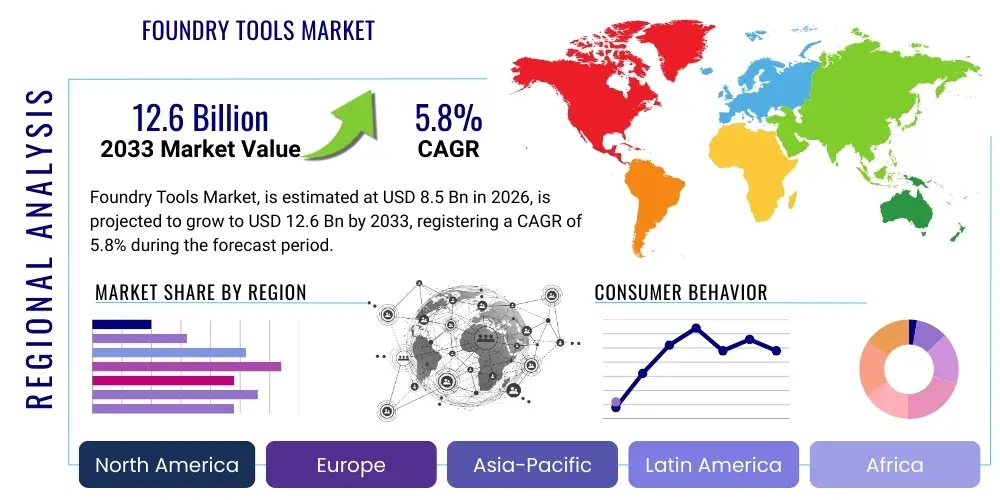

Foundry Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438707 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Foundry Tools Market Size

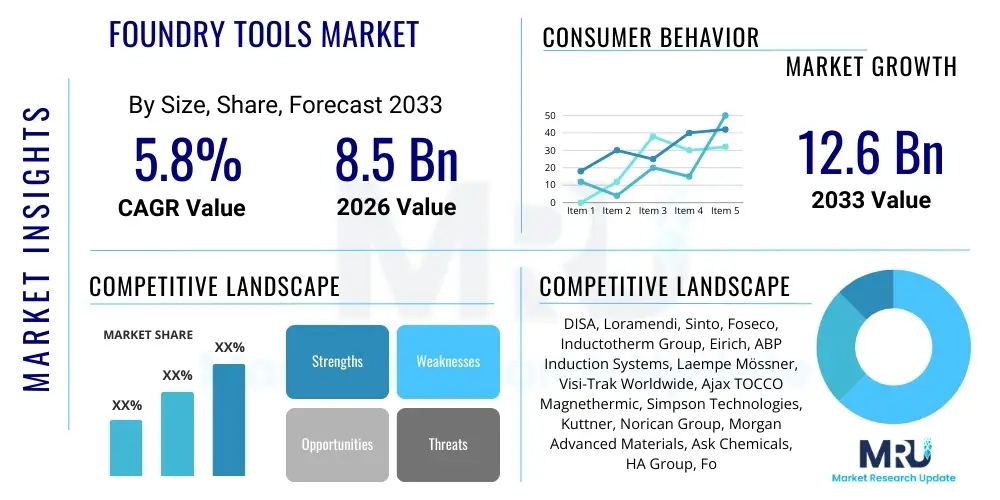

The Foundry Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by robust demand from core manufacturing sectors globally, necessitating continuous investment in high-efficiency, precision casting equipment. The valuation reflects the high average unit cost of automated molding lines, sophisticated melting systems, and advanced finishing machinery, which are foundational capital expenditures for large-scale industrial operations, ensuring ongoing replacement cycles and capacity increases worldwide.

The growth trajectory is expected to be maintained by replacement cycles in mature industrialized economies, coupled with significant capacity expansion in emerging economies, particularly across Asia Pacific where industrialization is accelerating. Furthermore, the increasing complexity of cast components required by the aerospace and electric vehicle (EV) industries demands tools with tighter tolerances and integrated quality assurance features, driving up the average value of procured equipment. The global focus on reducing energy consumption and material waste within the manufacturing sector also necessitates the adoption of state-of-the-art induction furnaces and sophisticated sand reclamation systems, ensuring sustainable market volume growth throughout the forecast period as foundries adhere to global sustainability and efficiency mandates.

Foundry Tools Market introduction

The Foundry Tools Market constitutes the core infrastructure required for metal casting, a process integral to virtually all heavy industries. This market spans an exhaustive range of high-precision, heavy-duty equipment necessary to transform raw metal and molding materials into finished cast components. Products extend beyond basic machinery to include highly specialized systems such as horizontal and vertical automatic molding lines (HMB and VMB systems, respectively) which enable continuous, high-speed production of uniform molds. Additionally, the market covers sophisticated core-making equipment utilizing various bonding chemistries (e.g., cold box, shell core) to create the internal geometry of castings, ensuring structural integrity and precise dimensions for complex parts like engine manifolds and hydraulic valves. The efficiency and reliability of these tools are paramount, directly influencing the final quality, cost structure, and production timelines of metal parts. Foundries are now demanding systems that offer integrated cooling management and automated sand regeneration capabilities as part of the primary molding solution, moving beyond simple casting formation to comprehensive process control.

Major applications for foundry tools are inextricably linked to the global capital goods and transportation sectors. The automotive industry is the largest consumer, relying on these tools for mass production of critical components such as engine blocks, cylinder heads, gearboxes, and suspension parts. With the global shift towards Electric Vehicles (EVs), there is an accelerating demand for specialized die-casting tools capable of handling lightweight non-ferrous alloys (aluminum and magnesium) for battery casings and structural components, demanding extreme precision and repeatable high quality. This high demand is pushing the boundaries of material handling and injection speed in High-Pressure Die Casting (HPDC) machinery. Beyond automotive, industrial machinery manufacturers utilize heavy-duty tooling for producing robust frames, housings, and large components for construction equipment, agricultural machinery, and power generation turbines. The increasing stringency of safety and performance standards in these sectors mandates continuous technological upgrades in the tools utilized, particularly concerning durability and operational reliability under continuous stress. This includes investment in advanced non-destructive testing (NDT) equipment that is integrated into the production line.

The benefits derived from adopting advanced foundry tooling are substantial, extending across operational, financial, and environmental domains. Operationally, modern automated systems significantly boost productivity, often reducing casting cycle times by over 30% compared to traditional methods, while maintaining far superior consistency and dimensional accuracy. Economically, automation mitigates reliance on high-cost, specialized labor and dramatically reduces scrap rates through optimized processes and real-time defect detection, which collectively improves the overall utilization of expensive metal inputs. Environmentally, the adoption of modern induction furnaces minimizes greenhouse gas emissions and improves energy efficiency by up to 40% compared to older technologies like cupolas, supporting compliance with directives such as the EU's Industrial Emissions Directive. Furthermore, advanced sand preparation and reclamation systems allow for up to 95% reuse of molding sand, significantly reducing landfill waste and associated disposal costs. These compelling advantages, coupled with the competitive necessity of producing higher quality components, are the fundamental drivers for sustained market investment and robust growth.

Foundry Tools Market Executive Summary

The Foundry Tools Market trajectory is defined by three principal dynamics: accelerating automation adoption, robust demand concentrated in Asian manufacturing hubs, and a pronounced technological pivot towards sustainable and intelligent systems. Business trends clearly show that equipment providers are transitioning from component suppliers to integrated solution partners, offering turnkey foundry installations that combine melting, molding, handling, and quality control under a single, digitally connected architecture. The emphasis is on delivering Total Cost of Ownership (TCO) advantages through efficiency gains, rather than just initial price points. Mergers and acquisitions are common, particularly aimed at integrating specialized robotics and advanced software capabilities into the portfolios of traditional machinery manufacturers, enhancing their competitive edge in complex project tendering and lifecycle support services.

Regional trends firmly establish Asia Pacific as the undeniable market growth leader, capitalizing on burgeoning automotive production and massive state-backed infrastructure investments, particularly in rail, power, and construction sectors across China, India, and Vietnam. While APAC focuses heavily on capacity expansion, North America and Europe lead in technological innovation, where high labor costs necessitate investment in fully autonomous production cells and where strict environmental regulations mandate the quickest adoption of the cleanest, most energy-efficient tooling. The regional dichotomy highlights varying procurement strategies globally. The Middle East and Africa, driven by localized manufacturing objectives and diversification away from oil dependence, present nascent but high-potential opportunities, especially in setting up modern, optimized casting facilities for local industrial supply chains and meeting rising domestic consumption needs.

Segmentation analysis reveals a definitive shift favoring tools optimized for Non-Ferrous Metals, directly reflecting the automotive industry’s aggressive lightweighting agenda and the electric vehicle transition. Die-casting machinery and specialized low-pressure casting equipment are experiencing disproportionately high demand compared to traditional ferrous tooling used for heavy industrial components. Within the product categories, automated molding lines (HMB/VMB) remain the backbone of high-volume production, while energy-efficient induction melting systems continue their phase-out of conventional melting methods. Crucially, the integration of advanced process control hardware—sensors, programmable logic controllers (PLCs), and supervisory control and data acquisition (SCADA) systems—is standard across all modern segments, confirming that the future of foundry tooling is inseparable from smart, connected manufacturing principles focused on data-driven decision making.

AI Impact Analysis on Foundry Tools Market

User inquiries frequently highlight the necessity for AI to address the perennial challenges of quality variance and unpredictable downtime inherent in foundry operations. Foundries are deeply interested in AI's capacity to transform maintenance schedules from reactive to predictive, using machine learning models to analyze the complex interplay of factors (vibration, heat, pressure, material integrity) affecting critical equipment lifespan, thereby preventing catastrophic failures of high-cost assets like large molding machines or furnaces. A major theme is the application of deep learning in automated visual inspection (AVI) systems, where algorithms are trained on vast datasets of casting flaws to instantly and accurately detect complex, subtle defects like micro-porosity or cold shuts, vastly exceeding the speed and consistency of human inspectors and leading to significantly improved throughput and yield.

Furthermore, there is a strong focus on using AI for holistic process optimization, particularly in maximizing energy efficiency during melting and minimizing scrap rates during pouring. Users seek solutions that can dynamically adjust process variables—such as sand composition, compaction forces, metal temperature, and cooling profiles—in real-time, based on predicted outcomes, effectively closing the loop between physical operation and digital control. This level of optimization, unattainable through traditional fixed logic controllers, is seen as essential for foundries striving for world-class manufacturing standards, especially in high-volume, precision applications like aerospace and high-performance automotive parts. The expected outcome is a significant reduction in operational expenditure, minimization of waste, and a marked improvement in yield and component reliability, positioning AI as a crucial enabling technology rather than merely an enhancement layer for foundry tools.

- AI-driven predictive maintenance utilizes real-time monitoring data (temperature, acoustics, current draw) from induction furnaces and hydraulic systems to forecast failure points, enabling pre-emptive part replacement and maximizing equipment uptime, significantly reducing unplanned outages.

- Machine learning enhances automated quality control by accurately classifying surface and internal casting defects from high-resolution scans, utilizing neural networks to detect subtle patterns indicative of flaws, reducing false positives and accelerating throughput in the finishing department.

- AI algorithms optimize energy usage in melting cycles by calculating the most efficient power curve based on metal charge composition, ambient temperature, and target superheat requirements, contributing to substantial cost savings and reduced carbon emissions.

- Process optimization uses AI to recommend and automatically adjust parameters (e.g., pouring speed, inoculation levels, cooling rates) to stabilize metallurgical consistency and reduce variance in final component properties across long production runs.

- Integration of AI with digital twin models allows for continuous system learning, where operational data feeds back into the simulation environment to refine and improve future casting design and process strategies, accelerating time-to-market for new component designs.

DRO & Impact Forces Of Foundry Tools Market

The expansion of the Foundry Tools Market is fundamentally driven by the relentless global requirement for industrial modernization and the pressure to achieve higher sustainability metrics. Key Drivers include the unprecedented growth in automotive output, particularly in Asia, alongside the high-volume replacement demand in established markets where aging equipment must be upgraded to meet strict modern performance criteria. Furthermore, the global mandate for decarbonization positions highly efficient induction and electric melting systems as mandatory investments, fueling a significant equipment replacement cycle. However, the market faces potent Restraints: the monumental capital outlay required for high-end, automated VMB or HMB lines often excludes smaller and medium-sized enterprises (SMEs), leading to market fragmentation. Coupled with this financial hurdle is a critical global deficit of technical expertise—maintenance engineers and highly skilled operators—capable of managing sophisticated digital foundry ecosystems, hindering rapid automation adoption and maximizing operational risk.

Significant Opportunities exist through technological paradigm shifts and specific sectorial demands. The transition to electric vehicles (EVs) creates a specialized, high-growth niche for tools focusing on lightweight structural aluminum and high-integrity battery component castings, demanding new investments in specialized die-casting equipment capable of handling complex geometries. Parallelly, the Industry 4.0 revolution offers the opportunity for manufacturers to introduce subscription-based services (Equipment-as-a-Service or EaaS) and advanced software packages for process simulation and predictive maintenance, creating stable, high-margin recurring revenue streams beyond hardware sales and enhancing customer loyalty. Environmentally, the growing acceptance and financial viability of sophisticated sand reclamation technologies offer tool providers a chance to capitalize on the circular economy model, providing solutions that drastically reduce the environmental footprint of casting operations and comply with emerging global waste directives and resource efficiency goals.

These dynamics result in powerful Impact Forces that fundamentally reshape market competition. The dominant force is the mandatory shift toward comprehensive solution provision; customers increasingly prefer suppliers offering integrated, end-to-end systems that minimize interface issues and maximize efficiency, forcing manufacturers to enhance collaboration or consolidation to offer integrated robotic and software packages. Secondly, the market is subject to intense pricing pressure from cost-effective Asian manufacturers in the commodity tool segments, pushing Western OEMs to focus exclusively on high-margin, technologically superior, and customized automation solutions requiring proprietary software integration. Finally, the regulatory environment acts as a constant upward pressure force, ensuring that all new investment decisions prioritize energy efficiency and emission reduction, making environmental compliance a non-negotiable feature for any market-viable foundry tool manufactured today, driving continuous innovation in process efficiency.

Segmentation Analysis

The segmentation of the Foundry Tools Market is essential for understanding the diverse needs of the global casting industry, reflecting variances in production scale, material requirements, and component complexity. Analyzing the market by product type highlights the capital investment focus, with molding machines and melting furnaces representing the largest expenditure categories, closely followed by advanced core-making systems essential for intricate internal component structures. The differentiation between horizontal and vertical molding lines, for instance, underscores the trade-off between flexible tooling changeovers and continuous high-volume output required by different industrial applications. This granular analysis allows stakeholders to target market segments effectively, whether supplying high-speed, automated lines to automotive Tier 1 suppliers or providing robust, versatile furnaces to general jobbing foundries requiring flexibility in alloy processing.

Segmentation by metal type is crucial as it directly dictates the technology used and the required material handling systems. The ferrous metals segment relies heavily on sand casting and large induction furnaces for producing traditional iron and steel parts for heavy machinery and infrastructure, a segment characterized by stability and size requirements. Conversely, the non-ferrous segment, expanding rapidly due to lightweighting trends, requires specialized, faster tooling like high-pressure die casting machines that operate under different thermal and pressure constraints, necessitating highly specific maintenance and consumable supply chains. Furthermore, the application segment maps consumption patterns directly to global industrial cycles, confirming that the fate of the foundry tools industry is inextricably linked to the production volumes and technological demands set by the global automotive and machinery sectors, dictating the need for either high-tolerance or high-throughput equipment and specific material compatibility.

- By Product Type:

- Molding Machines (Horizontal, Vertical, Jolt Squeeze) The high-speed automation segment, particularly VMB, is experiencing strong demand due to cycle time advantages and small footprint suitability for modern facilities.

- Core Making Equipment (Cold Box, Hot Box, Shell Core) Driven by the requirement for internal geometry precision in complex engine and pump parts, with cold box technology offering faster curing times.

- Melting Furnaces (Induction, Electric Arc, Cupola) Induction furnaces dominate new installations due to energy efficiency, precise temperature control, and compliance with stringent low emissions profiles.

- Sand Preparation and Treatment Equipment (Mixers, Reclamation Systems) High growth driven by environmental mandates for resource conservation and necessity of high-quality, consistent molding sand properties.

- Cleaning and Finishing Tools (Shot Blasting, Fettling, Grinding) Increasingly automated using robotics to enhance worker safety, consistency, and accuracy in final component preparation.

- Die Casting Machinery (High Pressure, Low Pressure, Gravity) Critical segment for non-ferrous lightweight components for the EV market, demanding sophisticated injection and clamping control systems.

- By Metal Type:

- Ferrous Metals (Iron, Steel) Stable, high-volume segment supplying infrastructure and heavy industrial components, focusing on large-scale melt capacity.

- Non-Ferrous Metals (Aluminum, Copper, Magnesium, Zinc) Fastest growing segment due to aerospace and automotive lightweighting strategies, demanding high-speed, precise pressure casting.

- By Application:

- Automotive and Transportation The largest consumer, heavily dictating tooling specifications for high-volume, precise parts, especially structural components for EVs.

- Industrial Machinery and Equipment Includes tools for agriculture, mining, and power generation, requiring robust, durable castings with long operational lifecycles.

- Construction and Infrastructure Demand driven by urban development, requiring large-format iron castings and standardized component production capacity.

- Aerospace and Defense High-specification, low-volume segment demanding extreme quality, material control, and highly controlled melting/casting environments.

- Others (e.g., Energy, Consumer Goods) Diversified usage across various consumer and specialized manufacturing processes requiring short-run casting versatility.

- By Operation:

- Automated/Robotic Systems Highest growth and investment segment, minimizing labor costs and ensuring superior process consistency and data capture.

- Semi-Automated Systems Transitional solutions, popular in emerging markets upgrading from manual methods, offering incremental efficiency gains.

- Manual Tools Decreasing segment, retained mainly for low-volume, highly specialized jobbing work or artisanal casting where automation is not cost-effective.

Value Chain Analysis For Foundry Tools Market

The foundational strength of the Foundry Tools value chain lies in its reliance on highly specialized upstream manufacturing expertise. This stage involves sophisticated engineering companies that supply critical sub-systems, including high-frequency converters for induction furnaces, specialized robotics for handling hot metal and molds, and highly durable refractory ceramics designed to withstand extreme thermal shock and chemical erosion. Strategic sourcing in this upstream sector focuses on securing components that ensure high operational duty cycles and minimal maintenance requirements for the final equipment. Relationships with these suppliers are often long-term and collaborative, particularly in the development of proprietary control software and integrated sensor technology, which form the technological core of modern, highly reliable foundry machinery and impact the final system performance.

The core activity of the value chain is the Original Equipment Manufacturer (OEM) stage, where specialized machinery is designed, fabricated, assembled, and rigorously tested. Given the scale and complexity of units like full automatic molding lines, logistics and quality assurance are paramount, often involving pre-shipment testing under simulated production loads. Distribution is split between two distinct models: Direct distribution is preferred for high-value, customized, and complex projects, such as integrating a new vertical molding line or installing a large induction melt shop. This model allows the OEM to provide specialized installation, commissioning, proprietary training, and initial operational support directly, ensuring high levels of customer satisfaction and system integration success. Conversely, indirect channels, relying on experienced regional distributors and agents, handle the sales and servicing of standardized peripheral equipment, consumables (such as sand binders and fluxes), and critical spare parts, ensuring quick local access, particularly in geographically diverse and rapidly developing markets like Asia and Latin America.

Downstream operations are defined by the critical importance of after-sales service and ongoing consumables supply, which often represent substantial, sustainable revenue streams for OEMs. Installation and commissioning involve integrating the new machinery into the customer's existing production flow and IT infrastructure, a process that can take several months and requires specialized engineering teams. Post-installation, customers prioritize reliable access to spare parts and advanced service contracts, particularly those incorporating predictive maintenance driven by remote diagnostics and Industrial IoT (IIoT) platforms. This downstream focus on continuous support and performance optimization solidifies the long-term customer relationship, ensuring that the high initial CapEx investment yields optimal productivity and minimizing expensive operational downtime for the foundry end-user, often through customized service level agreements tailored to specific production requirements.

Foundry Tools Market Potential Customers

The Foundry Tools Market serves a sophisticated industrial clientele primarily composed of high-volume metal component manufacturers whose operational viability depends heavily on reliable, high-precision casting infrastructure. Automotive OEMs and their dedicated Tier 1 suppliers constitute the largest and most demanding customer segment. These buyers are continuously focused on maximizing throughput and achieving stringent quality standards (e.g., zero-defect tolerances), driving demand for the most advanced automated molding, core-making, and die-casting machinery, particularly those enabling high integrity structural and safety-critical components for internal combustion engines and electric powertrain systems. Their procurement decisions are often influenced by the total lifecycle cost, encompassing energy efficiency, maintenance requirements, and the seamless integration capacity with existing enterprise resource planning (ERP) and manufacturing execution systems (MES).

Another essential customer base includes foundries supplying the general industrial sector, covering heavy equipment used in construction, agriculture, and mining, along with specialized components for machinery like compressors, pumps, and valves. These jobbing foundries often require more flexible, versatile equipment that can handle short runs of varied component types and materials, often prioritizing medium-scale induction furnaces and adaptable sand preparation systems. While not always requiring the absolute fastest cycle times of automotive lines, these customers place high value on equipment robustness, durability, and the ability to switch swiftly between different alloys and mold dimensions, facilitating efficient order fulfillment across a diverse portfolio of manufacturing clients under competitive time pressures. Reliability and ease of maintenance are paramount considerations for these customers.

Emerging but high-value customers include specialized aerospace and defense contractors and manufacturers operating in the renewable energy sector, particularly wind turbine and specialized geothermal component producers. Aerospace customers demand unparalleled quality assurance, necessitating advanced non-destructive testing tools and highly controlled vacuum or inert atmosphere melting and casting equipment for high-performance superalloys. The energy sector, focused on scaling up production of large-format turbine components, requires massive melting capacity and large-scale, automated handling systems capable of producing components with exceptional dimensional stability. Across all customer types, there is a unified move towards purchasing equipment bundled with advanced software solutions for simulation and operational intelligence, transforming procurement from a simple hardware acquisition into a strategic investment in integrated, smart manufacturing capability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISA, Loramendi, Sinto, Foseco, Inductotherm Group, Eirich, ABP Induction Systems, Laempe Mössner, Visi-Trak Worldwide, Ajax TOCCO Magnethermic, Simpson Technologies, Kuttner, Norican Group, Morgan Advanced Materials, Ask Chemicals, HA Group, Foundry Automation, LLC, KUKA Foundry, StrikoWestofen, Frech Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foundry Tools Market Key Technology Landscape

The Foundry Tools Market is characterized by intense technological evolution centered on achieving precision, speed, and sustainability, driven by the principles of Industry 4.0. A cornerstone of this landscape is the dominance of high-speed automated molding lines, particularly DISA's Vertical High-Pressure Molding (VMM) and Sinto's Horizontal High-Speed Molding (HMM) systems. These technologies rely on precise sand shooting and controlled compaction mechanisms, integrated with rapid mold handling, to achieve unprecedented cycle times, making them indispensable for large-scale automotive production. The ongoing technological refinement in this area involves minimizing compressed air consumption, optimizing hydraulic power efficiency, and integrating sophisticated sensor arrays to monitor mold integrity and compaction uniformity in real-time, thereby reducing casting defects before pouring even commences and providing granular operational data.

Crucially, melting technology has witnessed a fundamental shift away from fossil fuels toward advanced induction melting furnaces. The technological edge here lies in Medium-Frequency (MF) induction systems, which offer rapid melting rates, superior metallurgical control, and significantly enhanced energy efficiency, aligning with global climate initiatives and CO2 reduction targets. Innovations include the development of sophisticated furnace lining monitoring systems, using advanced sensors to predict refractory wear and scheduling necessary maintenance, and sophisticated electromagnetic stirring controls to ensure homogenous alloy mixing and temperature distribution. Parallelly, the rise of specialized die-casting machinery, including large-tonnage High-Pressure Die Casting (HPDC) and robust Low-Pressure Die Casting (LPDC) units, is critical for utilizing highly fluid aluminum and magnesium alloys in structural components, necessitating specialized vacuum assist technologies to eliminate internal porosity and ensure high structural integrity in safety-critical parts.

The widespread integration of Industrial Internet of Things (IIoT) platforms and robotics is redefining operational capability. Modern foundry tools are now IIoT-enabled, generating vast amounts of data regarding temperature, pressure, vibration, and energy consumption, which is critical for achieving predictive maintenance. This data is leveraged by cloud-based analytics platforms to provide operational insights, facilitate predictive maintenance schedules, and enable remote diagnostics by OEM technicians, reducing reliance on on-site expertise. Robotics are moving beyond simple material handling, with articulated arms equipped with specialized end-effectors performing complex tasks like precision cleaning (fettling) and grinding, significantly reducing human exposure to hazardous environments and ensuring consistent surface finishing standards. Furthermore, additive manufacturing (3D printing) technologies for producing intricate sand cores and patterns are gaining traction, allowing for rapid prototyping and the creation of highly complex internal geometries previously deemed uncastable, accelerating product development cycles across the industry.

Regional Highlights

Asia Pacific (APAC) stands as the undeniable leader in the consumption and production of foundry tools, a position cemented by massive capital investment across China, India, and Southeast Asia. This region's dominance is multifaceted: it serves as the global manufacturing center, particularly for automotive and heavy machinery exports, driving high demand for volume production equipment. While China leads in sheer scale, implementing rapid technological upgrades to meet domestic environmental regulations and boost local quality standards, India is experiencing robust expansion supported by governmental 'Make in India' initiatives promoting domestic industrial capacity. Investment in APAC tends to balance between high-speed automation for multinational corporations and cost-effective, semi-automated solutions for the large segment of local, smaller jobbing foundries, reflecting a highly diverse technological maturity level within the region and ensuring sustained market growth across varied enterprise scales.

North America and Europe, while slower in capacity expansion compared to APAC, maintain their leadership in technology adoption and high-specification tooling. In these regions, investment decisions are primarily driven by the need to optimize efficiency against high labor costs and meet highly restrictive environmental legislation (e.g., EU's Industrial Emissions Directive and REACH regulations). Consequently, European foundries, particularly those in Germany and Italy, heavily invest in highly integrated, robotic foundry cells, advanced digital twins, and the latest generation of ultra-low-emission induction melting systems. North America's growth is tied closely to the resurgence of domestic manufacturing, focusing on specialized, high-integrity castings for aerospace, medical, and specialized EV applications, where process control, quality traceability, and material specialization are prioritized over raw volume output.

Latin America and the Middle East & Africa (MEA) represent important emerging markets where market penetration is steadily increasing. Latin America, with Brazil and Mexico as key economic centers, sees demand linked primarily to automotive assembly and regional infrastructure development, driving foundational investment in melting and basic molding tools, often through technology transfer from foreign investors. MEA is poised for significant future growth, spurred by economic diversification initiatives in the Gulf nations aimed at building robust local industrial supply chains, reducing reliance on imports, and establishing regional hubs for manufacturing, particularly in metallurgy and heavy industry components. These regions often look to turnkey solutions that offer a balance of initial cost affordability, operational robustness, and comprehensive local technical support from equipment suppliers to minimize operational risk during initial setup.

- Asia Pacific (APAC): Dominates consumption volume; epicenter of new capacity expansion; aggressive adoption of both cost-effective and premium high-speed molding technology driven by the automotive and infrastructure boom in China and India.

- North America: Focus on high-value, low-volume, specialized castings; strong market for advanced robotics, IIoT integration, and predictive maintenance software to counteract high labor overheads and enhance component integrity.

- Europe: Regulatory environment dictates technology choices; leads in sustainability focus, rapid adoption of green foundry tools, and sophisticated digital process control (Digital Twins) for precision engineering sectors like luxury automotive and machinery.

- Latin America: Stable growth tied to local economic stability and automotive manufacturing; strong demand for reliable, mid-range induction melting technology and foundry modernization projects in key industrial zones like Brazil and Mexico.

- Middle East and Africa (MEA): Emerging investment driven by industrial diversification goals; initial focus on establishing core metal casting capability, leading to procurement of versatile, robust foundational equipment with an emphasis on energy efficiency and scalability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foundry Tools Market.- DISA Group (Part of Norican Group)

- Loramendi S. Coop.

- Sinto Group

- Foseco (A Vesuvius Company)

- Inductotherm Group

- Eirich Group

- ABP Induction Systems GmbH

- Laempe Mössner Sinto GmbH

- Visi-Trak Worldwide LLC

- Ajax TOCCO Magnethermic Corporation

- Simpson Technologies Corporation

- Kuttner GmbH & Co. KG

- Norican Group (Including DISA, Italpresse Gauss, StrikoWestofen)

- Morgan Advanced Materials plc

- Ask Chemicals GmbH

- HA Group (Hüttenes-Albertus Chemische Werke GmbH)

- Foundry Automation, LLC

- KUKA AG (Robotics focused on foundry applications)

- StrikoWestofen GmbH (Part of Norican Group)

- Frech Group

Frequently Asked Questions

Analyze common user questions about the Foundry Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of new foundry tools?

The primary driver is the increasing global demand for lightweight, high-integrity metal components, particularly from the electric vehicle (EV) sector, coupled with stringent environmental regulations forcing foundries to invest in energy-efficient automation and melting technologies.

How is Industry 4.0 affecting the Foundry Tools Market?

Industry 4.0 integration, including IoT sensors and AI-driven analytics, is enabling predictive maintenance, real-time quality control, and optimized process parameters, fundamentally shifting foundry operations towards efficiency and minimal downtime, maximizing equipment utilization.

Which segmentation segment is expected to show the highest growth rate?

The Non-Ferrous Metals segment, specifically relating to high-pressure and low-pressure die-casting tools for aluminum and magnesium components, is projected to exhibit the highest CAGR due to the ongoing lightweighting trend in automotive and aerospace applications.

What are the key challenges for smaller foundries investing in new equipment?

Smaller foundries face significant challenges primarily related to the high initial capital expenditure (CapEx) required for automated machinery and the difficulty in securing and retaining skilled technicians necessary to operate and maintain sophisticated digital tooling systems.

What is the role of digital twin technology in modern foundry operations?

Digital twin technology allows foundries to create virtual models of the entire casting process, enabling simulation of material flow and solidification, optimization of mold design, and precise prediction of potential defects, significantly reducing prototyping costs and accelerating time-to-market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager