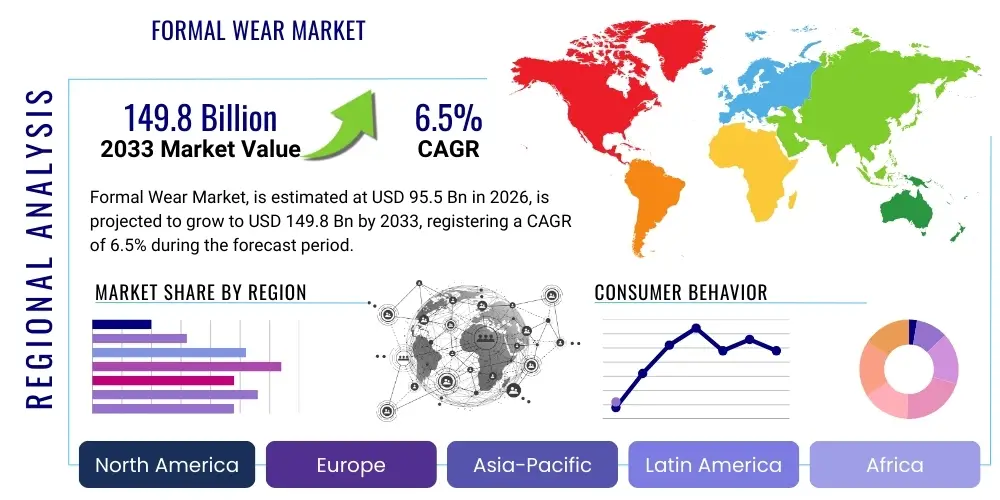

Formal Wear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435602 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Formal Wear Market Size

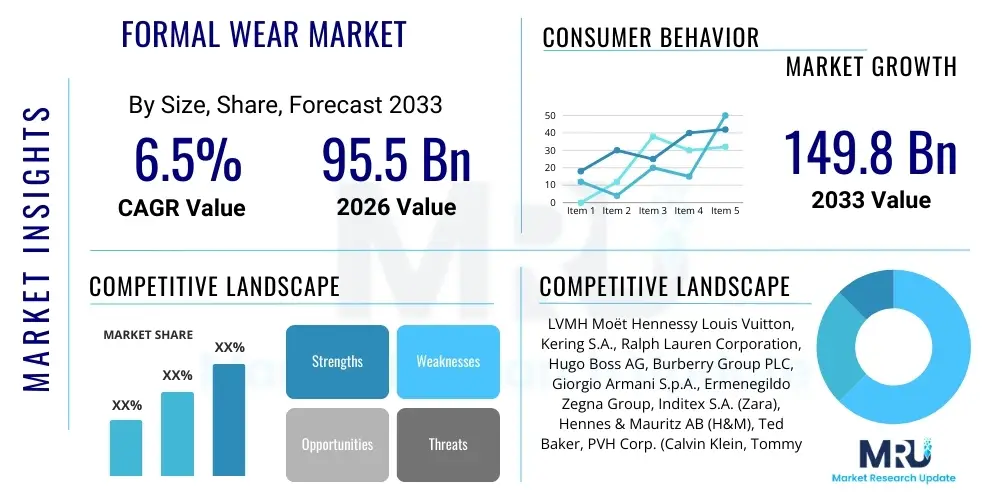

The Formal Wear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 95.5 Billion in 2026 and is projected to reach USD 149.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the resurgence of corporate culture, increasing urbanization, rising disposable incomes in emerging economies, and the continuous demand for premium, customized, and sustainable formal attire globally. The market size reflects the combined value of ready-to-wear (RTW) and bespoke formal garments, including suits, tuxedos, dresses, shirts, and related accessories for both men and women.

Formal Wear Market introduction

The Formal Wear Market encompasses the production, distribution, and sale of clothing specifically designed for business, professional, ceremonial, or high-social occasions, demanding a structured and conventional aesthetic. Key products include traditional business suits, evening gowns, tailored jackets, dress shirts, formal trousers, and related accessories like ties and cufflinks. Major applications span corporate environments, weddings, gala events, professional conferences, and educational graduations. The primary benefits derived from formal wear include enhancing professional image, adhering to established social codes, promoting self-confidence, and signifying respect for the occasion. Driving factors fueling this market include rapid globalization leading to standardized business dressing, the flourishing wedding and events industry, aggressive marketing by luxury brands emphasizing quality and heritage, and consumer interest in sustainable and technologically advanced (e.g., wrinkle-resistant) fabrics.

Formal Wear Market Executive Summary

The global Formal Wear Market is undergoing significant transformation, characterized by distinct business, regional, and segment trends. Business trends highlight a strong shift toward omnichannel retailing, merging traditional brick-and-mortar bespoke services with high-tech online customization platforms, often utilizing 3D scanning and virtual try-ons. Furthermore, sustainability and ethical sourcing have become critical differentiators, pushing major brands to adopt circular economy models and transparent supply chains. Regional trends show robust growth acceleration in the Asia Pacific (APAC) region, particularly driven by China and India, where rising middle-class populations and increased corporate employment fuel demand. Conversely, mature markets like North America and Europe focus heavily on personalization, premiumization, and rental services as cost-effective alternatives. Segment trends reveal the men's formal wear category maintains market dominance, while the women's segment shows the fastest growth, primarily due to increasing female participation in corporate leadership roles. The ready-to-wear segment still accounts for the largest revenue share, though made-to-measure (MTM) and bespoke services are gaining traction due to consumer desires for perfect fit and uniqueness.

AI Impact Analysis on Formal Wear Market

User queries regarding the impact of Artificial Intelligence (AI) on the Formal Wear Market predominantly revolve around three critical themes: personalized fit and design, optimized supply chain efficiency, and enhanced customer shopping experiences. Consumers are deeply interested in how AI can solve the long-standing challenge of perfect sizing and tailoring without multiple physical fittings. Brands, conversely, are focused on leveraging AI for predictive analytics to forecast demand for specific styles and colors, thereby minimizing overstocking and reducing material waste, a major sustainability concern in fashion. There is also significant anticipation regarding AI-driven virtual stylists and design tools that can instantly generate bespoke garment options based on individual body metrics, style preferences, and occasion requirements, streamlining the design-to-consumer pipeline and making luxury formal wear more accessible and personalized.

- AI-Powered Customization: Utilization of deep learning algorithms and 3D body scanners to create highly accurate digital avatars, enabling hyper-personalized fit recommendations for made-to-measure (MTM) and bespoke suits and dresses.

- Predictive Demand Forecasting: AI algorithms analyzing social media trends, sales data, and macroeconomic indicators to accurately predict seasonal demand for specific formal wear categories (e.g., wedding attire vs. business suits), optimizing inventory and minimizing obsolescence.

- Supply Chain Optimization: Implementation of machine learning to enhance material sourcing, streamline factory scheduling, and improve logistics, ensuring faster turnaround times for custom orders and better visibility throughout the production chain.

- Virtual Styling and Try-On: Deployment of augmented reality (AR) and AI-driven virtual dressing rooms that allow customers to visualize formal wear items on their body types, significantly reducing online return rates related to sizing and style discrepancies.

- Chatbot and Customer Service Automation: AI-powered chatbots providing 24/7 personalized consultation on fabric care, styling advice, and formal etiquette, enhancing the luxury shopping experience digitally.

- Sustainable Material Traceability: Use of AI and blockchain technology to track raw materials (wool, silk, cotton) from farm to finished garment, ensuring compliance with ethical sourcing and sustainability mandates, a growing requirement for high-end formal wear consumers.

- Trend Analysis and Design Generation: Employing generative AI tools to rapidly analyze runway trends, consumer feedback, and historical data to propose novel formal wear designs and color palettes that align with future market demands.

DRO & Impact Forces Of Formal Wear Market

The Formal Wear Market is fundamentally shaped by a dynamic interplay of market drivers, constraints, and emerging opportunities, all contributing to overall market impact forces. Key drivers include the mandatory adoption of professional attire in global corporate settings, the consistently growing number of large-scale social events and celebrations like weddings and galas, and increasing consumer willingness to invest in high-quality, durable garments as a form of social capital. However, the market faces significant restraints, notably the rapid shift toward casualization in certain corporate and academic environments, particularly post-pandemic, and the high cost associated with premium, tailored formal wear, which limits market access for lower-income groups. Opportunities arise from technological advancements, such as smart fabrics that offer enhanced performance (stretch, breathability, stain resistance) and the expansion of sustainable rental and resale models addressing both cost constraints and environmental concerns. These forces collectively dictate the market trajectory, prioritizing customization, quality, and accessible luxury.

The impact forces within the formal wear sector are complex, reflecting macroeconomic changes and shifting socio-cultural norms. Demand elasticity is moderate; while basic formal wear remains necessary, luxury spending is highly sensitive to economic downturns. However, the increasing dominance of fast fashion alternatives in the broader apparel industry places continuous pressure on formal wear pricing and speed-to-market. The strongest impact force is the convergence of sustainability and technology. Brands that successfully integrate ethical manufacturing with innovative supply chain solutions and hyper-personalized digital experiences are best positioned for long-term growth and market dominance. Furthermore, the rising influence of social media mandates that formal wear offerings remain consistently aligned with contemporary aesthetics, requiring rapid adaptation of traditional tailoring techniques to modern silhouettes.

The shift towards gender neutrality in formal attire presents a significant long-term opportunity, moving beyond traditional gendered segments to create versatile, non-binary formal clothing lines. This demographic adjustment, coupled with geographical expansion into underserved emerging markets in Southeast Asia and Africa, ensures diversified revenue streams. Conversely, legislative changes regarding textile imports, tariffs, and labor practices pose ongoing operational restraints, necessitating localized production or highly resilient global sourcing strategies. Successfully managing these internal and external pressures will determine competitive advantage in the highly saturated, yet specialized, formal wear industry.

Segmentation Analysis

The Formal Wear Market is primarily segmented based on Type (Suits, Dresses, Trousers, Shirts, Blazers), Gender (Men, Women, Unisex), Distribution Channel (Offline Stores, Online Stores, Rental Services), and Fabric Type (Natural, Synthetic, Blended). The segmentation provides granular insights into consumer behavior and specific market needs. The Men's segment typically leads in terms of value due to the higher frequency of suit and tailored clothing purchases for professional settings. However, the Women's segment is rapidly closing the gap, driven by increasing demand for high-end formal dresses and business attire. The segmentation by distribution channel highlights the critical transition towards e-commerce, offering convenience and broader access to bespoke and specialized formal wear brands globally.

Analyzing the segmentation by Type, the suits and related separates (blazers, trousers) hold a commanding share, especially in corporate segments, whereas formal dresses and gowns dominate the event-driven segment (weddings, galas). Furthermore, the market is increasingly defined by the Material segmentation, where sustainability considerations are paramount. Natural fibers like wool, cashmere, and silk, despite their higher cost, are preferred for luxury formal wear due to their inherent quality and breathability. The blended fabric segment is witnessing innovation through performance-enhancing synthetics, offering wrinkle resistance and stretch essential for modern business travel attire.

- By Type:

- Suits and Tuxedos

- Formal Dresses and Gowns

- Blazers and Jackets

- Dress Shirts and Blouses

- Formal Trousers and Skirts

- Footwear and Accessories (Ties, Cufflinks, Belts)

- By Gender:

- Men's Formal Wear (Dominant share)

- Women's Formal Wear (Fastest growing segment)

- Unisex and Gender-Neutral Attire (Emerging trend)

- By Distribution Channel:

- Offline Retail (Specialty Stores, Department Stores, Exclusive Brand Outlets)

- Online Retail (E-commerce Websites, Multi-brand Platforms)

- Rental and Subscription Services (Growing rapidly for event wear)

- By Fabric/Material:

- Natural Fibers (Wool, Silk, Cotton, Linen)

- Synthetic Fibers (Polyester, Rayon, Viscose)

- Blended Fabrics (Performance blends)

- By Price Point:

- Luxury (Bespoke, High-End Designer)

- Premium (Designer Ready-to-Wear)

- Mid-Range (Mass Market Formal Wear)

- By Occasion:

- Business/Corporate Attire

- Ceremonial/Event Wear (Weddings, Galas)

- Cocktail Attire

Value Chain Analysis For Formal Wear Market

The Formal Wear Market value chain is highly specialized, beginning with the upstream raw material procurement, encompassing textile manufacturing and fabric finishing. Upstream analysis involves securing high-quality, often imported, raw materials such as fine merino wool, cashmere, and specialized silks, where partnerships with certified ethical suppliers are critical for luxury branding. Fabric production requires precise weaving, dyeing, and finishing processes to achieve the desired drape, hand-feel, and performance characteristics (e.g., water resistance, stretch) essential for premium formal attire. Efficiency and traceability at this stage directly impact the final garment quality and brand reputation.

The middle segment of the value chain focuses on manufacturing and design. This involves complex pattern cutting, skilled tailoring, and assembly, whether for ready-to-wear production in large factories or individual bespoke craftsmanship. Downstream activities involve market distribution and sales, which are bifurcated into direct and indirect channels. Direct channels include owned flagship stores and exclusive brand e-commerce sites, allowing for greater control over pricing and customer experience. Indirect distribution relies heavily on high-end department stores, multi-brand luxury boutiques, and increasingly, specialized online formal wear marketplaces and rental platforms. Customer service, alterations, and after-sales support form a crucial part of the downstream value proposition, particularly for premium and bespoke products.

Distribution channels for formal wear are strategically critical. While high-volume, ready-to-wear formal shirts and trousers are often sold through major department stores and online retailers, bespoke suits and high-end gowns predominantly rely on specialized, often invitation-only, boutiques or dedicated tailoring houses. The rental channel has disrupted the downstream structure, offering high-value formal wear for a fraction of the purchase price, particularly popular among millennials and Generation Z for one-off events. Effective logistics and inventory management, especially for geographically dispersed, season-sensitive inventory, remain essential to maintaining profitability across the value chain.

Formal Wear Market Potential Customers

The primary consumers and end-users of the Formal Wear Market are diverse, ranging from corporate professionals requiring daily business attire to individuals participating in major life events. The most lucrative customer segments include high-net-worth individuals (HNWIs) and senior executives who prioritize bespoke tailoring, luxury fabrics, and international designer brands as status symbols. Mid-level corporate employees, particularly in finance, law, and consulting sectors, represent a large volume segment, favoring premium ready-to-wear or quality made-to-measure services for durability and professional conformity.

A rapidly growing segment comprises wedding participants and attendees. Brides, grooms, and wedding parties are significant buyers of custom suits, tuxedos, and elaborate gowns, often representing a single, high-value transaction. Furthermore, younger consumers (Millennials and Gen Z) are engaging with the formal wear market through sustainable consumption models, specifically formal wear rental services for proms, graduations, and job interviews, prioritizing accessibility and variety over ownership. Organizations, including corporate entities, educational institutions, and hospitality providers, also act as large institutional buyers, procuring standardized formal uniforms for their staff, representing a stable B2B revenue stream for specialized suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.5 Billion |

| Market Forecast in 2033 | USD 149.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton, Kering S.A., Ralph Lauren Corporation, Hugo Boss AG, Burberry Group PLC, Giorgio Armani S.p.A., Ermenegildo Zegna Group, Inditex S.A. (Zara), Hennes & Mauritz AB (H&M), Ted Baker, PVH Corp. (Calvin Klein, Tommy Hilfiger), Brooks Brothers, Men's Wearhouse (Tailored Brands), Dolce & Gabbana, Prada Group, Canali S.p.A., Salvatore Ferragamo, Kiton, Tom Ford International, Paul Smith. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Formal Wear Market Key Technology Landscape

The technological landscape of the Formal Wear Market is rapidly evolving, driven by the necessity for enhanced personalization, efficiency, and sustainability. Key technological integrations focus on 3D body scanning and biometric measurement systems, which allow tailoring companies to capture precise customer dimensions remotely or in-store, facilitating highly accurate made-to-measure production without traditional repeated fittings. This technology significantly reduces lead times and improves the fit consistency essential for high-quality formal attire. Furthermore, AI-driven CAD (Computer-Aided Design) systems are being utilized to optimize pattern layouts, minimizing fabric waste, a crucial step in fulfilling sustainability mandates and reducing production costs associated with expensive raw materials.

Material innovation represents another vital component of the technology landscape. Research and development are concentrated on creating 'smart formal wear' fabrics that integrate performance characteristics without compromising traditional aesthetics. Examples include self-cleaning, anti-microbial, temperature-regulating, and high-stretch wool blends and performance synthetic mixtures, catering specifically to business travelers and active professionals. Additionally, digital twin technology is being employed in supply chain management to create virtual representations of physical formal wear items and production processes, enabling real-time monitoring of inventory, quality control, and predictive maintenance of manufacturing equipment.

In the consumer-facing segment, the adoption of Augmented Reality (AR) and Virtual Reality (VR) platforms is transforming the online shopping experience. Luxury formal wear brands are implementing virtual try-on features via mobile apps or web platforms, allowing consumers to digitally sample garments before purchase, thereby bridging the sensory gap inherent in e-commerce for high-touch items like tailored suits and wedding gowns. Blockchain technology is also gaining traction, particularly for proving the authenticity and sustainable provenance of premium materials, providing high-end consumers with immutable proof of ethical sourcing and brand heritage, which reinforces the value proposition of luxury formal wear.

Regional Highlights

The Formal Wear Market exhibits pronounced regional variations in growth rates, style preferences, and distribution models, necessitating localized strategies for global brands. North America, characterized by high disposable incomes and a strong corporate culture, remains a dominant market in terms of revenue, though growth is steady rather than explosive. The region is a leader in adopting specialized rental services and incorporating performance technology into business formal wear, reflecting the fast-paced lifestyle of its professional demographic. Demand here is strongly influenced by designer brands and a preference for tailored fit, often utilizing advanced made-to-measure platforms.

Europe, the historical epicenter of luxury formal wear and bespoke tailoring, maintains its leadership in high-end, luxury segment sales. Countries like Italy, the UK, and France uphold strong traditions in craftsmanship (e.g., Savile Row, Italian tailoring), driving demand for ultra-premium and artisan-made garments. While facing slower overall volume growth compared to emerging markets, Europe commands the highest average selling price (ASP). The region is also at the forefront of the sustainable formal wear movement, with stricter regulations and consumer demands pushing brands towards circular business models and certified organic textiles.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is spurred by rapid urbanization, the massive expansion of the white-collar workforce, and the increasing number of high-profile social and cultural events. Specifically, China and India are experiencing a surging demand for both Western-style business suits and premium ceremonial formal wear, reflecting both globalized professional standards and rich local wedding traditions. Market entry strategies in APAC often require balancing global brand messaging with local cultural nuances in color, silhouette, and ornamentation. Latin America and the Middle East & Africa (MEA) represent nascent but promising markets, driven primarily by oil wealth and increasing participation in international business, creating significant demand for imported luxury formal wear brands.

- North America (NA): Focus on convenience, performance fabrics, and the prominence of rental services. High adoption rate of personalized e-commerce solutions and strong presence of major corporate buying segments.

- Europe: Dominated by heritage luxury brands, high demand for bespoke and artisan tailoring. Key focus on sustainability, ethical sourcing, and preservation of craftsmanship quality.

- Asia Pacific (APAC): Highest projected CAGR, driven by rising middle class, rapid corporate expansion, and significant investment in the wedding and event industry. Market characterized by a mix of traditional and modern formal aesthetics.

- Latin America (LATAM): Emerging market with increasing demand for imported luxury brands. Economic volatility presents challenges, making mid-range and accessible luxury formal wear popular among the growing urban professional class.

- Middle East & Africa (MEA): Growth fueled by investment in infrastructure, regional business hubs (e.g., UAE, Saudi Arabia), and high-net-worth consumers driving demand for ultra-exclusive, customized formal wear and luxury modest fashion options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Formal Wear Market.- LVMH Moët Hennessy Louis Vuitton

- Kering S.A.

- Ralph Lauren Corporation

- Hugo Boss AG

- Burberry Group PLC

- Giorgio Armani S.p.A.

- Ermenegildo Zegna Group

- Inditex S.A. (Zara)

- Hennes & Mauritz AB (H&M)

- Ted Baker

- PVH Corp. (Calvin Klein, Tommy Hilfiger)

- Brooks Brothers

- Men's Wearhouse (Tailored Brands)

- Dolce & Gabbana

- Prada Group

- Canali S.p.A.

- Salvatore Ferragamo

- Kiton

- Tom Ford International

- Paul Smith

- Gucci (Kering subsidiary)

- Dior (LVMH subsidiary)

- Richemont Group (Various formal wear brands)

- Rent the Runway (Rental segment specialist)

- The Black Tux (Men's rental specialist)

Frequently Asked Questions

Analyze common user questions about the Formal Wear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Formal Wear Market?

The market growth is primarily propelled by the global standardization of professional dressing codes, the continuous expansion of the wedding and corporate events industry, rising disposable incomes in APAC and other emerging economies, and the increasing consumer preference for high-quality, customized, and tailored garments that project a professional image. Technological advancements enabling better fit (e.g., 3D scanning) also contribute significantly.

How is the trend of corporate casualization impacting formal wear sales?

Corporate casualization acts as a restraint, particularly impacting the sale of traditional, heavy suits. However, this trend has created a niche for "smart casual" and "business casual" formal wear, which includes performance blazers, tailored knitwear, and stretch trousers. Brands are adapting by producing hybrid garments that offer the structure of formal wear with the comfort of casual attire.

Which formal wear segment shows the highest growth potential?

While the Men's segment holds the largest current value, the Women's Formal Wear segment, particularly focusing on power dressing, tailored separates, and high-end dresses for professional and ceremonial use, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to increased female leadership in global corporate sectors.

What role does sustainability play in the purchasing decisions of formal wear consumers?

Sustainability is a critical factor, especially for luxury and premium formal wear buyers. Consumers prioritize ethically sourced materials (like certified organic wool), transparent supply chains, and durable, long-lasting garments. The rise of formal wear rental services is a direct response to consumer demands for environmentally conscious and circular consumption models.

What major technological advancement is revolutionizing formal wear fitting and manufacturing?

Artificial intelligence (AI) combined with 3D body scanning technology is revolutionizing the industry by enabling hyper-personalized, made-to-measure garments to be designed and cut remotely with minimal error. This accelerates production cycles, reduces the need for multiple physical fittings, and significantly enhances customer satisfaction for tailored clothing.

What is the key difference between bespoke and made-to-measure (MTM) formal wear?

Bespoke tailoring involves creating a completely original pattern from scratch based on the client's unique measurements, often requiring numerous fittings and hand finishing. Made-to-measure (MTM) uses an existing, pre-designed block pattern which is then adjusted and scaled to fit the client's dimensions. Bespoke offers maximum customization and fit perfection, while MTM offers a faster, more accessible premium tailoring experience.

Which distribution channel is experiencing the most significant disruption in the Formal Wear Market?

Rental and Subscription Services are causing significant disruption, especially in the ceremonial and event wear categories. These services offer consumers access to high-value designer attire for temporary use, capitalizing on affordability and variety, appealing strongly to event attendees who seek novelty without the investment of ownership.

How are luxury formal wear brands maintaining brand value amidst economic fluctuations?

Luxury brands focus on reinforcing brand heritage, emphasizing unparalleled craftsmanship, and investing heavily in exclusive customer experiences (both digital and in-store). They often pivot towards higher quality, limited-edition bespoke services and materials that resist inflation and maintain their status as investment pieces, ensuring perceived value remains high despite economic shifts.

What types of performance fabrics are becoming popular in business formal wear?

Performance fabrics increasingly popular in business formal wear include stretch wool blends enhanced with Lycra or spandex for comfort, crease-resistant travel suits treated with specialized finishes, and moisture-wicking, breathable cotton or synthetic mixtures designed for warmer climates and long days of wear. These innovations blend traditional tailoring with athletic performance attributes.

Why is the Asia Pacific region such a critical market for future formal wear growth?

APAC's criticality stems from its massive demographic base, rapidly increasing urbanization, substantial growth in the young professional population, and a cultural emphasis on elaborate and frequent formal social events, particularly large weddings and festivals, driving both volume and high-end spending in the formal wear segment.

What are the main challenges associated with the global supply chain for formal wear materials?

The main challenges involve securing ethical and certified high-quality materials (like fine wool), managing the complex logistics of specialized textile production, navigating international trade tariffs and geopolitical risks, and ensuring traceability to satisfy consumer demand for sustainable and transparent sourcing practices, particularly for luxury fabrics.

How does the influence of social media affect formal wear trends and consumer choice?

Social media profoundly affects trends by rapidly disseminating images of celebrity event wear and runway styles, creating immediate demand for specific silhouettes, colors, and cuts. This forces formal wear manufacturers to accelerate design cycles and introduce seasonal micro-collections that align with highly visible, influencer-driven fashion mandates, prioritizing aesthetic appeal and visual impact.

What is the primary motivation for companies to invest in AI-driven pattern cutting in formal wear?

The primary motivation is efficiency and waste reduction. AI-driven pattern cutting optimizes fabric utilization (nesting patterns tighter), significantly minimizing material wastage, which is highly beneficial given the high cost of luxury formal wear fabrics. This process also speeds up the pattern adjustment phase for made-to-measure orders.

Are formal uniforms for institutional buyers (B2B) a significant part of the market?

Yes, formal uniforms procured by institutional buyers such as airlines, luxury hotels, banking chains, and private schools represent a stable, high-volume B2B segment. These contracts often prioritize durability, consistency, and specific performance attributes, providing predictable revenue streams for specialized uniform suppliers within the broader formal wear market.

What are the risks associated with the increasing adoption of virtual try-on technology for formal wear?

While virtual try-on improves online conversion, risks include inaccuracies in fabric texture and drape visualization, which are critical for formal wear. Misrepresentation of how the garment physically feels or moves can lead to customer dissatisfaction and high return rates if the technology fails to accurately replicate the sensory experience of wearing high-quality tailored clothing.

How do designers cater to the increasing demand for versatile formal wear that can transition across multiple occasions?

Designers are focusing on modular and convertible formal wear—suits with interchangeable lining or detachable elements, and formal dresses designed with removable sleeves or overlays. These versatile designs maximize the utility of the garment, appealing to consumers looking for greater value and flexibility in their wardrobe investments.

What financial factors most restrain the expansion of the bespoke formal wear segment?

The high financial restraints are primarily the significant labor costs associated with highly skilled artisan tailoring, the premium price of high-grade raw materials, and the extensive time required for the production process. These factors position bespoke wear as a luxury product largely inaccessible to the mass market.

Beyond clothing, what formal wear accessories are showing strong market growth?

Accessories showing strong growth include premium, ethically sourced leather goods (belts, briefcases), customizable jewelry like cufflinks and tie clips, and high-quality formal footwear. Consumers are increasingly focusing on these details to complete a sophisticated formal look, viewing them as long-term investment pieces.

What role do global economic conditions play in the Formal Wear Market?

Global economic conditions significantly influence discretionary spending, particularly affecting the luxury and premium formal wear segments. During economic downturns, consumers often defer high-value purchases like bespoke suits, leading to increased demand for mid-range ready-to-wear or formal wear rental services as more cost-effective options.

How is the concept of 'gender fluidity' impacting the design of modern formal wear?

Gender fluidity is leading designers to create less structured, more adaptable silhouettes that appeal across gender lines. This includes tailored trousers, structured jackets, and universal shirting, focusing on fit and material quality rather than strictly traditional masculine or feminine features, promoting inclusivity in professional and ceremonial attire.

What is the significance of the base year 2025 in the formal wear market report analysis?

2025 serves as the Base Year, providing a stable, recent benchmark against which historical data (2019-2024) is finalized and future projections (2026-2033) are calculated. It encapsulates the market's recovery and stabilization post-global health crises, offering a current representation of market structure and pricing.

In which region is the demand for custom wedding formal wear currently highest?

While weddings drive demand globally, the Asia Pacific region, particularly countries like India and China, demonstrates the highest volume demand for custom and elaborate ceremonial formal wear, owing to culturally significant, large-scale, multi-day wedding celebrations that often require multiple high-value outfits.

What emerging material technologies are relevant to sustainable formal wear manufacturing?

Emerging material technologies include recycled synthetic fibers (e.g., regenerated nylon for linings), innovative plant-based materials (e.g., Tencel or specialized plant silks), and advanced dyeing techniques that significantly reduce water and chemical consumption, minimizing the environmental footprint of formal textile production.

How do brands ensure customer loyalty in the highly competitive formal wear luxury segment?

Loyalty is maintained through exceptional, highly personalized service, including exclusive in-store appointments, lifetime alteration guarantees, access to private viewing of new collections, and robust after-sales care. These non-monetary benefits reinforce the high value and status associated with the luxury purchase, cultivating long-term client relationships.

What defines the Luxury Price Point segment within the Formal Wear Market?

The Luxury Price Point is defined by unparalleled quality of raw materials (e.g., rare wools, high-count silks), genuine bespoke craftsmanship, exclusivity of design, the inclusion of extensive hand-finishing, and association with internationally recognized, high-heritage designer or tailoring houses, typically resulting in pricing above USD 5,000 for a single suit or gown.

What is the role of specialized formal wear specialty stores in the current distribution landscape?

Specialty stores remain vital as they offer a curated, expert-led shopping experience, especially for bespoke and made-to-measure services. They provide essential elements like professional measuring, fitting rooms, and on-site alteration services that cannot be fully replicated by purely online channels, maintaining their relevance for high-value and complex purchases.

Which segment, ready-to-wear or bespoke/MTM, currently dominates the formal wear market revenue?

Ready-to-wear (RTW) currently dominates the market revenue by volume and value due to its accessibility, immediate availability, and standardized sizing, catering to the large mid-range corporate segment. However, bespoke and made-to-measure (MTM) services are rapidly gaining market share due to increasing demand for personalization and improved production efficiency.

What challenges does the Formal Wear Market face regarding intellectual property and design protection?

The market faces significant challenges from rapid copying and counterfeit production, particularly affecting luxury designs and unique fabric patterns. Protecting intellectual property requires continuous legal action, advanced textile tagging (like NFC chips), and stringent monitoring of global manufacturing and distribution channels, especially in high-volume, low-cost regions.

How is the shift towards remote work impacting the type of formal wear purchased?

While remote work reduced the daily need for full suits, it shifted purchasing toward pieces required for hybrid work—high-quality blazers, refined knitwear suitable for video conferencing, and comfortable yet tailored trousers. The demand for ceremonial formal wear (weddings, galas) has remained robust, compensating partly for the drop in daily business attire sales.

What is the key differentiator for mid-range formal wear brands aiming for market penetration?

The key differentiator for mid-range brands is offering exceptional value by balancing quality, fit, and price. They often utilize advanced blended performance fabrics and streamlined MTM production processes, providing near-bespoke fit and professional styling guidance at a fraction of the traditional luxury cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager