Foundry Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434173 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Foundry Equipment Market Size

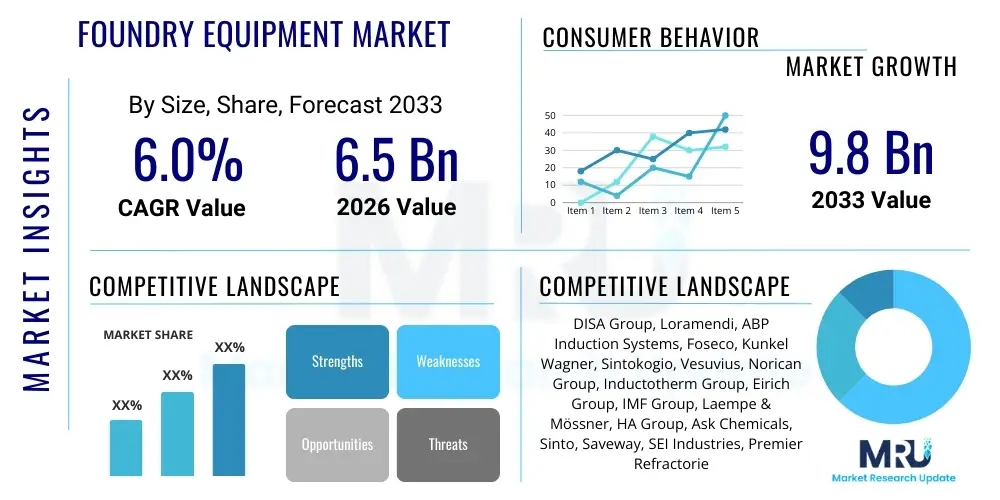

The Foundry Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033.

Foundry Equipment Market introduction

The Foundry Equipment Market encompasses specialized machinery and integrated systems required for melting metals, forming molds, casting components, and performing subsequent finishing operations within industrial foundries. This specialized equipment includes melting furnaces (such as induction and arc furnaces), core making machines, molding lines (e.g., green sand and No-Bake processes), and advanced cleaning and finishing apparatus. The foundational purpose of this market is to provide durable, high-precision tools enabling manufacturers to produce complex metallic parts, crucial for sectors like automotive, aerospace, construction, and heavy machinery, where components must withstand extreme stress, temperature, or wear.

Foundry equipment facilitates the precise manufacturing of foundational components essential for modern industrial infrastructure, offering significant benefits such as superior material utilization, ability to achieve complex geometries otherwise unattainable, and high-volume production capabilities. Products manufactured using this equipment range from engine blocks and transmission casings to turbine blades and structural components for civil engineering projects. The increasing global focus on material lightweighting, particularly in the automotive sector driven by electric vehicle (EV) adoption, mandates the use of more precise, energy-efficient casting equipment capable of handling advanced non-ferrous alloys like aluminum and magnesium, thereby pushing the boundaries of technological integration.

Major driving factors sustaining the market's trajectory include rapid urbanization and infrastructure development across emerging economies, specifically boosting demand for construction and heavy machinery components. Furthermore, stringent global emission standards and the pervasive trend of industrial automation (Industry 4.0) necessitate the continuous upgrade of older equipment to highly automated, closed-loop systems offering superior environmental performance and operational efficiency. The lifecycle of traditional foundry machinery is extensive, but competitive pressures force foundries to invest in modernizing equipment to reduce energy consumption, improve dimensional accuracy, and minimize material scrap, ensuring sustained market activity and technological evolution.

Foundry Equipment Market Executive Summary

The Foundry Equipment Market is characterized by intense technological competition focused primarily on integrating digital controls, enhancing energy efficiency, and improving automation levels to address the rising operational costs and skilled labor shortages faced by foundries globally. Business trends indicate a consolidation among equipment manufacturers, with leading players acquiring specialized technology providers to offer comprehensive, turnkey solutions encompassing melting, molding, handling, and quality inspection. There is a marked shift toward modular equipment designs that allow foundries to scale production and integrate new technologies, such as advanced sensor systems and robotic fettling cells, without requiring complete facility overhauls, driving capital expenditure flexibility.

Regionally, the Asia Pacific (APAC) continues to dominate the market share, fueled by massive manufacturing bases in China and India, which are rapidly transitioning from manual casting methods to automated high-volume lines to meet global export demands and domestic automotive production goals. North America and Europe, while possessing slower absolute growth rates, exhibit the highest demand for premium, high-automation equipment specifically tailored for complex, short-run parts utilizing advanced or exotic alloys for aerospace and high-performance automotive applications. The Middle East and Africa (MEA) are emerging as significant growth areas due to government initiatives promoting industrial diversification and localized manufacturing capacity development, spurring investment in modern, energy-efficient foundry setups.

Segment trends reveal a pronounced shift in investment from traditional sand casting towards high-pressure die casting (HPDC) equipment, largely mandated by the requirements of the EV battery casing and structural component markets, which demand lightweight, thin-walled, and highly structural components. Concurrently, the core making equipment segment is experiencing innovation through the increased adoption of 3D printing for complex core geometries, reducing reliance on conventional tooling and speeding up prototyping and short-run production. Within melting equipment, electric induction furnaces are increasingly favored over cupola furnaces due to superior energy efficiency, precise temperature control, and reduced environmental footprint, aligning with global sustainability mandates and operational cost reduction targets.

AI Impact Analysis on Foundry Equipment Market

User inquiries regarding Artificial Intelligence (AI) in the foundry equipment market center heavily on quantifiable return on investment (ROI) derived from AI implementation, specifically in defect prediction, process optimization, and predictive maintenance protocols. Key user concerns revolve around the complexity of integrating AI models with legacy machinery, the availability of high-quality, labeled datasets necessary for training accurate defect classification algorithms, and the necessary skill transfer required for existing foundry staff to manage and leverage AI-driven insights. Users are particularly keen on understanding how AI vision systems can accelerate and standardize non-destructive testing (NDT) processes, moving quality control from post-process auditing to real-time, in-line monitoring to minimize scrap rates, a critical challenge in high-volume casting operations.

The implementation of AI is fundamentally transforming operational paradigms within the foundry environment, moving away from reactive maintenance and subjective quality assessment towards proactive, data-driven manufacturing. AI algorithms, leveraging vast datasets collected from integrated IoT sensors embedded within melting and molding equipment, can accurately predict imminent mechanical failures, scheduling maintenance precisely before critical components break down, thereby drastically improving equipment uptime and overall equipment effectiveness (OEE). Furthermore, machine learning models are being deployed to dynamically adjust parameters like pouring temperature, cooling rates, and mold pressure in real-time based on incoming material variability, ensuring consistent quality and significantly reducing the incidence of common casting defects such as porosity, shrinkage, and cold shuts.

Beyond defect prevention and maintenance, AI is also playing a crucial role in resource optimization, particularly in energy management, which represents a significant operational cost in foundries. AI systems analyze energy consumption patterns across melting, sand reclamation, and ventilation units, identifying inefficiencies and recommending optimal scheduling or power adjustments to minimize peak load charges and overall energy expenditure. This sophisticated analysis and autonomous process adjustment capabilities represent the core value proposition of AI in foundry equipment, promising higher throughput, consistent quality standards, and substantial reductions in both material waste and environmental impact, thereby future-proofing investment in modern machinery.

- Real-time Defect Prediction and Classification using machine vision and deep learning models.

- Predictive Maintenance scheduling based on continuous analysis of vibration, temperature, and current sensors (IoT data).

- Energy Optimization algorithms for intelligent furnace loading and power management during non-peak hours.

- Autonomous Process Parameter Adjustment to compensate for variations in raw material quality and environmental factors.

- Simulation and Digital Twin creation for rapid testing and optimization of new casting designs and process flows.

DRO & Impact Forces Of Foundry Equipment Market

The Foundry Equipment Market is propelled by powerful drivers centered on industrial modernization, the stringent demands of the automotive sector, and global environmental mandates, while simultaneously being constrained by high capital expenditure requirements and complex regulatory compliance. The demand for lightweight components driven by the transition to Electric Vehicles (EVs) is a primary engine of growth, requiring foundries to invest heavily in advanced high-pressure die casting (HPDC) and low-pressure casting equipment capable of producing large, structurally sound aluminum and magnesium parts. This technological shift is compounded by the global trend toward sophisticated automation, necessitated by the increasing scarcity of skilled labor in developed foundry markets, making automated molding lines and robotic handling systems crucial investments.

Conversely, significant restraints hinder market acceleration, most notably the inherently high initial investment cost associated with purchasing, installing, and commissioning state-of-the-art foundry machinery, which creates substantial financial barriers for small and medium-sized enterprises (SMEs). Furthermore, the foundry industry is subject to extremely rigorous environmental regulations concerning air emissions, noise pollution, and waste disposal (particularly spent sand and slag), requiring continuous investment in costly abatement technologies and complex sand reclamation systems. This regulatory burden often necessitates operational halts and capital allocation towards non-productive infrastructure, slowing the pace of modernization investments focused purely on capacity expansion or efficiency gains.

Opportunities for market expansion are strongly linked to the hybridization of manufacturing techniques, particularly the integration of additive manufacturing (3D printing) for creating complex cores and molds, which significantly accelerates prototyping and short-run production, opening new avenues for specialized component manufacturing. Emerging markets in Southeast Asia, Latin America, and Africa present substantial growth opportunities as industrialization efforts intensify, requiring foundational investment in localized casting capabilities. The overarching impact forces—including global supply chain volatility affecting material costs (especially scrap metal), fluctuating energy prices, and geopolitical trade tensions—exert pervasive pressure, compelling manufacturers to focus on localized production and resilient, highly efficient equipment capable of mitigating external economic shocks.

Segmentation Analysis

The segmentation analysis of the Foundry Equipment Market offers a granular view of investment patterns across different operational stages and end-user industries, revealing where technological innovation and capital expenditure are most concentrated. The market is primarily segmented by equipment type, application, and the type of metal processed. The largest segment by type, molding equipment, is experiencing rapid advancements driven by the demand for higher cycle speeds, greater repeatability, and larger mold formats, particularly in automated flaskless molding systems designed for high-volume automotive production. Melting equipment, while a mature segment, is witnessing a foundational shift toward electric induction technology due to superior energy efficiency and improved environmental profiles compared to traditional combustion-based furnaces.

Further segmentation by application highlights the automotive sector as the predominant consumer of foundry equipment, accounting for the largest market share globally due to the ongoing high demand for engine components (both internal combustion engine and electric vehicle drivetrain components), chassis parts, and structural castings. However, the aerospace and defense sector, while smaller in volume, demands highly specialized, extremely precise equipment for handling superalloys and reactive metals, often requiring vacuum casting or highly controlled atmosphere furnaces. The construction and infrastructure application segment provides stable, long-term demand for heavy machinery castings and robust structural components, often utilizing large-scale sand molding systems.

The bifurcation of the market based on metal type—ferrous (iron, steel) and non-ferrous (aluminum, magnesium, copper)—reflects diverging technological pathways. The ferrous segment, characterized by high-volume traditional sand casting, is prioritizing durable, high-capacity machinery and advanced sand reclamation systems. Conversely, the non-ferrous segment is the fastest-growing area, driven by lightweighting trends, demanding specialized equipment such as HPDC machines, precise dosing furnaces, and advanced robotics to manage the highly specific temperature and handling requirements of alloys like aluminum, which are critical for maximizing the energy efficiency and range of electric vehicles.

- By Equipment Type:

- Molding Equipment (Sand Molding Machines, Die Casting Machines, Flaskless Molding)

- Melting Equipment (Induction Furnaces, Arc Furnaces, Cupola Furnaces, Dosing Furnaces)

- Core Making Machines (Cold Box, Hot Box, Shell Core, 3D Sand Printing Systems)

- Cleaning and Finishing Equipment (Shot Blasting Machines, Grinding and Fettling Robots)

- Sand Reclamation and Preparation Systems

- By Metal Type:

- Ferrous Metals (Iron, Steel)

- Non-Ferrous Metals (Aluminum, Magnesium, Copper, Zinc Alloys)

- By Application:

- Automotive Industry

- Aerospace and Defense

- Heavy Machinery and Equipment

- Construction and Infrastructure

- General Engineering

Value Chain Analysis For Foundry Equipment Market

The value chain for the Foundry Equipment Market is highly complex, beginning with upstream suppliers of specialized raw materials and critical components, extending through sophisticated equipment manufacturing and integration, and culminating in downstream deployment by end-user foundries and long-term maintenance services. Upstream activities involve the production of high-specification components, including refractory materials for furnace linings, specialized electrical systems (transformers, inverters for induction units), and precision mechanical components such as high-tolerance hydraulic and pneumatic systems required for molding machines and automated handlers. The quality and availability of these upstream components directly impact the final reliability and performance characteristics of the complex foundry machinery, necessitating robust supplier relationship management by major OEMs.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs), who undertake the design, fabrication, assembly, and testing of large-scale, integrated foundry systems. Distribution channels are typically bifurcated: Direct sales are prevalent for large, complex, and customized installations, such as continuous molding lines or complete turnkey foundry setups, where high levels of technical consultation and site-specific engineering are mandatory. Indirect channels, utilizing regional distributors, sales agents, and specialized industrial supply houses, are more common for standardized, lower-cost peripheral equipment, consumables, and replacement parts, ensuring localized support and quicker delivery times for smaller foundries globally.

Downstream elements involve the installation, commissioning, training, and crucially, the long-term maintenance and servicing of the equipment throughout its lifecycle, which often spans decades. Equipment suppliers are increasingly moving toward providing comprehensive service contracts, integrating remote diagnostics and IoT monitoring to offer predictive maintenance packages, thereby transforming service revenue into a major contributor to the overall value chain. The efficiency of the service network is paramount, as downtime in high-volume foundries can lead to massive financial losses. Therefore, the value derived by the end-user is heavily dependent not only on the equipment's technological capability but also on the strength and responsiveness of the after-sales support infrastructure provided by the equipment manufacturers.

Foundry Equipment Market Potential Customers

The primary consumers and buyers of foundry equipment are industrial entities whose core operational requirement is the production of complex, durable metallic components through casting processes. The largest segment of potential customers includes Tier 1 and Tier 2 automotive suppliers globally, who require high-speed, high-precision equipment to manufacture engine blocks, cylinder heads, transmission casings, and, increasingly, large structural components and battery enclosures for electric vehicles. These customers prioritize equipment reliability, cycle speed, and the ability to maintain stringent quality standards necessary to meet demanding OEM specifications and high-volume delivery schedules.

Another critical customer group consists of heavy machinery and industrial equipment manufacturers, including those serving the construction, mining, and agricultural sectors. These customers typically require equipment capable of handling large-format, heavy-section castings, often utilizing robust sand molding systems and high-capacity melting furnaces optimized for ferrous metals like steel and ductile iron. The procurement decisions in this segment are typically influenced by equipment longevity, robustness under severe operating conditions, and ease of handling very large molds and finished parts.

Furthermore, specialized foundries serving the aerospace and defense industries represent a high-value customer segment, although they purchase in lower volumes. These foundries demand ultra-high precision equipment, such as vacuum induction melting (VIM) furnaces and investment casting systems, required for producing components from superalloys (e.g., nickel-based and titanium alloys) used in jet engine turbines and critical structural airframe parts. For these customers, the key purchasing criteria are metallurgical control, dimensional accuracy down to the micrometer level, and strict adherence to certification and traceability requirements, making these sales highly technical and consulting-intensive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISA Group, Loramendi, ABP Induction Systems, Foseco, Kunkel Wagner, Sintokogio, Vesuvius, Norican Group, Inductotherm Group, Eirich Group, IMF Group, Laempe & Mössner, HA Group, Ask Chemicals, Sinto, Saveway, SEI Industries, Premier Refractories, Shandong Kaitai, Otto Junker. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foundry Equipment Market Key Technology Landscape

The contemporary technology landscape of the Foundry Equipment Market is fundamentally defined by the principles of Industry 4.0, emphasizing connectivity, data utilization, and autonomous operation to achieve unprecedented levels of efficiency and quality control. Core technological advancements center on integrating Internet of Things (IoT) sensors into critical mechanical systems—such as hydraulic presses, cooling systems, and sand mixers—to capture real-time operational metrics (vibration, temperature, pressure). This sensor data forms the foundation for predictive maintenance programs, drastically reducing unscheduled downtime and optimizing the operational lifespan of high-value machinery. Furthermore, sophisticated Human-Machine Interfaces (HMIs) and Supervisory Control and Data Acquisition (SCADA) systems are standardizing operations, allowing operators to monitor and adjust complex casting parameters from centralized digital dashboards, replacing traditional manual control methods.

A major area of focused innovation is in high-pressure die casting (HPDC) technology, specifically the evolution toward vacuum-assisted HPDC and large-tonnage clamping forces necessary for structural automotive components (Giga Casting). These technologies are crucial for producing thin-walled, lightweight, and structurally sound aluminum and magnesium parts required by the EV industry, minimizing porosity defects which are detrimental to component strength. Concurrent improvements in metallurgical process control include advanced temperature monitoring and precise metal dosing systems, which ensure that molten metal is delivered at the exact optimal temperature and volume, minimizing thermal shock and improving casting quality, particularly for sensitive non-ferrous alloys.

Another crucial technological development involves sustainability-focused solutions, particularly in sand reclamation and preparation. Modern sand reclamation systems utilize advanced mechanical and thermal processes to recover and condition up to 95% of spent sand, significantly reducing waste disposal costs and raw material consumption. In the core making sector, the advent of industrial-grade 3D sand printing is disrupting conventional tooling methods, allowing foundries to produce complex cores and molds without physical patterns, drastically cutting lead times for prototypes and small-batch production runs. This blending of traditional metallurgical processes with cutting-edge digital fabrication is defining the competitive edge in the advanced foundry equipment space.

Regional Highlights

Regional dynamics within the Foundry Equipment Market exhibit significant divergence based on local industrial maturity, regulatory environment, and prevailing end-user demands, shaping investment priorities across key geographic zones. Asia Pacific (APAC) stands as the undeniable leader in terms of market volume and growth trajectory, largely attributed to the robust manufacturing expansion in China, India, and Southeast Asian nations. These countries are driven by massive infrastructure investments, burgeoning domestic automotive production, and a pronounced need to modernize existing manual foundries with automated, high-output casting lines to meet global supply chain requirements. The focus in APAC is primarily on scaling production capacity and implementing affordable, highly reliable automation technologies to enhance efficiency and reduce reliance on manual labor, particularly in high-volume ferrous and non-ferrous component production.

Europe represents a mature yet technologically sophisticated market, characterized by stringent environmental regulations and a focus on high-mix, low-volume, precision casting for specialized applications, including aerospace, defense, and high-performance automotive. Countries like Germany and Italy remain pivotal centers for equipment manufacturing and innovation, driving demand for complex, energy-efficient equipment such as advanced induction melting systems, specialized sand reclamation units, and robotic finishing cells tailored for complex alloys. European foundries prioritize equipment offering superior process control, traceability, and minimized environmental footprint, leading to higher average expenditure per machine installed compared to global averages, driven by regulatory compliance and demand for premium quality components.

North America is experiencing a renewed focus on domestic manufacturing capability (reshoring), particularly catalyzed by supply chain disruptions and government initiatives aimed at boosting local electric vehicle production. This translates into substantial investment in advanced HPDC equipment capable of producing the large, structural aluminum castings required for EV platforms. The North American market emphasizes equipment integration with existing IT infrastructure, robust data analytics capabilities, and full automation to mitigate persistent skilled labor shortages. Latin America, meanwhile, shows steady growth, particularly in Brazil and Mexico, linked to regional automotive assembly operations and localized industrial production, favoring reliable, mid-range automation solutions with strong local service support.

- Asia Pacific (APAC): Dominates market volume; driven by automotive manufacturing expansion in China and India; high growth in demand for high-volume automated molding lines and aluminum casting equipment for mass markets; increasingly focused on integrating basic Industry 4.0 solutions.

- Europe: Characterized by high technological maturity and strict environmental standards; emphasis on precision casting, advanced melting technologies (induction), and robotic finishing for high-mix, specialty components; strong focus on energy efficiency and compliance with EU Green Deal mandates.

- North America: Focused on investment in structural casting technologies (Giga Casting) to support Electric Vehicle manufacturing reshoring efforts; high demand for integrated automation, AI-driven quality control, and robust systems to counteract labor scarcity.

- Latin America: Stable growth fueled by regional automotive and heavy machinery sectors (especially Brazil and Mexico); prioritizing reliable, robust equipment and favorable service contracts; price sensitivity remains a key procurement factor.

- Middle East & Africa (MEA): Emerging market driven by strategic government initiatives to diversify economies away from oil dependency; foundational investments in localized industrial capacity, leading to initial high-volume procurement of melting and sand casting equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foundry Equipment Market.- DISA Group (part of Norican Group)

- Loramendi S. Coop.

- ABP Induction Systems GmbH

- Foseco (part of Vesuvius)

- Kunkel Wagner Manufacturing GmbH

- Sintokogio, Ltd. (Sinto)

- Vesuvius Plc

- Norican Group

- Inductotherm Group

- Eirich Group

- IMF Group S.r.l.

- Laempe & Mössner GmbH

- HA Group (Hüttenes-Albertus Chemische Werke GmbH)

- Ask Chemicals GmbH

- Saveway Corporation

- SEI Industries Ltd.

- Premier Refractories

- Shandong Kaitai Group Co., Ltd.

- Otto Junker GmbH

- Frech Group

Frequently Asked Questions

Analyze common user questions about the Foundry Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary impact of the Electric Vehicle (EV) transition on foundry equipment demand?

The EV transition is shifting demand sharply towards specialized equipment for non-ferrous metals, primarily high-pressure die casting (HPDC) and Giga Casting machines. These systems are essential for manufacturing large, structural, thin-walled aluminum and magnesium components like battery casings and chassis parts, prioritizing lightweighting and material integrity over traditional ferrous casting volume.

How are Industry 4.0 principles being applied to modernize traditional foundry operations?

Industry 4.0 integrates IoT sensors, cloud computing, and AI into foundry machinery to enable real-time performance monitoring, predictive maintenance, and closed-loop process control. This modernization focuses on minimizing downtime, optimizing energy consumption in melting processes, and using machine vision systems for automated, in-line quality inspection to reduce scrap rates.

What are the most significant constraints currently hindering growth in the foundry equipment sector?

The most critical constraints include the extremely high initial capital investment required for state-of-the-art automated machinery, persistent global shortages of skilled foundry technicians and maintenance labor, and the continuously increasing complexity and cost associated with adhering to strict environmental compliance and emissions regulations.

Which segment of foundry equipment is experiencing the fastest technological adoption?

The Core Making Machines segment is seeing the fastest technological adoption, primarily through the integration of industrial 3D Sand Printing systems. This technology eliminates the need for physical patterns and tooling, drastically accelerating the prototyping cycle and enabling the production of highly complex internal core geometries previously deemed impossible or uneconomical.

What role does sustainability play in the purchasing decisions for new foundry equipment?

Sustainability is a central factor, driving purchasing decisions toward highly energy-efficient equipment, notably electric induction furnaces over fossil fuel-based systems. Foundries prioritize advanced sand reclamation and preparation systems, which maximize material reuse and minimize waste disposal costs, directly contributing to both regulatory compliance and long-term operational savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Foundry Equipment Market Statistics 2025 Analysis By Application (Automotive, Aerospace, Machinery, Shipbuilding, Power Generation and Electricity), By Type (Die Casting Machine, Centrifugal Casting Machine, Induction Furnace, Moulding Machine, Coremaking Machine, Shot Blasting Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Foundry Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Die Casting Machine, Centrifugal Casting Machine, Induction Furnace, Moulding Machine, Coremaking Machine, Shot Blasting Machine), By Application (Automotive, Aerospace, Machinery, Shipbuilding, Power Generation and Electricity, Industrial, Applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager