Fortified Bakery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432453 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fortified Bakery Market Size

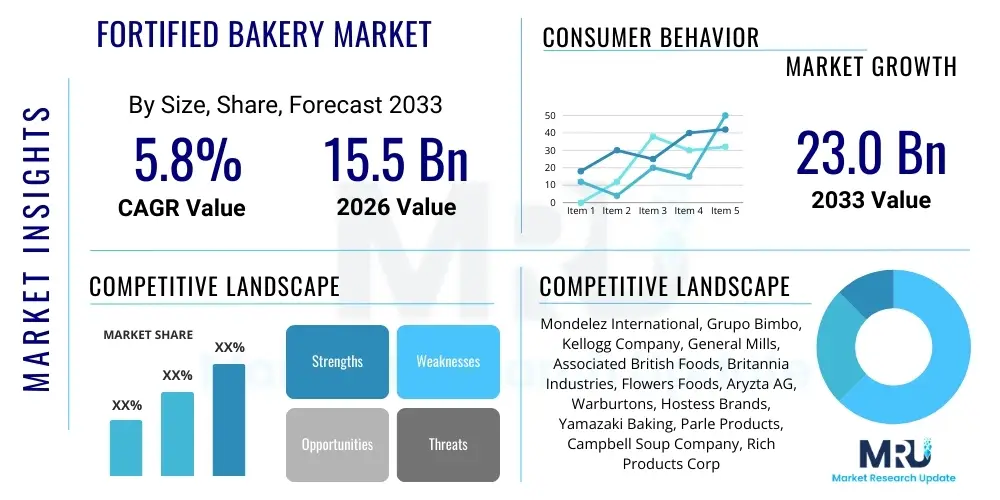

The Fortified Bakery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 billion in 2026 and is projected to reach USD 23.0 billion by the end of the forecast period in 2033.

Fortified Bakery Market introduction

The Fortified Bakery Market encompasses a wide range of baked goods—including bread, cookies, cakes, and breakfast cereals—that have been enhanced with essential micronutrients such as vitamins (A, D, B complex), minerals (iron, calcium, zinc), and often functional ingredients like fiber or protein. This market segment has emerged in direct response to increasing global awareness regarding nutritional deficiencies and the growing consumer demand for functional foods that offer benefits beyond basic sustenance. Fortification is primarily achieved through the addition of specific nutrients during the processing or mixing stages of production, aiming to maximize bioavailability and stability in the final product. The critical objective is to address public health concerns related to widespread malnutrition while integrating seamlessly into daily dietary habits through familiar and convenient food formats.

Major applications of fortified bakery products span various consumer groups, from infants and school-age children requiring specific developmental nutrients to the elderly needing calcium and Vitamin D for bone health, and the general population seeking convenient ways to bridge dietary gaps. These products are particularly vital in regions where staple food diets lack diversity or where government mandates prioritize widespread nutritional supplementation via accessible food channels. The primary product description centers on delivering high nutritional value without compromising on taste, texture, or shelf life, a balance that drives significant innovation in ingredient technology and processing techniques across the industry.

Driving factors for the substantial growth of this market include rigorous government regulatory frameworks advocating for mandatory fortification programs, especially in staple bread and flour products, alongside rising disposable incomes and rapid urbanization in developing economies. Furthermore, the persistent trend towards preventative health and wellness, spurred by global health crises and increased consumer education, positions fortified bakery items as preferred choices over traditional, non-fortified alternatives. The inherent benefits—convenience, accessibility, and the effective delivery of essential nutrients—solidify the fortified bakery sector as a key growth area within the global food industry, necessitating sophisticated supply chain management and targeted marketing strategies to educate consumers about the added value.

Fortified Bakery Market Executive Summary

The Fortified Bakery Market is characterized by robust growth, driven primarily by favorable government policies promoting nutritional security and the surging consumer interest in health and functional foods globally. Business trends indicate a strong focus on clean-label fortification, where manufacturers are increasingly utilizing naturally sourced micronutrients and prioritizing transparency regarding ingredient origin and processing methods. Key market strategies revolve around product diversification, particularly the integration of high-value nutrients like Omega-3 fatty acids and probiotics into traditional baked goods, moving beyond standard vitamin and mineral enrichment. Consolidation among major food manufacturers acquiring specialized nutritional ingredient suppliers is also shaping the competitive landscape, emphasizing vertically integrated operations to control quality and cost, especially in rapidly expanding Asian and Latin American markets.

Regional trends reveal that North America and Europe currently represent significant market shares due to high consumer awareness, stringent quality standards, and established fortification mandates, driving innovation in areas such as gluten-free and low-sugar fortified options. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, fueled by large populations grappling with widespread micronutrient deficiencies, increasing purchasing power, and active government initiatives in countries like India and China to scale up food fortification programs. The Middle East and Africa (MEA) region also presents substantial growth opportunities, particularly in wheat-based products, driven by humanitarian efforts and state-sponsored nutritional interventions aimed at vulnerable populations.

Segment trends underscore the dominance of the Bread segment, largely due to its status as a dietary staple globally, making it the most common target for mandatory fortification efforts. However, the Biscuits and Cookies segment is registering accelerated growth, appealing to consumers seeking convenient, ready-to-eat fortified snacks. In terms of micronutrients, fortification with Iron and Vitamin D remains paramount globally, though there is a perceptible shift towards complex fortification blends that include Fiber and Protein to meet the growing demand for comprehensive nutritional benefits. Distribution trends are shifting towards online retail, which provides better accessibility and detailed nutritional information, complementing the sustained importance of supermarkets and hypermarkets for high-volume sales and consumer accessibility.

AI Impact Analysis on Fortified Bakery Market

Common user questions regarding AI's impact on the Fortified Bakery Market often center on its role in optimizing nutrient stability, predicting ingredient interaction, and improving personalized nutrition offerings. Users frequently inquire about how AI can ensure the dosage accuracy of micronutrients during mass production and minimize degradation across varying processing conditions. There is also significant interest in AI's capacity to streamline supply chain logistics for specialized nutritional ingredients and to analyze vast datasets of consumer preferences to rapidly innovate new fortified flavor profiles and product textures that appeal to specific demographic segments. These questions collectively highlight a key expectation: AI is viewed as a critical enabler for enhancing the precision, efficiency, and customization capabilities of fortification processes, moving beyond traditional trial-and-error methodologies towards data-driven optimization.

The implementation of AI and machine learning models is revolutionizing quality control within the fortified bakery sector. These systems are used to monitor real-time processing parameters, such as temperature, moisture content, and mixing time, ensuring optimal nutrient retention and homogeneous distribution throughout the product matrix. By analyzing data collected from sophisticated sensors, AI algorithms can predict and preemptively adjust production lines to maintain consistency, a factor crucial for meeting regulatory standards related to declared nutrient levels. Furthermore, predictive modeling powered by AI is essential for understanding the long-term stability of sensitive micronutrients in various formulations, allowing manufacturers to select excipients and packaging solutions that maximize shelf life and efficacy, thereby reducing waste and enhancing product reliability for the end consumer.

Beyond the manufacturing floor, AI significantly impacts market strategy and consumer engagement. AI tools are capable of analyzing vast amounts of retail data, social media sentiment, and demographic health statistics to identify emerging nutritional needs and market gaps. This intelligence allows companies to quickly launch highly targeted fortified products, such as bakery items specifically designed for diabetic management or high-protein options tailored for sports nutrition enthusiasts. Moreover, AI-driven chatbots and recommendation engines are beginning to personalize the customer journey, offering tailored advice on which fortified bakery products best suit an individual's dietary requirements, thereby boosting consumer confidence and fostering brand loyalty in a highly competitive nutritional landscape.

- AI-driven precision dosing systems for micronutrient application, ensuring regulatory compliance and consistency.

- Machine learning algorithms optimizing mixing processes to achieve uniform nutrient dispersion in high-volume production.

- Predictive modeling of nutrient stability and degradation rates under different storage and packaging conditions, extending product shelf life.

- Utilization of computer vision and sensor technology for real-time quality control and contamination detection in raw materials.

- AI analysis of consumer data and health trends to identify demand for novel fortification combinations (e.g., specific vitamin ratios).

- Automated supply chain management (SCM) for specialized, temperature-sensitive nutritional ingredients, optimizing inventory and logistics.

- Development of personalized nutrition platforms recommending specific fortified bakery products based on user health data and dietary gaps.

- Robotics integration, guided by AI, for high-throughput packaging and handling of fragile fortified bakery items, minimizing damage.

DRO & Impact Forces Of Fortified Bakery Market

The Fortified Bakery Market is fundamentally shaped by robust Drivers, constrained by technical and cost-related Restraints, and presents significant strategic Opportunities, all contributing to measurable Impact Forces that dictate market direction and investment. The primary drivers include aggressive government intervention through mandated fortification laws, particularly in flour, salt, and edible oils, aimed at tackling national-level micronutrient deficiencies. Coupled with this is the escalating global health consciousness among consumers who actively seek preventative dietary solutions and convenient functional foods to improve overall well-being. These forces collectively create a consistent, policy-backed demand base that sustains market expansion even amidst economic fluctuations.

However, the market faces significant restraints. The complexity and high cost associated with sourcing, processing, and integrating specific, stable micronutrient premixes into bakery matrices often pose financial hurdles, especially for Small and Medium Enterprises (SMEs). Furthermore, maintaining the sensory integrity of baked goods—taste, texture, and aroma—after fortification is a persistent technical challenge, as certain vitamins and minerals can impart undesirable flavors or affect dough properties. Lack of widespread consumer awareness, particularly concerning the specific benefits of various micronutrients in fortified products across developing regions, also slows adoption rates and necessitates sustained educational marketing campaigns, adding to operational overheads.

Strategic opportunities lie primarily in the development of specialized and premium fortified products tailored to specific health demographics, such as high-fiber, low-glycemic fortified breads for diabetic populations or immune-boosting snacks containing specific probiotics and Vitamin C. The expanding reach of e-commerce and digital distribution channels offers a scalable platform for reaching niche consumer groups interested in specialized fortification. The major impact forces driving change are technological advancements in encapsulation and micro-dosing techniques, which effectively mask undesirable tastes and improve nutrient stability, alongside stringent regulatory pressures ensuring product safety and accurate labeling, which reinforces consumer trust and drives reputable manufacturers to innovate constantly in formulation science and production efficiency.

Segmentation Analysis

The Fortified Bakery Market is broadly segmented based on product type, the specific micronutrient utilized for fortification, and the primary distribution channel through which the products reach consumers. Understanding these segmentations is crucial for manufacturers and investors to target specific consumer needs and align production capabilities with demand patterns. The market exhibits distinct growth rates across these segments, influenced by regulatory mandates, consumer trends toward specific functional benefits (e.g., gut health, energy), and regional dietary staples. Product classification helps differentiate between everyday consumption items and specialized snack categories, while nutrient segmentation highlights public health priorities and premium ingredient innovation.

The analysis of segments reveals a structural shift driven by consumer preference for convenience and functional health benefits. While staple bread remains the largest volume driver due to mandatory fortification, the Biscuits and Cookies segment shows faster growth, indicating a shift towards fortified snacking. Micronutrient segmentation reflects the historical focus on correcting widespread deficiencies (Iron, Vitamin D) but also points toward future growth in holistic health ingredients such as Protein and specialized dietary Fiber. The rapid expansion of online retail as a distribution channel is democratizing access to specialized or niche fortified products that might not be available in traditional, high-street retail outlets, particularly those with specific dietary claims like vegan or keto-friendly fortification.

- By Product Type:

- Bread (Loaves, Rolls, Buns)

- Biscuits and Cookies

- Cakes and Pastries

- Breakfast Cereals (Ready-to-Eat, Hot)

- Rusks and Toasts

- Pretzels and Crackers

- By Micronutrient:

- Vitamins (A, B Complex, C, D, E)

- Minerals (Iron, Calcium, Zinc, Iodine)

- Protein and Amino Acids

- Dietary Fiber and Prebiotics

- Omega-3 Fatty Acids

- Probiotics

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Artisan Bakeries and Specialty Food Stores

- Online Retail and E-commerce Platforms

- Foodservice/Institutional Sales

Value Chain Analysis For Fortified Bakery Market

The value chain for the Fortified Bakery Market is complex, beginning with upstream sourcing of raw materials, particularly specialized nutritional ingredients, and concluding with downstream distribution channels that deliver the product to the end consumer. Upstream analysis focuses heavily on the procurement of core bakery ingredients (flour, sugar, fats) and, critically, the high-purity micronutrient premixes supplied by specialized ingredient manufacturers. Quality control and certifications at this stage are paramount, as the efficacy and stability of the final fortified product depend entirely on the quality and encapsulation technology of these nutritional inputs. Strategic partnerships between large bakery manufacturers and key nutritional science companies are essential to ensure a reliable supply of stable, bioavailable fortificants.

The mid-stream encompasses manufacturing, which involves specialized mixing equipment to ensure homogeneous distribution of micronutrients, followed by baking, cooling, and packaging. Direct channel distribution involves sales through company-owned stores or dedicated online portals, offering better control over pricing and brand messaging. Indirect distribution, which constitutes the majority of sales, relies on established relationships with large retailers, wholesalers, and food service providers. Managing cold chain logistics, especially for products incorporating temperature-sensitive fortificants like certain probiotics or unstable vitamins, adds another layer of complexity to this stage of the value chain. Efficient inventory management is crucial to minimize losses due to the relatively short shelf life of many fresh bakery items.

Downstream activities center on marketing, sales, and retail placement. Retailers play a vital role in educating consumers about the nutritional benefits, often utilizing shelf tags or special displays to highlight the fortified claims. The effectiveness of the distribution channel—whether large-scale supermarkets offering volume and accessibility, or targeted online platforms offering detailed nutritional transparency—directly impacts market penetration. The overall efficiency of the value chain is increasingly being enhanced by technology, utilizing data analytics to forecast demand fluctuations and optimize logistics, ensuring that high-demand fortified products reach consumers quickly and maintain their declared nutritional potency throughout their transit and shelf life.

Fortified Bakery Market Potential Customers

The primary customer base for the Fortified Bakery Market is exceptionally broad, spanning multiple demographic and socio-economic groups, largely dictated by the specific type of fortification offered. Core end-users include the general population seeking convenient, everyday food staples that contribute to better health, such as families purchasing fortified bread or breakfast cereals as part of standard meals. This segment is highly price-sensitive but values reliability and the adherence to basic nutritional claims (e.g., rich in iron or calcium). Government procurement agencies and NGOs involved in public health and feeding programs also represent a massive institutional buying segment, focusing on affordability and the efficacy of mandatory fortifications to address widespread deficiencies in vulnerable populations like school children and pregnant women.

A rapidly growing segment comprises health-conscious individuals and patients managing specific chronic conditions, such as diabetes or obesity, who seek specialty fortified bakery items. These buyers are willing to pay a premium for products with advanced fortification claims, such as high protein, high fiber, low glycemic index, or specialized functional ingredients like prebiotics and Omega-3s. This includes athletes, seniors, and those following restrictive diets (e.g., vegan, gluten-free) who require tailored nutritional delivery through convenient bakery formats. This segment relies heavily on detailed ingredient labeling and scientific backing, often engaging with online retail channels for specialized sourcing.

Furthermore, the food service industry, including large institutional caterers, hospitals, and quick-service restaurants, constitutes a significant customer segment. These buyers incorporate fortified baked goods into meals to enhance the nutritional profile of their offerings, especially where regulatory standards mandate certain levels of nutritional quality for institutional feeding. The demand here focuses on bulk supply, consistency, and stability under different serving conditions. Ultimately, the consumer base is moving toward a highly informed state, where the purchasing decision is not merely based on taste but on the perceived functional health outcome derived from the specific micronutrients added to the baked product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mondelez International, Grupo Bimbo, Kellogg Company, General Mills, Associated British Foods, Britannia Industries, Flowers Foods, Aryzta AG, Warburtons, Hostess Brands, Yamazaki Baking, Parle Products, Campbell Soup Company, Rich Products Corporation, FGF Brands, Rudi's Organic Bakery, United Biscuits, Finsbury Food Group, Cereal Partners Worldwide, Nature's Own |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fortified Bakery Market Key Technology Landscape

The technological landscape of the Fortified Bakery Market is heavily focused on sophisticated ingredient science and processing techniques designed to overcome the critical challenges of nutrient stability, bioavailability, and sensory impact. One of the paramount technologies is microencapsulation, where sensitive vitamins, minerals, or Omega-3 fatty acids are encased in protective matrices (e.g., lipids or proteins). This process shields the nutrient from harsh processing conditions like high heat during baking, prevents oxidation, and successfully masks undesirable metallic or bitter tastes associated with specific minerals like iron or zinc. Advances in controlled-release encapsulation also ensure that the nutrients are optimally absorbed in the digestive tract, maximizing their bioavailability and functional effectiveness for the consumer.

Furthermore, advancements in precision dosing and homogeneous blending systems are crucial for compliance with rigorous regulatory standards, particularly for staple products under mandatory fortification. Modern production lines utilize gravimetric feeders and real-time monitoring sensors coupled with advanced mixing technologies (like high-shear mixers or fluid bed processors) to ensure the micronutrient premixes are evenly distributed throughout the dough or batter, preventing "hot spots" or areas of deficiency in the final product. The integration of advanced diagnostics, including near-infrared (NIR) spectroscopy, allows manufacturers to non-invasively test the nutrient concentration in batches instantaneously, significantly accelerating quality assurance protocols and reducing product hold times.

Another emerging area involves the use of high-pressure processing (HPP) and sophisticated heat management systems to preserve the integrity of heat-sensitive fortificants, particularly B-vitamins and specific probiotics, which degrade easily under conventional baking temperatures. Finally, technology focusing on clean label solutions is gaining momentum. This involves leveraging natural sources for fortification, such as mineral-rich algal powders or plant-based proteins, and employing minimal processing techniques. This satisfies the growing consumer preference for foods perceived as less artificial, providing a technological solution that bridges nutritional goals with market demand for transparency and natural ingredients in the fortification matrix.

Regional Highlights

Regional variations in the Fortified Bakery Market are significant, reflecting diverse dietary patterns, economic development levels, and the maturity of regulatory frameworks governing food fortification. North America and Europe, characterized by high disposable incomes and advanced health consciousness, lead the market in terms of premiumization, driving demand for specialized fortification (e.g., high-protein, keto-friendly, or immunity-boosting bakery items). In these regions, the emphasis is on voluntary fortification to differentiate products and target lifestyle segments, supported by sophisticated supply chains and a preference for clean label ingredients and transparency regarding nutrient source.

The Asia Pacific (APAC) region is poised for the most rapid growth, largely driven by large-scale government intervention aimed at public health. Countries like India, China, and Indonesia have implemented or are expanding mandatory fortification programs for staple foods like wheat flour and rice. The sheer volume of population, coupled with increasing urbanization and a growing middle class that seeks convenient, value-added food products, makes APAC a critical investment hub. Growth here is volume-driven and focused on addressing macro deficiencies such as iron-deficiency anemia and Vitamin A deficiency through affordable, mass-market bakery goods like fortified biscuits and basic bread.

Latin America (LATAM) and the Middle East and Africa (MEA) represent important emerging markets where fortification is frequently mandatory for staple goods, addressing chronic nutritional gaps. LATAM, with strong traditions in wheat and corn consumption, sees high utilization of fortified flour in bread and tortillas. The MEA region is characterized by high rates of malnutrition in specific areas, making mandatory fortification, often supported by international aid organizations, a dominant market driver, particularly in the production of fortified rolls and buns used in institutional feeding programs. These regions present complex logistics challenges but offer high potential for market penetration in basic, affordable fortified items.

- North America (U.S., Canada): Market leader in innovation; driven by voluntary fortification focusing on functional benefits (e.g., gut health, brain function); strong demand for gluten-free and low-sugar fortified options.

- Europe (Germany, UK, France): Highly regulated market; strong focus on clean label and sustainable ingredient sourcing; substantial consumption of fortified breakfast cereals and specialty breads.

- Asia Pacific (China, India, Australia, Japan): Highest CAGR projected; driven by massive population size and increasing governmental mandatory fortification programs; high potential for fortified biscuit and rusk segments.

- Latin America (Brazil, Mexico, Argentina): Market characterized by mandatory fortification of staple flours; increasing middle-class demand for convenience foods like fortified snack cakes and packaged bread.

- Middle East and Africa (South Africa, Saudi Arabia): Growth dictated by public health initiatives and addressing widespread micronutrient deficiencies; significant role of institutional sales and basic fortified staples (flour, subsidized bread).

- Australia and New Zealand (ANZ): Mature market similar to Europe, focusing on high-quality, non-GMO, and organic fortified products with emphasis on unique native ingredients for nutrient sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fortified Bakery Market.- Mondelez International

- Grupo Bimbo S.A.B. de C.V.

- Kellogg Company

- General Mills, Inc.

- Associated British Foods plc

- Britannia Industries Limited

- Flowers Foods, Inc.

- Aryzta AG

- Warburtons Limited

- Hostess Brands, LLC

- Yamazaki Baking Co., Ltd.

- Parle Products Pvt. Ltd.

- Campbell Soup Company

- Rich Products Corporation

- FGF Brands

- Rudi's Organic Bakery

- United Biscuits (Pladis)

- Finsbury Food Group Plc

- Cereal Partners Worldwide (CPW)

- Nature's Own (Flowers Foods subsidiary)

- Bakers Delight Group

- Mondelēz India Foods Private Limited

- Gardenia Foods (S) Pte Ltd

- PepsiCo, Inc. (Quaker Oats segment)

- Sunmola Foods Limited

Frequently Asked Questions

Analyze common user questions about the Fortified Bakery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between enriched and fortified bakery products?

Enrichment restores nutrients (like B vitamins and iron) that were lost during processing to their original levels, primarily in refined grains. Fortification, conversely, adds nutrients not originally present or significantly increases the existing nutrient levels beyond natural amounts to address specific public health deficiencies, such as adding Vitamin D or calcium to bread. Fortification targets specific nutritional gaps.

Which micronutrients are most commonly mandated for fortification in staple bakery products globally?

Globally, the most common micronutrients mandated for fortification in staple bakery products, especially wheat flour and bread, are Iron (to combat anemia), Folic Acid (a B vitamin essential for preventing birth defects), and other essential B-vitamins like Niacin, Thiamin, and Riboflavin. Iodine fortification is also critical, although typically delivered through salt, it impacts overall dietary requirements considered by bakers.

How do manufacturers ensure nutrient stability during the high-heat baking process?

Manufacturers utilize advanced technologies, predominantly microencapsulation, where sensitive vitamins (like Vitamin C or Omega-3s) are physically protected within a stabilizing matrix. They also employ heat-stable forms of nutrients (e.g., ferric pyrophosphate instead of ferrous sulfate for iron) and adjust processing parameters, such as minimizing baking time or reducing peak oven temperatures, to preserve nutrient potency and bioavailability.

What regulatory factors are currently driving the growth of the fortified bakery market?

The primary growth drivers are mandatory national and regional fortification laws implemented by governments and international bodies (like WHO/FAO) requiring specific nutrient additions to staple foods like flour, rice, and oil. These regulations standardize fortification levels, ensure widespread consumption, and create a non-negotiable volume demand for fortified ingredients, particularly in developing economies focused on public health metrics.

What role does clean label manufacturing play in the future of fortified bakery products?

Clean label principles demand transparency, minimal processing, and the use of recognizable, natural ingredients. In fortification, this means using naturally sourced vitamins and minerals (e.g., calcium from algae, natural Vitamin E) and avoiding artificial colors or preservatives. This trend drives technological innovation toward natural encapsulation techniques and organic certification for fortification premixes to meet increasing consumer preference for healthy, transparent food sourcing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager