Forex and Prop Trading Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440338 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Forex and Prop Trading Market Size

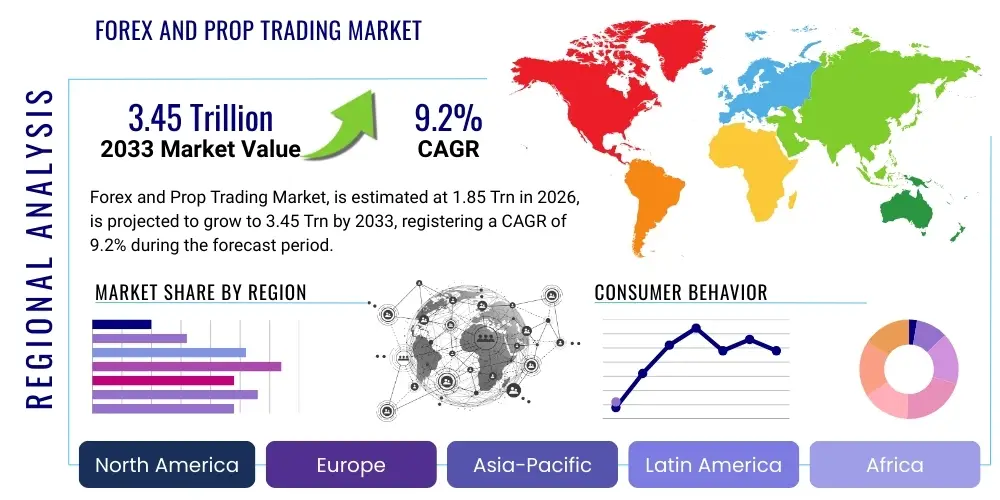

The Forex and Prop Trading Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 1.85 trillion in 2026 and is projected to reach USD 3.45 trillion by the end of the forecast period in 2033.

Forex and Prop Trading Market introduction

The Forex and Prop Trading market encompasses the vast ecosystem where individuals and institutions engage in the speculative exchange of currencies and other financial assets with the aim of profiting from price fluctuations. Forex, or foreign exchange, trading involves buying one currency while simultaneously selling another, constituting the world's largest and most liquid financial market. Proprietary (Prop) trading, on the other hand, involves financial firms or individuals trading directly with the firm's own capital, rather than on behalf of clients, allowing them to retain all profits and bear all losses. This dynamic sector is characterized by its high liquidity, 24-hour accessibility (for Forex), and the immense leverage opportunities it offers, attracting a diverse range of participants from retail traders to large institutional investors. The product description of this market fundamentally revolves around access to global financial instruments, sophisticated trading platforms, and the specialized analytical tools required to navigate complex market conditions. Major applications include hedging against currency risks for international businesses, speculative investment for capital growth, and diversification of investment portfolios.

The benefits of engaging in the Forex and Prop Trading market are manifold, ranging from the potential for significant financial returns due to high leverage and market volatility, to unparalleled market access across various time zones, enabling continuous trading opportunities. It provides a platform for individuals to leverage their analytical skills and market insights directly, without the constraints often associated with traditional investment vehicles. Furthermore, the development of advanced trading technologies and educational resources has significantly lowered barriers to entry, making these markets accessible to a broader audience. Driving factors for market growth include the increasing digitalization of financial services, which has made trading more accessible and efficient, coupled with a surge in retail investor interest seeking alternative income streams and wealth accumulation strategies. The continuous innovation in trading platforms, the proliferation of sophisticated algorithmic trading tools, and the global economic interconnectedness that inherently fuels currency exchange requirements further bolster the expansion of this market. Emerging economies also contribute to this growth by increasing their participation in global trade and financial markets, thereby stimulating demand for foreign exchange services and prop trading opportunities.

Forex and Prop Trading Market Executive Summary

The Forex and Prop Trading market is currently experiencing robust growth, driven by key business trends such as the widespread adoption of advanced trading technologies, including artificial intelligence and machine learning, which are enhancing analytical capabilities and automating trading strategies. There's a notable shift towards greater retail participation, facilitated by user-friendly platforms and reduced trading costs, alongside an increased demand for diversified financial instruments beyond traditional currency pairs, encompassing commodities, indices, and cryptocurrencies offered through various trading mechanisms. Regulatory developments continue to shape market practices, aiming to enhance transparency and investor protection while also presenting compliance challenges for market participants. From a regional perspective, Asia Pacific is emerging as a significant growth engine, fueled by its burgeoning middle class, increasing internet penetration, and a growing appetite for speculative investments, complementing the established dominance of North America and Europe in terms of trading volume and technological innovation. Emerging markets across Latin America and Africa also present nascent but promising opportunities for market expansion, as economic development and digital infrastructure improve. Segment-wise, the market is seeing strong performance in algorithmic trading platforms due to their efficiency and speed, while prop trading firms are diversifying their offerings to include various asset classes and advanced training programs for traders, indicating a maturing and highly competitive landscape.

AI Impact Analysis on Forex and Prop Trading Market

User inquiries regarding AI's impact on the Forex and Prop Trading market frequently center on its potential to revolutionize trading strategies, enhance risk management, and predict market movements with greater accuracy. Common questions explore how AI-driven algorithms can outperform human traders, the implications for employment within the industry, and the ethical considerations surrounding automated decision-making. Users are keenly interested in understanding the practical applications of AI in real-time trading, its role in detecting complex patterns invisible to human analysis, and its capacity to mitigate human error and emotional biases. There's also significant curiosity about the accessibility of these advanced AI tools for retail traders versus institutional players, and the overall impact on market liquidity and volatility. The overarching themes revolve around efficiency, predictive power, automation, and the competitive advantage AI offers, balanced with concerns about systemic risks, data privacy, and the potential for market manipulation by highly sophisticated AI systems. Users seek clear insights into how AI will reshape the landscape, fostering both innovation and potential disruption.

- Enhanced predictive analytics for market forecasting.

- Automated high-frequency trading (HFT) and execution.

- Improved risk management and fraud detection.

- Personalized trading strategies and portfolio optimization.

- Sentiment analysis of news and social media for market insights.

- Backtesting and strategy development acceleration.

- Reduction of human emotional biases in trading decisions.

- Development of AI-powered chatbots for trader support.

DRO & Impact Forces Of Forex and Prop Trading Market

The Forex and Prop Trading market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and impact forces that collectively shape its trajectory. Key drivers include the ever-increasing globalization of trade and finance, which inherently boosts demand for foreign exchange services and instruments, coupled with rapid technological advancements such as high-speed internet, mobile trading applications, and sophisticated analytical software that make trading more accessible and efficient for a broader audience. The growing interest from retail investors seeking alternative investment avenues and the expansion of educational resources on trading further fuel market participation. Restraints, conversely, pose significant challenges, prominently featuring the inherent market volatility and unpredictability, which can lead to substantial financial losses, alongside stringent and evolving regulatory frameworks in various jurisdictions designed to protect investors but often increasing compliance burdens for market participants. The high capital requirements for institutional prop trading and the psychological pressures associated with high-stakes trading also act as significant barriers for many. Opportunities abound, particularly in the integration of cutting-edge technologies like artificial intelligence, machine learning, and blockchain for enhanced trading efficiency, security, and innovative product development. The expansion into emerging markets, offering untapped potential for growth in both retail and institutional segments, and the diversification of tradable instruments, including new digital assets, also present significant avenues for market players. Impact forces, which are broader external factors, include geopolitical events that can cause sudden market shifts, macroeconomic trends such as interest rate changes and inflation impacting currency valuations, and the continuous evolution of technological infrastructure that underpins the entire trading ecosystem. These forces necessitate constant adaptation and innovation from market participants to remain competitive and resilient.

Segmentation Analysis

The Forex and Prop Trading market is highly segmented, allowing for a detailed understanding of its diverse components and participant behaviors. This segmentation helps identify key market dynamics, target specific customer groups, and develop tailored strategies for growth and competitive advantage. The market can be broadly categorized based on several critical dimensions, including the type of instrument traded, the nature of the trader, the underlying technology utilized, and the operational model of firms involved. Each segment presents unique characteristics, regulatory considerations, and growth prospects, contributing to the overall complexity and vibrancy of the market landscape. Understanding these distinctions is crucial for stakeholders aiming to optimize their offerings and capture specific market shares within this dynamic financial domain.

- By Asset Type:

- Currencies (Majors, Minors, Exotics)

- Commodities (Gold, Silver, Oil, Natural Gas)

- Indices (S&P 500, NASDAQ 100, DAX 40)

- Cryptocurrencies (Bitcoin, Ethereum, Ripple)

- Stocks/Equities

- By Participant Type:

- Retail Traders

- Institutional Traders (Hedge Funds, Asset Managers, Banks)

- Proprietary Trading Firms

- By Trading Platform:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- Proprietary Platforms

- Web-based Platforms

- Mobile Trading Apps

- By Technology:

- Algorithmic Trading

- Manual Trading

- AI/Machine Learning Enhanced Trading

- Blockchain-based Trading

- By Business Model (for Prop Trading Firms):

- Funded Trading Programs

- Direct Capital Allocation

- Training and Education Services

Value Chain Analysis For Forex and Prop Trading Market

The value chain for the Forex and Prop Trading market is intricate, involving multiple layers of service providers and intermediaries that facilitate the entire trading process from data acquisition to final trade execution and post-trade settlement. Upstream activities are dominated by technology providers offering trading platforms, liquidity aggregators, market data vendors, and connectivity solutions critical for real-time information flow and efficient order routing. These entities provide the foundational infrastructure and raw data necessary for market participants to make informed decisions and execute trades effectively. Additionally, educational institutions and training providers form a crucial part of the upstream segment by equipping aspiring traders with the necessary skills and knowledge.

Downstream, the value chain extends to the end-users and the mechanisms through which they access the market. This primarily involves individual retail traders, institutional investors such as hedge funds and asset managers, and professional proprietary trading firms who are the ultimate consumers of trading services. Distribution channels are varied, encompassing direct and indirect approaches. Direct channels typically involve traders accessing proprietary platforms offered by prop firms or brokers where they directly interact with the market. Indirect channels often involve intermediary brokers who aggregate liquidity from multiple sources, offering their clients access to a wider array of instruments and better pricing, or through managed accounts where third-party managers trade on behalf of clients. The efficiency of this value chain is paramount, as any friction at any stage, whether in data latency, platform reliability, or execution speed, can significantly impact trading outcomes and profitability for all participants.

Forex and Prop Trading Market Potential Customers

The potential customer base for the Forex and Prop Trading market is remarkably diverse, spanning a wide spectrum from individual retail investors to sophisticated institutional entities, each with unique needs and motivations for engaging in these markets. On the retail front, individuals seeking opportunities for wealth generation, portfolio diversification, or simply a supplementary income stream constitute a significant segment. These traders are often attracted by the market's accessibility, high leverage potential, and the continuous 24-hour trading window of the Forex market, often utilizing user-friendly online platforms and mobile applications. Their decisions are frequently influenced by readily available educational content and the perceived low entry barriers for initial capital.

In the institutional domain, potential customers include a range of professional entities that leverage Forex and proprietary trading for various strategic objectives. This includes hedge funds and asset management firms that engage in speculative trading to generate alpha for their clients, often employing complex quantitative strategies and substantial capital. Investment banks and corporate treasuries utilize the Forex market extensively for hedging currency exposure arising from international business operations, managing liquidity, and facilitating cross-border transactions. Additionally, other financial institutions, such as pension funds and sovereign wealth funds, may also engage in currency trading for diversification and yield enhancement. Proprietary trading firms themselves are a category of end-users, where the firm's own capital is deployed by skilled traders to generate profits, often within a structured and highly risk-managed environment. These firms may also offer funded trading programs, effectively making aspiring professional traders their "customers" by providing capital in exchange for a profit share. The common thread among all these potential customers is the pursuit of financial gain or risk mitigation within the highly liquid and dynamic global financial markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Trillion |

| Market Forecast in 2033 | USD 3.45 Trillion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eightcap, FTMO, The Funded Trader, MyForexFunds, Topstep, FundedNext, MFFX, Fidelcrest, Darwinex, IC Markets, Pepperstone, XM, FBS, Exness, Interactive Brokers, OANDA, IG Group, Saxo Bank, Plus500, AvaTrade |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forex and Prop Trading Market Key Technology Landscape

The technological landscape of the Forex and Prop Trading market is characterized by rapid innovation, driven by the need for speed, efficiency, and sophisticated analytical capabilities to gain a competitive edge. At its core are advanced trading platforms like MetaTrader 4 and 5, cTrader, and various proprietary systems, which provide traders with charting tools, technical indicators, order execution functionalities, and access to market data. These platforms are constantly evolving to integrate new features, improve user experience, and ensure robust security. High-frequency trading (HFT) systems, relying on ultra-low latency connectivity and powerful algorithms, are paramount for institutional players, enabling them to execute a vast number of orders in milliseconds and capitalize on fleeting market inefficiencies. The development of Application Programming Interfaces (APIs) has also become critical, allowing traders and developers to connect their custom trading strategies and third-party tools directly to brokerage systems, fostering a vibrant ecosystem of specialized add-ons and automated solutions.

Beyond execution platforms, the market is increasingly leveraging big data analytics and artificial intelligence (AI) and machine learning (ML) to process vast amounts of market information, identify complex patterns, and generate predictive insights. AI-driven algorithms are used for sentiment analysis of news feeds, economic data interpretation, and even to personalize trading strategies for individual risk profiles. Blockchain technology is emerging as another transformative force, offering potential solutions for enhanced transaction security, transparency, and faster settlement times, particularly in the realm of cryptocurrency trading and tokenized assets, which are increasingly intertwined with traditional forex. Cloud computing infrastructure plays a vital role by providing scalable, flexible, and reliable hosting for trading applications and data storage, ensuring accessibility and performance across global markets. Furthermore, robust cybersecurity measures and encryption technologies are indispensable to protect sensitive financial data and prevent unauthorized access, reflecting the high stakes involved in this digitally intensive environment. These technologies collectively enable traders to analyze markets more deeply, execute trades more precisely, and manage risk more effectively than ever before.

Regional Highlights

- North America: A mature market characterized by high trading volumes, significant institutional participation, and a strong presence of technology innovators. The U.S. and Canada lead in financial technology adoption and advanced algorithmic trading, driven by a robust regulatory framework and a culture of sophisticated investment strategies.

- Europe: A diverse and highly competitive region with major financial hubs like London and Frankfurt. Regulatory bodies such as ESMA and CySEC significantly influence market structure. High retail participation and a growing number of prop trading firms, alongside strong innovation in fintech, characterize this market.

- Asia Pacific (APAC): The fastest-growing region, fueled by increasing internet penetration, a burgeoning middle class, and rising disposable incomes, particularly in countries like China, India, and Southeast Asia. Significant growth in retail trading, often driven by mobile-first strategies, and increasing interest in local and exotic currency pairs.

- Latin America: An emerging market with significant growth potential, though often challenged by economic volatility and varying regulatory landscapes. Countries like Brazil and Mexico are seeing increased adoption of online trading platforms, driven by a desire for alternative investment opportunities and financial inclusion.

- Middle East and Africa (MEA): A region with untapped potential, particularly in the Gulf Cooperation Council (GCC) countries and parts of Africa, driven by economic diversification efforts and improving digital infrastructure. Growing interest from high-net-worth individuals and increasing access to international brokers contribute to market expansion, albeit with varying degrees of regulatory sophistication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forex and Prop Trading Market.- Eightcap

- FTMO

- The Funded Trader

- MyForexFunds

- Topstep

- FundedNext

- MFFX

- Fidelcrest

- Darwinex

- IC Markets

- Pepperstone

- XM

- FBS

- Exness

- Interactive Brokers

- OANDA

- IG Group

- Saxo Bank

- Plus500

- AvaTrade

Frequently Asked Questions

What is proprietary trading and how does it differ from traditional forex trading?

Proprietary trading involves firms or individuals trading financial instruments using the firm's own capital, aiming to profit directly from market movements. In contrast, traditional forex trading often involves individuals or institutions trading currency pairs through a broker, using their own invested capital or on behalf of clients. Prop trading typically offers access to larger capital and often more sophisticated tools, with traders often sharing profits with the firm after meeting certain performance criteria.

How is artificial intelligence (AI) transforming the Forex and Prop Trading market?

AI is revolutionizing the Forex and Prop Trading market by enabling advanced algorithmic trading strategies, enhancing predictive analytics, and improving risk management. AI-powered systems can analyze vast datasets, identify complex patterns, execute trades at high speed, and minimize human error and emotional biases. This leads to more efficient market analysis, optimized trade execution, and personalized trading strategies, providing a significant competitive advantage to firms and traders who adopt these technologies.

What are the primary risks associated with Forex and Prop Trading?

The primary risks include high market volatility, which can lead to rapid and substantial losses, especially when employing leverage. Regulatory changes can also impact trading conditions and access. Furthermore, the inherent complexity of global markets requires continuous learning and adaptation, and there's always the risk of platform malfunction or cybersecurity breaches. For prop trading, meeting performance targets to retain funding is a significant pressure, and for all traders, capital preservation is a constant challenge due to the speculative nature of these markets.

Is the Forex and Prop Trading market accessible to retail investors?

Yes, the Forex and Prop Trading market has become highly accessible to retail investors through online brokers offering user-friendly platforms and mobile apps. Many prop trading firms also offer funded accounts after successful evaluation programs, allowing retail traders with proven skills to trade with significant capital without risking their own. Educational resources and demo accounts further lower the barrier to entry, making it possible for individuals to learn and participate, although the inherent risks remain high.

What are the key technological advancements driving growth in this market?

Key technological advancements driving growth include the widespread adoption of AI and machine learning for predictive analysis and automated trading, blockchain for enhanced security and faster settlements, and high-frequency trading (HFT) systems for ultra-low latency execution. Cloud computing provides scalable infrastructure, while advanced APIs facilitate integration with third-party tools. These innovations collectively improve efficiency, speed, data analysis capabilities, and accessibility for all market participants, fostering continuous market evolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager