating diverse logistical challenges and providing suitable financing structures are key determinants of success in these emerging markets, making them critical future growth regions for global tractor manufacturers seeking market diversification.

- North America: Focus on high-horsepower tractors, autonomous systems, and advanced precision technologies.

- Europe: Driven by strict emissions regulations (Stage V), demand for specialized tractors (orchard/vineyard), and sustainability requirements.

- Asia Pacific (APAC): Largest volume market, driven by government subsidies, small farm mechanization (utility tractors), particularly in India and China.

- Latin America: High growth potential fueled by expanding large-scale commodity farming and need for robust equipment.

- Middle East and Africa (MEA): Emerging market with significant potential for basic mechanization and utility tractor adoption, supported by government initiatives for food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forestry and Agricultural Tractor Market.- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- SDF Group

- Mahindra & Mahindra Ltd.

- JCB

- Iseki & Co., Ltd.

- Yanmar Holdings Co., Ltd.

- Arbos Group

- Valtra (AGCO)

- Fendt (AGCO)

- Escorts Limited

- Tractors and Farm Equipment Limited (TAFE)

- Versatile

- Kirovets

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Lovol Heavy Industry Co., Ltd.

- TYM Corporation

Frequently Asked Questions

Analyze common user questions about the Forestry and Agricultural Tractor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Forestry and Agricultural Tractor Market?

The market is projected to grow at a healthy CAGR of 5.8% between 2026 and 2033, driven primarily by technological advancements in precision agriculture and increasing demand for mechanized farming solutions globally.

What major technological trends are driving the growth of modern agricultural tractors?

Key technological drivers include the integration of autonomous guidance systems, advanced telematics and IoT connectivity for data-driven farming, adherence to stringent Tier 4 Final/Stage V emission standards, and the progressive development of electric and hybrid powertrains.

Which regional market holds the largest potential for tractor sales, and why?

Asia Pacific (APAC) is projected to be the fastest-growing and largest regional market. This growth is sustained by significant government support, widespread mechanization of smallholder farms, and high demand for durable, affordable utility tractors in countries like India and China.

How is the adoption of Artificial Intelligence (AI) affecting tractor operations?

AI is crucial for enabling fully autonomous field operations, optimizing input usage through machine vision and variable rate application technology, and improving equipment reliability via predictive maintenance algorithms analyzing real-time operational data.

What are the primary restraints impacting the expansion of the Agricultural Tractor Market?

The main restraints include the high initial capital investment costs required for modern, high-horsepower machinery, complex compliance with increasingly strict global engine emission regulations, and fluctuations in agricultural commodity prices affecting farmer purchasing power.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager