Foundry Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432262 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Foundry Machinery Market Size

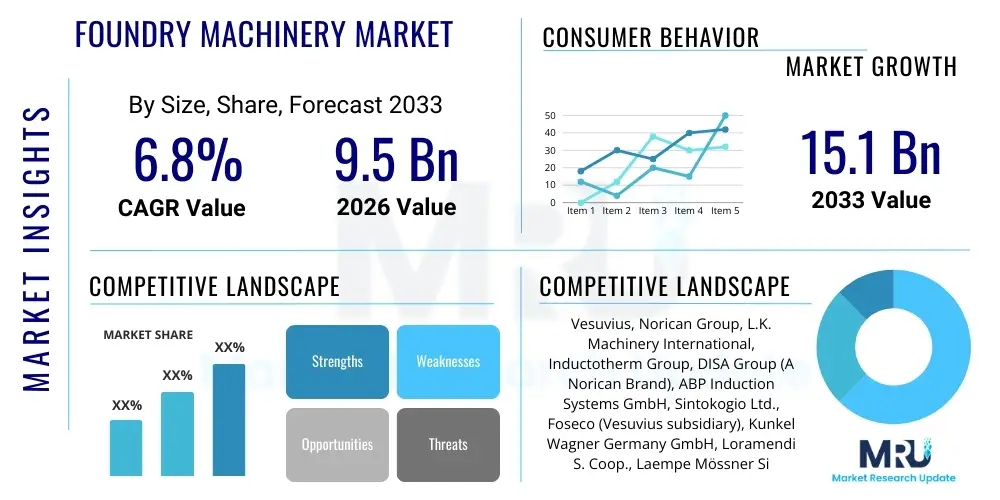

The Foundry Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.1 Billion by the end of the forecast period in 2033.

Foundry Machinery Market introduction

The Foundry Machinery Market encompasses a wide range of specialized equipment used in the metal casting process, including melting furnaces, molding machines, core shooters, sand preparation plants, shot blasting equipment, and automated handling systems. These sophisticated machines are indispensable for producing metal components with high precision, superior structural integrity, and optimized efficiency across various industrial sectors. The core function of foundry machinery is to transform raw metal materials into finished or semi-finished parts by pouring molten metal into molds, requiring rigorous control over temperature, pressure, and material composition. The machinery supports traditional casting methods like sand casting and high-pressure methods such as die casting, adapting to the diverse requirements of modern manufacturing demands for lightweight and durable materials, particularly in high-volume production environments.

Product descriptions within this market span from large-scale induction melting systems capable of processing tons of metal per hour, to highly specialized robotic cells for intricate core assembly and finishing operations. Major applications are concentrated in the automotive industry for engine blocks, chassis components, and drivetrain parts; the heavy machinery sector for construction and agricultural equipment components; and increasingly, in the aerospace and renewable energy industries requiring specialized alloys and high-integrity castings. The primary benefits derived from investing in advanced foundry machinery include significantly enhanced operational throughput, reduction in material waste, superior component quality and repeatability, and improved worker safety through increased automation. These technological advancements enable foundries to meet stringent quality certifications and tight delivery schedules required by global supply chains, thereby sustaining competitiveness in a rapidly evolving manufacturing landscape.

Driving factors for market expansion are rooted in the global resurgence of infrastructure projects, the rapid growth of electric vehicle (EV) production necessitating lightweight aluminum castings, and the pervasive trend toward digitalization, embodied by Industry 4.0. Modern foundry machinery integrates complex sensor arrays and control software, enabling predictive maintenance, real-time quality monitoring, and adaptive process control. Furthermore, stringent global environmental regulations regarding emissions and energy consumption are compelling foundries to adopt energy-efficient melting and molding technologies, such as advanced induction furnaces and resource-saving sand reclamation systems. This push for sustainability and operational excellence forms the backbone of the market’s sustained growth trajectory over the forecast period.

Foundry Machinery Market Executive Summary

The global Foundry Machinery Market is experiencing robust acceleration driven primarily by transformative business trends centered on automation and energy efficiency. Key business trends show a marked shift toward fully integrated, highly automated foundry lines, often incorporating robotics for material handling, pouring, and finishing, which significantly reduces cycle times and operational labor costs. Strategic investments are flowing into machinery capable of handling advanced materials, particularly aluminum and magnesium alloys crucial for automotive weight reduction goals. The competitive landscape is characterized by innovation in additive manufacturing techniques being integrated with traditional casting processes, allowing for rapid prototyping of molds and cores, thereby compressing the product development lifecycle. Consolidation among major original equipment manufacturers (OEMs) is also a persistent trend, aiming to offer comprehensive, end-to-end solutions that cover the entire casting value chain, from metal preparation to component testing and validation.

Regionally, Asia Pacific maintains its dominance, spurred by massive industrial output in China and India, where increasing domestic demand for vehicles and machinery necessitates continuous capacity expansion and modernization of existing foundries. North America and Europe, while growing at a steadier pace, are focusing intensely on quality and sustainable manufacturing; their growth is primarily fueled by the replacement of aging equipment with highly sophisticated, energy-saving models compliant with strict environmental standards (such as REACH and EPA regulations). Emerging markets in Latin America and the Middle East are witnessing preliminary but aggressive growth, spurred by foreign direct investment and burgeoning local construction and energy sectors demanding locally manufactured cast components, leading to localized production capability development and machinery procurement.

Segmentation trends highlight the increasing prominence of die casting machinery, particularly high-pressure die casting (HPDC) equipment, due to its critical role in producing intricate, thin-walled components for electric vehicles and consumer electronics. Within the operation segment, fully automated systems are projected to exhibit the highest CAGR, reflecting the industry's commitment to minimizing human error and maximizing efficiency metrics, often measured through Overall Equipment Effectiveness (OEE). Furthermore, the core making machinery sub-segment is seeing rapid advancements through technologies like 3D sand printing and inorganic binder systems, which address toxicity concerns associated with traditional organic binders, positioning 'green' foundry solutions as a significant growth vector across all geographical markets.

AI Impact Analysis on Foundry Machinery Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Foundry Machinery Market frequently revolve around optimizing complex casting parameters, automating quality control, and predicting equipment failure. Common questions ask: "How can AI reduce casting defects?", "What is the role of machine learning in sand quality control?", and "Can AI-driven predictive maintenance significantly lower downtime?". The consensus of these themes points to a strong user expectation that AI and Machine Learning (ML) will move foundry operations from reactive processes to proactive, predictive environments. Users are primarily concerned with operationalizing high-dimensional data generated by sensors in melting, pouring, and cooling stages to establish optimal process windows, ultimately aiming for a "zero-defect" manufacturing goal. This synthesis of user concerns underscores that AI's key influence lies in democratizing advanced process knowledge and automating decision-making that traditionally required highly skilled metallurgists or operators, thereby enhancing both quality consistency and resource utilization efficiency across the board.

The integration of AI into foundry machinery is rapidly transforming quality assurance from manual inspection to automated, vision-based defect detection. High-speed cameras and computer vision algorithms, trained on vast datasets of acceptable and defective components, can identify subtle surface and sub-surface flaws (such as porosity, shrinkage, or cold shuts) in real-time, far surpassing the speed and consistency of human inspectors. This immediate feedback loop allows machinery to dynamically adjust process variables—such as pouring temperature, injection velocity in HPDC, or compaction force in molding—to mitigate future defect generation within the same production run. Consequently, scrap rates are dramatically reduced, directly improving the profitability of foundry operations and lowering the environmental footprint associated with reprocessing defective materials, demonstrating a powerful combination of economic and sustainability benefits enabled by intelligent systems.

Beyond quality control, AI is critically influencing the lifecycle management of expensive foundry equipment. By analyzing vibration, temperature, and power consumption data collected from induction furnaces, hydraulic systems, and robotic actuators, machine learning models can accurately predict the remaining useful life (RUL) of critical components. This capability shifts maintenance strategies from calendar-based or failure-based schedules to condition-based monitoring, optimizing maintenance downtime and inventory management for spare parts. The proactive scheduling of repairs prevents catastrophic failures, which can halt entire production lines for extended periods. Furthermore, AI algorithms are being applied to optimize energy consumption in melting processes by calculating the optimal heating profile based on real-time electricity costs and alloy properties, making foundry operations significantly more responsive to external economic variables and contributing to the overall reduction of operational expenditures.

- Real-time Defect Prediction: AI algorithms analyze sensory data (temperature, pressure, flow) during casting to predict and prevent defects like porosity and shrinkage before they solidify.

- Automated Quality Inspection: Computer vision systems utilizing deep learning enable rapid, non-destructive, and highly accurate inspection of castings, replacing manual methods.

- Predictive Maintenance (PdM): Machine learning models analyze equipment performance data to forecast component failure, minimizing unplanned downtime and optimizing maintenance schedules.

- Process Parameter Optimization: AI adjusts complex machinery settings (e.g., pouring speed, cooling rates, injection pressure) dynamically to maximize yield and casting consistency.

- Energy Efficiency Management: Smart systems optimize furnace power utilization based on metal load and energy market prices, reducing operational electricity costs substantially.

- Digital Twin Creation: AI facilitates the development and calibration of digital models of foundry processes, enabling simulation and testing of new alloys or machine settings virtually.

- Supply Chain Resilience: ML forecasts demand fluctuations and optimizes raw material inventory (sand, binders, metals) procurement strategies to ensure smooth production flow.

DRO & Impact Forces Of Foundry Machinery Market

The Foundry Machinery Market is profoundly shaped by a confluence of accelerating drivers, persistent restraints, and significant opportunities, generating powerful impact forces that dictate market trajectory. A primary driver is the exponential global demand for complex, lightweight components stemming from the electric vehicle (EV) industry, requiring high-pressure die casting (HPDC) machinery for large structural parts and battery enclosures. Simultaneously, rigorous environmental regulations, particularly regarding particulate emissions and energy usage, act as a forceful driver compelling foundries worldwide to decommission older, inefficient equipment in favor of modern, energy-saving induction furnaces and highly efficient sand reclamation systems. These drivers create a continuous demand for advanced capital equipment replacement and capacity expansion, underpinned by the industry's pursuit of lower total cost of ownership (TCO) through automation.

However, the market faces considerable restraints, notably the substantial initial capital investment required for state-of-the-art foundry equipment, which poses a significant barrier to entry, particularly for small and medium-sized enterprises (SMEs). This high cost, coupled with the long operational lifecycle of foundry equipment (often spanning decades), slows down the rate of technological adoption, even when superior machinery is available. Furthermore, the persistent global shortage of skilled labor, specifically technicians and engineers proficient in operating, programming, and maintaining highly automated and digitally integrated foundry lines, restricts the full utilization potential of advanced machinery. The complexity inherent in integrating disparate systems—such as melting, molding, cooling, and finishing—from various vendors also represents a technical constraint that demands specialized expertise and robust industrial network infrastructure.

Opportunities for growth are concentrated in the areas of material innovation and regional market penetration. The increasing use of novel alloys (e.g., high-strength aluminum, titanium) in aerospace and medical applications presents an opportunity for OEMs to develop specialized casting machinery capable of handling high-temperature and reactive materials with extreme precision. Moreover, the vast untapped potential in developing economies, particularly across Southeast Asia and Africa, represents a long-term opportunity for machinery vendors to establish localized manufacturing hubs and service networks. The powerful impact forces driving the market are characterized by intense competition on the technological front, where differentiation is achieved through superior automation features (Industry 4.0 readiness), enhanced energy efficiency metrics, and comprehensive post-sales service offerings, effectively transforming foundry machinery from mere capital goods into critical, intelligent production assets.

Segmentation Analysis

The Foundry Machinery Market is broadly segmented based on machine type, casting technology, end-user industry, and level of automation, providing a comprehensive framework for market sizing and strategic analysis. Segmentation by machine type often includes dedicated categories such as melting equipment (induction, arc furnaces), molding equipment (sand molding, gravity die casting, HPDC), core-making machines (hot box, cold box, inorganic), and finishing equipment (shot blasting, fettling). This classification is crucial as it reflects varying capital expenditures and operational complexities tailored to specific casting requirements, whether high volume, low complexity components or low volume, high precision parts. The technological sophistication varies significantly across these segments, with melting and die casting machinery often representing the highest value components in a modern foundry setup.

The End-User segment is dominated by the Automotive sector, which utilizes castings extensively for powertrain, chassis, and increasingly, structural battery components for electric vehicles. However, the diversification across Heavy Machinery (construction, mining, agricultural), Aerospace & Defense, and Railway sectors provides stability against cyclical downturns in any single industry. Furthermore, the segmentation by operation, classifying machinery as fully automatic, semi-automatic, or manual, clearly delineates the ongoing trend toward automation, which commands a premium price point but offers superior return on investment (ROI) through labor reduction and process repeatability. Understanding these intersecting segments allows vendors to tailor their product offerings, focusing R&D efforts on areas like automated pouring systems or robotics integration that deliver maximum value to high-growth end-user categories like EV component manufacturers.

- Type:

- Melting Equipment (Induction Furnaces, Arc Furnaces, Crucible Furnaces)

- Molding Machines (Horizontal, Vertical, Disamatic)

- Core Making Machines (Cold Box, Hot Box, Inorganic Binders)

- Die Casting Machines (High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Gravity Die Casting)

- Sand Preparation and Reclamation Systems

- Finishing and Processing Equipment (Shot Blasting, Grinding, Fettling)

- Casting Technology:

- Sand Casting

- Die Casting

- Investment Casting

- Permanent Mold Casting

- End-User Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, EVs)

- Heavy Machinery and Construction

- Aerospace and Defense

- Railways

- Pumps and Valves

- General Industrial Applications

- Operation:

- Fully Automatic

- Semi-Automatic

- Manual/Conventional

Value Chain Analysis For Foundry Machinery Market

The value chain for the Foundry Machinery Market initiates with the upstream analysis, dominated by specialized component suppliers providing critical inputs such as high-grade steel and alloys for machine construction, precision electrical components (motors, sensors, PLCs), and specialized hydraulic or pneumatic systems. Key upstream activities involve intensive R&D to enhance material durability and thermal resistance, particularly for components exposed to extreme temperatures or wear, such as furnace linings and tooling for die casting. Suppliers in this phase must maintain stringent quality control and possess specialized metallurgy expertise, ensuring that the machinery foundation can withstand the rigorous and continuous operation characteristic of high-volume foundries. The cost structure in the upstream stage is significantly influenced by global commodity prices for metals and complex electronic components, which dictates the final cost base of the machinery OEM.

The midstream phase is occupied by the Original Equipment Manufacturers (OEMs), who focus on design, fabrication, assembly, and testing of the machinery. OEMs differentiate themselves through technological innovation, offering integrated automation packages, proprietary software for process control, and customization capabilities to meet specific client needs regarding alloy types and production volume. Distribution channels in this market are predominantly direct for large-scale, high-value machinery (e.g., automated molding lines or specialized induction furnaces). This direct channel allows OEMs to provide highly specialized technical consultation, installation supervision, and training, which are critical components of the sale. However, for standardized equipment (e.g., smaller ancillary devices or spare parts), indirect distribution through established regional distributors or agents is often utilized, facilitating local market penetration and faster service delivery across diverse geographies.

The downstream analysis centers on the end-users—the foundries—and the subsequent service and maintenance network. Foundries represent the immediate buyers, utilizing the machinery to produce cast components for various industries. The long-term profitability of the machinery is heavily reliant on robust after-sales support, encompassing maintenance contracts, software updates, and the timely supply of replacement parts and consumables (like specialized sand, binders, or refractory materials). This recurring revenue stream often constitutes a significant portion of the total market value and serves as a vital touchpoint for fostering customer loyalty. The entire value chain is currently being optimized through digital platforms that enable remote diagnostics and predictive maintenance, shortening reaction times and increasing the overall effectiveness of the capital equipment deployed in the field.

Foundry Machinery Market Potential Customers

The primary customers for foundry machinery are metal casting operations ranging from captive foundries, which are owned and operated by major manufacturing entities (e.g., automotive OEMs like Volkswagen or Toyota), to large independent jobbing foundries and specialized investment casting houses. Captive foundries typically purchase high-volume, highly customized, and fully automated machinery lines to ensure proprietary component quality and meet strict internal production schedules for their end products, such as engine blocks, transmissions, or complex aerospace components. Their purchasing decisions are often driven by strategic imperatives like vertical integration, quality control, and maximizing OEE, making them prime targets for high-end automation solutions and advanced robotics.

Independent jobbing foundries, conversely, represent a vast and diverse customer base whose purchasing strategy focuses more on flexibility, versatility, and return on investment across a diverse portfolio of short-run and medium-run casting orders for various industrial clients. These customers seek versatile molding and melting systems that can handle rapid alloy changes and different mold sizes efficiently. A rapidly growing segment of potential customers includes specialized manufacturers focusing exclusively on electric vehicle (EV) components, particularly those specializing in gigacasting techniques, requiring enormous, highly sophisticated HPDC machines. These EV-centric customers prioritize machine tonnage, cycle speed, and the ability to cast large, thin-walled aluminum structures, making them targets for the largest and most technologically advanced machinery offerings currently available on the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vesuvius, Norican Group, L.K. Machinery International, Inductotherm Group, DISA Group (A Norican Brand), ABP Induction Systems GmbH, Sintokogio Ltd., Foseco (Vesuvius subsidiary), Kunkel Wagner Germany GmbH, Loramendi S. Coop., Laempe Mössner Sinto GmbH, HA Group, Oskar Frech GmbH & Co. KG, Italpresse Gauss, Buhler Group, Ube Machinery Corporation, Suzhou Mingzhi Technology Co., Ltd., Eirich Group, Savelli Technologies S.r.l., Otto Junker GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foundry Machinery Market Key Technology Landscape

The Foundry Machinery Market is undergoing a rapid technological transformation, moving towards precision, integration, and sustainability. A key technological pillar is the widespread adoption of Industry 4.0 principles, manifested through pervasive sensor integration across all equipment, enabling the collection of massive datasets (Big Data). This data is channeled through Industrial Internet of Things (IIoT) platforms, facilitating real-time monitoring and advanced analytics. Advanced control systems, utilizing high-performance Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems, manage complex process parameters with micrometer precision, which is essential for modern, safety-critical components. Furthermore, the integration of high-payload and high-speed robotics is now standard, automating hazardous tasks such as metal pouring, mold handling, and fettling, dramatically improving safety metrics and production consistency across highly diverse foundries.

Another crucial technology segment is the evolution of Die Casting machinery, specifically in response to the Electric Vehicle (EV) revolution. The emergence of 'Gigacasting' technology requires immense high-pressure die casting (HPDC) machines, boasting locking forces exceeding 6,000 tons. These machines use proprietary vacuum assistance and specialized injection profiles to produce single, large-format structural components (e.g., rear underbodies), replacing dozens of traditionally welded parts. Complementary to this is the advancement in molding technology, particularly the shift towards inorganic binder systems in core making. Inorganic binders offer environmentally friendly alternatives to traditional organic compounds, significantly reducing harmful emissions and odors in the workplace, which addresses both stringent regulatory demands and worker health concerns, positioning this as a critical sustainability differentiator.

Furthermore, technology focused on optimizing raw material usage is gaining significant traction, particularly in sand casting. Highly efficient sand reclamation systems utilize thermal or mechanical processes to restore used molding sand to nearly virgin quality, dramatically reducing the consumption of new sand and minimizing landfill waste. This closed-loop resource management is crucial for large-scale operations. Additionally, the development of sophisticated simulation software (e.g., solidification modeling) allows foundry engineers to predict potential defects and optimize mold and runner designs virtually before committing to expensive physical tooling. This pre-production optimization, facilitated by powerful computational fluid dynamics (CFD) and finite element analysis (FEA), shortens the time-to-market for new castings and reduces costly physical prototyping iterations, cementing simulation as a foundational element of modern foundry technology.

Regional Highlights

The global Foundry Machinery Market exhibits distinct growth patterns and maturity levels across major geographic regions, driven by localized industrial policies, automotive manufacturing intensity, and investment capacity for modernization. Asia Pacific (APAC) stands as the undeniable market leader, primarily fueled by the sheer volume of manufacturing output, led by China and India. China's "Made in China 2025" initiative continues to promote massive investment in replacing older machinery with automated, energy-efficient models, focusing on high-precision casting for electronics and automotive parts. India is rapidly emerging as a global casting hub, benefiting from favorable government policies and an expanding domestic automotive sector, ensuring sustained, high growth rates for machinery procurement across both ferrous and non-ferrous foundries. The focus in APAC remains on increasing production capacity while simultaneously improving component quality to meet global export standards.

North America, characterized by high labor costs and stringent environmental standards, focuses heavily on technological replacement and automation rather than simple capacity expansion. Investment is concentrated in sophisticated, energy-saving induction melting systems and robotic automation cells to maximize labor efficiency and maintain compliance with environmental protection agency (EPA) regulations. The growing electric vehicle manufacturing base across the US and Canada is a major catalyst, driving demand for specialized aluminum die casting machinery required for large structural components. The maturity of the industrial base means North American foundries prioritize sophisticated software integration, such as manufacturing execution systems (MES) and predictive maintenance capabilities, ensuring minimal downtime and optimal asset utilization.

Europe represents a highly mature but innovation-centric market, characterized by intense focus on sustainable manufacturing and advanced metallurgy. European foundries are leading adopters of inorganic core making technology and advanced thermal sand reclamation systems to adhere to strict EU directives, such as the Industrial Emissions Directive. Germany, as a global leader in precision engineering and automotive manufacturing, remains the heart of machinery demand, particularly for high-end, customized equipment. Growth in Europe is primarily tied to modernization cycles and the imperative to maintain global competitiveness through superior product quality and highly efficient production processes, making energy efficiency a crucial purchasing criterion for all new capital expenditures.

Latin America and the Middle East & Africa (MEA) currently represent smaller but high-potential emerging markets. Latin America, particularly Brazil and Mexico, benefits from proximity to the North American automotive supply chain and significant local mining/heavy equipment sectors, driving intermittent demand for both traditional sand casting and high-pressure die casting equipment. However, market growth can be volatile, dependent on local economic stability and foreign investment influx. In MEA, growth is nascent but accelerating, particularly in the Gulf Cooperation Council (GCC) countries, supported by diversification away from oil economies into manufacturing and infrastructure. Investments here are targeted at establishing foundational foundry capacity to localize supply chains for industrial projects, offering opportunities for vendors specializing in robust, semi-automated systems that require less immediate dependence on highly skilled local labor.

- Asia Pacific (APAC): Dominant market share due to high-volume manufacturing, driven by China and India's automotive and infrastructure boom. Focus on capacity expansion and digitalization.

- North America: Focus on automation and replacement cycles; strong growth driven by the shift towards EV component manufacturing and lightweight structural castings.

- Europe: Highly mature market prioritizing sustainability, precision, and technological excellence (Industry 4.0). Leading adoption of green foundry technologies like inorganic binders and advanced sand reclamation.

- Latin America: Emerging market, with demand tied to automotive manufacturing in Mexico and Brazil and regional heavy machinery sectors.

- Middle East & Africa (MEA): Potential high-growth market driven by government initiatives to diversify industrial base and localize manufacturing for construction and energy sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foundry Machinery Market.- Vesuvius

- Norican Group (including DISA Group and Italpresse Gauss)

- L.K. Machinery International Ltd.

- Inductotherm Group

- ABP Induction Systems GmbH

- Sintokogio Ltd.

- Foseco (a subsidiary of Vesuvius)

- Kunkel Wagner Germany GmbH

- Loramendi S. Coop.

- Laempe Mössner Sinto GmbH

- HA Group (Hüttenes-Albertus)

- Oskar Frech GmbH & Co. KG

- Buhler Group

- Ube Machinery Corporation

- Suzhou Mingzhi Technology Co., Ltd.

- Eirich Group

- Savelli Technologies S.r.l.

- Otto Junker GmbH

- Sankyo Kasei Co., Ltd.

- Ashland Global Holdings Inc. (Binders Segment)

Frequently Asked Questions

Analyze common user questions about the Foundry Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for High-Pressure Die Casting (HPDC) machinery?

The surging global demand for lightweight structural components in Electric Vehicles (EVs), such as large battery housings and chassis elements, is the primary driver for HPDC machinery, necessitating high-tonnage machines and advanced automation capabilities.

How is the Foundry Machinery Market addressing global sustainability and environmental regulations?

The market is addressing these challenges through the development and adoption of energy-efficient induction melting furnaces, highly effective thermal and mechanical sand reclamation systems, and the implementation of non-toxic, inorganic binder technologies for core making, minimizing emissions and waste.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC), led by China and India, holds the largest market share due to its vast manufacturing output, continuous industrial modernization, and strong government support for capacity expansion across automotive and general industrial sectors.

What role does Industry 4.0 play in modern foundry machinery operations?

Industry 4.0 enables machine intelligence through IIoT sensor integration, real-time data analytics, and Artificial Intelligence (AI) for predictive maintenance, process optimization, and automated quality control, significantly enhancing operational efficiency and component consistency.

What are the key restraints impacting the growth of the Foundry Machinery Market?

Key restraints include the extremely high initial capital investment required for advanced automated machinery and a persistent global shortage of skilled technical labor capable of operating, programming, and maintaining these highly complex, integrated foundry systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager