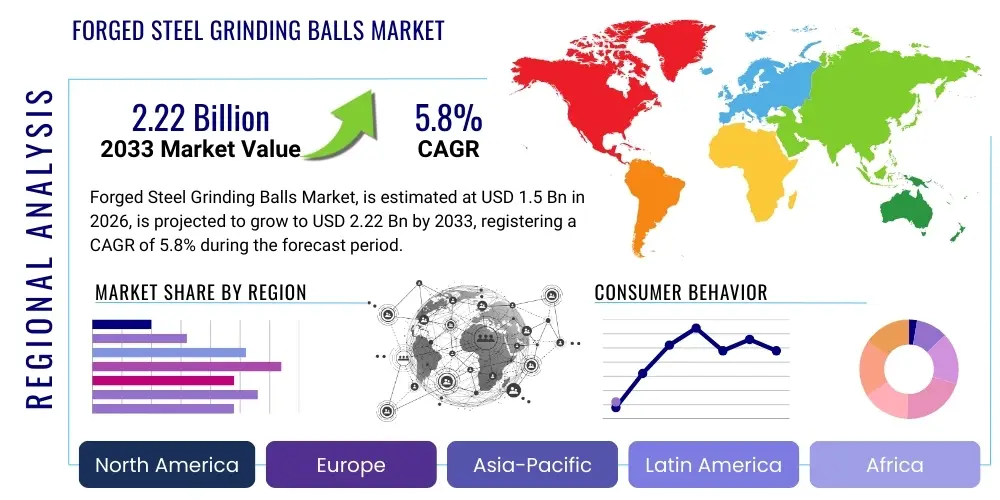

Forged Steel Grinding Balls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435505 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Forged Steel Grinding Balls Market Size

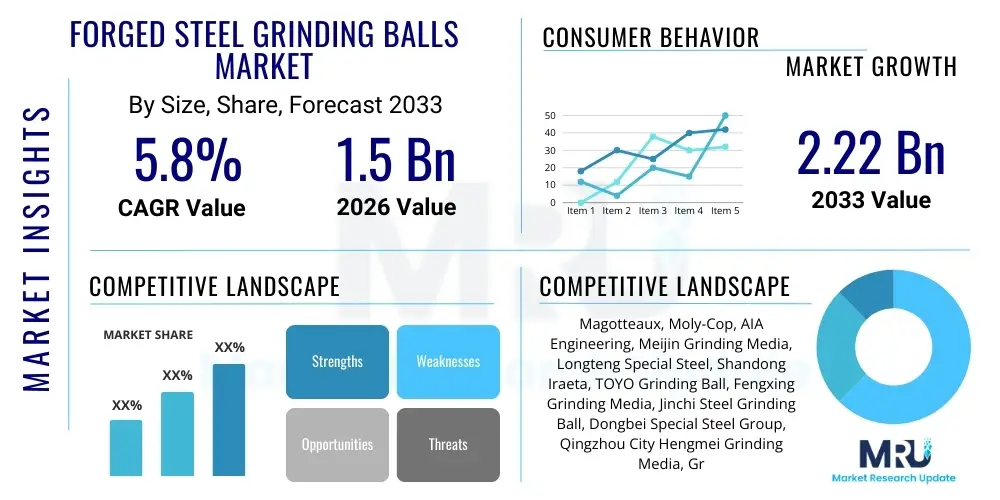

The Forged Steel Grinding Balls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Forged Steel Grinding Balls Market introduction

The Forged Steel Grinding Balls Market involves the manufacturing and distribution of specialized steel spheres used as grinding media in ball mills and related equipment across various heavy industries. These media are essential for reducing the particle size of raw materials through impact and attrition, a critical step in mineral processing, cement manufacturing, and thermal power generation. Forging ensures high density, superior hardness, and excellent wear resistance compared to cast alternatives, thereby extending the service life and improving milling efficiency. The rigorous forging process aligns the internal grain structure of the steel, minimizing internal defects and providing consistent performance under high-stress operating environments, which is crucial for large-scale industrial operations where downtime is extremely costly. The demand for these forged balls is directly correlated with global mineral extraction rates, infrastructure investment, and the efficiency mandates imposed by major industrial consumers aiming to optimize energy consumption during comminution.

The primary materials used in manufacturing include various grades of medium and high carbon steel, often alloyed with elements such as chromium, molybdenum, and manganese to enhance specific characteristics like corrosion resistance and surface hardness. Product quality is dictated by factors such as diameter uniformity, sphericity, volumetric hardness, and overall resistance to chipping and spalling. Major applications span the entire mining value chain, particularly in the grinding of copper, gold, iron ore, and platinum group metals, where consistent quality and minimizing media consumption per tonne of ore processed are paramount. The market is highly competitive, driven by technological advancements in forging techniques, heat treatment protocols, and proprietary steel compositions designed to maximize energy efficiency and operational throughput in demanding industrial settings.

Key driving factors propelling market expansion include the sustained demand for essential minerals globally, fueled by electrification trends and the transition to renewable energy infrastructure, which requires significant amounts of copper, lithium, and rare earth elements. Furthermore, the increasing complexity of mined ores, which often necessitate finer grinding to achieve liberation, drives the requirement for high-quality, high-performance grinding media capable of enduring aggressive comminution processes. The inherent benefits of forged steel balls, such as lower consumption rates, reduced mill liner wear, and subsequent reduction in operational costs, position them favorably against lower-cost, but less durable, cast grinding media in high-volume, continuous operation facilities.

Forged Steel Grinding Balls Market Executive Summary

The Forged Steel Grinding Balls Market is experiencing robust growth characterized by strategic technological shifts focusing on high-efficiency media and sustainable production practices. Business trends indicate a movement towards greater operational integration among key manufacturers, often involving vertical integration into steel sourcing or specialization in advanced heat treatment processes to maintain competitive edge and ensure stringent quality control. Geographically, market expansion is heavily concentrated in resource-rich regions, particularly Asia Pacific and Latin America, driven by massive investments in new mining projects and expansion of existing processing capacities, especially for base metals critical to the global energy transition. Furthermore, regulatory pressures regarding energy consumption and environmental impact are compelling end-users to prioritize premium forged media that reduce specific energy consumption per tonne of throughput, thus driving premium pricing for advanced alloy compositions.

Regional trends reveal Asia Pacific as the dominant market, primarily due to the vast mining operations in China, Australia, and India, coupled with massive infrastructure development requiring cement. North America and Europe, while mature, focus heavily on technological upgrades and maximizing operational efficiency in existing mills, showing high demand for niche, specialized grinding balls with superior performance characteristics designed for specific ore types. Latin America presents significant growth opportunities, particularly in Chile and Peru, major global producers of copper and iron ore, necessitating reliable, high-volume supply chains for grinding media. This regional disparity necessitates tailored supply chain strategies, focusing on localized manufacturing or strategic warehousing to minimize logistical costs and lead times, which are substantial given the product's high weight and volume.

Segment trends underscore the dominance of the Mining application segment, specifically within gold, copper, and iron ore extraction, which collectively account for the majority of the overall market volume and value. Within the product diameter segmentation, medium-sized balls (typically 70 mm to 100 mm) remain the workhorse of primary grinding circuits, although the demand for smaller diameter balls (less than 50 mm) is growing due to the push for ultra-fine grinding required for complex or low-grade ores. In terms of material composition, high carbon content combined with increased chromium and molybdenum alloying is witnessing elevated adoption, driven by the need for enhanced abrasion resistance in highly corrosive or exceptionally hard rock grinding environments. Manufacturers are increasingly focusing on lifecycle cost analysis rather than initial purchase price, leading customers to favor high-durability products that ultimately yield lower Total Cost of Ownership (TCO).

AI Impact Analysis on Forged Steel Grinding Balls Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Forged Steel Grinding Balls Market predominantly center around optimizing manufacturing processes, improving quality consistency, and applying predictive analytics in end-user operations. Key themes revolve around how AI can enhance the forging process itself—specifically in controlling heat treatment cycles and automating quality inspection to minimize defects—thereby reducing production costs and increasing product uniformity. There is significant interest in how AI-driven predictive maintenance systems in mining and cement plants utilize sensor data to forecast media wear rates, optimize ball charge composition, and schedule mill shutdowns, directly influencing the demand patterns and inventory management of grinding media suppliers. Users expect AI to fundamentally shift the traditional supplier-customer relationship from transaction-based sales to data-driven service models, where media manufacturers provide real-time performance diagnostics.

The core concerns often address the implementation challenges, including the high initial investment in sensors and AI infrastructure necessary both at the manufacturing plant and the customer's site. Users also question the security and standardization of data sharing across the value chain, as mill operating data is proprietary and crucial for accurate wear modeling. Expectations are high regarding enhanced product performance traceability; AI systems are anticipated to link specific production batches of forged balls to their in-mill performance metrics, creating a closed-loop feedback mechanism for continuous improvement in alloy design and forging parameters. This capability promises to unlock new levels of efficiency, making the selection of the optimal grinding media less empirical and more data-driven, thereby favoring suppliers who can integrate advanced digital services with their physical product offering.

Ultimately, AI's influence is expected to stabilize demand through better inventory forecasting and performance monitoring, rather than drastically changing the physical product. AI implementation in the manufacturing stage will lead to lower variance in hardness and density, crucial factors for media performance. In end-use applications, AI algorithms analyzing ore hardness variability and mill power draw will dictate optimal ball diameter distribution and replenish rates, potentially leading to more specialized, just-in-time deliveries rather than bulk purchases, transforming logistical requirements and supply chain responsiveness across the industry globally.

- AI-driven optimization of heat treatment cycles leading to enhanced, uniform product hardness.

- Implementation of machine vision and automated defect detection in forging and inspection processes, improving quality consistency.

- Use of predictive maintenance (PdM) analytics by end-users to optimize grinding media consumption and inventory levels.

- Creation of digital twins for ball mills, utilizing AI to model grinding efficiency and predict optimal ball charge load.

- Data integration between manufacturers and end-users to offer performance-as-a-service models and real-time wear analysis.

- Enhanced material traceability and quality control linking specific batch chemistries to field performance metrics through large dataset analysis.

DRO & Impact Forces Of Forged Steel Grinding Balls Market

The dynamics of the Forged Steel Grinding Balls Market are governed by a complex interplay of demand-side drivers originating from global industrial growth and supply-side constraints, coupled with continuous technological pressure. The primary driving force remains the sustained global commitment to mining critical minerals necessary for energy transition technologies, including electric vehicles and renewable energy storage. This necessitates large-scale, efficient comminution circuits, inherently increasing the demand for high-quality grinding media. Conversely, the market faces significant restraints stemming from the volatility in raw material costs, particularly steel scrap and alloying elements like chromium and molybdenum, which directly impact manufacturing margins and product pricing stability. Opportunities are predominantly centered around the development of ultra-high-performance alloys that promise exceptional wear life and reduced energy consumption, alongside the geographic expansion into newly developing mining frontiers in Africa and Southeast Asia.

Impact forces currently shaping the market are centered around competitive rivalry and supplier power. The market structure features a few global behemoths possessing extensive integrated operations and strong brand recognition, leading to intense competition based on product quality, guaranteed supply, and long-term contractual agreements. Supplier power is moderate; while raw steel is a commodity, the specialized alloying and precise forging technology required confer significant power to specialized media manufacturers. Furthermore, regulatory forces, particularly those relating to industrial safety and environmental protection, push manufacturers to adopt cleaner production methods and develop products with enhanced durability, reducing the environmental burden associated with media disposal and frequent replacement. Technological substitution pressure remains a latent threat, driven by advancements in alternative comminution technologies such as High Pressure Grinding Rolls (HPGRs), which, while not a direct replacement for all ball milling, can reduce the overall throughput requirement for grinding media in certain applications.

Market growth is also critically influenced by macroeconomic indicators such as global GDP growth and investment cycles in the construction and infrastructure sectors, particularly in emerging economies. The high capital expenditure required for new mining projects dictates the volume of new grinding mill installations, which, in turn, fuels initial demand for ball charges. Subsequent replacement demand, which accounts for the vast majority of ongoing consumption, is influenced by the operational characteristics of existing mills and the quality of the media used. Consequently, the long-term impact forces lean towards sustained demand, mitigated by the necessity for manufacturers to continually innovate and minimize the cost-per-tonne of processed material for the end-user, ensuring that forged steel media remains the most economical and efficient solution for intensive comminution processes.

Segmentation Analysis

The Forged Steel Grinding Balls Market is structurally segmented based on crucial industrial parameters including product diameter, primary material composition, and the specific application industry, which dictates performance requirements and volume demand. This segmentation is vital for manufacturers to tailor product offerings and marketing strategies, recognizing that the optimal grinding media composition and size varies significantly between processing hard, abrasive iron ore and softer materials like cement clinker. Analyzing these segments provides deep insights into regional demand characteristics, pricing sensitivities, and the technological focus required for future product development. The application segment, specifically mining, holds the largest market share, dictating the overall market trends, although diversification into industrial segments like thermal power and chemicals provides stability.

Segmentation by diameter is critical as it directly relates to the target particle size reduction and the size of the ball mill. Large diameter balls (above 100 mm) are primarily used for initial, coarser grinding stages in larger mills, offering high impact energy, while smaller diameter balls (less than 50 mm) are required for fine and ultra-fine grinding circuits where surface area contact is prioritized over brute impact. Material segmentation reflects the trade-off between cost and wear life; high chrome steel formulations, though more expensive, offer superior abrasion and corrosion resistance, suitable for challenging, complex ore bodies. Conversely, lower chrome or specialized carbon steels are often utilized where initial cost savings or less aggressive grinding environments are primary considerations, ensuring a diversified product portfolio meets varied budget and operational constraints globally.

The market’s future trajectory will likely see increasing fragmentation within the application segment, particularly as specific ore types (e.g., lithium, cobalt) require highly tailored grinding solutions to achieve maximum yield, driving demand for specialized alloys. Furthermore, the push towards standardized, globally recognized specifications for grinding media quality will reinforce the importance of material and diameter segments, favoring manufacturers capable of maintaining strict tolerances and certified performance characteristics. Understanding these segmentation nuances is key for investment decisions and strategic capacity planning across the manufacturing base.

- By Diameter:

- Small Diameter Balls (Less than 50 mm)

- Medium Diameter Balls (50 mm to 100 mm)

- Large Diameter Balls (Above 100 mm)

- By Application:

- Mining (Iron Ore, Copper, Gold, Platinum Group Metals, Other Metals)

- Cement Industry

- Thermal Power Generation (Coal Grinding)

- Chemical Industry

- Other Industrial Applications

- By Material/Grade:

- High Carbon Steel (Standard Forged)

- High Chrome Steel Alloy

- Medium Carbon/Alloy Steel

Value Chain Analysis For Forged Steel Grinding Balls Market

The value chain for the Forged Steel Grinding Balls Market initiates with the procurement and processing of raw materials, primarily high-quality steel scrap, ferroalloys (such as chromium, molybdenum, and manganese), and carbon additives. Upstream analysis focuses on steel manufacturers and specialized alloy suppliers, whose pricing volatility and quality consistency fundamentally influence the final product cost and performance. Efficient sourcing and hedging strategies are paramount for grinding media producers to mitigate the substantial risks associated with fluctuating global commodity markets. The quality of the procured steel feedstock, particularly its chemical purity and low inclusion content, dictates the subsequent forging success and the final wear resistance characteristics of the grinding ball, making upstream quality control critical.

The core manufacturing process involves steel preparation, precision heating, hot forging, and rigorous, proprietary heat treatment—the latter being the most value-adding step as it determines the microstructure and hardness profile. Distribution channels primarily involve large direct sales contracts with major mining and cement companies, facilitated by regional sales offices and specialized logistics partners capable of handling high-volume, heavy cargo shipments. Indirect channels, involving third-party distributors or agents, are typically utilized for smaller volume sales, localized industrial applications, or in regions where the manufacturer does not maintain a direct operational presence. The efficiency of the distribution network, particularly the ability to deliver bulk quantities reliably and on schedule to remote mining sites, is a significant competitive differentiator in this market.

Downstream analysis centers on the end-user sectors, dominated by large-scale mineral processing plants and cement manufacturing facilities. The product lifecycle concludes with the consumption of the media in the mill, where performance metrics like wear rate, grinding efficiency, and specific energy consumption are monitored. Manufacturers increasingly engage in downstream technical support, offering consulting services regarding ball charge optimization and mill liner protection, effectively integrating their product offering with performance optimization services. This move strengthens customer retention and allows for valuable feedback regarding product efficacy in varied operational environments, closing the loop for continuous product improvement and market responsiveness.

Forged Steel Grinding Balls Market Potential Customers

Potential customers for Forged Steel Grinding Balls are predominantly heavy industrial entities operating large-scale comminution circuits where material reduction is a prerequisite for downstream processing. The largest buyers are global mining corporations involved in the extraction and processing of high-volume base metals and precious minerals, including copper miners, iron ore producers, and gold mining operations. These entities prioritize media quality, long-term contractual stability, and reliability of supply, often requiring tailored performance guarantees to meet specific ore body characteristics and throughput targets. The scale of operation in the mining sector necessitates frequent, high-volume replenishment of grinding media, making this segment the backbone of the market demand.

The second major category includes cement manufacturers, where ball mills are extensively used for grinding cement clinker and raw materials. While the abrasiveness profile may differ from hard rock mining, the cement industry demands consistent quality and often smaller diameter balls for fine grinding processes. Energy efficiency is a critical purchasing criterion in this sector, driving demand for media that minimizes mill power consumption. Other significant industrial end-users include thermal power generation plants utilizing coal-fired boilers, requiring media for coal pulverization, and certain chemical processing industries that rely on wet grinding for material preparation, each presenting unique logistical and quality requirements based on the material being processed.

Procurement decisions within these large corporations are highly technical and capital-intensive, typically involving metallurgical experts and procurement teams analyzing the Total Cost of Ownership (TCO), considering not just the initial ball cost but the wear rate, energy efficiency gains, and impact on mill liner life. Suppliers must effectively demonstrate superior wear resistance and consistent quality through certified product testing and successful long-term operational track records. Consequently, the market favors established manufacturers capable of handling complex logistics and providing robust technical support across diverse global operating locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magotteaux, Moly-Cop, AIA Engineering, Meijin Grinding Media, Longteng Special Steel, Shandong Iraeta, TOYO Grinding Ball, Fengxing Grinding Media, Jinchi Steel Grinding Ball, Dongbei Special Steel Group, Qingzhou City Hengmei Grinding Media, Grinding Media (Pty) Ltd., ArcelorMittal (via subsidiaries), CITIC Heavy Industries, Scaw Metals Group, Estanda, Metso Outotec, Klinger, Dalian Dexing Steel, Anhui Ningguo Grinding Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forged Steel Grinding Balls Market Key Technology Landscape

The technological landscape of the Forged Steel Grinding Balls Market is fundamentally focused on optimizing the manufacturing process to achieve superior material properties, primarily maximizing the combination of hardness, toughness, and wear resistance. Central to this is the advancement in hot forging techniques, which utilize highly automated presses to ensure precision shaping and internal structure alignment, minimizing internal stresses and defects inherent in cast products. Modern forging operations incorporate sophisticated temperature monitoring and control systems to manage the deformation process meticulously, ensuring that the crystalline structure achieves optimal refinement before entering the critical heat treatment phase. Continuous innovation in die design and forging pressure management also contributes to enhanced sphericity and dimensional stability, reducing logistical costs and improving mill performance efficiency.

The most significant area of technological differentiation lies in proprietary heat treatment protocols, often involving precise quenching and tempering cycles tailored to specific alloy compositions. Manufacturers employ advanced induction heating systems and controlled atmosphere quenching baths to achieve a deeply hardened microstructure that extends from the surface well into the core of the ball, preventing premature failure due to spalling or chipping. The application of sophisticated computational modeling, including Finite Element Analysis (FEA), helps predict the internal stress distribution and wear behavior under various operating conditions, allowing for iterative refinement of both the alloy composition and the thermal processing cycle, ultimately leading to products that offer a lower consumption rate per unit of ore processed.

Furthermore, the market is leveraging advancements in alloying technology, moving beyond traditional medium-carbon steel to complex compositions incorporating higher levels of chromium, nickel, and molybdenum. These super-alloyed forged balls are designed to withstand highly corrosive environments and extreme abrasive wear conditions, characteristic of new, complex ore bodies. Integrating IoT sensors and data analytics in the manufacturing plant allows for real-time quality assurance, tracing the entire production history of each batch, which is essential for providing performance traceability and meeting the rigorous quality expectations of global mining customers. This integration of material science, mechanical engineering, and digital technology defines the competitive edge in the modern forged grinding media market.

Regional Highlights

Regional dynamics heavily influence the demand and supply structure of the Forged Steel Grinding Balls Market, given the localized nature of raw material extraction and processing. Asia Pacific (APAC) stands out as the largest and fastest-growing market, primarily due to the presence of high-volume mineral processing operations in China and Australia, coupled with rapid urbanization and infrastructure development necessitating substantial cement production. China, in particular, dominates both consumption and manufacturing capacity, driving global pricing and innovation in high-volume, cost-effective forged media. Furthermore, increasing mining activities in countries like India, Indonesia, and the Philippines, targeting coal, nickel, and iron ore, solidify APAC's leading position, requiring manufacturers to establish robust local supply chains or manufacturing hubs to manage logistical efficiencies and import duties.

North America and Europe represent mature markets characterized by stringent quality requirements and a strong focus on operational sustainability and efficiency. While the volume growth is less aggressive than in APAC, these regions drive demand for premium, highly durable, and specialized grinding media designed to minimize replacement frequency and energy usage. Mining operations in Canada and the United States, targeting gold, copper, and iron ore, require media that offers exceptional performance consistency. European demand, while smaller in scale, is concentrated in the cement and quarrying sectors, where strict environmental regulations push for the adoption of high-performance media that reduce the operational footprint and waste generation associated with comminution processes.

Latin America, especially the Andean region encompassing Chile, Peru, and Brazil, is critical due to its substantial production of copper and iron ore. This region serves as a massive consumption hub, with major international mining companies maintaining continuous, large-scale operations. Demand here is sensitive to global commodity prices and relies heavily on reliable imports or local manufacturing capacity established by international players. The Middle East and Africa (MEA) region is emerging, driven by developing mining sectors in South Africa (PGMs, iron ore) and new ventures across North and West Africa. Investment in regional infrastructure and resource extraction is catalyzing demand, positioning MEA as a key growth region where logistical challenges often necessitate strategic partnerships with local distributors and port operators.

- Asia Pacific (APAC): Dominant market share and highest growth rate, fueled by Chinese and Australian mining sectors and massive infrastructure demand; focus on cost-efficient, high-volume production.

- Latin America: Major consumption hub driven by world-leading copper (Chile, Peru) and iron ore (Brazil) production; highly dependent on global commodity cycles and efficiency mandates.

- North America: Mature market focused on high-quality, specialized media for gold and copper mining; emphasis on technological integration and lower Total Cost of Ownership (TCO).

- Europe: Stable demand primarily from cement and quarrying sectors; strong regulatory push for sustainability and energy-efficient media consumption.

- Middle East & Africa (MEA): Emerging high-growth region driven by new mining projects and infrastructure expansion, notably in South Africa, relying on improved logistical frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forged Steel Grinding Balls Market.- Magotteaux

- Moly-Cop

- AIA Engineering

- Meijin Grinding Media

- Longteng Special Steel

- Shandong Iraeta

- TOYO Grinding Ball

- Fengxing Grinding Media

- Jinchi Steel Grinding Ball

- Dongbei Special Steel Group

- Qingzhou City Hengmei Grinding Media

- Grinding Media (Pty) Ltd.

- ArcelorMittal (via subsidiaries)

- CITIC Heavy Industries

- Scaw Metals Group

- Estanda

- Metso Outotec

- Klinger

- Dalian Dexing Steel

- Anhui Ningguo Grinding Materials

Frequently Asked Questions

Analyze common user questions about the Forged Steel Grinding Balls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using forged steel grinding balls over cast iron media?

Forged steel grinding balls offer significantly superior wear resistance, higher impact toughness, and a more uniform hardness profile that penetrates deeper into the core compared to cast media. This results in reduced media consumption rates, less mill downtime, and lower overall operational costs for end-users like mining companies.

Which industry segment accounts for the largest demand for forged grinding media globally?

The Mining Industry segment, particularly the processing of base metals (copper, iron ore) and precious metals (gold), accounts for the vast majority of the global demand for high-quality forged steel grinding balls due to the large scale and continuous operation requirements of mineral processing facilities.

How does the volatility of raw material prices affect the market?

Fluctuations in the prices of key raw materials, primarily steel scrap and alloying elements such as chromium and molybdenum, directly impact the manufacturing cost and profit margins of grinding media producers. Manufacturers often implement forward contracts and strategic sourcing to mitigate this significant cost volatility.

What role does heat treatment play in the performance of forged steel grinding balls?

Heat treatment is arguably the most critical step, determining the final microstructure, surface hardness, and volumetric hardness of the ball. Proprietary heat treatment protocols maximize wear resistance and toughness, ensuring the ball maintains its structural integrity and effectiveness throughout its service life in the mill.

Which geographical region exhibits the strongest growth potential in the foreseeable future?

Asia Pacific (APAC) is projected to maintain the strongest growth potential, driven by ongoing infrastructure expansion, continued high-volume mineral extraction in Australia and China, and the development of new industrial processing capacities across Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager