Forging Presses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432096 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Forging Presses Market Size

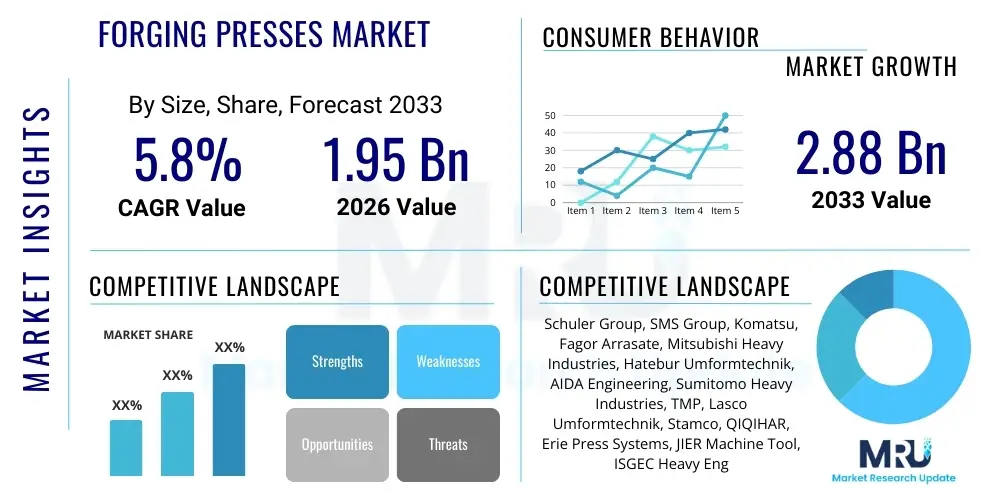

The Forging Presses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033.

Forging Presses Market introduction

The Forging Presses Market encompasses the production, distribution, and utilization of heavy-duty machinery designed to shape metal through compressive force, a process known as forging. These sophisticated machines are pivotal for creating high-strength, durable metal components with superior mechanical properties and refined grain structure, essential for critical applications across numerous industries. Forging presses, categorized primarily into mechanical, hydraulic, and screw presses, vary significantly in their tonnage capacity, speed, energy efficiency, and suitability for different materials and component geometries. Modern forging presses integrate advanced control systems and automation technologies to enhance precision, reduce material waste, and increase throughput, addressing the stringent quality demands of end-user sectors such as aerospace and defense.

The primary applications of these presses include the manufacturing of automotive powertrain components (crankshafts, connecting rods), structural elements for aircraft (landing gear parts, turbine blades), heavy industrial equipment components (gears, valves), and tools. The benefits derived from using forged components—including reduced porosity, excellent fatigue resistance, and predictable performance under high stress—drive sustained demand for advanced forging equipment. Furthermore, the drive toward lightweighting in the automotive and aerospace sectors, coupled with the increasing adoption of higher-strength alloys requiring precise deformation control, necessitates investment in newer, more powerful, and technologically integrated forging press systems capable of handling complex hot and cold forming operations effectively.

Key driving factors accelerating market expansion include the robust recovery and subsequent growth in global automotive production, particularly in emerging economies, and the continuous demand for high-performance components in the aerospace industry due to increasing passenger travel and military expenditure. Technological advancements, such as the development of servo-driven and hybrid presses that offer superior control over ram speed and energy consumption, further stimulate market growth by providing operational flexibility and reduced operating costs to manufacturers. Additionally, stringent regulatory requirements concerning material integrity and component safety across industrial and transport applications necessitate the quality assurance provided by forged parts, thereby securing the fundamental importance of forging presses in the industrial manufacturing landscape.

Forging Presses Market Executive Summary

The global Forging Presses Market is characterized by intense technological evolution, driven by the imperative for enhanced efficiency and integration within Industry 4.0 frameworks. Current business trends indicate a shift toward customizable, high-tonnage presses capable of processing novel, difficult-to-form materials like titanium and specialized nickel alloys, critical for advanced aerospace and energy applications. Strategic alliances focusing on offering comprehensive, integrated forging solutions, including automation, material handling, and simulation software integration, are becoming common among leading equipment manufacturers. Furthermore, sustainability is becoming a core competitive factor, pushing the adoption of energy-efficient technologies, particularly servo-mechanical presses, which offer reduced energy consumption compared to traditional hydraulic systems.

Regionally, the Asia Pacific (APAC) region dominates the market, primarily due to the vast manufacturing base, particularly in China and India, coupled with significant investments in automotive, infrastructure, and heavy machinery production. North America and Europe, while mature, remain crucial markets characterized by high demand for advanced, precision forging systems catering to strict aerospace and defense specifications, driving innovation in areas like isothermal and hot isostatic forging. The competitive landscape is intensely focused on technological differentiation, with key players concentrating on expanding their service offerings, including remote diagnostics and predictive maintenance platforms, to maximize equipment uptime and overall operational efficiency for their clients globally.

Segment trends reveal that the mechanical press segment maintains dominance owing to its speed and suitability for high-volume automotive production, though the hydraulic press segment is experiencing rapid growth driven by its superior force control capability and flexibility for complex shapes and large-size components required in heavy industry and shipbuilding. The trend in segmentation by application is clearly dictated by the automotive industry, which constitutes the largest user base, though the aerospace and defense sector, while smaller in volume, demands the most technologically sophisticated and highest precision equipment. Tonnage trends show increasing demand across the mid-to-high tonnage range (1,000 MT to 6,000 MT) to accommodate larger components and harder-to-deform materials necessary for high-integrity structural applications.

AI Impact Analysis on Forging Presses Market

Common user inquiries regarding AI's impact on the Forging Presses Market center predominantly on how artificial intelligence can optimize process parameters, enhance predictive maintenance schedules, and improve quality control through real-time defect detection. Users are keen to understand the shift from traditional, experience-based parameter setting to data-driven optimization, particularly concerning temperature, speed, and force profiles, which are crucial for minimizing component stress and achieving optimal material flow. Key concerns also revolve around the feasibility and cost-effectiveness of retrofitting existing forging lines with AI-enabled sensor technologies and the level of expertise required to manage these sophisticated systems. The overarching expectation is that AI will dramatically reduce scrap rates, improve energy efficiency, and enable faster turnaround times for new product introductions by facilitating rapid simulation and optimization cycles, thereby securing a competitive edge for early adopters.

- AI-Driven Process Optimization: Utilizing machine learning algorithms to dynamically adjust press parameters (ram speed, stroke position, temperature) in real-time based on material properties and desired component geometry, significantly reducing variations and improving yield stability during hot forging operations.

- Predictive Maintenance (PdM): Deployment of AI to analyze vibration, acoustic, and thermal sensor data collected from press components (e.g., drives, bearings, clutches) to forecast potential failures accurately, thus maximizing uptime and reducing unplanned maintenance costs through scheduled interventions.

- Automated Quality Inspection: Implementation of deep learning models combined with vision systems to conduct instantaneous, non-destructive inspection of forged components for surface defects, dimensional inaccuracies, and subtle structural irregularities immediately after the forging operation, ensuring zero-defect output.

- Simulation and Digital Twin Technology: AI enhances finite element analysis (FEA) simulations by optimizing mesh generation and material models, accelerating the creation of a digital twin of the forging press and the process itself, allowing manufacturers to test new designs and alloys virtually before committing to physical prototyping.

- Energy Management Optimization: AI systems analyze production schedules and energy tariffs to determine the most energy-efficient operating profiles for the forging press, potentially managing peak load demands and reducing overall electricity consumption, particularly critical for large mechanical and hydraulic systems.

- Enhanced Die Life Prediction: Machine learning models trained on historical usage data, temperature cycles, and force statistics predict the remaining useful life of expensive forging dies, enabling timely replacement and preventing catastrophic failures that lead to extended downtime and substantial repair costs.

- Supply Chain Resilience: AI analyzes global supply chain data, forecasting component lead times and optimizing inventory levels for critical spare parts for the forging press machinery, improving overall operational security and responsiveness to geopolitical or logistical disruptions.

- Operator Assistance Systems: AI-powered interfaces provide real-time guidance and feedback to operators, particularly useful for complex or custom forging operations, standardizing operational procedures and reducing reliance on highly specialized, long-tenured personnel.

- Closed-Loop Control Systems: Integration of AI into press controls to create self-learning systems that continuously refine process inputs based on measured outputs, achieving unprecedented levels of precision and repeatability in forming complex or tolerance-sensitive components.

DRO & Impact Forces Of Forging Presses Market

The dynamics of the Forging Presses Market are significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its impact forces. Primary drivers include the massive global demand for high-integrity, safety-critical components in key sectors such as automotive (especially heavy-duty vehicles and electric vehicle components requiring high-strength battery enclosures), aerospace (driven by commercial aircraft production backlogs and military modernization), and infrastructure development. The intrinsic advantages of forged metal parts, such as superior tensile strength, durability, and better resistance to fatigue compared to cast or machined equivalents, ensure persistent demand. Furthermore, the push towards efficient manufacturing techniques and the adoption of high-strength, lightweight materials necessitate advanced presses capable of delivering consistent, high-force shaping, fueling technological upgrades and new equipment sales globally.

Restraints impeding faster growth primarily relate to the substantial capital expenditure required for acquiring, installing, and maintaining large forging press systems, which creates high barriers to entry, particularly for smaller manufacturers. The complexity of operations demands a highly skilled workforce, and the shortage of trained technicians and operators capable of managing advanced CNC-controlled presses and sophisticated material handling systems poses an ongoing challenge. Moreover, the cyclical nature of end-user industries, such as automotive and construction, makes the forging equipment market susceptible to economic downturns and fluctuations in raw material prices, which directly impact manufacturers' investment decisions in new machinery. The environmental impact associated with high energy consumption during hot forging processes also presents a regulatory and operational constraint, demanding continuous investment in energy-efficient press technology.

Opportunities for market expansion are abundant, centered around the ongoing implementation of Industry 4.0, which promotes the integration of forging presses into fully digitized smart factories, utilizing IoT and cloud connectivity for enhanced monitoring and optimization. The growing demand for specialized forgings in emerging applications, such as large wind turbine components, high-pressure equipment for the oil and gas industry, and components for next-generation electric vehicle platforms, offers significant diversification potential. The shift toward specialized materials (e.g., composites and highly resistant alloys) also creates a demand niche for highly specialized, high-force presses like screw presses and isothermal forging equipment. Strategic regional expansion, particularly targeting increasing industrialization in Southeast Asia and Latin America, represents a key avenue for market penetration and sustained revenue growth for global equipment suppliers.

Segmentation Analysis

The Forging Presses Market is intricately segmented based on technology type, force capacity (tonnage), and the specific end-use application, reflecting the diverse requirements of the global manufacturing sector. Analyzing these segments provides crucial insights into technological adoption rates and investment priorities across various industries. The primary segmentation by type differentiates between mechanical presses, which are favored for speed and efficiency in high-volume, less complex parts; hydraulic presses, which offer precise force control and longer contact times essential for complex shapes and exotic alloys; and screw presses, known for their high energy delivery suitable for large, intricate components.

The tonnage capacity segmentation is essential for understanding the component size and material strength being processed, ranging from small presses used in consumer electronics to massive high-tonnage presses (over 8,000 metric tons) utilized for producing large structural aerospace components or heavy shipbuilding parts. The application segmentation, arguably the most critical dimension, links forging press demand directly to the macro-economic performance of key industrial sectors. Dominant users include the automotive industry (which requires mass production of durable powertrain and chassis components), the aerospace sector (demanding ultimate integrity and lightweight solutions), and the construction/heavy machinery segment (relying on robust forged tools and structural elements).

Geographically, market segmentation highlights distinct regional technological preferences. For example, Europe and North America often prioritize servo-mechanical and hydraulic presses due to stringent quality control and high material costs, whereas Asia Pacific often focuses on optimizing throughput using traditional mechanical presses for mass market applications. Continuous technological advancements, such as the introduction of hybrid and servo-hydraulic systems, are blurring the lines between these traditional segments, providing manufacturers with machinery that offers the speed of mechanical systems combined with the controllability of hydraulic systems, thereby reshaping the segmentation landscape and driving new investment cycles across industrial segments worldwide.

- By Type:

- Mechanical Forging Presses: Characterized by high speed and a fixed stroke length; ideal for high-volume production of smaller to medium-sized components, such as automotive gears and flanges. They dominate the mass-market forging sector due to their efficiency.

- Hydraulic Forging Presses: Offer precise control over ram speed and forging force throughout the entire stroke; essential for deep drawing, closed-die forging of complex shapes, and processing temperature-sensitive or exotic materials like titanium and nickel-based alloys.

- Screw Forging Presses (Friction and Servo): Provide high energy output, delivering a powerful impact; preferred for high-precision components requiring extensive deformation or specialized applications like isothermal forging, often used in aerospace turbine blade manufacturing.

- Servo Forging Presses (Servo-Mechanical/Servo-Hydraulic): Represent the cutting-edge of forging technology, offering superior energy efficiency, customizable ram kinematics, and quiet operation; rapidly gaining adoption in high-value, highly flexible manufacturing environments due to their programmable nature.

- By Tonnage Capacity:

- Less than 1,000 Metric Tons (MT): Used primarily for small-scale, precision forgings and specialty tool manufacturing.

- 1,000 MT to 6,000 MT: The primary segment catering to high-volume automotive components, medium-sized aerospace parts, and general industrial forgings.

- Above 6,000 MT: Dedicated to heavy forgings, including large crankshafts, complex landing gear components, power generation turbine shafts, and large structural elements for shipbuilding and heavy machinery.

- By Application/End-Use Industry:

- Automotive Industry: Largest consumer, requiring presses for crankshafts, connecting rods, axles, steering components, and increasingly, structural components for high-performance conventional and electric vehicles.

- Aerospace and Defense: Demands high precision and integrity for components such as turbine discs, airframe structural parts, and landing gear assemblies; often utilizes hydraulic and isothermal presses for specialty alloys.

- General Manufacturing and Industrial: Covers tools, fittings, fasteners, valves, and components for machinery, relying heavily on mid-range mechanical and hydraulic presses for versatile production needs.

- Oil and Gas: Requires heavy, high-pressure forged components like wellhead equipment, pipe fittings, and valve bodies, favoring high-tonnage hydraulic presses capable of handling specialized steels.

- Construction and Mining: Utilizes forged parts for heavy equipment tracks, excavator teeth, large gears, and structural supports, driving demand for robust, high-durability forgings.

- By Operation Type:

- Hot Forging: The most common process, requiring heating the material above its recrystallization temperature to reduce forming force; demands presses with high rigidity and speed.

- Warm Forging: Performed at intermediate temperatures, offering better dimensional accuracy and reduced scaling compared to hot forging.

- Cold Forging: Performed near room temperature, yielding excellent surface finish and dimensional precision but requiring extremely high force; often uses specialized knuckle-joint presses.

Value Chain Analysis For Forging Presses Market

The value chain for the Forging Presses Market begins with upstream activities centered on the sourcing of critical materials and component manufacturing. This phase involves suppliers of high-grade steel and specialized alloys necessary for the construction of press frames, cylinders, and moving components, as these structures must withstand immense cyclic stresses over decades. Key upstream suppliers also include manufacturers of high-performance hydraulic systems (pumps, valves, accumulators), high-precision electrical control systems (PLCs, CNCs, sensors), and robust driving mechanisms (motors, clutches, flywheels). The efficiency and reliability of these upstream components directly dictate the performance, durability, and technological sophistication of the final forging press equipment. Strict quality control and reliable long-term partnerships with these specialized component providers are essential for maintaining the market leadership of major press manufacturers.

The core of the value chain involves the press manufacturers themselves, where design, engineering, assembly, and testing take place. This stage is characterized by high intellectual property investment in press kinematics, energy recovery systems, and proprietary control software that optimizes forming processes. Once manufactured, the presses move through distribution channels, which are typically segmented into direct sales models for large, custom, high-tonnage machines, often involving extensive consultation and installation services, and indirect channels through authorized distributors or agents for standardized, medium-sized presses. Direct sales ensure deep engagement with the end-user, facilitating customized solutions and integration into existing production lines, particularly critical for aerospace and complex automotive manufacturing facilities that require stringent regulatory compliance.

Downstream activities focus on installation, commissioning, after-sales service, and continuous maintenance, which are significant revenue generators for press manufacturers over the equipment's long operational life (often 20+ years). Specialized service engineers provide routine maintenance, critical spare parts, and technology upgrades, including retrofitting presses with modern controls (PLCs/CNCs) or adding automation features (robotics, induction heating). The efficiency of this downstream network, encompassing technical support and rapid response capabilities, is crucial for minimizing downtime for end-users like tier-one automotive suppliers and aerospace component fabricators. Successful players in the market utilize advanced remote diagnostics and IoT platforms to streamline service delivery and enhance customer loyalty, effectively closing the loop on the value chain by informing future design improvements based on real-world operational data and performance feedback.

Forging Presses Market Potential Customers

The primary potential customers and end-users of forging press equipment are large-scale manufacturing enterprises across safety-critical and high-stress industries that require components with superior mechanical properties and guaranteed structural integrity. Dominant buyers include global automotive Tier 1 suppliers specializing in powertrain components like connecting rods, transmission shafts, and engine valves, who rely on high-speed mechanical presses to meet vast production volumes while ensuring component durability for vehicle longevity and safety standards. Additionally, manufacturers focusing on heavy-duty commercial vehicles and specialized agricultural and construction machinery constitute a robust customer base, prioritizing high-tonnage hydraulic presses for large, robust components such as axles, gears, and structural frames that must withstand extreme operational environments and repetitive heavy loads.

A second crucial segment consists of aerospace and defense contractors, who represent the premium tier of the customer base. These entities demand the highest precision forging capabilities, often utilizing specialized screw presses or isothermal forging technology for critical components such as turbine blades, aircraft landing gear forgings, and structural bulkheads made from advanced materials like titanium, Inconel, and high-strength aluminum alloys. For these customers, the repeatability, dimensional accuracy, and ability of the press to maintain specific microstructural properties in the forged material are paramount, often overriding cost considerations. The high barrier to entry in this segment means that press manufacturers must provide extensive certification and proven track records in delivering highly reliable equipment compliant with stringent industry standards like NADCAP and ISO certifications.

Furthermore, significant growth potential lies in the energy sector, encompassing manufacturers of components for oil and gas exploration (e.g., valve bodies, fittings, high-pressure flanges), nuclear power generation (structural elements, heat exchanger parts), and increasingly, renewable energy infrastructure. The manufacturing of massive shafts and hub components for multi-megawatt wind turbines, for example, requires extremely high-tonnage presses (often exceeding 10,000 MT) and specialized handling equipment. These customers are seeking presses that offer robust construction, maximum force consistency, and the capability to handle extremely large billets. The continuous need for material upgrades and increased component size in these energy applications ensures that this customer segment remains a key driver for investment in the largest and most powerful forging press machinery globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler Group, SMS Group, Komatsu, Fagor Arrasate, Mitsubishi Heavy Industries, Hatebur Umformtechnik, AIDA Engineering, Sumitomo Heavy Industries, TMP, Lasco Umformtechnik, Stamco, QIQIHAR, Erie Press Systems, JIER Machine Tool, ISGEC Heavy Engineering, Siempelkamp, Hefei Metalforming Machine Tool, Dalian Machine Tool, Sany Heavy Industry, Hefei Forging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forging Presses Market Key Technology Landscape

The technological landscape of the Forging Presses Market is rapidly evolving, driven by the need for increased energy efficiency, enhanced precision, and greater flexibility in handling diverse materials and complex geometric shapes. The most transformative technology currently is the widespread adoption of servo-driven press systems, both servo-mechanical and servo-hydraulic hybrids. These systems replace traditional flywheels, clutches, and standard hydraulic pumps with high-torque servo motors, allowing for customizable ram movement profiles (kinematics). This programmability provides unparalleled control over speed and contact time, which is critical for minimizing defects and maximizing material flow in challenging forging operations, leading to significant improvements in component quality and reductions in cycle time compared to conventional presses.

Another crucial technological advancement is the integration of advanced control systems utilizing high-speed PLCs and CNC controllers specifically designed for forging applications. These systems facilitate real-time monitoring and data acquisition, enabling closed-loop control where in-process sensors measure parameters like temperature and force, automatically adjusting the press stroke or die positioning to maintain strict tolerances. This high level of digital control is essential for achieving the exacting specifications required by the aerospace industry. Furthermore, the development of sophisticated simulation software packages, often incorporating AI algorithms, allows manufacturers to model the forging process virtually, predicting material behavior, optimizing die design, and reducing the time and cost associated with physical trial and error, thereby significantly accelerating product development cycles.

In addition to control and kinematic advancements, the market is seeing continuous improvements in peripheral technologies and energy recovery systems. Innovations in induction heating equipment ensure precise and rapid billet heating, minimizing scale formation and energy waste. Hydraulic presses are benefiting from advanced pumping systems that utilize variable speed drives (VSDs) to reduce energy consumption during idle periods, significantly boosting their operational efficiency and reducing overall noise levels. For heavy forging applications, technologies focused on structural rigidity, such as pre-stressed tie-rod designs and advanced frame materials, are essential for maintaining the alignment and longevity of the press, especially when operating at extreme tonnages necessary for large industrial and power generation components.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Trajectory

The APAC region holds the largest market share and is projected to exhibit the highest CAGR during the forecast period. This dominance is fundamentally driven by the region's massive manufacturing base, particularly in automotive production, heavy machinery manufacturing, and rapid infrastructure development, especially within China, India, and Southeast Asian nations. Governments in these countries actively support manufacturing and heavy industry through investment incentives, leading to continuous capacity expansion. The high-volume requirement for low-to-mid complexity forged parts in the automotive sector makes mechanical presses a dominant technology. However, rising standards and increasing domestic aerospace ambitions are fueling demand for high-precision hydraulic and specialized screw presses. Local manufacturers are rapidly closing the technological gap with Western competitors, often focusing on competitive pricing and localized service networks, further cementing the region's position as the global center for forging press deployment and utilization.

The technological adoption in APAC is dual-faceted: massive deployment of standard mechanical presses for commodity forgings, alongside targeted investments in advanced servo presses by multinational corporations operating in the region to service high-value exports and domestic high-tech sectors. Investment patterns in countries like South Korea and Japan are heavily focused on modernization, replacing older machinery with energy-efficient servo technology and integrated automation systems to address rising labor costs and maximize production efficiency. India's burgeoning automotive and defense sectors are generating sustained demand for durable, medium-tonnage hydraulic and mechanical systems, making it a critical secondary growth engine within the vast APAC market landscape.

- North America: Focus on Precision, Aerospace, and Modernization

North America is a technologically mature market characterized by a strong emphasis on high-quality, high-precision forging, primarily driven by the expansive aerospace, defense, and high-performance energy sectors. Demand here is less about volume growth and more about modernization and technological replacement, with a strong preference for advanced servo-hydraulic and screw presses capable of handling complex, high-strength materials like titanium and specialized steels required for aircraft structures and oil and gas exploration equipment. The region's stringent quality standards and regulatory environment necessitate the use of presses that offer superior process control and comprehensive data logging capabilities, aligning perfectly with Industry 4.0 principles.

The automotive sector in North America is increasingly investing in specialized forging capacity tailored for electric vehicle components, such as lightweight chassis parts and precision motor shafts, necessitating investment in cold and warm forging presses for improved surface finish and strength. Manufacturers here prioritize efficiency, demanding integrated solutions that include advanced automation, robotic material handling, and sophisticated quality inspection systems integrated directly into the press operation. The substantial domestic defense industrial base ensures continuous, reliable demand for high-tonnage presses suitable for large structural forgings and specialized military components, maintaining the region's position as a key market for high-value equipment sales and technological innovation.

- Europe: Technological Innovation and Sustainability Leadership

Europe remains a powerhouse for technological innovation in the forging press market, leading the charge in developing and implementing energy-efficient, sustainable press technologies, notably advanced servo-mechanical systems and hybrid hydraulic presses. European manufacturers, particularly in Germany and Italy, focus on producing high-end, customized machinery that offers maximum operational flexibility and precision, catering to highly demanding industrial segments like premium automotive components, wind energy, and sophisticated industrial machinery. Regulatory pressures regarding energy consumption and carbon emissions strongly influence purchasing decisions, favoring suppliers who can demonstrate reduced environmental impact alongside high performance.

The European forging industry is characterized by a strong presence of small and medium-sized enterprises (SMEs) that specialize in niche, high-value forgings, driving steady demand for flexible, multi-purpose presses capable of quickly switching between different production batches. The region also hosts major global aerospace entities, ensuring continuous, stringent demand for specialized isothermal and high-force presses. Furthermore, Europe's proactive adoption of digital manufacturing practices means there is a high uptake of AI-enabled condition monitoring and predictive maintenance services attached to new press sales, enhancing overall equipment effectiveness and extending the operational lifespan of the machinery significantly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forging Presses Market.- Schuler Group

- SMS Group

- Komatsu

- Fagor Arrasate

- Mitsubishi Heavy Industries

- Hatebur Umformtechnik

- AIDA Engineering

- Sumitomo Heavy Industries

- TMP (Taylor & Challen)

- Lasco Umformtechnik

- Stamco

- QIQIHAR Heavy CNC Equipment

- Erie Press Systems

- JIER Machine Tool

- ISGEC Heavy Engineering

- Siempelkamp Maschinen- und Anlagenbau

- Hefei Metalforming Machine Tool (Hefei Forging)

- Dalian Machine Tool Group

- Sany Heavy Industry Co., Ltd.

- Ajax Manufacturing Co.

Frequently Asked Questions

Analyze common user questions about the Forging Presses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydraulic and mechanical forging presses, and which type is preferred for aerospace components?

Mechanical presses are favored for speed and high-volume consistency, using a fixed stroke determined by a crank or eccentric drive, which makes them ideal for mass-producing automotive parts. Hydraulic presses offer full force throughout the stroke and highly precise ram speed control, essential for processing expensive, difficult-to-form alloys like titanium. Therefore, hydraulic and specialized screw presses (often incorporating isothermal capabilities) are generally preferred for high-integrity aerospace components due to their superior force control and dwell time capabilities, ensuring optimal material flow and microstructural integrity.

How is Industry 4.0 impacting the operational efficiency and maintenance of modern forging presses?

Industry 4.0 principles, driven by IoT sensors and cloud connectivity, fundamentally transform forging press operations by enabling real-time data acquisition and analytical processing. This integration supports predictive maintenance (PdM) systems that forecast component failure, drastically reducing unplanned downtime. Furthermore, advanced AI-driven control loops allow for self-optimization of forming parameters, leading to higher precision, improved energy utilization, and significant reductions in material waste, ultimately boosting Overall Equipment Effectiveness (OEE) substantially.

What are the main drivers of market growth for high-tonnage forging presses (above 6,000 MT)?

The growth in the high-tonnage segment is primarily propelled by the need for extremely large, high-strength components in key industries. This includes the manufacturing of massive structural forgings and landing gear for wide-body aircraft, large turbine and generator shafts for the power generation sector (both conventional and wind energy), and critical high-pressure components for the expanding oil, gas, and petrochemical industries. These applications require immense force to deform large billets of specialized, high-performance steel or superalloys effectively and with integrity.

Which geographical region currently dominates the global Forging Presses Market, and why?

The Asia Pacific (APAC) region currently dominates the global Forging Presses Market, driven primarily by the colossal manufacturing output in China and India. The region benefits from massive investments in industrialization, rapid expansion in the automotive and general machinery sectors, and sustained government support for domestic production capabilities. APAC’s large volume requirements for forged components, combined with ongoing modernization efforts and favorable cost structures, ensure its leading position in both equipment sales and operational utilization globally.

What role do servo-mechanical presses play in achieving sustainability and energy efficiency in forging operations?

Servo-mechanical presses represent a major leap in sustainability by replacing energy-intensive components like mechanical clutches and flywheels with programmable, high-efficiency servo motors. These systems only draw power when force is actively being applied and can recover kinetic energy during deceleration, resulting in up to 30-50% less energy consumption compared to traditional mechanical presses for equivalent output. This superior energy management, combined with reduced noise and vibration, makes servo technology crucial for manufacturers adhering to increasingly strict environmental and operational sustainability mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Forging Presses Market Size Report By Type (Closed Die Forging, Open Die Forging, Extrusion Presses, Other), By Application (Automotive, Hardware tools, Engineering machinery, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Closed Die Forging Presses Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hydraulic presses, Mechanical presses, Screw presses), By Application (Automotive, Hardware tools, Engineering machinery, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager