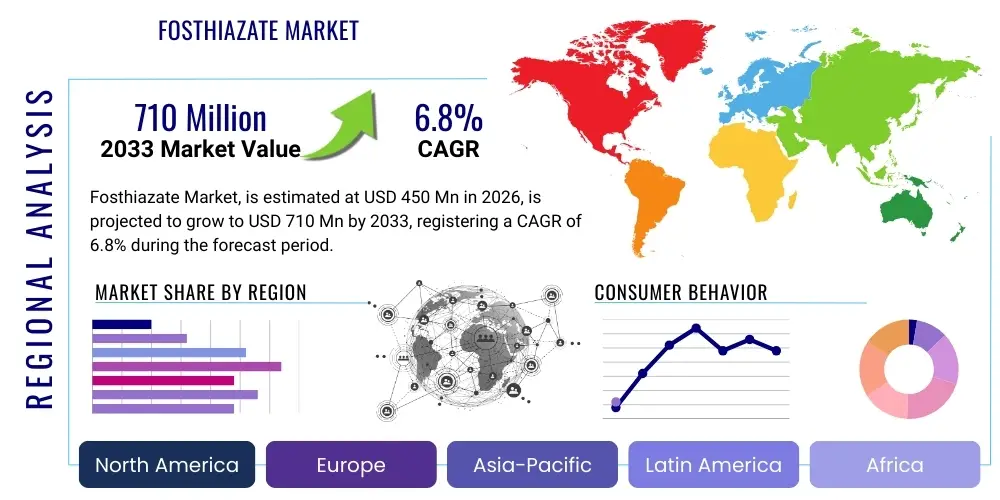

Fosthiazate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437168 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fosthiazate Market Size

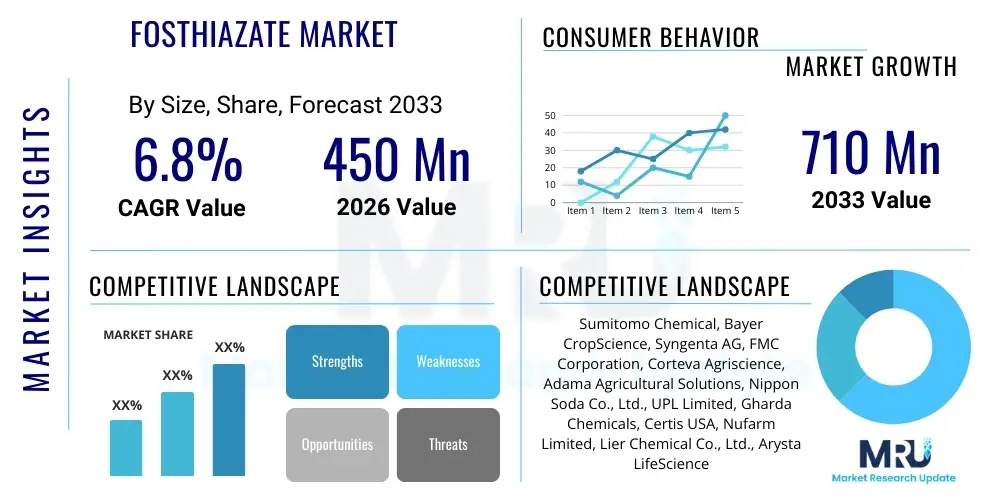

The Fosthiazate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Fosthiazate Market introduction

Fosthiazate, a highly effective organophosphate nematicide and insecticide, represents a critical chemical component within modern high-yield agricultural practices globally. Developed primarily for controlling plant-parasitic nematodes, which cause substantial economic losses in various high-value crops, Fosthiazate is recognized for its systemic action and versatility, offering both contact and localized systemic activity in the soil. Its application is crucial for maintaining soil health and maximizing productivity in intensive cropping systems. The substance is particularly vital in cash crops where nematode infestations severely compromise root structure and nutrient uptake, thereby diminishing overall harvest quality and volume. As regulatory scrutiny on older, highly toxic nematicides increases, Fosthiazate offers a viable, often preferred, alternative, balancing efficacy with comparatively improved toxicological profiles compared to predecessors like methyl bromide, driving its adoption across diverse agricultural economies.

The product description of Fosthiazate emphasizes its unique chemical structure, which enables effective control of a broad spectrum of nematodes, including root-knot, cyst, and lesion nematodes. It is typically formulated as granular (GR) or emulsifiable concentrate (EC) products, suitable for application either pre-plant or as a side-dressing treatment during the growing season. This flexibility in application methodology allows farmers to integrate Fosthiazate seamlessly into varied crop management strategies. Major applications span high-acreage crops such as potatoes, sweet potatoes, tomatoes, tobacco, and bananas, alongside crucial specialty crops like citrus fruits and vineyards. The efficacy of Fosthiazate in protecting root systems is directly correlated with higher yields and improved crop quality, justifying the investment for growers focused on export-quality produce or maximizing returns from limited arable land.

The market is predominantly driven by the escalating global demand for food security and the need to mitigate the estimated $80 billion annual crop losses attributed to nematode damage worldwide. Key benefits of Fosthiazate include its relatively low application rate requirement, its persistent action in the root zone, and its successful integration into Integrated Pest Management (IPM) programs, especially in regions phasing out harsher chemistries. Furthermore, the expansion of protected horticulture (greenhouses) and the increasing focus on specialty crops in developing economies significantly contribute to sustained demand, as these environments often require targeted and robust nematode control solutions to prevent rapid pest build-up.

Fosthiazate Market Executive Summary

The Fosthiazate market exhibits robust growth fueled by persistent agricultural challenges, regulatory shifts, and technological advancements in application. Key business trends indicate a strong move toward developing micro-granular and encapsulated formulations that enhance safety and improve targeted delivery efficiency, thereby reducing environmental impact and maximizing uptake. Strategic partnerships between large agrochemical manufacturers and regional distributors are defining market access, particularly in high-growth agricultural regions like Asia Pacific and Latin America, where intensified farming practices necessitate reliable crop protection inputs. Furthermore, pricing power remains concentrated among a few key patent holders, though generic competition is emerging rapidly following patent expiries, gradually influencing pricing dynamics and accessibility in cost-sensitive markets, urging major players to differentiate through service and formulation innovation.

Regionally, Asia Pacific commands the largest market share, predominantly driven by extensive cultivation of rice, potatoes, and high-value vegetables, coupled with the inherent pressure from tropical nematode populations. North America and Europe, while representing mature markets, show consistent demand, spurred by stringent quality standards for fresh produce and the adoption of high-tech farming systems, including precision agriculture tools that optimize nematicide use. Latin America is projected as the fastest-growing region, specifically driven by the expansion of large-scale banana, coffee, and sugarcane plantations, which are highly susceptible to nematode damage and require preventative chemical measures. Governments in emerging economies are also increasingly supporting the use of effective crop protection chemicals to ensure domestic food supply stability and enhance export potential.

Segment-wise, the market is primarily segmented by Application Method (Soil Incorporation, Drenching, and Seed Treatment) and Crop Type (Potatoes, Vegetables, Fruits, and Others). The application in potato cultivation represents the largest segment due to the crop’s high vulnerability to root-knot nematodes and the substantial global acreage dedicated to potato farming. Trend analysis suggests a growing shift towards lower-dose, systemic formulations that integrate well with irrigation systems (drenching/fertigation), offering labor efficiency benefits and minimizing human exposure. The increasing cultivation of protected crops (greenhouses) is also boosting the demand for granular formulations designed for confined soil environments, highlighting a major segmentation opportunity focused on intensive, controlled environment agriculture (CEA).

AI Impact Analysis on Fosthiazate Market

User inquiries concerning AI's influence on the Fosthiazate market primarily focus on how advanced data analytics and machine learning can optimize the application of nematicides, thereby reducing overuse and enhancing efficacy. Key themes revolve around precision agriculture adoption, predicting nematode outbreaks, and customizing treatment zones. Users are keen to understand if AI-driven diagnostics will lead to 'need-based' application rather than traditional broadcast methods, potentially lowering overall consumption volumes but increasing the value derived from each application. Concerns also include the integration challenges of existing legacy farming equipment with new AI monitoring systems, and the ability of AI models to accurately predict the complex biological and soil interactions that influence Fosthiazate’s performance, aiming for a balance between maximizing yield protection and minimizing environmental residue.

- AI drives precision application: Machine learning algorithms analyze soil maps, historical pest data, and satellite imagery to determine optimal Fosthiazate application rates and locations.

- Enhanced disease forecasting: AI models predict nematode pressure outbreaks based on climatic conditions and crop rotation data, enabling timely prophylactic treatment.

- Optimized supply chain: Predictive analytics improve inventory management for manufacturers and distributors, matching supply precisely with seasonally shifting agricultural demand.

- Robotic field scouting: AI-powered drones and robotic sensors identify early signs of nematode damage, localizing the need for nematicide application.

- Formulation optimization: AI simulations assist R&D efforts in designing more stable and effective Fosthiazate formulations compatible with advanced fertigation and soil injection technologies.

DRO & Impact Forces Of Fosthiazate Market

The Fosthiazate market dynamics are shaped by a complex interplay of growth drivers stemming from global agricultural intensification and stringent restraints related to environmental safety and regulatory oversight. Opportunity primarily resides in the adoption of precision agriculture techniques and the expanding scope of protected cultivation, while impact forces ensure that market players must constantly innovate to maintain regulatory compliance and consumer trust. The primary drivers include the necessity for increased food production to feed a growing global population, coupled with the proven efficacy of Fosthiazate against highly destructive plant parasitic nematodes. Conversely, the market faces significant hurdles due to increasing public scrutiny over agrochemical residues in food and water, leading to stricter governmental regulations regarding registration and Maximum Residue Limits (MRLs), particularly in key import markets like the EU and Japan. This regulatory environment necessitates substantial investment in toxicology testing and safer formulation development, which acts as a restraint on immediate market expansion.

A key driver accelerating market adoption is the phase-out and banning of older, more toxic chemical alternatives, such as specific organochlorines and certain carbamates, leaving Fosthiazate as a preferred chemical alternative in many jurisdictions. Furthermore, the expansion of high-value crops like specialty vegetables and fruits, which offer higher profit margins but are extremely sensitive to yield losses from nematode damage, directly boosts demand for premium, reliable nematode control solutions. Opportunities for growth are significantly tied to geographical expansion into emerging agricultural markets in Africa and Southeast Asia, where farming infrastructure is rapidly modernizing, and the adoption rate of modern crop protection technologies is high. The development of biopesticides, however, poses a long-term threat, representing a competitive alternative, but for now, Fosthiazate's reliable chemical potency provides a consistent market advantage in severe infestation scenarios.

Impact forces on the market are profound, stemming from both internal industry trends and external socio-economic pressures. The need for sustainable farming practices has created a strong impact force, compelling manufacturers to invest heavily in stewardship programs and ensure responsible use, minimizing off-target effects. Economically, commodity price volatility can influence farmers' purchasing power, occasionally delaying or reducing nematicide application in favor of basic fertilizers, impacting short-term demand. However, the long-term impact force remains focused on technological advancement in application equipment (e.g., localized soil injection systems) which maximize Fosthiazate efficacy while reducing overall volume application, aligning market objectives with sustainability goals and enhancing the compound’s longevity in the face of environmental activism.

Segmentation Analysis

The Fosthiazate market segmentation provides a granular view of market dynamics based on the diverse ways the product is utilized across various agricultural landscapes and application requirements. Understanding these segments is crucial for manufacturers to tailor marketing strategies and R&D investments, specifically targeting high-potential applications like protected cultivation or major commodity crop defense. The market is primarily divided based on Crop Type, Formulation Type, and Application Method, reflecting the varying needs of growers globally. Crop Type segmentation reveals critical areas of demand concentration, with cash crops demonstrating the highest intensity of Fosthiazate usage due to their economic vulnerability to nematode damage.

The Formulation Type segment is particularly dynamic, encompassing Granular (GR), Emulsifiable Concentrate (EC), and others. Granular formulations currently hold a leading share, favored for their ease of soil incorporation and sustained release properties, especially in large-scale field applications for crops like potatoes and sweet potatoes. However, there is a distinct trend favoring more soluble or dispersible concentrates that can be efficiently utilized through modern irrigation systems (drenching and fertigation), offering better labor efficiency and precision. This shift is a key indicator of technological maturity in application methods and drives innovation in formulation chemistry to ensure stability and bioavailability within water delivery systems.

Further segmentation by Application Method—broadcasting/soil incorporation versus localized/spot treatment—highlights the move toward sustainable usage. While traditional soil incorporation is prevalent, the emphasis on localized treatments (drenching or in-furrow application) is increasing, particularly in high-density or protected cropping environments. This preference is driven by regulatory pressures demanding lower chemical load per hectare and the economic benefits of targeting chemical delivery precisely to the root zone where nematodes actively feed. These segmented insights are pivotal for market players aiming to optimize product portfolios for specific geographic and agricultural requirements.

- By Crop Type:

- Potatoes and Sweet Potatoes

- Vegetables (Tomatoes, Cucurbits, Carrots)

- Fruits (Bananas, Citrus, Grapes)

- Tobacco and Ornamentals

- Others (Sugarcane, Coffee)

- By Formulation Type:

- Granular (GR)

- Emulsifiable Concentrate (EC)

- Others (Micro-encapsulated formulations, Soluble Concentrates)

- By Application Method:

- Soil Incorporation/Broadcast

- Drenching/Fertigation

- In-Furrow and Spot Treatment

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fosthiazate Market

The Fosthiazate value chain begins with upstream analysis focusing on raw material sourcing, primarily the complex chemical intermediates required for synthesizing the active ingredient (AI). This stage is characterized by high barriers to entry due to stringent safety regulations governing chemical synthesis and the specialized manufacturing infrastructure required. Key input suppliers, often specialized chemical manufacturers, negotiate long-term supply agreements with major agrochemical producers. Efficiency and cost management at this stage are crucial, as raw material costs significantly influence the final product pricing, leading manufacturers to prioritize vertical integration or secure diversified sourcing strategies to mitigate supply chain disruptions and volatility in commodity chemical markets.

The midstream process involves formulation, packaging, and branding, where the synthesized Fosthiazate AI is converted into commercial products (GR, EC). This phase is critical for product differentiation, focusing on enhancing stability, shelf life, and user safety. Downstream analysis focuses on distribution channels, which primarily involve a mix of direct sales to large agricultural cooperatives or wholesalers, and indirect channels through regional distributors, specialized retail outlets, and agronomist networks. Due to the technical nature of nematicide application, the distribution channel often incorporates significant technical support and farmer education programs, ensuring proper dosage and adherence to safety guidelines, thereby adding substantial value post-manufacturing.

Direct distribution, utilized mostly by multinational corporations for high-volume, established markets, allows for tighter inventory control and direct interaction with large commercial farming enterprises. Conversely, indirect channels are vital for penetrating fragmented markets, smallholder farmer communities, and regions requiring localized technical expertise; here, distributors serve as crucial intermediaries, managing logistics and credit risk. The efficiency of the distribution network, including cold chain management where applicable for certain formulations, directly influences product availability and accessibility during critical planting seasons, underscoring the importance of robust logistics infrastructure across regional markets.

Fosthiazate Market Potential Customers

The primary end-users and potential buyers of Fosthiazate are diverse, spanning large-scale commercial farming enterprises, specialized greenhouse operators, agricultural cooperatives, and individual smallholder farmers cultivating high-value crops susceptible to nematode damage. Commercial growers specializing in staples like potatoes, sweet potatoes, and tomatoes represent the largest consumer base. These entities require high-efficacy, reliable solutions to protect vast acreage and ensure consistent quality demanded by global food processors and retailers. Their purchasing decisions are driven by proven field results, cost-per-acre efficacy, and alignment with Good Agricultural Practices (GAP) standards.

Another significant segment comprises growers of permanent and perennial crops such as bananas, citrus, and coffee. Nematode control in these settings is paramount because infestations can lead to permanent damage to root structures, severely reducing the productive life of the orchard or plantation. These customers often require sustained-release formulations and specialized application equipment for efficient delivery within established root zones, leading them to prioritize premium, long-acting Fosthiazate products. They often engage in long-term contracts with suppliers to ensure chemical stewardship and consistent supply throughout the growing cycle.

Furthermore, the rapidly expanding protected agriculture sector—including advanced greenhouses and vertical farms—constitutes a high-potential, specialized customer segment. While the total volume of chemical application is lower in controlled environments, the need for immediate, localized, and highly effective pest elimination is critical to prevent rapid spread in enclosed systems. These customers value formulations that have low volatility and are approved for use in closed-system irrigation, focusing on safety and rapid turnaround times. Government agencies and non-profit organizations supporting sustainable agriculture also act as influential buyers, procuring and distributing Fosthiazate in development programs aimed at improving smallholder productivity and crop resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, Bayer CropScience, Syngenta AG, FMC Corporation, Corteva Agriscience, Adama Agricultural Solutions, Nippon Soda Co., Ltd., UPL Limited, Gharda Chemicals, Certis USA, Nufarm Limited, Lier Chemical Co., Ltd., Arysta LifeScience (now part of UPL), Sinon Corporation, Rotam Agrochemical Co., Ltd., SinoHarvest, Helm AG, Jiangsu Yangnong Chemical Co., Ltd., King Quenson Industry Group, Albaugh LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fosthiazate Market Key Technology Landscape

The technology landscape surrounding the Fosthiazate market is rapidly evolving, driven by the need for enhanced safety, reduced environmental load, and maximized efficacy in the root zone. A significant technological focus is on advanced formulation science, moving beyond basic granular (GR) and emulsifiable concentrate (EC) forms towards specialized delivery systems. Micro-encapsulation technology, for instance, is gaining traction. This involves coating the active ingredient in polymer matrices, allowing for a slower, more controlled release profile. This not only extends the duration of nematode control but also significantly reduces leaching potential and minimizes operator exposure during handling and application, aligning the product with global sustainability standards and modern farming techniques that prioritize worker safety.

Furthermore, innovation in application technology is fundamentally reshaping how Fosthiazate is used in the field. The proliferation of precision agricultural tools, including variable rate technology (VRT) applicators and sophisticated injection systems integrated with GPS and sensor data, allows for highly localized treatment. This technological integration ensures that the nematicide is applied only where soil tests or sensor data indicate high nematode pressure, drastically reducing the overall volume of chemical used per hectare compared to traditional broadcast methods. This approach is highly valued by large commercial farms seeking to optimize input costs and demonstrate environmental stewardship, making the compatibility of Fosthiazate formulations with these high-tech systems a critical competitive factor.

Another crucial technological element is the use of drone technology and advanced soil mapping. Drones equipped with hyperspectral imaging capabilities can identify early signs of nematode stress in crops that are invisible to the naked eye. This data feeds into farm management software, which then generates precise prescription maps for targeted Fosthiazate delivery. Additionally, advances in soil chemistry research related to Fosthiazate focus on understanding its degradation pathways and persistence in various soil types, leading to the development of stabilizers or synergists that enhance its biological activity under diverse field conditions. This technological push is essential for overcoming issues related to product degradation and maintaining consistent performance across varied global climates and soil pH levels.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, characterized by intensive agricultural systems, high incidence of plant-parasitic nematodes in tropical and subtropical climates, and vast acreage dedicated to staple crops (rice, potatoes) and high-value vegetables. China, India, and Japan are key consumers, driven by domestic food security mandates and export-focused agriculture. The market here benefits from the necessity to control high levels of nematode population in multi-cropping systems, fueling consistent demand for effective nematicides like Fosthiazate.

- North America: This region is defined by advanced, large-scale commercial farming and stringent quality standards. Demand for Fosthiazate is stable, driven primarily by potato, tobacco, and high-value vegetable cultivation. Adoption is heavily influenced by precision agriculture technology, favoring sophisticated formulations compatible with variable rate application (VRA) and advanced irrigation systems, prioritizing efficiency and environmental safety compliance.

- Europe: The European market, particularly in Western and Southern Europe (e.g., Spain, Italy, Netherlands), utilizes Fosthiazate predominantly in protected cultivation (greenhouses) and specialized crops (vineyards, ornamentals, tomatoes). The market growth is constrained by rigorous EU regulatory approval processes and public preference for biological solutions, making compliance with strict Maximum Residue Limits (MRLs) and demonstrating low environmental persistence mandatory for market success.

- Latin America (LATAM): Projected as the fastest-growing market, LATAM exhibits rapidly expanding banana, coffee, sugarcane, and potato plantations in Brazil, Colombia, and Mexico. High temperatures and humidity create ideal conditions for nematode proliferation, necessitating robust chemical control. Economic growth and modernization in agricultural practices contribute significantly to increased adoption rates, positioning this region as a critical revenue generator for Fosthiazate manufacturers.

- Middle East and Africa (MEA): Growth in MEA is driven by increasing investment in high-tech greenhouse agriculture to ensure food security in water-stressed regions, especially the GCC states. In Africa, Fosthiazate is essential for cash crops like bananas and certain root vegetables. Market expansion is contingent upon improved agricultural infrastructure, regulatory harmonization, and increased access to reliable distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fosthiazate Market.- Sumitomo Chemical

- Bayer CropScience

- Syngenta AG

- FMC Corporation

- Corteva Agriscience

- Adama Agricultural Solutions

- Nippon Soda Co., Ltd.

- UPL Limited

- Gharda Chemicals

- Certis USA

- Nufarm Limited

- Lier Chemical Co., Ltd.

- Arysta LifeScience (now part of UPL)

- Sinon Corporation

- Rotam Agrochemical Co., Ltd.

- SinoHarvest

- Helm AG

- Jiangsu Yangnong Chemical Co., Ltd.

- King Quenson Industry Group

- Albaugh LLC.

Frequently Asked Questions

Analyze common user questions about the Fosthiazate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fosthiazate and its primary agricultural function?

Fosthiazate is a broad-spectrum organophosphate nematicide and insecticide primarily used in agriculture to control plant-parasitic nematodes, particularly root-knot nematodes, which severely damage high-value crops like potatoes, bananas, and tomatoes, ensuring crop yield protection and soil health.

Which geographic region currently dominates the global Fosthiazate market?

The Asia Pacific (APAC) region currently holds the largest market share for Fosthiazate consumption. This dominance is driven by intensive farming practices, high population density requiring extensive food production, and severe nematode pressure in tropical and subtropical climates, particularly in China and India.

How is regulatory pressure impacting the future growth of the Fosthiazate market?

Regulatory pressure, specifically the phase-out of older, more toxic nematicides, acts as a driver by increasing demand for Fosthiazate as a preferred alternative. However, increasingly strict Maximum Residue Limits (MRLs) in key markets like the EU restrain growth, necessitating significant investment in R&D for lower-dose and safer formulations.

What are the key technological advancements influencing Fosthiazate application?

Key technological advancements include the adoption of micro-encapsulation for controlled release and the integration of precision agriculture technologies, such as variable rate applicators and GPS-guided soil injection systems, which optimize application efficiency and reduce the overall chemical load per hectare.

What are the primary formulation types available for Fosthiazate?

The primary commercial formulation types for Fosthiazate are Granular (GR) and Emulsifiable Concentrate (EC). Granular formulations are widely used for soil incorporation, while EC formulations are increasingly favored for drenching and sophisticated fertigation systems in modern and protected cultivation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager