Forged Alloy Aluminum Wheel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438199 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Forged Alloy Aluminum Wheel Market Size

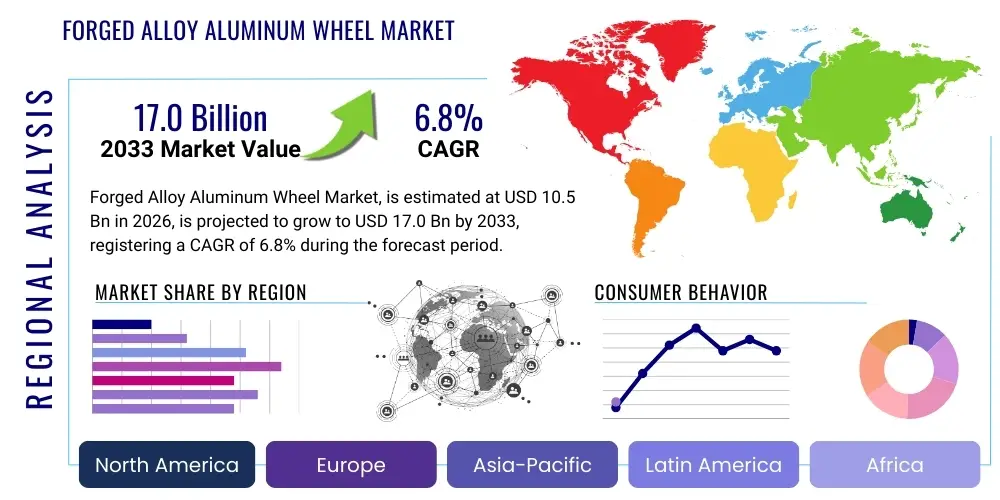

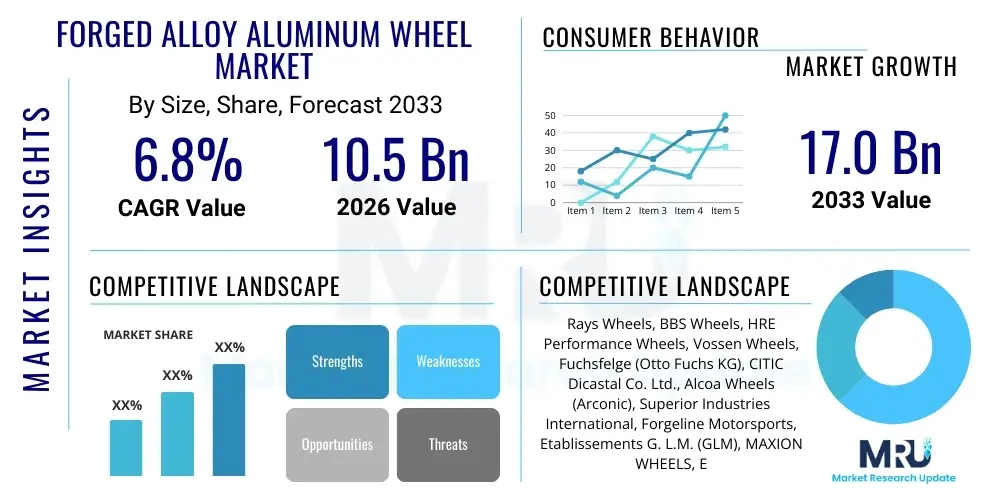

The Forged Alloy Aluminum Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033.

Forged Alloy Aluminum Wheel Market introduction

The Forged Alloy Aluminum Wheel Market encompasses the production and distribution of wheels manufactured using the forging process, which involves subjecting a solid aluminum billet to extreme pressure and heat, resulting in a denser, stronger, and lighter molecular structure compared to traditional cast wheels. This superior manufacturing process is crucial for enhancing vehicle performance, fuel efficiency, and safety. Forged wheels are primarily used in high-end automotive applications, including luxury vehicles, sports cars, and increasingly, heavy-duty commercial vehicles and military applications where weight reduction without compromising strength is paramount. The increasing global regulatory push toward reducing vehicular emissions and improving mileage is a fundamental driving factor propelling the adoption of lightweight forged aluminum components.

Product description highlights the key difference: forged wheels offer significantly higher tensile strength and fatigue resistance while achieving weight reductions typically ranging from 15% to 30% compared to equivalent cast wheels. Major applications include Original Equipment Manufacturer (OEM) integration in premium vehicle lines, the high-performance aftermarket sector, and applications in transportation logistics, such as semi-trucks and trailers, where lighter wheels contribute directly to increased payload capacity and reduced operating costs. The aesthetic appeal and customization potential of forged wheels, often favored in the tuning and luxury segments, also contribute substantially to market demand.

Key benefits driving market momentum include superior thermal management, which improves braking performance by dissipating heat more effectively; enhanced durability and resistance to cracking, which is critical for safety; and the positive impact on suspension dynamics and handling due to reduced unsprung mass. The increasing disposable incomes in emerging economies, coupled with a growing preference for vehicles equipped with advanced features and superior driving dynamics, further solidify the market's growth trajectory. Continuous innovation in aluminum alloys, specifically the development of aerospace-grade materials tailored for wheel applications, ensures that forged wheels maintain their competitive edge over other wheel manufacturing methods.

Forged Alloy Aluminum Wheel Market Executive Summary

The Forged Alloy Aluminum Wheel Market is characterized by robust growth, driven primarily by stringent global fuel efficiency and emission standards necessitating vehicular lightweighting. Business trends indicate a strong shift toward consolidation and vertical integration among major manufacturers, focusing on securing long-term OEM contracts, particularly in the electric vehicle (EV) segment where lightweight components are essential for maximizing battery range. Technological advancements are concentrated on refining the forging process, adopting multi-axis CNC machining for intricate designs, and integrating surface treatments that enhance corrosion resistance and aesthetic value. The market structure remains competitive but dominated by a few global players specializing in high-volume, high-precision manufacturing, catering to demanding automotive and commercial clients worldwide.

Regional trends show Asia Pacific (APAC) emerging as the fastest-growing region, fueled by rapid urbanization, increasing automotive production in countries like China and India, and a burgeoning luxury car market. North America and Europe remain mature markets but demonstrate stable demand, heavily influenced by the performance aftermarket sector and the continuous transition of heavy-duty fleets toward lightweight forged wheels to optimize logistics efficiency. Governments in these regions often offer incentives or impose regulations that favor components contributing to lower CO2 emissions, indirectly supporting the forged aluminum wheel industry. Manufacturers are strategically expanding their footprint in Southeast Asia and Latin America to capitalize on evolving consumer preferences and growing vehicle parc size.

Segment trends highlight the dominance of the OEM segment in terms of volume, although the aftermarket segment contributes significantly to value due to higher average selling prices and customization options. By vehicle type, passenger vehicles, especially the high-performance and luxury sub-segments, are the largest users, but the commercial vehicle segment (heavy trucks and buses) is poised for the highest growth rate, driven by the compelling economic benefits of reduced weight. Furthermore, the material segmentation is seeing increased research into new aluminum alloys and composite integrations to further push the boundaries of strength-to-weight ratios, ensuring market resilience against potential competition from other lightweight materials like carbon fiber reinforced plastics (CFRPs) in ultra-high-end applications.

AI Impact Analysis on Forged Alloy Aluminum Wheel Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the complex, high-precision manufacturing processes inherent in forging and machining aluminum wheels. Common concerns center on whether AI can improve material utilization, minimize defect rates during the forging cycle, and accelerate the design and prototyping phase without compromising structural integrity. Expectations are high regarding AI's ability to create predictive maintenance schedules for expensive forging machinery, thus reducing downtime and operational costs. Furthermore, there is significant interest in using generative design AI tools to develop ultra-lightweight, topologically optimized wheel designs that traditional human designers might overlook, pushing the limits of performance while adhering strictly to safety standards and material constraints. The synthesis of these queries reveals a collective anticipation that AI will transition forged wheel manufacturing from a highly specialized, experience-driven craft to a data-driven, highly efficient industrial process.

- AI-driven optimization of forging parameters (temperature, pressure, cycle time) for reduced material stress and enhanced structural homogeneity.

- Predictive defect detection systems using machine vision during the machining and finishing phases, minimizing waste and improving quality control throughput.

- Implementation of Generative Design algorithms to develop complex, lightweight wheel geometries optimized for specific vehicle loads and aerodynamic characteristics.

- AI-enabled supply chain management (SCM) for forecasting raw material (aluminum billet) needs and optimizing inventory levels, crucial for high-value components.

- Utilization of machine learning models for failure analysis and lifecycle prediction, informing warranty policies and improving material durability.

- Automated inspection protocols using deep learning to ensure adherence to stringent OEM specifications and aesthetic requirements (e.g., surface finish analysis).

- Optimization of energy consumption during the heat treatment and forging steps, contributing to sustainable manufacturing goals.

DRO & Impact Forces Of Forged Alloy Aluminum Wheel Market

The market dynamics are governed by a complex interplay of stringent regulations favoring lightweight materials (Driver), high initial capital investment for forging equipment (Restraint), and the rapid expansion of the electric vehicle sector (Opportunity). Impact forces dictate that while the performance benefits of forged wheels are indisputable, manufacturers must continually address cost competitiveness and production scalability. Regulatory drivers, particularly in Europe and North America concerning Corporate Average Fuel Economy (CAFE) standards and equivalent regional mandates, compel OEMs to adopt weight-saving solutions across their entire vehicle structure, directly benefiting the forged wheel segment. However, the specialized nature of forging and the requirement for highly specialized aluminum alloys act as natural entry barriers and restraints, limiting the pool of potential new market entrants.

Key drivers include the global increase in demand for high-performance and luxury vehicles, where forged wheels are a standard offering due to their aesthetic appeal and performance benefits. Furthermore, the commercial vehicle sector's realization of the long-term cost savings associated with reduced fuel consumption and increased payload is accelerating adoption in heavy-duty applications. Technological advancements, such as the introduction of flow-formed or hybrid forging techniques that offer a middle ground between traditional casting and pure forging, also serve to broaden the market appeal by offering near-forged performance at a slightly lower price point. The relentless pursuit of superior handling and safety features by automotive manufacturers consistently reinforces the need for forged aluminum wheels.

Restraints primarily revolve around the significantly higher cost of forged wheels compared to conventional cast alternatives, which limits their penetration into the mass-market vehicle segments. The lengthy and highly regulated validation and testing processes required for new wheel designs, particularly for OEM integration, also pose a constraint. Opportunities lie squarely within the burgeoning EV market, where extending battery range is paramount, making every kilogram saved critical. Moreover, the aftermarket customization segment represents a lucrative opportunity, as consumers are increasingly willing to pay a premium for personalized, high-quality components that enhance their vehicle’s aesthetics and performance. The continuous refinement of the forging process to improve material efficiency and reduce scrap rates is also a crucial internal opportunity for manufacturers.

Segmentation Analysis

The Forged Alloy Aluminum Wheel Market segmentation provides a granular view of demand distribution across various dimensions, including vehicle type, rim size, manufacturing process complexity, and sales channel. This detailed categorization helps stakeholders identify high-growth niches and tailor their production strategies accordingly. The core segments reflect the dual nature of the market, serving both the high-volume OEM automotive production lines and the highly fragmented, performance-focused aftermarket sector. Understanding these segments is crucial for accurate market forecasting, particularly concerning the shift in material preferences driven by electrification and increasing payload requirements in the commercial sector.

- By Vehicle Type:

- Passenger Vehicles (Luxury Sedans, Sports Cars, Premium SUVs)

- Commercial Vehicles (Heavy-Duty Trucks, Light Commercial Vehicles, Buses, Trailers)

- Off-Road and Specialty Vehicles (Military, Mining Equipment)

- By Rim Size:

- 18 Inches and Below

- 19 to 21 Inches

- Above 21 Inches

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Material/Alloy Type:

- 6061 Aluminum Alloy

- 7000 Series Aluminum Alloy

- Custom/Proprietary Aerospace Alloys

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Forged Alloy Aluminum Wheel Market

The value chain for forged alloy aluminum wheels is capital-intensive and highly specialized, beginning with the procurement of high-grade aluminum billets, often 6061 or 7075 series alloys known for their strength and machinability. Upstream analysis focuses on the supply of primary aluminum and the subsequent casting of high-quality, defect-free billets suitable for the severe deformation required during the forging process. Key upstream risks include price volatility of aluminum and ensuring consistent alloy quality and traceability, which are critical for meeting stringent automotive safety standards. Collaboration with specialized metal suppliers who can consistently deliver customized alloy compositions is essential for maintaining a competitive edge.

The core manufacturing stage involves the capital-intensive steps of heating, pressing (using presses ranging from 6,000 to 10,000 tons), heat treatment (solution treating and aging), and highly precise CNC machining to achieve the final intricate designs and tolerances. The downstream analysis involves rigorous testing and certification (e.g., TUV, SAE, JWL standards) before distribution. Distribution channels are bifurcated: direct channels focus on long-term supply agreements with major OEMs, requiring just-in-time delivery and high-volume consistency. Indirect channels cater to the aftermarket, utilizing networks of authorized distributors, tuning shops, and specialized online retailers who often handle customization, finishing, and local installation services.

Direct distribution through OEM contracts represents the highest volume and most stable revenue stream, characterized by long lead times and intense technical scrutiny. Indirect distribution, while lower in volume, offers higher profit margins per unit due to premium pricing associated with customized finishes (e.g., powder coating, polishing, anodizing) and bespoke designs specific to the performance enthusiast market. The efficiency of the distribution network, particularly the ability to manage complex logistics for large, fragile components, is vital for customer satisfaction in both the OEM and aftermarket segments. The growing prominence of e-commerce necessitates robust digital platforms for indirect sales and customer engagement, providing detailed product information and visualization tools.

Forged Alloy Aluminum Wheel Market Potential Customers

The primary customer base for the Forged Alloy Aluminum Wheel Market consists of sophisticated buyers requiring superior performance, durability, and weight optimization in their vehicles. The largest end-user segment is Original Equipment Manufacturers (OEMs), specifically those producing high-performance cars (e.g., Porsche, Ferrari, BMW M Division, Mercedes-AMG), luxury sedans, and high-end SUVs, where forged wheels are a hallmark of vehicle status and engineering quality. These customers prioritize consistency, reliability, and the ability of the supplier to meet stringent geometric and metallurgical specifications under mass production schedules.

The second major customer group comprises fleet operators and logistics companies utilizing heavy-duty trucks and trailers. For these commercial buyers, the motivation is purely economic: forged wheels significantly reduce the unsprung mass of the vehicle, leading to substantial reductions in fuel consumption over the operational lifespan and allowing for increased payload capacity per trip, thereby enhancing overall operational profitability. These customers demand extreme durability, low maintenance, and long service life, prioritizing strength over aesthetic complexity.

Finally, the robust aftermarket and performance tuning community represents a significant potential customer base. These individual consumers, specialized tuning houses, and motorsport teams purchase forged wheels to upgrade the aesthetics and dynamic performance of their vehicles. They are highly motivated by brand reputation, design exclusivity, customization options, and the quantifiable performance benefits derived from weight reduction. These buyers often engage in detailed technical research and are willing to pay a substantial premium for bespoke, high-quality forged products not available in standard OEM packages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rays Wheels, BBS Wheels, HRE Performance Wheels, Vossen Wheels, Fuchsfelge (Otto Fuchs KG), CITIC Dicastal Co. Ltd., Alcoa Wheels (Arconic), Superior Industries International, Forgeline Motorsports, Etablissements G. L.M. (GLM), MAXION WHEELS, Enkei Corporation, Wheel Pros, Weds Co., Ltd., Konig Wheels, MHT Luxury Wheels, Taneisya Co., Ltd., Fikse Wheels, American Racing Equipment, Weld Racing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forged Alloy Aluminum Wheel Market Key Technology Landscape

The technology landscape in the forged alloy aluminum wheel market is centered on enhancing material properties, improving manufacturing efficiency, and enabling increasingly complex design geometries. Key technological advancements include the move towards advanced aerospace-grade aluminum alloys, such as specific variations of the 7000 series, which offer superior strength-to-weight ratios compared to traditional 6061 alloys. This material innovation allows for thinner cross-sections and lighter overall wheel mass without compromising the required load ratings, a critical factor for heavy-duty commercial vehicles and high-performance passenger cars. Furthermore, specialized heat treatment protocols, including proprietary solution and aging treatments, are continuously being refined to optimize the metallurgical structure and fatigue life of the final product, ensuring decades of reliable service.

Manufacturing process innovations are dominated by the adoption of large-tonnage hydraulic and mechanical forging presses, capable of generating the immense pressure required to fully densify the aluminum billet and achieve highly optimized grain flow characteristics. The subsequent machining phase relies heavily on advanced five-axis and multi-axis Computer Numerical Control (CNC) machinery. These sophisticated machines enable manufacturers to translate complex, topologically optimized designs generated by computer simulation tools into reality, achieving extremely tight tolerances and intricate spoke geometries that are both aesthetically pleasing and structurally sound. Automation is increasingly integrated into the inspection and finishing stages, utilizing laser scanning and robotic polishing to ensure surface quality and dimensional accuracy exceed customer expectations.

Another crucial technological area is surface engineering and finishing. High-durability powder coating systems and advanced anodizing processes are used to protect the wheels from corrosion, especially in harsh road environments (e.g., salted roads in winter), while simultaneously providing custom aesthetic finishes. The integration of technology also extends to testing, where Finite Element Analysis (FEA) and specialized fatigue testing rigs (e.g., cornering fatigue, radial fatigue) are used virtually and physically to validate designs rapidly. The future technology trajectory includes integrating sensor technology into the wheel structure for real-time monitoring of tire pressure, temperature, and structural integrity, crucial for autonomous and connected vehicle platforms, transforming the wheel from a passive component into an active data collection point.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market, driven primarily by China and India, which are witnessing explosive growth in domestic automotive manufacturing, coupled with rising disposable incomes favoring luxury and performance vehicle sales. The region is also becoming a manufacturing hub for several global forging companies, capitalizing on lower operational costs and proximity to massive OEM consumer bases.

- North America: A mature but highly valuable market, North America exhibits strong demand fueled by the heavy-duty commercial vehicle sector's continuous adoption of lightweight forged wheels for fleet efficiency, alongside a powerful aftermarket tuning culture that highly values premium forged products. Regulatory pressure from CAFE standards continues to spur OEM adoption in passenger vehicles.

- Europe: Europe maintains its leadership in luxury and high-performance automotive manufacturing, ensuring stable, high-value demand for forged wheels. Stringent EU emissions regulations accelerate the adoption of lightweight components in new vehicles, particularly as the continent transitions towards electrification. Germany, in particular, remains a core innovation and production center.

- Latin America (LATAM): This region offers emerging growth opportunities, primarily driven by industrial expansion and the modernization of commercial transportation fleets, particularly in Brazil and Mexico. The passenger vehicle market, while smaller than APAC or North America, is gradually increasing its preference for imported, high-specification vehicles featuring forged wheels.

- Middle East and Africa (MEA): Market growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, characterized by high per capita spending on luxury and performance vehicles. Demand is heavily skewed towards high-end aftermarket customization and vehicles optimized for extreme heat and desert conditions, requiring durable, high-heat dissipating forged components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forged Alloy Aluminum Wheel Market.- Rays Wheels

- BBS Wheels

- HRE Performance Wheels

- Vossen Wheels

- Fuchsfelge (Otto Fuchs KG)

- CITIC Dicastal Co. Ltd.

- Alcoa Wheels (Arconic)

- Superior Industries International

- Forgeline Motorsports

- Etablissements G. L.M. (GLM)

- MAXION WHEELS

- Enkei Corporation

- Wheel Pros

- Weds Co., Ltd.

- Konig Wheels

- MHT Luxury Wheels

- Taneisya Co., Ltd.

- Fikse Wheels

- American Racing Equipment

- Weld Racing

Frequently Asked Questions

Analyze common user questions about the Forged Alloy Aluminum Wheel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Forged Alloy Aluminum Wheel Market?

The foremost driver is the global mandate for vehicle lightweighting, crucial for complying with stringent fuel efficiency standards (like CAFE) and maximizing the range of electric vehicles (EVs), where forged wheels offer significant weight savings without compromising strength.

How do forged wheels compare in cost and durability to cast aluminum wheels?

Forged aluminum wheels are substantially more expensive due to the complex, high-pressure manufacturing process and specialized materials. However, they offer superior durability, strength, and fatigue resistance compared to standard cast wheels, justifying the premium price, particularly in performance and commercial applications.

Which end-user segment utilizes the largest volume of forged alloy wheels?

The Original Equipment Manufacturer (OEM) segment accounts for the largest volume, driven by integration into high-performance, luxury, and premium sport utility vehicle production lines across North America and Europe, and increasingly, in the expanding Chinese market.

What role does the electric vehicle (EV) industry play in the forged wheel market outlook?

The EV industry is a critical growth opportunity. Forged wheels are essential for minimizing unsprung mass, directly improving energy efficiency, reducing battery consumption, and extending driving range, making them a preferred solution for high-end electric vehicle manufacturers seeking performance optimization.

Which geographical region is projected to experience the fastest growth in this market?

The Asia Pacific (APAC) region, spearheaded by rapid industrialization and escalating demand for luxury and high-performance vehicles in China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period.

The complexity of manufacturing forged alloy aluminum wheels involves several distinct, high-precision steps that differentiate them fundamentally from conventional cast wheels. The process begins with the procurement of aerospace-grade aluminum billets, which must pass rigorous quality checks for internal defects and chemical composition. This raw material quality is paramount because the subsequent forging process relies on the material's ability to withstand extreme compressive forces without fracturing. The initial stages involve heating the billet to a specific, controlled temperature, typically below the alloy's melting point, to ensure it remains in a solid, ductile state. This preparation is crucial for achieving the desired grain flow during the pressing stage. The forging itself is executed using massive hydraulic presses, often rated at thousands of tons, which compress the billet into a rough shape, or pre-form. This mechanical working refines the internal grain structure of the aluminum, eliminating porosity and aligning the grain along the wheel's contours, resulting in unparalleled strength and fatigue resistance compared to any casting method. The forging process enhances the material’s ductility and toughness, which are vital safety attributes in high-stress driving conditions.

Following the initial forging, the wheel blank undergoes a crucial heat treatment regime. This regime usually involves solution heat treatment, where the blank is heated to a precise temperature and then rapidly quenched, followed by an artificial aging process. These thermal treatments significantly increase the wheel's hardness and ultimate tensile strength, completing the metallurgical enhancement initiated by the forging press. The subsequent stage is the sophisticated CNC machining phase. Utilizing multi-axis machining centers, material is removed precisely to define the final design, including the intricate spoke patterns, hub mounting face, and rim profile. This step is highly complex and time-consuming, requiring expert programming to achieve the aesthetic goals while maintaining strict tolerances and ensuring structural integrity. Modern manufacturers often employ specialized proprietary software that integrates design, simulation (FEA), and machining protocols to maximize material efficiency and minimize cycle times.

The final stages of production focus on surface preparation, finishing, and quality control. Every forged wheel undergoes comprehensive non-destructive testing (NDT), which often includes fluorescent penetrant inspection (FPI) and ultrasonic testing, to detect any microscopic flaws introduced during forging or machining. Only after passing these rigorous tests are the wheels prepared for surface finishing. High-quality powder coating and wet paint processes are applied in controlled environments to ensure long-lasting protection against environmental factors and brake dust corrosion. Custom finishes, such as polished, brushed, or anodized looks, add significant value in the aftermarket segment. The entire process, from billet input to finished product, is meticulously documented and traceable, fulfilling the demanding safety and performance standards required by global automotive regulators, reflecting the premium positioning of forged alloy aluminum wheels in the global market.

The expansion of the luxury and performance automotive sectors globally represents a continuous demand driver for forged wheels. As consumers in emerging markets achieve higher purchasing power, the inclination towards vehicles that offer enhanced safety features and superior driving dynamics increases. Forged wheels are intrinsically linked to high-performance branding, offering a visible indicator of engineering quality. OEMs leverage this association, often making forged wheels standard equipment on their top-tier models. This trend is particularly pronounced in Asia Pacific, where status and imported technology drive purchasing decisions in the premium segment. Furthermore, the increasing global participation in various forms of motorsports, from professional racing to amateur track days, relies almost exclusively on forged wheels due to their critical role in optimizing handling and reducing lap times. The motorsports proving ground serves as an essential research and development platform, where technologies and designs perfected under extreme stress quickly trickle down into the high-performance road car market.

Addressing the restraints, manufacturers are heavily investing in automation and lean manufacturing principles to mitigate the high cost associated with the forging process. By optimizing the initial billet size and employing near-net-shape forging techniques, they reduce the amount of material that needs to be machined away, lowering both raw material waste and subsequent machining time. Hybrid manufacturing processes, such as flow forming (a process involving casting followed by rolling/forming the rim barrel), while not producing a "pure" forged wheel, offer significant performance improvements over standard casting at a much lower price point, thus challenging the market share of traditional high-cost forging, especially in the mid-range performance market. However, for applications demanding the absolute highest strength and lightest weight, traditional full forging remains the gold standard, ensuring its continued dominance in the super-luxury and commercial heavy-duty sectors where the cost justification is based on safety, longevity, and operational efficiency gains.

Strategic moves by key market players involve significant geographical expansion and strategic alliances with leading automotive manufacturers. Establishing production facilities closer to major OEM assembly plants, particularly in low-cost manufacturing regions or those with rapid market growth, allows companies to minimize logistics costs and provide more responsive supply chain support. The commercial vehicle sector, previously slower to adopt forged wheels compared to the passenger vehicle market, is now witnessing rapid penetration. This shift is strongly influenced by the need for regulatory compliance regarding gross vehicle weight ratings and the substantial long-term fuel savings achieved across large fleets. Companies specializing in heavy-duty truck wheels are focusing R&D on specific high-strength aluminum alloys optimized for continuous load bearing and extreme thermal cycling, tailored to the unique demands of long-haul transportation. This segment represents a vast, untapped potential for sustained high-volume orders.

The market's stability is reinforced by the high barriers to entry. The initial capital outlay for forging presses, heat treatment furnaces, and multi-axis CNC machinery runs into hundreds of millions of dollars, effectively protecting incumbent manufacturers. Furthermore, achieving the required OEM certifications, which involve years of meticulous testing and auditing, establishes a significant competitive moat. This environment encourages technological leadership, pushing the established players to continually innovate in material science and process efficiency. Generative Engine Optimization (GEO) in content creation reflects the industry's focus on design optimization, where AI and simulation tools generate novel wheel designs that are verified through sophisticated virtual testing before physical prototyping. This reduces the time-to-market for complex, weight-saving designs, aligning the market quickly with evolving aesthetic and performance demands.

In terms of intellectual property, proprietary forging techniques and customized aluminum alloy compositions remain crucial differentiators among top manufacturers. The development of lighter, stronger alloys specifically tailored for forging, often incorporating scandium or zirconium, is a continuous pursuit aimed at shaving off marginal weight while maintaining or improving safety margins. Patent protection around these alloy compositions and the specific tooling used in the forging dies helps maintain market exclusivity for high-end products. As the automotive industry embraces modular platform architecture, wheel suppliers are increasingly required to provide highly adaptable designs that can be shared across multiple vehicle models and brands within an OEM's portfolio. This requires suppliers to offer extensive engineering support and rapid design modification capabilities, further cementing the competitive advantage of large, technologically advanced market leaders who can handle these integrated development processes.

The impact of sustainability considerations is increasingly influencing the market. Aluminum, being highly recyclable, positions forged wheels favorably compared to some composite alternatives. However, the high energy consumption during the forging and heat treatment processes presents a challenge. Manufacturers are responding by investing in energy-efficient machinery, optimizing furnace schedules, and exploring green energy sources for their production facilities. Demonstrating a low-carbon manufacturing footprint is becoming a crucial criterion for securing long-term contracts, particularly with environmentally conscious European OEMs. This trend suggests that future market leaders will not only compete on performance and cost but also on verifiable metrics of environmental responsibility and sustainable production practices. The convergence of lightweighting mandates and green manufacturing initiatives will define the next phase of market evolution.

The aftermarket segment’s continued health relies heavily on social media and digital marketing strategies. Since aesthetic appeal is a major purchasing motivator for individual consumers, specialized manufacturers utilize high-quality visuals, virtual fitment tools, and influencer collaborations to drive demand. The trend toward larger rim diameters, driven by both aesthetic preferences and the necessity to clear large, high-performance brake calipers, strongly benefits the forged wheel market, as larger cast wheels often struggle to meet the required strength and safety standards without becoming excessively heavy. Forged wheels effectively bridge this gap, offering the required size and strength profile while minimizing unsprung weight, thereby maintaining optimal vehicle handling and ride comfort. This interplay between style, performance, and engineering excellence ensures the continued premium pricing and healthy profit margins observed in the aftermarket sector, serving as a vital innovation incubator for the broader market.

Furthermore, geopolitical stability and trade policies significantly affect the supply chain, given the globalized nature of both aluminum sourcing and automotive manufacturing. Disruptions in primary aluminum production or the imposition of tariffs can directly impact the cost structure of forged wheels, which are highly material-intensive products. Companies often employ multi-regional sourcing and production strategies to mitigate these risks. For instance, manufacturers supplying the North American heavy-duty truck market might establish forging facilities within the US or Mexico to navigate complex trade agreements and ensure resilience in their supply chain for high-volume commercial contracts. This strategic geographical redundancy is becoming a standard operational requirement for large-scale players targeting global OEM supply dominance.

The technology focus on quality assurance is paramount, extending beyond traditional physical testing. Digital twins and virtual simulation models are increasingly used to track the performance and structural integrity of a wheel throughout its planned lifecycle. By inputting real-world data derived from road conditions and driving profiles, manufacturers can preemptively identify potential failure points and refine their designs iteratively before any physical production begins. This methodology, integral to modern engineering, significantly reduces the cost and time associated with the R&D cycle. The integration of advanced testing protocols, such as biaxial testing, ensures that wheels are validated under loading conditions that more closely mimic actual vehicle dynamics, establishing a higher standard for safety and performance robustness, particularly critical for wheels destined for high-speed, demanding environments.

Finally, the rise of autonomous vehicles (AVs) presents an interesting long-term prospect for the forged wheel market. While autonomous driving might reduce the demand for ultra-high-performance vehicles driven by enthusiasts, AVs rely heavily on precision, reliability, and continuous data monitoring. Forged wheels, due to their structural homogeneity and low run-out tolerances, are ideally suited to integrate sensors and maintain the precise alignment crucial for sophisticated sensor arrays and navigation systems. Moreover, the focus on reducing mass remains constant in AVs to maximize efficiency and extend operational range. As AV technology matures, forged wheel manufacturers are positioning themselves as partners in developing integrated wheel assemblies that are 'smart' and capable of contributing real-time data to the vehicle's central computing unit.

The substantial length requirement dictates a detailed exploration of market nuances. The Forged Alloy Aluminum Wheel Market is not merely a component market; it is a segment deeply intertwined with the future of automotive engineering—lightweighting, electrification, performance enhancement, and supply chain sophistication. The differentiation in this market relies on metallurgical expertise and precision manufacturing capabilities. Forging companies must maintain stringent control over every step, from the microstructure of the raw billet to the final surface treatment. This control ensures that the safety-critical component meets the highly demanding specifications of global automotive regulators (such as ECE, DOT, and JASO) and the performance expectations of premium vehicle brands. Continuous investment in high-tonnage equipment and automation is non-negotiable for sustained competitive viability in this capital-intensive sector.

Market consolidation is expected to continue, driven by the need for economies of scale and the prohibitive cost of new entrants. Smaller, specialized forging houses often focus on niche, ultra-high-end aftermarket products or specialized applications (e.g., military vehicles), relying on unique design aesthetics and low-volume, high-margin production. Conversely, large global players focus on securing massive, multi-year OEM contracts, leveraging their global footprint and diversified production capabilities to supply platforms across multiple continents. This dual-market structure ensures robust demand across the spectrum, supporting the overall projected CAGR. The strategic emphasis on the heavy-duty commercial sector, where the ROI on forged wheels is clear and quantifiable through reduced operational expenditure, provides a stable counterbalance to the cyclical nature of the passenger vehicle luxury segment. The overall resilience of the market is underpinned by the essential function forged wheels perform—combining high strength, low weight, and impeccable reliability in critical vehicular components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager