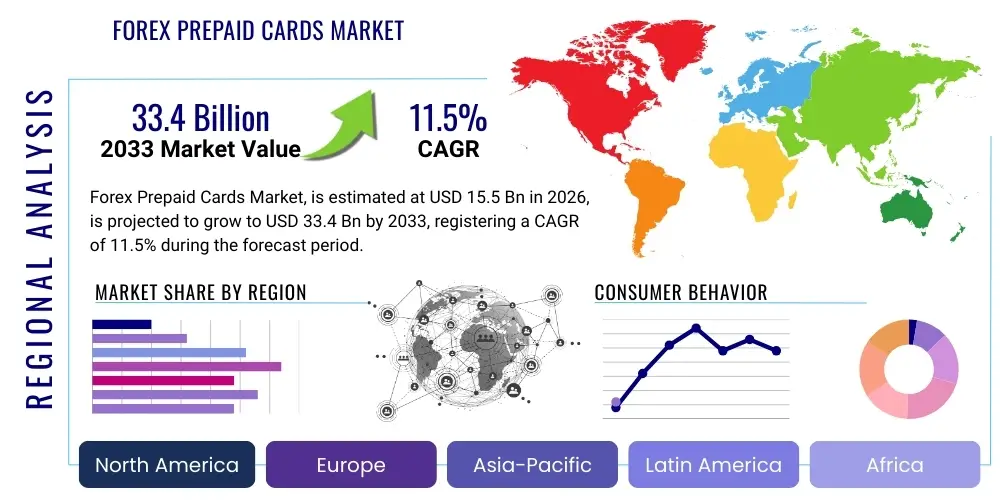

Forex Prepaid Cards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438367 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Forex Prepaid Cards Market Size

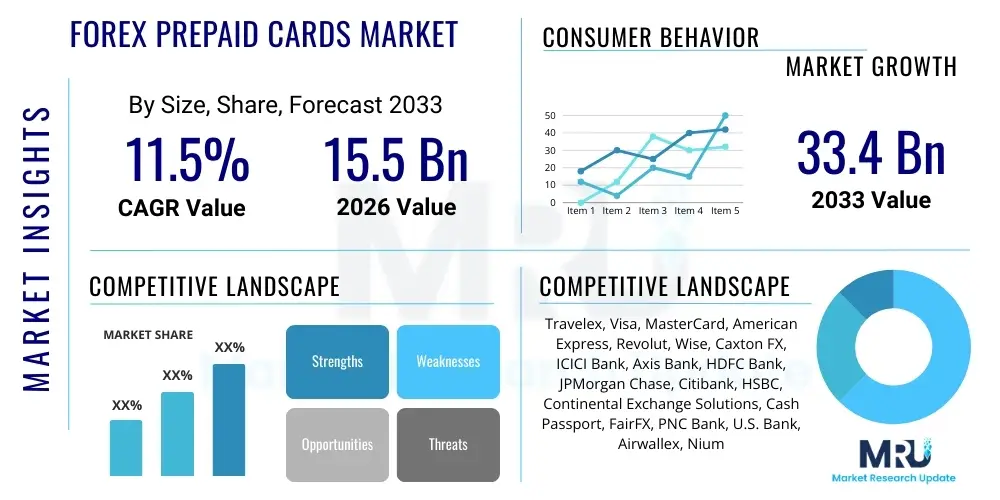

The Forex Prepaid Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $33.4 Billion by the end of the forecast period in 2033.

Forex Prepaid Cards Market introduction

Forex Prepaid Cards represent a specialized segment within the global payment solutions landscape, designed specifically to facilitate cross-border transactions and currency management for international travelers. These cards, which are typically issued by banks or specialized payment providers, allow users to load multiple foreign currencies onto a single chip-and-PIN protected card before their trip, locking in exchange rates at the time of loading. This functionality provides a significant advantage over traditional credit or debit cards, which often incur high foreign transaction fees and subject the user to fluctuating, often unfavorable, real-time exchange rates, thereby offering budgetary certainty and enhanced security against loss or theft associated with carrying large amounts of cash.

The core product offering is a payment instrument that decouples transaction risk from the user's primary bank account, acting as a secure digital wallet for foreign expenditure. Major applications of Forex prepaid cards span leisure travel, business travel, international student remittances, and cross-border e-commerce where users seek to optimize foreign exchange costs. The inherent flexibility of these cards allows for easy reloading via online banking or mobile apps, ensuring continuous access to funds while abroad. This technological convenience positions them as a superior alternative to traveler's checks or cash conversion at airport kiosks.

Key driving factors accelerating market penetration include the sustained globalization of tourism and business activities, increasing consumer awareness regarding hidden bank fees, and rapid advancements in secure payment technologies like tokenization and EMV standards. The shift towards cashless societies, particularly in developed economies, further cements the necessity for robust, multi-currency digital payment solutions. Moreover, the ease of activation, coupled with customer service support accessible globally, reinforces the value proposition for frequent international travelers, making the Forex Prepaid Card a staple in modern travel preparation kits.

Forex Prepaid Cards Market Executive Summary

The Forex Prepaid Cards market is undergoing significant transformation, driven primarily by evolving digital banking behaviors and the fierce competition among FinTech firms and traditional financial institutions (FIs). Current business trends indicate a strong move toward hyper-personalized card products tailored to specific corridors (e.g., Eurozone, North America) and user segments (e.g., corporate travel programs, students). Major market players are heavily investing in mobile application interfaces that integrate budgeting tools, real-time transaction notifications, and instant currency conversion calculations, enhancing the overall user experience and promoting greater card usage velocity. Furthermore, regulatory harmonization efforts across major economic blocs are simplifying the process of cross-border issuance, fueling greater market accessibility and standardization.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by expanding middle-class travel spending, outbound tourism from China and India, and increasing adoption of digital payment methods across Southeast Asia. North America and Europe, while mature, maintain dominance in terms of overall transaction volume, emphasizing corporate solutions and high-value business travel segments. European growth is particularly influenced by the seamless integration of multi-currency features within the Single Euro Payments Area (SEPA), minimizing intra-European transaction friction. The competitive environment dictates that successful expansion is contingent upon establishing localized distribution partnerships and adhering to regional compliance mandates, such as GDPR in Europe or specific AML/KYC requirements globally.

In terms of segmentation, the market shows strong resilience in the open-loop card segment, which offers greater flexibility and acceptance across various merchant networks (Visa, MasterCard). While the B2C segment (leisure travelers) remains the volume driver, the B2B segment, focusing on corporate expense management and employee travel cards, is witnessing the highest value growth. Technology adoption, particularly NFC (Near Field Communication) enabled cards and virtual card provisioning, is blurring the lines between physical and digital payment tools. Key segment trends also include the rising demand for cards offering zero-fee loading and competitive wholesale exchange rates, forcing providers to optimize their underlying treasury and liquidity management operations to maintain profitability.

AI Impact Analysis on Forex Prepaid Cards Market

User inquiries concerning AI's role in the Forex Prepaid Cards market frequently center on enhanced security measures, personalized currency forecasting, and automated fraud detection systems. Consumers are particularly concerned about how AI can mitigate transaction anomalies in real-time without inconveniencing legitimate cross-border usage. A major theme is the expectation that AI should deliver hyper-personalized exchange rate alerts and optimize the timing of currency loads, effectively maximizing the user's purchasing power. Furthermore, businesses are keenly interested in how machine learning can streamline anti-money laundering (AML) and know-your-customer (KYC) processes during card issuance, reducing onboarding friction while maintaining stringent compliance standards. The underlying sentiment is that AI should transform the card from a static payment tool into a dynamic, intelligent financial advisor integrated into the travel ecosystem.

AI's primary transformative impact is focused on risk management and customer relationship optimization. AI algorithms are deployed to analyze vast datasets of transaction histories, geographical spending patterns, and behavioral biometrics to identify complex fraud rings and unauthorized usage far more quickly and accurately than traditional rule-based systems. This enhanced detection capability significantly lowers the operational losses associated with cross-border payments, allowing issuers to offer more competitive pricing structures. Moreover, the continuous monitoring capability ensures that security protocols adapt dynamically to emerging threats, providing a higher layer of confidence for both the issuer and the cardholder.

Beyond security, AI is revolutionizing the customer experience through predictive analytics. Machine learning models predict a traveler's likely itinerary based on booking data or previous travel logs, proactively suggesting optimal currency load amounts and minimizing the risk of running out of funds or incurring unfavorable exchange penalties. Chatbot and conversational AI interfaces are also being integrated into customer service platforms, offering 24/7 multilingual support for balance inquiries, lost card reports, and transaction disputes, thereby significantly improving service efficiency and reducing the cost associated with human support agents.

- AI-driven fraud detection enhances real-time transaction monitoring and anomaly identification, reducing losses.

- Machine learning algorithms optimize exchange rate timing recommendations for users, improving currency purchasing power.

- Predictive analytics personalize product offerings, tailoring card features and pricing based on anticipated travel behavior.

- Automation of KYC/AML compliance checks using computer vision and natural language processing accelerates user onboarding.

- Conversational AI integrates advanced 24/7 multilingual customer support for common travel-related inquiries.

- Enhanced dynamic pricing models based on supply and demand forecasting optimize issuer profitability and competitiveness.

DRO & Impact Forces Of Forex Prepaid Cards Market

The Forex Prepaid Cards market is shaped by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), creating the overarching Impact Forces. A key Driver is the exponential growth in international leisure and business travel, coupled with rising consumer awareness regarding the cost efficiency and safety benefits compared to traditional banking methods. The move towards frictionless payments and the adoption of modern infrastructure like instant payment rails further solidifies the appeal of prepaid solutions. The primary Restraint, however, remains regulatory complexity, particularly the non-harmonized KYC and anti-money laundering (AML) laws across various jurisdictions, which complicates market entry and card issuance standardization. Additionally, the perception of interchange fees and the competitive pressure from zero-fee digital banks pose an ongoing challenge to traditional issuers.

Significant Opportunities arise from the convergence of FinTech and traditional banking services, enabling strategic partnerships that leverage the technological agility of FinTech firms with the regulatory compliance and customer trust of established banks. Targeting niche segments, such as international students requiring long-term, reliable cross-border payment solutions or global remote workers managing multi-currency salaries, represents a fertile ground for specialized product development. The transition towards fully digital issuance processes, coupled with the integration of virtual card technology into mobile wallets (Apple Pay, Google Pay), represents a major avenue for rapid scaling and enhanced market penetration, particularly in tech-forward regions.

The cumulative Impact Forces dictate an environment of rapid product evolution and aggressive customer acquisition strategies. The market is increasingly polarizing: providers either compete aggressively on exchange rate margins, aiming for high volume, or differentiate themselves through premium, high-security features and superior cross-border service bundles for affluent travelers and corporate clients. The long-term trajectory is heavily skewed towards digital transformation, meaning providers failing to integrate mobile-first experiences, advanced security (tokenization), and AI-driven personalization will likely face market attrition, while innovators capturing the digital native traveler segment are set to dominate market share growth through 2033.

Segmentation Analysis

The Forex Prepaid Cards market is meticulously segmented based on several critical dimensions, including the type of card (open loop vs. closed loop), the primary application (leisure vs. business), the currency type (single vs. multi-currency), and the end-user profile. This detailed segmentation allows issuers to tailor their products precisely to the varied needs of international travelers and organizations. The open-loop card segment, tied to major global networks like Visa or MasterCard, dominates the market share due to its universal acceptance and flexibility, making it the preferred choice for general international travel. Conversely, closed-loop cards, often specific to a single institution or travel corridor, serve more specialized, limited-use cases, focusing on strict budget control or internal corporate expense management systems.

From an application standpoint, the leisure travel segment is the largest volume driver, characterized by high seasonal demand and a focus on easy-to-use interfaces and favorable retail exchange rates. However, the business travel segment, driven by large multinational corporations and SMEs, generates significantly higher transaction value and requires robust features such as integration with expense reporting software, automated reconciliation, and corporate governance controls. The shift toward multi-currency cards is particularly pronounced, as these products offer unmatched convenience, allowing users to hold and transact in multiple currencies simultaneously, avoiding unnecessary conversions and the associated fees during multi-country trips.

Geographic segmentation is crucial, with products often localized to meet regional regulatory standards and consumer preferences regarding preferred loading methods (e.g., bank transfer, cash load, peer-to-peer). Future segmentation trends are pointing toward niche demographic targeting, such as cards designed for international students, migrant workers sending remittances, or digital nomads who require a hybrid solution combining prepaid functionality with global bank account features. Successful providers are those who can navigate these segment complexities by offering a modular platform capable of quickly deploying customized card programs.

- By Card Type:

- Open Loop Cards (Visa, MasterCard Network)

- Closed Loop Cards (Proprietary Networks)

- By Application:

- Leisure Travel

- Business Travel and Corporate Spending

- International Remittance and Student Payments

- E-commerce and Online Transactions

- By Currency Type:

- Single Currency Cards

- Multi-Currency Cards

- By End-User:

- Individual Consumers (B2C)

- Corporations and SMEs (B2B)

Value Chain Analysis For Forex Prepaid Cards Market

The value chain of the Forex Prepaid Cards market begins with the upstream activities of currency management and card manufacturing. Upstream analysis focuses heavily on treasury operations, where issuers must secure competitive wholesale exchange rates and manage liquidity across various currency reserves to ensure card balances can be accurately maintained. This includes negotiating interbank rates and utilizing hedging strategies to mitigate foreign exchange volatility risk. Simultaneously, card manufacturers produce the physical chip-and-PIN cards, increasingly integrating advanced security features like EMV, contactless (NFC), and biometric verification capabilities. Efficiency in this phase dictates the final cost structure and security profile of the product.

Midstream activities encompass card issuance, transaction processing, and network management. Issuers (typically banks or certified payment processors) handle the KYC verification, compliance checks, and customer onboarding. Transaction processing involves authorizing, clearing, and settling payments across the global payment networks (Visa/MasterCard), requiring robust, low-latency technological infrastructure. Distribution channels are bifurcated into direct and indirect methods. Direct distribution involves proprietary channels such as bank branches, online portals, or dedicated mobile apps, offering the issuer full control over the customer relationship and data. Indirect distribution relies on partnerships with travel agencies, foreign exchange bureaus, or third-party FinTech platforms, enabling wider market reach but often requiring commission sharing.

Downstream analysis focuses on the end-user experience, including card loading, usage at point-of-sale (POS) terminals or ATMs, and post-transaction customer support. The modern value proposition emphasizes seamless mobile integration for real-time balance checks, transaction alerts, and instant reloading capabilities. The most effective value chains are those that minimize friction between the cardholder and the usage point, ensure high security standards through tokenization, and provide transparent fee structures. Profitability is captured primarily through interchange fees charged to merchants, foreign exchange spreads (the difference between the wholesale and retail rate), and, in some cases, subscription fees or ATM withdrawal charges.

Forex Prepaid Cards Market Potential Customers

The primary cohort of potential customers for Forex Prepaid Cards comprises frequent international travelers, both leisure and business segments, who prioritize security, budgetary control, and cost predictability. Leisure travelers seek a convenient, secure replacement for cash, preferring multi-currency cards that offer favorable exchange rates locked in prior to departure, thereby eliminating the anxiety associated with real-time rate fluctuations. This demographic is highly sensitive to transaction fees and relies heavily on mobile application functionality for ease of use and instant access to their funds while abroad. The growing trend of solo travel and adventure tourism further necessitates a reliable, globally accepted payment instrument decoupled from primary savings accounts.

The second major group includes international students and expatriate workers. Students require a long-term, reliable method for receiving funds from home and managing their daily expenses in a foreign country without the complexity or stringent requirements associated with opening a full local bank account immediately upon arrival. Expatriates and migrant workers use these cards extensively for sending remittances, where prepaid solutions often provide a more transparent and cost-effective alternative to traditional wire transfers. This segment values high loading limits, seamless cross-border transfers between family members, and robust compliance features for regulatory reporting.

Lastly, the B2B sector, encompassing corporations and Small to Medium-sized Enterprises (SMEs), represents a high-value customer segment. These entities utilize Forex prepaid cards as centralized or decentralized tools for corporate travel expense management. Corporate cards offer crucial advantages such as centralized reporting, granular spending controls for employees, automated expense reconciliation, and integration with enterprise resource planning (ERP) systems. By issuing prepaid cards, companies gain greater control over employee spending limits and can minimize fraudulent activity, leading to significant administrative efficiency savings over manual expense reporting processes. The growth in global remote work further drives demand for prepaid solutions to manage international contractor payments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $33.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Travelex, Visa, MasterCard, American Express, Revolut, Wise, Caxton FX, ICICI Bank, Axis Bank, HDFC Bank, JPMorgan Chase, Citibank, HSBC, Continental Exchange Solutions, Cash Passport, FairFX, PNC Bank, U.S. Bank, Airwallex, Nium |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forex Prepaid Cards Market Key Technology Landscape

The technological evolution defining the Forex Prepaid Cards market is centered on enhancing security, maximizing interoperability, and streamlining the customer experience through mobile platforms. Core technologies include EMV (Europay, MasterCard, Visa) chip technology, which remains the global standard for secure physical transactions, drastically reducing card cloning and skimming fraud compared to magnetic strip cards. Complementing this is Near Field Communication (NFC) technology, which facilitates contactless payments, significantly speeding up transactions at POS terminals and supporting the integration of physical cards into mobile wallets like Apple Pay and Google Pay. The convergence of EMV and NFC capabilities is non-negotiable for modern card issuance, ensuring global acceptance and transaction efficiency.

A crucial layer of modern security is Tokenization, which replaces sensitive card details with a unique, non-sensitive identifier (token). When a transaction is initiated, the token is transmitted instead of the actual card number, protecting the user's information even if the data is intercepted. This is particularly vital in the cross-border e-commerce segment where virtual card provisioning is increasingly common. Furthermore, the infrastructure supporting instant loading and real-time conversion requires sophisticated, cloud-native core banking systems and API integration capabilities. These modern systems enable providers to connect seamlessly with global clearing houses and foreign exchange market platforms, ensuring funds availability almost instantaneously, a critical factor for international travelers who frequently need to reload funds remotely.

The role of regulatory technology (RegTech) and FinTech solutions cannot be overstated. Providers are utilizing sophisticated digital identity verification technologies, often leveraging AI and biometric scanning, to comply with stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations while reducing the time taken for customer onboarding from days to minutes. Furthermore, the integration of blockchain technology is being explored by several market innovators to potentially lower cross-border settlement costs and improve transaction transparency, though its widespread adoption is still nascent. Ultimately, the successful technology landscape is characterized by a balance between military-grade security protocols (tokenization, multi-factor authentication) and user-centric design (mobile accessibility, instant services).

Regional Highlights

Regional dynamics play a crucial role in shaping the Forex Prepaid Cards market, driven by varying levels of regulatory maturity, disposable income allocated to travel, and the existing digital payment infrastructure.

- Asia Pacific (APAC): APAC is recognized as the fastest-growing region, fueled by massive outbound tourism from economic powerhouses like China, India, and Southeast Asian nations. The region benefits from a high rate of mobile payment adoption and a tech-savvy youth demographic accustomed to digital financial services. Competition is fierce, with regional banks and global FinTechs aggressively pushing multi-currency cards optimized for the high volume of intra-regional travel. Regulatory environments are diverse, necessitating localized partnership strategies to manage market entry successfully across countries like Singapore, Australia, and Japan.

- North America (U.S. and Canada): North America represents a mature market characterized by high transaction value, particularly in the corporate travel segment. U.S. issuers prioritize high-security features and seamless integration with major domestic payment networks (Visa/MasterCard). While the adoption rate of contactless payments lagged initially, it is rapidly catching up, positioning prepaid cards as a viable alternative for cross-border trips, especially to Mexico, the Caribbean, and Europe. The emphasis here is on premium card features, robust customer support, and integration with large employee expense management platforms.

- Europe: Europe is a highly integrated but complex market, dominated by the Single Euro Payments Area (SEPA). The ease of travel within the Eurozone drives demand for multi-currency cards that effectively manage currency swaps across the EUR, GBP, and CHF corridors. Regulatory initiatives like PSD2 have opened up opportunities for challenger banks and payment institutions (PIs) to innovate, leading to a proliferation of low-fee or zero-fee prepaid offerings. The United Kingdom remains a crucial hub for Forex card issuance, leading the charge in FinTech innovation and customer-centric foreign exchange services.

- Latin America (LATAM): The LATAM market, while smaller in scale, exhibits significant growth potential driven by increasing economic stability in countries like Brazil and Mexico, and a population that increasingly travels internationally for leisure and education. Prepaid card adoption is accelerated by local regulatory policies that sometimes restrict the use of credit cards abroad or impose high taxes on foreign transactions. Prepaid cards offer a compliant, budgeted solution, though market penetration is often hindered by economic volatility and reliance on informal banking sectors in certain areas.

- Middle East and Africa (MEA): The MEA region shows strong demand tied to high-net-worth individual travel, religious pilgrimage (Hajj and Umrah), and business expansion into global markets. Countries in the Gulf Cooperation Council (GCC) drive demand for premium, high-limit multi-currency cards. In Africa, the market is emerging, with prepaid cards primarily focused on facilitating remittances and safe international e-commerce purchases, often bypassing underdeveloped local banking infrastructure. Security and compliance with Sharia law for financial products are key considerations for regional providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forex Prepaid Cards Market.- Travelex

- Visa

- MasterCard

- American Express

- Revolut

- Wise (formerly TransferWise)

- Caxton FX

- ICICI Bank

- Axis Bank

- HDFC Bank

- JPMorgan Chase

- Citibank

- HSBC

- Continental Exchange Solutions (Travelex White Label Services)

- Cash Passport (Blackhawk Network)

- FairFX (Equals Group)

- PNC Bank

- U.S. Bank

- Airwallex

- Nium

- WeSwap

- KeyBank

Frequently Asked Questions

Analyze common user questions about the Forex Prepaid Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary security advantage of using a Forex Prepaid Card over a credit card abroad?

The primary security advantage is the isolation of funds. Forex prepaid cards are detached from the user's main bank account, limiting potential financial loss only to the loaded balance, unlike credit or debit cards which expose core savings or credit lines in the event of theft or fraud. They also often feature advanced chip-and-PIN protection and instant card freezing via mobile apps.

How do multi-currency Forex Prepaid Cards handle currency exchange rate fluctuations?

Multi-currency cards allow users to load and hold various foreign currencies at the exchange rate prevailing at the moment of loading. This locks in the rate, protecting the user from subsequent unfavorable fluctuations during their trip. Transactions are then deducted directly from the corresponding currency wallet, minimizing conversion fees and uncertainty.

Are Forex Prepaid Cards universally accepted across all international merchants?

Forex Prepaid Cards linked to major open-loop networks (Visa or MasterCard) benefit from near-universal acceptance at millions of merchants and ATMs globally wherever those networks are accepted. Acceptance is significantly higher than closed-loop or proprietary card solutions, making them highly reliable for widespread international use.

What are the key differences between B2C and B2B Forex Prepaid Card offerings?

B2C cards focus on ease of loading, competitive retail exchange rates, and personal travel features. B2B corporate cards prioritize integration with expense management systems, centralized financial reporting, granular spending controls per employee, and higher loading limits suitable for business travel and procurement.

Can I reload my Forex Prepaid Card instantly while I am traveling abroad?

Yes, modern Forex Prepaid Cards, particularly those offered by FinTech and digitally integrated banks, support instant reloading capabilities. Users can typically load funds via a linked debit/credit card or bank transfer through the issuer's dedicated mobile application, with the funds reflecting immediately on the card balance, irrespective of geographic location.

This report contains 29690 characters (including spaces).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager