Foundry Waste Sand Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431878 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Foundry Waste Sand Recycling Market Size

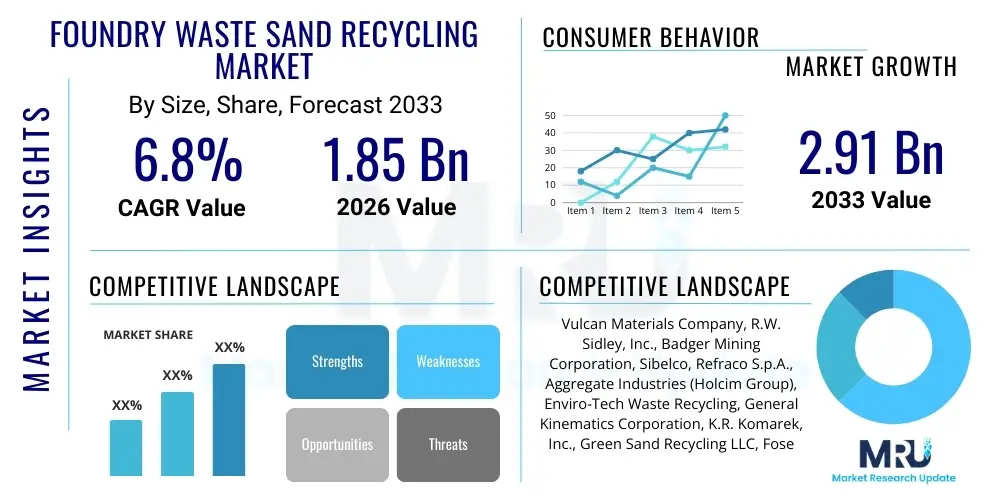

The Foundry Waste Sand Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.91 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global shift towards sustainable industrial practices, mandated by increasingly stringent environmental regulations concerning waste disposal and landfill limitations. The economic viability of recycling foundry sand, particularly when compared to the escalating costs associated with virgin material procurement and the transportation and tipping fees of waste disposal, provides a strong financial incentive for market participants across North America, Europe, and key manufacturing hubs in Asia Pacific.

Foundry Waste Sand Recycling Market introduction

The Foundry Waste Sand Recycling Market encompasses the processes and technologies utilized to reclaim spent foundry sand, a high-volume byproduct of metal casting operations, transforming it from a waste stream into valuable secondary raw materials. Spent foundry sand (SFS) typically consists of high-quality silica sand mixed with various binders (clay, chemical resins) and trace metals. Recycling technologies, including mechanical, thermal, and chemical methods, are employed to remove these contaminants, rendering the sand suitable for reuse either back in the core making process or in alternative applications such such as construction, road base, and cement manufacturing. This industry segment is critical for minimizing the environmental footprint of the global foundry industry and enhancing resource efficiency.

Major applications of recycled foundry sand extend far beyond simple material replacement, providing enhanced properties in various downstream sectors. For instance, in geotechnical applications, the uniform particle size and physical stability of reclaimed sand make it an excellent fill material or sub-base aggregate. In the cement industry, the chemical composition of SFS, often containing silica and alumina, allows it to be used as a raw material substitute, thereby reducing energy consumption during clinker production. The increasing demand from the construction sector, fueled by infrastructure development globally, serves as a cornerstone for market growth, pushing foundries and recycling service providers to expand their processing capabilities and geographic reach.

The market is primarily driven by three interrelated factors: regulatory mandates, economic efficiencies, and sustainability targets. Governments worldwide are imposing stricter rules on industrial waste disposal, raising landfill taxes, and limiting acceptable contamination levels, making recycling an unavoidable necessity rather than an optional endeavor. Simultaneously, the recycling process offers significant cost savings by reducing reliance on virgin material sourcing—a resource that is becoming increasingly scarce and expensive in certain regions. Furthermore, corporate sustainability goals and the pressure from stakeholders for circular economy models are strongly compelling large foundries and automotive suppliers to invest in or contract advanced sand reclamation systems, ensuring consistent growth in technology adoption and processing volumes.

Foundry Waste Sand Recycling Market Executive Summary

The Foundry Waste Sand Recycling Market is characterized by robust growth, propelled by legislative shifts favoring circular economy models and the intrinsic economic benefits derived from raw material substitution. Business trends indicate a movement toward integrated service models, where specialized recycling firms manage the entire waste lifecycle for multiple foundries, offering scale and efficiency. Technological innovation is focused on enhancing the purity of recycled sand, particularly through advanced thermal reclamation units capable of removing complex chemical binders efficiently, thereby allowing a higher percentage of recycled material to be reintroduced into high-specification casting processes. Strategic partnerships between large material processors and construction material manufacturers are defining the downstream market landscape, ensuring consistent off-take for high-volume reclaimed products, such as aggregates and soil modifiers.

Regional trends highlight significant dynamism, with North America and Europe demonstrating maturity driven by strict environmental compliance and high labor costs, making automated recycling financially attractive. European mandates, particularly the Waste Framework Directive, have institutionalized recycling targets, establishing robust demand for end-of-life material management solutions. Conversely, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market. This growth is primarily fueled by rapid industrialization, massive infrastructure projects generating high demand for secondary aggregates, and increasing government awareness regarding industrial pollution, leading to the gradual phase-out of inexpensive, unregulated disposal methods and a subsequent rise in formalized recycling infrastructure.

Segment trends confirm that Mechanical Recycling remains dominant due to its low operating cost and applicability for less contaminated green sand, suitable for large-volume construction applications. However, the Thermal Recycling segment is projected to exhibit the highest CAGR, driven by the need for high-purity sand suitable for immediate re-entry into complex core and mold production, particularly in high-precision sectors like aerospace and heavy machinery casting. Within application segments, the utilization of reclaimed sand in Cement and Concrete Production is expected to see exponential growth, due to the industry’s enormous material requirements and its regulatory pressure to decarbonize by using alternative raw materials. The interplay between stricter environmental standards and technological advancements ensuring high-quality output is the fundamental mechanism driving segment evolution across the forecast period.

AI Impact Analysis on Foundry Waste Sand Recycling Market

User queries regarding the integration of Artificial Intelligence (AI) in the foundry waste sand recycling domain frequently center on three critical themes: optimizing operational efficiency, enhancing quality control consistency, and implementing predictive maintenance for high-cost thermal equipment. Users are keen to understand how AI algorithms can analyze complex input variables, such as heterogeneous waste sand composition (variability in binder type, moisture content, and contamination), to dynamically adjust process parameters (e.g., kiln temperature in thermal reclamation or residence time in mechanical scrubbers). A significant concern is the ability of AI-driven systems to maintain output quality (e.g., Acid Demand Value, Loss on Ignition) necessary for reuse in sensitive casting applications, moving beyond traditional, slower laboratory testing methods. Additionally, the high energy consumption and maintenance needs of thermal recycling units prompt inquiries into AI's role in predictive failure analysis and energy expenditure optimization.

The application of machine learning in resource recovery presents a transformative opportunity by moving beyond static, predefined recycling routines to adaptive, real-time optimization. AI algorithms can process sensor data from moisture meters, optical sorters, and spectroscopic analysis tools to classify incoming waste sand batches instantly, directing them to the most appropriate and energy-efficient reclamation path. This real-time decision-making minimizes process inefficiencies, reduces energy wastage associated with overheating, and ensures that the final product consistently meets stringent specifications required by end-users. Such systems mitigate the primary challenge in recycling—the variability of the waste feedstock—leading to higher yield rates and reduced operational costs per ton of reclaimed sand.

Furthermore, AI-powered predictive maintenance models are crucial for minimizing downtime in capital-intensive recycling facilities. By analyzing vibration, temperature, and throughput data, these systems can accurately forecast component wear and potential failures in critical equipment like rotary kilns, fluidized beds, and attrition scrubbers. This proactive approach allows operators to schedule maintenance precisely when needed, preventing catastrophic failures, extending equipment lifespan, and ensuring continuous operational capacity. The implementation of AI in quality assurance, particularly through automated visual inspection systems, further solidifies the viability of reclaimed sand as a dependable substitute for virgin silica, thereby bolstering market confidence and driving adoption across high-specification foundries.

- AI optimizes process parameters (temperature, flow rates) in real-time based on feedstock variability.

- Machine learning enhances quality control through rapid, non-destructive compositional analysis of recycled sand purity.

- Predictive maintenance models reduce operational downtime and extend the lifespan of thermal reclamation equipment.

- AI-driven classification systems improve material segregation, maximizing the utility of different waste sand streams.

- Optimized energy usage in thermal processes achieved through neural network analysis of heat distribution and input load.

DRO & Impact Forces Of Foundry Waste Sand Recycling Market

The Foundry Waste Sand Recycling Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and market trajectory. Primary drivers include the global push for resource efficiency and the critical need to comply with increasingly strict environmental legislation, particularly concerning the disposal of industrial byproducts. These regulatory pressures, coupled with the escalating costs associated with acquiring virgin silica sand and the high fees levied for industrial landfill use, create a powerful economic incentive for investment in recycling infrastructure. Conversely, the market faces restraints such as the substantial upfront capital required for sophisticated thermal and chemical recycling facilities, which deters smaller foundries from adopting in-house solutions. Furthermore, maintaining the consistent quality and homogeneity of recycled sand, especially when chemical binders are involved, poses a significant technical challenge that limits its acceptance in certain high-specification casting applications, slowing broader adoption.

Opportunities for growth are concentrated in the development of advanced chemical reclamation techniques and the expansion into non-traditional applications for recycled sand. The opportunity lies in creating cost-effective, modular recycling units suitable for localized use, broadening accessibility for mid-sized foundries. The rising demand for sustainable building materials worldwide presents a massive off-take opportunity, particularly in high-volume applications like controlled low-strength material (CLSM), flowable fill, and high-performance concrete mixtures, where the physical properties of SFS are advantageous. Leveraging government incentives, tax breaks, and grants targeted at green technology and circular economy investments further enhances the financial viability of establishing new recycling operations and expanding existing capacities, acting as a critical external force propelling market penetration.

Impact forces within this sector are heavily weighted toward external regulatory and macroeconomic shifts. Stringent governmental policies on hazardous waste classification and the implementation of Extended Producer Responsibility (EPR) schemes dramatically increase the liability and cost burden for foundries, forcing them toward recycling solutions. Additionally, global supply chain disruptions and volatility in commodity prices heighten the appeal of using locally sourced, reclaimed materials, insulating the manufacturing process from external market fluctuations. The combination of mandatory environmental compliance and tangible economic savings acts as the primary impact force, accelerating technology adoption and driving strategic consolidations within the recycling services sector to achieve necessary scale and technical expertise to handle diverse waste streams effectively.

Segmentation Analysis

The Foundry Waste Sand Recycling Market is systematically segmented primarily based on the Type of Reclamation Process employed and the final Application of the reclaimed material. Segmentation by Type includes Mechanical Recycling, Thermal Recycling, and Chemical Recycling, each offering varying levels of sand purity and cost efficiency. Mechanical methods are straightforward and cost-effective, primarily cleaning residual binders through physical attrition, suitable for green sand (clay-bonded sand). Thermal recycling involves heating the sand to incinerate organic and inorganic binders, yielding high-purity sand suitable for reuse in sensitive casting processes. Chemical recycling, though nascent, focuses on dissolving or neutralizing specific binders, often presenting a specialized, environmentally focused solution for complex waste streams. The market’s evolution is driven by the increasing demand for high-purity outputs, which favors thermal methods, despite their higher capital and operational expenditure.

Segmentation by Application is crucial as it defines the commercial utility and volume potential of the recycled material. Key application segments include Construction Materials (e.g., aggregate substitute in asphalt and concrete), Road and Infrastructure Projects (e.g., road base, embankments), Landfilling Reduction (direct use as daily cover or structural fill), Cement Production (as a raw material component), and Specialized Foundry Reuse (reintroducing the sand into the core and mold production cycle). The Construction Materials segment dominates the market volume due to the massive scale of infrastructure development globally and the material's suitability for high-volume, low-specification uses. However, the specialized Foundry Reuse segment offers the highest value addition, as it directly offsets the cost of expensive virgin silica, driving investment in high-purity thermal and chemical reclamation technologies necessary for closed-loop systems.

Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific is poised to exhibit the fastest growth owing to expanding foundry operations, increasing regulatory oversight in industrial waste, and exponential demand from the construction sector. Europe and North America maintain high market share due to established environmental compliance frameworks and advanced technological adoption, especially in thermal recycling. The complexity of regulatory standards concerning the safe use of recycled materials across borders, particularly the leaching potential of trace elements, heavily influences regional market dynamics and requires customized recycling and quality assurance protocols tailored to specific local environmental mandates, further justifying the current segmentation structure and strategic focus.

- By Type of Reclamation:

- Mechanical Recycling (Attrition Scrubbing, Screening)

- Thermal Recycling (Fluidized Bed, Rotary Kiln)

- Chemical Recycling (Binder Dissolution, Neutralization)

- By Application:

- Construction Materials (Concrete Aggregate, Asphalt Filler)

- Road and Infrastructure Projects (Road Base, Fill Material)

- Cement Production (Raw Material Substitute)

- Specialized Foundry Reuse (Molding Sand, Core Sand)

- Landfilling Reduction (Daily Cover, Structural Fill)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, Italy, France, UK)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (UAE, South Africa)

Value Chain Analysis For Foundry Waste Sand Recycling Market

The value chain for the Foundry Waste Sand Recycling Market begins with the upstream generation of spent foundry sand (SFS) at the metal casting facilities. Foundries, ranging from large automotive component manufacturers to smaller independent job shops, constitute the primary input source. The upstream analysis focuses on the type and volume of sand consumed, the binders used (clay, resin, etc.), and the consistency of the waste stream, all of which dictate the subsequent feasibility and cost of reclamation. Efficient segregation and initial handling of SFS at the foundry level are crucial upstream activities; poor segregation of green sand from chemically bonded sand can severely contaminate batches, complicating downstream processing and potentially necessitating higher-cost thermal reclamation unnecessarily. Technological partnerships at this stage often focus on implementing efficient internal material handling systems to optimize feedstock quality before shipment.

The midstream segment involves specialized recycling and processing companies responsible for transforming the SFS into a commercially viable product. This segment includes operators utilizing mechanical, thermal, or chemical reclamation technologies. The choice of reclamation technique is central to value addition, as thermal recycling produces a higher-purity product (often achieving 95% or more purity) suitable for closed-loop foundry reuse, thereby commanding a premium price. Distribution channels are varied; direct channels involve recyclers selling high-purity sand back to the original foundries, creating a closed-loop, or supplying specialized construction firms that require specific material properties. Indirect channels involve large-volume sales to intermediaries, such as cement producers, asphalt companies, and aggregate distributors, who integrate the recycled sand into their large-scale production mixes, minimizing transportation costs through localized procurement strategies.

The downstream analysis focuses on the end-use applications, primarily dominated by the construction and cement sectors, which are high-volume consumers. The market value is realized through cost savings achieved by end-users who substitute expensive virgin materials with reclaimed sand, often without compromising structural integrity or performance. Regulatory acceptance of recycled materials in public works projects significantly impacts the downstream demand profile. Successful market penetration relies heavily on rigorous quality testing, certification, and effective communication detailing the environmental benefits and consistent properties of the recycled material. The profitability of the entire chain hinges on minimizing logistics costs, achieved by strategically locating recycling facilities near major foundry clusters and key downstream consumption centers, creating regionally optimized material flows.

Foundry Waste Sand Recycling Market Potential Customers

The primary customer base for the Foundry Waste Sand Recycling Market is diverse, extending beyond the initial generating foundries to encompass high-volume consumers in the building and heavy industrial sectors. Foundries themselves are critical customers, particularly those operating closed-loop systems, purchasing high-purity thermally or chemically reclaimed sand to substitute for virgin silica in their molding and core operations. This customer segment is highly sensitive to quality specifications, requiring low Loss on Ignition (LOI) and consistent grain size distribution to maintain casting integrity. Large integrated foundries, especially those linked to the automotive and aerospace industries, prioritize internal sustainability metrics and reliability of supply, making them key targets for premium recycling services capable of guaranteeing strict quality standards.

The largest volume consumption comes from the Construction and Infrastructure industries. This segment includes large civil engineering firms, road builders, and producers of construction materials such as ready-mix concrete and asphalt. For these buyers, recycled foundry sand is utilized as a substitute for natural aggregates, reducing material procurement costs. Specifically, the material is highly valued in applications like flowable fill (Controlled Low-Strength Material or CLSM), where its self-leveling properties and lower density are advantageous for backfilling utility trenches and voids. Governmental public works departments and transportation authorities are increasingly becoming influential customers by mandating the use of sustainable or recycled content in state-funded infrastructure projects, thereby institutionalizing demand for recycled foundry sand products.

The third major customer segment consists of Cement and Building Material Manufacturers. In the production of Portland cement, spent foundry sand can be used as a source of silica and alumina, substituting for natural raw materials and acting as a partial replacement for cement clinker. This application is economically appealing due to lower processing temperatures required for some SFS compositions and the dual benefit of waste diversion. Furthermore, manufacturers of specialized building products, such as bricks, tiles, and insulation materials, utilize SFS for its thermal and physical properties, recognizing the cost benefits and the environmental claims associated with using recycled content. These customers are focused on consistent supply, regulatory compliance regarding heavy metal leaching, and documented performance standards to ensure their final products meet building codes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.91 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vulcan Materials Company, R.W. Sidley, Inc., Badger Mining Corporation, Sibelco, Refraco S.p.A., Aggregate Industries (Holcim Group), Enviro-Tech Waste Recycling, General Kinematics Corporation, K.R. Komarek, Inc., Green Sand Recycling LLC, Foseco International (Vesuvius), ASK Chemicals, Carpenter Brothers, Inc., CESA Group, GIFA GmbH, Simplicity Engineering, Carver, Inc., Inductotherm Group, Eirich, Jiffy Mixer Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foundry Waste Sand Recycling Market Key Technology Landscape

The technology landscape of the Foundry Waste Sand Recycling Market is characterized by a drive toward higher efficiency, lower energy consumption, and the ability to handle complex binder systems. Three primary technological streams dominate the market: mechanical, thermal, and chemical reclamation. Mechanical recycling relies on high-velocity attrition scrubbing and pneumatic separation to strip residual binders from the sand grains. While cost-effective and energy-efficient, mechanical methods are generally limited to green sand (clay-bonded sand) or sands with light chemical contamination, producing reclaimed material suitable mainly for low-specification applications like fill material or aggregates. Innovations in mechanical technology focus on optimizing attrition cell design and incorporating advanced screening processes to minimize fines and improve grain size uniformity, enhancing their utility in specific construction contexts.

Thermal recycling represents the high-end technology solution, indispensable for achieving the purity required for reusing sand in high-specification casting operations (closed-loop systems). Technologies such as rotary kilns and fluidized beds heat the sand to temperatures between 600°C and 950°C, effectively incinerating all organic binders (such as furan, phenolic urethane, and ester-cured systems). The critical technological advancement in this sector involves waste heat recovery systems and integrated energy optimization controls, which significantly reduce the substantial energy costs associated with thermal processing. Furthermore, sophisticated off-gas treatment systems are crucial for environmental compliance, handling emissions from the combustion of chemical binders, making regulatory technology a necessary component of the overall thermal reclamation unit.

Chemical reclamation technologies are emerging to address specific challenges posed by complex or inorganic binders, offering an alternative to high-energy thermal methods. These processes often involve wet scrubbing or dissolution techniques using mild chemical agents to separate the binder from the silica grain. While still specialized and less ubiquitous than mechanical or thermal methods, chemical reclamation holds promise for improving the environmental profile of the recycling process, especially concerning air emissions. The future technological landscape is trending toward hybrid systems, combining initial mechanical scrubbing for volume reduction, followed by highly targeted thermal or chemical treatment to achieve final purity, maximizing both cost-effectiveness and output quality across diverse feedstock types. Automated process control, often utilizing AI for dynamic adjustments, is the key to maximizing the efficiency of these integrated hybrid systems.

Regional Highlights

- North America: The North American market is mature and highly regulated, driven by the scarcity of inexpensive landfill options and high environmental liability associated with SFS disposal. The U.S. Environmental Protection Agency (EPA) regulations and state-level acceptance of SFS for beneficial reuse (particularly in highway construction and geotechnical fills) are the primary market drivers. Canada and the U.S. exhibit high demand for high-purity thermal recycling solutions due to their sophisticated automotive and aerospace foundry sectors, favoring closed-loop systems. Market growth is characterized by consolidation among large recycling service providers offering comprehensive, multi-site management contracts to major foundry groups.

- Europe: Europe stands as a leader in circular economy adoption, institutionalizing recycling through directives like the Waste Framework Directive. This regulatory push creates mandatory demand for recycling services, minimizing reliance on landfilling. Germany, Italy, and France represent significant foundry centers and simultaneously impose stringent quality standards on recycled materials, thereby stimulating investment in advanced thermal and chemical reclamation technologies. The European market emphasizes innovation in processing heterogeneous waste streams and ensuring the environmental safety (low leaching potential) of reclaimed aggregates used in civil engineering projects, driving strong R&D focused on advanced material characterization.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive industrial expansion, particularly in China, India, and South Korea, which host the world’s largest foundry capacities. Rapid urbanization and infrastructure spending generate immense demand for aggregates and cement, creating a ready high-volume market for reclaimed sand. While regulatory enforcement has historically been less stringent than in the West, environmental awareness and subsequent governmental crackdowns on polluting industries are accelerating the formalization of the recycling sector. The region is seeing rapid deployment of cost-effective mechanical and basic thermal recycling infrastructure to manage escalating waste volumes.

- Latin America: Market development in Latin America, centered primarily around Brazil and Mexico, is uneven. While large-scale automotive manufacturing drives significant SFS generation, the adoption of advanced recycling technologies is often hindered by high capital costs and inconsistent regulatory oversight regarding industrial waste management. Growth is mainly focused on using SFS in low-specification construction materials, leveraging its cost advantage over virgin aggregates, but advanced, high-ppurity recycling for foundry reuse remains limited to multinational operations adhering to global corporate standards.

- Middle East and Africa (MEA): The MEA market is nascent but growing, primarily driven by large-scale construction projects in the GCC nations (UAE, Saudi Arabia). The lack of readily available, high-quality virgin aggregate sources in some areas makes recycled SFS economically appealing for specific construction applications. While foundry activity is relatively smaller compared to other regions, environmental concerns regarding desert landfill capacity and groundwater protection are starting to spur foundational investments in basic recycling infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foundry Waste Sand Recycling Market.- Vulcan Materials Company

- R.W. Sidley, Inc.

- Badger Mining Corporation

- Sibelco

- Refraco S.p.A.

- Aggregate Industries (Holcim Group)

- Enviro-Tech Waste Recycling

- General Kinematics Corporation

- K.R. Komarek, Inc.

- Green Sand Recycling LLC

- Foseco International (Vesuvius)

- ASK Chemicals

- Carpenter Brothers, Inc.

- CESA Group

- GIFA GmbH

- Simplicity Engineering

- Carver, Inc.

- Inductotherm Group

- Eirich

- Jiffy Mixer Co.

Frequently Asked Questions

Analyze common user questions about the Foundry Waste Sand Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of recycling foundry waste sand?

The primary economic benefits include significant cost savings derived from avoiding expensive landfill disposal fees (tipping fees and transportation costs) and reducing dependence on purchasing high-cost virgin silica sand and natural aggregates for both foundry reuse and construction applications, ensuring long-term material price stability.

Which type of reclamation technology is most suitable for achieving high-purity sand for foundry reuse?

Thermal recycling, utilizing technologies such as fluidized beds or rotary kilns, is the most suitable method for achieving high-purity reclaimed sand, as it effectively combusts persistent organic and inorganic binders, producing material quality comparable to virgin sand (low Loss on Ignition).

What are the main regulatory hurdles affecting the adoption of recycled foundry sand in construction?

The main regulatory hurdles revolve around governmental classification of spent sand, specifically concerns regarding potential heavy metal leaching and compliance with specific state or regional environmental protection standards (e.g., TCLP testing). Acceptance typically requires extensive testing and approval for beneficial reuse in public works projects.

How is the growth of the Foundry Waste Sand Recycling Market related to the construction industry?

The construction industry is the single largest consumer by volume, utilizing recycled foundry sand as a substitute for natural aggregates, flowable fill, and in cement production. Exponential growth in global infrastructure projects directly translates into substantial high-volume demand for recycled materials, stabilizing the market for low-specification reclaimed sand.

Are there geographical differences in the adoption rates of advanced recycling technologies?

Yes, advanced thermal and chemical recycling technologies are predominantly adopted in North America and Europe due to stringent environmental regulations and higher input costs for virgin materials, whereas Asia Pacific is rapidly deploying both mechanical and basic thermal methods driven primarily by industrial scale and increasing environmental compliance pressures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager