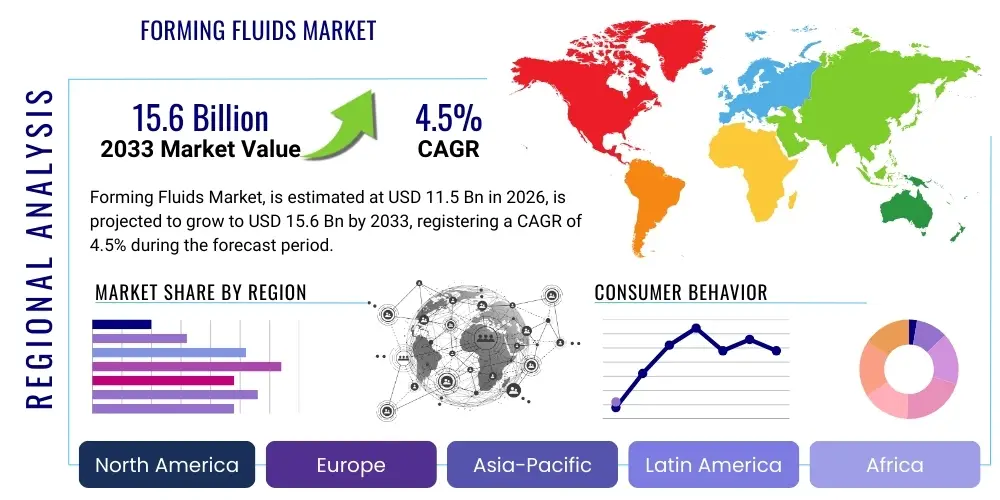

Forming Fluids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438456 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Forming Fluids Market Size

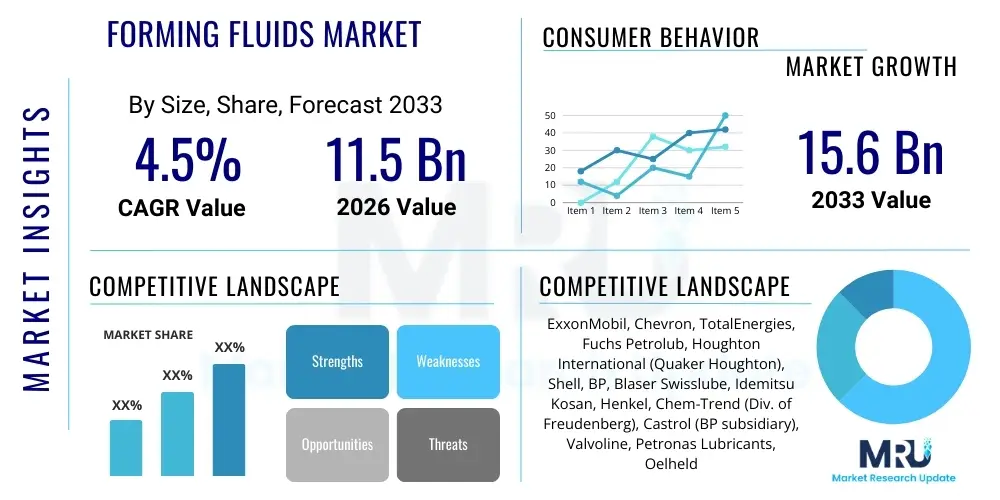

The Forming Fluids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 15.6 billion by the end of the forecast period in 2033.

This growth trajectory is primarily fueled by the accelerating expansion of the automotive and construction sectors, particularly in emerging economies across Asia Pacific. Forming fluids, essential for processes such as stamping, drawing, forging, and extrusion, play a critical role in enhancing efficiency, extending die life, and ensuring high-quality surface finishes on fabricated components. The increasing demand for lightweight, high-strength materials, such as advanced high-strength steels and aluminum alloys, mandates the use of highly specialized forming fluid formulations designed to manage severe pressure and temperature conditions, thereby driving market value upwards.

Furthermore, stringent environmental regulations regarding volatile organic compounds (VOCs) and hazardous substances are compelling manufacturers to shift towards bio-based and synthetic forming fluids. This regulatory environment is not only influencing product formulation but also fostering innovation in fluid recovery and recycling technologies, thereby impacting operational costs and sustainability metrics across the entire value chain. The investment in R&D aimed at developing multi-functional fluids that offer corrosion protection and cooling alongside lubrication is a key determinant shaping the market structure over the forecast period.

Forming Fluids Market introduction

Forming fluids are specialized chemical compounds utilized in various metalworking processes, including cold forming, hot forming, deep drawing, and stamping, where they minimize friction, dissipate heat, prevent adhesion between the workpiece and the tooling, and ensure dimensional accuracy. These products typically fall into categories such as straight oils, soluble oils, synthetics, and semi-synthetics, differentiated by their base fluid composition and additive packages designed for specific material combinations and process severity. Major applications span critical industrial sectors including automotive component manufacturing, aerospace part fabrication, general engineering, appliance production, and construction material forming. The core benefits derived from optimal forming fluid selection include improved production speed, reduced tool wear, enhanced surface finish quality, and significant reduction in component rejection rates, positioning them as indispensable consumables in modern manufacturing operations. The market is fundamentally driven by global industrial output, technological advancements in metal alloys requiring customized lubrication solutions, and the persistent regulatory push towards environmentally safer, high-performance formulations.

Forming Fluids Market Executive Summary

The Forming Fluids Market is characterized by a strong convergence of demand driven by electric vehicle (EV) manufacturing and increased infrastructure investment, demanding lightweight structural components produced through advanced forming techniques. Business trends highlight strategic partnerships between fluid suppliers and tooling manufacturers to co-develop integrated process solutions, improving operational efficacy. Regionally, Asia Pacific maintains dominance due to robust automotive and electronics manufacturing bases, while North America and Europe emphasize the adoption of premium, synthetic, and bio-based fluids driven by rigorous environmental mandates. Segment trends indicate accelerated growth in the synthetic fluid category, favored for their stability, extended sump life, and superior performance in high-severity operations like forging and hydroforming. Furthermore, the increasing focus on the total cost of ownership (TCO) rather than mere initial purchasing price is shifting procurement decisions toward high-efficiency, long-life fluid formulations that minimize maintenance downtime and waste generation across all key end-use industries.

AI Impact Analysis on Forming Fluids Market

User inquiries frequently center on how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the usage and management of forming fluids, focusing on predictive maintenance, fluid condition monitoring, and formulation optimization. Common concerns revolve around the integration cost of sensor technology (IoT) and AI platforms, the accuracy of predictive modeling for fluid degradation, and the potential for AI to streamline complex additive package adjustments in real-time. Users anticipate that AI will significantly enhance fluid lifespan by predicting contamination levels and necessary adjustments, thereby reducing fluid consumption, minimizing waste, and ensuring consistent product quality in high-throughput metal forming operations. The consensus expectation is that AI integration will transform forming fluids from a consumable commodity into a highly managed and data-driven process component, offering substantial efficiency gains.

- AI-driven predictive maintenance optimizes fluid change intervals, reducing unscheduled downtime and labor costs associated with manual monitoring.

- Machine Learning algorithms analyze sensor data (viscosity, pH, concentration, contamination) to predict fluid degradation patterns with high accuracy, extending effective lifespan.

- AI assists in formulating custom fluid packages by simulating performance under various extreme forming conditions, accelerating R&D cycles.

- Integration of smart sensors (IoT) allows for real-time monitoring of fluid parameters, ensuring immediate corrective actions and maintaining optimal lubrication efficacy.

- Generative AI tools are used to simulate complex material flow and stress distribution during forming processes, enabling the precise selection of the most suitable fluid type.

- Automated dosing systems, governed by AI analytics, maintain precise fluid concentrations, ensuring consistent performance regardless of operational variability.

The implementation of AI and IoT technologies in the forming fluid market is fundamentally shifting the supplier-customer relationship. Suppliers are evolving into service providers, offering Fluid Management Programs (FMPs) that leverage data analytics to optimize customer processes. This transition requires significant investment in data infrastructure and specialized metallurgical expertise, creating barriers to entry for smaller players but offering substantial competitive advantages for integrated chemical and technology companies.

Furthermore, AI models are proving invaluable in addressing the growing demand for sustainability. By accurately predicting the end-of-life of fluid batches, AI minimizes unnecessary disposal, contributing directly to circular economy initiatives within the manufacturing sector. This capability, coupled with the ability to optimize fluid use per component produced, translates directly into measurable environmental compliance improvements, which is a major purchasing driver in regulatory-heavy regions like Europe.

DRO & Impact Forces Of Forming Fluids Market

The market growth is primarily driven by the expansion of the global manufacturing sector, particularly in automotive lightweighting initiatives and robust infrastructural development requiring high volumes of fabricated metal components. Restraints include the increasing volatility in crude oil prices, which impacts the cost of synthetic and mineral oil-based fluids, and the high disposal costs associated with spent fluids, posing environmental compliance challenges. Significant opportunities arise from the increasing adoption of bio-based and renewable-source fluids, advancements in nano-lubrication technology to handle extreme pressure applications, and the expansion into niche markets like 3D printing post-processing. The primary impact forces include technological advancements in material science (requiring new fluid chemistries), stringent governmental regulations on health, safety, and environment (HSE), and the economic fluctuation in global industrial production indices, collectively determining market velocity and directional shifts.

Segmentation Analysis

The Forming Fluids Market is segmented based on product type, base oil, forming process, and end-use industry. Product segmentation typically covers high-performance synthetic fluids, semi-synthetic fluids offering a balance of performance and cost, soluble oils (emulsions) for general use, and straight oils for specific, high-lubricity applications. Segmentation by forming process includes dedicated fluids for stamping and drawing, forging, extrusion, rolling, and hydroforming, each requiring unique rheological and thermal properties. The end-use industry analysis highlights automotive, aerospace, heavy machinery, and construction as the primary consumption centers. This granular segmentation allows suppliers to tailor formulations to the highly specific mechanical and thermal requirements of different manufacturing applications, ensuring optimized process efficiency and material integrity.

- By Product Type:

- Straight Oils

- Soluble Oils (Emulsions)

- Semi-Synthetic Fluids

- Synthetic Fluids

- By Base Oil:

- Mineral Oil

- Synthetic Oil (PAOs, Esters)

- Bio-based Oil (Vegetable Oil)

- Water-Based

- By Forming Process:

- Stamping and Drawing

- Forging (Hot and Cold)

- Extrusion

- Rolling (Flat and Tube)

- Hydroforming and Bending

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Construction and Heavy Machinery

- Electrical and Electronics

- General Engineering

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

The synthetic fluids segment is witnessing robust growth due to their superior thermal stability and compatibility with high-speed forming equipment and advanced metal alloys like titanium and nickel superalloys. These fluids offer enhanced tool life and reduced maintenance frequency compared to traditional mineral oil-based counterparts, justifying their higher initial cost, especially in precision manufacturing sectors such as aerospace and medical devices. The shift towards minimal quantity lubrication (MQL) techniques further favors synthetic, low-viscosity formulations designed for efficient delivery and residue minimization.

Within the forming process segmentation, stamping and drawing processes account for the largest market share due to the high volume production of automotive body panels and appliance components globally. However, the forging segment, particularly cold forging, demands the most sophisticated and robust fluid chemistries to manage extreme pressures and friction, often necessitating specialized graphite or polymer-loaded formulations. The increasing complexity of component geometries necessitates advanced fluid performance to prevent material rupture and maintain surface integrity during severe plastic deformation.

Value Chain Analysis For Forming Fluids Market

The value chain for the Forming Fluids Market begins with upstream analysis involving the sourcing and refinement of base oils—mineral, synthetic, or bio-based—alongside the manufacturing of performance-enhancing additives (e.g., extreme pressure agents, corrosion inhibitors, emulsifiers). Key suppliers of these raw materials often include major petrochemical and specialty chemical companies. The midstream involves the fluid formulators and blenders who combine these components, often customizing additive packages based on specific end-use requirements and regional regulatory constraints. Downstream analysis focuses on the distribution channel, which is highly fragmented, utilizing both direct sales models for large OEMs and complex indirect networks (distributors, specialized chemical resellers) to serve small and medium-sized enterprises (SMEs). Direct distribution ensures technical support and fluid management services, crucial for complex synthetic fluids, while indirect channels provide market penetration and logistical efficiency for high-volume, standardized products.

Forming Fluids Market Potential Customers

Potential customers, or end-users, of forming fluids are concentrated in industries that utilize intensive metal deformation processes to fabricate components. The primary buyers include Original Equipment Manufacturers (OEMs) in the automotive industry (stamping parts, body structures), aerospace manufacturers (titanium and superalloy components), and producers of heavy industrial equipment and construction machinery (forged components, pipes, and beams). Additionally, independent metal service centers, specialized component fabricators (e.g., fasteners, tubes), and large appliance manufacturers represent significant segments of demand. These buyers prioritize fluids based on performance metrics such as die life extension, waste reduction, occupational safety ratings, and compatibility with their existing manufacturing infrastructure and subsequent cleaning processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Chevron, TotalEnergies, Fuchs Petrolub, Houghton International (Quaker Houghton), Shell, BP, Blaser Swisslube, Idemitsu Kosan, Henkel, Chem-Trend (Div. of Freudenberg), Castrol (BP subsidiary), Valvoline, Petronas Lubricants, Oelheld GmbH, Cimcool Industrial Products, Master Chemical Corporation, JX Nippon Oil & Energy, Dow Chemical Company, Lubrizol Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forming Fluids Market Key Technology Landscape

The technological landscape of the Forming Fluids Market is rapidly evolving, driven by the need for higher performance under extreme conditions and stricter environmental compliance. Key technological advancements center around the development of high-shear stable synthetic esters and polyalphaolefins (PAOs) that offer superior thermal resistance and reduced residue formation compared to mineral oils. A significant trend is the incorporation of nanotechnology, specifically utilizing nano-additives like carbon nanotubes, graphene, and specialized ceramic nanoparticles, which enhance the boundary lubrication capabilities and load-bearing capacity of the fluids, critical for deep drawing and high-speed stamping operations.

Another area of intense focus is the advancement of Minimum Quantity Lubrication (MQL) techniques and fluids. MQL requires highly refined, volatile, or semi-volatile fluids delivered in precise, atomized doses, minimizing the need for post-forming cleaning and reducing fluid consumption by up to 90%. This shift demands specialized fluid delivery systems and highly stable fluid compositions that can perform effectively in very thin films. Furthermore, the development of bio-based fluids, often derived from renewable sources like rapeseed or sunflower oil, is crucial for meeting European and North American ecological standards, necessitating advanced esterification processes to improve their oxidative stability and shelf life.

The integration of digital technology, encompassing IoT sensors, cloud-based monitoring, and AI-driven fluid management systems (as detailed previously), represents a paradigm shift. These systems move beyond simple fluid supply to offering integrated, data-driven fluid lifecycle management. This digitalization ensures not only optimal performance but also maximizes resource efficiency, directly addressing the industry pressure to adopt Industry 4.0 standards and enhance overall manufacturing sustainability and traceability.

Regional Highlights

Regional dynamics significantly influence the consumption patterns and technological adoption within the Forming Fluids Market, reflecting disparate regulatory environments, industrial maturation, and automotive production shifts.

- Asia Pacific (APAC): Dominates the global market volume due to being the largest hub for automotive manufacturing (especially China, India, and Japan), extensive electronics production, and rapid infrastructure development. The region exhibits high consumption of both soluble oils and synthetic fluids, driven by sheer production volume and a growing preference for advanced formulations in precision manufacturing segments.

- North America: Characterized by mature industrial processes and stringent environmental regulations (e.g., EPA standards). The market shows a high adoption rate of premium, synthetic, and bio-based forming fluids, driven primarily by the high-value aerospace and advanced automotive (lightweighting for EVs) sectors, where performance and compliance are paramount.

- Europe: Exhibits the highest propensity for adopting sustainable and environmentally friendly fluids due to rigorous REACH regulations and a strong commitment to circular economy principles. Germany, Italy, and France are key consumers, focusing on high-precision cold forging and stamping for the automotive and machinery industries, favoring synthetic fluids with low VOC content.

- Latin America (LATAM): Growth is primarily tied to local automotive production (Brazil and Mexico) and mining equipment manufacturing. The market often favors cost-effective soluble oils, though there is a gradual shift towards higher-performance semi-synthetics spurred by international OEM standards.

- Middle East and Africa (MEA): Smallest market share, largely dependent on oil and gas infrastructure projects and local manufacturing initiatives. Demand focuses on robust fluids capable of operating efficiently in high-temperature environments, often supplied through international distributors linked to major petrochemical firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forming Fluids Market.- Quaker Houghton (Houghton International)

- Fuchs Petrolub SE

- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP plc (Castrol)

- Chevron Corporation

- TotalEnergies SE

- Blaser Swisslube AG

- Idemitsu Kosan Co. Ltd.

- Henkel AG & Co. KGaA

- Chem-Trend (Div. of Freudenberg Group)

- Dow Chemical Company

- Lubrizol Corporation (Berkshire Hathaway subsidiary)

- Oelheld GmbH

- Cimcool Industrial Products LLC (A part of DuBois Chemicals)

- Master Chemical Corporation

- Petronas Lubricants International

- JX Nippon Oil & Energy Corporation

- Valvoline Inc.

- Clariant AG

Frequently Asked Questions

Analyze common user questions about the Forming Fluids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of synthetic forming fluids?

The shift towards synthetic forming fluids is driven by their superior thermal stability, extended operational lifespan, and compatibility with advanced lightweight alloys (e.g., AHSS, titanium) used in modern automotive and aerospace manufacturing, leading to reduced tool wear and enhanced component quality.

How do environmental regulations, like REACH, impact forming fluid formulation?

Regulations such as REACH necessitate the replacement of conventional additives containing hazardous materials (like certain chlorine compounds) with safer alternatives. This mandates R&D focus on bio-based oils, advanced esters, and low-VOC synthetic formulations to ensure fluids are compliant and sustainable.

Which end-use industry holds the largest market share for forming fluids?

The Automotive and Transportation sector currently holds the largest market share, predominantly due to the high volume of stamping, drawing, and forging operations required for producing internal combustion engine and electric vehicle chassis, body panels, and powertrain components globally.

What is Minimum Quantity Lubrication (MQL) and its relevance to forming fluids?

MQL is a technique that applies a precise, minimal amount of lubricant (often specialized synthetic or vegetable oil) during forming. Its relevance lies in significantly reducing fluid consumption, eliminating or minimizing post-process cleaning requirements, and improving the environmental footprint of manufacturing operations.

How is Industry 4.0 influencing the management of metal forming fluids?

Industry 4.0, via IoT sensors and AI analytics, enables real-time fluid condition monitoring and predictive maintenance. This allows manufacturers to optimize fluid concentration, anticipate contamination, and extend the effective sump life, transforming fluid management into a data-driven, efficiency-focused process.

What are the key technical challenges in formulating fluids for cold forging applications?

Cold forging demands fluids with exceptionally high film strength and lubricity to withstand severe plastic deformation pressures without failure. Formulators must incorporate robust extreme pressure (EP) additives and anti-wear agents while maintaining compatibility with subsequent heat treatment processes.

Why is fluid residue removal a significant consideration in forming operations?

Fluid residue must be thoroughly removed post-forming, especially if components undergo subsequent processes like welding, painting, or heat treatment, as residual films can interfere with adhesion, cause surface defects, or compromise metallurgical integrity. Low-residue fluids are therefore highly valued.

How does the base oil type affect the performance and cost of forming fluids?

Mineral oils are cost-effective but offer lower thermal stability. Synthetic base oils (PAOs, Esters) provide superior thermal and oxidative stability for high-severity applications but at a higher cost. Bio-based oils offer excellent lubricity and biodegradability, balancing performance with environmental benefits.

What role do corrosion inhibitors play in soluble forming fluid emulsions?

Corrosion inhibitors are essential in soluble (water-based) fluids to protect both the metal workpiece and the expensive tooling/machinery from rust and staining, especially when the fluids contain high levels of water and operate in humid environments.

In which regions is the demand for bio-based forming fluids highest?

Demand for bio-based forming fluids is highest in Western Europe and North America, driven by strict mandates on occupational health, safety, and environmental impact (HSE), alongside consumer preference for sustainable manufacturing practices.

What is the expected long-term impact of electric vehicle manufacturing on forming fluid demand?

EV manufacturing drives demand for specialized fluids for stamping lightweight materials (aluminum, high-strength steel) and precision forming of battery components. This shifts demand towards advanced synthetic fluids optimized for complex, lightweight component formation.

How do additives enhance the extreme pressure (EP) performance of forming fluids?

EP additives, typically containing sulfur, phosphorus, or chlorine compounds (though chlorine is decreasing), react chemically with the metal surface under high pressure and temperature to form a sacrificial protective layer, preventing direct metal-to-metal contact and tool welding.

What challenges do fluid suppliers face regarding raw material cost volatility?

Since base oils and many key additives are derived from petrochemical sources, fluctuations in global crude oil and chemical commodity prices directly impact the production costs and subsequent pricing stability of forming fluids, necessitating robust supply chain risk management.

What is the significance of thermal management in hot forging fluids?

In hot forging, fluids must primarily provide cooling and act as thermal barriers to protect dies from excessive heat shock and wear. Specialized graphite-based and polymer coatings are crucial for releasing the formed component and dissipating heat rapidly.

How does the aerospace sector influence innovation in forming fluid technology?

The aerospace sector demands fluids for forming exotic alloys (e.g., titanium, Inconel) that operate under extreme stress. This necessitates innovation in high-purity, synthetic, and specialized nano-lubricants that ensure zero defects and maintain the stringent metallurgical standards required for flight safety.

What are the advantages of using synthetic fluids over soluble oils in terms of fluid lifespan?

Synthetic fluids typically have longer sump lives because they resist biological degradation and chemical breakdown (oxidation and hydrolysis) more effectively than water-based soluble oils, reducing disposal frequency and maintenance costs.

How is digital traceability integrated into the forming fluids supply chain?

Digital traceability, often leveraging IoT and blockchain technologies, allows end-users to track the origin, composition, quality metrics, and usage history of specific fluid batches, ensuring compliance and rapid identification of quality control issues.

What is the typical role of distribution channels for SME manufacturers?

For Small and Medium Enterprises (SMEs), indirect distribution channels (local distributors and resellers) are crucial, providing timely smaller-volume deliveries, inventory management, and accessible technical support tailored to general engineering applications.

What measures are taken to mitigate foaming issues in water-based forming fluids?

Foaming is managed by incorporating high-performance, rapid de-aerating defoamers into the fluid formulation, ensuring the concentration of the emulsion is accurately maintained, and optimizing machine tank design to minimize turbulence.

What differentiates a semi-synthetic fluid from a fully synthetic fluid?

Semi-synthetic fluids contain a mix of highly refined mineral oil (typically 10-40%) and synthetic base components, offering a performance enhancement over soluble oils at a lower cost than pure synthetics. Fully synthetics contain no mineral oil.

What is the primary driver for growth in the Forming Fluids Market in Asia Pacific?

The massive scale of automotive production, coupled with the rapid expansion of electronics and general manufacturing industries in countries like China and India, constitutes the primary volume and value driver for forming fluids in the APAC region.

How does the integration of AI lead to reduced fluid consumption in manufacturing?

AI optimizes fluid usage by precisely predicting necessary change intervals and monitoring concentration in real-time. This eliminates premature disposal and ensures the fluid operates optimally for the maximum duration, significantly cutting consumption and waste generation.

What specific challenges do advanced high-strength steels (AHSS) pose for forming fluids?

AHSS alloys are challenging due to their high yield strength and reduced ductility, requiring fluids with exceptional film strength and lubricity to prevent galling, limit tool wear, and avoid component cracking during severe stamping operations.

Which segment of forming fluids is expected to demonstrate the highest CAGR?

The Synthetic Fluids segment is anticipated to exhibit the highest CAGR due to increased adoption in precision industries, driven by their superior performance characteristics and alignment with stringent environmental and operational efficiency goals.

What is the main restraining factor affecting market profitability for fluid manufacturers?

The primary restraining factor is the volatility and unpredictability of upstream raw material prices (base oils and performance additives), leading to fluctuating operational margins and difficulty in stable long-term pricing.

How are fluid formulators addressing the need for multi-metal compatibility?

Formulators develop advanced additive packages that minimize reactivity with sensitive metals like aluminum, copper, and specialized coatings, ensuring the fluid is stable and non-staining across diverse production lines that process multiple types of alloys.

What is the role of technical service and support in the forming fluids market?

Technical service is critical; suppliers often provide extensive support, including fluid condition analysis, troubleshooting, fluid management programs (FMPs), and regulatory compliance guidance, adding substantial value beyond the physical product itself.

What is 'galling' and how do forming fluids mitigate it?

Galling is the transfer of material from the workpiece onto the tooling surface, leading to scratches and defects. Forming fluids mitigate galling by providing a high-strength boundary layer of lubrication that physically separates the tool and workpiece under intense pressure.

How does the shift to hydroforming technology affect fluid requirements?

Hydroforming requires fluids that must be highly clean, non-foaming, and possess excellent lubricity under high hydrostatic pressures (often water-based emulsions), facilitating complex shape creation while protecting internal component surfaces.

Why is waste fluid disposal a regulatory challenge globally?

Spent forming fluids, especially those containing mineral oil, heavy metals, or hazardous additives, are classified as industrial waste. Regulations mandate careful processing, treatment, or specialized incineration, driving up operational costs for end-users and requiring certified waste management systems.

How are nano-lubricants enhancing the performance of existing forming fluids?

Nano-lubricants use ultra-fine particles that act as micro-bearings, significantly improving the load-carrying capacity and friction reduction capabilities of the fluid, particularly effective in severe deformation processes like deep drawing and tube bending.

What is the influence of powder metallurgy on forming fluid consumption?

While powder metallurgy (PM) often requires specialized binders, the subsequent steps, such as sizing or coin pressing of sintered parts, still require specific forming lubricants or release agents to ensure component density and precise dimensional tolerance.

What is the core difference between lubrication for hot forging versus cold forging?

Hot forging lubricants focus primarily on heat dissipation and release (often graphite or glass-based coatings), whereas cold forging lubricants focus on providing extreme pressure resistance and friction reduction through robust boundary films.

In the Value Chain, what is the role of the specialty chemical manufacturers?

Specialty chemical manufacturers are crucial upstream providers, responsible for synthesizing the complex additive packages (anti-oxidants, EP agents, emulsifiers, biocides) that dictate the final performance and longevity of the forming fluid blend.

How does the TCO (Total Cost of Ownership) factor into fluid procurement decisions?

TCO emphasizes not just the purchase price, but also costs related to fluid consumption, disposal fees, tool replacement frequency, and labor for maintenance. High-performance, long-life fluids often justify a higher unit price due to lower TCO.

What are the inherent disadvantages of bio-based forming fluids?

Historically, bio-based fluids have suffered from poor oxidative stability, leading to shorter shelf lives and potential for rancidity. However, modern esterification and stabilization techniques are largely mitigating these performance limitations.

Why is fluid compatibility with subsequent cleaning processes important for manufacturers?

If the forming fluid cannot be easily and completely removed by the standard industrial cleaning system, it increases processing time, raises energy costs, and potentially compromises the quality of subsequent operations like painting, plating, or bonding.

Which geographical region is rapidly increasing its market share in forming fluids?

Southeast Asia (Vietnam, Thailand, Indonesia) is rapidly increasing its market share, driven by foreign direct investment shifting manufacturing capacity, particularly in automotive component stamping, resulting in growing regional demand for forming fluids.

What is the role of emulsifiers in soluble oil formulations?

Emulsifiers are surfactants that allow oil to be stably dispersed in water, forming a milky or transparent emulsion. They are critical for fluid stability and ensuring uniform cooling and lubrication properties during the forming process.

How does the shift towards precision engineering impact fluid requirements?

Precision engineering demands fluids that leave minimal residue, offer exceptional cleanability, and provide consistent, high-level lubrication to ensure tight dimensional tolerances and superior surface finishes on components, favoring advanced synthetics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager