Forklift AGV Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435038 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Forklift AGV Market Size

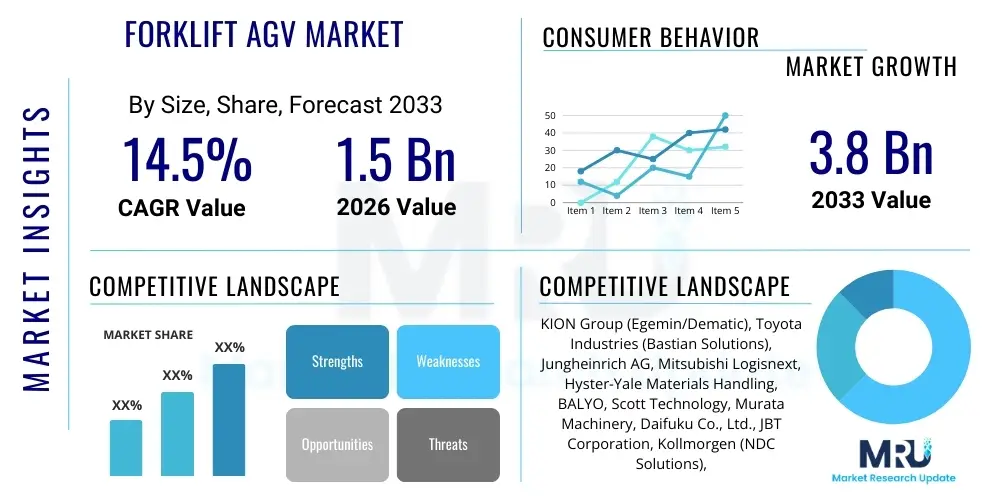

The Forklift AGV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Forklift AGV Market introduction

The Forklift Automated Guided Vehicle (AGV) Market encompasses autonomous material handling systems designed to perform traditional forklift tasks without human intervention. These systems utilize sophisticated navigation technologies—such as laser guidance, natural feature navigation (NFN), and Vision Guided Vehicles (VGV)—to transport, stack, and retrieve pallets and goods within complex industrial environments like warehouses, manufacturing plants, and distribution centers. Forklift AGVs are typically integrated with Warehouse Management Systems (WMS) or Manufacturing Execution Systems (MES) to ensure seamless operational flow, optimizing internal logistics and inventory management processes.

Major applications for Forklift AGVs span across highly regulated and high-throughput industries, including automotive assembly, food and beverage processing, pharmaceuticals, and particularly the rapidly expanding e-commerce and third-party logistics (3PL) sectors. In automotive manufacturing, AGVs are essential for just-in-time (JIT) parts delivery and sequencing, minimizing production line bottlenecks. For e-commerce fulfillment centers, these automated forklifts provide the essential horizontal transport and vertical stacking capability needed to manage large volumes of diverse Stock Keeping Units (SKUs) efficiently and reliably across multiple shifts.

The primary benefits driving the robust adoption of Forklift AGVs include significant reductions in operational labor costs, substantial improvements in workplace safety by minimizing human error and associated accidents, and enhanced operational precision and consistency around the clock. Key market drivers involve the intensifying global shortage of skilled labor for material handling, increasing demand for 24/7 autonomous operations, and the necessity for scalable, flexible intralogistics solutions to manage the volatility and complexity introduced by modern supply chains. Furthermore, advancements in sensor technology and AI-driven path planning capabilities are continuously lowering deployment barriers and increasing the versatility of these automated systems.

Forklift AGV Market Executive Summary

The global Forklift AGV market is experiencing a paradigm shift characterized by accelerated technological convergence, focusing heavily on integrating Artificial Intelligence (AI) and advanced sensor fusion for improved navigation reliability and operational flexibility. Business trends highlight strategic partnerships between traditional material handling equipment manufacturers and specialized robotics and software providers, aiming to offer complete, turnkey automation solutions. There is a strong movement towards flexible deployment models, such as Robotics-as-a-Service (RaaS), which lowers the high capital expenditure barrier, making automation accessible to Small and Medium-sized Enterprises (SMEs). This shift is critical for sustaining market momentum and driving faster adoption across diverse industrial landscapes.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of volume and deployment due to the massive scale of manufacturing operations in China, Japan, and South Korea, coupled with significant governmental initiatives promoting factory automation. North America and Europe, however, lead in terms of technology adoption intensity and sophisticated integration, particularly in advanced warehousing and cold chain logistics, driven by extremely high labor costs and stringent safety regulations. Specifically, the implementation of Very Narrow Aisle (VNA) AGVs is a strong trend in space-constrained European facilities, maximizing storage density and operational efficiency within existing infrastructure footprints.

Analysis of market segments reveals that the laser guidance technology segment currently holds the largest share due to its proven accuracy and widespread industrial standardization, though natural feature navigation (NFN) is rapidly gaining traction due to its lower infrastructure modification requirements and quick setup time. By end-user, the 3PL and E-commerce segments are projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the persistent need to automate complex fulfillment processes, including cross-docking and high-rise storage applications. The counterbalanced forklift type remains the most utilized configuration, primarily due to its versatility in handling various load sizes and weights in general warehouse operations.

AI Impact Analysis on Forklift AGV Market

Common user questions regarding AI's impact on Forklift AGVs frequently revolve around safety protocols, specifically how AI ensures collision avoidance in dynamic human-machine environments, and the return on investment (ROI) derived from implementing systems capable of advanced decision-making. Users are keenly interested in understanding how AI-driven predictive maintenance can minimize unplanned downtime and how machine learning algorithms optimize complex multi-AGV traffic management in congested areas. Furthermore, inquiries often address the seamless integration of AI-powered AGVs with existing legacy WMS systems and the need for standardized communication protocols to facilitate scalable fleet operations.

Based on this analysis, the key themes summarizing user expectations center on operational resilience, enhanced intelligence, and cost efficiency. Users anticipate that AI will transition AGVs from merely programmed paths to truly autonomous systems capable of real-time, dynamic route planning (avoiding unexpected obstacles or rerouting based on priority changes), significantly boosting throughput without compromising safety. The expectation is that AI will handle the 'last mile' complexities of material placement with greater accuracy than current technologies, reducing product damage and maximizing vertical storage utilization. The market views AI as the essential layer required for achieving true operational flexibility and swarm intelligence in large-scale AGV deployments.

This increased intelligence layer, enabled by advanced deep learning models processing massive amounts of sensor data, allows Forklift AGVs to achieve superior situational awareness. For instance, AI algorithms are now crucial in interpreting visual data from cameras (Vision Guided AGVs) to accurately identify specific pallet types, assess load stability, and even detect subtle changes in floor conditions, which is vital for maintaining high speeds safely. The integration of AI also facilitates continuous learning, where the AGV fleet collectively improves its operational efficiency over time based on historical performance data, leading to superior resource allocation and minimized energy consumption across the entire intralogistics network.

- Enhanced route optimization and dynamic path planning through machine learning models.

- Implementation of predictive maintenance using sensor data analysis to reduce system downtime.

- Improved safety and collision avoidance through advanced AI-driven sensor fusion and anomaly detection.

- Facilitation of complex fleet management and swarm intelligence for high-density operations.

- Real-time load stability assessment and precise material placement using deep learning vision systems.

- Seamless integration with WMS/ERP systems, enabling intelligent task prioritization and scheduling.

DRO & Impact Forces Of Forklift AGV Market

The Forklift AGV Market is primarily driven by persistent global labor shortages in logistics and warehousing, compelling businesses to seek automated alternatives to maintain operational capacity. Simultaneously, the explosive growth of the e-commerce sector demands ultra-efficient, high-throughput fulfillment capabilities that conventional, manual systems cannot reliably provide, necessitating 24/7 automation. Despite these strong drivers, the high initial capital investment required for procurement and infrastructure modification remains a significant restraint, especially for smaller market players. However, opportunities abound in the development of modular and flexible AGV solutions, the integration of 5G connectivity for enhanced communication reliability, and the rapid expansion of the RaaS model to mitigate upfront costs and accelerate market penetration.

The primary driving force underpinning market expansion is the economic imperative of operational efficiency and cost reduction. Forklift AGVs offer a compelling financial argument by eliminating recurring wage, benefit, and training costs associated with human operators, providing a clear and quantifiable return on investment over the system's lifecycle. Moreover, stringent regulatory pressure concerning workplace safety, particularly in markets like North America and Europe, favors the deployment of AGVs, which demonstrably reduce material handling accidents and associated liabilities. The rapid advancement in battery technology, particularly lithium-ion and fuel cell solutions, also drives adoption by increasing operating times and reducing charging cycles, enhancing overall fleet utilization rates.

Restraints are generally centered on integration complexity and standardization challenges. Deploying AGVs often requires significant upfront investments in facility infrastructure (like floor preparation or specialized navigation markers) and complex integration with existing legacy IT systems (WMS, ERP). The lack of global standardization across different AGV vendors regarding communication protocols and operational interfaces creates vendor lock-in concerns and complicates the management of mixed-vendor fleets. Furthermore, the reliance on high-bandwidth, stable Wi-Fi connectivity in large facilities can pose operational hurdles, particularly in older buildings with structural impediments to signal propagation.

Opportunities for future growth are closely tied to technological advancements and new business models. The emergence of affordable and reliable Visual SLAM (Simultaneous Localization and Mapping) technology significantly reduces the need for expensive structural modifications, broadening the scope of deployable environments. The shift towards RaaS models transforms CapEx into predictable OpEx, making sophisticated automation accessible to a wider array of businesses and fostering quicker deployment cycles. Additionally, the proliferation of Industry 4.0 initiatives across the globe positions AGVs as a foundational technology for achieving fully connected and intelligent factory logistics, providing fertile ground for innovation in machine-to-machine communication.

Segmentation Analysis

The Forklift AGV market segmentation provides a granular view of diverse product types, technologies, applications, and end-user industries that define the commercial landscape. Analysis across these segments is vital for understanding specific demands and technological preferences within different operational contexts. The market is primarily categorized by the type of forklift (e.g., counterbalanced, reach truck, VNA), the navigation method utilized (e.g., laser, magnetic tape, vision), and the specific industry vertical (e.g., automotive, logistics, food & beverage). This multidimensional segmentation helps manufacturers tailor solutions that meet precise handling requirements, such as high-density storage access or hazardous environment operation.

Key segment trends indicate that while laser guidance remains dominant due to reliability, the fastest-growing technology segment is Natural Feature Navigation (NFN) and Vision Guided Vehicles (VGV). NFN utilizes existing environmental features for mapping and localization, offering superior flexibility and lower deployment costs by eliminating the need for physical infrastructure guides (wires or magnetic tape). In terms of application, horizontal transport remains the highest volume application, but stacking and retrieval applications are generating higher revenue growth due as they involve more complex, high-value systems like automated reach trucks and VNA models.

From an end-user perspective, the 3PL and E-commerce sectors demonstrate unprecedented growth, reflecting their need for scalable, seasonal volume management and speed in fulfillment operations. Conversely, the Automotive segment, while mature, continues to invest heavily in AGV technology for highly repeatable, precise tasks such as line-side feeding and assembly buffer management. The complexity of material handling varies significantly between industries; for example, the Food & Beverage sector requires robust, wash-down-safe AGVs, while the Pharmaceutical industry demands validated, highly traceable systems, influencing the required certifications and material construction within those specific AGV types.

- By Type:

- Counterbalanced Forklift AGVs

- Reach Truck AGVs

- Pallet Stacker AGVs

- VNA (Very Narrow Aisle) Forklift AGVs

- Tow Tractor AGVs

- By Navigation Technology:

- Laser Guidance (LGV)

- Natural Feature Navigation (NFN)

- Magnetic Guidance

- Vision Guided Vehicles (VGV)

- Inertial Guidance

- By Application:

- Horizontal Transportation

- Stacking and Retrieval

- Raw Material Handling

- Finished Goods Storage

- Trailer Loading/Unloading

- By End-User Industry:

- Automotive

- E-commerce and Retail

- Third-Party Logistics (3PL)

- Food and Beverage

- Pharmaceuticals and Healthcare

- Manufacturing (General)

Value Chain Analysis For Forklift AGV Market

The value chain for the Forklift AGV market is complex, spanning from highly specialized component manufacturing to system integration and post-deployment maintenance services. The upstream segment involves critical technology suppliers providing essential components such as advanced sensors (Lidar, cameras, ultrasound), high-capacity power solutions (lithium-ion batteries, charging infrastructure), and core motion control systems (drives, motors). These component suppliers must maintain high standards of quality and ensure continuous innovation to support the sophisticated demands of autonomous navigation and safety protocols, directly influencing the performance and reliability of the final AGV product.

The midstream phase is dominated by the AGV manufacturers, which handle the design, assembly, software development (fleet management systems, proprietary navigation algorithms), and quality assurance of the robotic platforms. These companies often operate on two models: converting standard manual forklifts into AGVs (conversion model) or designing purpose-built AGVs from the ground up (native AGV model). Efficient manufacturing and scalable production capacities are crucial in this segment to meet increasing global demand, especially from high-volume markets in APAC. Strategic intellectual property related to navigation and safety systems forms a key competitive advantage at this stage.

The downstream segment is critical for market penetration and customer satisfaction, primarily involving system integrators, distributors, and value-added resellers (VARs). Integrators play a pivotal role, customizing the AGV solution to the client's specific facility layout, integrating the AGVs with the client's existing WMS/ERP systems, and providing installation and ongoing maintenance. Direct distribution often occurs for large, established manufacturers with global presence, focusing on major accounts, while indirect channels (local distributors and 3PL partners) are essential for reaching SMEs and specific regional markets, providing crucial local support and domain expertise in complex operational environments.

Forklift AGV Market Potential Customers

The primary end-users and buyers of Forklift AGVs are high-volume logistics operators and manufacturers facing intense pressure to reduce operational costs, maximize space utilization, and ensure safety in material flows. Core customers include large multinational corporations in the Automotive sector (Tier 1 suppliers and OEMs), utilizing AGVs for synchronous delivery of parts and raw materials to the assembly line, and leading players in the Food & Beverage industry, where AGVs ensure precise, hygienic, and damage-free transport of perishable goods in temperature-controlled environments. These customers prioritize reliability, system validation, and robust integration capabilities with complex manufacturing execution systems (MES).

A rapidly expanding customer base resides within the Third-Party Logistics (3PL) and E-commerce fulfillment sectors. These companies require highly flexible and scalable solutions capable of handling rapid volume spikes during peak seasons. For 3PL providers, AGVs are instrumental in improving the speed and accuracy of cross-docking and inventory put-away, providing a competitive edge in service offerings. E-commerce giants deploy Forklift AGVs in high-rack environments for efficient pallet retrieval and staging, often favoring VNA AGVs and specialized reach trucks to optimize vertical storage density and minimize the facility footprint required for vast product inventories.

Emerging potential customers include players in cold storage and specialty manufacturing sectors like chemicals and pharmaceuticals. Cold storage facilities pose unique challenges, requiring AGVs designed to operate reliably in sub-zero temperatures, often utilizing specialized battery heating systems and robust component shielding. The Pharmaceutical industry is driven by the need for strict compliance and verifiable material movement, making AGVs an ideal tool for ensuring traceability and minimizing human contamination risks within cleanroom and sensitive environments. These niche customers prioritize vendor certifications, system validation documentation, and long-term operational support over initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group (Egemin/Dematic), Toyota Industries (Bastian Solutions), Jungheinrich AG, Mitsubishi Logisnext, Hyster-Yale Materials Handling, BALYO, Scott Technology, Murata Machinery, Daifuku Co., Ltd., JBT Corporation, Kollmorgen (NDC Solutions), Swisslog (KUKA), Elettric 80, SICK AG, Seegrid Corporation, Siemens, Hikrobot, Geek+, Knapp AG, Rocla AGV Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forklift AGV Market Key Technology Landscape

The technological landscape of the Forklift AGV market is defined by continuous advancements in sensor fusion, navigation accuracy, power management, and communication infrastructure. Core navigation technologies have evolved significantly from basic wire or magnetic tape guidance to sophisticated natural feature navigation (NFN) and 3D LiDAR-based Simultaneous Localization and Mapping (SLAM). These advanced methods allow AGVs to operate flexibly in highly dynamic environments, rapidly adjusting to changes in facility layout and maximizing operational uptime by eliminating the need for extensive physical infrastructure. Sensor fusion—combining data from LiDAR, ultrasonic sensors, and vision systems—is crucial for reliable collision avoidance in environments where AGVs and human workers interact.

Power management technologies, particularly the widespread adoption of lithium-ion batteries, are transforming AGV efficiency. Lithium-ion offers significantly higher energy density and longer cycle life compared to traditional lead-acid batteries, enabling continuous operation through opportunity charging during brief pauses in the workflow. Furthermore, sophisticated Battery Management Systems (BMS) are integrated to monitor battery health, optimize charging cycles, and ensure safety, directly translating into lower total cost of ownership (TCO) for the end-user. The future of power management includes integrating advanced inductive charging solutions, allowing for hands-free, automated power replenishment without requiring physical connections.

The operational intelligence of AGVs is heavily reliant on advanced fleet management software (FMS). These sophisticated platforms utilize algorithms rooted in artificial intelligence (AI) to manage traffic, prioritize tasks based on real-time inventory needs, and dynamically allocate resources across the fleet. Communication infrastructure is increasingly shifting toward dedicated 5G networks within large facilities, providing the low latency and high bandwidth necessary for real-time data exchange between the AGV, the FMS, and the central WMS/ERP system. This robust connectivity is essential for implementing complex maneuvers and ensuring system-wide visibility and coordination across hundreds of automated vehicles operating concurrently.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Forklift AGVs, driven by expansive manufacturing bases in China, Vietnam, and India, combined with rapid urbanization and the proliferation of mega-scale e-commerce fulfillment centers. Government initiatives promoting 'smart factory' deployment and Industry 4.0 standards, coupled with cost-competitive local manufacturing, ensure sustained dominance.

- North America: Characterized by high labor costs and significant investments in technological innovation, North America is a critical market, leading in the adoption of sophisticated vision-guided and AI-powered AGVs. The 3PL and Food & Beverage sectors are major consumers, demanding highly accurate systems for cold chain and large-scale distribution operations.

- Europe: Europe is defined by stringent safety standards and a strong focus on maximizing existing infrastructure. The region shows high demand for specialized AGVs, particularly VNA (Very Narrow Aisle) models and reach trucks, optimizing space utilization in dense warehouse settings. Germany and the Benelux countries are major innovation hubs, driven by robust automotive and pharmaceutical manufacturing sectors.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, with adoption concentrated in large economies like Brazil and Mexico. Growth is primarily centered around automotive production and large retail distribution centers seeking to modernize aging logistics infrastructure and mitigate rising labor costs.

- Middle East and Africa (MEA): Adoption in MEA is largely concentrated in the Gulf Cooperation Council (GCC) countries, driven by massive infrastructure projects, investments in non-oil economic diversification (logistics hubs), and the establishment of new, fully automated mega-warehouses tailored for e-commerce and fast-moving consumer goods (FMCG).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forklift AGV Market.- KION Group (Egemin Automation/Dematic)

- Toyota Industries Corporation (Bastian Solutions)

- Jungheinrich AG

- Mitsubishi Logisnext Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- BALYO SA

- Scott Technology Ltd.

- Murata Machinery, Ltd.

- Daifuku Co., Ltd.

- JBT Corporation

- Kollmorgen (NDC Solutions)

- Swisslog (KUKA AG)

- Elettric 80 S.p.A.

- SICK AG

- Seegrid Corporation

- Siemens AG

- Hikrobot (Hikvision)

- Geek+ Technology Ltd.

- Knapp AG

- Rocla AGV Solutions

Frequently Asked Questions

Analyze common user questions about the Forklift AGV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Forklift AGV Market?

The Forklift AGV Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033, driven primarily by the global shift towards automated intralogistics and persistent labor shortages in the material handling sector.

What are the primary navigation technologies used in modern Forklift AGVs?

The key navigation technologies include laser guidance (LGV) for high precision, magnetic guidance for cost-effective fixed routes, and the rapidly growing Natural Feature Navigation (NFN) and Vision Guided Vehicles (VGV) utilizing SLAM algorithms for infrastructure-free, flexible operation.

How does the RaaS model impact the adoption of Forklift AGVs?

Robotics-as-a-Service (RaaS) significantly lowers the barrier to entry by converting the high upfront capital expenditure (CapEx) into predictable operating expenditure (OpEx), enabling Small and Medium-sized Enterprises (SMEs) to adopt sophisticated automation without major initial investment risk.

Which end-user segment is driving the highest growth in the AGV market?

The E-commerce and Third-Party Logistics (3PL) sectors are currently driving the highest growth due to the intense pressure for high-throughput fulfillment, 24/7 operational capability, and the need for scalable solutions to handle seasonal volume variability effectively.

What role does Artificial Intelligence play in Forklift AGV operations?

AI is crucial for enabling advanced functionalities such as real-time dynamic route optimization, complex fleet management (swarm intelligence), predictive maintenance, and enhanced safety through sophisticated sensor fusion and collision avoidance protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager